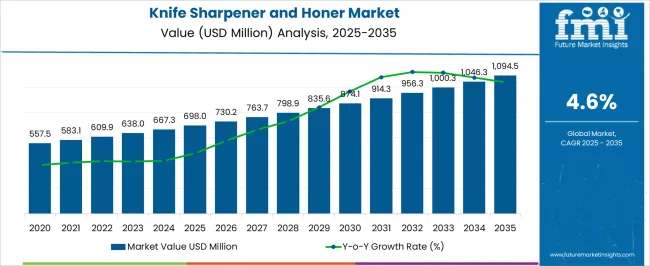

The knife sharpener and honer market is estimated to be valued at USD 698.0 million in 2025 and is projected to reach USD 1094.5 million by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period.

The knife sharpener and honer market is projected to reach USD 698.0 million in 2025 and grow to USD 1,094.5 million by 2035, exhibiting a CAGR of 4.6%. From 2021 to 2025, the market has seen steady growth, increasing from USD 557.5 million to USD 698.0 million. Over the next decade, the growth trajectory is expected to continue, with a consistent climb in market value, eventually surpassing USD 1 billion in 2030. This value accumulation is indicative of the market’s stable demand driven by the rise in home cooking and DIY activities, as well as growing consumer awareness of knife maintenance.

The year-on-year growth follows a steady pattern, reflecting gradual but constant adoption of both manual and electric sharpeners, particularly among residential consumers. The market value saw an increase from USD 557.5 million in 2021 to USD 583.1 million in 2022 and continued rising in subsequent years. By 2024, the market had reached USD 667.3 million, before achieving USD 698.0 million by 2025. This indicates a solid growth curve in response to increasing consumer spending on premium kitchen tools, further compounded by a growing awareness of the importance of maintaining kitchen knives in top condition. In 2035, the market is expected to cross USD 1 billion, with the cumulative value seeing a peak-to-trough analysis that supports this steady, long-term growth trajectory.

Professional kitchens drive substantial demand through high-volume blade maintenance requirements that create predictable replacement cycles for commercial-grade sharpening equipment. Restaurant operators, butcher shops, and food processing facilities typically maintain relationships with specialized suppliers who provide industrial sharpening systems capable of handling continuous use patterns.

These commercial buyers prioritize durability and processing speed over cost considerations, creating a market segment where premium pricing remains sustainable. Procurement departments in large food service chains often establish long-term contracts with equipment suppliers, reducing price volatility but creating barriers for new market entrants seeking to establish distribution channels.

Consumer markets demonstrate different purchasing behaviors influenced by cooking frequency, blade quality awareness, and storage space constraints in residential kitchens. Retail channels include specialty culinary stores, general merchandise retailers, and online platforms where product differentiation occurs through brand positioning rather than functional capabilities.

Marketing strategies focus on ease of use and safety features rather than technical specifications, reflecting the knowledge gap between professional and amateur users. Price sensitivity varies considerably across geographic markets, with premium segments emerging in regions where culinary education and cooking culture support higher spending on kitchen maintenance tools.

| Metric | Value |

|---|---|

| Knife Sharpener and Honer Market Estimated Value in (2025 E) | USD 698.0 million |

| Knife Sharpener and Honer Market Forecast Value in (2035 F) | USD 1094.5 million |

| Forecast CAGR (2025 to 2035) | 4.6% |

The knife sharpener and honer market is experiencing consistent growth, supported by the rising demand for effective and convenient blade maintenance solutions across both residential and commercial environments. Increasing consumer interest in cooking, driven by culinary awareness and home dining trends, is expanding the need for products that extend the life and efficiency of knives. Technological advancements in sharpening mechanisms and ergonomic designs are improving ease of use and safety, encouraging higher adoption rates.

The availability of diverse product formats catering to varying skill levels and budgets is broadening the consumer base. Additionally, growing emphasis on food preparation hygiene and precision cutting in both home and professional kitchens is influencing purchase decisions.

The proliferation of e-commerce channels is enhancing accessibility and product variety, while the integration of durable materials and advanced honing technologies is boosting product lifespan As consumers increasingly prioritize performance, safety, and convenience in kitchen tools, the market is expected to maintain steady expansion, with innovation and functionality driving competitive differentiation among leading manufacturers.

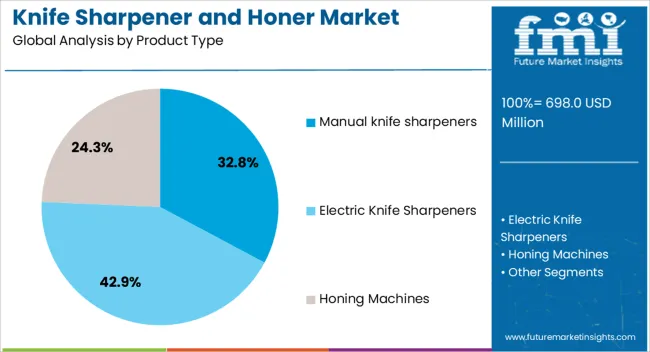

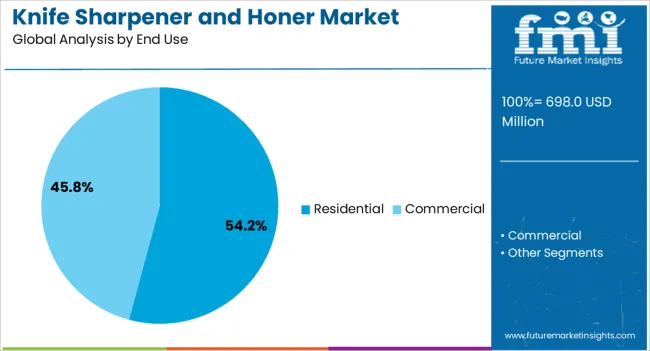

The knife sharpener and honer market is segmented by product type, end use, and geographic regions. By product type, knife sharpener and honer market is divided into Manual knife sharpeners, Electric Knife Sharpeners, and Honing Machines. In terms of end use, knife sharpener and honer market is classified into Residential and Commercial. Regionally, the knife sharpener and honer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The manual knife sharpeners segment is projected to hold 32.8% of the knife sharpener and honer market revenue share in 2025, positioning it as the leading product type. This dominance is being driven by the affordability, portability, and user-friendly nature of manual devices, which appeal to a wide range of consumers. Manual sharpeners require no electricity, making them accessible for use in any setting, including outdoor and remote locations.

The segment benefits from a perception of greater control during sharpening, allowing users to fine-tune blade edges according to preference. Advances in abrasive materials and multi-stage sharpening slots are improving performance consistency and reducing wear on blades.

The durability and low maintenance requirements of manual sharpeners further support their popularity in both residential and light commercial environments With rising demand for cost-effective yet reliable sharpening solutions, and the continued preference for hands-on control in kitchen maintenance, this segment is expected to retain its leadership position over the forecast period.

The residential segment is anticipated to account for 54.2% of the knife sharpener and honer market revenue share in 2025, making it the largest end-use category. This leadership is being reinforced by the increasing popularity of home cooking, meal preparation, and gourmet culinary practices among households. The segment benefits from the growing trend of investing in quality kitchen tools and maintaining them for long-term use, particularly among consumers who own high-value knives.

Residential users often seek sharpening and honing solutions that combine ease of use, safety, and compact storage, making them more inclined to purchase products tailored for home environments. Marketing initiatives highlighting product safety features, ergonomic designs, and time-saving capabilities are further influencing household adoption.

The expansion of online retail channels is also enabling greater access to a variety of models, encouraging product upgrades and replacements As consumer awareness about knife maintenance continues to rise, the residential segment is expected to sustain its dominant position through a combination of practicality, affordability, and functional performance.

The knife sharpener and honer market is experiencing steady growth, driven by the rising popularity of home cooking and DIY activities. As more consumers invest in premium kitchen tools, particularly knives, the demand for reliable sharpening and honing solutions is increasing. The market offers a wide range of products, including manual and electric sharpeners, catering to both residential and commercial users. The residential segment holds a significant share of the market and is expected to maintain its dominance throughout the forecast period as awareness of knife maintenance continues to grow.

A significant hurdle is the safety concerns associated with manual sharpeners, which require skill and experience to achieve the correct angle and pressure. This can lead to inconsistent sharpening quality and potential accidents. Additionally, the availability of alternative sharpening methods, such as professional sharpening services, poses competition to the market. The high cost of advanced electric sharpeners may also deter some consumers from adopting these products. Furthermore, the market is fragmented with numerous players offering a wide range of products, making it challenging for consumers to identify the most suitable option for their needs. Addressing these challenges requires continuous innovation, consumer education, and improved product designs to enhance safety and usability.

The knife sharpener and honer market is primarily driven by the increasing demand for home cooking and DIY activities. The popularity of cooking shows and online culinary content has inspired many individuals to engage in home cooking, leading to a higher demand for quality kitchen tools, including knives. As consumers invest in premium knives, the need for proper maintenance through sharpening and honing becomes essential to prolong the lifespan and performance of these tools. Additionally, the growing awareness about the importance of knife maintenance and safety has contributed to the market's expansion. The availability of a wide range of sharpening products, from manual to electric models, offers consumers various options to suit their preferences and budgets. These factors collectively contribute to the robust growth of the knife sharpener and honer market.

The knife sharpener and honer market presents numerous opportunities for innovation and expansion. Advancements in technology have led to the development of electric sharpeners with features such as adjustable sharpening angles, multiple grinding stages, and ergonomic designs, catering to both amateur and professional chefs. The integration of smart technologies, such as Bluetooth connectivity and app integration, allows users to monitor and control the sharpening process remotely, enhancing convenience and precision. Furthermore, the growing trend of outdoor activities and camping has increased the demand for portable and compact sharpening tools. Manufacturers can capitalize on these trends by developing products that cater to specific consumer needs, thereby expanding their market reach. Additionally, partnerships with culinary schools, professional chefs, and online culinary platforms can further promote product adoption and brand recognition.

The increasing preference for electric sharpeners over manual ones is driven by their ease of use and consistent results. Consumers are seeking products that offer convenience, speed, and precision in the sharpening process. The integration of advanced technologies, such as digital displays, angle guides, and automated sharpening systems, is enhancing the functionality and user experience of these products. There is also a growing emphasis on the development of compact and portable sharpening tools, catering to consumers with limited storage space or those who require mobility. Additionally, the rise of online retail platforms has made it easier for consumers to access a wide variety of sharpening products, leading to increased competition and innovation in the market.

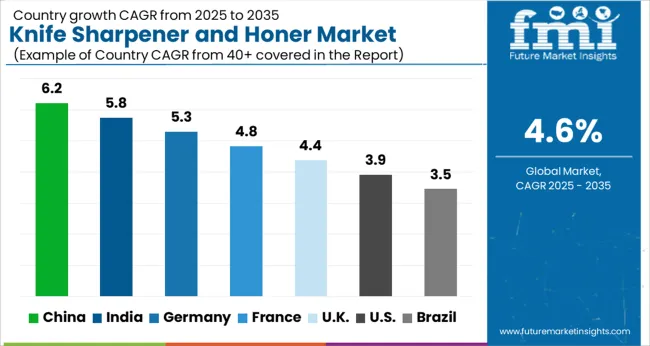

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

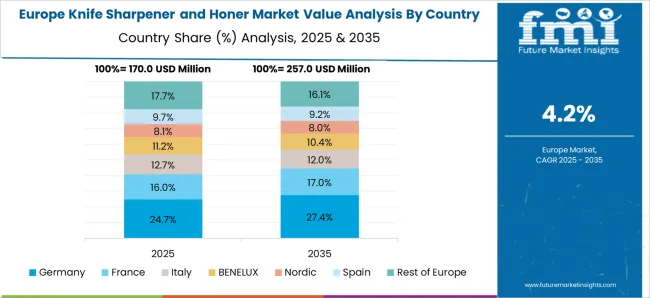

The global knife sharpener and honer market is growing at a CAGR of 4.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 6.2%, followed by India at 5.8%, and Germany at 5.3%. The United Kingdom and the United States show more moderate growth rates of 4.4% and 3.9%, respectively. The growth is driven by the rising demand for high-quality kitchen tools in the foodservice, retail, and consumer sectors. As urbanization, home cooking, and culinary interest rise, the market for specialized sharpeners and honers continues to expand. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global knife sharpener and honer market, expanding at a CAGR of 6.2% from 2025 to 2035. The growing demand for precision kitchen tools in the country’s expanding foodservice and home cooking industries is driving the market’s growth. China’s increasing urbanization and improving disposable income are also contributing to higher demand for high-quality kitchen equipment, including knife sharpeners and honers. As e-commerce and online sales continue to grow, the demand for innovative, easy-to-use knife sharpeners is expected to rise. China’s significant manufacturing base in consumer goods ensures the availability of a wide variety of sharpener products.

The knife sharpener and honer market in India is set to expand at a CAGR of 5.8% from 2025 to 2035. The growing demand for kitchen appliances in India’s expanding middle class is one of the key factors driving the market. As urbanization increases, more people are adopting modern kitchen tools, including knife sharpeners and honers, for both commercial and home use. Additionally, the rise in foodservice and hospitality sectors, along with greater awareness about maintaining kitchen tools, is expected to further boost the market. The increasing availability of knife sharpeners through online and offline retail channels is also contributing to the growth of the market.

The knife sharpener and honer market in France is growing at a CAGR of 5.3% from 2025 to 2035. The country’s strong culinary culture and high demand for professional kitchen tools are key factors contributing to this growth. As France continues to focus on high-quality food preparation and innovation in the culinary field, the demand for reliable and durable knife sharpeners is rising. The market is also being driven by the increasing popularity of home cooking and DIY kitchen projects. As awareness grows about the importance of maintaining kitchen tools, the demand for specialized sharpeners and honers continues to increase.

The knife sharpener and honer market in the United Kingdom is expanding at a CAGR of 4.4% from 2025 to 2035. The UK is experiencing a growing interest in premium kitchen tools, with consumers increasingly investing in high-quality knives and sharpening systems. The demand for kitchen accessories, including knife sharpeners, is also rising due to the growing popularity of culinary shows and home cooking. As people continue to value well-maintained, long-lasting kitchen tools, the market for specialized sharpeners and honers is expected to see continued growth. The retail expansion and e-commerce boom in the UK are further boosting market accessibility.

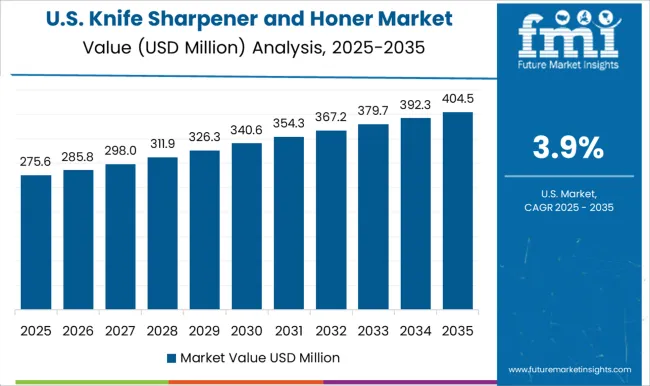

The USA knife sharpener and honer market is expected to grow at a CAGR of 3.9% from 2025 to 2035. The USA market is largely driven by the increasing focus on kitchen efficiency and the growing consumer interest in home cooking and culinary skills. As people continue to invest in premium kitchen tools and equipment, the demand for quality knife sharpeners and honers is expected to rise. The market is also supported by a growing trend of specialty knives and custom kitchenware, further driving the need for precision sharpening and maintenance tools in residential and professional kitchens.

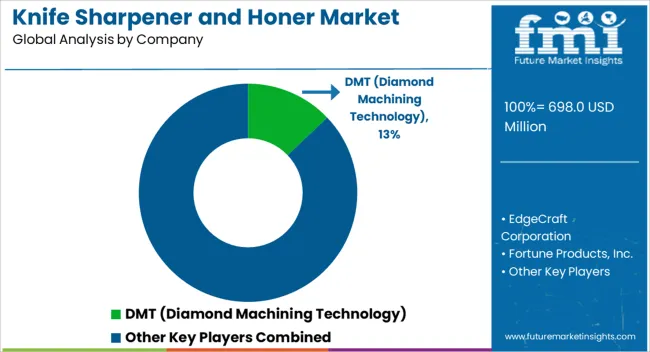

The knife sharpener and honer market is driven by brands offering diverse sharpening technologies, catering to both professional and consumer segments. DMT (Diamond Machining Technology) leads with diamond-impregnated sharpening tools that ensure precision, durability, and consistent performance across manual and bench models. EdgeCraft Corporation, under its Chef’sChoice brand, dominates the electric sharpener segment with multi-stage sharpening and honing systems designed for professional kitchens and home users. Fortune Products, Inc. and Smith’s Consumer Products, Inc. specialize in manual and pull-through sharpeners, focusing on affordability and ease of use.

KAI Corporation and Global (F. Dick GmbH) provide hybrid solutions that combine traditional craftsmanship with modern sharpening technologies, targeting culinary professionals. Lansky Sharpeners is recognized for its guided systems that deliver precision angle control, ideal for enthusiasts and outdoor users. Tormek AB offers premium water-cooled systems that minimize blade wear while achieving razor-sharp finishes, appealing to workshops and professional chefs.

Wüsthof and Zwilling J.A. Henckels produce high-end sharpeners designed to complement their knife lines, ensuring edge consistency and premium usability. Messermeister, Spyderco, Sharpal, and Razor Edge Systems focus on portable, compact solutions for outdoor, tactical, and everyday applications. Competitive differentiation centers on technology, ergonomics, and reliability across both manual and electric sharpening categories.

The knife sharpener and honer market is driven by brands offering diverse sharpening technologies, catering to both professional and consumer segments. DMT (Diamond Machining Technology) leads with diamond-impregnated sharpening tools that ensure precision, durability, and consistent performance across manual and bench models. EdgeCraft Corporation, under its Chef’sChoice brand, dominates the electric sharpener segment with multi-stage sharpening and honing systems designed for professional kitchens and home users. Fortune Products, Inc. and Smith’s Consumer Products, Inc. specialize in manual and pull-through sharpeners, focusing on affordability and ease of use.

KAI Corporation and Global (F. Dick GmbH) provide hybrid solutions that combine traditional craftsmanship with modern sharpening technologies, targeting culinary professionals. Lansky Sharpeners is recognized for its guided systems that deliver precision angle control, ideal for enthusiasts and outdoor users. Tormek AB offers premium water-cooled systems that minimize blade wear while achieving razor-sharp finishes, appealing to workshops and professional chefs.

Wüsthof and Zwilling J.A. Henckels produce high-end sharpeners designed to complement their knife lines, ensuring edge consistency and premium usability. Messermeister, Spyderco, Sharpal, and Razor Edge Systems focus on portable, compact solutions for outdoor, tactical, and everyday applications. Competitive differentiation centers on technology, ergonomics, and reliability across both manual and electric sharpening categories.

| Item | Value |

|---|---|

| Quantitative Units | USD 698.0 Million |

| Product Type | Manual knife sharpeners, Electric Knife Sharpeners, and Honing Machines |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DMT (Diamond Machining Technology); EdgeCraft Corporation; Fortune Products, Inc.; Global (F. Dick GmbH); KAI Corporation; Lansky Sharpeners; Messermeister, Inc.; Razor Edge Systems; Sharpal; Smith’s Consumer Products, Inc.; Spyderco, Inc.; Tormek AB; Wüsthof; Zwilling J.A. Henckels. |

| Additional Attributes | Dollar sales by product type (manual, electric, belt), sharpening medium (diamond, ceramic, steel, water-cooled), and applications (professional, home, outdoor). Demand dynamics are influenced by consumer preference for convenience, with electric sharpeners gaining traction for their ease of use, while manual sharpeners are favored for precision. Regional trends show strong adoption in North America and Europe, driven by the growing interest in culinary activities and outdoor hobbies, leading to increased demand for high-quality and portable sharpening solutions. |

The global knife sharpener and honer market is estimated to be valued at USD 698.0 million in 2025.

The market size for the knife sharpener and honer market is projected to reach USD 1,094.5 million by 2035.

The knife sharpener and honer market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in knife sharpener and honer market are manual knife sharpeners, _sharpening stones, _honing rods, _handheld manual sharpeners, _manual rotary sharpeners, electric knife sharpeners, _two-stage electric sharpeners, _three-stage electric sharpeners, honing machines, _manual honing machines and _electric honing machines.

In terms of end use, residential segment to command 54.2% share in the knife sharpener and honer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Knife Sterilizer Market – Industry Demand & Forecast 2025 to 2035

Table Knife Market Size and Share Forecast Outlook 2025 to 2035

Paint Knife Market Size and Share Forecast Outlook 2025 to 2035

Gamma Knife Market Analysis - Growth & Forecast 2025 to 2035

Rotary Knife Cutters Market

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA