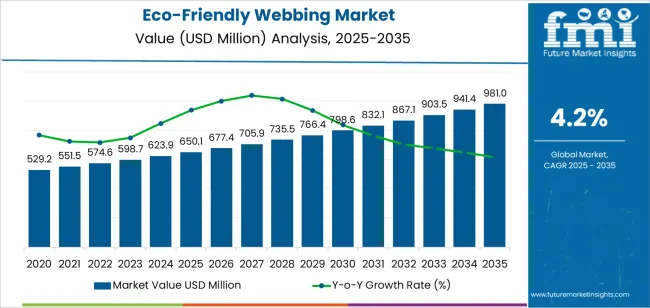

The eco-friendly webbing market is expected to grow to USD 650.1 million in 2025, and the market is projected to reach USD 980.9 million by 2035, gaining USD 330.8 million in additional value and expanding by 50.9% over the decade. Growth progresses at a 4.2% CAGR, with demand increasing nearly 1.51 times as manufacturers adopt recycled polyester, bio-based fibers, and environmentally responsible textile processes. The early growth phase from 2025 to 2030 lifts the market to USD 798.5 million, adding USD 148.4 million, driven by the rising adoption of RPET webbing in automotive seat belts, outdoor gear, and safety harness systems. This period sees extended producer responsibility regulations prompting manufacturers to increase the use of recycled content while maintaining strength and durability standards.

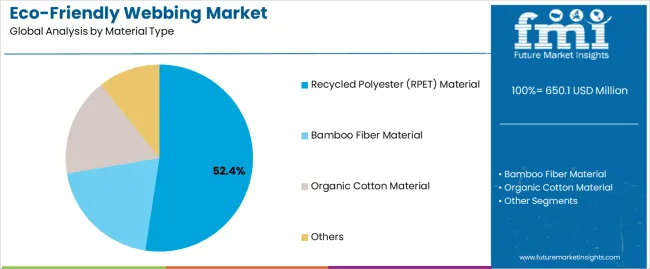

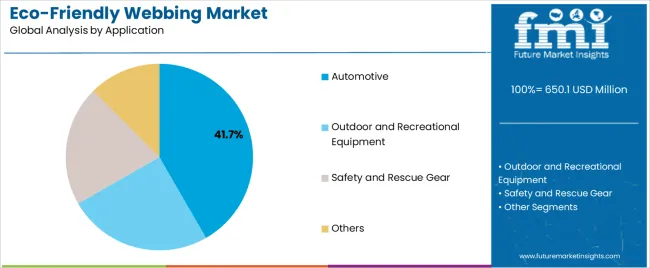

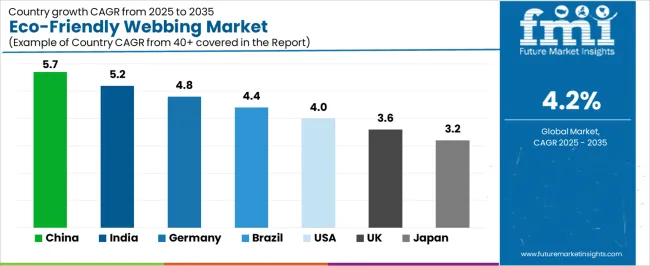

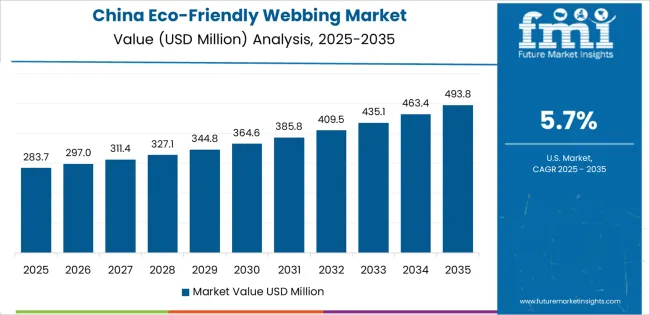

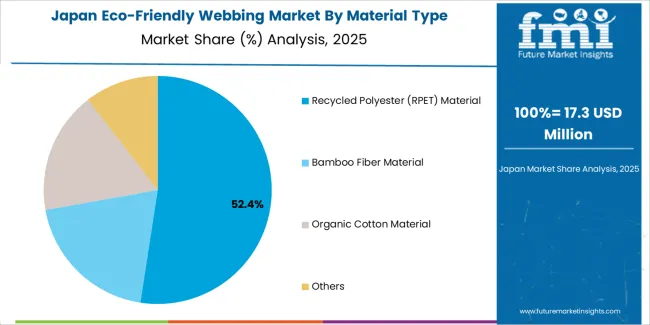

The later phase from 2030 to 2035 adds USD 182.4 million, supported by advances in bio-based fiber technologies, closed-loop recycling systems, and third-party certification frameworks validating environmental claims. RPET maintains its leadership with a 52.4% share, reflecting its mechanical reliability and established recycling infrastructure. Automotive applications account for 41.7%, driven by vehicle-level environmental commitments, recycled-content regulations, and the integration of eco-friendly webbing across restraint and interior systems. Regionally, China leads with a 5.7% CAGR, followed by India at 5.2%, supported by textile recycling expansion and the growth of automotive and outdoor equipment manufacturing clusters. Germany grows at 4.8%, driven by environmental leadership and strong outdoor brand presence, while the United States expands at 4.0%

From 2030 to 2035, the market is forecast to grow from USD 798.5 million to USD 980.9 million, adding another USD 182.4 million, which constitutes 55.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of bio-based fiber technologies enabling fully compostable webbing products, the development of advanced recycling systems supporting closed-loop material flows, and the growth of certification programs verifying environmental claims and responsible sourcing practices. The growing adoption of corporate environmental targets and circular design principles will drive demand for eco-friendly webbing with enhanced environmental credentials and verified lifecycle performance attributes.

Between 2020 and 2025, the market experienced steady growth, driven by increasing consumer awareness of environmental issues and growing recognition of eco-friendly webbing materials as viable alternatives offering comparable performance to conventional petroleum-based products. The market developed as outdoor equipment brands and automotive suppliers recognized the potential for eco-friendly webbing to reduce environmental footprint, meet environmental commitments, and appeal to environmentally conscious consumers while maintaining strength, durability, and safety performance requirements. Technological advancement in recycled fiber processing and environmentally responsible material development began focusing the critical importance of maintaining consistent mechanical properties and colorfastness standards in demanding application environments.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 650.1 million |

| Forecast Value in (2035F) | USD 980.9 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

Market expansion is being supported by the increasing global focus on environmental responsibility and circular economy initiatives driven by consumer demand and regulatory requirements, alongside the corresponding need for environmentally responsible textile materials that can deliver equivalent strength, maintain durability standards, and reduce environmental impact across various automotive restraint systems, outdoor equipment straps, and safety harness applications. Modern brand owners and equipment manufacturers are increasingly focused on implementing eco-friendly webbing solutions that can demonstrate carbon footprint reduction, support recycled content targets, and provide transparent supply chain verification in consumer-facing applications.

The growing focus on corporate environmental commitments and environmental, social, and governance reporting is driving demand for eco-friendly webbing that can support measurable environmental improvements, enable product differentiation, and ensure comprehensive compliance with emerging regulations regarding recycled content and environmentally responsible materials. Equipment manufacturers' preference for environmentally responsible materials that combine environmental credentials with performance reliability and cost competitiveness is creating opportunities for innovative eco-friendly webbing implementations. The rising influence of outdoor recreation participation growth and environmentally conscious lifestyle trends is also contributing to increased adoption of eco-friendly webbing products that can provide reliable performance without compromising environmental values or product safety requirements.

The market is segmented by material type, application, and region. By material type, the market is divided into recycled polyester (RPET) material, bamboo fiber material, organic cotton material, and others. Based on application, the market is categorized into automotive, outdoor and recreational equipment, safety and rescue gear, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The recycled polyester (RPET) material segment is projected to maintain its leading position in the market in 2025 with a 52.4% market share, reaffirming its role as the preferred environmentally responsible material for high-strength webbing applications across automotive, outdoor equipment, and safety gear sectors. Equipment manufacturers and brand owners increasingly utilize RPET webbing for its proven mechanical properties comparable to virgin polyester, established recycling infrastructure utilizing post-consumer plastic bottles, and superior cost-effectiveness relative to alternative environmentally responsible materials while supporting circular economy objectives. RPET material technology's performance reliability and environmental benefit documentation directly address the market requirements for eco-friendly webbing that maintains safety certification standards and durability expectations across diverse load-bearing and restraint applications.

This material segment forms the foundation of environmentally responsible webbing production, as it represents the material with the greatest commercial availability and established manufacturing processes across multiple webbing production facilities and geographic regions. Industry investments in plastic recycling infrastructure continue to strengthen material supply among webbing manufacturers and converters. With increasing corporate commitments to utilize recycled content and consumer demand for products made from post-consumer materials, RPET webbing aligns with both environmental objectives and performance requirements, making it the central component of comprehensive environmentally responsible textile strategies.

The automotive application segment is projected to represent the largest share of eco-friendly webbing demand in 2025 with a 41.7% market share, underscoring its critical role as the primary driver for environmentally responsible webbing adoption across seat belt systems, airbag components, and interior trim applications in passenger vehicles and commercial vehicles. Automotive manufacturers prefer eco-friendly webbing materials due to their contribution to vehicle-level environmental targets, ability to meet stringent safety performance standards, and capacity to reduce manufacturing environmental footprint while supporting regulatory compliance and corporate environmental commitments. Positioned as essential materials for environmentally responsible automotive interior systems, eco-friendly webbing offers both environmental benefits and technical performance assurance.

The segment is supported by continuous tightening of automotive environmental regulations and the growing implementation of recycled content requirements that mandate minimum percentages of environmentally responsible materials with verified environmental attributes and lifecycle documentation. Automotive manufacturers are investing in comprehensive environmentally responsible materials programs to support carbon neutrality commitments, circular economy initiatives, and consumer preference for environmentally responsible vehicles that incorporate eco-friendly materials throughout interior and safety systems. As automotive environmental standards advance and consumer awareness increases, the automotive application will continue to dominate the market while supporting expanded eco-friendly material integration and supply chain transparency initiatives.

The eco-friendly webbing market is advancing steadily due to increasing demand for environmentally responsible textile products driven by consumer environmental awareness and growing implementation of circular economy regulations that require materials providing reduced carbon footprint and recyclability characteristics across diverse automotive safety systems, outdoor recreation equipment, and industrial safety applications. The market faces challenges, including higher costs compared to conventional webbing materials, limited availability of certain environmentally responsible fibers at commercial scale, and technical constraints related to color consistency and UV stability in some natural fiber applications. Innovation in recycled fiber processing and bio-based material development continues to influence product advancement and market expansion patterns.

The growing implementation of circular economy legislation and extended producer responsibility requirements is driving demand for webbing materials that incorporate post-consumer recycled content, support end-of-life recycling systems, and enable manufacturers to meet mandatory recycled content targets in textile products. Automotive and outdoor equipment applications increasingly require eco-friendly webbing that provides documented environmental attributes, verified recycled content percentages, and third-party certification supporting regulatory compliance and environmental claims. Equipment manufacturers are recognizing the strategic advantages of establishing environmentally responsible material supply chains that address current regulations while positioning for anticipated future requirements, creating opportunities for certified eco-friendly webbing products with transparent material traceability and verified environmental performance data.

Modern eco-friendly webbing manufacturers are incorporating chemical recycling processes, mechanical fiber recovery systems, and bio-based polymer development to enhance material quality, expand feedstock sources, and support comprehensive environmental objectives through innovative fiber production and processing technologies. Leading companies are developing advanced RPET formulations with improved UV resistance, implementing bamboo fiber processing techniques that maintain strength characteristics, and advancing organic cotton cultivation practices that reduce water consumption and chemical inputs. These developments improve material performance while enabling new market opportunities, including fully biodegradable webbing for temporary applications, carbon-neutral production processes, and closed-loop recycling systems that recover and reprocess post-industrial waste. Advanced material integration also allows manufacturers to support comprehensive environmental certification requirements and product differentiation beyond conventional environmental attributes.

The expansion of environmentally responsible product certification programs and supply chain transparency initiatives is driving demand for eco-friendly webbing backed by verified environmental claims, third-party certification, and comprehensive documentation addressing raw material sourcing, manufacturing processes, and lifecycle environmental impacts. These applications require rigorous testing protocols, standardized measurement methodologies, and independent verification systems that ensure credibility of environmental claims, creating market segments with differentiated value propositions based on certification levels and environmental performance documentation. Manufacturers are investing in certification compliance, blockchain traceability systems, and environmental impact assessment capabilities to serve brands requiring documented environmental credentials while supporting consumer trust and regulatory compliance in environmentally sensitive markets.

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.7% |

| India | 5.2% |

| Germany | 4.8% |

| Brazil | 4.4% |

| United States | 4.0% |

| United Kingdom | 3.6% |

| Japan | 3.2% |

The market is experiencing solid growth globally, with China leading at a 5.7% CAGR through 2035, driven by expanding textile recycling infrastructure, growing automotive production requiring environmentally responsible materials, and increasing government focus on circular economy development. India follows at 5.2%, supported by developing recycled fiber processing capacity, expanding outdoor equipment manufacturing, and rising environmental awareness among consumers and manufacturers.

Germany shows growth at 4.8%, focusing automotive environmental leadership, outdoor equipment brand concentration, and advanced recycling technology implementation. Brazil demonstrates 4.4% growth, supported by outdoor recreation market expansion, automotive industry environmental initiatives, and growing environmental consciousness. The United States records 4.0%, focusing on outdoor equipment market strength, automotive recycled content requirements, and consumer demand for environmentally responsible products. The United Kingdom exhibits 3.6% growth, focusing environmentally conscious fashion initiatives, outdoor equipment innovation, and circular economy commitment. Japan shows 3.2% growth, supported by automotive quality standards, environmental technology advancement, and precision textile manufacturing capabilities.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is projected to exhibit exceptional growth with a CAGR of 5.7% through 2035, driven by massive textile recycling infrastructure development and rapidly expanding automotive and outdoor equipment manufacturing sectors supported by government circular economy policies and environmental protection initiatives. The country's dominant position in global textile production and increasing focus on environmentally responsible manufacturing are creating substantial demand for eco-friendly webbing materials. Major webbing manufacturers and automotive suppliers are establishing comprehensive recycled material processing capabilities to serve both domestic markets and international brand requirements.

India is expanding at a CAGR of 5.2%, supported by the country's developing textile recycling capabilities, expanding automotive component manufacturing, and increasing adoption of environmentally responsible materials among domestic and export-oriented manufacturers. The country's comprehensive textile industry infrastructure and rising environmental awareness are driving demand for eco-friendly webbing solutions throughout diverse application sectors. Leading webbing manufacturers and international brands are establishing production partnerships and material sourcing relationships to address growing environmentally responsible product requirements.

Germany is expanding at a CAGR of 4.8%, supported by the country's automotive environmental leadership, strong outdoor equipment brand presence, and advanced circular economy implementation throughout manufacturing sectors. The nation's environmental commitment and technological capabilities are driving sophisticated eco-friendly webbing applications throughout automotive and recreation industries. Leading automotive manufacturers and outdoor equipment brands are investing extensively in environmentally responsible material specifications and supply chain development.

Brazil is expanding at a CAGR of 4.4%, supported by the country's growing outdoor recreation market, developing automotive industry environmental initiatives, and increasing environmental awareness among consumers and manufacturers. Brazil's natural resource orientation and outdoor lifestyle culture are driving demand for eco-friendly webbing solutions. Equipment manufacturers and automotive suppliers are investing in environmentally responsible material adoption to serve both domestic markets and international brand partnerships.

The United States is expanding at a CAGR of 4.0%, supported by the country's large outdoor recreation equipment market, automotive recycled content initiatives, and strong consumer preference for environmentally responsible products with verified environmental credentials. The nation's outdoor lifestyle culture and environmental consciousness are driving demand for eco-friendly webbing solutions. Outdoor equipment brands and automotive manufacturers are investing in environmentally responsible material sourcing and certification programs to meet consumer expectations and regulatory requirements.

The United Kingdom is expanding at a CAGR of 3.6%, driven by the country's circular economy initiatives, environmentally conscious fashion movement, and outdoor equipment brand innovation supporting environmental material adoption. The United Kingdom's environmental leadership and consumer environmental consciousness are driving demand for certified eco-friendly webbing materials. Outdoor equipment brands and fashion companies are investing in environmentally responsible material integration and supply chain transparency programs.

Japan is expanding at a CAGR of 3.2%, supported by the country's automotive quality standards, environmental technology development, and precision textile manufacturing capabilities serving domestic and international markets. Japan's technological sophistication and quality focus are driving demand for high-specification eco-friendly webbing products. Automotive manufacturers and specialty webbing producers are investing in environmentally responsible material development and quality certification programs.

What is the market split by country in Europe?

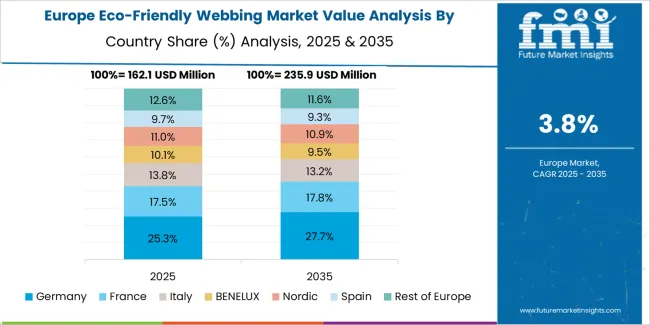

The eco-friendly webbing market in Europe is projected to grow from USD 231.6 million in 2025 to USD 355.2 million by 2035, registering a CAGR of 4.4% over the forecast period. Germany is expected to maintain leadership with a 29.8% market share in 2025, moderating to 29.3% by 2035, supported by automotive environmental leadership, outdoor equipment brand concentration, and circular economy implementation.

The United Kingdom follows with 17.9% in 2025, projected at 17.6% by 2035, driven by circular economy initiatives, outdoor equipment innovation, and environmentally conscious fashion movement. France holds 15.4% in 2025, rising to 15.6% by 2035 on the back of automotive environmental standards, outdoor equipment manufacturing, and environmental commitment. Italy commands 11.7% in 2025, increasing slightly to 11.9% by 2035, while Spain accounts for 9.3% in 2025, reaching 9.5% by 2035 aided by outdoor equipment production and automotive component manufacturing. The Netherlands maintains 5.1% in 2025, up to 5.2% by 2035 due to circular economy leadership and environmentally responsible textile innovation. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 10.8% in 2025 and 10.9% by 2035, reflecting steady progress in environmentally responsible material adoption, outdoor equipment manufacturing, and environmental regulation implementation.

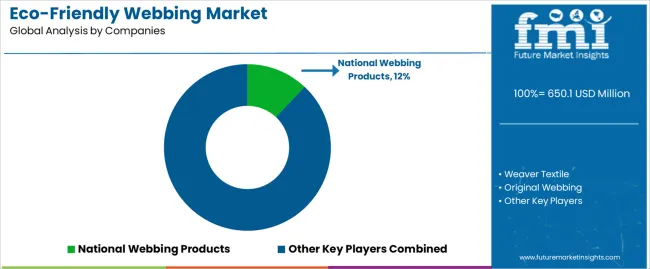

The market is characterized by competition among established webbing manufacturers, environmentally responsible textile innovators, and specialized material suppliers. Companies are investing in recycled material processing, environmentally responsible fiber sourcing, product certification programs, and technical performance validation to deliver reliable, environmentally responsible, and competitively priced eco-friendly webbing solutions. Innovation in recycled fiber quality, bio-based material development, and environmental certification systems is central to strengthening market position and competitive advantage.

National Webbing Products leads the market with comprehensive webbing solutions with a focus on recycled polyester materials, automotive safety applications, and certified environmentally responsible content across diverse industrial and consumer applications. Weaver Textile provides specialized webbing products with focus on outdoor equipment applications, environmentally responsible material options, and technical performance assurance. Original Webbing delivers custom webbing solutions with focus on environmentally responsible materials and application-specific designs. Pfeiffer offers technical webbing products with focus on safety applications and quality manufacturing. ACW provides webbing and strap solutions with focus on industrial and outdoor equipment applications.

Fuwei specializes in webbing manufacturing for Asian markets with focus on environmentally responsible material processing. Strapworks focuses on custom webbing and hardware solutions for diverse applications. BOLIN WEBBING provides webbing products for outdoor equipment and industrial sectors. Qiheng Weaves emphasizes specialized webbing manufacturing with environmentally responsible material capabilities. Jude Webbing offers webbing solutions for automotive and industrial applications. ChangYe Webbing provides comprehensive webbing products serving multiple market segments.

Eco-friendly webbing represents a growing environmentally responsible materials segment within textile and automotive component manufacturing, projected to grow from USD 650.1 million in 2025 to USD 980.9 million by 2035 at a 4.2% CAGR. These environmentally responsible textile products serve as functional components in automotive safety systems, outdoor equipment, and industrial applications where material strength, durability, and environmental credentials are essential. Market expansion is driven by increasing consumer environmental awareness, growing circular economy regulations, expanding automotive recycled content requirements, and rising implementation of corporate environmental commitments across diverse automotive, outdoor recreation, safety equipment, and industrial strap applications.

How Environmental Regulators Could Strengthen Environmental Standards and Material Requirements?

How Industry Associations Could Advance Certification Systems and Best Practices?

How Eco-Friendly Webbing Manufacturers Could Drive Innovation and Market Leadership?

How Equipment Manufacturers and Brand Owners Could Optimize Environmentally Responsible Material Integration?

How Research Institutions Could Enable Technology Advancement?

How Recycling Infrastructure Providers Could Support Circular Economy Development?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 650.1 million |

| Material Type | Recycled Polyester (RPET) Material, Bamboo Fiber Material, Organic Cotton Material, Others |

| Application | Automotive, Outdoor and Recreational Equipment, Safety and Rescue Gear, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | National Webbing Products, Weaver Textile, Original Webbing, Pfeiffer, ACW |

| Additional Attributes | Dollar sales by material type and application category, regional demand trends, competitive landscape, technological advancements in recycled fiber processing, environmental certification programs, circular economy innovation, and environmentally responsible material integration strategies |

The global eco-friendly webbing market is estimated to be valued at USD 650.1 million in 2025.

The market size for the eco-friendly webbing market is projected to reach USD 981.0 million by 2035.

The eco-friendly webbing market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in eco-friendly webbing market are recycled polyester (rpet) material, bamboo fiber material, organic cotton material and others.

In terms of application, automotive segment to command 41.7% share in the eco-friendly webbing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Tubular Webbing Market Size and Share Forecast Outlook 2025 to 2035

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Aramid Flame Retardant Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA