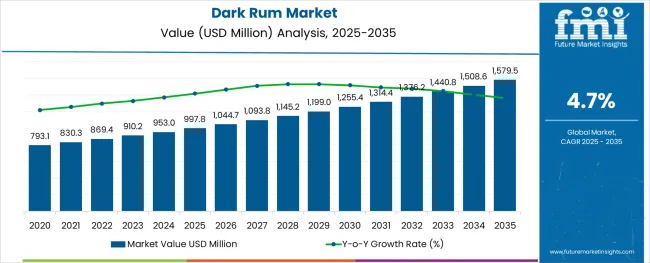

The global dark rum market is expected to expand, with its value estimated at USD 997.8 million in 2025 and projected to reach USD 1,579.5 million by 2035, registering a CAGR of 4.7% during the forecast period. This growth reflects a broader transformation in consumer preferences toward premiumization in the alcoholic beverage industry.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 997.8 Million |

| Projected Industry Value (2035F) | USD 1579.6 Million |

| Value-based CAGR (2025 to 2035) | 4.7% |

As global demand for spirits becomes more discerning, dark rum, characterized by its extended aging, rich flavor complexity, and heritage associations, is gaining momentum across both mature and emerging markets. Once considered a niche product largely confined to traditional consumption geographies like the Caribbean and Latin America, it is now emerging as a culturally versatile and globally embraced spirit.

The dark rum market registers a modest yet growing share within its parent markets. As of 2025, it accounts for approximately 3-5% of the global alcoholic beverages market and around 7-9% of the spirits market, owing to its niche but expanding appeal.

Within the distilled beverages market, it comprises 8-10%, reflecting its status alongside categories like vodka, gin, and whisky. In the premium alcohol market, it accounts for about 6-8%, supported by rising consumer interest in aged and craft spirits. Notably, it commands a larger share, 15-18%, within the fermented and distilled sugarcane products market, which includes all rum types. Its share across these parent categories is expected to rise as consumers increasingly favor authenticity, depth of flavor, and cultural heritage in spirits.

The segment presents manufacturers with a compelling value proposition: strong margins, brand storytelling potential, and global adaptability. Growth is particularly notable in OECD countries where the "experience economy" continues to influence alcohol consumption behaviors.

BRICS and ASEAN markets are seeing increased demand as middle-class consumers begin to explore international spirits. The combination of premium positioning, regional provenance, and cultural resonance makes the product a category with both emotional appeal and commercial viability in the next few years.

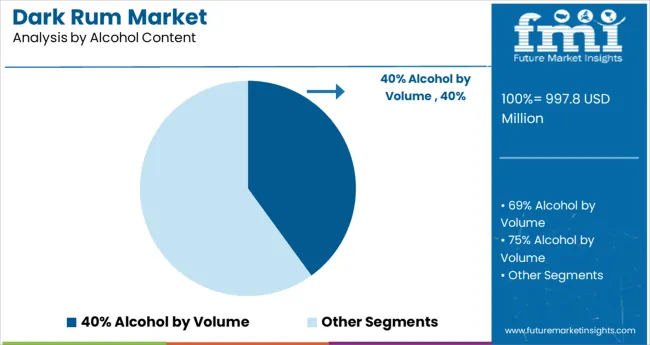

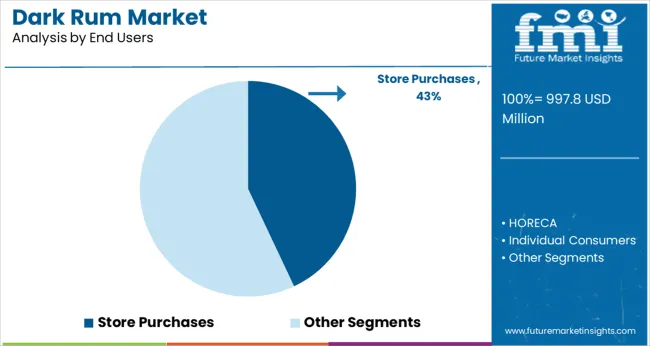

In 2025, dark rum with 40% ABV leads by alcohol content, holding a 40% market share due to its balanced strength, health-conscious appeal, and versatility in consumption. Store purchases dominate end-user segments with a 43% share, driven by rising off-trade retail availability, at-home consumption trends, and growing demand for premium and craft rum.

In terms of alcohol content, the 40% Alcohol by Volume (ABV) segment is the dominant category, accounting for 40% of the market share in 2025. This segment’s leadership stems from a growing global preference for moderately strong yet flavorful spirits that offer a balance between intensity and drinkability.

Among the various end-user segments, store purchases lead the dark rum market, accounting for 43% of the total market share in 2025. This dominance highlights the strong consumer inclination toward off-trade retail channels such as liquor stores, supermarkets, and specialty outlets.

Premiumization and evolving palates are driving demand for aged, small-batch dark rum, especially among younger consumers in mature markets. The rise of off-trade retail and at-home mixology is reshaping purchase behavior and boosting premium bottle sales globally.

Dark rum is increasingly positioned as a premium spirit, aligning with shifting consumer preferences for aged, artisanal, and heritage-based alcohols. In mature markets like North America and Europe, there’s a noticeable movement toward flavor complexity and storytelling, rather than mass consumption. This trend is elevating demand for cask-aged and small-batch dark rums, expanding their appeal beyond traditional drinkers.

The global pivot toward home-based consumption has transformed retail dynamics for dark rum. Supermarkets, liquor chains, and e-commerce platforms are emerging as key growth nodes, while consumers are investing more in bar-quality experiences at home. This off-trade strength is reshaping distribution strategies and packaging formats.

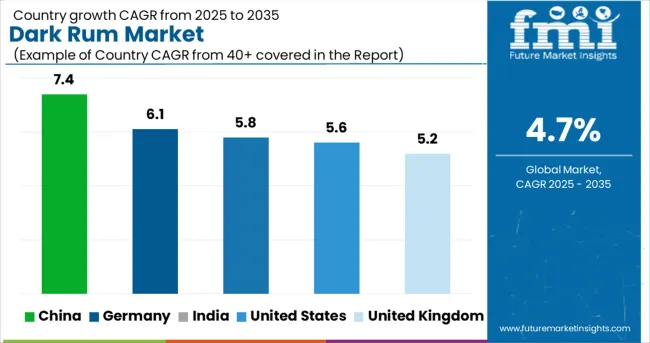

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| United Kingdom | 5.2% |

| Germany | 6.1% |

| China | 7.4% |

| India | 5.8% |

The global dark rum market is projected to grow at a 4.7% CAGR from 2025 to 2035, yet leading BRICS and OECD economies are advancing at notably higher rates. China tops the list at 7.4%, nearly three percentage points above the global average, driven by premiumization trends and the rise of products in cocktail culture among younger urban consumers.

India, also part of BRICS, is growing at 5.8%, supported by expanding middle-class consumption and premium rum variants gaining shelf space in organized retail.

The United States, an OECD market, is expected to grow at 5.6%, fueled by a resurgence in craft rum, barrel-aged variants, and rising demand from specialty bars and mixology platforms. Germany posts 5.2%, while the United Kingdom leads European OECD peers at 6.1%, benefiting from heritage branding and spiced dark rum.

ASEAN markets, especially the Philippines and Thailand, are witnessing rising interest in aged rum blends, positioning them as emerging premium dark rum hubs.

The CAGR of the dark rum market in the United States rose from around 4.2% during 2020 to 2024 to approximately 5.6% in the 2025 to 2035 period, reflecting renewed interest in premium spirits, evolving cocktail culture, and experiential consumption patterns.

The post-pandemic rebound in the hospitality sector, alongside the expansion of mixology-driven product lines in both off-trade and on-trade channels, helped solidify dark rum’s appeal among urban millennial consumers. Craft distilleries across Florida, California, and New York have also gained momentum, catering to niche flavor seekers.

E-commerce and subscription-based spirits clubs are playing a key role in broadening reach and consumer education. The introduction of Caribbean-origin single-cask products, often positioned as collector items, has further boosted premium positioning and value growth.

The CAGR of the UK dark rum market increased from approximately 3.9% during 2020 to 2024 to 5.2% between 2025 and 2035, driven by the drink's growing acceptance among younger consumers and the rise of heritage-oriented alcohol preferences. Changing attitudes toward whisky and gin, alongside the influence of Caribbean culinary culture in urban centers like London, Birmingham, and Manchester, have positioned products as a trendy yet historic choice.

The expanding footprint of high-end liquor retail, coupled with increased educational marketing from rum producers, has made UK consumers more experimental. Seasonal promotions, gift sets, and bar-led awareness campaigns also played a role in improving brand recognition and value growth across price tiers. Import volumes of aged Caribbean rums rose significantly after 2023, reflecting both increased demand and better retail shelf visibility.

The CAGR for Germany’s dark rum market moved up from 4.4% during 2020 to 2024 to 6.1% over the 2025 to 2035 period, reflecting consumers' increasing appreciation for aged and craft rums as alternatives to traditional spirits like schnapps or whiskey. Germany's cocktail culture is maturing, with bars in cities such as Berlin, Munich, and Hamburg prioritizing craft rum over mass-market options.

German consumers are showing a strong preference for product transparency and origin labelling, especially in premium categories. International rum festivals and retail partnerships with Caribbean exporters are enhancing consumer exposure. Retailers are also experimenting with exclusive bottlings and rum clubs, offering personalized experiences and limited-edition products to drive loyalty and premiumization.

China’s CAGR for dark rum increased from 5.1% during 2020 to 2024 to an estimated 7.4% between 2025 and 2035, driven by the emergence of cocktail bars in Tier 1 and Tier 2 cities and a broader pivot to international spirits among affluent consumers. While still a small segment within the broader spirits market, it is rapidly capturing attention among younger consumers seeking global drinking experiences.

Cross-border e-commerce platforms are promoting Caribbean and Latin American brands, while domestic distilleries are starting to explore rum production using imported molasses. Online mixology communities, KOL endorsements, and live-streamed tastings are helping educate consumers about dark rum's heritage and flavor complexity.

India's dark rum market CAGR grew from around 3.5% during 2020 to 2024 to 5.8% in the 2025 to 2035 period, with the shift led by urban premiumization and growing influence of global spirits culture among India’s middle and upper-middle class. While mass-market rum still dominates, premium brands, both imported and domestic, are gaining ground, especially in metropolitan areas like Mumbai, Delhi, and Bangalore.

Events such as rum festivals, tasting pop-ups, and influencer mixology sessions have broadened consumer engagement. The growth of duty-paid retail and online liquor platforms has also improved availability, while Indian-made craft rums are beginning to position themselves as globally competitive in taste and branding.

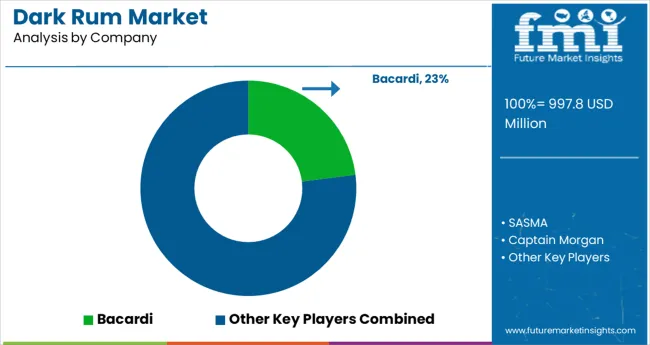

In the dark rum market, key players are capitalizing on heritage branding, regional authenticity, and premium aged offerings to appeal to evolving consumer palates. Global giants like Bacardi and Captain Morgan continue to dominate with broad distribution networks and iconic product lines, while Malibu leverages flavored variants and lifestyle branding to attract younger demographics.

Radico Khaitan and Amrut Distilleries are expanding India’s footprint in the global premium rum space, with a focus on craft, molasses-rich expressions, and single-cask bottlings.

Emerging producers such as SASMA are gaining traction in regional markets through selective aging, small-batch production, and label transparency. These brands are aligning with rising demand for authenticity and experimentation, particularly among Gen Z and millennial consumers in urban centers. Retail and on-premise growth strategies remain central, with investments in limited editions, curated tastings, and storytelling-led campaigns.

Leading Company - Bacardi

Industry Share - 23%

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 997.8 million |

| Projected Industry Size (2035) | USD 1,579.5 million |

| CAGR (2025 to 2035) | 4.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Alcohol Content Analyzed (Segment 1) | 40% Alcohol by Volume, 69% Alcohol by Volume, and 75% Alcohol by Volume |

| End Users Analyzed (Segment 2) | HORECA, Individual Consumers, Store Purchases, and Others. |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | SASMA, Bacardi, Captain Morgan, Radico Khaitan, Malibu, and Amrut Distilleries. |

| Additional Attributes | Dollar sales, share by region, growth trends by ABV segment, consumer preferences, top retail channels, competitor positioning, demand outlook 2025-2035, and premiumization opportunities. |

The industry includes 40% alcohol by volume, 69% alcohol by volume, and 75% alcohol by volume.

The industry is segmented into HORECA, individual consumers, store purchases, and others.

The industry is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific.

The industry is valued at USD 997.8 million in 2025.

It is forecasted to reach USD 1,579.5 million by 2035.

The industry is anticipated to grow at a CAGR of 4.7% during this period.

40% Alcohol by Volume is projected to lead the market with a 40% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 7.4%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dark Fiber Market Forecast and Outlook 2025 to 2035

Dark Tourism Market Forecast and Outlook 2025 to 2035

Dark Circle Treatments Market Size and Share Forecast Outlook 2025 to 2035

Dark Analytics Market Size and Share Forecast Outlook 2025 to 2035

Dark Store Market Size and Share Forecast Outlook 2025 to 2035

Glow in the Dark Cosmetics Market

Rum Market Trends – Craft Distilling & Premiumization 2024 to 2034

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA