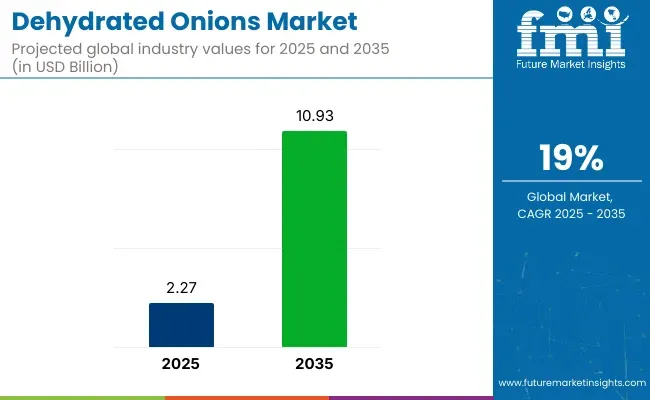

The dehydrated onions market is valued at USD 2.27 billion in 2025 and is poised to surge to USD 10.93 billion by 2035, reflecting a strong CAGR of 19% over the forecast period. India is positioned as the most lucrative market, owing to its robust agricultural infrastructure, cost-competitive supply chain, and significant share in global onion exports.

Dehydrated Onions Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.27 billion |

| Forecast Value in (2035F) | USD 10.93 billion |

| Forecast CAGR (2025 to 2035) | 19% |

Meanwhile, China is expected to emerge as the fastest-growing market, driven by urbanization, evolving dietary preferences, and rising demand for convenient, nutritious meal components.

The global dehydrated onions market is projected to grow from USD 2.27 billion in 2025 to approximately USD 10.93 billion by 2035, recording an absolute increase of USD 8.66 billion over the forecast period. This translates into a total growth of 381.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 19% between 2025 and 2035. The overall market size is expected to grow by nearly 4.8X during the same period, supported by increasing demand for convenience foods, growing processed food sector, and rising demand for ready-to-eat meals.

Between 2025 and 2030, the dehydrated onions market is projected to expand from USD 2.27 billion to USD 5.2 billion, resulting in a value increase of USD 2.93 billion, which represents 33.8% of the total forecast growth for the decade.

This phase of growth will be shaped by rising consumer demand for convenience foods, increasing penetration of dehydrated ingredients in processed foods, and growing adoption of shelf-stable ingredients in food service sectors. Food manufacturers are expanding their dehydrated onion product portfolios to address the growing demand for flavor-enhancing, long-lasting ingredients.

From 2030 to 2035, the market is forecast to grow from USD 5.2 billion to USD 10.93 billion, adding another USD 5.73 billion, which constitutes 66.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of B2C distribution channels, integration of advanced drying technologies, and development of organic and clean-label product varieties. The growing adoption of ready-to-cook meal solutions and increasing preference for natural flavor enhancers will drive demand for premium dehydrated onions with enhanced quality and extended shelf life.

Between 2020 and 2025, the dehydrated onions market experienced robust expansion, driven by increasing consumer focus on convenience foods and growing awareness of shelf-stable ingredients. The market developed as food manufacturers recognized the need for effective flavor solutions to meet evolving consumer preferences for quick-cooking and ready-to-eat products. Rising urbanization and busy lifestyles began emphasizing the importance of dehydrated vegetables in modern food preparation and commercial food processing.

The dehydrated onion market is entering a phase of steady expansion. As consumers, food manufacturers, and retailers place higher value on convenience, shelf life, and ingredient quality, dehydrated onions are increasingly seen not just as substitutes for fresh onions but as essential inputs. Rising demand in processed foods, logistics advantages, and technological improvements in dehydration are creating strong growth levers. Through eight well-defined pathways, the market could generate USD ~4.5-8.0 billion in additional revenue by 2034-35.

Market expansion is being supported by the increasing demand for convenience foods that align with busy consumer lifestyles and the corresponding need for shelf-stable, flavor-rich ingredients. Modern consumers are increasingly focused on time-saving food preparation methods that can deliver authentic taste without compromising on nutritional value. Dehydrated onions' proven efficacy in providing concentrated flavor, extended shelf life, and ease of storage makes them a preferred ingredient in processed food formulations.

The growing emphasis on ready-to-eat and processed food products is driving demand for dehydrated onions across various food categories including snacks, soups, sauces, and seasoning blends. Consumer preference for products that combine convenience with authentic flavor profiles is creating opportunities for innovative applications. The rising influence of food service industry growth and institutional kitchen requirements is also contributing to increased product adoption across different market segments and geographic regions.

The market is segmented by nature, variety, form, end use, technology, distribution channel, and region. By nature, the market is divided into organic and conventional. Based on variety, the market is categorized into white onion, red onion, pink onion, and hybrid. In terms of form, the market is segmented into chopped, minced, granules, powder, flakes, kibbled, and sliced.

By end use, the market is classified into food processing (dressing & sauces, ready meals, snacks & savory, infant food, soups, others), food service providers, and retail/household. By technology, the market is divided into air drying, vacuum drying, freeze drying, microwave drying, spray drying, and others.

By distribution channel, the market covers B2B and B2C (hyper/super markets, convenience stores, specialty stores, traditional grocery retailers, online retailers). Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

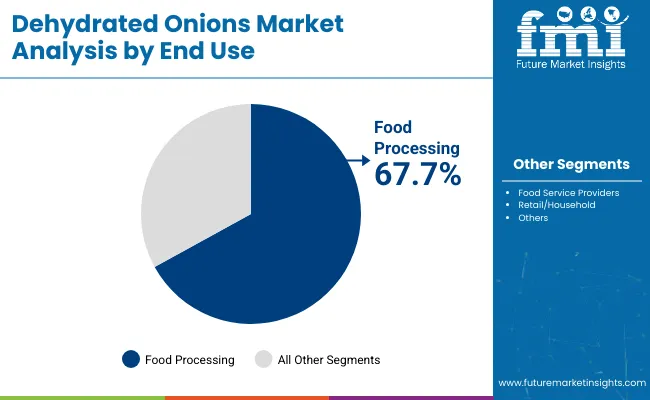

'The food processing end use is projected to account for 67.7% of the dehydrated onions market in 2025, reaffirming its position as the category's primary application. Food manufacturers increasingly understand the value of dehydrated onions in providing consistent flavor, extended shelf life, and cost-effective ingredient solutions for mass production. Dehydrated onions' well-documented properties in enhancing taste profiles directly address industry needs for reliable, scalable flavoring ingredients.

This segment forms the foundation of market demand, as it represents the most significant and established application of dehydrated onions in commercial food production. Industry adoption and ongoing product development continue to strengthen the position of dehydrated onions in processed foods. With food processing operations requiring consistent, high-quality ingredients that can withstand various manufacturing processes, food processing applications align with both efficiency and flavor enhancement goals, making it the central growth driver of dehydrated onions demand.

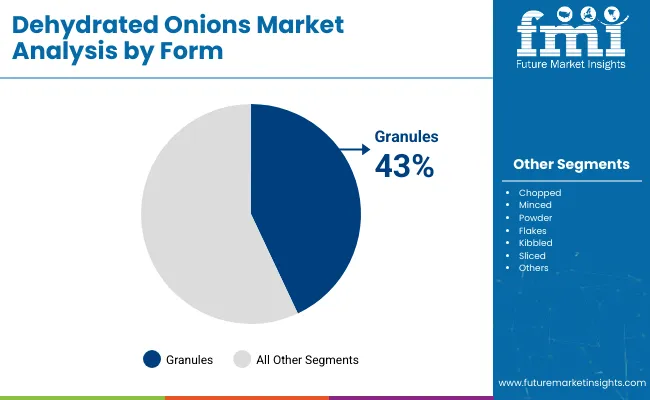

Granules are projected to represent 43% of dehydrated onions demand in 2025, underscoring their role as the preferred form for versatile culinary applications. Consumers and food processors gravitate toward granules for their uniform texture, optimal rehydration properties, and ability to blend seamlessly into various food preparations. Positioned as the ideal balance between powder and larger pieces, granules offer both convenience in measurement and consistent flavor distribution.

The segment is supported by the rising popularity of granular ingredients in commercial food production, where uniformity and ease of incorporation play crucial roles in manufacturing efficiency. Additionally, granules are increasingly favored in retail applications where consumers prefer ingredients that dissolve evenly and provide consistent results in home cooking. As both industrial processors and household consumers prioritize convenience and performance, dehydrated onion granules will continue to dominate market demand, reinforcing their versatile positioning within the ingredient market.

The dehydrated onions market is advancing rapidly due to increasing demand for convenience foods and growing adoption in food processing industries. However, the market faces challenges including raw material price volatility, seasonal supply variations, and competition from fresh alternatives. Innovation in drying technologies and sustainable sourcing practices continue to influence product development and market expansion patterns.

Expansion of B2C Distribution Channels and Direct Consumer Access

The growing adoption of B2C distribution channels is enabling brands to reach consumers directly and provide convenient access to dehydrated onion products. Retail channels offer accessibility, product variety, and packaging options that influence purchasing decisions. E-commerce growth and specialty store expansion are driving brand awareness and product adoption, particularly among consumers who value convenience and cooking efficiency in their food preparation routines.

Integration of Advanced Drying Technologies and Processing Innovations

Modern dehydrated onion manufacturers are incorporating advanced drying technologies such as spray drying, microwave drying, and freeze drying to enhance product quality and processing efficiency. These technologies improve moisture removal while preserving flavor compounds and extending product shelf life. Advanced processing techniques also enable specialized product varieties that deliver enhanced culinary performance and better nutritional retention in final applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14.5% |

| Japan | 14.0% |

| USA | 12.5% |

| UK | 11.0% |

| Germany | 10.5% |

| South Korea | 10.8% |

| France | 10.3% |

The dehydrated onions market is experiencing robust growth globally, with China leading at a 14.5% CAGR through 2035, driven by rapid urbanization, rising disposable income, and increasing adoption of convenience foods. Japan follows closely at 14.0%, supported by consumer preference for high-quality, shelf-stable ingredients and growing processed food consumption.

The USA shows strong growth at 12.5%, focusing on food processing applications and convenience food trends. The UK records 11.0%, emphasizing processed food sector expansion and consumer demand for cooking convenience. Germany shows 10.5% growth, prioritizing quality ingredients and advanced food processing technologies.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from dehydrated onions in China is projected to exhibit strong growth with a CAGR of 14.5% through 2035, driven by rapid adoption of processed foods among urban consumers and increasing demand from the food service industry. The country's expanding middle class and growing preference for convenience foods are creating significant demand for shelf-stable cooking ingredients. Major food processors and international brands are establishing comprehensive supply chains to serve the growing population of convenience-oriented consumers across tier-1 and tier-2 cities.

Revenue from dehydrated onions in Japan is expanding at a CAGR of 14.0%, supported by consumer preference for high-quality ingredients, growing processed food consumption, and rising demand for convenient meal solutions. The country's aging population and busy urban lifestyle are driving demand for shelf-stable, easy-to-use cooking ingredients. Food manufacturers and retailers are establishing distribution channels to serve the growing demand for reliable, consistent-quality food ingredients.

Demand for dehydrated onions in the USA is projected to grow at a CAGR of 12.5%, supported by strong food processing industry demand and consumer preference for convenient cooking solutions. American food manufacturers are increasingly focused on ingredient consistency, cost efficiency, and production scalability. The market is characterized by strong demand for reliable ingredients that combine flavor enhancement with operational efficiency across various food processing applications.

Revenue from dehydrated onions in the UK is projected to grow at a CAGR of 11.0% through 2035, supported by rising processed food consumption and consumer demand for cooking convenience. British food processors value ingredient reliability, shelf stability, and consistent quality, positioning dehydrated onions as essential components in ready meal production and food service applications.

Revenue from dehydrated onions in Germany is projected to grow at a CAGR of 10.5% through 2035, supported by the country's advanced food processing infrastructure and emphasis on ingredient quality and consistency. German food manufacturers prioritize reliable sourcing, processing efficiency, and product standardization, making dehydrated onions valuable ingredients in industrial food production.

Revenue from dehydrated onions in South Korea is projected to grow at a CAGR of 10.8% through 2035, driven by expanding food service sector and increasing consumer adoption of convenience foods. The country's urban lifestyle and growing restaurant industry are creating demand for efficient, shelf-stable cooking ingredients. Food service operators and processors are establishing supply chains to meet growing demand for reliable flavor enhancement ingredients.

Revenue from dehydrated onions in France is projected to grow at a CAGR of 10.3% through 2035, supported by the country's established culinary industry and food processing sector demand for quality ingredients. French food manufacturers and culinary professionals value ingredient authenticity, flavor consistency, and processing reliability in commercial food production applications.

The dehydrated onions market in Europe is projected to grow at a CAGR of 17.0% over the forecast period. Germany is expected to lead the regional market with 22.5% market share in 2025, moderating to 21.0% by 2035, supported by advanced food-processing infrastructure and strong industrial demand for shelf-stable ingredients. The United Kingdom follows with 18.0% in 2025, rising to 19.0% by 2035, driven by growth in ready-meals and processed food manufacturing and expanding retail adoption of convenience ingredients.

France holds 16.0% in 2025, edging to 16.5% by 2035, aided by its culinary industry and demand for premium, clean-label dehydrated ingredients. Italy accounts for 12.5% in 2025, easing to 11.5% by 2035, with demand focused on processed foods and foodservice channels. Spain represents 10.0% in 2025, moving to 9.0% by 2035, supported by tourism-related foodservice and municipal food processing.

BENELUX countries contribute 6.0% in 2025, slightly declining to 5.5% by 2035, reflecting concentrated trade and re-export activity. The Rest of Europe (Eastern Europe, Nordic, and other markets) collectively rises from 15.0% in 2025 to 17.5% by 2035, reflecting accelerating adoption of industrial dehydration capacity and increasing processed-food production across emerging European markets.

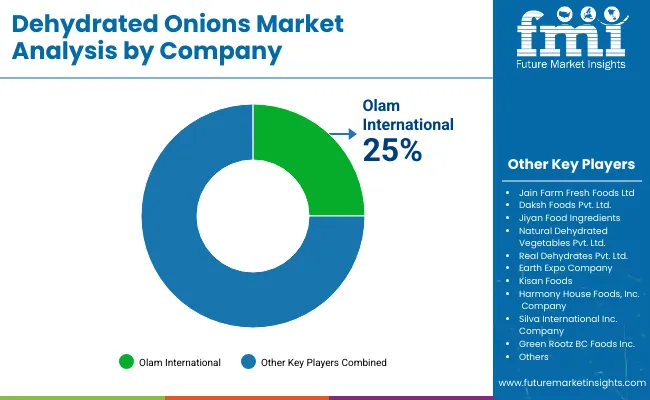

The dehydrated onions market is characterized by competition among established food ingredient suppliers, agricultural processors, and specialized dehydration companies. Companies are investing in advanced drying technologies, sustainable sourcing practices, quality control systems, and distribution network expansion to deliver reliable, cost-effective, and high-quality dehydrated onion solutions. Product standardization, processing innovation, and market reach are central to strengthening product portfolios and competitive positioning.

Olam International leads the market as a global agricultural commodity supplier, offering comprehensive dehydrated vegetable solutions with focus on supply chain efficiency and quality consistency. Jain Farm Fresh Foods Ltd provides specialized dehydrated vegetable products with emphasis on food safety and processing standards. Daksh Foods Pvt. Ltd. delivers cost-effective dehydrated solutions with focus on Indian market requirements. Jiyan Food Ingredients focuses on ingredient supply for food processing applications.

Natural Dehydrated Vegetables Pvt. Ltd. and Real Dehydrates Pvt. Ltd., operating in India, provide specialized dehydration services with emphasis on quality control and processing efficiency. Earth Expo Company offers comprehensive vegetable dehydration solutions across multiple product categories. Kisan Foods provides agricultural processing services with focus on farmer relationships and supply chain integration. Harmony House Foods, Inc. and Silva International Inc. serve North American markets with retail and food service applications.

The success of dehydrated onions, supported by convenience food demand, extended shelf life requirements, and sustainability in processing, will not only expand value-added use of onions but also strengthen food security and reduce post-harvest losses. It will consolidate emerging markets as key suppliers of processed onions while aligning advanced economies with low-waste, clean-label ingredient sourcing. This calls for a concerted effort by all stakeholders: governments, industry bodies, suppliers, OEMs, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.27 Billion |

| Nature | Organic, Conventional |

| Variety | White Onion, Red Onion, Pink Onion, Hybrid |

| Form | Chopped, Minced, Granules, Powder, Flakes, Kibbled, Sliced |

| End Use | Food Processing, Food Service Providers, Retail/Household |

| Technology | Air Drying, Vacuum Drying, Freeze Drying, Microwave Drying, Spray Drying, Others |

| Distribution Channel | B2B, B2C, Hyper/Super Markets, Convenience Stores, Specialty Stores, Traditional Grocery Retailers, Online Retailers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Olam International, Jain Farm Fresh Foods Ltd, Daksh Foods Pvt. Ltd., Jiyan Food Ingredients, Natural Dehydrated Vegetables Pvt. Ltd., Real Dehydrates Pvt. Ltd., Earth Expo Company, Kisan Foods, Harmony House Foods, Inc., Silva International Inc. |

| Additional Attributes | Market analysis by dehydration technology and processing methods, regional demand trends, competitive landscape, buyer preferences for organic versus conventional varieties, integration with food processing applications, innovations in drying technologies, quality control standards, and sustainable sourcing practices |

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

The dehydrated onions market is expected to grow from USD 2.27 billion in 2025 to USD 10.93 billion by 2035, at a CAGR of 19%.

Food processing is projected to hold the largest share, accounting for 67.7% of the dehydrated onions market in 2025.

The organic segment is forecasted to grow at a CAGR of 8.3% from 2025 to 2035, driven by rising demand for clean-label foods.

China is expected to be the fastest-growing country with a CAGR of 14.5% during the forecast period.

Spray drying is the fastest-growing technology, anticipated to grow at a CAGR of 7.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Dehydrated Onions Market Share

UK Dehydrated Onions Market Report – Trends, Demand & Outlook 2025–2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Australia Dehydrated Onions Market Trends – Size, Demand & Forecast 2025–2035

Demand for Dehydrated Onions in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Dehydrated Garlic Market Size and Share Forecast Outlook 2025 to 2035

Dehydrated Skin Product Market Forecast Outlook 2025 to 2035

Dehydrated Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dehydrated Culture Media Market Analysis - Size, Share, and Forecast 2025 to 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Market Share Insights of Dehydrated Meat Products Providers

Dehydrated Meat Product Market Growth & Demand Forecast 2025-2035

Korea Dehydrated Vegetable Market Analysis by Product Type, Form, Nature, End Use, Technology, Distribution Channel, and Region Through 2035

Demand for Dehydrated Vegetables in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Dehydrated Vegetables Market Analysis by Product Type, Form, Nature, End Use, Technology, Distribution Channel, and Country Through 2025 to 2035

Demand of Dehydrated Vegetables in Japan Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA