The global Rum market is estimated to be worth USD 18.0 billion in 2024 and is projected to reach a value of USD 25.4 billion by 2034, expanding at a CAGR of 3.5% over the assessment period of 2024 to 2034

| Attributes | Description |

|---|---|

| Estimated Global Rum Business Size (2024E) | USD 18.0 billion |

| Projected Global Rum Business Value (2034F) | USD 25.4 billion |

| Value-based CAGR (2024 to 2034) | 3.5% |

Rum is a distilled alcoholic beverage which is made from sugarcane by-products, like molasses, sugarcane juice, through a process of fermentation and distillation. Rum’s cultural value in the Caribbean is deep. It has history in the region’s colonial past and sugarcane planting.

With time, rum has become important to Caribbean culture, festivals, and social life. Its production and consumption are deeply connected into the cultural fabric, symbolizing resilience, heritage, and community spirit, which makes it a precious and traditional beverage.

Brands are leveraging innovative marketing strategies to attract new consumer segments. They are introducing limited edition rums, which helps is creating a sense of exclusivity and urgency. Moreover, they are offering a variety of flavored rums, appealing to diverse tastes and preferences. These approaches, combined with engaging storytelling and targeted promotions, improves brand appeal and drive consumer interest and loyalty.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2023) and current year (2024) for global rum market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 2.9% (2023 to 2033) |

| H2 | 3.2% (2023 to 2033) |

| H1 | 3.4% (2024 to 2034) |

| H2 | 3.7% (2024 to 2034) |

The above table presents the expected CAGR for the global rum demand space over semi-annual period spanning from 2024 to 2034. In the first half (H1) of the year 2023, the business is predicted to surge at a CAGR of 2.9%, followed by a slightly higher growth rate of 3.2% in the second half (H2) of the same year.

Moving into year 2024, the CAGR is projected to increase slightly to 3.4% in the first half and remain relatively moderate at 3.7% in the second half. In the first half (H1 2024) the market witnessed a decrease of 19 BPS while in the second half (H2 2024), the market witnessed an increase of 25 BPS.

The Surge of Flavored and Spiced Rums

Flavor innovation in the rum industry is appealing to a diverse audience. Brands are introducing new flavors like coconut, pineapple, and spices, which attract consumers searching for new taste and experiences. These flavored and spiced rums offer versatility, which makes them perfect for cocktails and mixed drinks. This is especially famous among younger consumers and those who are new to rum, as it provides an easy entry point into the category while also adding excitement and variety to their drinking options.

The Versatility of Rum in state-of-the-art Cocktails

The flourishing cocktail culture is prominently boosting rum sales. Rum’s versatility makes it a preferred choice for a wide range of cocktails, from classic mojitos and daiquiris to innovative new variety. The rise of home bartending, especially during the pandemic, has further fueled this shift. Consumers are experimenting with rum-based cocktails at home, driven by online tutorials and virtual mixology classes. This trend has expanded rum’s appeal, making it a staple in both professional bars and home setups.

Engaging Consumers Through Experiential Marketing in the Rum Industry

Brands are leveraging experiential marketing to emotionally engage with consumers. This includes virtual tastings, which means consumers can explore different rums from home, and get brewery tours that provides a behind-the-scenes look at rum production. Interactive social media campaigns, such as live cocktail-making sessions and user-generated content contests, also plays an important role. These engaging strategy promotes brand loyalty and creates a personal connection with consumers, which makes them feel more invested in the brand and its story.

Souvenirs and Gifts: Driving Rum Sales in Travel Retail

The expansion of travel retail, especially at airports and on cruise ships, has become an important sales channel for rum. Travelers usually buy premium and unique rums as souvenirs or gifts, which is driving major growth in this segment. These purchases are often influenced by the desire for exclusive products that aren’t easily available elsewhere. The convenience of duty-free shopping and the appeal of bringing back a special item from their travels further boost sales, which makes travel retail an essential segment of the rum market’s expansion.

Cultural Shifts in the Asia-Pacific Region

In the Asia-Pacific region, rising disposable incomes are allowing more consumers to afford premium alcoholic beverages, including rum. Moreover, cultural attitudes towards alcohol consumption is changing, especially in metropolitan cities of countries like India and the Philippines. Youths are more open to social drinking and trying out diverse spirits. This shift is further supported by the growing influence of Western lifestyles and the increasing popularity of bars and nightlife.

Global Rum sales increased at a CAGR of 3.1% from 2019 to 2023. For the next ten years (2024 to 2034), projections are that expenditure on Rum will rise at 3.5% CAGR

Lighter rums are a healthier option compared to other drinks, this is thought by many health-conscious consumers. Many individuals are being selective of their alcohol consumption and its impact on health. Lighter rums usually have fewer calories and lower sugar content compared to darker spirits, which makes them a preferred choice for those who want to enjoy a drink without excessive caloric intake. Further, when mixed with low-calorie mixers, such as soda water or fresh juices, lighter rums make refreshing cocktails that go with healthy lifestyle choices.

The history of rum production, which is often interlinked with local traditions and craftsmanship, adds value to the drinking experience. Many brands focuses on their artisanal approaches and regional ingredients, which allures to consumers seeking a genuine bond to the product. This appreciation for authenticity not only improves the charisma of rum but also encourages a sense of exploration and appreciation for diverse cultures and their unique spirits.

Ron Diplomático, a Venezuelan rum that highlights its artisanal production process and the use of local ingredients. The brand tells the story of its heritage, drawing on Venezuela's rich cultural background, which resonates with consumers looking for a genuine and authentic rum experience.

Tier 1 companies comprise market leaders with market revenue of above USD 50 million capturing significant sales domain share of 50% to 60% in the global sphere. These companies are defined by high production capacity and a wide product offerings, they are known for their broad expertise in manufacturing and reforming across multiple packaging formats and a broad geographical reach, supported by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Bacardi, Caliber, Captain Morgan, Malibu, Admiral Nelson's, Still Spirits, HPNOTIQ, and Hapeisy.

Tier 2 companies include mid-size players with revenue of USD 10 to 50 million having presence in specific regions and highly influencing the local retail space. These are characterized by a strong presence overseas and strong consumer base knowledge.

These industry players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Bumbu, Gran Centenario, Sailor Jerry, RumChata, Angostura, and Aristocrat.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche demand space having revenue below USD 50 million. These companies are notably oriented towards fulfilling local marketplace demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized field, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The following table shows the estimated growth rates of the top sales domains. Germany and India are set to exhibit high rum consumption, recording CAGRs of 6.5% and 7.5%, respectively, through 2034.

| Countries | CAGR 2024 to 2034 |

|---|---|

| United States | 2.9% |

| Germany | 3.0% |

| United Kingdom | 2.7% |

| India | 3.2% |

| Brazil | 2.5% |

The ecosystem for Rum in the United States is projected to exhibit a CAGR of 2.9% during the assessment period. By 2034, revenue from the sales of Rum in the country is expected to reach USD 9.5 billion. Events like Caribbean festivals and the popularity of Caribbean cuisine have introduced consumers to rum's rich legacy, and improved its appeal as a lifestyle choice associated with fun and relaxation.

The introduction of flavored and spiced rums has expanded the market, these creative offerings, including ingredients like coconut, pineapple, and spices, attract a broader audience, further encouraging experimentation and making rum a popular choice for creative cocktails.

Rum demand in Germany is calculated to rise at a value CAGR of 3.0% during the forecast period (2024 to 2034). By 2034, Germany is expected to account for 18.4% of Rum sales in Europe.

The rising cocktail culture in Germany has drastically boosted the demand for rum, as consumers are gradually finding out innovative and flavorful drink alternatives. Classic cocktails like mojitos and daiquiris, which prominently has rum, have gained popularity in bars and restaurants. This is driven by the growing interest in mixology, with bartenders experimenting with innovative recipes, further improving rum's appeal as a versatile and essential ingredient in the modern cocktail sphere.

Consumption of Rum in Brazil is projected to increase at a value CAGR of 2.5% over the next ten years. By 2034, the segment size is forecasted to reach USD 5.2 billion, with Brazil expected to account for a demand space share of 35% in Latin America.

In Brazil, the vigorous culture of cachaça, a sugarcane spirit similar to rum, has paved the way for increased interest in rum among consumers. As individuals have become more familiar with sugarcane-based spirits, they are exploring premium and flavored rums, attracted by their unique taste and versatility in cocktails.

Additionally, the rise in tourism has further boosted this, as both locals and visitors are introduced to a diverse variety of rum brands. This exposure stimulates a greater appreciation for rum, and encouraging consumers to experiment with different varieties and include them in their drinks, ultimately driving demand in the market.

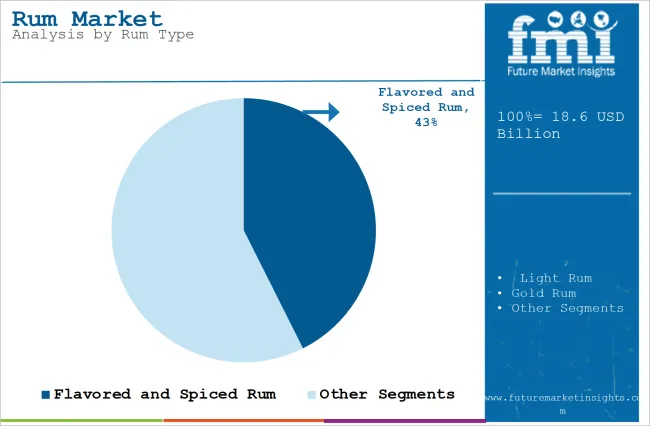

| Segment | Flavored and Spiced Rum (Rum Type) |

|---|---|

| Value Share (2024) | 42.6% |

Flavored and spiced rums are extremely versatile, which makes them preferred among mixologists and home bartenders who seek to craft exciting and innovative cocktails. Their diverse flavor composition allows for unique experimentation, and enabling the creation of unique drinks that addresses to various tastes and preferences. This versatility is particularly captivating in social gathering, where consumers enjoy trying new cocktails.

Additionally, flavored rums often go with seasonal trends and themes. For instance, tropical flavors are popular during summer gatherings, while spiced rums gain attention during the winter holidays, as they give a feeling of warmth and comfort. This seasonal and thematic relevance drives demand, further encouraging consumers to include flavored rums into their celebrations and everyday drinking experiences.

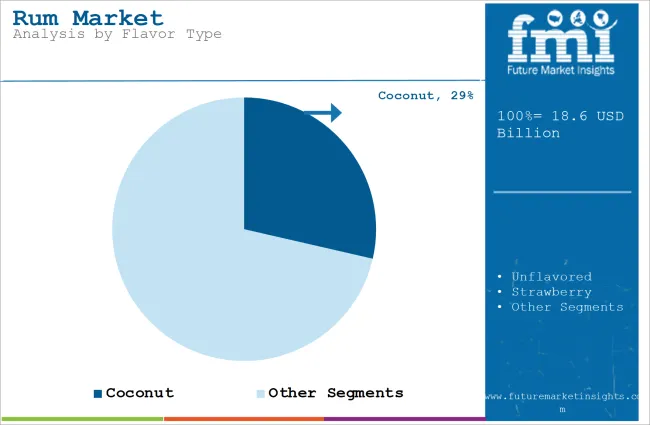

| Segment | Coconut (Flavor Type) |

|---|---|

| Value Share (2024) | 28.6% |

Customers searching for a vacation-like experience in their drinks choose coconut rum because of its tropical appeal, which improves its value by bringing up memories of sun-drenched beaches and far away locations. During summertime, when individuals are inclined to favor cool, tropical drinks, this connection is especially useful.

The demand for coconut rum is additionally driven by its versatility in drinks. It mixes well with a range of beverages, including new mixed cocktails, colorful tropical punches, and piña coladas. Professionals and home bartenders can experiment and create unique mixes that are attractive to individuals who are drinking for pleasure because of its capacity to mix well with various flavors.

To attract consumers, companies constantly develop new flavors, blends, and limited-edition products. It includes launching premium aged rums as well as flavored and spiced rums. Small-batch, artisanal manufacturing methods are being promoted by multiple companies in an attempt to stand out to customers looking for quality and authenticity.

This involves focusing on regional ingredients and traditional extraction methods. In order to appeal to consumers who care about sustainability, rum producers are gradually implementing sustainable practices like eco-friendly packaging, ethical ingredient sourcing, and reducing waste.

For instance:

As per rum type, the ecosystem has been categorized into light rum, gold rum, dark rum, black rum, premium aged rum, and flavored and spiced rum.

This segment is further categorized into unflavored, strawberry, lemon, apple, coconut, pineapple, and tropical.

This segment is further categorized into food service, travel retail (airports, cruise ships, others), and retail.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The global Rum industry is estimated at a value of USD 17.4 billion in 2024.

Sales of Rum increased at 3.1% CAGR between 2019 and 2023.

Bacardi, Caliber, Captain Morgan, Malibu, Admiral Nelson's, Still Spirits, HPNOTIQ, and Hapeisyare some of the leading players in this industry.

The North America sales domain is projected to hold a revenue share of 35.8% over the forecast period.

North America holds 29.3% share of the global demand space for Rum.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drum Brake Shoe Market Size and Share Forecast Outlook 2025 to 2035

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum Liner Market Analysis - Size, Share & Industry Forecast 2025 to 2035

Breaking Down Market Share in the Drum Liner Industry

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Positioning & Share in the Serum Bottles Market

Serum Separating Tubes Market

Murumuru Butter Market

Durum Wheat Flour Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA