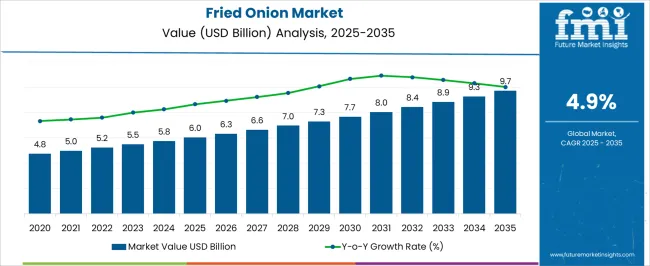

The fried onion market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The fried onion market is projected to grow from USD 6 billion in 2025 to USD 9.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 4.9%. Year-on-year, market value is expected to rise steadily, reaching USD 6.6 billion in 2027 and USD 7.7 billion by 2030, highlighting consistent consumer demand and increasing adoption in foodservice, packaged foods, and culinary applications. Revenue expansion is being driven by the growing popularity of convenience foods and ready-to-eat products, where fried onions are increasingly incorporated for flavor enhancement and texture.

Throughout the 2025 to 2035 period, market momentum is being shaped by the scaling of processing capabilities and wider distribution channels. Fried onion supply chains are being optimized to meet the rising demand, and manufacturers are being positioned to leverage quality, shelf life, and product variety as key value drivers. Growth is being reinforced by changing dietary preferences and expanding applications in both domestic and international markets, which together support revenue accumulation and long-term market stability. By 2035, market presence is expected to be well-entrenched across multiple segments, reflecting strong uptake and consistent commercial performance.

| Metric | Value |

|---|---|

| Fried Onion Market Estimated Value in (2025 E) | USD 6.0 billion |

| Fried Onion Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The fried onion market is estimated to occupy a notable proportion within its parent markets, representing approximately 5-6% of the processed food market, around 8-9% of the snack food market, close to 12-14% of the condiments and seasonings market, about 6-7% of the ready-to-eat and convenience foods market, and roughly 4-5% of the culinary ingredients market. Collectively, the cumulative share across these parent segments is observed in the range of 35-41%, reflecting a strong presence of fried onions as both a flavor enhancer and a convenient ingredient in multiple food segments. The market has been influenced by rising demand for ready-to-use toppings, easy-to-cook solutions, and the appeal of enhancing taste and texture in meals, where quality, shelf-life, and flavor consistency are highly prioritized.

Adoption is further guided by procurement decisions focused on cost-effectiveness, versatility, and compatibility with diverse culinary applications, ranging from packaged snacks to restaurant kitchens. Market participants have emphasized advanced processing techniques, packaging solutions, and consistent product quality to maintain reliability and meet consumer expectations. Consequently, the Fried Onion Market has not only captured a significant share within snack and seasoning categories but has also influenced processed, convenience, and culinary ingredient segments, demonstrating its integral role in enhancing food flavor profiles and supporting efficiency across the broader food supply chain.

The fried onion market is experiencing notable growth driven by increasing consumer demand for convenient, ready-to-use food ingredients that enhance both flavor and presentation. Rising popularity of gourmet home cooking, fast food culture, and packaged meal solutions is encouraging greater use of fried onions in a variety of dishes.

Advances in processing techniques have improved shelf life, flavor retention, and texture consistency, broadening application in both household and commercial food sectors. Health-conscious product innovations, including low-oil and organic variants, are further attracting diverse consumer segments.

Expanding availability across organized retail formats, coupled with targeted marketing in emerging economies, is amplifying product visibility and accessibility. With continued product diversification and strong integration into global foodservice supply chains, the market outlook remains positive, supported by the dual appeal of convenience and taste enhancement.

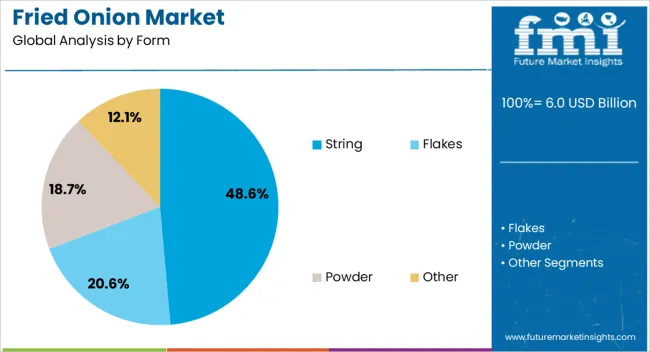

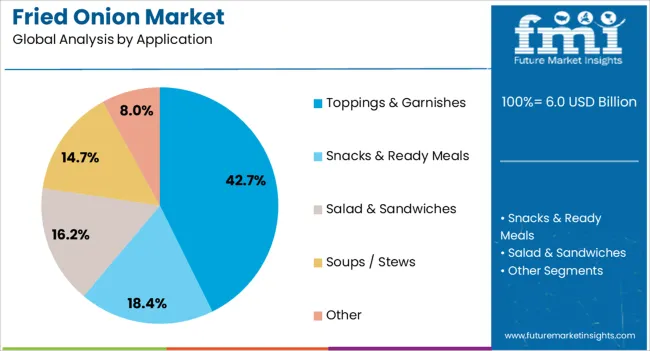

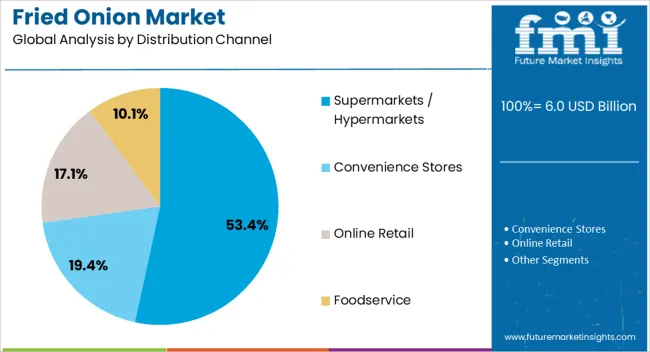

The fried onion market is segmented by form, application, distribution channel, and geographic regions. By form, fried onion market is divided into string, flakes, powder, and other. In terms of application, fried onion market is classified into toppings & garnishes, snacks & ready meals, salad & sandwiches, soups / stews, and other. Based on distribution channel, fried onion market is segmented into supermarkets / hypermarkets, convenience stores, online retail, and foodservice. Regionally, the fried onion industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The string form segment is projected to hold 48.6% of the total market revenue by 2025 within the form category, making it the most prominent segment. Its dominance is supported by versatility in both household and commercial kitchens, offering a crisp texture and visual appeal that complements a variety of dishes.

The ease of portion control, quick preparation, and compatibility with both hot and cold recipes have increased adoption.

Furthermore, its suitability for long-term storage without compromising taste has positioned string form fried onions as a staple ingredient in packaged meal kits, restaurant menus, and catering services.

The toppings and garnishes segment is expected to account for 42.7% of the total market revenue by 2025 within the application category, positioning it as the leading segment. This growth is attributed to increasing use in enhancing the presentation and flavor profile of fast food, bakery items, salads, and ready-to-eat meals.

Their role in delivering both visual appeal and textural contrast has strengthened their demand in foodservice and home cooking.

Additionally, the influence of social media on food presentation trends has further boosted consumer interest in toppings and garnishes.

The supermarkets and hypermarkets segment is projected to contribute 53.4% of total market revenue by 2025 under the distribution channel category, making it the largest segment. This dominance is driven by the wide product assortment, ease of access, and ability to influence purchase decisions through in-store promotions and sampling.

Consumers benefit from the opportunity to compare brands, packaging sizes, and price points, leading to higher sales volumes.

The increasing penetration of organized retail in urban and semi-urban areas continues to reinforce this channel’s leadership in fried onion distribution.

The fried onion market is driven by rising demand in convenience foods, packaged snacks, and fast-casual dining. Opportunities are emerging from premium, flavored, and value-added variants, while trends emphasize ready-to-use and long shelf-life products for households and foodservice operators. Challenges persist due to raw material supply fluctuations, seasonal variability, and cost pressures. Despite these constraints, fried onions continue to be widely adopted as garnishes, toppings, and flavor enhancers, supporting market expansion and prompting manufacturers to focus on innovation, product quality, and distribution efficiency.

The demand for fried onions has been increasingly influenced by their extensive use in ready-to-eat meals, packaged snacks, and fast-food chains. Culinary applications such as garnishes, toppings, and flavor enhancers in soups, salads, and sandwiches have further strengthened adoption. Retailers and foodservice providers are incorporating fried onions into instant noodles, frozen meals, and snack mixes to meet consumer preference for convenience and taste. E-commerce and grocery delivery channels have expanded product reach, ensuring year-round availability. This trend is particularly prominent in North America, Europe, and Asia-Pacific, where busy lifestyles and preference for quick meal solutions have intensified the reliance on fried onion products.

Opportunities in the fried onion market are increasing due to the introduction of premium, flavored, and organic variants. Producers are experimenting with seasoning blends such as spicy, tangy, and herb-infused coatings to cater to gourmet and health-conscious consumers. Packaged snack companies are integrating these variants to differentiate offerings and capture niche segments. The development of value-added fried onions for salad toppings, burger garnishes, and international cuisines provides additional avenues for revenue growth. As consumer willingness to pay a premium rises, manufacturers are leveraging product innovation to strengthen brand positioning and expand their market presence across emerging and established regions.

A key trend shaping the fried onion market is the focus on ready-to-use, long shelf-life products that simplify food preparation for households and foodservice operators. Vacuum-fried, dehydrated, and pre-seasoned onion products are being introduced to enhance convenience and maintain crispness and flavor during storage. Food brands are increasingly sourcing these products to reduce preparation time and improve menu consistency. The popularity of meal kits and instant recipes is boosting demand for pre-packaged fried onions. These trends are encouraging suppliers to optimize packaging, preservation techniques, and portion sizes to meet evolving consumer expectations for quality and convenience.

The fried onion market faces challenges arising from inconsistent onion supply, seasonal variability, and price fluctuations. Raw onion availability is affected by weather conditions, cultivation cycles, and export restrictions, impacting production costs and inventory planning. High oil and seasoning expenses further contribute to overall cost pressures. Manufacturers are required to implement robust sourcing strategies, maintain buffer stocks, and negotiate long-term contracts with suppliers to mitigate risks. These challenges affect pricing strategies, profit margins, and the ability to maintain consistent product quality, compelling producers to adopt efficient processing, storage, and supply chain management practices.

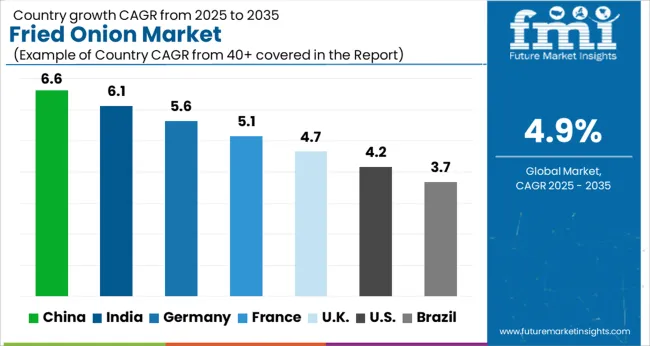

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global fried onion market is projected to grow at a CAGR of 4.9% from 2025 to 2035. China leads with a growth rate of 6.6%, followed by India at 6.1%, and Germany at 5.6%. The United Kingdom records a growth rate of 4.7%, while the United States shows the slowest growth at 4.2%. Growth is fueled by increasing consumer preference for ready-to-eat foods, convenience ingredients in cooking, and the rise of fast-food and casual dining sectors. Emerging markets such as China and India witness higher adoption due to expanding retail chains, rising disposable incomes, and growing awareness of convenience foods. Developed economies like the USA, UK, and Germany see steady growth driven by established foodservice channels, premium product offerings, and consistent consumer demand. This report includes insights on 40+ countries; the top markets are highlighted here for reference.

The fried onion market in China is projected to grow at a CAGR of 6.6%. Increasing consumption of ready-to-eat and convenience foods, including packaged snacks and pre-cooked meals, drives market demand. Foodservice chains, including fast-food restaurants and casual dining outlets, are incorporating fried onions into menus, enhancing adoption. Local manufacturers are expanding production capacities, improving quality standards, and offering flavored or value-added variants to cater to evolving tastes. Urban population growth and rising disposable incomes contribute to increased household usage. E-commerce platforms and modern retail chains further facilitate distribution, ensuring widespread product availability. These factors collectively strengthen the overall fried onion market in China, supporting sustained growth over the forecast period.

The fried onion market in India is projected to grow at a CAGR of 6.1%. Rising household consumption of convenience foods and pre-packaged ingredients fuels demand. Quick-service restaurants and casual dining chains are increasingly using fried onions to enhance menu offerings, contributing to market adoption. Manufacturers focus on high-quality production, packaging innovations, and extended shelf-life variants to meet consumer expectations. The growing urban population, increasing disposable incomes, and exposure to global culinary trends further support market expansion. Retail expansion across modern trade outlets and online platforms ensures product accessibility across urban and semi-urban regions. India’s food processing industry growth, along with rising demand for flavored and ready-to-use ingredients, continues to drive steady market development.

The fried onion market in Germany is projected to grow at a CAGR of 5.6%. Rising preference for ready-to-use cooking ingredients, convenience foods, and culinary applications contributes to market demand. The foodservice sector, including restaurants and catering services, increasingly incorporates fried onions to add flavor and texture to meals. Manufacturers focus on premium quality, clean-label ingredients, and innovative packaging to cater to health-conscious consumers. Retail chains, supermarkets, and e-commerce platforms ensure wide product availability. Market growth is further supported by Germany’s strong food processing industry and consumer inclination toward convenience without compromising quality. These combined factors help maintain steady adoption and expansion of fried onions in Germany over the forecast period.

The fried onion market in the United Kingdom is projected to grow at a CAGR of 4.7%. Steady consumer demand for convenience foods, pre-packaged ingredients, and flavor enhancers contributes to market growth. The quick-service restaurant and casual dining sectors increasingly integrate fried onions into menu offerings. Manufacturers emphasize product quality, hygiene, and packaging innovations to meet regulatory and consumer expectations. Retail distribution through supermarkets, convenience stores, and e-commerce ensures widespread availability. Rising awareness of culinary convenience, combined with established foodservice channels, supports steady market adoption. These factors collectively strengthen the fried onion industry in the UK, maintaining moderate but consistent growth throughout the forecast period.

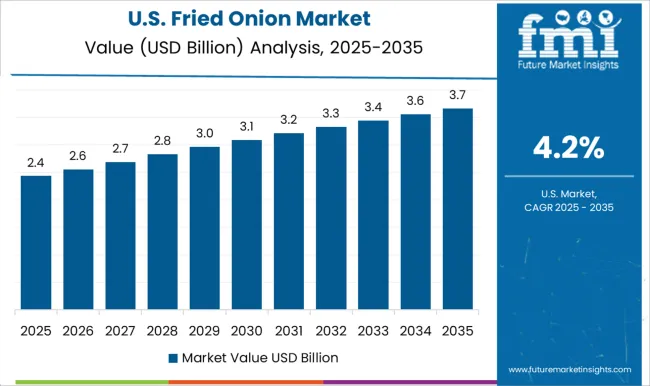

The fried onion market in the United States is projected to grow at a CAGR of 4.2%. Demand is driven by household use in cooking, ready-to-eat foods, and pre-packaged meal solutions. Fast-food chains, casual dining, and catering services increasingly use fried onions to enhance flavor and presentation, boosting adoption. Manufacturers focus on high-quality production, extended shelf-life, and flavor innovation to cater to evolving consumer preferences. Retail chains, online platforms, and specialty food stores ensure broad product availability. The mature foodservice and retail infrastructure, coupled with consistent consumer demand for convenience ingredients, supports steady market growth. Continued innovation and diversified applications in culinary, retail, and foodservice sectors maintain stable expansion of fried onions in the USA

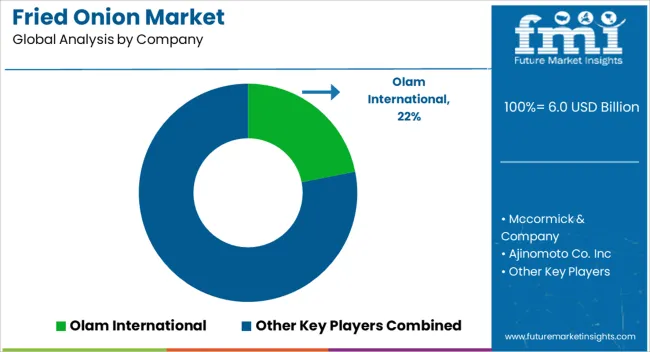

The fried onion market is shaped by competition among global flavor specialists and regional snack ingredient suppliers delivering crispy, aromatic products for retail, foodservice, and industrial applications. Olam International, McCormick & Company, and Ajinomoto Co. Inc dominate with broad portfolios emphasizing taste consistency, quality, and shelf stability. Their brochures highlight superior crunch, flavor retention, and versatility across culinary uses, appealing to manufacturers of ready-to-eat meals, snacks, and gourmet dishes. B&G Foods Inc., Roland Foods, and Kissan International focus on branded retail products, emphasizing convenience, taste intensity, and international flavor profiles to attract home cooks and professional chefs. Lion Foods B.V. and Fresh Gourmet Company target premium segments, promoting natural ingredients and clean-label processing.

Meanwhile, Pereg Gourmet Spices and Verstegen Spices & Sauces UK Ltd. leverage specialty and ethnic flavor blends, ensuring differentiated offerings in competitive markets. Regional and emerging players such as The Onion Group, Sadaf, Beevis, Kings Crispy Onion, and Pik-Nik Foods compete on price, local sourcing, and product customization for niche culinary applications. Marketing materials often highlight production reliability, uniform texture, and rapid integration into various recipes, reflecting rising demand for convenience, ready-to-use ingredients, and flavor enhancement.

Competition is driven by taste profile, crunch retention, oil absorption, and packaging innovation. Brochures frequently stress freshness, aroma preservation, and compatibility with multiple cooking methods, positioning fried onions as essential ingredients for both industrial food production and retail culinary experiences. The strategic focus of these players ensures they maintain relevance across global markets while addressing consumer preference for high-quality, flavorful, and easy-to-use fried onion products.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 billion |

| Form | String, Flakes, Powder, and Other |

| Application | Toppings & Garnishes, Snacks & Ready Meals, Salad & Sandwiches, Soups / Stews, and Other |

| Distribution Channel | Supermarkets / Hypermarkets, Convenience Stores, Online Retail, and Foodservice |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Olam International, Mccormick & Company, Ajinomoto Co. Inc, B&G Foods Inc., Roland Foods, Kissan International, Lion Foods B.V., Fresh Gourmet Company, Pereg Gourmet Spices, Verstegen Spices & Sauces Uk Ltd., The Onion Group, Sadaf, Beevis, Kings Crispy Onion, and Pik-Nik Foods |

| Additional Attributes | Dollar sales by product type (crispy fried, dehydrated, powdered) and application (snacks, ready-to-eat meals, condiments, fast food) are key metrics. Trends include rising demand for convenient and ready-to-use ingredients, growth in the foodservice and packaged food sectors, and increasing adoption in global cuisines. Regional preferences, technological advancements, and food safety regulations are driving market growth. |

The global fried onion market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the fried onion market is projected to reach USD 9.7 billion by 2035.

The fried onion market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in fried onion market are string, flakes, powder and other.

In terms of application, toppings & garnishes segment to command 42.7% share in the fried onion market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Onion Powder Market

Onion Essential Oils Market

Dehydrated Onions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Dehydrated Onions Market Share

UK Dehydrated Onions Market Report – Trends, Demand & Outlook 2025–2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Australia Dehydrated Onions Market Trends – Size, Demand & Forecast 2025–2035

Demand for Dehydrated Onions in EU Size and Share Forecast Outlook 2025 to 2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA