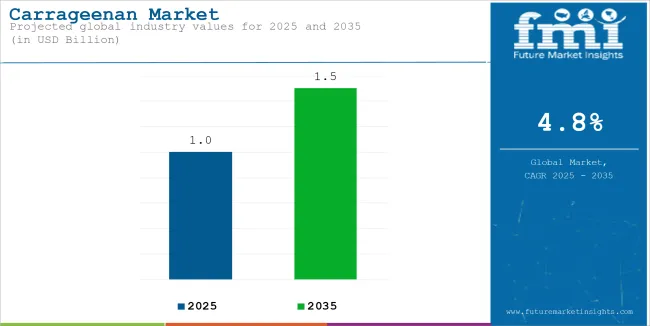

The global carrageenan market is estimated to account for USD 1 billion in 2025. It is anticipated to grow at a CAGR of 4.8% during the assessment period and reach a value of USD 1.5 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Carrageenan Market Size (2025E) | USD 1 billion |

| Projected Global Carrageenan Market Value (2035F) | USD 1.5 billion |

| Value-based CAGR (2025 to 2035) | 4.8% |

Carrageenan is a natural thickening and gelling agent derived from red seaweed. It has been used for centuries in various cuisines, particularly in Asian dishes, to improve the texture and consistency of foods. This agent is popular in products such as dairy, desserts, sauces, and plant-based alternatives due to its ability to stabilize and emulsify ingredients.

This seaweed extract is valued for its broad range of uses and is often seen as a healthier option compared to synthetic additives. With its natural origins and functional properties, carrageenan plays an important role in both food production and the cosmetic industry.

Good Gelling Attributes of Kappa to Boost its Adoption

| Attributes | Details |

|---|---|

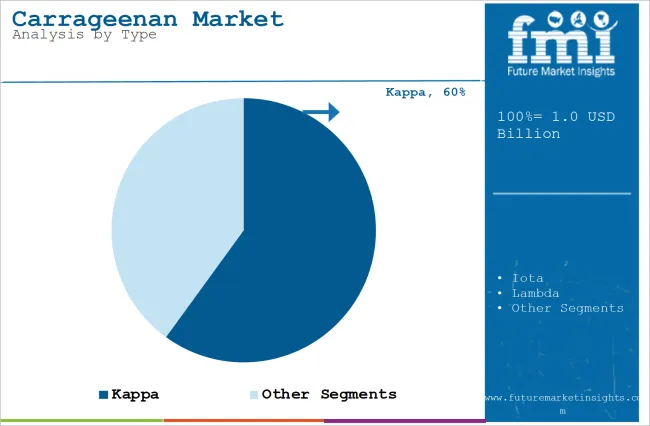

| Top Type | Kappa |

| Market Share in 2025 | 60% |

By type, the market is divided into iota, kappa, and lambda. The kappa segment is poised to hold 60% share in 2025 owing to its good gelling properties. It is widely used in food products such as dairy, desserts, and meat substitutes because it creates a firm texture that is enjoyed by users. Additionally, kappa carrageenan works well with other ingredients, making it useful for various applications.

Its ability to form gels when mixed with potassium salts is highly valued in the food industry. As a result, many manufacturers prefer kappa type carrageenan for its effectiveness and reliability, leading to its significant market share.

Eco-friendly Property of Unprocessed Carrageenan to Foster Uptake

| Attributes | Details |

|---|---|

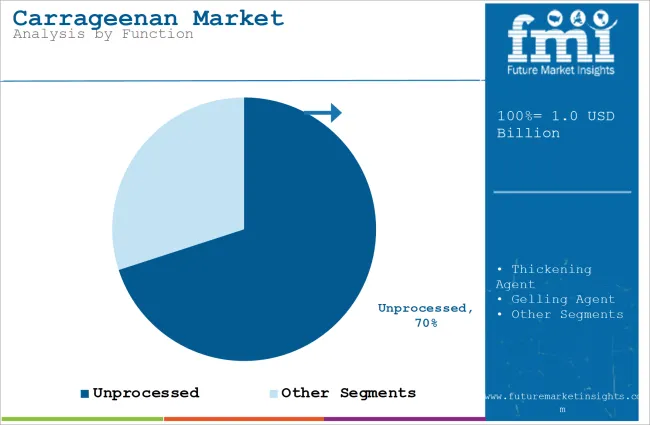

| Top Function | Unprocessed |

| Market Share in 2025 | 70% |

By function, the market is divided into thickening agent, gelling agent, stabilizer, and other functions. The unprocessed segment is anticipated to register 70% share in 2025. It is generally cheaper to produce than refined versions, hence it is preferred by manufacturers looking to cut costs. Many consumers also prefer unprocessed ingredients because they are seen as more natural and less altered, which aligns with the demand for clean-label products.

Additionally, unprocessed carrageenan is versatile and can be used in various applications, from food to cosmetics, providing the necessary thickening and stabilizing properties without further processing. Moreover, unprocessed carrageenan is often viewed as a more eco-friendly option, requiring fewer resources and processing steps. These factors contribute to its dominant position in the market.

Retention of More Natural Components in Semi-refined Technology to Impel its Use

In terms of processing technology, the market is segmented into alcohol precipitation, semi-refined, and others. The semi-refined technology is being widely used for processing carrageenan owing to its ability to retain more natural components present in the seaweed. Additionally, less chemical treatment is required in this process, making it more eco-friendly as compared to its counterparts. It has also garnered much more attention in food applications, including plant-based substitutes, dairy products, and others.

Wide Usage of the Product in Food & Beverages Industry to Augment Sales

Based on end use, the market is divided into pharmaceuticals, personal care & cosmetics, food & beverages, and other end uses. The product is being widely used in the food & beverages industry owing to its stabilizing and gelling properties. Additionally, it has a common usage in dairy products, processed items, plant-based substitutes, and more. It enhances the consistency and texture of food items and improves shelf life.

The pricing dynamics of the market are influenced by various factors, including raw material costs, packaging, distribution channels, and product segmentation. With a wide range of offerings from budget-friendly to premium, pricing plays a critical role in determining consumer choice and market competitiveness.

| Product Type | Price Range (per kg) |

|---|---|

| Refined Carrageenan | USD 10 to USD 25 |

| Semi-refined Carrageenan | USD 8 to USD 20 |

| Kappa Carrageenan | USD 15 to USD 30 |

| Iota Carrageenan | USD 20 to USD 35 |

| Lambda Carrageenan | USD 18 to USD 40 |

In the carrageenan market, prices vary widely based on the type and grade of the product. Refined carrageenan is the most expensive, costing between USD 10 and USD 25 per kilogram. This higher price is due to its purity and its use in premium applications such as high-end food products and cosmetics. On the other hand, semi-refined carrageenan is more affordable, priced between USD 8 and USD 20 per kilogram, and is typically used in industrial applications such as processed foods and pet foods.

Kappa carrageenan, known for its strong gelling properties, ranges from USD 15 to USD 30 per kilogram. In contrast, iota carrageenan, which produces a softer gel, is priced higher at USD 20 to USD 35 per kilogram. The most expensive option, lambda carrageenan, is used in specific applications such as beverages and dairy products, with prices ranging from USD 18 to USD 40 per kilogram.

These pricing trends reflect a growing demand for specialized carrageenan products, as both consumers and manufacturers prioritize quality, natural ingredients, and sustainability. The differences in price among various grades and types are influenced by factors such as raw material quality, production processes, and intended uses.

Environmental concerns and regulations regarding carrageenan extraction also play a role in pricing strategies. As the market evolves, companies are looking for cost-effective sourcing options and improving production techniques to meet regional demand. Competition among suppliers is expected to lead to price fluctuations and innovation in the industry.

Understanding these pricing dynamics is essential for businesses to optimize their market positioning and identify potential growth opportunities across diverse markets.

| Year | Export Data (in USD Million) (Philippines) |

|---|---|

| 2021 | 560 |

| 2022 | 580 |

| 2023 | 600 |

| 2024 | 620 |

| 2025 | 640 |

The carrageenan market has experienced steady growth in export and import activities in recent years. Countries such as the Philippines, China, and Indonesia are the top exporters, with their exports increasing from 2021 to 2025. This growth is mainly driven by the demand for carrageenan as a food additive and its use in pharmaceuticals and cosmetics. These countries have strong production facilities, allowing them to meet global demand as carrageenan applications expand.

On the import side, the USA, Vietnam, and several European nations are the leading importers. Their import data shows consistent growth from 2021 to 2025, reflecting a rising need for carrageenan in food processing, personal care, and nutraceuticals.

This growth indicates that more consumers prefer natural and plant-based ingredients. Overall, the ongoing trade between major exporters and importers shows that the global carrageenan market is strong and well-distributed across different regions.

Rising Demand for Plant-Based and Vegan Products to Expedite Growth

As more people choose plant-based and vegan diets, carrageenan has become a popular ingredient. This plant-derived thickening and gelling agent is widely used in vegan dairy alternatives, such as plant-based milks, yogurts, and cheeses. It is also found in meat substitutes, as it can mimic the texture of animal-based products without using any animal ingredients. This shift in consumer preferences is driving the demand for carrageenan in various food products.

Growing Applications in the Food & Beverage Industry to Bolster Demand

Carrageenan is widely used in the food and beverage industry for its properties as a stabilizer, emulsifier, and gelling agent. It enhances the texture and shelf life of many products, including dairy items, sauces, dressings, ice creams, and beverages. With a growing consumer preference for clean-label products, carrageenan is favored for its natural origin and functional benefits. Additionally, it is increasingly used in health-focused products, as more consumers seek foods that offer nutritional advantages, such as digestive health support.

Safety Issues May Hamper Demand

Despite carrageenan's widespread use, there are ongoing debates and concerns about its safety, especially in food products. Some studies suggest that degraded carrageenan, which can occur during processing, may cause gastrointestinal inflammation and other health issues. As a result, health-conscious consumers are becoming more cautious about consuming products containing carrageenan.

This growing awareness is prompting some manufacturers to explore alternatives or remove carrageenan from their products. Such concerns can limit market growth, particularly in regions with stricter food safety regulations and a strong focus on natural or organic ingredients.

Eco-friendly Sourcing

There is a rising inclination toward sustainability owing to the increasing awareness of environmental impact. Manufacturers are emphasizing sustainable and eco-friendly sourcing of seaweed, which is the major raw material for carrageenan. Additionally, the market is witnessing efforts to enhance harvesting methods, ensure ethical sourcing, and decrease carbon footprint of production.

Consumer Trend

There is a growing trend toward plant-based and natural ingredients in food, beverages, and personal care products. As people become more health-conscious and environmentally aware, they prefer products that are seen as natural, sustainable, and free from artificial additives. Carrageenan, derived from seaweed, fits perfectly into this trend, serving as a natural thickening agent, stabilizer, and emulsifier in many applications.

The growing demand for plant-based foods, especially dairy alternatives, vegan snacks, and clean-label products, is driving the use of carrageenan. This allows manufacturers to meet consumer desires for transparency, health, and sustainability. Together, these factors highlight the importance of eco-friendly practices and natural ingredients in shaping the future of the market.

India

India is slated to grow at the highest CAGR of 10.3% during the forecast period. The carrageenan market in the country is growing due to increased demand for processed and convenience foods. As the food industry develops, there is a rising preference for products with better texture, consistency, and shelf life, which carrageenan helps achieve. Its use in dairy, desserts, sauces, and ready-to-eat meals is expanding as urbanization drives the need for quick food options.

India’s strong agriculture sector supports local carrageenan production, making it accessible and cost-effective. With more awareness of natural food additives, carrageenan is favored over synthetic ones. Its use in cosmetics and personal care products also boosts market growth.

USA

The U.S. market is expected to grow at a CAGR of 6.5% during the forecast period. The growth of plant-based food products is fueling the market expansion in the country. More consumers are adopting plant-based diets and seeking vegan alternatives, making carrageenan an important ingredient for improving the texture of dairy substitutes such as almond milk and soy yogurt.

The rising interest in functional foods, which offer added nutritional benefits, is also increasing carrageenan's popularity. Additionally, carrageenan is used in the cosmetics and personal care sectors for its stabilizing properties in skincare products and shampoos, contributing to its broader market presence across various industries.

UK

Health-conscious eating and the popularity of functional foods in the U.K. are driving the growth of the market. Functional foods, which provide additional health benefits such as digestive support, often use carrageenan to enhance texture and mouthfeel.

As consumers become more aware of the benefits of natural ingredients, the product is being increasingly adopted in food and non-food industries, including cosmetics and personal care products. This shift toward eco-friendly and clean-label solutions is expected to continue boosting the demand for the product in the U.K., reflecting changing consumer preferences.

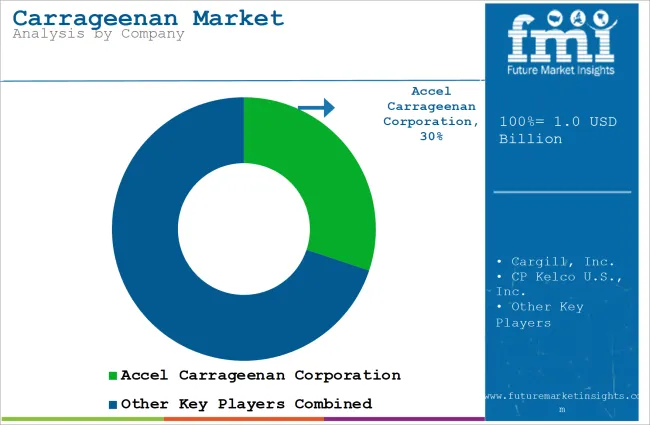

The competitive landscape of the carrageenan market features several key players competing through partnerships, product variety, and innovation. Major companies include CP Kelco, Ingredion Incorporated, DuPont, TIC Gums, and Gelymar. These companies invest heavily in research and development to enhance the quality and use of carrageenan, helping them stay ahead in the market. They are also focusing on sustainable sourcing and production to meet the growing demand for eco-friendly products.

To expand their reach, these companies diversify their product lines, offering different grades of carrageenan for various uses, such as food, pharmaceuticals, and personal care. In addition to innovation, they strengthen their distribution networks and explore emerging markets, particularly in Asia Pacific and Latin America, where demand for carrageenan is rising. Many companies pursue growth through mergers, acquisitions, and partnerships with local distributors.

For example, CP Kelco collaborates with regional suppliers to improve its supply chain in developing countries, while Ingredion makes strategic acquisitions to enter new food and beverage categories. These strategies help companies enhance their competitive position and adapt to changing market needs and regulations effectively.

Many innovative startups are entering the market with an emphasis on product innovation and sustainability, serving niche consumer demands. Some of the key companies include Innofood Innovations, Sambavan Biotech, and others. These companies are focusing on new applications of the product, specifically in cosmetics, pharmaceuticals, and food sectors by determining its potential as a natural gelling and thickening agent. Moreover, Sambavan Biotech is focusing on the production of the product using environmentally sustainable processes and Soluble Solutions emphasizes creating formulations for plant-based food substitutes.

By type, the market is segmented into kappa, iota, and lambda.

By function, the market is segmented into thickening agent, gelling agent, stabilizer, and other functions.

By processing technology, the market is segmented into semi-refined, alcohol precipitation, and others.

By end use, the market is segmented into food & beverages, personal care & cosmetics, pharmaceuticals, and other end uses.

By region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The market is slated to reach USD 1 billion in 2025.

The market is predicted to reach a size of USD 1.5 billion by 2035.

Some of the key companies manufacturing carrageenan are Accel Carrageenan Corporation, Cargill, Inc., CP Kelco U.S., Inc., DuPont Nutrition & Health, and others.

Asia Pacific is a prominent hub for carrageenan manufacturers.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Function, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Function, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Function, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Function, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Function, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Function, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Function, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Function, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Function, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Function, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Function, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Function, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Function, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Function, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Function, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Function, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Function, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Function, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Function, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Function, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Function, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Function, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Carrageenan Gum Market Share & Growth Drivers

Market Share Distribution Among Carrageenan Film Manufacturers

Carrageenan Film Market Analysis – Growth, Applications & Outlook 2025-2035

Carrageenan Gum Market Analysis – Trends & Forecast 2025-2035

UK Carrageenan Gum Market Trends – Size, Demand & Growth 2025-2035

Comprehensive Overview Carrageenan Gum Industry: Sales Outlook, Growth Factor, Exploring New Opportunities, Application, Development of Food & Beverage Sector

Comprehensive Analysis Europe Carrageenan Gum Industry: Sales Outlook, Exploring New Opportunity, Application, Development of Food & Beverage Sector

Analysis and Growth Projections for Food Grade Carrageenan Market

Deep Dive into the Asia Pacific Carrageenan Gum Market: Asian Demand Trends, Growth Catalysts, Innovation Potential, and Food & Beverage Advancements

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA