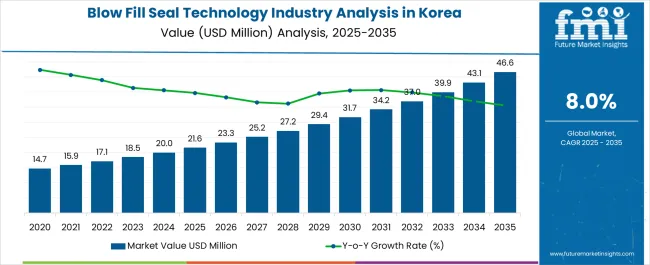

The Blow Fill Seal Technology Industry Analysis in Korea is estimated to be valued at USD 21.6 million in 2025 and is projected to reach USD 46.6 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Blow Fill Seal Technology Industry Analysis in Korea Estimated Value in (2025 E) | USD 21.6 million |

| Blow Fill Seal Technology Industry Analysis in Korea Forecast Value in (2035 F) | USD 46.6 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The blow fill seal (BFS) technology industry in Korea is expanding steadily, supported by the pharmaceutical sector’s stringent requirements for aseptic packaging and the broader adoption of efficient, contamination-free filling solutions. Current industry dynamics are defined by rising demand for single-dose and unit-dose packaging formats, combined with regulatory alignment that emphasizes sterility and patient safety.

The technology’s cost-effectiveness, reduced human intervention, and ability to ensure product integrity are strengthening its adoption. Market participants are investing in automation, advanced polymers, and flexible manufacturing systems to meet evolving end-user needs.

The future outlook remains positive as BFS applications extend beyond pharmaceuticals into personal care and food and beverage segments, driven by consumer preference for convenience and safety Growth rationale is anchored in the scalability of BFS technology, its ability to support mass production without compromising quality, and the industry’s capacity to align with Korea’s advancing healthcare infrastructure, thereby ensuring consistent revenue generation and market expansion in the forecast period.

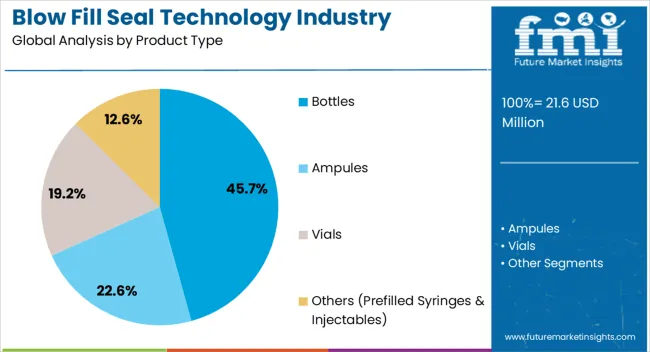

The bottles segment, accounting for 45.7% of the product type category, has established its leadership due to widespread adoption in packaging liquid pharmaceuticals and sterile solutions. Its dominance has been maintained by high compatibility with BFS systems, which allow for efficient large-scale production and reliable sealing against contamination.

The segment’s growth is supported by consistent demand for oral and ophthalmic medications packaged in bottle formats, as well as the flexibility to serve adjacent sectors such as nutraceuticals. Standardization in design and the availability of multiple volume options have improved adoption across domestic and export markets.

Continued emphasis on product integrity, combined with the operational benefits of reduced handling and faster turnaround times, is expected to sustain the strong positioning of bottles within the Korean BFS technology landscape.

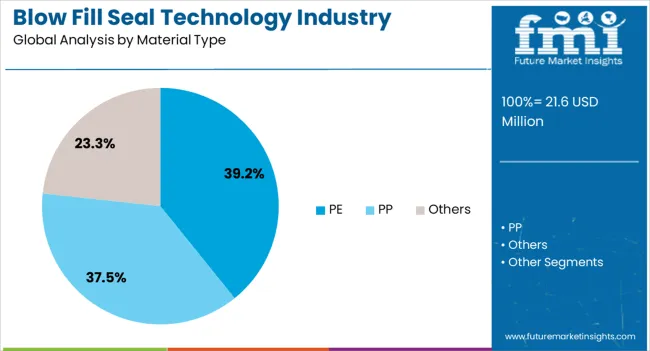

The polyethylene (PE) segment, holding 39.2% of the material type category, has emerged as the leading material due to its favorable balance of cost-effectiveness, durability, and compatibility with BFS processes. Its resilience to sterilization methods, ease of molding, and regulatory acceptance for pharmaceutical applications have reinforced its widespread use.

Demand stability has been ensured by consistent supply chains and the material’s adaptability for diverse container formats. Growth has also been supported by PE’s recyclability and alignment with sustainability trends, which are increasingly important in Korea’s packaging regulations.

Continuous improvements in resin formulations and processing technologies are further enhancing product performance, ensuring that PE remains the preferred material choice in BFS applications.

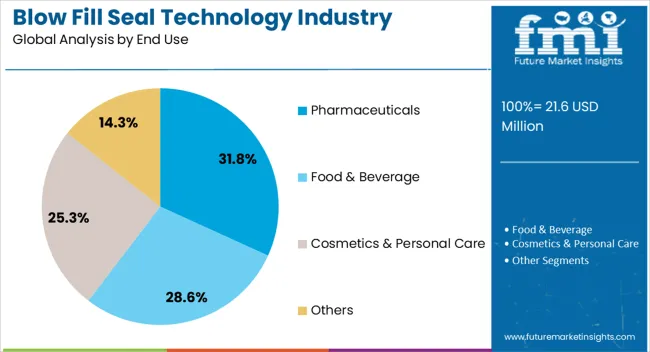

The pharmaceuticals segment, representing 31.8% of the end use category, has maintained its leading share due to Korea’s strong emphasis on healthcare quality, rising incidence of chronic diseases, and the prioritization of aseptic packaging in drug delivery. BFS technology has been widely adopted in the production of eye drops, respiratory therapies, and injectable solutions, where sterility and precision dosing are critical.

Regulatory compliance and alignment with global quality standards have reinforced adoption, while government support for domestic pharmaceutical manufacturing has strengthened industry growth. The segment benefits from consistent demand from both domestic consumption and export-oriented pharmaceutical companies.

Over the forecast period, increased investment in biologics, generics, and personalized medicine is expected to further consolidate the dominance of pharmaceuticals as the primary driver of BFS technology utilization in Korea.

The demand outlook for BFS technology in Korea suggests that polyethylene (PE) is widely preferred, accounting for 60.6% of industry share in 2025. PE's malleability makes it ideal for the complicated molding procedures required in BFS technology. Its ability to be molded into various container forms meets the diverse packaging needs of pharmaceutical products, facilitating flexibility and customization in the manufacturing process.

| Leading Material for Blow Fill Seal (BFS) Technology in Korea | PE |

|---|---|

| Total Value Share (2025) | 60.6% |

The lightweight qualities of PE lead to easier handling and lower transportation costs. Its user-friendly features improve operational efficiency and logistical ease, meeting the demands of standardized supply chain management. Furthermore, many types of PE materials are recyclable, aligning with Korea’s sustainability aims and regulatory requirements for environmentally friendly packaging solutions. This characteristic promotes PE in the BFS technology industry as a sustainable and compliant choice that meets growing environmental criteria.

The demand outlook for BFS technology in Korea indicates that pharmaceuticals are the leading end use and captures 97.6% of the industry shares in 2025. The adaptability of BFS technology to meet the demands of the pharmaceutical sector for customized packaging solutions, including variable container sizes, shapes, and volumes, illustrates its versatility. This adaptability is crucial in addressing the diverse needs of the pharmaceutical industry.

| Leading End Use for Blow Fill Seal (BFS) Technology in Korea | Pharmaceuticals |

|---|---|

| Total Value Share (2025) | 97.6% |

The booming pharmaceutical industry in Korea is experiencing an enormous spike in demand for a wide range of pharmaceutical products. The potential of BFS technology to effectively handle this expanding demand, including the manufacturing of over-the-counter and prescription pharmaceuticals, positions it as an invaluable tool for the industry's expansion goals.

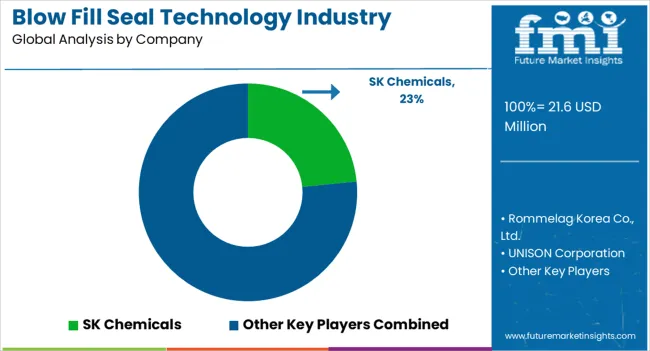

The competitive landscape of the blow fill seal (BFS) technology industry in Korea is characterized by a mix of international leaders, regional rivals, and adept innovators. Quality, regulatory compliance, and innovation are critical, and firms that excel in these areas are likely to prosper in Korea's competitive pharmaceutical packaging industry. Companies are increasingly focusing on sustainable materials and packaging solutions, which give them a competitive advantage. Sustainability fits with global trends and environmental laws, giving Korea’s eco-friendly BFS providers a competitive edge.

Strategies for Key Players to Tap into Potential Growth Opportunities

Recent Developments Observed in Blow Fill Seal (BFS) Technology in Korea

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 21.6 million |

| Projected Industry Size by 2035 | USD 46.6 million |

| Anticipated CAGR between 2025 to 2035 | 8.0% CAGR |

| Historical Analysis of Demand for Blow Fill Seal (BFS) Technology in Korea | 2020 to 2025 |

| Demand Forecast for Blow Fill Seal (BFS) Technology in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Blow Fill Seal (BFS) Technology Adoption in Korea, Insights on Global Players and their Industry Strategy in Korea, Ecosystem Analysis of Local and Regional Korean Manufacturers |

| Key Cities Analyzed While Studying Opportunities in Blow Fill Seal (BFS) Technology in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

| Key Companies Profiled | SK Chemicals; Rommelag Korea Co., Ltd.; UNISON Corporation; SHINJIN KOREA CO., LTD.; Korea BFS Co., Ltd.; KORIL; Hanmi Pharmaceutical Co., Ltd.; HANWHA Corporation; Kanglim Co., Ltd.; DAIHAN Pharmaceutical Co., Ltd. |

The global blow fill seal technology industry analysis in korea is estimated to be valued at USD 21.6 million in 2025.

The market size for the blow fill seal technology industry analysis in korea is projected to reach USD 46.6 million by 2035.

The blow fill seal technology industry analysis in korea is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in blow fill seal technology industry analysis in korea are bottles, 0.2 to 100 ml, 100 to 500 ml, above 500 ml, ampules, 0.1 to 10 ml, 10 to 100 ml, vials, 0.1 to 10 ml, 10 ml to 50 ml and others (prefilled syringes & injectables).

In terms of material type, pe segment to command 39.2% share in the blow fill seal technology industry analysis in korea in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Blow Molded Bottles Market Size, Share & Forecast 2025 to 2035

Blow-Off Valves Market Growth – Trends & Forecast 2025 to 2035

Blow Molded Plastic Market by Molding Type from 2024 to 2034

Blowout Preventers Market

Blowing Torch Market Analysis - Size, Share, and Forecast 2025 to 2035

Blow Molding Resin Market Growth – Trends & Forecast 2024-2034

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Blown Film Extrusion Machine Market Size and Share Forecast Outlook 2025 to 2035

Blow Moulded Plastic Packaging Market

Industry Share & Competitive Positioning in Blowing Torch Industry

Leading Providers & Market Share in Blow Molded Plastic

Key Players & Market Share in Blown Film Extrusion Machine Market

Blow-fill-seal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blow Fill Seal Technology Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Blow-Fill-Seal Technology Industry

Blow Fill Seal Technology Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA