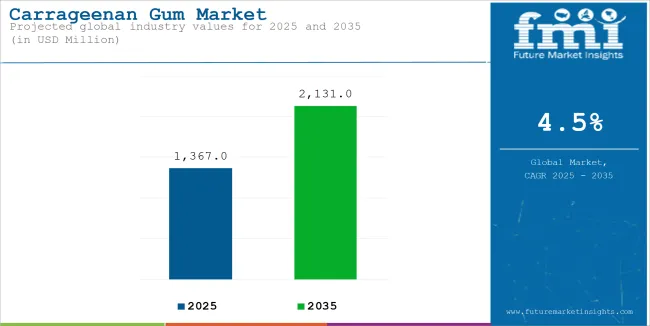

The Carrageenan Gum Industry is estimated to be worth USD 1,367 million by 2025 and is projected to reach a value of USD 2,131 million by 2035, reflecting CAGR of 4.5% over the assessment period 2025 to 2035.

The Carrageenan gum industry is growing very fast and witnessing impressive growth, particularly due to the rising demand for natural and plant-based elements in various sectors like as personal care, pharmaceuticals, food and beverages. As market focus more on sustainable, clean-label products, carrageenan gum from red seaweed is becoming popular for its gelling and stabilizing properties.

In countries like Europe and America, people are more concerned about maintaining their health. In such countries, natural ingredients like carrageenan are being used more.

Manufacturers are using a carrageenan to meet the needs of consumers by obtaining raw materials in a transparent and appropriate manner as per their wishes. This substance improves the texture of food and can be stored well for a long time. The use of organic and eco-conscious friendly substances is increasing in the production of cosmetics and medicines.

This also helps in the economic growth of the country. Carrageenan is a very useful and natural substance. People are now coming to know about the health benefits of carrageenan and its benefits for the environment. For all these reasons, the use of carrageenan will increase in the future and its business will spread all over the world.

| Attributes | Description |

|---|---|

| Estimated Carrageenan Gum Industry size (2025E) | USD 1,367 million |

| Projected Carrageenan Gum Industry value (2035F) | USD 2,131 million |

| Value-based CAGR (2025 to 2035) | 4.5% |

Rising Demand For Processed Food

Processed food companies are growing promptly as consumer demand foods that are convenient to prepare, ready to eat immediately, and can be stored for long periods of time. People prefer foods that contain natural ingredients and are good for the environment. CP Kelco is a famous company that manufactures carrageenan gum. This company shows that people are starting to eat more processed foods.

The company offers high-quality carrageenan, which is a very useful ingredient. It is used in making jellies, thickening and stabilizing foods. CP Kelco carrageenan is added to foods like milk, beverages and meat. All these foods are an important part of the processed food market. People are now increasingly choosing ready-made foods and foods that are easy to eat. CP Kelco is ready to meet the growing demand for such excellent ingredients.

Gelymar, a key supplier of carrageenan, helps meet the growing demand for processed foods. As more people choose convenience and prepared foods, Gelymar carrageenan is used to improve the texture, stability and shelf life of foods such as dairy products, desserts and meats. By providing high-quality ingredients, Gelymar helps grow the processed food market and ensures that products maintain their desired texture and quality.

The American company FMC makes carrageenan, which is used to make food last longer, look better, and taste better. They make three types of carrageenan: kappa for milk and meat, lota for ice cream and desserts, and lambda for drinks, sauces, and milk. As people in North America eat more processed foods, this carrageenan helps make food easier to prepare and keep longer.

Growth Of Personal Care and Toiletries

Carrageenan is an substantial ingredient in personal care and products because it helps to thicken, hydrate, and stabilize. It maintain the skin moisturized, reduces inflammation, and increases the effectiveness of products.

As a result of the growing demand for natural and sustainable products, especially in regions such as Asia pacific, Europe, and North America where user are more curious in the advantage of natural skincare, carrageenan-based products have become more popular. In North America and Europe market, it is well-liked with eco friendly consumers, while in the Asia-Pacific region, it helps to create lower-cost products.

W Hydrocolloids, Inc. exert carrageenan in personal care products like skin creams and shampoos, where it performs as a natural thickener and stabilizer. Carrageenan helps keep the skin hydrating, reduces swelling, and increases the effectualness of products .Regions like North America, Europe, and Asia Pacific where people place more importance on natural skin care products, the demand for carrageenan-based products is increasing.

Innovation and Advancement In the industry

Carrageenan gum is increasingly being utilized in innovative products to cater to the growing demand for natural, sustainable, and functional ingredients. TIC Gums is a dominant in the carrageenan gum market, give innovative solutions that are used in a wide range of industries. They are proficient in gum technology and have developed blends of carrageenan with other ingredients such as agar and guar gum, which improve the texture and stability of the product.

Their flagship product is TIC Pretested® Carrageenan, which is specifically formulated for milk and milk alternative products, providing superior gelation and viscosity control.

The company also focuses on clean-label products, which meet consumer demands for transparency and sustainability. TIC Gums is self-sustaining, providing innovative solutions and making further progress in various industries.

Ashland, famous for manufactures proficient chemicals and materials, focuses on sustainability with its SeaGel™ product. It is a natural gelling in industries such as food, beverage, and personal care. Using this product enhances the taste and quality of products. Ashland sources materials from sources that are environmentally friendly and minimizes the environmental impact of its production. With its focus on sustainability and research, the company provides effective and innovative solutions that meet the needs of its customers.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.6% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 5.7% |

| H2 (2025 to 2035) | 6.5% |

The carrageenan gum arena is anticipated to grow steadily, showcasing notable half-yearly compound annual growth rates (CAGR) From 2024 to 2034, H1 is expected to grow at 4.6%, while H2 demonstrates a slightly higher growth rate of 5.6%. Moving to the 2025 to 2035 period, H1 is projected to grow at 5.7%, with H2 reflecting a higher growth rate of 6.5%

Between 2020 and 2024 the world-wide carrageenan gum sector experienced steady growth. It was generally used in food, beauty products, and pharmaceuticals. During this period, the necessity for natural gelling and thickening agents increased. However, still did not grow rapidly, as many alternatives were available. Nevertheless, carrageenan gum remained a strong position in the region where demand for plant-based and clean-label products was increasing.

From 2025 to 2035, the growth of carrageenan gum will increase, as the demand for natural and sustainable materials increases in several sectors. New uses and formulations in products will make carrageenan gum more popular, especially due to the rise of plant-based foods and clean label trends.

Carrageenan gum is expected to grow further, especially in the second half of this period, due to its increasing use in food, pharmaceuticals, and personal care products. With a CAGR of 5.7% in the first half of 2025 to 2035 and a CAGR of 6.5% in the second half, the carrageenan gum sector is poised for strong growth, which could offer more opportunities for manufacturers and suppliers in the coming decade.

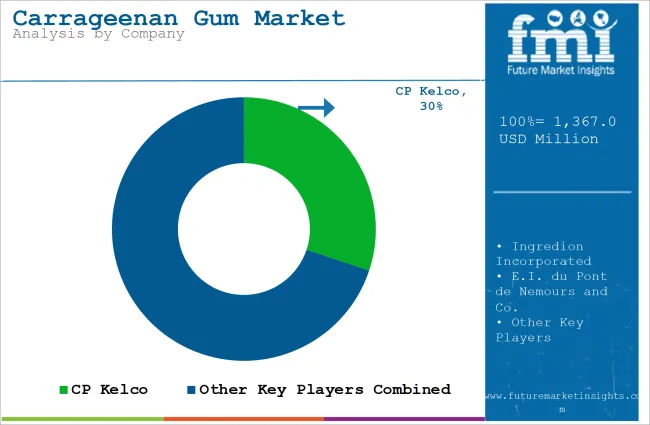

The carrageenan gum industry is growing rapidly. The reason, People want natural and sustainable products in food, beauty products, and medicine. Large companies such as CP Calco, Gelymar, and FMC Corporation are leading this arena. They have money, a good research and development team, and a good supply chain. This makes them perform well in the segment everywhere.

More people are choosing plant-based and natural products. This has conduct to an increase in the demand for carrageenan, Particularly, in the Europe, Asia and USA market. Carrageenan is a type of glue that thickens and stabilizes food.

Companies are also creating new types of carrageenan products. For example, TIC gums are blend with other ingredients to produce carrageenan, which improves the texture and stability of the product. This shows that the industry is moving to with regard more sustainable and efficient ingredients.

Throughout to next ten years, the carrageenan market is expected to grow at a rate of 4.5%. This growth will be seen increased in the USA, India and UK market. Because people are becoming more aware of the benefits of natural ingredients.

The American food industry is projected to grow at a rate of 7.7% yearly from 2025 and 2035. This growth is elementally procure by the expanding demand for natural and clean-labeled food products. Carrageenan used in health-given and natural foods, such as plant-based, dairy-free, and organic foods. These foods are nutritious and natural. These mirrors are used in food, beverages, and plant-based alternatives.

This healthy and natural product is a choice for the young and health conscious. Carrageenan is added with whey protein, soy protein, almond milk and coconut milk. Carrageenan products help enhance the quality of food, extend its ledge, and make it safe for people with allergies. Most carrageenan products are available online and in health food stores, and e-commerce is also growing rapidly.

Prominent American players like Cargill, Incorporated, and Kemin Industries are using robust R&D capacities and distribution systems to serve both local and international markets. Consumers now prefer products that are healthy, sustainable, and have clean labels, driving the demand for carrageenan.

The United Kingdom is now forming new agreements and partnerships so that it can trade more goods around the world. As such, the UK is strengthening its trade with other countries and trying to create a new environment, with a CAGR of 7.8% CAGR during 2025 to 2035. Key The exchange benefits from improved supply chains and offers global trade opportunities. E-commerce is rapidly expanding alongside traditional retail, as consumers increasingly prioritize ethical sourcing, convenience, and sustainability.

In India carrageenan gum sector is expected to grow at robust CAGR of 12.0% between 2025 and 2035.The economy is driven by its convenient use in popular foods, beverages, dairy alternatives and plant-based products. Consumers are choosing carrageenan for its enhancing factors and stabilizing qualities, especially in plant-based and dairy-free foods. The target customer segment includes health-conscious people, vegans, lactose intolerant individuals and people looking for clean, sustainable ingredients.

Popular ingredients with carrageenan include peanut protein, almond milk, coconut milk and soy protein. The benefits of carrageenan include improving adhesion, improving stability and providing hypoallergenic qualities.

E-commerce, health food stores and convenience supermarkets are the most important sales channels, and are the preferred choice for clean-label products. As consumer preferences shift towards healthier and sustainable options, the demand for carrageenan in India's food sector is increasing.

| Segment | Value share (2025) |

|---|---|

| Food & Beverages | 56% |

Carrageenan gum is a natural polysaccharide, is attain popularity in the food and beverages industry for its thickening, and stabilizing, gelling properties. It is substantially used in dairy products like yogurt, processed cheese and ice cream where it helps improve texture.

This ensures that products maintain their quality throughout storage and consumption. Carrageenan offering similar benefits to traditional dairy products and similar benefits for plant-based alternatives. Additionally, it is commonly used in beverages such as smoothies and functional drinks to stabilize emulsions and maintain product consistency over time.

The rising demand clean-label products has further fueled carrageenan's use in the food sector. With an increasing demand for simple, natural ingredients, carrageenan, being naturally sourced, aligns perfectly with this trend. It is obtain popularity in organic and minimally processed foods, meeting both functional and transparency demands. These companies continue to innovate, developing versatile carrageenan products that address the evolving needs of food manufacturers, such as improving texture.

Industry of carrageenan gum mainly led by top companies like Gelymar, CP kelco and FMC Corporation, which are well-established for their many product ranges, strong research and development efforts, and global supply networks. These leaders are working to enhance the functionality, stability, and quality of carrageenan by producing more innovative, sustainable, and clean-label products.

This respond to the increasing consumer demand for natural, organic elements that are free from artificial additives. As the segment becomes more competitive, companies priority on improving extraction techniques to produce plant-based, non-GMO carrageenan that meets the increasing trends for sustainability and food safety. Additionally, businesses are heavily investing in expanding their production capacities to meet global demand while forming strategic partnerships with research organizations to enhance product development.

These investments are helping these companies stay competitive in the fast-evolving sector. With growing awareness around health and sustainability, carrageenan producers are also exploring new applications in industries like food and beverages pharmaceuticals, and personal care.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The Carrageenan Gum is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2025 and 2035, reaching an estimated value of USD 2,131 million by 2035.

The USA, UK, and India are expected to experience significant growth in the carrageenan gum market, with India projected to grow at the highest rate of 12% CAGR between 2025 and 2035.

In the food industry, carrageenan gum is used for gelling, thickening, and stabilizing in products such as dairy-free ice creams, plant-based milks (almond milk, soy milk), processed meats, and bakery items. It is also used in dairy alternatives and to improve texture and shelf life in plant-based foods.

The Carrageenan Gum industry in Europe is expected to grow at a CAGR of 4.5% from 2025 and 2035.

The Carrageenan Gum industry is experiencing significant growth in regions like North America, Europe, and Asia-Pacific, driven by the increasing demand for plant-based, clean-label, and sustainable products.

Major players include CP Kelco, Ingredion, FMC Corporation, DuPont, Gelymar, and Ashland Global Holdings. These companies are known for their strong distribution networks, innovative products, and investments in sustainable, clean-label solutions.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 02: Global Market Volume (MT) Forecast by Region, 2017 to 2032

Table 03: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 04: Global Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 05: Global Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 06: Global Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 07: Global Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 08: Global Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 09: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 12: North America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 14: North America Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 16: North America Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 20: Latin America Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 22: Latin America Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 24: Latin America Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (MT) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Europe Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 30: Europe Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 32: Europe Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: East Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 35: East Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 36: East Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 37: East Asia Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 38: East Asia Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 39: East Asia Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 40: East Asia Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: South Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 43: South Asia Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 44: South Asia Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 45: South Asia Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 46: South Asia Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 47: South Asia Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 48: South Asia Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: Oceania Market Volume (MT) Forecast by Country, 2017 to 2032

Table 51: Oceania Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 52: Oceania Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 53: Oceania Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 54: Oceania Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 55: Oceania Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 56: Oceania Market Volume (MT) Forecast by Automation, 2017 to 2032

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 58: MEA Market Volume (MT) Forecast by Country, 2017 to 2032

Table 59: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 60: MEA Market Volume (MT) Forecast by Product Type, 2017 to 2032

Table 61: MEA Market Value (US$ Million) Forecast by End Use Application, 2017 to 2032

Table 62: MEA Market Volume (MT) Forecast by End Use Application, 2017 to 2032

Table 63: MEA Market Value (US$ Million) Forecast by Automation, 2017 to 2032

Table 64: MEA Market Volume (MT) Forecast by Automation, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Automation, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 14: Global Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 18: Global Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 21: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 22: Global Market Attractiveness by End Use Application, 2022 to 2032

Figure 23: Global Market Attractiveness by Automation, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Automation, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 34: North America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 38: North America Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 42: North America Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 45: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 46: North America Market Attractiveness by End Use Application, 2022 to 2032

Figure 47: North America Market Attractiveness by Automation, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Automation, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 58: Latin America Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 62: Latin America Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 66: Latin America Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by End Use Application, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Automation, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Automation, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 82: Europe Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 86: Europe Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 90: Europe Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 93: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by End Use Application, 2022 to 2032

Figure 95: Europe Market Attractiveness by Automation, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: East Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 98: East Asia Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 99: East Asia Market Value (US$ Million) by Automation, 2022 to 2032

Figure 100: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: East Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 106: East Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 109: East Asia Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 110: East Asia Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 113: East Asia Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 114: East Asia Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 117: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 118: East Asia Market Attractiveness by End Use Application, 2022 to 2032

Figure 119: East Asia Market Attractiveness by Automation, 2022 to 2032

Figure 120: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 121: South Asia Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 122: South Asia Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 123: South Asia Market Value (US$ Million) by Automation, 2022 to 2032

Figure 124: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: South Asia Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 130: South Asia Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 133: South Asia Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 134: South Asia Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 137: South Asia Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 138: South Asia Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 141: South Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 142: South Asia Market Attractiveness by End Use Application, 2022 to 2032

Figure 143: South Asia Market Attractiveness by Automation, 2022 to 2032

Figure 144: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 145: Oceania Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 146: Oceania Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 147: Oceania Market Value (US$ Million) by Automation, 2022 to 2032

Figure 148: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 153: Oceania Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 154: Oceania Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 157: Oceania Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 158: Oceania Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 161: Oceania Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 162: Oceania Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 165: Oceania Market Attractiveness by Product Type, 2022 to 2032

Figure 166: Oceania Market Attractiveness by End Use Application, 2022 to 2032

Figure 167: Oceania Market Attractiveness by Automation, 2022 to 2032

Figure 168: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 169: MEA Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 170: MEA Market Value (US$ Million) by End Use Application, 2022 to 2032

Figure 171: MEA Market Value (US$ Million) by Automation, 2022 to 2032

Figure 172: MEA Market Value (US$ Million) by Country, 2022 to 2032

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 174: MEA Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 177: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 178: MEA Market Volume (MT) Analysis by Product Type, 2017 to 2032

Figure 179: MEA Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 181: MEA Market Value (US$ Million) Analysis by End Use Application, 2017 to 2032

Figure 182: MEA Market Volume (MT) Analysis by End Use Application, 2017 to 2032

Figure 183: MEA Market Value Share (%) and BPS Analysis by End Use Application, 2022 to 2032

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End Use Application, 2022 to 2032

Figure 185: MEA Market Value (US$ Million) Analysis by Automation, 2017 to 2032

Figure 186: MEA Market Volume (MT) Analysis by Automation, 2017 to 2032

Figure 187: MEA Market Value Share (%) and BPS Analysis by Automation, 2022 to 2032

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Automation, 2022 to 2032

Figure 189: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 190: MEA Market Attractiveness by End Use Application, 2022 to 2032

Figure 191: MEA Market Attractiveness by Automation, 2022 to 2032

Figure 192: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Analyzing Carrageenan Gum Market Share & Growth Drivers

UK Carrageenan Gum Market Trends – Size, Demand & Growth 2025-2035

Comprehensive Overview Carrageenan Gum Industry: Sales Outlook, Growth Factor, Exploring New Opportunities, Application, Development of Food & Beverage Sector

Comprehensive Analysis Europe Carrageenan Gum Industry: Sales Outlook, Exploring New Opportunity, Application, Development of Food & Beverage Sector

Deep Dive into the Asia Pacific Carrageenan Gum Market: Asian Demand Trends, Growth Catalysts, Innovation Potential, and Food & Beverage Advancements

Market Share Distribution Among Carrageenan Film Manufacturers

Carrageenan Film Market Analysis – Growth, Applications & Outlook 2025-2035

Carrageenan Market Insights – Natural Hydrocolloids & Clean-Label Trends 2025-2035

Analysis and Growth Projections for Food Grade Carrageenan Market

Gummed Tape Market Size and Share Forecast Outlook 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Gum Arabic Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Gummy Market Analysis by Product, Ingredient, End-Use, Distribution Channel, and Region - Forecast through 2025 to 2035

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Gum Hydrocolloid Market Analysis by Product Type, Source, and Region through 2035

Key Companies & Market Share in the Gummed Tape Sector

Evaluating Gum Fiber Market Share & Provider Insights

Gum Rosin Market Size & Demand Analysis 2024-2034

Gum Content Tester Market

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA