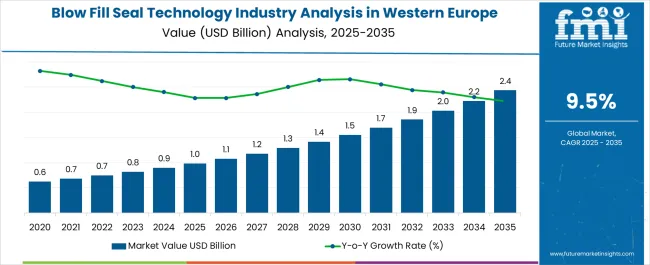

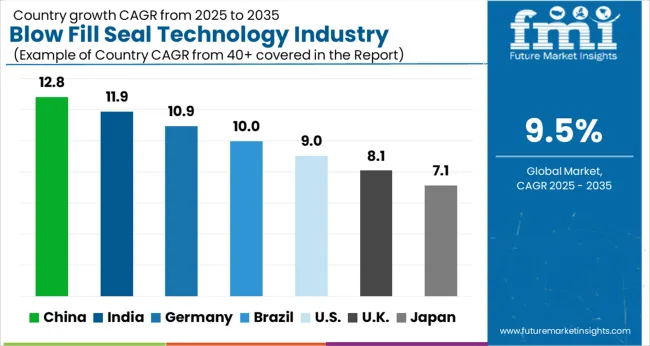

The Blow Fill Seal Technology Industry Analysis in Western Europe is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Blow Fill Seal Technology Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 1.0 billion |

| Blow Fill Seal Technology Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The Blow Fill Seal technology industry in Western Europe is experiencing robust growth. Increasing demand for sterile and contamination-free packaging in the pharmaceutical and healthcare sectors is driving market expansion. Current market dynamics are influenced by stringent regulatory requirements, rising focus on patient safety, and technological advancements in automated filling and sealing processes.

The region benefits from well-established manufacturing infrastructure, skilled labor, and strong R&D capabilities that support continuous innovation. Future growth is expected to be driven by the increasing adoption of single-use and high-precision packaging solutions, expansion of biologics and injectable drugs, and rising healthcare expenditure.

Growth rationale is supported by the ability of Blow Fill Seal technology to enhance production efficiency, ensure product sterility, and reduce human intervention, thereby lowering contamination risks Continuous process optimization, integration with advanced materials, and compliance with European regulatory standards are expected to further strengthen market position, driving sustained adoption across pharmaceutical and related industries.

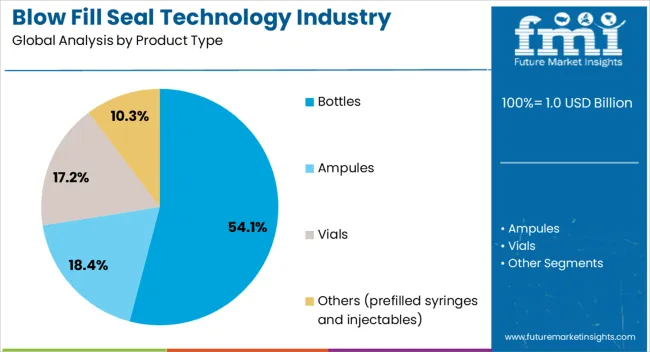

The bottles segment, holding 54.1% of the product type category, has been leading due to its critical role in packaging sterile liquids and pharmaceuticals. Adoption has been driven by the versatility of bottle formats, compatibility with various filling volumes, and ability to maintain product integrity.

Automation in bottle production and sealing has enhanced operational efficiency while ensuring compliance with hygiene standards. Demand stability has been reinforced by the growing pharmaceutical sector and the requirement for high-speed production lines.

Continued innovation in bottle design, including tamper-evident and ergonomic features, is expected to sustain market share and support broader adoption across multiple therapeutic segments.

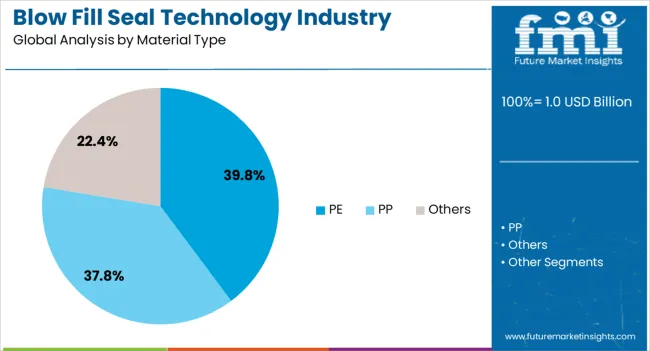

The PE material segment, accounting for 39.8% of the material type category, has maintained dominance due to its chemical inertness, durability, and cost-effectiveness. Its adoption is supported by compatibility with sterile filling processes and regulatory acceptance in pharmaceutical applications.

Material performance in maintaining product stability and ensuring contamination-free packaging has reinforced preference among manufacturers. Advances in polymer processing and customization of PE grades have further enhanced usability and efficiency.

Ongoing emphasis on sustainability and recyclable PE formulations is expected to maintain the segment’s market share while aligning with regional environmental policies.

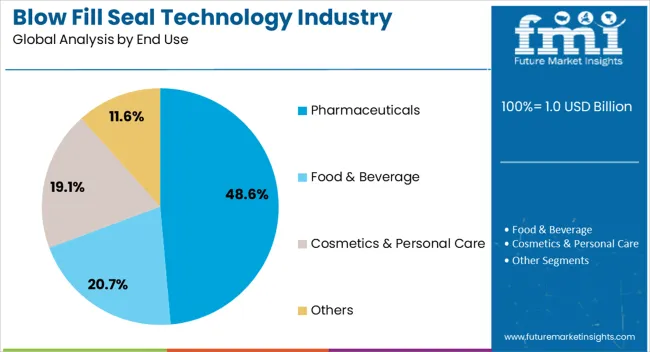

The pharmaceuticals end-use segment, representing 48.6% of the end-use category, has emerged as the leading sector due to the high demand for sterile packaging solutions for injectable drugs, biologics, and liquid formulations. Adoption is driven by stringent European regulatory standards requiring contamination-free production and packaging.

Demand stability has been supported by the growth of pharmaceutical manufacturing, expansion of healthcare infrastructure, and increasing R&D investments. Integration of Blow Fill Seal technology into production lines has improved efficiency, reduced human intervention, and minimized risk of product contamination.

Continuous innovation in process automation and expansion of production capacity are expected to sustain the segment’s market leadership and drive further adoption across the region.

This section provides category-wise insights into the adoption of blow fill seal technology, categorized by dominant product type and primary material choice. Notably, bottles emerged as the dominant product category and Polyethylene (PE) is the leading material choice in the blow fill seal (BFS) technology industry in Western Europe.

| Dominating Blow Fill Seal (BFS) Technology based on Product | Bottles |

|---|---|

| Value Share in 2025 | USD 1 million |

| CAGR from 2025 to 2035 | 8.2% |

Bottles dominate the blow fill seal technology sales outlook, capturing a substantial value share of USD 1 million in 2025. With a projected CAGR of 8.2% from 2025 to 2035, the bottles segment is poised for sustained expansion, making it an attractive prospect for manufacturers and investors.

| Top Material for Blow Fill Seal (BFS) Technology Adoption in Western Europe | PE |

|---|---|

| Value Share in 2025 | USD 498.9 million |

| CAGR from 2025 to 2035 | 9.4% |

Polyethylene (PE) emerges as the preferred material for blow fill seal (BFS) technology manufacturing in Western Europe, commanding a substantial value share of USD 498.9 million in 2025.

The projected CAGR of 9.4% from 2025 to 2035 signifies the sustained demand for PE in the BFS technology sector, presenting compelling opportunities for industry stakeholders.

This section talks about blow fill seal (BFS) technology adoption in specific countries. Each country's analysis covers distinct trends and growth factors. From Spain's sustainable packaging preferences to the United Kingdom's commitment to healthcare, a comprehensive outlook is presented.

These insights equip suppliers or investors with a deep understanding of the BFS technology trends in each country, enabling informed decision-making and strategic entry.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 1 million |

| CAGR from 2025 to 2035 | 9.0% |

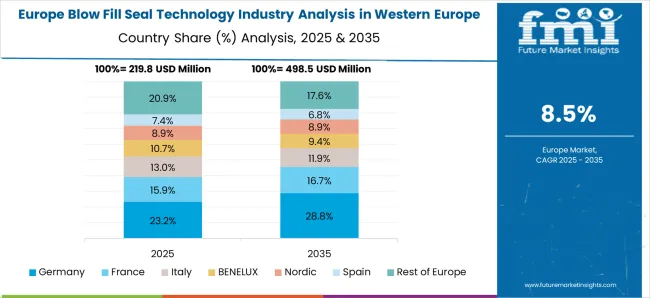

The blow fill seal technology sales outlook in Spain exhibits remarkable potential, surpassing USD 1 million in 2025. The demand for BFS technology is anticipated to rise at 9.0% in Spain through 2035.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 124.4 million |

| CAGR from 2025 to 2035 | 10.2% |

Italy's blow fill seal technology sector is thriving, with the sales outlook likely to surpass USD 124.4 million in 2025. The projected CAGR of 10.2% from 2025 to 2035 indicates substantial growth potential, attracting manufacturers and investors.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 210.0 million |

| CAGR from 2025 to 2035 | 9.7% |

Germany's blow fill seal technology sector demonstrates substantial revenue growth, crossing USD 210 million in 2025. A projected CAGR of 9.7% from 2025 to 2035 signifies sustained growth potential, making Germany a lucrative industry.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 165.7 million |

| CAGR from 2025 to 2035 | 9.0% |

The United Kingdom embraces blow fill seal technology solutions with a valuation of USD 165.7 million in 2025. A projected CAGR of 9.0% from 2025 to 2035 indicates a favorable demand outlook, attracting industry players.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 17.7 million |

| CAGR from 2025 to 2035 | 8.7% |

Benelux exhibits sustainable growth in blow fill seal technology, accounting for USD 17.7 million in 2025. However, a projected CAGR of 8.7% from 2025 to 2035 signifies hidden growth potential, making Benelux an appealing investment option.

| Attribute | Value |

|---|---|

| Industry Size in 2025 | USD 2.4 million |

| CAGR from 2025 to 2035 | 10.0% |

The BFS technology demand in France is anticipated to witness robust growth, boasting a noteworthy CAGR of 10.0% from 2025 to 2035. Currently valued at USD 2.4 million, the sales are expected to soar to USD 372.9 million by 2035.

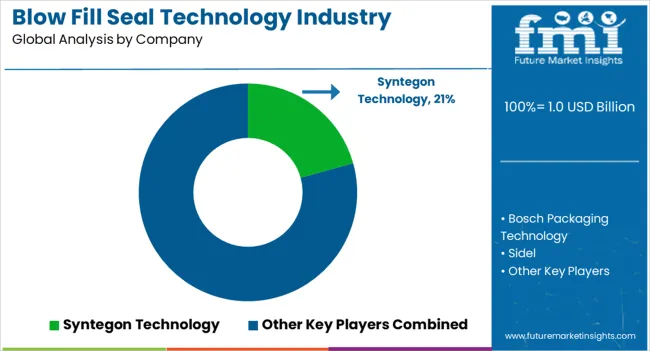

The blow fill seal (BFS) technology demand in Western Europe makes the region a field where key players continually strive to maintain their dominance.

Leading companies like Rommelag, Unither Pharmaceuticals, and Weiler Engineering, Inc. have etched their names in the annals of BFS technology. They leverage their extensive experience and technological prowess to lead the charge.

New entrants such as Catalent, Inc. and Recipharm AB are disrupting the status quo. Their innovative solutions and nimble approaches aim to reshape the landscape.

Established players invest heavily in research and development to stay ahead. Continuous innovation, such as the integration of IoT for predictive maintenance, ensures they offer cutting-edge solutions.

Recent Developments Observed in Blow Fill Seal (BFS) Technology Adoption in Western Europe

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.0 billion |

| Projected Industry Size in 2035 | USD 2.4 billion |

| Anticipated CAGR between 2025 to 2035 | 9.5% CAGR |

| Historical Analysis of Demand for Blow Fill Seal (BFS) Technology in Western Europe | 2020 to 2025 |

| Demand Forecast for Blow Fill Seal (BFS) Technology in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing blow fill seal (BFS) technology adoption in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local and Regional Western Europe Manufacturers |

| Key Countries Analyzed while Studying Opportunities in Blow Fill Seal (BFS) Technology in Western Europe | Spain, Italy, Germany, United Kingdom, Benelux, France, Nordic |

| Key Companies Profiled | Bosch Packaging Technology; Sidel; Krones; GEA Group; Tetra Pak; SIG; Illig Maschinenbau; Rommelag Vacuum Technology; Schubert Verpackungsmaschinen; Harro Höfliger; Syntegon Technology; IMA Group |

The global blow fill seal technology industry analysis in western europe is estimated to be valued at USD 1.0 billion in 2025.

The market size for the blow fill seal technology industry analysis in western europe is projected to reach USD 2.4 billion by 2035.

The blow fill seal technology industry analysis in western europe is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in blow fill seal technology industry analysis in western europe are bottles, 0.2 to 100 ml, 100 to 500 ml, above 500 ml, ampules, 0.1 to 10 ml, 10 to 100 ml, vials, 0.1 to 10 ml, 10 to 50 ml and others (prefilled syringes and injectables).

In terms of material type, pe segment to command 39.8% share in the blow fill seal technology industry analysis in western europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Blow Molded Bottles Market Size, Share & Forecast 2025 to 2035

Blow-Off Valves Market Growth – Trends & Forecast 2025 to 2035

Blow Molded Plastic Market by Molding Type from 2024 to 2034

Blowout Preventers Market

Blowing Torch Market Analysis - Size, Share, and Forecast 2025 to 2035

Blow Molding Resin Market Growth – Trends & Forecast 2024-2034

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Blown Film Extrusion Machine Market Size and Share Forecast Outlook 2025 to 2035

Blow Moulded Plastic Packaging Market

Industry Share & Competitive Positioning in Blowing Torch Industry

Leading Providers & Market Share in Blow Molded Plastic

Key Players & Market Share in Blown Film Extrusion Machine Market

Blow-fill-seal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blow Fill Seal Technology Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Blow-Fill-Seal Technology Industry

Blow Fill Seal Technology Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA