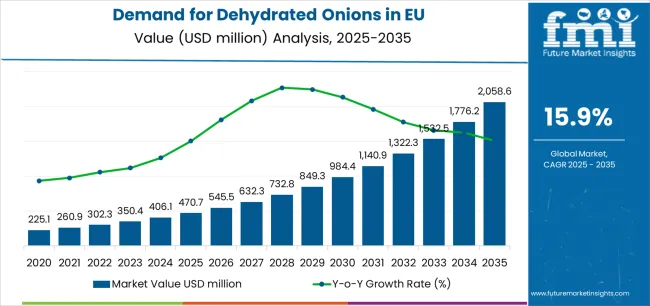

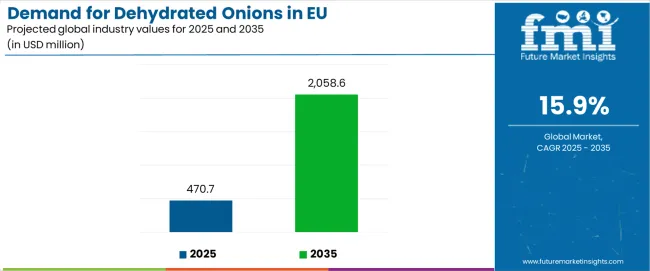

European Union dehydrated onions sales are projected to grow from USD 470.7 million in 2025 to approximately USD 2,058.6 million by 2035, recording an absolute increase of USD 1,585.2 million over the forecast period. This translates into total growth of 336.8%, with demand forecast to expand at a compound annual growth rate (CAGR) of 15.9% between 2025 and 2035. Based on industry-backed research by FMI, a provider frequently cited in dietary and functional ingredient markets, the overall industry size is expected to grow by nearly 4.4X during the same period, supported by the increasing demand for convenience food ingredients, growing adoption of dehydrated vegetables in food processing, and expanding applications across ready meals, sauces, snacks, and foodservice operations throughout European manufacturing and culinary channels.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 470.7 million |

| Market Forecast Value (2035) | USD 2,058.6 million |

| Forecast CAGR (2025-2035) | 15.9% |

Between 2025 and 2030, EU dehydrated onions demand is projected to expand from USD 470.7 million to USD 893.7 million, resulting in a value increase of USD 423 million, which represents 26.7% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer demand for convenience foods, increasing adoption of shelf-stable ingredients in food manufacturing, and growing recognition of dehydrated onions as cost-effective flavor solutions across ready meals, sauces, and snack applications. Manufacturers are expanding their product portfolios to address the evolving preferences for consistent quality, extended shelf life, and functionally optimized dehydration processes meeting European food safety standards.

From 2030 to 2035, sales are forecast to grow from USD 893.7 million to USD 2,058.6 million, adding another USD 1,162.2 million, which constitutes 73.3% of the overall ten-year expansion. This period is expected to be characterized by further expansion of organic varieties, integration into premium food formulations for enhanced flavor profiles, and development of specialized forms targeting specific culinary applications. The growing emphasis on clean-label ingredients and increasing manufacturer willingness to adopt premium dehydrated vegetable solutions will drive demand for high-quality dehydrated onions products that deliver authentic flavor with processing convenience.

Between 2020 and 2025, EU dehydrated onions sales experienced robust expansion at a CAGR of 11%, growing from USD 280 million to USD 470.7 million. This period was driven by increasing convenience food consumption among European consumers, rising awareness of ingredient shelf-stability benefits in food processing, and growing recognition of dehydrated onions' versatility across diverse culinary applications. The industry developed as major food processors and specialized dehydration companies recognized the commercial potential of shelf-stable vegetable ingredients. Product innovations, improved dehydration techniques, and flavor preservation enhancements began establishing manufacturer confidence and mainstream acceptance of dehydrated onions in industrial food production.

Industry expansion is being supported by the rapid increase in processed food manufacturing and foodservice operations across European countries and the corresponding demand for convenient, cost-effective, and consistent flavor ingredients with proven shelf stability and ease of handling. Modern food manufacturers rely on dehydrated onions as essential flavoring components in ready meals, soup bases, seasoning blends, savory snacks, and sauce formulations, driving demand for products that deliver authentic onion flavor, consistent particle size, and reliable rehydration characteristics. Even minor production challenges, such as fresh onion price volatility, seasonal supply disruptions, or labor-intensive preparation requirements, can drive comprehensive adoption of dehydrated onions to maintain optimal production efficiency and support cost-effective manufacturing.

The growing awareness of food preservation technologies and increasing recognition of dehydrated onions' quality advantages are driving demand for dehydrated vegetable ingredients from certified suppliers with appropriate food safety credentials and processing transparency. Regulatory authorities are increasingly establishing clear guidelines for dehydrated vegetable quality standards, moisture content specifications, and microbial safety requirements to maintain consumer protection and ensure product consistency. Scientific research studies and sensory analyses are providing evidence supporting dehydrated onions' flavor retention and functional performance, requiring specialized dehydration methods and standardized processing protocols for optimal moisture removal, appropriate particle characteristics, and consistent rehydration performance across diverse processing applications.

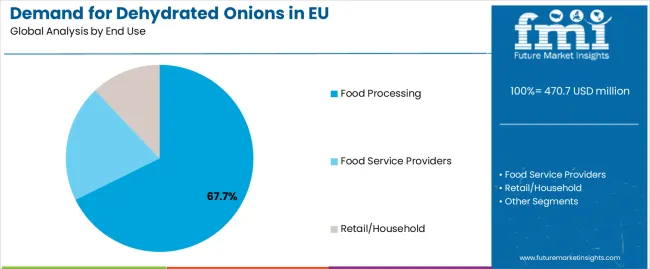

Sales are segmented by end use, product type (form), distribution channel, nature, and country. By end use, demand is divided into food processing, food service providers, and retail/household segments. Within food processing, sales are categorized into dressing & sauces, ready meals, snacks & savory, soups, infant food, and others. Based on product type, sales are classified into granules, powder, flakes, minced, chopped, kibbled, and sliced formats. In terms of distribution channel, demand is segmented into B2B and B2C. By nature, sales are classified into organic and conventional. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The food processing segment is projected to account for 67.7% of EU dehydrated onions sales in 2025, declining slightly to 64% by 2035, establishing itself as the dominant application across European operations. This commanding position is fundamentally supported by food processing's critical requirement for consistent ingredient quality, year-round supply availability, and labor-saving convenience enabling efficient production scaling. The food processing segment delivers exceptional value for manufacturers, providing ingredient solutions that eliminate fresh onion handling challenges, reduce labor costs, minimize waste, and ensure batch-to-batch consistency essential for standardized product quality.

This segment benefits from mature ingredient integration, well-established supplier relationships, and extensive application expertise from multiple food manufacturers who maintain rigorous quality specifications and continuous process optimization. Food processing applications offer versatility across various product categories, including ready meals, sauce bases, seasoning mixes, soup concentrates, and snack coatings, supported by proven dehydration technologies that address traditional challenges in flavor retention and moisture control.

The food processing segment is expected to maintain its dominant position through 2035 at 64%, demonstrating stable positioning as foodservice and retail segments complement rather than displace industrial processing's established dominance throughout the forecast period.

Key advantages:

Within food processing applications, dressing & sauces represent the largest sub-segment at 25% in 2025, maintaining this share through 2035. This segment benefits from dehydrated onions' excellent flavor dispersion in liquid systems, convenient no-chop preparation, and consistent particle size supporting smooth texture profiles in dressings, marinades, and sauce bases.

Ready meals account for 22% share, reflecting dehydrated onions' critical role in convenient meal solutions where rapid rehydration, authentic flavor delivery, and extended shelf life support product quality and manufacturing efficiency. The segment benefits from growing consumer demand for convenient meal options requiring minimal preparation time.

Snacks & savory applications represent 18% share, driven by dehydrated onions usage in seasoning blends, chip coatings, crackers, and savory bakery products where flavor intensity and shelf stability prove essential for product differentiation and quality consistency.

.webp)

Granules are positioned to represent 41% of total dehydrated onions demand across European operations in 2025, declining slightly to 39% by 2035, reflecting the segment's dominance as the preferred particle format within the overall category. This substantial share directly demonstrates that granulated dehydrated onions represent the majority preference, with food manufacturers utilizing this format for optimal rehydration speed, excellent flavor dispersion, and convenient handling characteristics.

Modern food processors increasingly view granulated dehydrated onions as the ideal compromise between powder's fine dispersion and larger forms' texture contribution, driving demand for products optimized for versatile applications with appropriate particle size enabling rapid rehydration, natural flavor release, and consistent processing performance. The segment benefits from continuous innovation focused on uniform particle distribution, controlled moisture levels, and enhanced flavor retention through advanced dehydration processes.

The segment's declining share reflects faster expansion in powder formats, which grow from 22% in 2025 to 24% in 2035, as instant food applications increasingly prioritize immediate dispersion and fine particle characteristics throughout the forecast period.

Key drivers:

B2B channels are strategically estimated to control 80% of total European dehydrated onions sales in 2025, declining to 72% by 2035, reflecting the critical importance of business-to-business transactions for serving food manufacturers, foodservice operators, and institutional buyers. European food industry operators consistently demonstrate preference for bulk ingredient procurement that delivers volume pricing, technical support, and reliable supply continuity across large-scale production requirements.

The segment provides essential value through direct supplier relationships, customized packaging solutions, and quality assurance protocols supporting food safety compliance and traceability requirements. Major dehydrated onions suppliers systematically invest in food-grade processing facilities, quality testing laboratories, and logistics infrastructure that strengthen B2B partnerships with ready meal producers, sauce manufacturers, foodservice distributors, and industrial processors requiring consistent quality and on-time delivery.

The segment's declining share through 2035 reflects growing retail consumer demand for home cooking ingredients and specialty food products, with B2B maintaining dominant positioning while representing a smaller percentage as B2C channels expand from 20% to 28% throughout the forecast period.

Success factors:

Conventional dehydrated onions products are strategically positioned to contribute 88% of total European sales in 2025, declining to approximately 85% by 2035, representing products produced through standard dehydration processes without organic certification requirements. These conventional products successfully deliver cost-effective functionality and consistent quality while ensuring broad commercial availability across all food manufacturing sectors that prioritize volume scalability and price competitiveness over organic certification.

Conventional production serves cost-conscious manufacturers, mainstream food applications, and value-oriented processors that require reliable ingredients at competitive price points without organic certification premiums. The segment derives significant competitive advantages from established onion supply chains, economies of scale in processing, and the ability to meet substantial volume requirements from major food manufacturers without organic certification constraints limiting raw material sourcing options.

The segment's declining share through 2035 reflects the category's evolution toward premium organic products, which grow from 12% in 2025 to 15% in 2035, as clean-label food manufacturers and premium product developers increasingly prioritize organic certification and sustainable sourcing practices.

Competitive advantages:

EU dehydrated onions sales are advancing rapidly due to increasing convenience food consumption, growing foodservice sector expansion, and rising preference for shelf-stable ingredients. The industry faces challenges, including fresh onion price fluctuations affecting raw material costs, energy-intensive dehydration processes impacting production expenses, and quality perception concerns among premium chefs preferring fresh ingredients. Continued innovation in dehydration technologies and flavor preservation remains central to industry development.

The rapidly accelerating development of organic dehydrated onions is fundamentally transforming the category from commodity ingredients to premium food components, enabling clean-label positioning and sustainability claims previously unattainable through conventional dehydration alone. Advanced sourcing platforms featuring certified organic onion farms, non-GMO verification, and transparent supply chains allow manufacturers to create dehydrated onions with clean-label credentials, environmental responsibility messaging, and authentic flavor profiles comparable to premium fresh onions. These premium innovations prove particularly transformative for health-focused food brands, organic ready meal producers, and natural product manufacturers, where ingredient certification proves essential for brand positioning and consumer trust.

Major dehydrated onions suppliers invest heavily in organic farm partnerships, certification body relationships, and traceability system development, recognizing that organic varieties represent high-value growth opportunities for differentiated product portfolios. Manufacturers collaborate with organic growers, certification experts, and sustainability consultants to develop scalable supply chains that ensure organic integrity while maintaining cost competitiveness supporting mainstream organic food production.

Modern dehydrated onions producers systematically incorporate advanced dehydration methods, including freeze-drying technology, infrared drying systems, and optimized hot-air dehydration processes that deliver superior flavor retention, enhanced color preservation, and improved rehydration characteristics compared to conventional drying methods. Strategic integration of technological improvements enables manufacturers to position dehydrated onions as premium ingredients where flavor quality directly determines food manufacturer purchasing decisions. These technical improvements prove essential for premium food applications, as quality-focused processors demand sensory validation, consistent performance testing, and scientific documentation supporting flavor equivalence to fresh onions.

Companies implement extensive process optimization programs, equipment technology upgrades, and quality control testing targeting sensory excellence, including volatile compound preservation, color stability during storage, and texture consistency throughout shelf life. Manufacturers leverage technology positioning in marketing communications, emphasizing flavor superiority and technical capabilities, positioning premium dehydrated onions as functional ingredients delivering authentic onion taste.

European food manufacturers increasingly prioritize customized dehydrated onions specifications featuring specific particle distributions, specialized cuts, and proprietary blends that differentiate products through optimized rehydration rates, targeted flavor release profiles, and application-specific performance characteristics. This customization trend enables suppliers to drive premium pricing through specialized solutions, strengthen customer relationships through technical collaboration, and create differentiated offerings resonating with food processors seeking competitive advantages. Customization proves particularly important for ready meal producers where ingredient performance directly impacts finished product quality and consumer satisfaction.

The development of sophisticated processing capabilities, including precision cutting systems, particle classification equipment, and custom blending facilities, expands suppliers' abilities to create tailored solutions meeting exact customer specifications without compromising quality consistency. Suppliers collaborate with food technologists, product developers, and culinary professionals to develop customized products balancing technical performance with sensory excellence, supporting premium positioning and customer loyalty while maintaining production efficiency across specialized manufacturing runs.

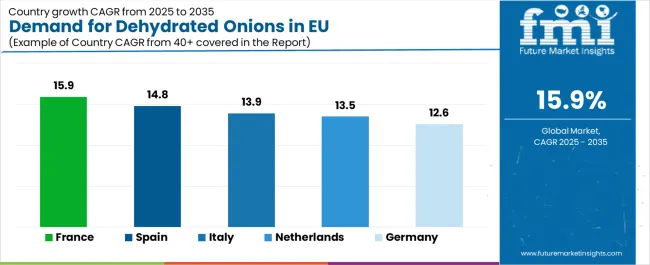

| Country | CAGR % (2025-2035) |

|---|---|

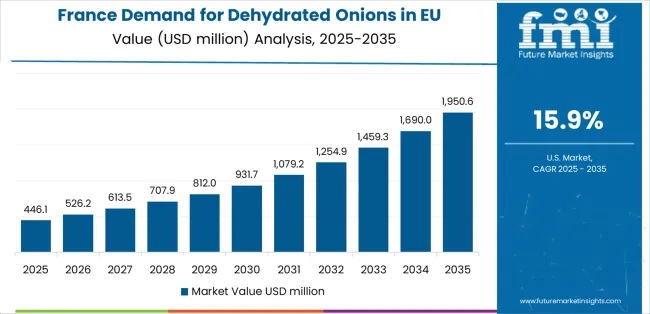

| France | 15.9% |

| Spain | 14.8% |

| Italy | 13.9% |

| Netherlands | 13.5% |

| Germany | 12.6% |

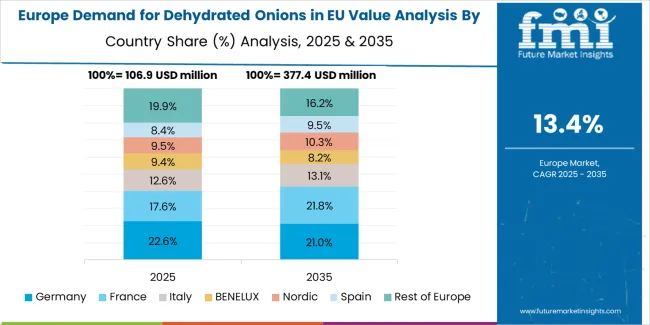

EU dehydrated onions sales demonstrate exceptional growth across major European economies, with Rest of Europe leading expansion at 16.6% CAGR through 2035, driven by emerging food processing infrastructure and growing convenience food adoption across smaller markets. France shows robust growth at 15.9% CAGR through strong culinary heritage and ready meal innovation. Spain maintains 14.8% CAGR, benefiting from expanding food exports and growing processed food sector. Italy records 13.9% CAGR reflecting traditional food manufacturing modernization. Netherlands demonstrates 13.5% CAGR with specialized food processing expertise. Germany shows 12.6% CAGR maintaining established market maturity. Overall, sales show exceptional regional development reflecting EU-wide convenience food growth and dehydrated ingredient adoption.

Revenue from dehydrated onions in Germany is projected to exhibit solid growth with a CAGR of 12.6% through 2035, driven by exceptionally well-developed food manufacturing sector, comprehensive processed food production capacity, and strong export-oriented operations throughout the country. Germany's sophisticated food processing infrastructure and internationally recognized leadership in food quality standards are creating substantial demand for reliable dehydrated onions supplies across all manufacturing segments.

Major food manufacturers, including numerous ready meal producers, sauce manufacturers, and snack companies, systematically incorporate dehydrated onions in formulations, often requiring specialized specifications meeting exact quality requirements and rigorous safety standards. German demand benefits from strong foodservice sector presence, substantial retail processed food consumption supporting ingredient volumes, and technical expertise that naturally supports dehydrated onions adoption across diverse food manufacturing applications beyond core ready meal production.

Growth drivers:

Revenue from dehydrated onions in France is expanding at a CAGR of 15.9%, supported by strong culinary tradition embracing flavor innovation, robust ready meal industry, and growing convenience food acceptance among French consumers. France's sophisticated food culture and quality-focused manufacturing create ideal conditions for premium dehydrated onions adoption across diverse applications.

Major food processors systematically invest in ingredient optimization and flavor profile enhancement, creating opportunities for dehydrated onions suppliers offering superior quality and technical support. French sales particularly benefit from strong sauce and dressing manufacturing tradition, creating natural demand for high-performing flavor ingredients supporting authentic French culinary standards. Growing convenience food consumption and expanding foodservice operations significantly enhance penetration rates across both industrial and commercial applications.

Success factors:

Revenue from dehydrated onions in Italy is growing at a robust CAGR of 13.9%, fundamentally driven by traditional food manufacturing evolving toward convenience formats, growing export-oriented processed food production, and gradual adoption of shelf-stable ingredients. Italy's traditional pasta sauce manufacturing, frozen food production, and specialty food processing are increasingly incorporating functional ingredients as product innovation accelerates.

Major food companies strategically invest in processing efficiency and shelf-life optimization improvements, creating opportunities for dehydrated onions suppliers offering consistent quality and application development services. Italian sales particularly benefit from quality-focused manufacturing culture, creating natural demand for premium dehydrated ingredients supporting authentic Italian flavor profiles and artisanal production scaled to industrial capacity.

Development factors:

Demand for dehydrated onions in Spain is projected to grow at a CAGR of 14.8%, substantially supported by expanding food processing sector, growing ready meal production, and increasing foodservice operations. Spanish food industry growth in sauces, prepared meals, and savory snacks positions dehydrated onions as aligned with manufacturing modernization and convenience food development.

Major food manufacturers systematically invest in capacity expansion and product innovation, with dehydrated onions supporting cost-effective flavor enhancement and processing efficiency improvements. Spain's growing position as Mediterranean food export hub supports ingredient demand through volume growth and application diversification across traditional and modern food categories.

Growth enablers:

Demand for dehydrated onions in the Netherlands is expanding at a CAGR of 13.5%, fundamentally driven by specialized food processing expertise, strong foodservice distribution networks, and export-oriented ingredient trading operations. Dutch food sector demonstrates particularly high efficiency standards and quality focus supporting premium dehydrated onions adoption.

Netherlands sales significantly benefit from established food ingredient distribution infrastructure, technical sophistication in food processing applications, and comprehensive quality systems supporting foodservice and retail channels. The country's food processing efficiency positions it as ingredient application testing ground for European food categories, with successful Dutch implementations often expanding to broader European operations.

Innovation drivers:

Demand for dehydrated onions in Rest of Europe is expanding at the leading CAGR of 16.6%, fundamentally driven by emerging food processing infrastructure across smaller EU markets, growing convenience food consumption in Central and Eastern European countries, and increasing foodservice sector development. These diverse markets demonstrate particularly high growth potential as modern food manufacturing expands and consumer preferences evolve toward convenient meal solutions.

Rest of Europe sales significantly benefit from developing processed food sectors, increasing retail chain expansion introducing convenience foods, and growing foodservice operations requiring shelf-stable ingredients. These markets represent high-growth opportunities as food manufacturing modernization accelerates and dehydrated ingredient adoption increases across both industrial and commercial applications.

Growth factors:

EU dehydrated onions sales are projected to grow from USD 470.7 million in 2025 to USD 2,058.6 million by 2035, registering a CAGR of 15.9% over the forecast period. The rest of Europe is expected to demonstrate the strongest growth trajectory with a 16.6% CAGR, supported by expanding food processing infrastructure, growing foodservice sectors, and increasing convenience food adoption. France follows with 15.9% CAGR, attributed to a strong culinary tradition and robust ready meal production.

Germany maintains the largest share at 28.2% in 2025, driven by extensive food manufacturing infrastructure and strong processed food exports, while growing at 12.6% CAGR. Spain demonstrates 14.8% CAGR, while Italy records 13.9% CAGR. Netherlands shows 13.5% CAGR, reflecting specialized food processing capabilities.

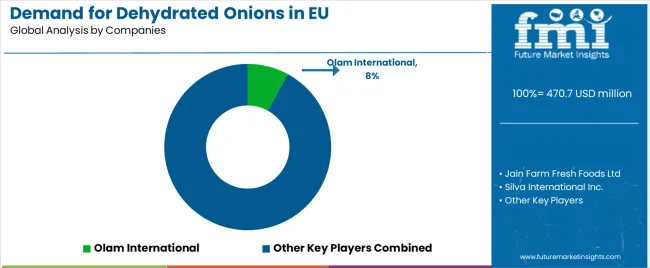

EU dehydrated onions sales are defined by competition among global ingredient suppliers, regional dehydration specialists, and vertically integrated food companies. Companies are investing in dehydration technologies, organic certification, quality assurance systems, and distribution network expansion to deliver high-quality, consistent, and competitively priced dehydrated onions solutions. Strategic partnerships with food manufacturers, foodservice distributors, and retail chains, along with technical service capabilities and sustainability initiatives, are central to strengthening competitive position.

Major participants include Olam International with an estimated 8% share, leveraging its global agricultural sourcing platform, comprehensive dehydration capabilities, and extensive distribution network across Europe. Olam benefits from vertically integrated supply chains, technical food ingredient expertise, and ability to supply multiple food industry segments from processing to foodservice, supporting broad market penetration and customer loyalty.

Jain Farm Fresh Foods Ltd holds approximately 6.5% share, emphasizing strong European customer relationships, consistent quality delivery, and specialized dehydration expertise. The company's success in developing reliable supply partnerships with major European food processors creates strong positioning across ready meal and sauce manufacturing applications, supported by quality assurance capabilities and responsive customer service.

Silva International Inc. accounts for roughly 4% share through its position as specialized dehydrated vegetable supplier with European distribution reach and foodservice channel expertise. The company benefits from flexible product offerings, competitive pricing strategies, and comprehensive logistics supporting both food manufacturing and foodservice operators requiring reliable ingredient supplies.

Natural Dehydrated Vegetables Pvt. Ltd. represents approximately 3.5% share, supporting growth through private-label supply capabilities, quality-focused production, and European market specialization. The company leverages manufacturing expertise, quality certifications, and customer collaboration enabling customized solutions across food manufacturing applications.

Other companies collectively hold 78% share, reflecting competitive dynamics within European dehydrated onions sales, where numerous regional processors, specialized dehydration companies, ingredient distributors, and emerging organic suppliers serve specific customer requirements, local markets, and niche applications. This competitive environment provides opportunities for differentiation through specialized forms, organic certification, customized specifications, and premium quality positioning resonating with food manufacturers seeking reliable ingredient partners.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,058.6 million |

| End Use | Food Processing, Food Service Providers, Retail/Household |

| Food Processing Sub-segments | Dressing & Sauces, Ready Meals, Snacks & Savory, Soups, Infant Food, Others |

| Product Type (Form) | Chopped, Minced, Granules, Powder, Flakes, Kibbled, Sliced |

| Distribution Channel | B2B, B2C |

| Nature | Organic, Conventional |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Olam International, Jain Farm Fresh Foods, Silva International, Natural Dehydrated Vegetables, BC Foods |

| Additional Attributes | Dollar sales by end use, product type (form), distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with global suppliers and regional processors; customer preferences for various particle sizes and forms; integration with food processing technologies and foodservice operations; innovations in dehydration processes and organic certification; adoption across food manufacturing, foodservice, and retail channels; regulatory framework analysis for dehydrated vegetable quality standards and food safety requirements; supply chain strategies; and penetration analysis for food processors and foodservice operators across European markets. |

The global demand for dehydrated onions in EU is estimated to be valued at USD 470.7 million in 2025.

The market size for the demand for dehydrated onions in EU is projected to reach USD 2,058.6 million by 2035.

The demand for dehydrated onions in EU is expected to grow at a 15.9% CAGR between 2025 and 2035.

The key product types in demand for dehydrated onions in EU are food processing , food service providers and retail/household.

In terms of product type (form), granules segment to command 41.0% share in the demand for dehydrated onions in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Dehydrated Onions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Dehydrated Onions Market Share

UK Dehydrated Onions Market Report – Trends, Demand & Outlook 2025–2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Western Europe Dehydrated Vegetables Market Analysis by Product Type, Form, Nature, End Use, Technology, Distribution Channel, and Country Through 2025 to 2035

Australia Dehydrated Onions Market Trends – Size, Demand & Forecast 2025–2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Demand for Dehydrated Vegetables in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Dehydrated Garlic Market Size and Share Forecast Outlook 2025 to 2035

Dehydrated Skin Product Market Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA