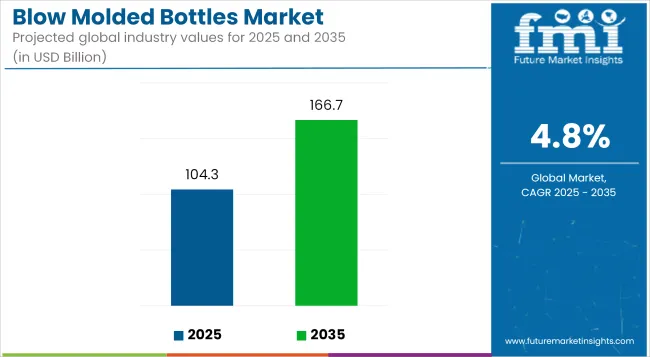

The blow molded bottles market is projected to grow from USD 104.3 billion in 2025 to USD 166.7 billion by 2035, registering a CAGR of 4.8% during the forecast period. This growth is driven by the increasing demand for lightweight, durable, and cost-effective packaging solutions across various industries, including food and beverages, pharmaceuticals, and personal care.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 104.3 billion |

| Industry Value (2035F) | USD 166.7 billion |

| CAGR (2025 to 2035) | 4.8% |

Technological advancements in blow molding processes, such as extrusion blow molding and injection stretch blow molding, have enhanced production efficiency and product quality. Additionally, the rising consumer preference for sustainable packaging options has led to innovations in recyclable and biodegradable materials, further propelling market expansion.

In 2023, Kautex Maschinenbau, one of the world's leading pioneers of sustainable innovations in the blow molding industry, will focus on final plastic products of highest quality at Chinaplas 2023. he booth is a clear visual statement of the "Final Plastic Product" philosophy of Kautex.

“For us, the plastic product of highest quality of our customers is in the foreground, not the producing machine," explains Geoffrey Chan, CEO, Kautex Asia. "We are aware that we are taking a different approach here as expected of a machine manufacturer. But we are convinced: First, we must talk about our customers' product in order to then talk about the production solution.

Only by understanding our customers’ real needs and product, we can satisfy them sustainably and in the long term. Furthermore, we act in accordance with our corporate vision, philosophy and mission. With the final customer product of highest quality at the center, we create leading change and added value.”

The global blow molded bottles market is characterized by diverse material applications, with polyethylene terephthalate (PET) being the most widely used due to its excellent barrier properties and recyclability. High-density polyethylene (HDPE) and polypropylene (PP) are also prevalent, offering strength and chemical resistance suitable for various applications.

The market is segmented based on capacity, material type, application, and production method. Smaller capacities, such as below 100 ml, are commonly used for personal care products, while larger capacities, above 500 ml, are prevalent in the food and beverage industry.

The growing consumer preference for eco-friendly packaging has led to the development of recyclable and biodegradable plastic bottles. Companies are increasingly adopting recycled polyethylene terephthalate (rPET) and bio-based resins to reduce their environmental footprint.

Technological advancements, such as automation systems in blow molding techniques, have led to smart manufacturing, enhancing production efficiency and product quality. These innovations enable manufacturers to meet the rising demand for customizable, high-performance products while adhering to stringent environmental regulations.

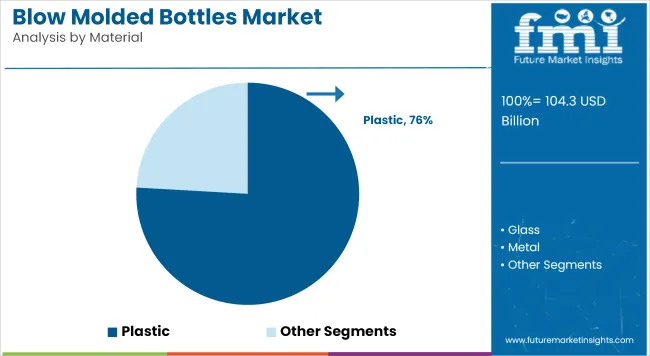

The market is segmented based on capacity, material, end-use application, and region. By capacity, the market includes below 100 ML, 100 to 500 ML, and above 500 ML bottles. In terms of material, the market is categorized into plastic, glass, metal, and other materials.

By end-use application, the market comprises pharmaceuticals, food & beverage, cosmetics & personal care, homecare, and others including chemicals. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Bottles in the 100 to 500 milliliters range are projected to account for 47.6% of the blow molded bottles market by 2025, driven by their widespread use across personal care, household, and food & beverage sectors. These mid-sized formats strike an ideal balance between volume efficiency and consumer convenience.

Lightweight and structurally stable, these bottles are often manufactured using extrusion or stretch blow molding for high-speed production and precision. Brands have favored this range for single-use drinks, shampoos, detergents, and condiments.

Customization in shapes and closures, coupled with compatibility with shrink sleeves and in-mold labeling, has made them ideal for brand marketing. Regulatory shifts toward lightweighting and extended producer responsibility (EPR) laws have spurred demand for sustainable 100-500 ML formats, often incorporating recycled PET or HDPE.

Plastic bottles are expected to command over 75.9% of the market share in 2025, owing to their flexibility, durability, and cost-effectiveness in mass production. High-density polyethylene (HDPE), polyethylene terephthalate (PET), and polypropylene (PP) dominate usage across food, cosmetics, and cleaning products. Innovations such as multi-layer co-extrusion, tethered caps, and mono-material packaging have enhanced recyclability and product protection.

Global consumer goods companies have set aggressive goals to shift toward post-consumer recycled (PCR) content, pushing blow molders to adopt closed-loop manufacturing systems. Plastic bottles remain integral to circular economy strategies, with partnerships formed across collection, sorting, and reprocessing networks. Lightweighting initiatives and bio-based resins are also being deployed to meet carbon footprint targets.

Environmental Concerns and Sustainability Regulations

There is growing scrutiny of the blow molded bottles market in regards to environmental issues pertaining to plastic waste and recycling. With increasing regulations globally on single-use plastics, manufacturers are being pushed towards sustainability. The compliance with these regulations escalates the production expenses and demands investments in the different materials (like biodegradable and recyclable plastics) to sustain in the market.

Fluctuating Raw Material Costs

Raw material pricing is very volatile especially for petroleum-based plastics, which significantly affect production costs for blow molded bottle manufacturing companies. Cost predictability and profit margins present challenge due to supply chain disruptions, geopolitical instability and dynamic crude oil price. Manufacturers will have to look for cost-effective material alternatives or optimize production efficiencies to reduce such risks.

Growing Demand for Eco-Friendly Packaging Solutions

Sustainable best practice in blow molded bottles, as the entire industry is moving towards sustainability and we are all dedicated to make the world a better place, the versatility of the blow molding process is remarkable with its ability to produce all types of plastic products in a sustainable way.

Packaging: Towards recycled PET or biodegradable plastics or plant-based resins companies that invest in green technologies and closed-loop recycling systems early will have a competitive advantage in tomorrow's packaging landscape.

Expanding Applications in Emerging Industries

Growing importance of blow molded bottles in different industries such as pharmaceuticals, personal care, food and beverages, and household chemicals is expected to boost their demand during the forecast period. In an ever-evolving e-commerce landscape, there is an increasing requirement for durable, lightweight, and tamper-proof packaging. Since technology has improved, manufacturers will have extensive options for creating customized and innovative bottles.

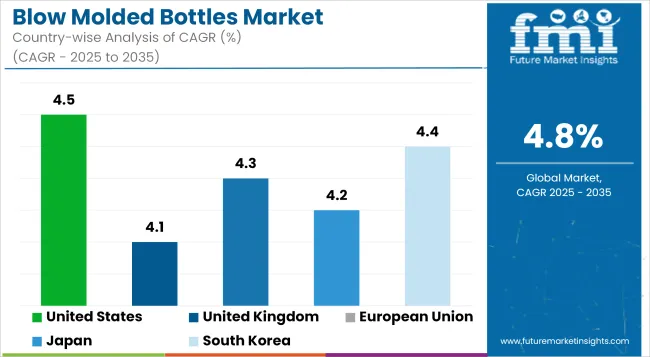

The United States blow molded bottles market is driven by the growing demand for lightweight, durable, and cost-effective packaging solutions in various industries, such as food & beverages, pharmaceuticals, and personal care. The growing retail industry and evolving consumer preference in the country toward easy to use and recyclable packaging drive the market in the estimated period.

Also, strict regulations on single-use plastics have made it mandatory for manufacturers to look for sustainable alternatives like biodegradable and recycled plastic bottles. The country is expected to maintain its position as one of the most lucrative End user for blow molded bottles as continuous development of molding processes and increasing investments in sustainable packaging solutions are undertaking within the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

Demand for bottle molding in the UK is growing, owing growth in eco-friendly packaging restrictions by the UK government on plastic waste and increasing consumer awareness of sustainable packaging have driven the shift towards recycled and bio-based plastic bottles.

The rise of the beverage and personal care industries is equally important in driving demand. Additionally, lightweight and high-barrier packaging solutions revolutionizing manufacturers to meet changing market demands are making the UK a major player in this field.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The largest market for blow molded bottles in Europe was held by the countries of Germany, France, and Italy which remain dominant globally. Stringent packaging waste directives and circular economy initiatives drive manufacturers across the region to spend on sustainable materials and advanced blow molding technologies.

Also, growth is being driven by the increasing utilization of PET and HDPE bottles in food, beverage and pharmaceutical industries. Manufacturers are increasingly adopting lightweight packaging materials to lower material usage and carbon footprint, which is further propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

The market Darwinism of blow molded bottles market in Japan is thriving with high demand for precision engineered and innovative packaging. There is a rich beverage industry in the region dominated by bottled tea, soft drinks, and functional beverages, all of which helped contribute to market growth in this country.

Moreover, Japan emphasizes sustainability and has an advanced recycling infrastructure, resulting in the prevalent use of recycled plastic bottles. Rising popularity for high-end and visually satisfying packaging, especially across personal care and cosmetics, is also impacting the market landscape causing innovation in bottle aesthetic designs along with implementation of offers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

The food and beverage sector, personal care sector and household product sector are the biggest end-users for the Attention to market blow molded bottles in South Korea. Because of the country’s robust technology in plastics manufacturing and packaging innovation, companies have been able to produce high-quality, light-weighted, durable bottle solutions.

Additionally, the government’s initiative for waste reduction with plastic and the growing demand for green packaging are influencing the market trends. The blow molded bottles market is projected to witness moderate growth, as companies discontinue traditional plastic bottles in favour of more sustainable and biodegradable alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The blow molded bottles market is witnessing significant growth, driven by the increasing demand for lightweight, cost-effective, and durable packaging solutions across various industries. Blow molding technology enables the production of bottles with high strength, flexibility, and resistance to breakage, making them ideal for applications in food & beverages, pharmaceuticals, personal care, and household products.

Additionally, the growing emphasis on sustainable packaging and the rising adoption of recycled and biodegradable plastics are further fueling market expansion. Advancements in blow molding techniques, such as extrusion, injection, and stretch blow molding, are improving production efficiency and customization options, catering to diverse industry needs.

Other Key Players

The overall market size for the blow molded bottles market was USD 104.3 billion in 2025.

The blow molded bottles market is expected to reach USD 166.7 billion in 2035.

The blow molded bottles market is expected to grow at a CAGR of 4.8% during the forecast period.

The demand for the blow molded bottles market will be driven by the growing demand for lightweight and durable packaging solutions, increasing use of plastic bottles in the food and beverage industry, rising adoption of sustainable and recyclable materials, expanding pharmaceutical packaging needs, and technological advancements in blow molding techniques.

The top five countries driving the development of the blow molded bottles market are the USA, China, India, Germany, and Brazil.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Blown oils Market Size and Share Forecast Outlook 2025 to 2035

Blow Fill Seal Technology Market Size and Share Forecast Outlook 2025 to 2035

Blow-fill-seal Equipment Market Size and Share Forecast Outlook 2025 to 2035

Blow Fill Seal Technology Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Blow Fill Seal Technology Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Blown Film Extrusion Machine Market Size and Share Forecast Outlook 2025 to 2035

Blowing Torch Market Analysis - Size, Share, and Forecast 2025 to 2035

Blow-Off Valves Market Growth – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Blowing Torch Industry

Key Players & Market Share in the Blow-Fill-Seal Technology Industry

Key Players & Market Share in Blown Film Extrusion Machine Market

Blow Molding Resin Market Growth – Trends & Forecast 2024-2034

Japan Blow Fill Seal Technology Market Insights – Growth & Forecast 2023-2033

Blow Moulded Plastic Packaging Market

Blowout Preventers Market

Leading Providers & Market Share in Blow Molded Plastic

Blow Molded Plastic Market by Molding Type from 2024 to 2034

Wall Blower Market Size and Share Forecast Outlook 2025 to 2035

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA