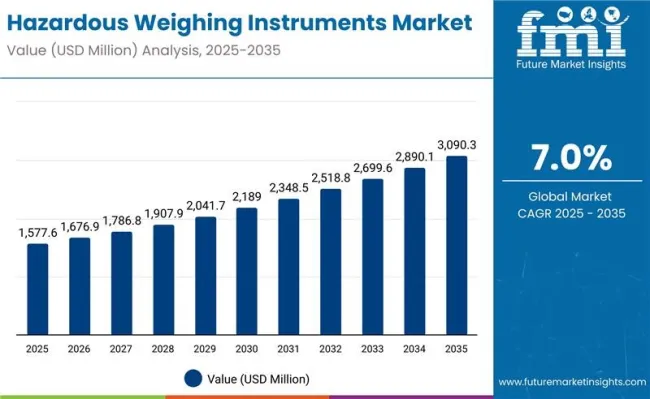

The global hazardous weighing instruments market is projected to be valued at USD 1,577.6 million in 2025 and is forecast to reach approximately USD 3,090.3 million by 2035. This reflects an absolute increase of USD 1,512.7 million, representing a growth of 95.9% over the forecast period. The market is poised to grow at a compound annual growth rate (CAGR) of 7.0%, with the overall market size expected to expand by 1.96X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,577.6 million |

| Industry Size (2035F) | USD 3,090.3 million |

| CAGR (2025 to 2035) | 7.0% |

Between 2025 and 2030, the market is estimated to increase from USD 1,577.6 million to USD 2,189.0 million, registering a value addition of USD 611.4 million. This growth is projected to be driven by increasing adoption of ATEX- and IECEx-compliant weighing solutions across hazardous industrial zones, including petrochemical refineries, chemical manufacturing units, and underground mining operations. The integration of load cells, floor scales, and bench-top weighing equipment into intrinsically safe automated production systems is accelerating across Europe, the Middle East, and Southeast Asia.

From 2030 to 2035, the market is forecast to expand from USD 2,189.0 million to USD 3,090.3 million, adding another USD 901.3 million in value. This phase will be influenced by digital advancements, including the use of IoT-enabled weighing platforms, wireless calibration alerts, and cloud-integrated compliance tracking. Increasing safety mandates, cross-border certification harmonization, and rising investment in smart industrial plants are anticipated to support demand for high-precision, explosion-proof weighing instruments.

Between 2020 and 2025, the global market for hazardous weighing instruments expanded from USD 1,205.0 million to USD 1,577.6 million, registering an increase of USD 372.6 million or 30.9%, at a compound annual growth rate (CAGR) of 5.5%.

This period marked a transition across multiple industries toward digital weighing systems tailored for use in fire-prone and dust-explosive environments. The implementation of ATEX, IECEx, and North American certification frameworks accelerated, with Europe and North America investing significantly in hazardous area validation infrastructure.

Post-pandemic safety regulations spurred a wave of upgrades in plant safety systems, including the integration of explosion-proof weighing modules across chemical, petrochemical, and food processing sites. Several manufacturers responded with modular solutions featuring encapsulated sensors, stainless steel housings, and corrosion-resistant designs.

These developments enabled broader use in marine, mining, and oil-handling applications. The pharmaceutical and agrochemical sectors also supported growth by retrofitting existing operations with GMP-compliant hazardous weighing installations, ensuring both precision and safety.

The hazardous weighing instruments market is categorized by product type into explosion-proof scales, intrinsically safe scales, load cells, weighing terminals, belt weighers, platform scales, and tank and silo systems, tailored to varying risk levels and weighing needs. Zone classifications cover Zone 0, Zone 1, Zone 2, and others, aligned with regulatory hazard definitions.

Technology types include digital, analog, and wireless systems, while key applications span chemical and pharmaceutical industries. Distribution channels range from direct sales and distributors to online retail and maintenance service providers, ensuring comprehensive global market access.

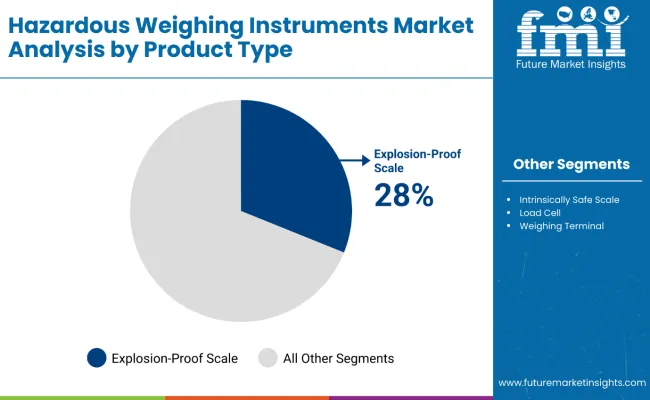

Explosion-proof scales are estimated to hold 28% of the hazardous weighing instruments market in 2025, expanding at a CAGR of 7.2% through 2035. These scales are certified to operate safely in explosive atmospheres, particularly in petrochemical and solvent-handling facilities. Their rugged enclosures and sealed electronics prevent ignition of flammable gases or dust, making them essential in Zone 1 and Zone 2 environments.

Demand has remained strong from oil refineries, paint manufacturing units, and gas processing plants where routine weighing tasks are conducted under hazardous conditions. Investments in fire-safe process infrastructure and rising deployment of modular blending units have further supported their integration across hazardous material handling setups.

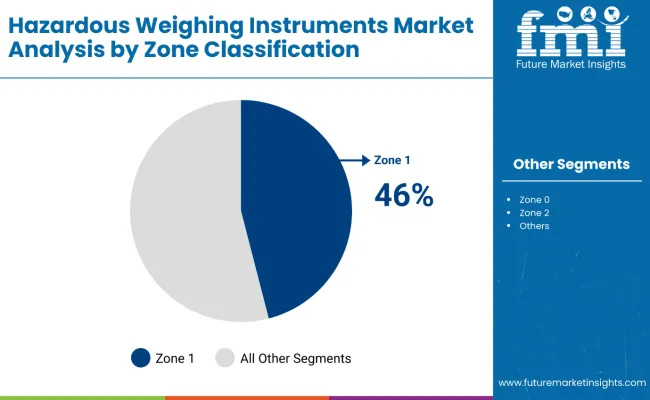

Weighing instruments deployed in Zone 1 hazardous areas are projected to account for 46% of global installations by 2025, with growth continuing at a CAGR of 7.1% through 2035. Zone 1 classification applies to environments where flammable substances are likely to exist during normal operations.

This includes pharmaceutical blending rooms, fuel storage units, and chemical reactors. Equipment used in such zones requires ATEX or IECEx compliance, leading to steady demand for certified explosion-proof and intrinsically safe weighing systems. Increased scrutiny by industrial safety regulators and emphasis on minimizing operator exposure have elevated the need for compliant weighing setups across both greenfield and brownfield facilities.

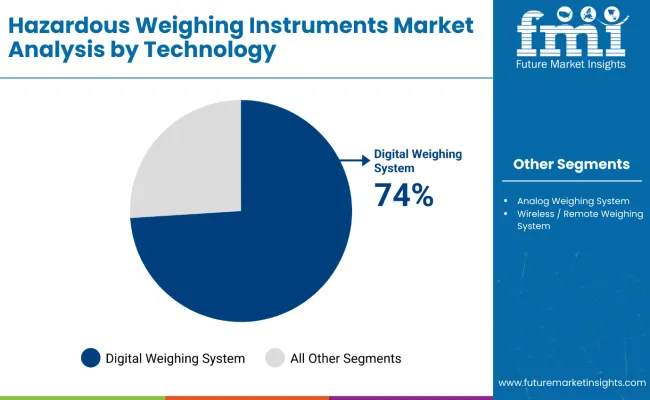

Digital weighing systems are forecast to represent 74% of total technology usage in 2025 and are expected to grow at a CAGR of 7.2% over the forecast period. These systems offer superior accuracy, rapid data processing, and seamless integration with control software and MES platforms.

They are widely adopted across pharmaceutical cleanrooms, chemical blending zones, and hazardous packaging areas where precise dosing and documentation are critical to safety and compliance. Their compatibility with explosion-proof HMIs, PLC-based automation, and traceable audit trails has positioned them as the default standard in hazardous weighing environments.

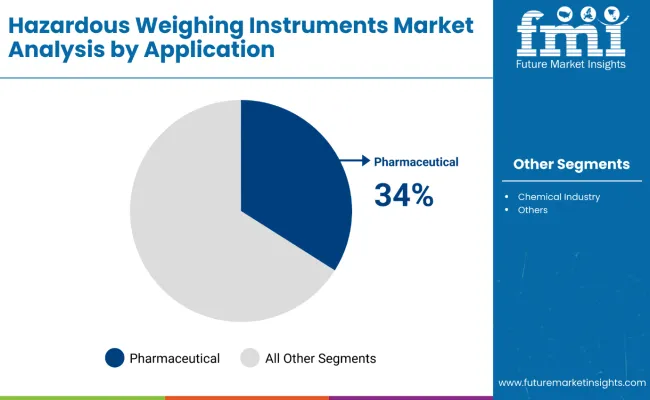

The pharmaceutical sector is expected to contribute 34% of total market demand in 2025 and is set to grow at a CAGR of 7.1% through 2035. Weighing instruments are used in GMP-compliant environments to measure APIs, excipients, and intermediate products. Intrinsically safe scales and terminals are favored in cleanrooms and classified zones to support safe batch production.

Stringent regulatory controls, operator safety mandates, and traceable measurement standards continue to fuel market growth in this vertical. Expansion of continuous manufacturing systems and containment solutions has also increased demand for zone-certified, contamination-free weighing tools across pharma operations globally.

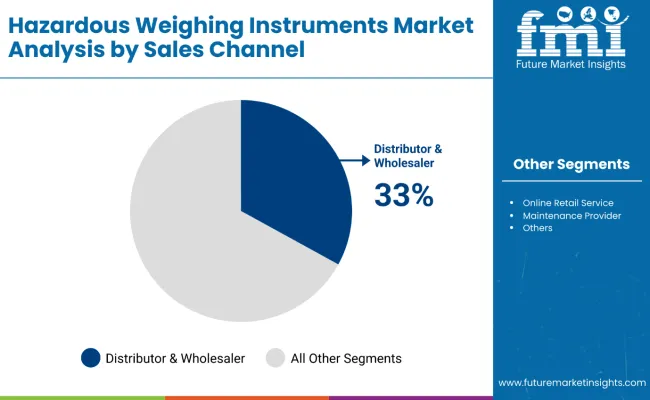

Distributors and wholesalers are projected to account for 33% of global sales in 2025, growing at a CAGR of 6.1% through 2035. These intermediaries provide crucial market access for OEMs by offering region-specific regulatory expertise, pre-sales support, and service coverage.

A strong distributor network is particularly important in fragmented markets like Eastern Europe, Southeast Asia, and the Middle East, where direct manufacturer presence remains limited. Distributors are also playing a growing role in after-sales maintenance, system calibration, and regional ATEX/IECEx recertification support, which enhances market retention and brand preference among end users.

The hazardous weighing instruments market is witnessing steady expansion as industries increasingly align with global safety regulations including ATEX, IECEx, and OSHA. These regulations require the integration of certified weighing solutions in hazardous environments where the presence of flammable gases, dust, or vapors poses ignition risks. Industrial operators across sectors such as chemicals, energy, and pharmaceuticals are replacing legacy equipment with intrinsically safe load cells, platform scales, and explosion-protected weighing terminals that adhere to these compliance frameworks.

Growth in this market is also supported by the rising complexity of manufacturing processes in facilities handling volatile substances. There is an increasing need to manage precision weighing operations without compromising safety. Advancements in intrinsically safe electronics, modular design, and wireless data acquisition have enabled safer integration and easier maintenance in confined or classified zones.

Ongoing upgrades in battery manufacturing, food processing, and waste recycling are creating new demand for these systems. Facility operators are deploying hazardous-area-rated instruments to support automated batching, in-process control, and compliance auditing.

The hazardous weighing instruments market is being positively influenced by regulatory enforcement, safety modernization mandates, and technological advances in precision measurement systems. Demand is also rising due to increasing industrial activity in sectors handling combustible materials and explosive dusts.

Safety-Certified Infrastructure Drives Equipment Replacement

A key driver has been the enforcement of stricter occupational safety and fire protection standards. ATEX and IECEx zones across chemical, oil & gas, and manufacturing plants are requiring full-scale upgrades of weighing systems. Load cells and weighing terminals with intrinsic safety certifications are being retrofitted to replace aging or unclassified equipment. This regulatory-driven replacement cycle is accelerating instrument turnover rates, especially in Europe and North America.

Precision and Process Control in Hazard Zones Gains Attention

Industrial players have prioritized consistent process accuracy even in volatile atmospheres. Hazardous weighing instruments are increasingly being integrated into automated dosing, formulation, and batch control operations. This trend is supporting the deployment of networked, explosion-proof systems with digital interfaces, remote diagnostics, and temperature-compensated sensors capable of functioning under thermal or chemical stress.

Compact and Modular Design Becomes an Industry Standard

A notable trend includes the shift toward compact, modular hazardous weighing devices. Manufacturers are designing scalable systems that can be quickly installed in space-constrained areas or retrofitted into brownfield sites without major infrastructure changes. This modularity also supports decentralized weighing operations, particularly in food processing, pharmaceuticals, and mobile chemical units.

Digitalization and Wireless Monitoring Penetrating Risk Zones

Digital transformation in manufacturing has extended to hazardous areas, where wireless connectivity, smart diagnostics, and remote calibration are increasingly deployed. Companies are adopting IIoT-enabled hazardous weighing instruments that allow remote data access and predictive maintenance, reducing exposure risks for workers and improving operational continuity in sensitive areas.

The hazardous weighing instruments market in Europe is projected to grow from USD 363.7 million in 2025 to USD 633.9 million by 2035, reflecting a CAGR of 5.7%. Growth is shaped by stricter ATEX compliance enforcement, modernization of industrial plants, and increased demand for explosion-proof instrumentation in sectors such as oil & gas, chemicals, and food processing.

Germany is expected to retain the largest share at 16.8% in 2035, driven by process automation upgrades in chemical and manufacturing hubs. Spain is projected to see a slight increase in share, rising to 12.9%, supported by food and beverage sector investments. Italy and France will experience steady demand due to retrofit programs in legacy production zones.

| Country | 2025 |

|---|---|

| Germany | 18.6% |

| Italy | 8.2% |

| France | 9.1% |

| UK | 8.1% |

| Spain | 12.5% |

| BENELUX | 3.4% |

| Russia | 10.8% |

| Rest of Europe | 29.3% |

| Country | 2035 |

|---|---|

| Germany | 16.8% |

| Italy | 7.8% |

| France | 8.3% |

| UK | 8.0% |

| Spain | 12.9% |

| BENELUX | 3.8% |

| Russia | 10.5% |

| Rest of Europe | 31.9% |

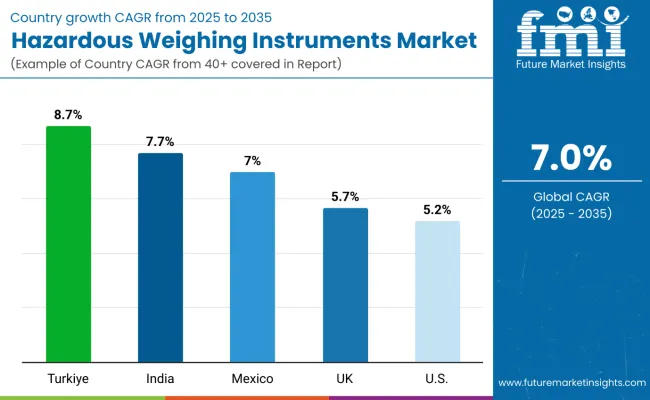

Türkiye is projected to record the highest CAGR of 8.7% from 2025 to 2035. The country is experiencing strong growth in chemical processing, fertilizer manufacturing, and fuel logistics-industries that require certified weighing systems in ATEX and IECEx zones. Local manufacturers are increasingly adopting modular load cells, explosion-protected terminals, and panel-mounted controllers to ensure workplace safety and meet EU-equivalent standards.

India’s hazardous weighing instruments market is projected to grow at 7.7% CAGR through 2035. The adoption of dust-ignition-proof systems and zone-classified weighing modules is being driven by upgrades across pharmaceutical, fertilizer, and agrochemical industries. Regulatory shifts mandating compliance with IEC 60079 and BIS standards are accelerating procurement, especially for digital, rugged, and stainless steel-based instruments.

Mexico is forecast to expand at a CAGR of 7% over the decade, underpinned by increased deployment of hazardous area weighing solutions in petroleum refineries, ethanol plants, and liquefied gas facilities. Strong exports of flammable materials and chemicals necessitate zoned packaging lines equipped with intrinsically safe instruments.

The UK market is projected to grow at a CAGR of 5.7%, supported by refurbishment of legacy weighing infrastructure in refineries and processing plants. The ongoing replacement of electromechanical scales with intrinsically safe weighing terminals is accelerating due to heightened compliance scrutiny and sustainability efforts.

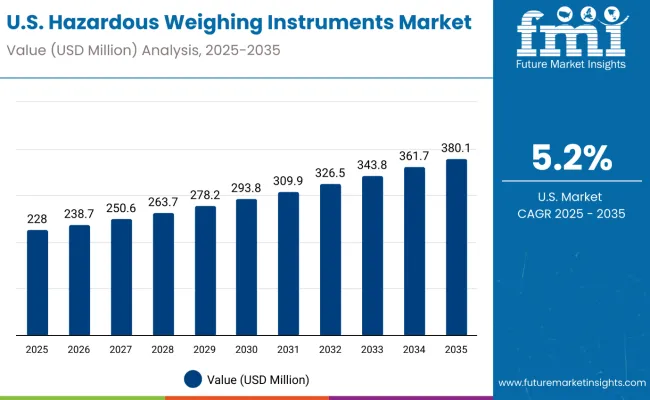

The USA market is estimated to grow at a CAGR of 5.2% during the same period. Adoption remains strong in oil terminals, chemical parks, and large-scale mining operations. Rising workplace safety audits, NFPA 70 compliance checks, and localized production of hazardous-area components are aiding steady demand.

Japan’s hazardous weighing instrument installations are concentrated in Zone 1 classified areas, representing 44% of the total market in 2025. These areas are characterized by frequent exposure to explosive gases or vapors, typically seen in chemical handling zones, solvent storage areas, and mixing rooms. Zone 2 environments, where exposure risk is less frequent, hold a 32% share, while Zone 0areas with continuous exposureaccounts for 14%. The remaining 10% is attributed to other specialized or hybrid zones.

In South Korea, explosion-proof scales account for the largest share at 30% of the hazardous weighing instruments market in 2025. These systems are essential for environments with high flammability risks, including chemical storage, petroleum handling, and solvent mixing areas.

Intrinsically safe scales follow with a 23% share, targeting low-voltage applications in pharmaceuticals and gas sampling. Tank and silo weighing systems contribute 17%, while belt weighers (15%), platform scales (4%), and smaller segments like load cells and weighing terminals (each at 3%) address niche industrial requirements.

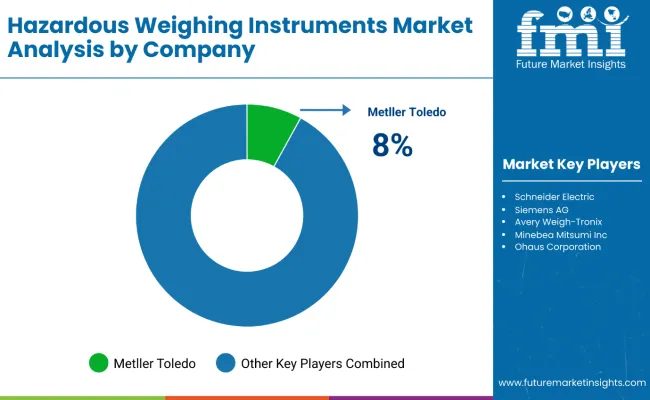

Competition in the hazardous weighing instruments market is being driven by the development of advanced, safety-compliant, and energy-efficient solutions. New offerings emphasize explosion-proof designs, digital load cells, and fully electric systems that enhance precision, operational safety, and sustainability in challenging environments. Market players are focusing on compliance with ATEX and IECEx standards while reducing environmental impact through hydraulic-free and energy-optimized technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,577.6 Million (2025) |

| Product Type | Explosion-Proof Scales, Intrinsically Safe Scales, Load Cells, Weighing Terminals, Belt Weighers , Platform Scales, Tank and Silo Weighing Systems, Other Product Types |

| Zone Classification | Zone 0, Zone 1, Zone 2, Other |

| Technology | Analog Weighing Systems, Digital Weighing Systems, Wireless / Remote Weighing Systems |

| Application | Chemical Industry, Pharmaceutical Industry, Others |

| Sales Channel | Direct Sales, Distributors & Wholesalers, Online Retail, Service & Maintenance Providers |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, Japan, South Korea |

| Key Companies Profiled | Mettler Toledo, Minebea Intec, Sartorius AG, Avery Weigh- Tronix , Doran Scales, Adam Equipment, Rice Lake Weighing Systems, Eilersen Electric Digital Systems A/S, Radwag Balances and Scales, Yamato Scale |

The market is expected to reach USD 3,090.3 million by 2035, growing from USD 1,577.6 million in 2025, at a CAGR of 7.0%.

Zone 1 leads installations in Japan and several global markets due to its frequent exposure to explosive gases, especially in pharmaceutical and chemical mixing areas.

Explosion-proof scales are expected to maintain dominance, driven by their deployment in volatile environments such as solvent storage and petrochemical processing.

Digital weighing systems and wireless/remote configurations are gaining ground due to their precision, safety compliance, and operational flexibility in hazardous areas.

Chemical plants, pharmaceutical manufacturers, and oil terminals are key buyers. Procurement is routed through direct sales, distributors, and increasingly through online platforms and service providers.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA