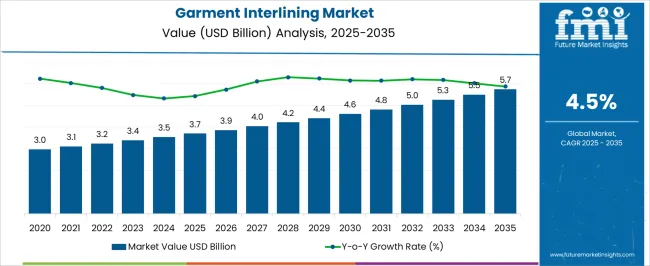

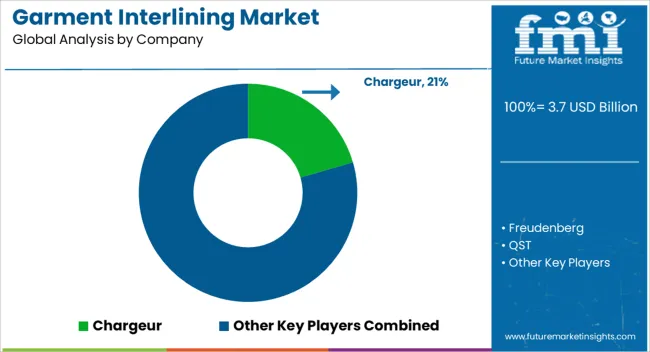

The garment interlining market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

Growth is driven by increasing demand for structured garments, premium apparel, and protective clothing across fashion, formal wear, and industrial uniforms. Advancements in nonwoven, woven, and fusible interlining materials are enhancing garment durability, fit, and aesthetics, which is encouraging adoption across manufacturers and designers. Half-decade weighted growth analysis divides the forecast period into two 5-year segments to assess relative contribution to overall market expansion. During the first half-decade from 2025 to 2030, weighted growth is moderate, driven primarily by replacement demand and adoption in mature markets such as North America and Europe, where garment manufacturing and fashion industry standards are established.

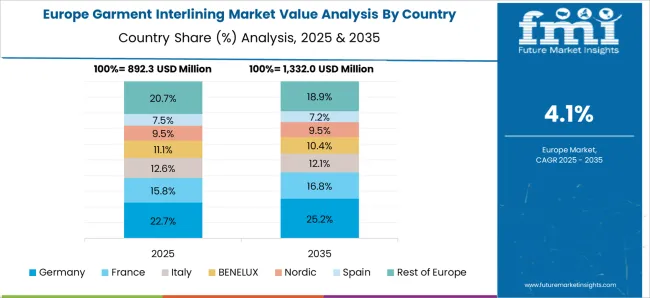

The second half-decade from 2030 to 2035 contributes a larger portion of absolute growth, reflecting accelerated adoption in Asia Pacific and Latin America. Rapid industrialization, rising apparel production, and increasing consumer preference for high-quality garments are driving demand in these emerging regions. Regional distribution of growth shows North America and Europe maintaining steady contributions, while Asia Pacific accounts for the highest weighted growth due to expanding manufacturing hubs. Overall, the half-decade weighted analysis indicates a stronger growth contribution from 2030–2035, emphasizing the market’s expansion potential across both mature and emerging regions with the USD 2.0 billion opportunity between 2025 and 2035.

| Metric | Value |

|---|---|

| Garment Interlining Market Estimated Value in (2025 E) | USD 3.7 billion |

| Garment Interlining Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The garment interlining market is driven by five primary parent markets, each contributing a specific share. Apparel manufacturing leads with 50%, reflecting the high demand for interlinings in clothing production for structure and durability. Textile and fabric manufacturing accounts for 25%, supplying raw materials for interlining production. Home furnishings and upholstery contribute 15%, as interlinings are used to provide stiffness and shape in furniture and decorative textiles. Automotive upholstery holds 5%, with interlinings applied in car interiors for comfort and support. Footwear and accessories represent 5%, incorporating interlinings for improved form and wearability. These markets collectively define overall demand.

Recent trends in the garment interlining market emphasize sustainability, innovation, and performance enhancement. Leading companies are producing biodegradable and recyclable interlinings to address environmental concerns. Technological advancements have introduced smart interlinings that adapt to temperature, humidity, or movement, improving garment comfort and functionality. Manufacturers are focusing on moisture-wicking, antimicrobial, and stretchable properties to meet high-performance apparel needs. The growth of e-commerce has expanded distribution channels, enabling faster delivery and wider accessibility. These strategies and innovations demonstrate the industry’s focus on responding to evolving consumer preferences, environmental responsibility, and technological integration, driving sustained growth and market diversification.

The Garment Interlining market is witnessing consistent growth due to the rising demand for improved garment aesthetics, structural support, and manufacturing efficiency in apparel production. Manufacturers are increasingly relying on advanced interlining materials that enhance durability, maintain shape retention, and support high-speed garment construction processes.

Growing adoption in both formalwear and casual wear, coupled with evolving fashion trends, is reinforcing the market’s expansion across global manufacturing hubs. As automation in garment manufacturing increases, the role of interlinings in enhancing precision and finish has become critical.

Additionally, the shift towards lightweight and sustainable textiles has prompted the development of innovative interlining materials that meet both performance and eco-friendly standards The future outlook remains strong, supported by increasing investments in textile innovation and the expanding footprint of ready-to-wear and export-oriented apparel industries.

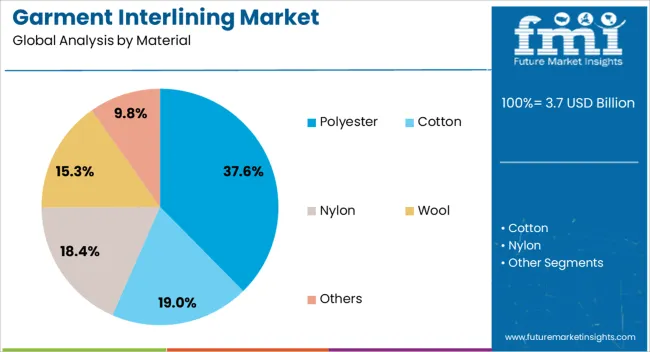

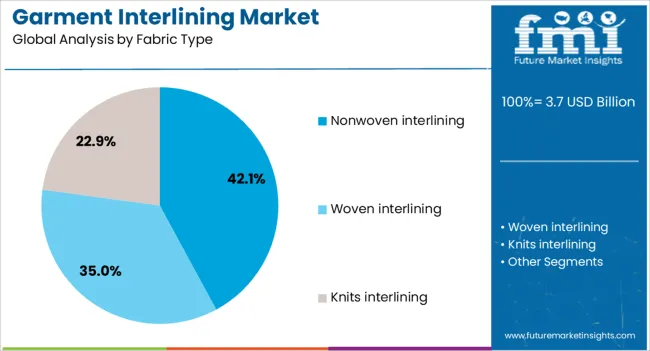

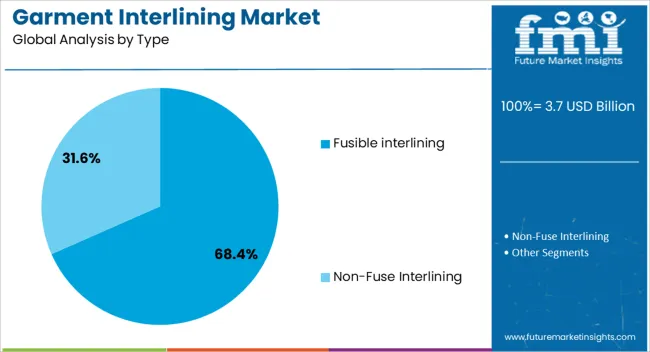

The garment interlining market is segmented by material, fabric type, type, application, and geographic regions. By material, garment interlining market is divided into polyester, cotton, nylon, wool, and others. In terms of fabric type, garment interlining market is classified into nonwoven interlining, woven interlining, and knits interlining. Based on type, garment interlining market is segmented into fusible interlining and non-Fuse Interlining. By application, garment interlining market is segmented into outerwear plackets & jackets, coat, blazers, flame retardant, and others. Regionally, the garment interlining industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester material segment is expected to account for 37.60% of the total garment interlining market revenue in 2025, establishing it as the leading material type. This prominence is being attributed to the material’s durability, cost-effectiveness, and compatibility with various fabric types.

Polyester interlinings have been widely adopted due to their resistance to shrinkage and deformation during garment washing and finishing processes. The consistent supply chain and availability of polyester across major textile-producing regions have also contributed to its dominance.

Its ability to maintain garment structure without compromising flexibility has made it a preferred choice for high-volume apparel production As consumer demand for wrinkle-resistant and easy-care garments continues to rise, the reliance on polyester-based interlinings is expected to remain substantial.

The nonwoven fabric type segment is projected to hold 42.10% of the market revenue in 2025, marking it as the leading fabric category. This growth has been driven by the segment’s ability to support rapid and uniform application in automated garment production.

Nonwoven interlinings are favored for their lightweight structure, smooth surface finish, and consistent performance across diverse garment styles. Their compatibility with various bonding techniques and ease of customization have made them highly suitable for fast-fashion manufacturing models.

The minimal fraying and simplified cutting processes associated with nonwoven materials have contributed to production efficiency and reduced fabric waste As garment manufacturers continue to prioritize speed, cost control, and product consistency, the nonwoven segment is expected to maintain its leading position.

The fusible interlining type segment is anticipated to command 68.40% of the market revenue in 2025, making it the most dominant type in the market. This strong position is being driven by the widespread use of heat-activated adhesives in garment assembly lines, allowing for precise and durable bonding.

Fusible interlinings have been widely integrated into modern production workflows due to their ability to provide consistent adhesion and shape retention during high-speed stitching and pressing. The simplicity of application, along with reduced need for manual sewing or reinforcement, has made fusible interlinings ideal for scalable manufacturing environments.

Their adaptability across various garment categories, from formal shirts to outerwear, has further supported their adoption With manufacturers seeking greater consistency and efficiency, the fusible segment is set to continue leading in both adoption and innovation.

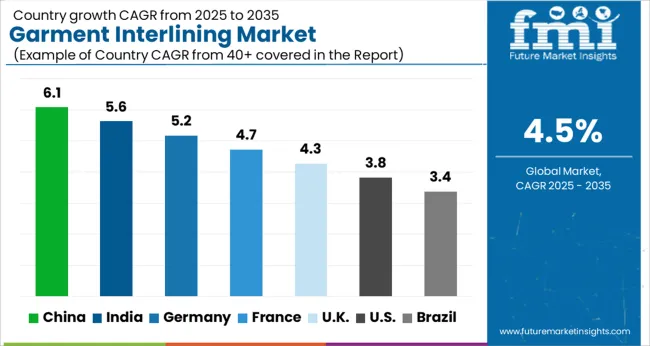

The garment interlining market is expanding due to increasing demand for structured apparel, quality finishing, and fashion-forward garments. Global growth is supported by a CAGR of 4.5%. China leads the market with a 6.1% share due to large-scale garment manufacturing and export activities. India follows with a 5.6% share, driven by textile clusters and rising domestic apparel production. Germany accounts for 5.2%, supported by premium apparel manufacturing. Interlining enhances fabric stability, shape retention, and garment durability. North America and Europe focus on high-end interlinings for tailored suits, coats, and formal wear. Demand is further driven by innovations in nonwoven, fusible, and lightweight interlinings for comfort and design flexibility across global fashion industries.

Fusible interlining accounts for the largest market share due to its ease of application and performance. Nonwoven interlining is growing due to cost-effectiveness and versatility across jackets, shirts, and trousers. Asia Pacific leads adoption, with China at 6.1% and India at 5.6% market share, supported by garment exports and domestic apparel production. Europe, including Germany (5.2%) and the UK (4.3%), emphasizes premium interlinings for structured suits and coats. Interlining improves collar, cuff, and lapel stability, enhancing overall garment quality. Increasing use of lightweight, breathable, and eco-friendly interlining materials drives adoption. Fashion brands and apparel manufacturers are integrating innovative interlining solutions to meet consumer demand for comfort and style globally.

Advances in fusible adhesives, bonding technologies, and lightweight materials are enhancing interlining performance. Heat-activated fusible interlining reduces manufacturing time by 15–20%. Nonwoven and woven interlinings provide stretch, flexibility, and shape retention for diverse garments. Asia Pacific manufacturers focus on cost-efficient, high-quality interlinings for bulk garment production. Europe emphasizes durability and premium aesthetics in interlining materials. Innovations include breathable, anti-wrinkle, and moisture-absorbent interlinings that improve garment comfort and longevity. Integration of synthetic fibers and blends allows interlinings to match fabric behavior and maintain dimensional stability. Continuous R&D ensures compatibility with modern fashion trends, industrial pressing equipment, and automated sewing processes, increasing global adoption.

Interlinings are widely used in formal shirts, jackets, coats, trousers, and outerwear. Asia Pacific dominates consumption, led by China (6.1%) and India (5.6%), due to large apparel production and export-oriented markets. Europe, including Germany (5.2%) and the UK (4.3%), focuses on high-end fashion and tailored garments. Interlining improves fabric rigidity, lapel structure, and collar support, enhancing garment quality. Outerwear and formal wear account for over 50% of market adoption due to premium finishing requirements. Lightweight interlinings are increasingly used in casual wear for comfort without compromising shape. Demand is driven by growing apparel production, fashion innovation, and garment quality standards globally.

High-quality interlining materials, including nonwoven, woven, and fusible variants, incur elevated production costs, which can be 15–25% higher than standard fabrics. Variability in adhesive strength, fabric compatibility, and machine calibration may impact garment quality. Asia Pacific and Europe focus on consistent quality control to meet industrial standards. Price sensitivity in emerging markets may restrict adoption of premium interlinings. Manufacturers are addressing challenges through lightweight, cost-efficient, and high-performance material solutions. Despite technological improvements, raw material costs, production complexity, and quality consistency remain key restraints for global garment interlining adoption.

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

In 2025, the garment interlining market is projected to grow at a global CAGR of 4.5% through 2035, driven by rising demand in apparel manufacturing, tailoring, and textile finishing applications. China leads at 6.1%, 36% above the global benchmark, supported by BRICS-driven growth in textile production, export-oriented apparel manufacturing, and adoption of high-performance interlining materials. India follows at 5.6%, 24% above the global average, reflecting increasing demand from domestic garment manufacturers, expansion of small and medium textile enterprises, and rising adoption of modern finishing techniques. Germany records 5.2%, 16% above the benchmark, shaped by OECD-backed innovations in high-quality interlinings, premium apparel production, and textile automation. The United Kingdom posts 4.3%, 4% below the global rate, influenced by selective adoption in tailored apparel, high-end fashion, and niche textile finishing. The United States stands at 3.8%, 16% below the benchmark, with steady uptake in premium garments, industrial tailoring, and specialty clothing applications. BRICS economies drive overall volume growth, OECD countries emphasize quality, performance, and advanced textile solutions, while ASEAN nations contribute through expanding garment production and finishing infrastructure.

The garment interlining market in China is projected to grow at a CAGR of 6.1%, well above the global CAGR of 4.5%, driven by expansion in textile manufacturing, rising demand for tailored apparel, and growth in fashion exports. In 2024, 41% of new interlining production targeted high-performance fabrics, including lightweight, thermal, and shape-retaining variants. Production facilities in Zhejiang, Jiangsu, and Guangdong increased output by 13% to meet domestic and international demand. Adoption of fusible, non-woven, and specialty interlinings grew by 16%, improving garment structure, durability, and comfort. Leading suppliers including Texhong, Bosideng, and Huafu Fashion introduced innovative interlining solutions with enhanced adhesion and flexibility. Growth surpasses the global average due to increasing apparel manufacturing, fashion retail expansion, and adoption of performance fabrics.

The garment interlining market in India is projected to grow at a CAGR of 5.6%, above the global CAGR of 4.5%, supported by rising textile production, apparel exports, and growing demand from fashion brands. In 2024, 38% of new production involved fusible, non-woven, and thermal interlinings for shirts, jackets, and formal wear. Production facilities in Maharashtra, Tamil Nadu, and Gujarat increased capacity by 12% to meet domestic and export requirements. Adoption of lightweight, shape-retaining, and eco-friendly interlinings grew by 14%, enhancing garment structure and comfort. Leading suppliers including Vardhman Textiles, Alok Industries, and Grasim introduced innovative interlining solutions for premium and mass-market apparel. Market growth remains above global average due to expanding textile infrastructure, increased fashion brand adoption, and rising export demand.

The garment interlining market in Germany is projected to grow at a CAGR of 5.2%, above the global CAGR of 4.5%, driven by premium apparel production, technical fabrics, and high-quality fashion demand. In 2024, 36% of new production targeted non-woven, fusible, and specialty interlinings for jackets, coats, and formal wear. Production facilities in Bavaria and North Rhine-Westphalia increased output by 10% to meet domestic and EU demand. Adoption of thermal, lightweight, and reinforced interlinings grew by 13%, improving garment durability and structure. Key suppliers including Freudenberg, Sandler, and Hohenstein provided innovative interlining solutions for premium and technical apparel. Germanys market growth surpasses the global average due to advanced textile technologies, high-quality fashion manufacturing, and strong export orientation.

The garment interlining market in the United Kingdom is projected to grow at a CAGR of 4.3%, slightly below the global CAGR of 4.5%, influenced by moderate growth in fashion manufacturing, formal wear, and technical apparel segments. In 2024, 32% of new production involved fusible, non-woven, and thermal interlinings. Production facilities in the Midlands and South East increased capacity by 9% to meet domestic consumption. Adoption of lightweight, eco-friendly, and reinforced interlinings grew by 11%, improving garment durability, fit, and structure. Leading suppliers including Freudenberg UK, Sandler, and Texet introduced modular interlining solutions for premium apparel. Market growth remains slightly below global average due to moderate demand in formal wear and limited large-scale textile manufacturing expansion.

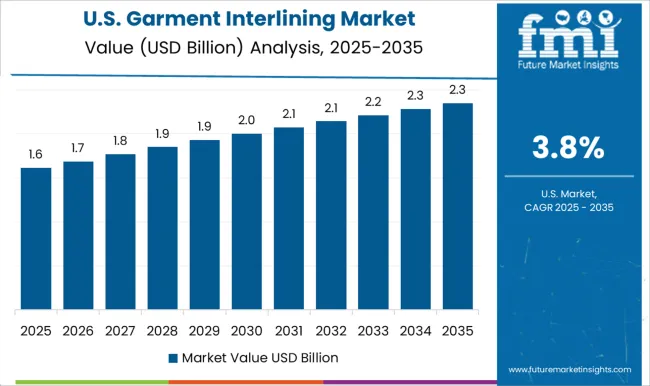

The garment interlining market in the United States is projected to grow at a CAGR of 3.8%, below the global CAGR of 4.5%, influenced by mature textile production, stable apparel manufacturing, and steady demand for formal wear and outerwear. In 2024, 34% of new production focused on fusible, non-woven, and specialty interlinings for shirts, jackets, and coats. Production facilities in North Carolina, California, and Texas increased output by 8% to meet domestic and regional demand. Adoption of lightweight, thermal, and eco-friendly interlinings grew by 10%, enhancing garment durability, structure, and comfort. Leading suppliers including Freudenberg USA, Sandler, and Avery Dennison introduced innovative interlining solutions for premium apparel. Market growth remains below global average due to mature textile infrastructure and limited expansion in apparel manufacturing.

Competition in the garment interlining market is being influenced by fabric quality, bonding performance, and compliance with textile standards. Market positions are being maintained through certified materials, technical support, and distribution networks that ensure availability for apparel manufacturers and designers. Chargeur is being represented with nonwoven and woven interlinings engineered for stability and shape retention, while Freudenberg is being promoted with fusible and sewn-in solutions optimized for garment durability. QST is being highlighted with lightweight interlinings suitable for tailored clothing and high-fashion applications. Kufner is being applied with specialty fabrics designed to enhance drape and support in outerwear and formalwear, while Veratex is being positioned with woven and knitted interlinings structured for precision and consistency. Edmund Bell is being recognized with heat-activated and adhesive interlinings engineered for professional tailoring.

Block Bindings is being advanced with interlining solutions adapted for workwear and protective garments. H&V is being showcased with reinforced interlinings for performance apparel, while NH Textil is being promoted with textile-compatible interlinings designed for easy integration in manufacturing. Wendler (DE) is being applied with fusible and non-fusible fabrics optimized for industrial and fashion applications. Evans Textile is being represented with functional interlinings that provide support, elasticity, and dimensional stability for diverse apparel categories. Strategies among these companies are being centered on product innovation, regulatory compliance, and customization for specific garment requirements.

Research and development efforts are being allocated to improve bonding strength, fabric flexibility, and durability under repeated use and washing. Product brochures are being structured with technical specifications covering fabric composition, weight, fusibility, thermal resistance, and application methods. Features including ease of handling, shrinkage control, and integration compatibility are being emphasized to guide procurement and production decisions. Each brochure is being arranged to highlight certification compliance, material performance, and technical support availability. Technical data is being presented in a clear, evaluation-ready format to assist apparel manufacturers, designers, and sourcing teams in selecting interlinings that meet quality, durability, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 billion |

| Material | Polyester, Cotton, Nylon, Wool, and Others |

| Fabric Type | Nonwoven interlining, Woven interlining, and Knits interlining |

| Type | Fusible interlining and Non-Fuse Interlining |

| Application | Outerwear plackets & Jackets, Coat, Blazers, Flame retardant, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chargeur, Freudenberg, QST, Kufner, Veratex, Edmund Bell, Block Bindings, H&V, NH Textil, Wendler (DE), and Evans Textile |

| Additional Attributes | Dollar sales by interlining type and end use, demand dynamics across apparel, footwear, and accessories, regional trends in garment manufacturing, innovation in lightweight, breathable, and adhesive materials, environmental impact of production and disposal, and emerging use cases in performance and smart textiles. |

The global garment interlining market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the garment interlining market is projected to reach USD 5.7 billion by 2035.

The garment interlining market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in garment interlining market are polyester, cotton, nylon, wool and others.

In terms of fabric type, nonwoven interlining segment to command 42.1% share in the garment interlining market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Garment Steamer Market Analysis - Size, Share, and Forecast 2025 to 2035

Evaluating Garment Steamer Market Share & Provider Insights

Garment Packing Machine Market Trends & Forecast 2024-2034

Japan Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Korea Garment Steamer Market Analysis – Size, Share & Trends 2025 to 2035

Direct to Garment Printing Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Direct to Garment Printing Market Share & Provider Insights

Intelligent Garment Hanging Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Western Europe Garment Steamer Market Analysis - Size, Share & Trends 2025 to 2035

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA