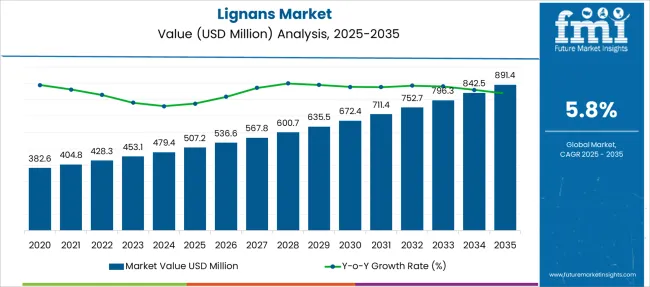

The Lignans Market is estimated to be valued at USD 507.2 million in 2025 and is projected to reach USD 891.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Lignans Market Estimated Value in (2025 E) | USD 507.2 million |

| Lignans Market Forecast Value in (2035 F) | USD 891.4 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The lignans market is expanding steadily, driven by increasing interest in natural bioactive compounds with health-promoting properties. Consumers are becoming more health-conscious and seeking ingredients with antioxidant and hormone-balancing effects, which has elevated the importance of lignans.

Agricultural trends have supported the growth of oilseeds as a primary source of lignans due to their rich lignan content and wide availability. Food and beverage manufacturers have incorporated lignans into product formulations to enhance nutritional profiles and meet clean-label demands.

The rising focus on plant-based diets and functional foods has further propelled lignan applications in this sector. Additionally, ongoing research into the potential health benefits of lignans has increased awareness among both consumers and product developers. As product innovation and consumer education continue, the lignans market is expected to grow through expanded use in food and beverages and other health-related applications. Segmental growth is expected to be led by oilseeds as the main source and the food and beverages sector as the primary application area.

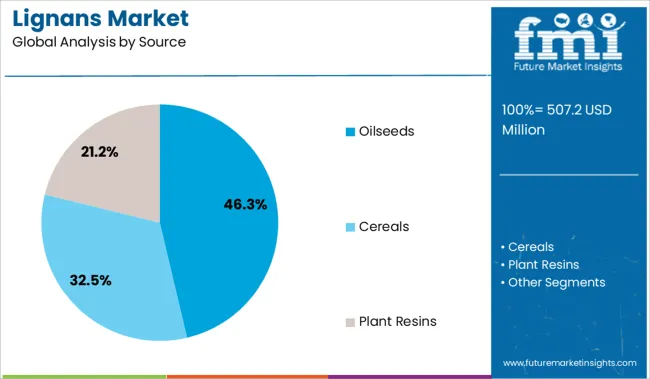

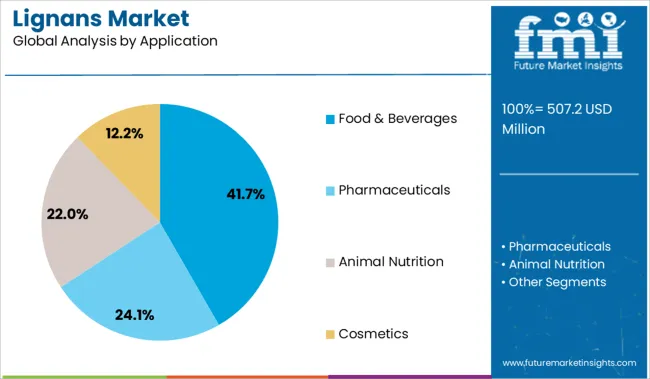

The market is segmented by Source and Application and region. By Source, the market is divided into Oilseeds, Cereals, and Plant Resins. In terms of Application, the market is classified into Food & Beverages, Pharmaceuticals, Animal Nutrition, and Cosmetics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Oilseeds segment is projected to contribute 46.3% of the lignans market revenue in 2025, holding its position as the leading source category. Oilseeds such as flaxseed, sesame, and sunflower seeds have been favored due to their high lignan content and sustainable cultivation practices.

Producers and ingredient suppliers have focused on optimizing extraction and processing methods to maximize lignan yield while maintaining product purity. The growing availability of oilseeds worldwide has ensured a steady supply for industrial use.

Consumer demand for natural and plant-based ingredients has supported the prominence of oilseeds as a lignan source. With increasing adoption in nutraceuticals and functional foods, the Oilseeds segment is expected to maintain its dominance.

The Food & Beverages segment is projected to account for 41.7% of the lignans market revenue in 2025, securing its position as the largest application segment. Growth in this segment has been driven by the incorporation of lignans into health-oriented food products such as cereals, baked goods, dairy alternatives, and beverages.

Food manufacturers have leveraged lignans for their antioxidant properties and potential to support cardiovascular and hormonal health. The rising trend toward clean-label and plant-based foods has increased the demand for functional ingredients like lignans.

Additionally, consumer interest in natural health supplements has led to the development of fortified food and drink products. As awareness of lignans' health benefits spreads, their use in the food and beverages sector is expected to expand further, reinforcing the segment’s leading position.

The global demand for lignans is anticipated to rise at a CAGR of 5.8% between 2025 and 2035, in comparison to 5.2% CAGR registered from 2020 to 2024. Growing demand for lignans from industries like pharmaceuticals, cosmetics & personal care, and food & beverages is a key factor spurring growth in lignans market.

In recent years, lignans have become highly popular across the world due to their attributes which include anti-microbial, immunosuppressive, antiviral, anti-inflammatory, anti-cancer, anti-oxidant properties. These attributes offered by lignans are expanding the application of the product in various industries including cosmetics, food, pharmaceuticals, and animal feed which is, therefore, augmenting the sales of lignans globally.

Aside from that, due to the dangers posed by synthetic compounds, consumers are shifting preferences toward bio-based products, which in turn is expanding the lignin market size.

It is believed that consumption of lignans improves prostate, ovarian and uterine health, improves digestion, enhances hair health, and decreases sugar levels.

According to market trends, rising prevalence of various types of cancer and increased global awareness of cancer prevention activities aimed at reducing disease-related mortality rate are expected to drive demand for lignans.

The implementation of supportive government efforts, such as the India Ministry of Women and Child Development's "Health Awareness Programs to spread awareness of cervical and breast cancer," are encouraging the adoption of cancer treatment in the region. Due to the presence of phytoestrogen, which has potential anti-cancer characteristics, lignans are becoming ideal ingredients used in cancer therapies. Driven by this, demand for lignans is slated to rise at a healthy pace during the forecast period.

Similarly, growing inclinations towards using natural chemicals in anticancer medicines will create lucrative opportunities for lignans manufacturers in the future.

Implementation of Stringent Regulations Pertaining to Food and Pharmaceutical Products Favoring Growth in Lignans Market

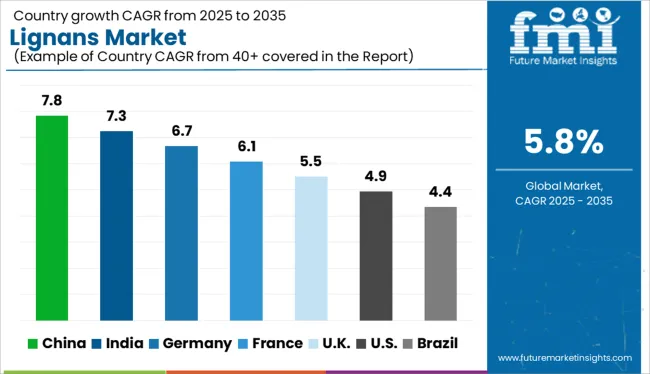

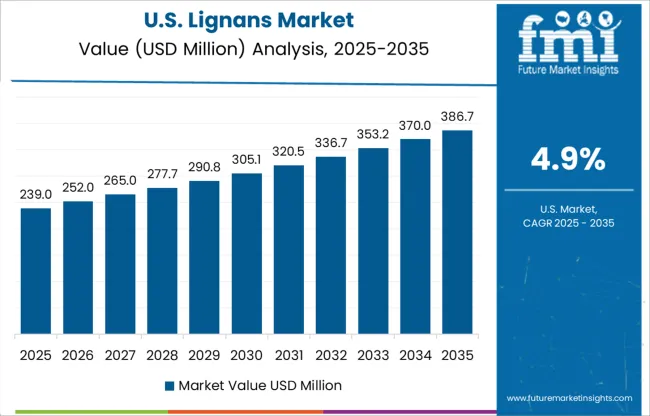

The lignans market in the USA is expected to grow at a significant rate during the forecast period, owing to the rising consumer spending on food and pharmaceutical products, surge in cancer cases, and heavy presence of leading pharmaceutical giants.

Implementation of strict government regulations across the USA has resulted in higher-quality manufacturing, which in turn is creating a conducive environment for lignans market growth. This product (lignans) has been designated as Generally Recognized as Safe (GRAS) by the US Food and Drug Administration, and there are no objections to its use in food processing.

Manufacturing industries based in the USA are increasingly adopting lignans to develop high-quality goods that strictly adhere to rules, lowering compliance costs, and increasing firm profitability.

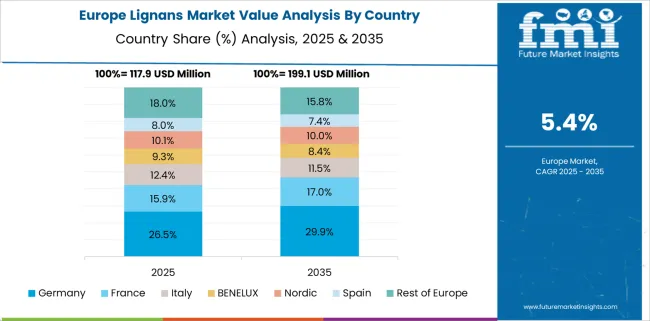

Growing Demand for Plant-based Therapies to Push Lignans Sales in Germany

German consumers feel that plant-based therapies have fewer negative effects than synthetic drugs; Hence, they prefer to use herbal medicines instead of synthetic drugs. This is playing a key role in pushing the demand for lignans in the country.

Similarly, rising health and fitness consciousness, changing lifestyle, and increasing consumption of oral dietary supplements is expected to boost the growth of lignans market in Germany during the forecast period.

Growing Awareness About Health Benefits of Lignans Stimulating Growth in the India Lignans Market

As per FMI, lignans market in India is poised to exhibit strong growth during the forecast period, owing to the growing awareness among people about the health benefits of lignans, increase in the number of lignans manufacturing companies, surge in consumer spending, rising prevalence of cardiovascular disease as a result of poor lifestyle.

A large portion of Indian population consumes lignan based products to prevent the acquisition of various diseases, promote health, and enhance immunity. Lignans aid in the decrease of cholesterol, blood pressure, and blood sugar levels, which is pushing up the Indian lignans market.

Lignans Derived from Cereals to Remain Highly Sought-After Among End Users

As per FMI, cereals segment leads the global lignans market and is likely to grow at a relatively higher CAGR during the forecast period, lowing to the rising end user preference for cereal based lignans.

Lignans derived from cereals have higher anti-inflammatory, antioxidant, and hormone mimicking effects in humans. As a result, both consumers and manufacturers use cereals based lignans.

Growing adoption of cereal derived lignans due to their possible estrogenic, antioxidant, anticarcinogenic, and antiestrogenic properties will therefore continue to stimulate the growth of cereals segment in the coming years.

Food & Beverage to Contribute Highest in Lignans Market

Based on application, food & beverages segment currently accounts for the largest share of the global lignans market and the trend is likely to continue during the forthcoming period, owing to the rising usage of lignans in food and beverage industry.

Lignans are commonly found in foods such as whole-grain breads, snack foods, pasta, energy bars, cereals, crackers, and meatless meal products. Increasing usage of lignans in these food products along with rising consumer spending on these products will therefore contribute towards the growth of this segment.

Plant lignans, found in high-fiber meals, are the forerunners of mammalian lignans, which have been linked to a lower risk of heart disease and cancer. As a result, the aforementioned elements boost the application of lignans in the food and beverage industries.

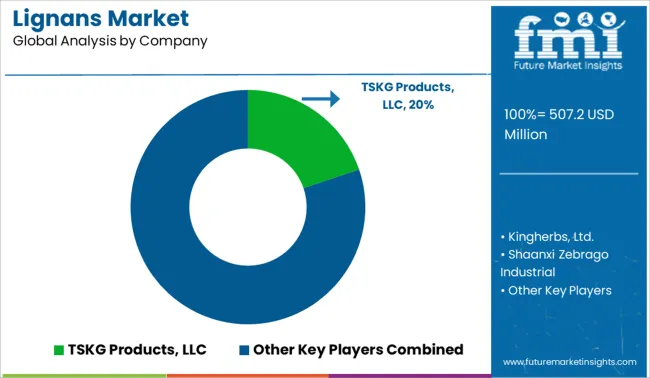

To strengthen their position and distribution channels globally, key players are pursuing a variety of strategies, including mergers and acquisitions. Furthermore, numerous firms are working on new product launches and development in order to expand their capacity as well as to increase their customer base.

Companies that make functional foods and beverages with lignan content are focusing on releasing new products and solutions while cutting their R&D costs significantly. They are also focusing on systematic ways to reinforce long-term contracts, invest/divest, launch marketing campaigns with care, and monitor lignan market developments on a regular basis.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 507.2 million |

| Projected Market valuation (2035) | USD 891.4 million |

| Anticipated CAGR (2025 to 2035) | 5.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; and MEA |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, and UAE |

| Key Segments Covered | Source, Application and Region |

| Key Companies Profiled | TSKG Products, LLC; Kingherbs, Ltd.; Shaanxi Zebrago Industrial; BioGin Biochemicals; FarmaSino Pharmaceuticals; Plamed Green Science Group; SPI Pharma; Xi'an Sinuotebio Tech; ADM; Arjuna Natural Pvt Ltd; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global lignans market is estimated to be valued at USD 507.2 million in 2025.

The market size for the lignans market is projected to reach USD 891.4 million by 2035.

The lignans market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in lignans market are oilseeds, cereals and plant resins.

In terms of application, food & beverages segment to command 41.7% share in the lignans market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA