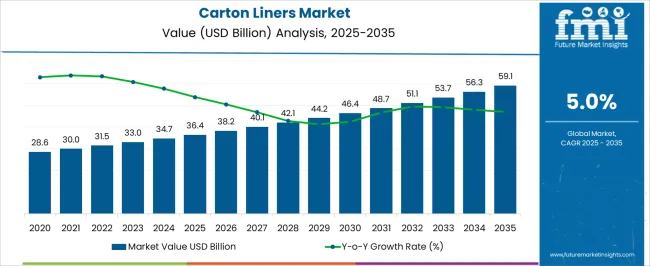

The Carton Liners Market is estimated to be valued at USD 36.4 billion in 2025 and is projected to reach USD 59.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Carton Liners Market Estimated Value in (2025 E) | USD 36.4 billion |

| Carton Liners Market Forecast Value in (2035 F) | USD 59.1 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The carton liners market is expanding steadily, driven by the growing need for effective packaging solutions that ensure product safety, extend shelf life, and maintain quality across diverse supply chains. Industry publications and packaging company disclosures have emphasized the increasing adoption of liners in sectors where contamination prevention and moisture resistance are critical. Rising global trade volumes and the growth of e-commerce have further fueled demand, as businesses prioritize protective packaging to reduce damage and wastage during transit.

Additionally, regulatory frameworks promoting food safety and hygiene standards have accelerated liner adoption in food-grade packaging. Technological innovations in barrier materials and recyclable polymers have also supported market expansion by aligning with sustainability objectives.

Looking ahead, carton liners are expected to benefit from rising demand in food and beverage supply chains, as well as growing applications in industrial, pharmaceutical, and agricultural sectors. Continuous investment in material science and circular economy initiatives is anticipated to reinforce the market’s long-term growth trajectory.

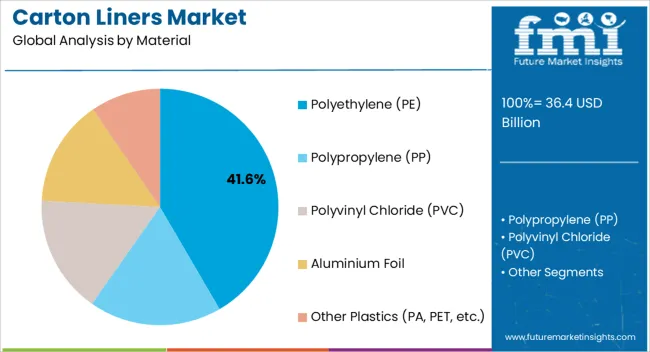

The Polyethylene (PE) segment is projected to account for 41.60% of the carton liners market revenue in 2025, securing its position as the leading material type. PE has been favored due to its durability, flexibility, and excellent moisture barrier properties, which are essential for maintaining product integrity during storage and transport.

Packaging industry reports have highlighted the material’s versatility in adapting to different liner designs, enabling wide-scale application across various sectors. Furthermore, PE’s cost-effectiveness compared to alternative polymers has strengthened its adoption among manufacturers seeking balance between performance and affordability.

Advances in recyclable and bio-based PE have further reinforced its market share, as sustainability becomes a key purchasing criterion for end users. With continuous innovation and strong alignment with packaging performance requirements, the PE segment is expected to maintain its dominant role in the carton liners market.

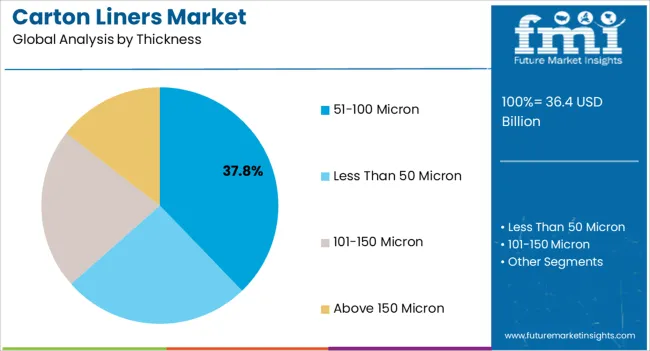

The 51–100 Micron segment is projected to hold 37.80% of the carton liners market revenue in 2025, emerging as the preferred thickness range. This category has been widely adopted because it offers an optimal balance between strength and flexibility, ensuring adequate protection without adding unnecessary weight or material cost.

Packaging specialists have emphasized that liners within this thickness range provide reliable resistance against punctures, moisture, and external contaminants, making them suitable for demanding logistics and storage conditions.

Additionally, the segment’s cost efficiency and ability to accommodate diverse applications have increased its preference in high-volume end-use industries. Manufacturers have continued to optimize film extrusion and lamination processes within this range, enhancing product consistency and durability. These factors collectively reinforce the strong position of the 51–100 Micron segment in the market.

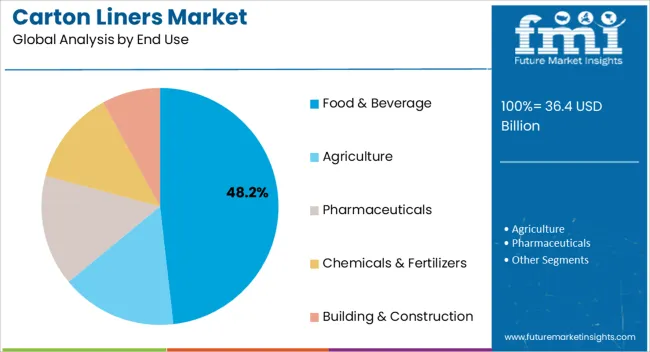

The Food & Beverage segment is projected to contribute 48.20% of the carton liners market revenue in 2025, establishing itself as the largest end-use category. Growth in this segment has been propelled by the critical role of carton liners in preserving freshness, preventing contamination, and maintaining the quality of packaged food products.

Industry reports and food safety standards have underscored the reliance on carton liners for compliance with stringent hygiene and packaging regulations. Increased global consumption of processed and packaged foods, coupled with rising exports of perishable goods, has further expanded demand.

The segment has also benefited from innovations in food-grade materials that enhance shelf stability while meeting sustainability requirements. With consumers placing greater emphasis on safe, convenient, and high-quality packaged foods, the Food & Beverage segment is expected to remain the primary driver of demand for carton liners.

The global demand for carton liners increased at a CAGR of 3.0% during the forecast period between 2020 and 2025, reaching a total of USD 59.1 billion in 2035.

According to Future Market Insights, a market research and competitive intelligence provider, the carton liners market was valued at USD 36.4 billion in 2025.

The rapid growth of the e-commerce and online retail industry has revolutionized the way consumers shop, presenting significant opportunities and challenges for the packaging sector. More and more consumers are turning to online shopping for their everyday needs, with the convenience of shopping from home and a wide range of products available at the click of a button. The shift in consumer behavior has resulted in a substantial increase in the volume of goods being shipped worldwide.

Carton liners play a crucial role in the e-commerce and retail industry by ensuring the safe and secure delivery of products to customers' doorsteps. The liners are designed to provide an additional layer of protection to products within the shipping boxes, safeguarding them from damage during transit. Fragile and delicate items, such as electronics, glassware, cosmetics, and other sensitive goods, greatly benefit from the added cushioning and shock-absorption properties of carton liners.

Carton liners contribute to enhancing the unboxing experience for customers, making it more enjoyable and memorable. Customized carton liners with branding, logos, or eye-catching designs add a touch of personalization, fostering a positive brand perception and encouraging customer loyalty. A well-packaged and attractive unboxing experience can leave a lasting impression on consumers, increasing the likelihood of repeat purchases and word-of-mouth recommendations.

In the highly competitive e-commerce landscape, where customer satisfaction is paramount, ensuring the safe delivery of products is essential. Damaged or broken items can result in customer complaints, returns, and negative reviews, all of which can have a detrimental impact on a brand's reputation and bottom line. Carton liners help mitigate these risks by providing an extra layer of protection, reducing the chances of product damage and ensuring that customers receive their orders in perfect condition.

Technological Advancements is Likely to be Beneficial for Market Growth

Technological advancements in manufacturing processes and materials have played a significant role in transforming carton liners from simple protective barriers to sophisticated and functional packaging solutions. The advancements have opened up new possibilities, allowing carton liners to cater to a broader range of industries and applications.

One key area of technological innovation in carton liners is the development of specialized coatings and treatments. For example, anti-static coatings are increasingly being applied to carton liners to prevent the buildup of static electricity. In industries where electronic components or sensitive devices are being shipped, such as the electronics industry, static electricity can pose a significant risk of damage. Anti-static carton liners help dissipate electrical charges, ensuring that the packaged items remain safe during transport.

Another area of advancement is the introduction of moisture-resistant coatings. The coatings provide an additional layer of protection against moisture and humidity, safeguarding the packaged products from potential water damage. Moisture-resistant carton liners are particularly valuable when shipping goods that are susceptible to moisture, such as pharmaceuticals, food items, and electronics.

Advancements in material science have led to the development of high-performance materials for carton liners. Manufacturers now have access to a wide range of materials, each with specific properties suited to different applications. For instance, corrugated board, kraft paper, and micro-flute materials offer varying degrees of strength, flexibility, and durability, allowing carton liners to be customized according to the specific needs of the products being shipped.

Increasing Use in Industrial Packaging to Fuel the Market Growth

The use of carton liners in industrial packaging has gained significant traction due to the unique advantages they offer for the safe and efficient handling of bulk and heavy items. The industrial sector encompasses a wide range of industries, including manufacturing, construction, automotive, and machinery, among others, all of which require robust packaging solutions to protect their products during storage and transportation.

One of the primary reasons for the increased use of carton liners in industrial packaging is their ability to provide an additional layer of protection to the goods being shipped. Industrial products, especially bulk and heavy items, are often more susceptible to damage during handling and transit due to their size and weight. Carton liners act as a cushioning and protective barrier, preventing physical impacts, abrasion, and surface scratches that can occur during movement or loading and unloading processes.

Carton liners offer excellent resistance against dust and moisture. In industrial environments, particularly in warehouses and manufacturing facilities, dust and dirt can accumulate on stored items over time, compromising their quality and appearance. Carton liners act as a barrier, preventing the ingress of dust and contaminants, thus preserving the integrity of the products.

Moisture is a common concern in many industrial applications. Carton liners with moisture-resistant coatings or materials act as a shield against humidity and external moisture, ensuring that the packaged items remain dry and unaffected, even in challenging environments.

By material, polyethylene (PE) segment is estimated to be the leading segment at a CAGR of 5.1% during the forecast period.

The Polyethylene (PE) segment is expected to boost the growth of the carton liners Market. Polyethylene is a versatile and widely used material known for its excellent strength, flexibility, and moisture resistance, making it a preferred choice for various packaging applications, including carton liners.

Polyethylene carton liners offer exceptional protective properties, acting as a barrier against moisture, dust, and contaminants. They help preserve the quality and integrity of the packaged goods during storage and transportation, making them ideal for protecting a wide range of products.

Polyethylene is available in various forms, such as high-density polyethylene (HDPE) and low-density polyethylene (LDPE), each with distinct properties. The versatility allows manufacturers to tailor the carton liners to specific requirements, ensuring they meet the unique needs of different industries and products.

Polyethylene is a cost-effective material, making it an attractive option for businesses seeking efficient and affordable packaging solutions. Its availability and widespread use contribute to its cost-effectiveness, making it a popular choice for carton liners, particularly for high-volume packaging needs.

Based on the end-use, the food & beverage segment holds the largest share of the market. The segment is expected to hold a CAGR of 5.1% during the forecast period.

The food and beverage industry requires reliable and hygienic packaging solutions to protect perishable items during storage and transportation. Carton liners provide an additional layer of protection against moisture, contaminants, and external elements, ensuring the freshness and quality of food products. The demand for carton liners in the food and beverage sector is expected to grow, as consumer preferences for fresh and ready-to-eat food increase.

The stringent regulations and standards related to food safety and hygiene are driving the adoption of advanced packaging solutions in the food industry. Carton liners help food manufacturers comply with these regulations by offering a secure and clean packaging option. Carton liners with appropriate barrier properties are gaining prominence, as the industry continues to prioritize food safety.

Carton liners can be customized with attractive designs and branding, enhancing the shelf appeal of packaged food products. They provide a convenient packaging solution for various food items, such as grains, cereals, and powdered products. The demand for carton liners in the food and beverage sector is expected to rise, as consumers seek convenience and visually appealing packaging.

Growth prospects of the carton liners market are high in the Asia Pacific market, which includes East Asia and South Asia & Pacific, is primarily owing to the increased use of cartons in packaging and shipments. China is expected to remain at the forefront of the Asia Pacific’s carton liners market. The region is expected to hold a CAGR of 5.1% over the analysis period.

High growth opportunities for the carton liners market and sales of carton liners are also expected in India and ASEAN countries, with a steady growth of trade activities and an increasing number of local carton liners market players in the region.

An embrace of research and development is underway in the carton liners market to leverage bioplastics and other eco-friendly materials to address mounting concerns over plastic pollution across the globe.

The strong presence of innovative companies in developed regions will continue to impact the growth of the carton liners market as well as boost demand for carton liners and escalate sales of carton liners.

Key players in the carton liners market are strongly focusing on profit generation from their existing product portfolios along while exploring potential new applications. The players are emphasizing on increasing their carton liners production capacities, to cater to the demand from numerous end use industries. Prominent players are also pushing for geographical expansion to decrease the dependency on imported carton liners.

Recent Developments:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Billion for value and Tons for Volume |

| Key Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel. |

| Key Segments Covered | Application, End Use, Material Type, Region |

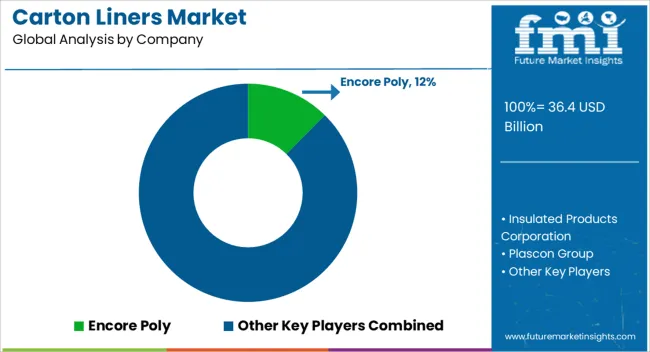

| Key Companies Profiled | Encore Poly; Insulated Products Corporation; Plascon Group; Sancell; Alpine Packaging, Inc.; Heritage Packaging; American Plastics Company; Protective Lining Corp.; Prior Packaging; Chantler Packages |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global carton liners market is estimated to be valued at USD 36.4 billion in 2025.

The market size for the carton liners market is projected to reach USD 59.1 billion by 2035.

The carton liners market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in carton liners market are polyethylene (pe), polypropylene (pp), polyvinyl chloride (pvc), aluminium foil and other plastics (pa, pet, etc.).

In terms of thickness, 51-100 micron segment to command 37.8% share in the carton liners market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carton Sealer Machine Market Size and Share Forecast Outlook 2025 to 2035

Carton Bottle Market Size and Share Forecast Outlook 2025 to 2035

Carton Display Market Size and Share Forecast Outlook 2025 to 2035

Carton Folding And Gluing Machine Market Size and Share Forecast Outlook 2025 to 2035

Carton Serialization Machine Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Market Share Breakdown of Carton Display Industry

Industry Share & Competitive Positioning in Carton Bottle Market

Carton Sealing Tape Market

Carton Sealer Market

Carton Form Fill Seal Machine Market

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Egg Carton Manufacturers

Milk Carton Market Trends & Growth Forecast 2024-2034

Key Players & Market Share in the Brick Carton Packaging Industry

Brick Carton Packaging Market by Packaging Type from 2024 to 2034

Pizza Cartons Market

Dairy Carton Market

Fluted Carton Trays Market Size, Share & Forecast 2025 to 2035

Leading Providers & Market Share in Liquid Carton Packaging

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA