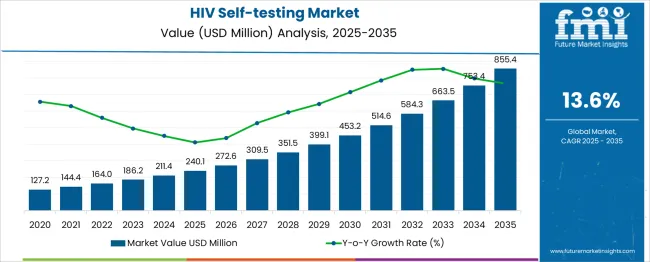

The global HIV self-testing market is projected to grow from USD 240.1 million in 2025 to approximately USD 855.4 million by 2035, recording an absolute increase of USD 615.3 million over the forecast period. This translates into a total growth of 256.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.6% between 2025 and 2035. The overall market size is expected to grow by nearly 3.56X during the same period, supported by increasing awareness about HIV prevention, rising demand for convenient testing solutions, and growing focus on early diagnosis and treatment accessibility.

Between 2025 and 2030, the HIV self-testing market is projected to expand from USD 240.1 million to USD 514.6 million, resulting in a value increase of USD 274.5 million, which represents 44.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising awareness about HIV prevention, increasing government initiatives for self-testing programs, and growing penetration of testing kits in remote and underserved areas. Healthcare organizations and diagnostic companies are expanding their HIV self-testing product portfolios to address the growing demand for accessible and reliable testing solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 240.1 million |

| Forecast Value in (2035F) | USD 855.4 million |

| Forecast CAGR (2025 to 2035) | 13.6% |

From 2030 to 2035, the market is forecast to grow from USD 514.6 million to USD 855.4 million, adding another USD 340.8 million, which constitutes 55.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of digital health platforms, integration of AI-powered result interpretation systems, and development of next-generation testing technologies. The growing adoption of telemedicine and remote healthcare services will drive demand for user-friendly HIV self-testing kits with enhanced accuracy and connectivity features.

Between 2020 and 2025, the HIV self-testing market experienced significant expansion, driven by the COVID-19 pandemic's impact on healthcare accessibility and the urgent need for at-home diagnostic solutions. The market developed as healthcare providers recognized the importance of maintaining HIV testing continuity during lockdowns and social distancing measures. Global health organizations and governments began emphasizing the role of self-testing in achieving HIV elimination goals and improving testing coverage in key populations.

Market expansion is being supported by the increasing global awareness about HIV prevention and the critical importance of early diagnosis in improving treatment outcomes and reducing transmission rates. Modern healthcare systems are increasingly focused on patient-centered care approaches that prioritize convenience, privacy, and accessibility. HIV self-testing's proven effectiveness in reaching populations who may avoid traditional healthcare settings makes it a preferred strategy for public health organizations and NGOs working toward HIV elimination goals.

The growing emphasis on reducing healthcare disparities and improving access to diagnostic services is driving demand for self-testing solutions that can reach remote, underserved, and stigmatized populations. Consumer preference for private, convenient testing options that provide rapid results is creating opportunities for innovative product development. The rising support from international health organizations, government initiatives, and funding from global health programs is also contributing to increased product adoption and market penetration across different regions and demographic groups.

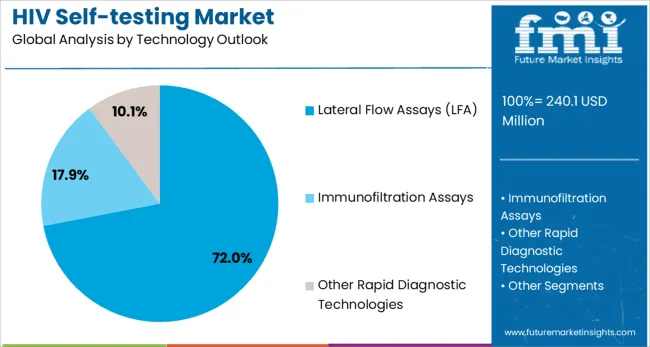

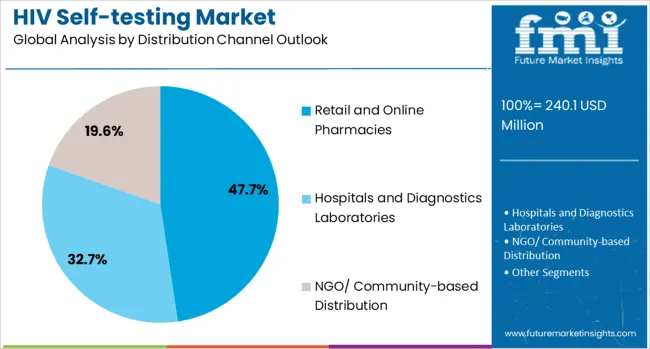

The market is segmented by type, technology, distribution channel, and region. By type, the market is divided into blood-based kits and saliva-based kits. Based on technology, the market is categorized into lateral flow assays (LFA), immunofiltration assays, and other rapid diagnostic technologies. In terms of distribution channel, the market is segmented into retail and online pharmacies, hospitals and diagnostic laboratories, and NGO/community-based distribution. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The blood-based kits segment is projected to account for 54.7% of the HIV self-testing market in 2025, reaffirming its position as the category's primary testing method. Healthcare providers and consumers increasingly recognize the superior accuracy and reliability of blood-based testing compared to alternative sample types. Blood-based HIV self-tests offer high sensitivity and specificity rates, typically exceeding 99%, which builds confidence among users and healthcare professionals recommending these products.

This segment forms the foundation of most public health programs and clinical guidelines, as it represents the most clinically validated and trusted approach to HIV self-testing. Regulatory approvals from major health authorities and ongoing clinical validation studies continue to strengthen trust in blood-based formulations. With healthcare systems prioritizing diagnostic accuracy and patient safety, blood-based kits align with both screening and confirmatory testing protocols, making them the central growth driver of HIV self-testing market demand.

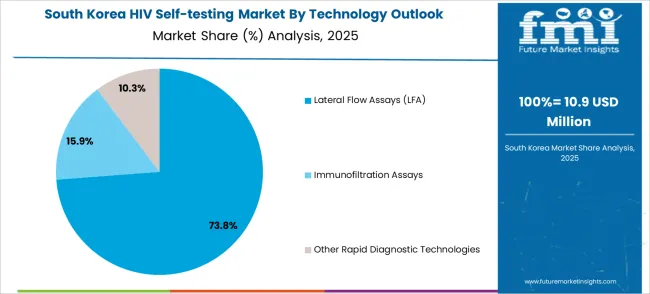

Lateral flow assays are projected to represent 72% of HIV self-testing technology demand in 2025, underscoring their role as the preferred diagnostic platform for rapid, point-of-care testing. Healthcare providers and consumers gravitate toward LFA-based tests for their simplicity, rapid results (typically 15-20 minutes), and ability to provide clear, easy-to-interpret visual results without requiring specialized equipment or technical expertise.

The segment is supported by the widespread adoption of lateral flow technology across various diagnostic applications and its proven track record in delivering reliable results in diverse environmental conditions. Manufacturers are increasingly developing combination tests that detect multiple biomarkers simultaneously, enhancing the clinical utility and cost-effectiveness of LFA-based HIV self-tests. As healthcare accessibility and patient empowerment remain priorities, lateral flow assays will continue to dominate the HIV self-testing technology landscape.

The retail and online pharmacies channel is forecasted to contribute 47.7% of the HIV self-testing market in 2025, reflecting the growing importance of accessible, consumer-friendly distribution networks. Consumers increasingly prefer the convenience, privacy, and availability offered by pharmacy-based distribution, which allows for discrete purchasing without the need for healthcare provider appointments or clinical visits.

This channel benefits from established pharmaceutical distribution networks, trained pharmacy staff who can provide basic guidance, and the growing acceptance of over-the-counter diagnostic products. The segment also capitalizes on the rapid growth of e-commerce platforms and online pharmacy services, which provide additional privacy and convenience for consumers who may feel stigmatized by in-person purchases. With digital health platforms expanding and telehealth consultations becoming more common, pharmacy-based distribution serves as a critical bridge between consumer accessibility and healthcare system integration.

The HIV self-testing market is advancing rapidly due to increasing global health initiatives focused on HIV elimination, growing consumer demand for private and convenient testing options, and expanding support from government and international health organizations. The market faces challenges, including regulatory approval complexities, quality control concerns with unregulated products, and the need for comprehensive user education and support systems. Innovation in digital connectivity, result interpretation systems, and integration with healthcare networks continues to influence product development and market expansion patterns.

The growing integration of HIV self-testing with digital health platforms is enabling users to access immediate support, counseling services, and linkage to care following testing. Smartphone applications and telemedicine platforms are providing real-time guidance for test administration, result interpretation, and next steps for both positive and negative results. Digital connectivity features are also supporting data collection for public health surveillance and program evaluation, while maintaining user privacy and confidentiality.

Modern HIV self-testing manufacturers are incorporating advanced quality control measures, user-friendly instructions, and comprehensive support systems to ensure accurate testing and appropriate follow-up care. These improvements include temperature-stable formulations, foolproof sample collection devices, and clear visual result interpretation guides. Advanced packaging and storage technologies also extend product shelf life and maintain test performance across diverse environmental conditions and distribution channels.

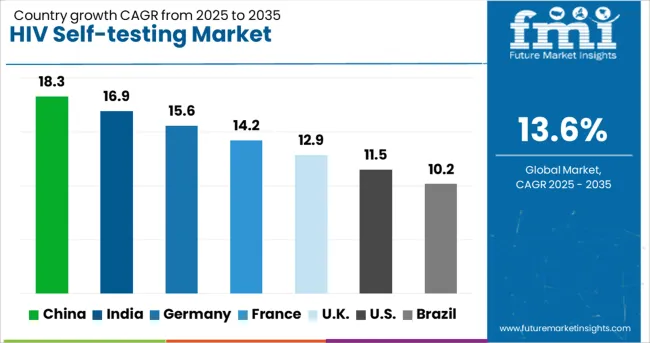

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 18.3% |

| India | 16.9% |

| Germany | 15.6% |

| France | 14.2% |

| UK | 12.9% |

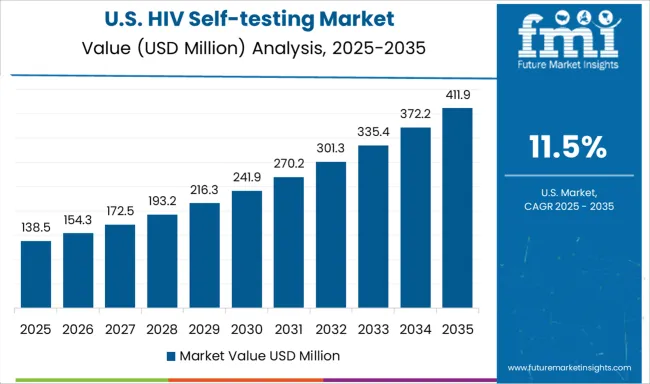

| USA | 11.5% |

| Brazil | 10.2% |

The HIV self-testing market is experiencing robust growth globally, with China leading at an 18.3% CAGR through 2035, driven by government initiatives to expand HIV testing coverage, growing awareness among key populations, and increasing integration of self-testing into national HIV prevention programs. India follows closely at 16.9%, supported by large-scale public health programs, NGO partnerships, and efforts to reach underserved populations in rural and remote areas.

Germany shows strong growth at 15.6%, emphasizing quality assurance, regulatory compliance, and integration with existing healthcare systems. France records 14.2% growth, focusing on innovative distribution models and comprehensive user support programs. The UK demonstrates 12.9% expansion, leveraging digital health platforms and community-based distribution networks. The USA shows steady growth at 11.5%, prioritizing FDA-approved products and integration with healthcare provider networks.

Revenue from HIV self-testing in China is projected to exhibit strong growth with a CAGR of 18.3% through 2035, driven by government-led initiatives to expand HIV testing coverage and reach key populations through innovative distribution strategies. The country's comprehensive approach to HIV prevention and the integration of self-testing into national health programs are creating significant demand for reliable, accessible testing solutions across urban and rural areas.

Government support for HIV prevention programs and substantial investment in healthcare infrastructure are driving adoption of self-testing technologies throughout major metropolitan areas and underserved regions. E-commerce platforms and digital health initiatives are supporting rapid product distribution and user education among populations who may avoid traditional healthcare settings for HIV testing.

Revenue from HIV self-testing in India is expanding at a CAGR of 16.9%, supported by extensive public health programs, international funding support, and growing recognition of self-testing's role in achieving HIV elimination goals. The country's diverse population and complex healthcare landscape require innovative approaches to HIV testing that can reach remote areas and marginalized communities effectively.

Rising awareness about HIV prevention among key populations and the general public is creating opportunities for self-testing programs that combine convenience, privacy, and reliability. Growing partnerships between government agencies, NGOs, and international health organizations are driving product distribution and user education across urban and rural markets nationwide.

Demand for HIV self-testing in the USA is projected to grow at a CAGR of 11.5%, supported by FDA-approved products, integration with healthcare provider networks, and comprehensive quality assurance standards. American healthcare systems are increasingly incorporating self-testing into routine prevention programs while maintaining strong linkage to care and support services for individuals with positive results.

Regulatory oversight and clinical validation requirements are ensuring product reliability and user safety while supporting healthcare provider confidence in recommending self-testing options. Growing awareness about HIV prevention and testing among diverse populations is driving demand for accessible, reliable testing solutions that complement traditional healthcare services.

Revenue from HIV self-testing in the UK is estimated to grow at a CAGR of 12.9% through 2035, supported by National Health Service initiatives, community partnerships, and innovative distribution strategies that prioritize accessibility and user support. British public health authorities are actively promoting self-testing as a key component of HIV elimination strategies while ensuring appropriate linkage to care and support services.

Growth in online distribution channels and community-based programs is increasing accessibility of HIV self-tests across diverse populations and geographic regions. Rising integration with digital health platforms and telehealth services is enhancing user experience and supporting comprehensive HIV prevention and care programs throughout the healthcare system.

Revenue from HIV self-testing in Germany is anticipated to grow at a CAGR of 15.6% through 2035, supported by stringent regulatory standards, comprehensive quality assurance programs, and integration with established healthcare systems. German healthcare authorities prioritize product reliability, user safety, and clinical validation, making HIV self-testing a trusted component of comprehensive HIV prevention and care programs.

Strict EU regulations and national quality standards are ensuring that HIV self-tests meet high performance criteria while remaining accessible to users who need them. Healthcare providers, pharmacies, and digital health platforms are enhancing product distribution and user education, while regulatory oversight supports continued confidence in self-testing technology and outcomes.

Revenue from HIV self-testing in France is projected to grow at a CAGR of 14.2% through 2035, driven by comprehensive national HIV prevention policies, strong public health infrastructure, and progressive approaches to expanding testing accessibility. The country's well-established healthcare system and pharmacy networks provide excellent distribution channels for HIV self-testing products while ensuring appropriate user education and linkage to care services.

Government support for innovative HIV prevention strategies and substantial investment in public health programs are driving adoption of self-testing technologies throughout urban and rural areas. France's progressive healthcare policies and strong emphasis on patient rights and privacy make self-testing an attractive option for populations who may avoid traditional testing settings.

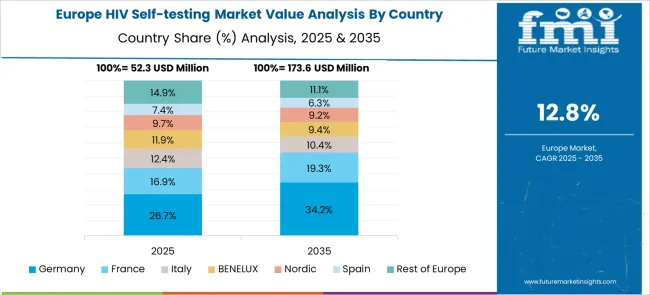

The HIV self-testing market in Europe demonstrates mature development across major economies with Germany showing a strong presence through its comprehensive healthcare system and well-established HIV prevention programs, supported by robust regulatory frameworks that ensure product quality and safety while maintaining accessibility for high-risk populations and general screening programs.

France represents a significant market driven by its national HIV prevention strategy and progressive public health policies, with healthcare authorities actively promoting self-testing as part of comprehensive HIV elimination efforts. The country's well-developed pharmacy network and digital health infrastructure support widespread distribution and user education programs.

The UK exhibits considerable growth through its National Health Service initiatives and community-based testing programs, with organizations actively distributing free HIV self-tests through various channels, including online platforms, pharmacies, and community organizations. Italy and Spain show expanding interest in self-testing solutions, particularly through NGO partnerships and targeted programs for key populations. Nordic countries contribute through their focus on innovation and digital health integration, while Eastern European nations display growing potential driven by international funding support and increasing awareness about HIV prevention and testing accessibility.

The Japanese HIV self-testing market demonstrates steady growth driven by precision healthcare focus, advanced diagnostic technologies, and healthcare system preference for high-quality testing systems ensuring superior clinical accuracy and safety compliance throughout public health operations. International companies establish presence through cutting-edge diagnostic technologies, aligning with Japan's sophisticated healthcare industry and stringent quality standards, while incorporating digital health integration and user support capabilities.

The market emphasizes automated quality control systems, precision diagnostic excellence, and advanced user-friendly innovations reflecting Japanese healthcare precision and attention to detail in diagnostic processes. Growing investment in digital health technologies supports intelligent testing systems with real-time support, predictive analytics, and optimized user experience. Japanese healthcare providers prioritize test reliability, consistent diagnostic outcomes, and regulatory compliance, creating opportunities for premium HIV self-testing solutions delivering exceptional performance across healthcare facilities, pharmacies, and community health applications requiring highest quality standards.

The South Korean HIV self-testing market shows exceptional growth potential driven by expanding healthcare infrastructure, increasing adoption of digital health technologies, and growing awareness about HIV prevention, requiring efficient and accessible diagnostic solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on healthcare innovation competitiveness, driving investment in modern HIV testing technologies meeting international clinical standards and regulatory requirements.

Korean healthcare organizations increasingly adopt digital health platforms, advanced diagnostic systems, and integrated testing technologies, improving user accessibility and clinical effectiveness while ensuring regulatory compliance. Growing influence of Korean healthcare innovations in global markets supports demand for sophisticated HIV self-testing solutions, ensuring diagnostic excellence while maintaining cost-effectiveness. Integration of digital health principles and smart diagnostic technologies creates opportunities for intelligent testing systems with connectivity features, user support capabilities, and real-time health optimization across diverse public health applications.

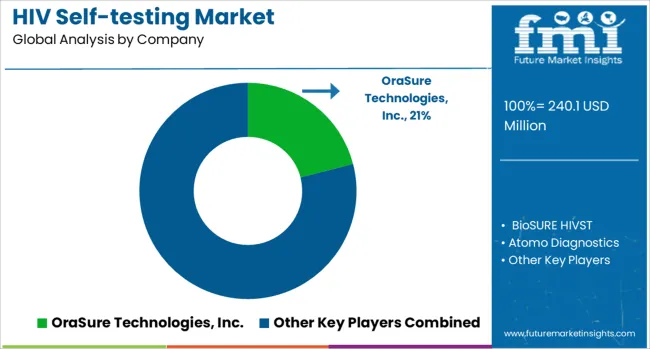

The HIV self-testing market is characterized by competition among established diagnostic companies, specialized biotechnology firms, and emerging digital health players. Companies are investing in advanced diagnostic technologies, regulatory approvals, user education programs, and distribution network expansion to deliver reliable, accessible, and user-friendly HIV self-testing solutions. Product innovation, quality assurance, and market access strategies are central to strengthening competitive positions and expanding global market presence.

OraSure Technologies Inc., USA-based, leads the market with significant global presence, offering FDA-approved HIV self-testing products with emphasis on accuracy, ease of use, and comprehensive user support. BioSURE HIVST, UK-based, provides innovative self-testing solutions with a focus on accessibility and user-friendly design. Atomo Diagnostics, Australia-based, delivers rapid diagnostic technologies with emphasis on simplicity and reliability for diverse user populations.

Chembio Diagnostics Inc. and SD Biosensor INC. focus on advanced diagnostic platforms that combine accuracy with ease of use, while CTK Biotech Inc. emphasizes affordable, reliable testing solutions for global markets. genedrive plc specializes in molecular diagnostic technologies, while Hydrex Diagnostics and Trinity Biotech provide comprehensive diagnostic solutions with strong regulatory compliance and quality assurance programs. Abbott continues to leverage its global healthcare presence and diagnostic expertise to expand HIV self-testing accessibility worldwide.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 240.1 million |

| Type | Blood-based Kits, Saliva-based Kits |

| Technology | Lateral Flow Assays (LFA), Immunofiltration Assays, Other Rapid Diagnostic Technologies |

| Distribution Channel | Retail and Online Pharmacies, Hospitals and Diagnostic Laboratories, NGO/Community-based Distribution |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | OraSure Technologies Inc., BioSURE HIVST, Atomo Diagnostics, Chembio Diagnostics Inc., SD Biosensor INC., CTK Biotech Inc., genedrive plc, Hydrex Diagnostics Sp., Trinity Biotech, Abbott |

| Additional Attributes | Market analysis by test accuracy levels, regulatory approval status, distribution channel effectiveness, user demographics and preferences, integration with healthcare systems, quality assurance standards, and digital health platform connectivity |

The global HIV self-testing market is estimated to be valued at USD 240.1 million in 2025.

The market size for the HIV self-testing market is projected to reach USD 855.4 million by 2035.

The HIV self-testing market is expected to grow at a 13.6% CAGR between 2025 and 2035.

The key product types in HIV self-testing market are blood-based kits and saliva-based kits.

In terms of technology outlook, lateral flow assays (lfa) segment to command 72.0% share in the HIV self-testing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Antivirals Market Size and Share Forecast Outlook 2025 to 2035

HIV/HBV/HCV Test Kits Market Trends and Forecast 2025 to 2035

Prophylactic HIV Drugs Market Growth - Industry Trends & Forecast 2025 to 2035

Vendor Neutral Archive Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Clinical Trial Biorepository & Archiving Solution Market Size and Share Forecast Outlook 2025 to 2035

Human Immunodeficiency Virus Type 1 (HIV 1) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA