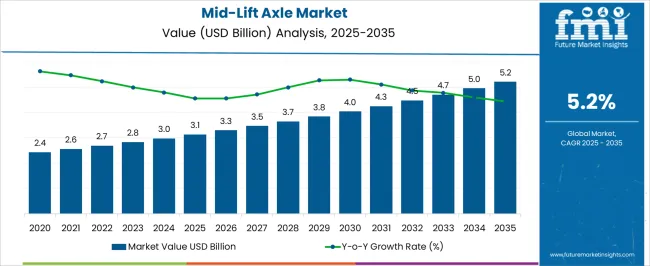

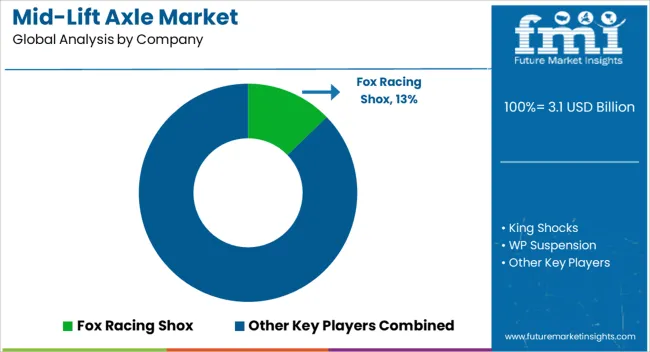

The Mid-Lift Axle Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Mid-Lift Axle Market Estimated Value in (2025 E) | USD 3.1 billion |

| Mid-Lift Axle Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Mid-Lift Axle market is experiencing steady growth, driven by increasing demand for efficient load management and fuel economy in commercial vehicles. Mid-lift axle systems enable dynamic weight distribution, which improves vehicle stability, reduces tire wear, and enhances operational efficiency. Adoption is being supported by regulatory requirements for axle load compliance and growing interest in cost-effective logistics solutions across industries such as transportation, construction, and distribution.

Advancements in axle technology, including improved materials and mechanical designs, are enabling higher durability and reduced maintenance costs. The rise in demand for lightweight vehicles that can achieve better fuel efficiency without compromising load capacity is further contributing to market expansion. Integration with telematics and vehicle monitoring systems is providing operators with actionable insights for load optimization.

As fleet operators increasingly focus on sustainability, cost efficiency, and operational safety, the mid-lift axle market is expected to witness sustained growth The market outlook is further strengthened by expanding adoption in both developed and emerging regions, driven by investments in commercial vehicle modernization and infrastructure development.

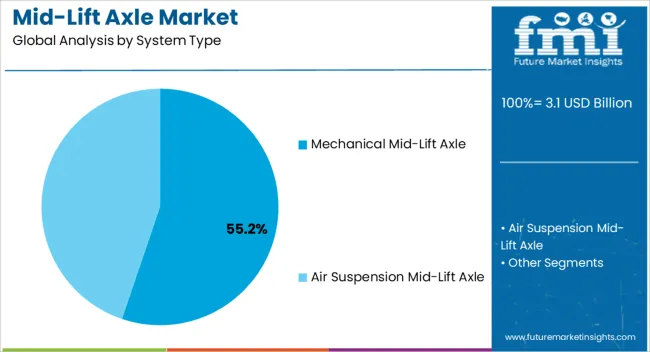

The mechanical mid-lift axle segment is projected to hold 55.2% of the market revenue in 2025, establishing it as the leading system type. Its dominance is driven by the reliability, simplicity, and lower cost of mechanical designs compared to pneumatic or hydraulic alternatives. Mechanical mid-lift axles provide consistent performance under heavy-duty and variable load conditions, ensuring operational safety and reduced downtime.

The ease of integration with existing vehicle chassis and lower maintenance requirements contribute to their widespread adoption among fleet operators and OEMs. Additionally, these systems offer effective weight distribution and improved maneuverability, which enhances fuel efficiency and tire longevity.

Continuous improvements in mechanical components, including enhanced durability and wear-resistant materials, have further strengthened their market position As commercial vehicle operators increasingly prioritize efficiency, safety, and total cost of ownership, mechanical mid-lift axles are expected to maintain their leadership, supported by proven performance and widespread industry acceptance.

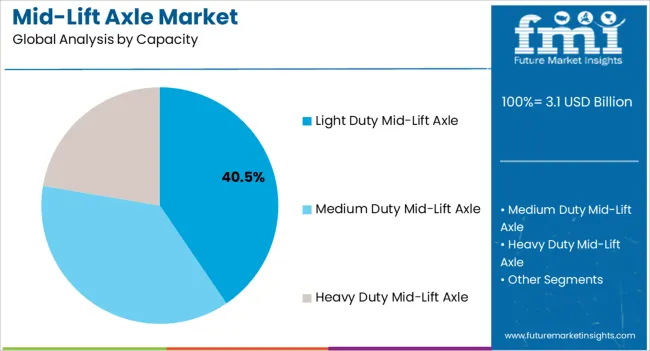

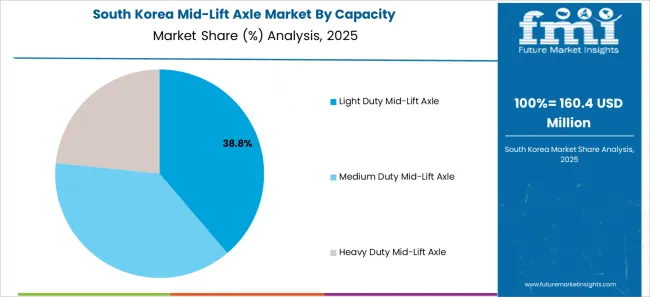

The light duty mid-lift axle capacity segment is anticipated to account for 40.5% of the market revenue in 2025, making it the leading capacity category. Its growth is being driven by the demand for mid-sized commercial vehicles that balance load management with fuel efficiency and maneuverability. Light duty axles are particularly suited for urban delivery, logistics, and light industrial applications, where vehicles frequently encounter variable load conditions and congested routes.

The ability to lift the axle when not fully loaded reduces rolling resistance, improves tire life, and enhances operational efficiency. Adoption is also being supported by fleet operators seeking cost-effective solutions that comply with regulatory axle load limits while optimizing payload capacity.

Technological advancements in materials and mechanical design have increased durability and reliability, further reinforcing the preference for light duty mid-lift axles As commercial operators continue to optimize fleets for performance, efficiency, and maintenance savings, the light duty segment is expected to remain the largest capacity category, driving overall market growth.

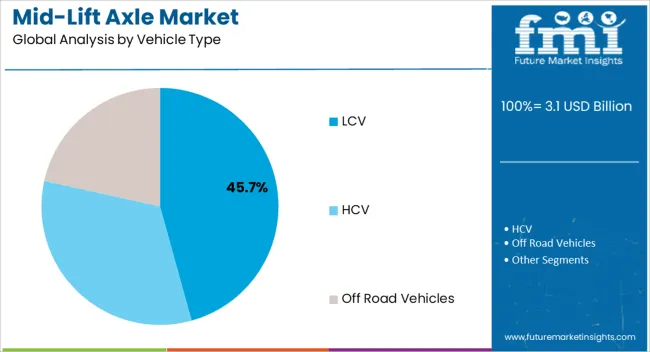

The LCV vehicle type segment is projected to hold 45.7% of the market revenue in 2025, establishing it as the leading vehicle category. Growth is being driven by the expanding use of light commercial vehicles for last-mile delivery, urban logistics, and small-scale industrial transportation. LCVs equipped with mid-lift axles offer improved load distribution, enhanced maneuverability, and better fuel efficiency, which are critical factors for operators in congested city environments.

The ability to lift axles when vehicles are under partial load reduces tire wear and energy consumption, enhancing overall operational efficiency. Fleet operators are increasingly adopting mid-lift axles in LCVs to optimize payload management and comply with axle load regulations without compromising performance.

Advancements in axle design, lightweight materials, and integration with telematics systems have strengthened adoption As demand for efficient and sustainable urban transport solutions grows, LCVs with mid-lift axles are expected to continue leading the market, supported by operational cost savings, regulatory compliance, and versatility across multiple commercial applications.

From 2020 to 2025, the global Mid-Lift Axle market experienced a CAGR of 5%, reaching a market size of USD 2,818.0 million in 2025.

From 2020 to 2025, the global Mid-Lift Axle industry witnessed steady growth due to the rising demand in construction and recreational sports. Mid-Lift Axles also find applications in machinery like tractors, which are integral part of modern agricultural procedures.

The vehicles used in logistics and transportation industry such as truck, trolleys, towing vehicles etc. extensively employ mid-lift Axle system.

The global Mid-Lift Axle industry expected to rise at a CAGR of 5.5% from 2025 to 2035. During the forecast period, the market size expect to reach USD 4,813.6 million.

The Mid-Lift Axle industry expected to continue its growth trajectory from 2025 to 2035, driven by increasing demands from numerous industries for a variety of applications.

The growth of the transportation, construction, agriculture, recreational and off road automobile sector and the rising adoption of battery-powered vehicles expected to drive the demand for Mid-Lift Axles during the forecast period.

The market is also likely to witness significant growth in the North America region due to the presence of huge transportation and heavy commercial vehicle industry.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 2,327.5 million |

| CAGR % 2025 to End of Forecast (2035) | 6.0% |

The Mid-Lift Axle industry in the United States expected to reach a market share of USD 2,327.5 million by 2035, expanding at a CAGR of 6.0%. The Mid-Lift Axle industry in the United States expected to witness growth due to high dependency of road transportation and growing mining and construction businesses. Additionally, there are a few other factors expected to drive the demand for Mid-Lift Axles in the country are:

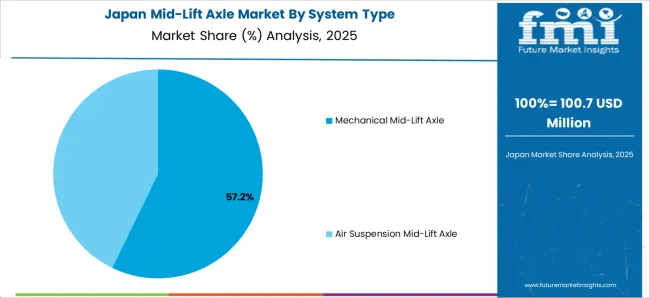

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 1,221.7 million |

| CAGR % 2025 to End of Forecast (2035) | 5.4% |

The Mid-Lift Axle industry in Japan expected to reach a market share of USD 1,221.7 million, expanding at a CAGR of 5.4% during the forecast period. The Mid-Lift Axle market in Japan estimated to experience growth owing to the rising demand for construction industry.

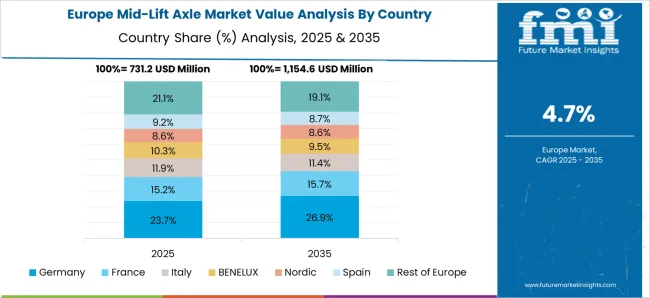

| Country | Germany |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 747.0 million |

| CAGR % 2025 to End of Forecast (2035) | 5.6% |

Germany’s Mid-Lift Axle manufacturing industry anticipated to reach a market share of USD 747.0 million, moving at a CAGR of 5.6 % during the forecast period. The Mid-Lift Axle industry in Germany expected to grow prominently due to the increasing demand from automotive and manufacturing sectors. Additionally, the government's focus on renewable energy generation is creating new opportunities for winch systems powered by un conventional energy sources.

| Country | South Korea |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 559.4 million |

| CAGR % 2025 to End of Forecast (2035) | 5.2% |

The Mid-Lift Axle industry in South Korea estimated to reach a market share of USD 559.4 million by 2035, thriving at a CAGR of 5.2%. The market in South Korea predicted to grow because of the increasing employment of Mid-Lift Axles in transportation and logistics.

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 423.0 million |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

The Mid-Lift Axle industry in China estimated to reach a market share of USD 423.0 million, expanding at a CAGR of 5.8% during the forecast period. China is the biggest market of electric vehicles, which deployed heavily even for commercial purposes. Rapidly increasing EV fleet of commercial vehicles is increasing demand for mid-lift Axle market.

The mechanical mid-lift Axle segment expected to dominate the Mid-Lift Axle industry with a CAGR of 5.9% from 2025 to 2035. This segment captures a significant market share in 2025 due to its robustness, high performance, and low maintenance requirements.

Mechanical mid-lift Axle systems are highly effective and popular in most of light and medium duty industrial applications and are most commonly employed type of system for lifting and transportation of heavy weights.

The Transportation and Logistics industry expected to dominate the Mid-Lift Axle industry with a CAGR of 5.6% from 2025 to 2035. This segment captures a significant market share in 2025 due to the high demand for increasing transportation and logistics Industry.

Mid-Lift Axles are deployed in most of transportation vehicles to join the equipment with the vehicle. Mid-Lift Axle systems finds applications in off-road vehicles, camping gears, kayak, canoes, recreational fishing, and boating attachments.

The Mid-Lift Axle industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Manufacturing companies are putting focus on development of robust products, which are able to withstand higher amounts of weights and simultaneously provide good suspension. Development in material sciences is driving the innovation and increasing the application spectrum of the product.

Strategic Partnerships and Collaborations

Many key manufacturers employs collaborations and strategic partnerships for product development because of the improved pace of research achieved through shared intellectual resources. Another popular trend of partnerships is to establish product-testing facilities along or establish project contracts with educational institutes such as universities and colleges.

Expansion into Emerging Markets

The Mid-Lift Axle industry is witnessing significant growth in emerging markets such as China. Key players are expanding their presence in these markets by establishing local manufacturing facilities and strengthening their distribution networks.

Mergers and Acquisitions

A merger between companies will eliminate competition among them, thus reducing the advertising price of the products. Also, acquisition of local players by key manufacturers help the key manufacturers in increasing their global presence and simultaneously offers a local player an international recognition.

Key Players in the Mid-Lift Axle Industry

Key Developments in the Mid-Lift Axle Market:

The global mid-lift axle market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the mid-lift axle market is projected to reach USD 5.2 billion by 2035.

The mid-lift axle market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in mid-lift axle market are mechanical mid-lift axle and air suspension mid-lift axle.

In terms of capacity, light duty mid-lift axle segment to command 40.5% share in the mid-lift axle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

HCV Axles Market

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automotive Axle Market Growth - Trends & Forecast 2025 to 2035

Automotive Axle and Propeller Shaft Market Growth - Trends & Forecast 2025 to 2035

Rail Wheel and Axle Market Growth – Trends & Forecast 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Snowmobile Trailer Axle Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA