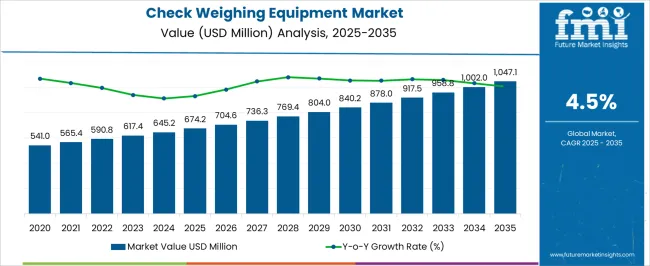

The Check Weighing Equipment Market is estimated to be valued at USD 674.2 million in 2025 and is projected to reach USD 1047.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The check weighing equipment market is experiencing steady expansion, driven by growing automation in production lines and heightened focus on quality assurance across manufacturing industries. The market benefits from increased regulatory emphasis on product accuracy, packaging integrity, and compliance with labeling standards.

Check weighers play a critical role in minimizing material waste and ensuring cost efficiency, thereby supporting operational optimization in high-speed packaging environments. Advancements in digital weighing sensors, connectivity solutions, and software analytics have further enhanced system precision and process transparency.

Industries are increasingly adopting automated check weighing systems to integrate with broader production control networks, enabling real-time data-driven quality management. The rising demand from the food, pharmaceutical, and chemical sectors, combined with global manufacturing digitization initiatives, positions the market for sustained growth over the coming decade.

| Metric | Value |

|---|---|

| Check Weighing Equipment Market Estimated Value in (2025 E) | USD 674.2 million |

| Check Weighing Equipment Market Forecast Value in (2035 F) | USD 1047.1 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

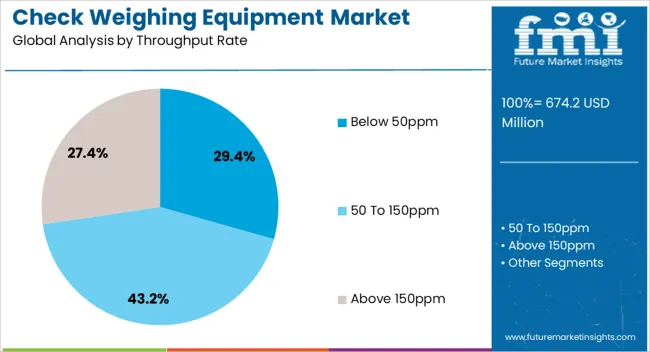

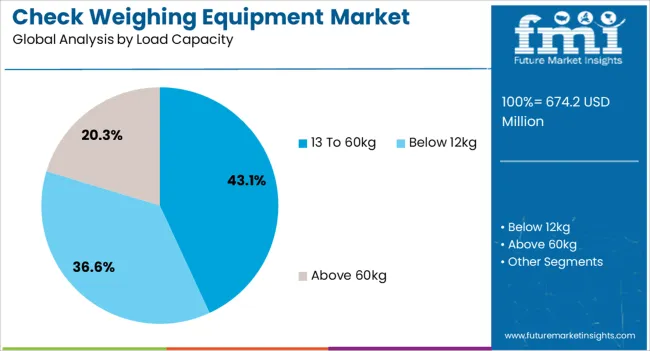

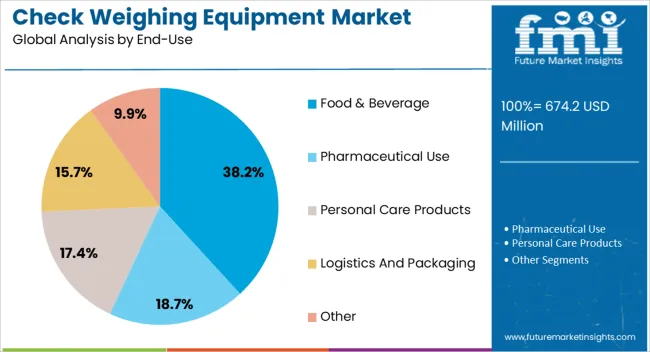

The market is segmented by Throughput Rate, Load Capacity, and End-Use and region. By Throughput Rate, the market is divided into Below 50ppm, 50 To 150ppm, and Above 150ppm. In terms of Load Capacity, the market is classified into 13 To 60kg, Below 12kg, and Above 60kg. Based on End-Use, the market is segmented into Food & Beverage, Pharmaceutical Use, Personal Care Products, Logistics And Packaging, and Other. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The below 50ppm segment accounts for approximately 29.40% share of the throughput rate category in the check weighing equipment market. Its dominance is driven by strong suitability for low- to mid-speed production environments, where precision and compliance outweigh volume requirements.

These systems are widely deployed in small-scale manufacturing units, specialty food processing, and pharmaceutical packaging lines. High accuracy, coupled with minimal maintenance requirements, enhances their appeal for cost-conscious operators.

The segment’s growth is also supported by advancements in user-friendly interfaces and modular system designs, improving adaptability across production lines. As quality control regulations tighten globally, demand for compact, high-accuracy check weighers within this throughput range is expected to remain strong.

The 13 to 60kg segment leads the load capacity category with approximately 43.10% share, attributed to its ability to handle a wide range of packaged goods and medium-weight products across industries. These systems are highly versatile, supporting diverse applications from bulk food items to industrial components.

Their operational balance between speed, precision, and load flexibility has strengthened adoption among manufacturers seeking efficient material handling solutions. The segment benefits from continuous technological improvements, including advanced strain gauge sensors and automated calibration systems.

With increasing industrial automation and demand for scalable solutions, the 13 to 60kg capacity range is projected to sustain its leading position in the check weighing equipment market.

The food and beverage segment dominates the end-use category, representing approximately 38.20% share of the market. This leadership is reinforced by stringent industry regulations mandating weight verification and product consistency.

Check weighers are integral to ensuring packaging compliance and minimizing giveaway in food production lines. The segment’s expansion is supported by the growing consumption of packaged and ready-to-eat foods, driving demand for efficient quality control equipment.

Integration with labeling, filling, and sorting systems further enhances productivity. With increasing automation investments and global emphasis on food safety, the food and beverage sector will continue to serve as a primary driver of market growth.

Market to Expand over 1.6X through 2035

The global check weighing equipment market is projected to expand over 1.6X through 2035, with a 2.4% increase in the expected CAGR compared to the historical one. This is due to the increasing demand for automated weighing solutions.

Global sales of check-weighing equipment are expected to rise due to the growing demand for customization & flexible solutions and the rising preference for cloud-based weighing systems. By 2035, the total market revenue is set to reach USD 1,023.9 million.

East Asia Leads the Check Weighing Equipment Market

East Asia is poised to emerge as a frontrunner in driving the demand for check weighing equipment, exhibiting a leading market share of 22.9% by 2035. This significant growth trajectory is anticipated to unfold by 2025, marking East Asia's pivotal role in shaping the check weighing equipment market landscape.

Dominance of 13 to 60kg Load Capacity in the Check Weighing Equipment Market

The 13 to 60 kg segment is expected to lead the global check-weighing equipment market with a volume share of 43.1% in 2025.

The check weighing equipment market grew at a CAGR of 2.3% between 2020 and 2025. Total market revenue reached a value of USD 674.2 million in 2025. In the forecast period, the check weighing equipment industry is set to thrive at a CAGR of 4.5%.

| Historical CAGR (2020 to 2025) | 2.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.5% |

The global check-weighing equipment market witnessed moderate growth between 2020 and 2025. Rising awareness of the benefits of using check-weighing equipment to optimize processes and reduce manual errors fueled market growth.

The COVID-19 pandemic highlighted the critical relevance of precise measurements for medication manufacturing and dose accuracy in the pharmaceutical and healthcare industries. The epidemic hastened the introduction of automation, increasing the need for sophisticated weighing systems to boost productivity and reduce reliance on manual labor.

Over the forecast period, the global check weighing equipment market is poised to exhibit healthy growth, totaling a valuation of USD 1,023.9 million by 2035. Increasing manufacturing activities across several sectors necessitated precise weighing equipment for quality control and production efficiency, driving demand for check weighing equipment.

Technological advancements, such as the integration of automation and Industry 4.0 principles, led to a growing demand for more sophisticated weighing solutions.

Strict regulatory standards and a focus on accurate measurements in industries such as pharmaceuticals and food & beverages are contributing to the adoption of check weighing equipment.

Growing Stringency of Regulations

The check weighing equipment market is experiencing a notable surge in demand due to the growing stringency of regulations, particularly in the food and pharmaceutical industries. As regulatory bodies enforce strict standards to ensure consumer safety and product quality, manufacturers in these sectors are investing in precise and reliable check-weighing solutions.

In the food industry, accurate weight measurement is crucial for compliance with labeling requirements and preventing under or overfilling packaged products. The demand for checkweighers in the pharma industry is increasing for calculating the weight of capsules, standing pouches, sachets/sticks, bags/cartons/cases, and bottles/cans.

Rising E-commerce Industry

The thriving e-commerce industry stands out as a significant driver propelling the demand for check-weighing equipment. As the e-commerce sector continues its exponential growth globally, there is an escalating need for accurate and efficient weight verification processes across warehouses and distribution centers.

In the e-commerce supply chain, precision in weighing plays a crucial role in several aspects, including order fulfillment, inventory management, and shipping accuracy. Checkweighing equipment ensures that packaged products meet specified weight criteria, reducing shipment errors and enhancing customer satisfaction.

Increasing Adoption in the Food and Beverage Industry

The escalating adoption of check weighing equipment in the food & beverage industry is a pivotal driver for the market's growth. With a focus on quality control, efficiency, and compliance with stringent regulations, the food and beverage sector increasingly integrates advanced check-weighing solutions into its production processes.

Checkweighers ensure accurate weight measurements of packaged food products, helping manufacturers maintain consistency and meet regulatory standards. As the demand for packaged and processed foods rises globally, reliable and high-throughput check-weighing equipment becomes paramount.

High Initial Investment and Maintenance Costs

The market for check weighing equipment is severely constrained by the high initial outlay and ongoing maintenance expenses linked to these advanced systems. For certain organizations, acquiring and installing sophisticated weighing equipment can be unaffordable, creating an obstacle to entrance.

Availability of Low-quality Check Weighing Equipment

An increase in low-quality checkweigher systems is restraining the market growth. Using low-quality checkweigher systems that do not require maintenance is set to result in unexpected negative consequences in small to large industrial premises.

Customers encountering these low-quality options are expected to experience operational inefficiencies, inaccuracies in weight measurement, and increased maintenance requirements. This hampers the trust in check-weighing equipment, making it crucial for buyers to carefully assess and select reputable suppliers to ensure the reliability and effectiveness of their checkweighing equipment.

The table below highlights key countries’ check weighing equipment market revenues. China, the United States, and India are expected to remain the top three consumers of check weighing equipment, with expected valuations of USD 1047.1 million, USD 87.2 million, and USD 64.5 million, respectively, in 2035.

| Countries | Check Weighing Equipment Market Revenue (2035) |

|---|---|

| United States | USD 87.2 million |

| China | USD 1047.1 million |

| Japan | USD 77.5 million |

| South Korea | USD 64.4 million |

| India | USD 64.5 million |

The table below shows the estimated growth rates of the top six countries. India, South Korea, and Japan are set to record high CAGRs of 4.9%, 5.9%, and 5.1%, respectively, through 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

| United Kingdom | 3.6% |

| China | 4.6% |

| Japan | 5.1% |

| South Korea | 5.9% |

| India | 4.9% |

The United States check weighing equipment market is projected to reach USD 87.2 million by 2035. Over the assessment period, demand for check weighing equipment in the United States is set to rise at 3.0% CAGR. The factors driving the country’s growth are as follows:

Sales of check weighing equipment in China are projected to soar at a CAGR of 4.6% during the assessment period. The market is anticipated to reach USD 1047.1 million by 2035. The factors responsible for this growth are as follows:

India's check weighing equipment market value is anticipated to reach USD 64.5 million by 2035. Over the forecast period, check weighing equipment demand is set to increase at a robust CAGR of 4.9%. The factors driving the market growth are as follows:

Japan is expected to surge at a CAGR of 5.1% through 2035. This is attributable to a combination of factors, including:

The United Kingdom is expected to rise at 3.6% CAGR by 2035. The primary factors bolstering the market size are:

The section below shows the above 150ppm segment dominating based on throughput rate. It is forecast to thrive at 4.6% CAGR between 2025 and 2035. Based on end-use, the food and beverage segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 3.6% during the forecast period.

| Top Segment (Throughput Rate) | Above 150ppm |

|---|---|

| CAGR (2025 to 2035) | 4.6% |

| Top Segment (End-use) | Food and Beverages |

|---|---|

| Projected CAGR (2025 to 2035) | 3.6% |

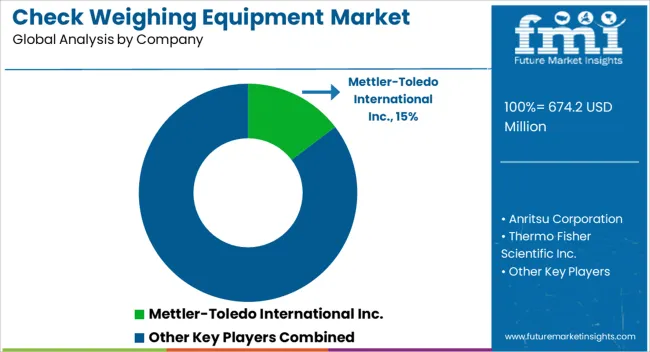

The global check weighing equipment market is consolidated, with leading players accounting for around 40% to 45% of the share. Mettler-Toledo International Inc., Thermo Fisher Scientific Inc., Minebea Intec, Teraoka Seiko Co., Ltd., Bizerba, Soc. Coop. Bilanciai Campogalliano and NEMESIS are the leading manufacturers and suppliers of check-weighing equipment listed in the report.

Key companies are investing in continuous research to produce new items and increase their capacity to meet end-user demand. They are also inclined toward adopting strategies to strengthen their footprint, including acquisitions, partnerships, mergers, and facility expansions.

Recent Developments

The global check weighing equipment market is estimated to be valued at USD 674.2 million in 2025.

The market size for the check weighing equipment market is projected to reach USD 1,047.1 million by 2035.

The check weighing equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in check weighing equipment market are below 50ppm, 50 to 150ppm and above 150ppm.

In terms of load capacity, 13 to 60kg segment to command 43.1% share in the check weighing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Checkpoint Inhibitor Refractory Cancer Market Size and Share Forecast Outlook 2025 to 2035

Check Rails Market

Self-checkout Systems Market Analysis by Portable Self-Checkout Devices and Stationary Self-Checkout Kiosks Through 2035

Market Share Breakdown of Self-Checkout System Manufacturers

Immune Checkpoint Inhibitors Market

Automatic Checkweigher Market Growth & Outlook 2025 to 2035

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Hazardous Weighing Instruments Market Size, Growth, and Forecast for 2025 to 2035

Container Weighing Systems Market Growth - Trends & Forecast 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Linear Net Weighing Machines Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Inspection & Weighing Machine Industry Analysis in ASEAN and Gulf Countries Analysis - Size, Share, and Forecast 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA