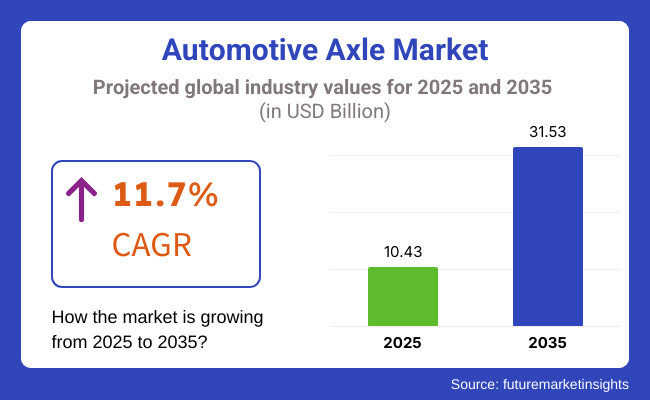

The global automotive axle market is projected to grow from USD 10.43 billion in 2025 to USD 31.53 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% during the forecast period.

This substantial growth is being driven by evolving performance requirements in commercial vehicles, the rise of electric drivetrains, and increased demand in high-load-bearing applications. Market expansion is further being supported by the growing preference for off-road, utility, and electric vehicle variants, which is prompting the adoption of advanced axle designs with enhanced durability, torque handling, and modular integration capabilities.

In March 2024, a new line of rear semi-float axles was introduced by Dana Incorporated for Jeep models in the aftermarket. These axles were designed to support heavier payloads and deliver improved off-road performance. Featuring bolt-in installation and modular compatibility, the new components are engineered for lifted or performance-modified vehicles, as reported by Aftermarket News.

Electrification trends are reshaping axle architectures across OEM platforms. In April 2024, Scania revealed a new three-axle battery-electric platform intended for urban transport applications. According to Bus-News.com, this configuration was optimized for city buses and logistics fleets, where axle integration plays a critical role in energy efficiency, weight distribution, and drivetrain performance.

Advancements in lightweight materials and CV axle innovation are also contributing to market evolution. In October 2024, Tenneco’s DRiV division unveiled its next-generation MOOG® constant velocity axles, designed with thermoplastic boots and precision-rolled splines to improve the strength-to-weight ratio and extend service life.

According to the company’s press release, this innovation was developed in response to increased demand for low NVH (noise, vibration, and harshness) and high durability in electric and hybrid vehicle platforms.

As OEMs continue transitioning toward modular electric architectures, the integration of hub motors and smart axle systems is expected to become standard. The automotive axle market is anticipated to benefit from regulatory mandates aimed at improving load efficiency, power distribution, and range optimization in electrified drivetrains. With rising investment in electric and hybrid segments, particularly across North America, Europe, and Asia-Pacific, the long-term outlook for the global axle market remains robust through 2035.

Drive automotive axles are projected to lead the global automotive axle market, accounting for approximately 62% of total market share in 2025. Between 2025 and 2035, this segment is forecast to grow at a CAGR of 12.3%, surpassing the overall industry growth rate of 11.7%.

The rising production of all-wheel-drive (AWD), rear-wheel-drive (RWD), and electric vehicles has driven increased demand for high-performance drive axles that can efficiently transmit torque from the powertrain to the wheels.

Automotive manufacturers are emphasizing the development of lightweight and integrated drive axle modules to enhance power efficiency and reduce vehicle weight. In the electric vehicle (EV) segment, electric drive axles are being deployed with inbuilt e-motors and reduction gear units to streamline drivetrain architecture.

This trend is contributing to reduced energy loss and better weight distribution. Tier-1 suppliers are investing in advanced materials and manufacturing technologies such as hollow axle shafts and high-strength composites to improve performance without compromising structural integrity. Additionally, axle durability is being optimized to withstand higher torque loads associated with electrified and high-performance vehicles.

Rear automotive axles are expected to contribute 58% of the global automotive axle market by 2025, with the segment projected to expand at a CAGR of 11.9% through 2035. Rear axles continue to serve as critical components in both commercial vehicles and performance-oriented passenger vehicles, particularly in RWD and AWD configurations.

The application of rear axles is being driven by their role in load-bearing, torque transfer, and suspension integration-especially in pickup trucks, heavy-duty SUVs, and vans. In electric vehicles, rear-mounted motor layouts are becoming increasingly common, placing greater emphasis on the performance and reliability of rear axles.

OEMs are responding by integrating multi-link suspension and regenerative braking mechanisms directly into rear axle assemblies. Furthermore, demand for modular rear axle platforms is rising, enabling compatibility across ICE, hybrid, and EV architectures. This flexibility is reducing development costs while allowing automakers to address a wider range of vehicle configurations and performance requirements.

Challenge

High Costs and Regulatory Complexities

High production costs, stringent regulatory requirements, and supply chain constraints are some of the challenges facing the Automotive Axle Market. Automotive axle production involves advanced materials, precision engineering, and compliance with international safety standards from organizations like the National Highway Traffic Safety Administration (NHTSA) and the European Union (EU).

The development of products also gets lengthened as meeting these stringent regulations escalates production costs. Additionally, raw material costs - steel and aluminum - have also fluctuated, which has increased costs and made it harder for manufacturers to maintain profitability.

To meet these challenges, firms should be focused on economical material sourcing, lean production methods, and advanced emission/safety regulations.

Market Saturation and Price Competition

The automotive axle market is characterized by a great deal of competition, with a large number of global and regional producers supplying similar products. Price wars come when there is market saturation, which means profits are low and companies find it hard to distinguish themselves.

Electric and hybrid vehicle demand is also revolutionizing traditional axle designs, with the OE segment having to adapt to new vehicle architectures. In order to stay ahead of the game, companies should prioritize innovation while using lightweight materials for their customized axle solutions that will benefit future vehicle designs.

Opportunity

Growing Demand for Lightweight and High-Performance Axles

Rising demand for fuel-efficient, high-performance vehicles is paving the way for the growth of the Automotive Axle Market. Automakers are turning to high-strength steel and other lightweight materials to enhance fuel efficiency by making vehicles lighter.

Cutting-edge axle technologies, such as independent suspension systems and electronically controlled differentials, are helping to improve vehicle performance and drive market growth. As the automotive industry continues to evolve, businesses that invest in research and development into durable but lightweight, high-performance axles will gain a competitive advantage.

Technological Advancements in Electric and Autonomous Vehicles

Wind of change in the Automotive Axle Market with the advent of electric and autonomous vehicles Dent said, "Your electric vehicles (EVs) will extract torque differently, meaning they will need different gearing elements, as well as features designed for regeneration. Precision-engineered axles with integrated sensors and smart control systems are directed for autonomous vehicles' stability and safety.

An electric component can last the life of multiple vehicles, creating the potential for open new revenue streams for manufacturers with modular and scalable axle designs. The next decade will witness the advent of electrical innovations in axle technology as applications for AI-integrated mobility solutions, such as electric drive axles, are developed by leading manufacturers, and companies that will find innovative ways to incorporate advanced features in axle designs will lead the pack in this regard.

The automotive axle market in the USA is witnessing steady growth, supported by increasing automotive production and growing demand for lightweight and high-performance axle solutions. The growing electric vehicle (EV) segment is also enhancing demand as automakers focus on improving drivetrain efficiency.

The integration of smart axles and advanced regenerative braking systems is another technological advancement in axle design that is fostering market expansion. Furthermore, the increasing consumer inclination towards all-wheel-drive (AWD) & off-road vehicles is driving the need for advanced axle configurations.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.2% |

In the UK, the automotive axle market is also growing steadily, aided by the surge in production of both electric and hybrid vehicles. The growing need for improved fuel efficiency from vehicle elements is increasing the demand for more axle types.

In response, government regulators are promoting reduced carbon emissions, causing automakers to participate in lightweight axle design. Moreover, increasing demand for performance and luxury vehicles with advanced suspension and drivetrain systems is also fuelling the growth of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.5% |

The demand for automotive axles in the European Union is strong, which is expected to drive the growth of the market over the forecast period with key manufacturing hubs in Germany, France, and Italy. The growing usage of electric and self-driving vehicle technologies is driving the demand for high-efficiency axle systems.

Axle Solutions - Move to Innovative Solutions Driven by the regulatory policies concerning vehicle weight reduction and fuel economy, manufacturers are moving towards innovative axle solutions. The increasing production of commercial vehicles and the expansion of associated logistics networks are also enhancing demand for heavy-duty, high-performance axles.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 11.7% |

With Japan being a leading force in automotive technology and design for efficiency-focused vehicles, its automotive axle market is growing continuously. Automakers are looking to implement lightweight, high-strength axle materials to improve the overall performance of the car.

The growing production of hybrid and electric vehicles boosts demand for advanced axle technologies, such as independent rear axles and torque vectoring systems. Moreover, growing investment in autonomous driving solution research and development is catalyzing the growth of the market further.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.3% |

South Korea’s automotive axle market has been expanding rapidly due to the strong presence of major automakers and a transition to electric mobility. The rising export of passenger and commercial vehicles also continues to drive the demand for durable and high-precision axle systems.

With that, the country aims to enhancing vehicle efficiency and performance, which is likely to expand the lightweight and low-friction axle designs in the country. Furthermore, investments in smart mobility along with advanced drivetrain components paved the way for country-based market growth over the forecast period.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.0% |

Dana Incorporated (18-22%)

With innovative e-axle solutions, lightweight driveline technologies and fuel-efficient, electrified axles, Dana is at the forefront of the market.

American Axle & Manufacturing (AAM) (15-19%)

With innovative e-axle solutions, lightweight driveline technologies and fuel-efficient, electrified axles, Dana is at the forefront of the market.

Meritor, Inc. (12-16%)

Meritor specializes in commercial vehicle axle systems, providing heavy-duty solutions with electric axle integration for enhanced energy efficiency and load-bearing capacity.

ZF Friedrichshafen AG (9-13%)

ZF is a key innovator in e-axles and advanced axle solutions, leveraging high-performance materials and intelligent control systems for next-generation mobility.

GKN Automotive (7-11%)

GKN Automotive is a leading supplier of AWD axles, electric driveline systems and modular e-axle solutions to automotive manufacturers moving to electric mobility.

The rest of the automotive axle market is supported by manufacturers providing innovative axle solutions for fuel efficiency and vehicle stability, as well as opportunities driven by electrification. Notable players include:

The overall market size for Automotive Axle Market was USD 10.43 Billion in 2025.

The Automotive Axle Market expected to reach USD 31.53 Billion in 2035.

The demand for the automotive axle market will grow due to increasing vehicle production, rising demand for fuel-efficient and lightweight components, advancements in electric and hybrid vehicle technologies, and the growing need for durable and high-performance drivetrain systems in commercial and passenger vehicles.

The top 5 countries which drives the development of Automotive Axle Market are USA, UK, Europe Union, Japan and South Korea.

Drive Automotive Axles and Rear Automotive Axles lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Axle Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Axle Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Axle Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 45: North America Market Attractiveness by Axle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Axle Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Axle Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Axle Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Axle Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Axle Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Axle Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Axle Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Axle Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Axle Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Axle Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Axle Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Axle and Propeller Shaft Market Growth - Trends & Forecast 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA