The bale clamp intensive market is projected to maintain a consistent upward trajectory through 2035, moving from USD 979 million in 2025 to USD 1,435.3 million. The forecast period is expected to define a gradual transition from conventional hydraulic clamp mechanisms toward digitally monitored, energy-efficient systems integrated with predictive maintenance frameworks. As industrial material handling evolves toward automation-based workflows, bale clamps will remain central to operations that rely on stable, non-palletized goods transport in logistics and manufacturing environments.

Technological progression will be defined by a shift toward intelligent hydraulic control and embedded monitoring systems. Advanced control valves and load sensors will enable real-time adjustment of clamping pressure, ensuring reduced material damage and consistent handling across varying bale densities. Integration of microprocessor-based systems will support predictive maintenance by recording pressure cycles, operational hours, and temperature fluctuations. Data collected through telematics interfaces will allow operators to anticipate wear patterns and plan service intervals more accurately, reducing unplanned downtime. The adoption of such systems is expected to expand first within large logistics centers and paper or textile plants where equipment utilization rates are high.

Operational priorities over the next decade will emphasize clamp durability, simplified maintenance, and lower energy consumption. Manufacturers are likely to focus on extended seal life, corrosion-resistant materials, and uniform force distribution to minimize product deformation. Hydraulic system efficiency will become a central benchmark, supported by design revisions that lower fluid loss and improve power transmission. Attention will also shift to modular construction, allowing easier replacement of wear components and shorter service cycles. Facility operators will evaluate performance based on total lifecycle cost rather than initial purchase price, driving gradual standardization of component quality and safety features across regions.

Market direction points toward consolidation among established suppliers emphasizing full integration of clamp systems into broader material handling platforms. Partnerships between forklift manufacturers and attachment producers are expected to strengthen as buyers prefer pre-engineered, compatibility-certified solutions. Regional suppliers will likely merge or form technical alliances to expand reach and maintain compliance with tightening safety standards. The consolidation trend will result in a smaller number of global producers offering broader product ranges with harmonized maintenance protocols.

From 2030 to 2035, the bale clamp intensive market is forecast to grow from USD 1,185.4 million to USD 1,435.3 million, adding another USD 249.9 million, which constitutes 54.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of precision agriculture technologies and smart material handling systems, the development of electric and hybrid material handling equipment with enhanced sustainability credentials, and the growth of specialized applications for renewable energy feedstock handling and recycling operations. The growing adoption of automation technologies and digital integration strategies will drive demand for bale clamps with enhanced functionality and operational performance features.

Between 2020 and 2025, the bale clamp intensive market experienced steady growth, driven by increasing agricultural mechanization and growing recognition of bale clamps as essential equipment for enhancing material handling efficiency and operational safety in diverse industrial and agricultural applications. The bale clamp intensive market developed as farm equipment operators and logistics managers recognized the potential for bale clamp technology to reduce manual labor, improve handling speed, and support productivity objectives while meeting stringent safety requirements. Technological advancement in clamp design and hydraulic systems began emphasizing the critical importance of maintaining load stability and equipment reliability in challenging operational environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 979 million |

| Forecast Value in (2035F) | USD 1,435.3 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

Market expansion is being supported by the increasing global demand for efficient material handling solutions driven by agricultural mechanization trends and labor shortage challenges, alongside the corresponding need for specialized equipment that can enhance operational productivity, enable safe handling operations, and maintain cost-effectiveness across various agriculture, forestry, construction, and logistics applications. Modern agricultural operators and industrial material handlers are increasingly focused on implementing bale clamp solutions that can improve handling speed, reduce product damage, and provide consistent performance in demanding operational conditions.

The growing emphasis on operational efficiency and labor productivity is driving demand for bale clamps that can support mechanized operations, enable single-operator workflows, and ensure comprehensive safety performance. Equipment manufacturers' preference for handling solutions that combine durability with operational versatility and cost-effectiveness is creating opportunities for innovative bale clamp implementations. The rising influence of sustainable agriculture practices and biomass energy production is also contributing to increased adoption of bale clamps that can provide superior handling capabilities without compromising functionality or equipment longevity.

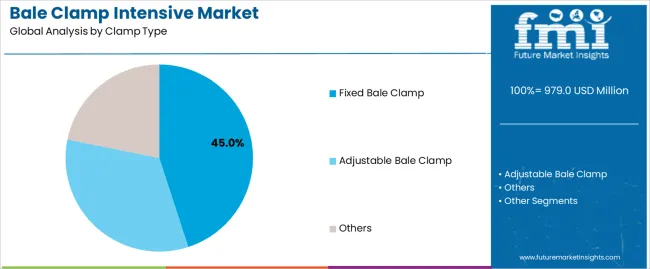

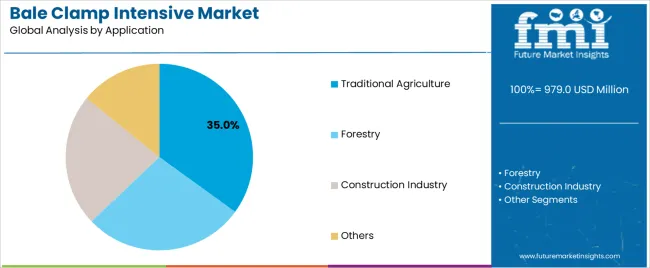

The bale clamp intensive market is segmented by clamp type, application, and region. By clamp type, the bale clamp intensive market is divided into fixed bale clamp, adjustable bale clamp, and others. Based on application, the bale clamp intensive market is categorized into traditional agriculture, forestry, construction industry, and others. Regionally, the bale clamp intensive market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The fixed bale clamp segment is projected to maintain its leading position with 45% market share in the bale clamp intensive market in 2025, reaffirming its role as the preferred clamp configuration for standardized bale handling and agricultural material management applications. Agricultural equipment operators and material handling specialists increasingly utilize fixed bale clamps for their robust construction, reliable performance, and proven effectiveness in handling consistent bale sizes while maintaining operational simplicity. Fixed clamp technology's proven effectiveness and cost advantages directly address the industry requirements for dependable material handling and efficient farm operations across diverse agricultural platforms and handling categories.

This clamp segment forms the foundation of modern agricultural material handling, as it represents the equipment with the greatest contribution to operational reliability and established performance record across multiple bale handling applications and farm sizes. Agricultural industry investments in mechanization technologies continue to strengthen adoption among farm operators and agricultural contractors. With economic pressures requiring efficient operations and reduced labor costs, fixed bale clamps align with both productivity objectives and budget requirements, making them the central component of comprehensive farm mechanization strategies.

The traditional agriculture application segment is projected to represent the 35% share of bale clamp demand in 2025, underscoring its critical role as the primary driver for bale clamp adoption across hay handling, straw management, and forage operations. Agricultural operators prefer bale clamps for material handling due to their exceptional versatility, operational efficiency benefits, and ability to reduce manual labor while supporting productivity objectives and operational safety. Positioned as essential equipment for modern farming operations, bale clamps offer both practical advantages and economic benefits.

The segment is supported by continuous innovation in agricultural equipment and the growing availability of advanced clamp designs that enable superior handling performance with enhanced durability and reduced maintenance requirements. Additionally, agricultural equipment manufacturers are investing in comprehensive product development programs to support increasingly competitive farming economics and farmer demand for reliable mechanization solutions. As agricultural modernization accelerates and labor availability decreases, the traditional agriculture application will continue to dominate the bale clamp intensive market while supporting advanced equipment utilization and farm productivity optimization strategies.

The bale clamp intensive market is advancing steadily due to increasing demand for mechanized agricultural solutions driven by labor shortages and growing adoption of efficient material handling practices that require specialized equipment providing enhanced operational capabilities and productivity benefits across diverse agriculture, forestry, construction, and logistics applications. However, the bale clamp intensive market faces challenges, including high initial equipment costs and capital investment requirements, competition from alternative handling methods and traditional manual operations, and operational constraints related to equipment compatibility and bale size standardization limitations. Innovation in hydraulic systems and attachment technologies continues to influence product development and market expansion patterns.

The growing adoption of mechanized farming practices is driving demand for specialized material handling equipment that addresses labor shortage challenges including reduced availability of skilled workers, increased labor costs, and seasonal workforce constraints. Modern agricultural operations require advanced bale clamp solutions that deliver superior efficiency across multiple parameters while maintaining equipment reliability and cost-effectiveness. Farm equipment dealers are increasingly recognizing the competitive advantages of bale clamp integration for agricultural productivity enhancement and operational differentiation, creating opportunities for innovative equipment designs specifically developed for next-generation farming applications.

Modern material handling operations are incorporating specialized equipment for biomass energy production and renewable feedstock management to enhance operational capabilities, support sustainability objectives, and address comprehensive handling requirements through optimized equipment performance and material versatility. Leading equipment manufacturers are developing specialized clamps for biomass applications, implementing enhanced gripping technologies, and advancing hydraulic systems that improve handling efficiency and operational flexibility. These technologies improve operational capabilities while enabling new market opportunities, including renewable energy production, waste material recycling, and environmentally conscious agricultural practices. Advanced equipment integration also allows operators to support comprehensive sustainability objectives and market differentiation beyond traditional agricultural applications.

The expansion of electric vehicle technology, advanced battery systems, and emission reduction requirements is driving demand for bale clamps compatible with electric and hybrid material handling platforms with precisely engineered hydraulic systems and exceptional energy efficiency. These advanced applications require specialized equipment designs with optimized power consumption that address sustainability requirements, creating premium market segments with differentiated value propositions. Manufacturers are investing in advanced engineering capabilities and compatibility testing systems to serve emerging sustainable equipment applications while supporting innovation in agricultural mechanization and material handling industries.

The integration of smart sensors and IoT-enabled monitoring technologies is emerging as a key trend shaping the bale clamp intensive market. Modern bale clamps are increasingly being equipped with load sensors, pressure monitoring systems, and real-time data analytics to improve operational accuracy and prevent equipment overloads. These technologies enable predictive maintenance, optimize hydraulic performance, and enhance overall equipment utilization efficiency. As digitalization penetrates agricultural and industrial operations, IoT-driven bale handling systems are helping operators track equipment usage, reduce downtime, and maintain operational consistency across fleets. This trend is also fostering the development of connected material handling ecosystems where data insights drive performance optimization and cost reduction initiatives.

| Trend/Driver | Impact on Market | Key Beneficiaries |

|---|---|---|

| Integration of IoT and Smart Sensors | Enhances operational visibility, predictive maintenance, and load safety | Agricultural operators, industrial warehouses |

| Data-Driven Equipment Optimization | Reduces hydraulic failure rates and improves efficiency | Equipment manufacturers, logistics managers |

| Connected Fleet Management | Enables remote diagnostics and maintenance scheduling | OEMs, service providers |

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

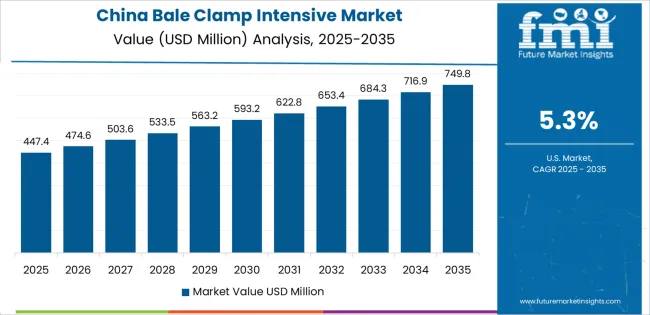

The bale clamp intensive market is experiencing solid growth globally, with China leading at a 5.3% CAGR through 2035, driven by expanding agricultural mechanization programs, growing forestry operations, and increasing adoption of modern material handling equipment in construction and logistics sectors. India follows at 4.9%, supported by government agricultural modernization initiatives, expanding dairy and livestock industries, and growing demand for efficient farm equipment. Germany shows growth at 4.5%, emphasizing precision agriculture adoption, biomass energy infrastructure, and advanced material handling technologies. Brazil demonstrates 4.1% growth, supported by large-scale agricultural operations, expanding forestry sector, and mechanization of sugarcane and fiber crop handling. The United States records 3.7%, focusing on agricultural productivity enhancement, warehouse automation, and replacement of aging equipment fleets. The United Kingdom exhibits 3.3% growth, emphasizing livestock farming equipment and biomass handling for renewable energy. Japan shows 2.9% growth, supported by agricultural workforce challenges and precision farming technology adoption.

The report covers an in-depth analysis of 20 countries top-performing countries are highlighted below.

Revenue from bale clamps in China is projected to exhibit exceptional growth with a CAGR of 5.3% through 2035, driven by expanding agricultural mechanization programs and rapidly growing forestry operations supported by government rural development initiatives and agricultural modernization policies. The country's massive agricultural sector transformation and increasing investment in efficient farming technologies are creating substantial demand for bale clamp solutions. Major agricultural equipment manufacturers and material handling companies are establishing comprehensive production capabilities to serve both domestic markets and export opportunities.

Revenue from bale clamps in India is expanding at a CAGR of 4.9%, supported by the country's agricultural modernization initiatives, expanding dairy and livestock industries, and increasing demand for efficient farm equipment driven by labor shortage challenges and productivity requirements. The country's comprehensive agricultural development programs and government support for mechanization are driving sophisticated bale clamp adoption throughout diverse farming sectors. Leading agricultural equipment manufacturers and international companies are establishing production and distribution facilities to address growing domestic demand.

Revenue from bale clamps in Germany is expanding at a CAGR of 4.5%, supported by the country's leadership in precision agriculture, expanding biomass energy infrastructure, and strong emphasis on efficient material handling technologies. The nation's advanced agricultural practices and emphasis on sustainability are driving sophisticated bale clamp capabilities throughout farming and energy sectors. Leading equipment manufacturers and agricultural suppliers are investing extensively in advanced equipment technologies and specialized applications.

Revenue from bale clamps in Brazil is expanding at a CAGR of 4.1%, supported by the country's large-scale agricultural operations, expanding forestry sector, and growing mechanization of sugarcane and fiber crop handling. The nation's comprehensive agricultural export industry and operational scale requirements are driving demand for robust bale clamp solutions. Agricultural equipment dealers and machinery manufacturers are investing in distribution network expansion and technical service capabilities to serve both commercial farms and agricultural contractors.

Revenue from bale clamps in the United States is expanding at a CAGR of 3.7%, supported by the country's focus on agricultural productivity enhancement, established material handling industry, and growing emphasis on equipment modernization and fleet replacement programs. The nation's comprehensive agricultural sector and logistics excellence are driving demand for reliable bale clamp solutions. Equipment manufacturers and agricultural dealers are investing in product development and service network expansion to serve both agricultural and industrial markets.

Revenue from bale clamps in the United Kingdom is expanding at a CAGR of 3.3%, driven by the country's livestock farming intensity, biomass energy development, and agricultural equipment modernization requirements. The nation's farming structure and sustainability emphasis are supporting investment in efficient material handling technologies. Agricultural equipment suppliers and farm machinery dealers are establishing service capabilities for equipment support and farmer training programs.

Revenue from bale clamps in Japan is expanding at a CAGR of 2.9%, supported by the country's agricultural workforce challenges, precision farming technology emphasis, and strong focus on labor-saving equipment for aging farmer population. Japan's agricultural structure and technology sophistication are driving demand for efficient material handling equipment. Equipment manufacturers and agricultural cooperatives are investing in specialized equipment suitable for smaller farm operations.

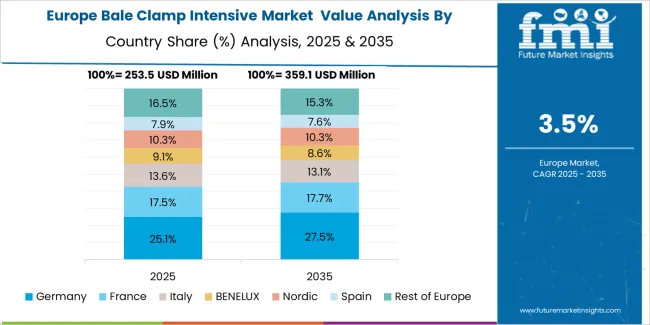

The bale clamp intensive market in Europe is projected to grow from USD 344.3 million in 2025 to USD 509.5 million by 2035, registering a CAGR of 4.0% over the forecast period. Germany is expected to maintain leadership with a 27.9% market share in 2025, moderating to 27.5% by 2035, supported by precision agriculture adoption, biomass energy infrastructure, and strong agricultural equipment manufacturing base.

France follows with 21.5% in 2025, projected at 21.8% by 2035, driven by large-scale farming operations, livestock industry, and agricultural modernization programs. The United Kingdom holds 14.7% in 2025, declining slightly to 14.3% by 2035 due to agricultural sector adjustments. Italy commands 11.6% in 2025, rising to 11.8% by 2035, while Spain accounts for 8.5% in 2025, reaching 8.7% by 2035 aided by agricultural mechanization and horticultural operations. Poland maintains 5.7% in 2025, up to 6.1% by 2035 due to expanding commercial agriculture. The Rest of Europe region, including Nordic countries, Netherlands, and other markets, is anticipated to hold 10.1% in 2025 and 9.8% by 2035, reflecting steady development in dairy farming, forestry operations, and biomass handling applications.

The bale clamp intensive market is characterized by competition among established material handling equipment manufacturers, agricultural machinery specialists, and forklift attachment producers. Companies are investing in hydraulic system development, equipment durability enhancement, product range expansion, and application-specific design optimization to deliver high-performance, reliable, and cost-effective bale clamp solutions. Innovation in gripping technologies, load stability systems, and attachment compatibility features is central to strengthening market position and competitive advantage.

Manitou leads the bale clamp intensive market with comprehensive material handling solutions with a focus on agricultural applications, versatile equipment design, and robust construction across diverse handling and farming applications. Cascade Corporation provides innovative attachment solutions with emphasis on hydraulic efficiency and equipment integration capabilities. Toyota Material Handling delivers reliable material handling equipment with focus on operational safety and equipment durability. Bolzoni Auramo offers specialized attachment systems with emphasis on customized solutions and application versatility. Liftomatic provides material handling equipment with comprehensive clamp offerings for industrial applications. Jungheinrich AG specializes in warehouse equipment and attachment solutions. Noblelift focuses on cost-effective material handling equipment for diverse applications. Anhui Heli provides comprehensive forklift and attachment solutions serving Asian markets. Hyster-Yale offers material handling equipment with advanced hydraulic systems. Moffett Engineering emphasizes truck-mounted forklift solutions with specialized attachments.

Bale clamps represent a specialized material handling equipment segment within agricultural and industrial applications, projected to grow from USD 979 million in 2025 to USD 1,435.3 million by 2035 at a 3.9% CAGR. These specialized attachments primarily serve material handling requirements in agricultural operations, forestry activities, construction projects, and recycling facilities where efficient bale handling, operational productivity, and equipment versatility are essential. Market expansion is driven by increasing agricultural mechanization, growing labor shortage challenges, expanding biomass energy production, and rising demand for efficient material handling solutions across diverse agricultural and industrial sectors.

How Industrial Regulators Could Strengthen Product Standards and Operational Safety?

How Industry Associations Could Advance Application Standards and Market Development?

How Bale Clamp Manufacturers Could Drive Innovation and Market Leadership?

How End-User Industries Could Optimize Equipment Performance and Operational Efficiency?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 979 million |

| Clamp Type | Fixed Bale Clamp, Adjustable Bale Clamp, Others |

| Application | Traditional Agriculture, Forestry, Construction Industry, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 20 countries |

| Key Companies Profiled | Manitou, Cascade Corporation, Toyota Material Handling, Bolzoni Auramo, Liftomatic, Jungheinrich AG |

| Additional Attributes | Dollar sales by clamp type and application category, regional demand trends, competitive landscape, technological advancements in hydraulic systems, equipment durability enhancement, application versatility development, and operational efficiency optimization |

The global bale clamp intensive market is estimated to be valued at USD 979.0 million in 2025.

The market size for the bale clamp intensive market is projected to reach USD 1,435.3 million by 2035.

The bale clamp intensive market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in bale clamp intensive market are fixed bale clamp, adjustable bale clamp and others.

In terms of application, traditional agriculture segment to command 35.0% share in the bale clamp intensive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Balers Market

Fiber Bale Packaging Film Market Analysis by Material Type, Thickness, End Use, and Region through 2025 to 2035

Fiber Bale Packaging Market Trends- Growth & Forecast 2025 to 2035

Key Companies & Market Share in the Fiber Bale Packaging Film Sector

Clamps Market Size and Share Forecast Outlook 2025 to 2035

Clamp Meter Market Analysis for 2025 to 2035

Skull Clamp Market Size and Share Forecast Outlook 2025 to 2035

Strain Clamp Market Size and Share Forecast Outlook 2025 to 2035

Cranial Clamps Market

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Intensive Sweeteners Market Analysis by Nature, Type, Application, Sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA