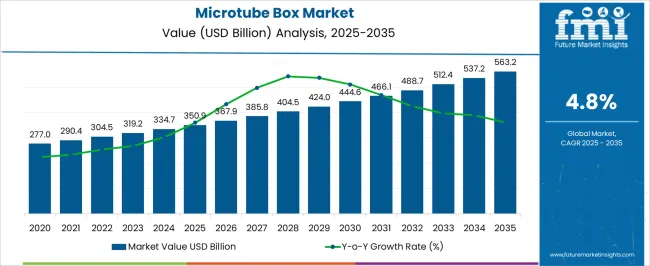

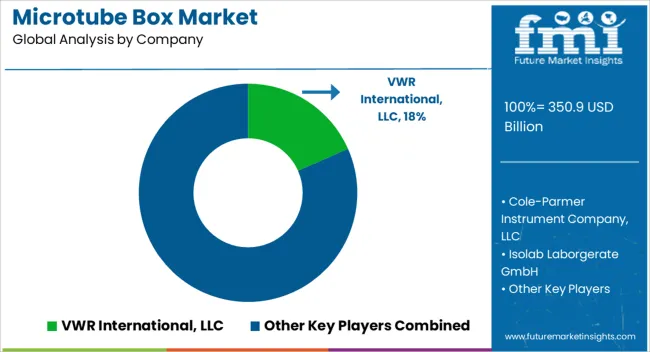

The Microtube Box Market is estimated to be valued at USD 350.9 billion in 2025 and is projected to reach USD 563.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Microtube Box Market Estimated Value in (2025 E) | USD 350.9 billion |

| Microtube Box Market Forecast Value in (2035 F) | USD 563.2 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The microtube box market is expanding steadily, supported by increasing adoption in laboratories, research centers, and clinical facilities where efficient sample storage and handling are critical. Current dynamics reflect growing emphasis on laboratory automation, precision-driven workflows, and rising demand for reliable consumables that ensure sample integrity.

Market growth is also being influenced by heightened research funding, expansion of biopharmaceutical R&D activities, and the integration of advanced storage solutions within modern laboratories. Competitive positioning is being reinforced through continuous improvements in product durability, temperature resistance, and user-friendly designs that enhance operational efficiency.

The outlook remains positive as the sector benefits from rising demand in both academic and industrial research domains, combined with broader healthcare infrastructure development across emerging markets Growth rationale is founded on the increasing necessity for standardized storage formats, expanding laboratory networks, and the introduction of high-quality, scalable storage systems that ensure consistency, compliance, and adaptability in diverse laboratory environments.

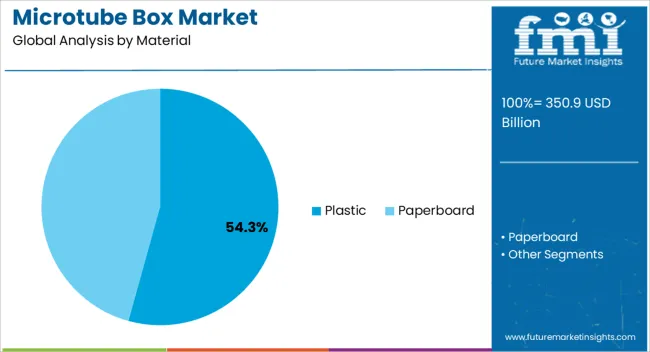

The plastic segment, holding 54.3% of the material category, is leading due to its widespread usage, durability, and cost-effectiveness in laboratory storage applications. Plastic microtube boxes offer resilience against temperature variations, chemical exposure, and repeated handling, ensuring consistent protection of stored samples.

Their lightweight structure and compatibility with various sterilization methods have further reinforced adoption across both small-scale and large-scale laboratory setups. Manufacturing scalability has enabled cost efficiency, while quality standards and compliance certifications have strengthened trust among end-users.

Demand resilience is being supported by continual innovation in polymer blends that enhance durability and transparency The segment’s leadership is expected to persist as laboratories seek dependable, easy-to-handle, and standardized storage options that meet operational requirements across clinical and research applications.

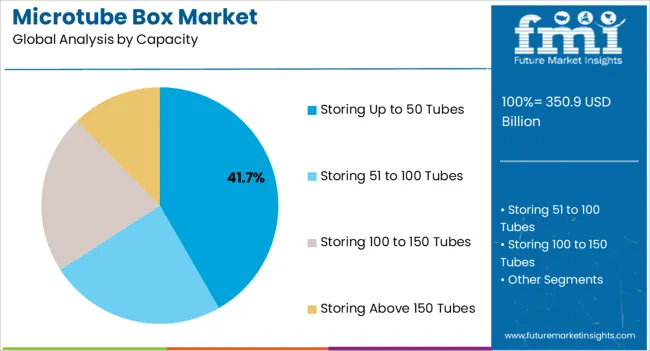

The storing up to 50 tubes segment, representing 41.7% of the capacity category, has maintained dominance owing to its practicality and suitability for routine laboratory operations. This capacity aligns with standard sample storage needs in research and diagnostics, balancing space efficiency with accessibility.

Laboratories prefer this format for its ability to organize multiple samples within a compact design, reducing handling errors and supporting streamlined workflows. Its demand is being reinforced by adoption in academic institutions, pharmaceutical R&D facilities, and diagnostic laboratories where frequent small-batch testing is common.

Production efficiencies and cost-effectiveness have also favored widespread use of this segment The share is expected to remain strong as laboratories continue to prioritize compact, reliable, and scalable storage solutions that integrate seamlessly with evolving automation and inventory management systems.

Short-term Analysis (From 2020 to 2025)

The microtube box market expanded gradually from 2020 to 2025, propelled by improvements in sample storage technologies and rising life science demand. The market experienced a low CAGR, with the accelerating adoption of automated storage systems and biobanking facilities sustaining growth.

Mid-term Analysis (From 2025 to 2035)

The microtube box market is anticipated to expand in the mid-term, between 2025 and 2035. The development of new materials, adopting environmentally friendly production techniques, and integrating data management systems ought to be significant forces.

Long-term Analysis (From 2035 to 2035)

The microtube box market is anticipated to grow at a robust CAGR between 2035 and 2035, looking out further. To serve the rising biotech and pharmaceutical sectors, market players for microtube box are likely to focus on creating intelligent, high-capacity storage solutions and cutting-edge designs. Eco-friendly and sustainable items are bound to grow.

A detailed market segmentation analysis summarizes this portion of the study. Consumer demand for plastic and microtube box trends in the industry attracts more attention from manufacturers. Regarding capacity, the 51 to 100 Tube category commands the market.

Due to its strength, adaptability, and affordability, plastic dominates the microtube box market. Plastic microtube boxes are the best choice for various industries, including healthcare and research, since they provide the best defense against moisture and physical harm. Plastic boxes are suitable for freezing and heating since they can endure a greater range of temperatures.

| Category | Material |

|---|---|

| Leading Segment | Plastic |

| Segment Share | 82.8% |

Plastic microtube boxes can be branded and labeled, which helps to distinguish products and build brand recognition. Reusing plastic boxes lowers waste and long-term costs. These characteristics make plastic the material of choice, offering an environmentally friendly answer to their packaging requirements, and boosting microtube boxes demand.

Due to its flexible capacity that meets various laboratory and storage needs, the 51 to 100 tubes segment commands the microtube box market share. The 51 to 100 tubes segment is famous for many enterprises since it balances space use with storage effectiveness. While keeping a small and influential form factor, the 51 to 100 tubes section offers enough storage for moderately sized collections.

| Category | Capacity |

|---|---|

| Leading Segment | 51 to 100 Tube |

| Segment Share | 42.4% |

For its adaptability, it can satisfy the various needs of companies in multiple industries, increasing its market share as a preferred option. The popularity of the 51 to 100 tubes category is evidence of its capacity to satisfy the practical requirements of a wide range of customers, which underpins its market leadership.

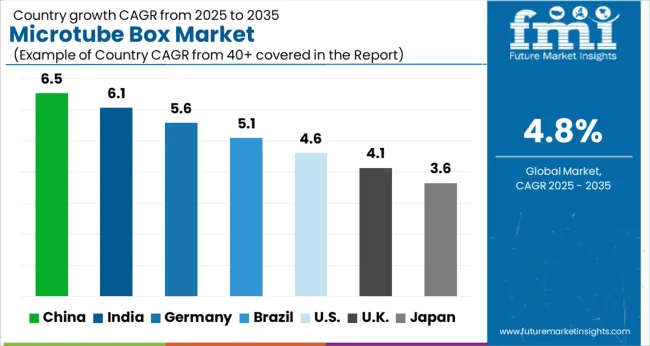

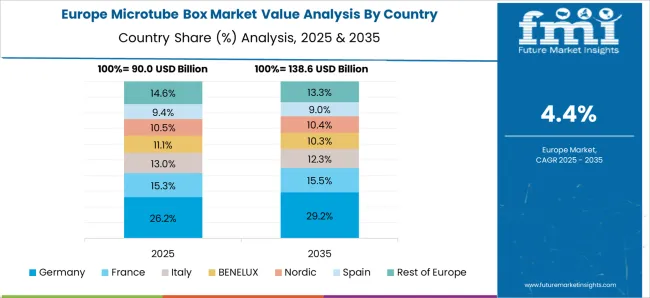

This part examines a thorough market analysis with information on various nations. Asia Pacific, Europe, and North America are all undergoing market growth. Europe has been developing consistently, followed by Asia Pacific, and North America has enormous opportunities for microtube box manufacturers.

| Attributes | Details |

|---|---|

| United States Market CAGR | 3.2% |

| Canada Market CAGR | 4.4% |

| Attributes | Details |

|---|---|

| United Kingdom Market CAGR | 4.5% |

| France Market CAGR | 3.7% |

| Italy Market CAGR | 3.2% |

| Spain Market CAGR | 2.9% |

| Germany Market CAGR | 2.2% |

| Attributes | Details |

|---|---|

| India Market CAGR | 7.7% |

| China Market CAGR | 6.8% |

| Thailand Market CAGR | 6.6% |

| Japan Market CAGR | 3.5% |

| South Korea Market CAGR | 5.9% |

The microtube box market's competitive landscape has a vibrant environment with several significant competitors contending for market share. Companies dominate the market, providing a variety of cutting-edge and excellent microtube boxes for use in laboratories and research. The market participants of microtube box compete on variables such as product quality, cost, and distribution systems.

To compete with established businesses, emerging ones propose novel features, materials, and eco-friendly choices. The microtube box industry is anticipated to become competitive as the need for sample storage solutions increases, promoting innovation and helping customers.

Latest Strides

| Company | Details |

|---|---|

| Tobin Scientific and Avantor to create a partnership |

|

| Labguru collaborates with Avantor |

|

The global microtube box market is estimated to be valued at USD 350.9 billion in 2025.

The market size for the microtube box market is projected to reach USD 563.2 billion by 2035.

The microtube box market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in microtube box market are plastic, _polyethylene, _polycarbonate, _polyethylene terephthalate, _polypropylene, _other plastics (pvc, ps, etc.) and paperboard.

In terms of capacity, storing up to 50 tubes segment to command 41.7% share in the microtube box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Carboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Carboxylated Nitrile Rubber Market Size and Share Forecast Outlook 2025 to 2035

Carboxy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Cellulose Market 2024-2034

Gearbox and Gear Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA