The lining bellows market is forecast to grow from USD 366.3 million in 2025 to USD 643.8 million by 2035 at a CAGR of 5.8%, with regional demand shaped by differences in chemical capacity, industrial infrastructure, purity requirements and replacement intensity. Asia Pacific remains the highest-growth region, supported by expanding chemical output in China and India, strong deployment of PTFE and PFA-lined systems in semiconductor fabrication, and rapid additions of water-treatment capacity across developing industrial clusters. The region’s fluid-handling architecture relies heavily on corrosion-resistant materials, resulting in accelerated procurement of lined bellows for reactors, transfer lines and mixing systems. New plant construction, modernization of existing facilities and rising adoption of high-purity polymer linings sustain long-cycle demand.

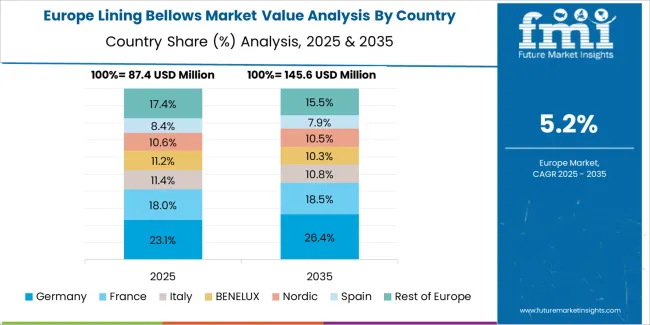

Europe shows compliance-driven and replacement-led demand, anchored by stringent material standards and strong reliance on fluoropolymer-lined components in chemicals, pharmaceuticals, food processing and regulated water systems. German, French and Italian process industries prioritize material integrity, temperature stability and long-life sealing performance, reinforcing the adoption of PTFE-based assemblies across expansion joints and corrosion-sensitive installations. Recurring maintenance and strict certification practices support predictable procurement cycles. North America maintains steady growth, led by modernization programs in US chemical plants, increased investment in pharmaceutical production and stable use of lined bellows in environmental and industrial fluid-control systems. Replacement intensity remains high due to aging pipelines and process equipment, while demand for low-contamination, mechanically flexible materials strengthens adoption across regulated industries.

Asia Pacific leads global market growth, driven by expanding chemical production and electronics manufacturing in China, India, and Southeast Asia. Europe and North America maintain steady adoption through established process industries and ongoing upgrades in fluid handling infrastructure. Key manufacturers include Andronaco Industries, Mersen, CRP, Galaxy Thermoplast, NICHIAS, and SGL Carbon, focusing on material purity, mechanical strength, and application-specific design.

Peak-to-trough analysis shows a moderate cyclical pattern influenced by industrial maintenance activity, pipeline expansion, and equipment-protection requirements. Between 2025 and 2028, the market is expected to reach an early growth peak as chemical processing, power generation, and wastewater facilities upgrade flexible connection systems to manage thermal movement, vibration, and corrosion. Higher installation activity in expansion projects will reinforce this phase.

A mild trough is likely between 2029 and 2031 as project pipelines stabilize and procurement shifts toward routine maintenance. This period may show slower growth due to budget adjustments in industrial facilities and temporary pauses in capital expansion. After 2031, the market is expected to enter a renewed upward phase as replacement demand increases and improved lining materials enhance durability and chemical resistance. Adoption in sectors requiring reliable containment, such as pharmaceuticals and food processing, will support this recovery. The peak-to-trough pattern reflects a stable industrial component market shaped by predictable maintenance cycles, incremental material innovation, and steady operational requirements across fluid-handling and thermal-management systems.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 366.3 million |

| Market Forecast Value (2035) | USD 643.8 million |

| Forecast CAGR (2025-2035) | 5.8% |

The lining bellows market is growing as industries increasingly require flexible, corrosion-resistant seals for handling aggressive chemicals, high temperatures and abrasive media. These bellows, often lined with materials such as PTFE or PFA, protect piping systems, valves and equipment in environments where ordinary bellows would degrade quickly. Growth is driven by expansion in sectors such as chemical processing, pharmaceuticals, water treatment and semiconductor manufacturing, all of which demand reliable fluid-handling solutions. Advancements in lining technology, improved bond strength between lining and substrate, and enhanced design for longer service life support adoption of next-generation lining bellows.

Infrastructure investment in emerging markets and rising production in high-end manufacturing increase replacement and retrofit cycles for protective bellows systems. Constraints include the higher cost of lined bellows compared with unlined alternatives, the need for customised manufacturing to match specific chemical or thermal conditions, and extended lead-times for engineered solutions. Regional regulatory variability and fluctuating raw-material costs may slow uptake in certain geographies.

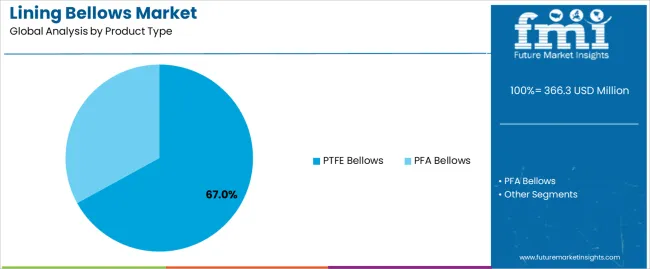

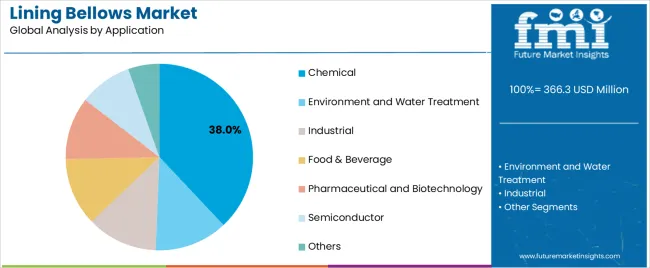

The lining bellows market is segmented by product type and application. By product type, the market includes PTFE bellows and PFA bellows. Based on application, it is categorized into chemical, environment and water treatment, industrial, food and beverage, pharmaceutical and biotechnology, semiconductor, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The PTFE bellows segment holds the leading position in the lining bellows market, representing an estimated 67.0% of total market share in 2025. PTFE bellows are widely used due to their high chemical resistance, thermal stability, and low friction properties, making them suitable for corrosive fluid handling, expansion joints, and mechanical isolation in pipelines and processing equipment.

Their dominance is reinforced by broad adoption in chemical plants, semiconductor facilities, and pharmaceutical production environments where aggressive acids, solvents, and high-purity media require non-reactive materials. PTFE also offers long service life in continuous operation, reducing maintenance frequency. The PFA bellows segment, estimated at 33.0%, is preferred in applications requiring superior purity and higher temperature performance, particularly in semiconductor and biotechnology processes.

Key factors supporting the PTFE bellows segment include:

The chemical segment accounts for approximately 38.0% of the lining bellows market in 2025. Chemical processing facilities rely on PTFE and PFA bellows to manage corrosive media, maintain pipeline flexibility, and protect system components from chemical attack. Their use spans reactors, transfer lines, storage tanks, and high-purity processing units.

The environment and water treatment segment follows with an estimated 20.0%, driven by demand for corrosion-resistant components in filtration systems, wastewater treatment lines, and chemical dosing equipment. The industrial segment holds around 15.0%, with use in general manufacturing and mechanical isolation applications. The food and beverage and pharmaceutical and biotechnology segments collectively contribute about 18.0%, supported by hygienic and non-reactive requirements. The semiconductor segment accounts for approximately 6.0%, where ultra-high purity flow control is critical. The others category makes up the remaining 3.0%.

Primary dynamics driving demand from the chemical segment include:

The lining bellows market is expanding due to rising requirements for lined flexible connectors in piping systems exposed to aggressive chemicals, high purity processes, and abrasive media. Industries such as chemical processing, pharmaceutical manufacturing, water and wastewater treatment, and semiconductor fabrication rely on bellows lined with materials like PTFE and PFA to protect equipment and maintain containment. Rapid industrialisation and stricter environmental regulations are prompting upgrades and expansions of fluid-handling systems, increasing consumption of lined bellows components designed to handle movement, vibration, and chemical attack while preserving system integrity.

Production of lining bellows involves complex manufacturing, specialty polymer materials, precision lining of metal shells and rigorous quality control, which increases unit cost compared with un-lined or standard bellows. The absence of universal specifications for lined bellows across industries means buyers face compatibility and certification challenges, which slows procurement. Alternative solutions like coated piping, ceramic liners or composite hose assemblies may serve similar functional needs, reducing the growth potential of lining bellows in some segments.

Manufacturers are developing lining bellows using hybrid constructions that combine advanced polymers with metal or carbon reinforcement to optimise performance, cost and flexibility. The Asia-Pacific region is becoming a major growth zone, driven by chemical, pharmaceutical and water-treatment-plant expansion in countries such as China and India. New applications in semiconductor process plating, water reuse systems and customised fluid-handling installations are increasing demand for non-standard lined bellows. These trends support a more diversified market profile and broader set of end-use industries.

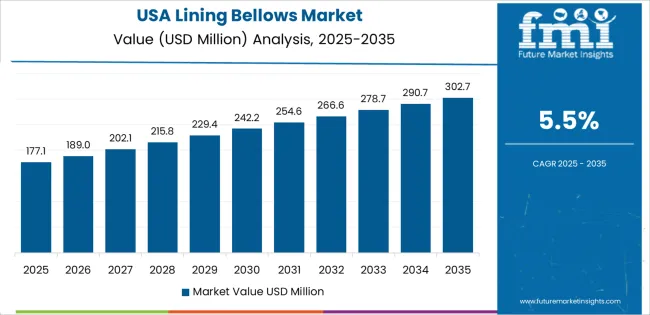

The global lining bellows market is expanding through 2035, supported by increased demand for equipment-protection components, wider use of automated machinery, and the need for durable flexible covers in industrial, manufacturing, and processing environments. China leads with a 7.8% CAGR, followed by India at 7.3%, reflecting strong industrial-capacity growth and higher adoption of protective bellows in machining and material-handling systems. Germany grows at 6.7%, supported by precision-engineering requirements and regulated manufacturing standards. Brazil records 6.1%, driven by automation in localized industrial sectors. The United States grows at 5.5%, while the United Kingdom (4.9%) and Japan (4.4%) maintain steady demand through established machinery networks and ongoing replacement cycles.

| Country | CAGR (%) |

|---|---|

| China | 7.8 |

| India | 7.3 |

| Germany | 6.7 |

| Brazil | 6.1 |

| USA | 5.5 |

| UK | 4.9 |

| Japan | 4.4 |

China’s market grows at 7.8% CAGR, supported by rapid expansion in industrial automation, increased machinery manufacturing, and strong procurement of protective components for CNC equipment, machining centers, and material-processing systems. Lining bellows are used to shield mechanical parts from dust, coolant, and debris, improving equipment reliability in high-volume production environments. Domestic manufacturers supply PVC, rubber-coated fabric, and high-temperature polymer bellows suited for varied industrial conditions. Broader deployment across automotive, electronics, and general-engineering facilities drives continuous adoption. Expansion of manufacturing parks and precision-machinery clusters increases long-term demand for protective bellows.

Key Market Factors:

India’s market grows at 7.3% CAGR, driven by expansion of manufacturing clusters, increased modernization of machine shops, and broader adoption of protective components in fabrication, machining, and tool-room operations. Lining bellows help prevent contamination of slides, spindles, and mechanical assemblies, supporting consistent equipment performance. Domestic fabricators and distributors supply coated-fabric and flexible-polymer bellows for CNC systems and industrial automation lines. Growth in precision engineering, infrastructure machinery, and automotive component manufacturing strengthens long-term demand. Increased availability through industrial suppliers enhances adoption across Tier-1 and Tier-2 manufacturing regions.

Market Development Factors:

Germany’s market grows at 6.7% CAGR, supported by high-precision engineering standards, strict safety guidelines, and widespread deployment of protective bellows in industrial machinery. Manufacturing facilities integrate lining bellows into CNC systems, robotics, and automated handling equipment to safeguard mechanical assemblies from contaminants. German suppliers develop bellows using durable synthetic fabrics and high-temperature polymer materials engineered to maintain dimensional stability. Industrial automation, machine-tool manufacturing, and automotive plants rely on consistent protective coverage to maintain equipment performance. Compliance with European safety and durability standards reinforces long-term adoption.

Key Market Characteristics:

Brazil’s market grows at 6.1% CAGR, driven by increased automation in manufacturing, growing use of CNC machinery, and rising awareness of equipment-protection requirements. Industries such as automotive parts, metal fabrication, and agricultural machinery use lining bellows to protect critical surfaces from contaminants and mechanical wear. Import-driven supply chains provide coated-fabric and polymer bellows suited for local environmental conditions. Expansion of small and mid-sized machine shops increases the use of protective covers for extended equipment life. Digital procurement platforms improve availability across major industrial regions.

Market Development Factors:

The United States grows at 5.5% CAGR, supported by widespread use of CNC systems, industrial robots, and automated processing machinery across manufacturing, aerospace, and fabrication sectors. Lining bellows are deployed to protect linear guides, spindles, and mechanical assemblies from dust, debris, and coolant overspray. Manufacturers offer high-durability coated fabrics and elastomer bellows designed for heavy-duty use in machining and material-handling environments. Growth in industrial retrofitting and maintenance programs strengthens replacement demand. Broader adoption of automated manufacturing systems drives continuous procurement across industrial facilities.

Key Market Factors:

The United Kingdom’s market grows at 4.9% CAGR, supported by stable industrial manufacturing activity, strong use of CNC equipment, and consistent demand for protective covers in machining and fabrication environments. Small and mid-sized workshops adopt lining bellows to maintain machinery reliability and reduce contamination risks. Distributors supply flexible bellows made from coated fabric and synthetic materials suited for machine-tool and automation systems. Growth in industrial refurbishment and maintenance increases recurring demand. Adoption is supported by the need to extend machine life across compact and high-precision production settings.

Market Development Factors:

Japan’s market grows at 4.4% CAGR, supported by established machinery industries, high precision requirements, and strong adoption of protective components within compact production environments. Lining bellows are used to protect critical mechanical assemblies in robotics, CNC systems, and automated inspection equipment. Domestic manufacturers focus on compact, durable bellows with high dimensional accuracy and thermal stability. Continuous improvement culture in manufacturing strengthens demand for consistent equipment protection. Use across automotive, electronics, and precision machinery sectors ensures stable procurement cycles.

Key Market Characteristics:

The lining bellows market is moderately consolidated, with about twenty manufacturers supplying corrosion-resistant expansion components for chemical processing, power generation, and industrial fluid handling. Andronaco Industries leads the market with an estimated 18.0% global share, supported by its broad portfolio of PTFE and fluoropolymer-lined bellows, consistent material integrity, and established supply relationships with chemical and pharmaceutical plants. Its position is reinforced by controlled manufacturing processes and documented resistance to aggressive media.

Mersen, CRP, and SGL Carbon follow as major competitors, offering lined bellows designed for high-purity, high-temperature, and corrosive service environments. Their competitive strengths include advanced fluoropolymer processing, graphite-reinforced components, and compliance with international pressure equipment standards. NICHIAS, BAUM, and STENFLEX Rudolf Stender maintain strong positions in Asia and Europe through engineered assemblies that support long service life in thermal cycling applications.

Mid-tier companies such as Galaxy Thermoplast, MEGAFLEXON, Kipflex, SEIRIS SAS, Kadant, and Pacific Hoseflex serve regional industrial markets with customized designs for chemical transfer lines and process equipment. Further diversity is provided by Allied Supreme, DuFlon, Bonde LPS, Italprotec Industries, Hi-Tech Applicator, Diflon Technology, Engiplas, MB Plastics Europe, ALMARC Engineering, J-Flon Products, and ALL FLUORO, which offer lined assemblies suited to localized installation and maintenance requirements.

Competition in this market centers on chemical resistance, flexural stability, dimensional accuracy, and conformity to piping specifications. Demand is sustained by the expansion of chemical processing capacity and increasing use of PTFE-lined and fluoropolymer bellows to improve reliability in corrosive and high-purity operating environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | PTFE Bellows, PFA Bellows |

| Application | Chemical, Environment and Water Treatment, Industrial, Food & Beverage, Pharmaceutical and Biotechnology, Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Andronaco Industries, Mersen, CRP, Galaxy Thermoplast, NICHIAS, SGL Carbon, STENFLEX Rudolf Stender, BAUM, MEGAFLEXON, Kipflex, SEIRIS SAS, Kadant, Pacific Hoseflex, Allied Supreme, DuFlon, Bonde LPS |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of fluoropolymer bellow and expansion joint manufacturers; advancements in PTFE and PFA corrosion-resistant bellow designs; integration with chemical processing, semiconductor fabrication, and high-purity fluid handling systems. |

The global lining bellows market is estimated to be valued at USD 366.3 million in 2025.

The market size for the lining bellows market is projected to reach USD 643.8 million by 2035.

The lining bellows market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in lining bellows market are ptfe bellows and pfa bellows.

In terms of application, chemical segment to command 38.0% share in the lining bellows market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lining Market Trends & Growth 2024-2034

Acid Proof Lining Market Trends 2025 to 2035

Garment Interlining Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Linings Market Size and Share Forecast Outlook 2025 to 2035

Germany Acid Proof Lining Market Trends 2022 to 2032

Cured-in-Place Pipe (CIPP) Lining Services Market Size and Share Forecast Outlook 2025 to 2035

Corrosion Protection Rubber Linings Market 2022 to 2032

Corrosion Protection Coatings & Acid Proof Lining Market Growth - Trends & Forecast 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA