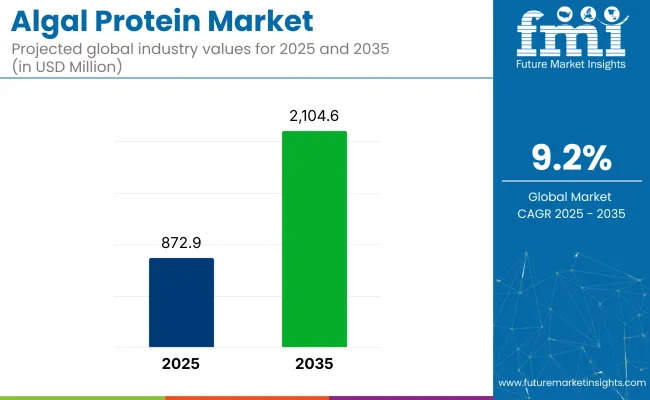

The algal protein market is expected to rise from USD 872.9 million in 2025 to USD 2,104.6 million by 2035, reflecting a strong CAGR of 9.2%. India, with a 12.5% CAGR, is anticipated to be the fastest-growing region, fueled by the increasing focus on plant-based protein alternatives.This growth is driven by increasing consumer demand for natural protein sources.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 872.9 million |

| Projected Market Size in 2035 | USD 2,104.6 million |

| CAGR (2025 to 2035) | 9.2% |

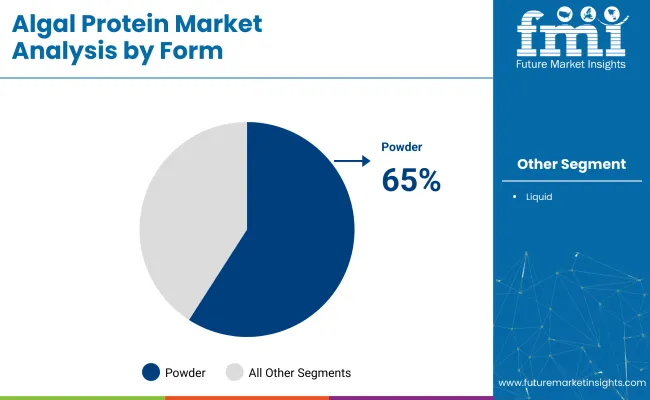

Powdered algal protein is anticipated to dominate, accounting for 65% of the share in 2025. This form of protein offers convenience in dietary supplements, functional foods and plant-based meat alternatives. The dietary supplements segment is expected to hold a good portion, driven by the increasing consumer preference for plant-based nutritional supplements. Companies like Corbion and Cyanotech are investing in algae farming projects and R&D to scale production and improve the extraction processes to meet the growing demand.

Corbion introduced AlgaPrime™ DHA P3, an algae-based omega-3 ingredient for pet food manufacturers. This product aims to enhance the nutritional profile of pet foods while reducing dependency on marine-based resources.

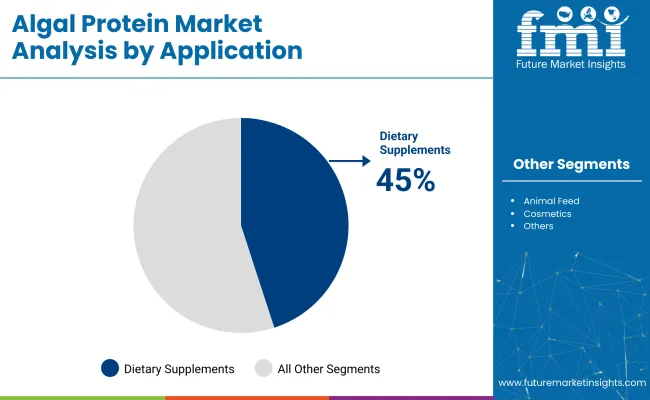

The industryis a niche segment within its parent markets, holding a relatively small percentage share. Within the dietary supplements market, algae protein’s share is more pronounced, with applications in supplements accounting for approximately 42.4% of global algae protein revenues.

Compared to the total dietary supplements market, algae protein accounts for less than 1%. Similarly, in animal feed, pharmaceuticals, and functional foods, algae protein’s share is still under 1% of the total market size, though it is growing due to consumer demand for nutrient-rich alternatives.

Algae products market analysis by top investment segments. The segmentation has been conducted by product form into powder and liquid. Product source has been categorized into marine algae and freshwater algae. Type has been divided into spirulina and chlorella.

Application has been segmented into dietary supplements, food and beverages, animal feed, cosmetics, and others. Region has been classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East and Africa.

The powder form segment is expected to hold 65% of the share in 2025. Algal protein powders are used in dietary supplements, plant-based food products, and health drinks due to their ease of incorporation and versatility.

The dietary supplements segment is projected to hold 45% of the market share in 2025. Algal protein is increasingly becoming a preferred source of nutrition in dietary supplements due to its rich amino acid profile and natural bioavailability.

The marine algae segment is expected to dominate with 55% of the share in 2025. Marine algae, including spirulina, chlorella, and algae species from the oceans, are rich in protein, omega-3s, and essential vitamins.

The spirulina segment is expected to account for 60% of the share in 2025. Spirulina, a type of blue-green algae, is renowned for its high protein content and rich nutrient profile, including vitamins, minerals, and antioxidants.

The industry is driven by increasing consumer demand for plant-based proteins and advancements in algae cultivation technologies. However, challenges such as high production costs and scalability issues continue to impact the expansion.

Rising Demand for Vegan Proteins

The industry is witnessing growth, primarily driven by the increasing consumer preference for plant-based diets and protein sources. Algae, particularly microalgae like spirulina and chlorella, are rich in essential amino acids, vitamins, and minerals, making them attractive alternatives to traditional animal-based proteins.

The shift towards plant-based diets is fueled by health-conscious consumers seeking lower cholesterol, reduced environmental impact, and ethical considerations associated with animal farming. The rise of vegan and vegetarian lifestyles, coupled with the growing awareness of the health benefits associated with algae consumption, is propelling the demand for algal protein in various applications, including dietary supplements, functional foods, and animal feed.

High Production Costs and Scalability Challenges

The cultivation of algae requires specialized infrastructure, controlled environments, and energy inputs. Achieving large-scale production while maintaining consistent quality is a hurdle. The complexity of algae cultivation, harvesting, and processing necessitates investment in research and development to improve efficiency and reduce costs.

Competition from other plant-based proteins, such as soy and pea, presents challenges to the widespread adoption of algal protein. Addressing these issues ensures growth and competitiveness.

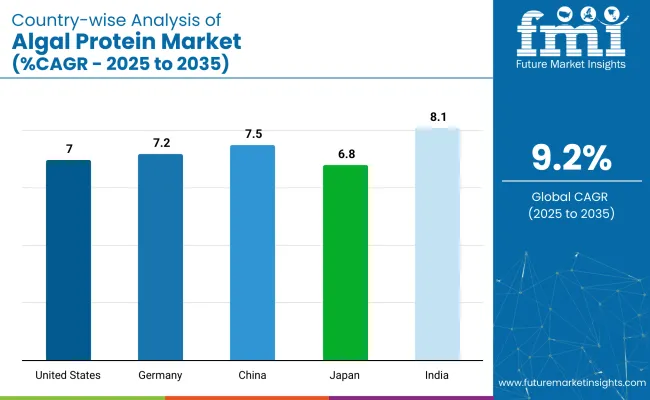

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 7% |

| Germany | 7.2% |

| China | 7.5% |

| Japan | 6.8% |

| India | 8.1% |

OECD countries, including the United States and Germany, are seeing growth. The United States, projected to grow at 7.0% CAGR, is driven by the demand for plant-based omega-3 supplements, as consumers increasingly seek plant-based alternatives to fish oil. Innovations in capsule technology and organic certifications are meeting the needs of a health-conscious market.

In Germany, expected to grow at 7.2% CAGR, clean-label products are key drivers, with increasing demand for high-quality, non-GMO algae oils in functional foods and supplements. Manufacturers are investing in fermentation and bioengineering technologies to meet strict European safety standards.

In the BRICS group, India accounts for a projected 8.1% CAGR, fueled by the popularity of plant-based nutrition and Ayurvedic wellness practices. The large vegetarian population and increasing awareness of non-animal protein are driving algae protein adoption. China, growing at 7.5% CAGR, is investing in local algae cultivation and promoting the use of spirulina and chlorella as natural protein sources.

In ASEAN, Japan is growing at 6.8% CAGR, driven by a focus on longevity, health, and anti-aging supplements. Japanese companies are advancing extraction technologies to improve the bioavailability of algae-based omega-3 oils, particularly for cognitive and cardiovascular health.

The USA is projected to grow at a CAGR of 7% from 2025 to 2035, driven by increasing demand for plant-based omega-3 supplements and functional foods. An increase in the vegan and vegetarian lifestyle trend and the rise in the demand for substitutes for fish oil-based omega-3 supplements are propelling demand.

Germany’s algal protein market is expected to grow at a CAGR of 7.2% from 2025 to 2035, driven by the country’s focus on clean-label dietary supplements, and innovative algae applications. Demand for high-quality, non-GMO algae oils is rising with the rise of flexitarian diets, functional wellness products, and agriculture initiatives.

China’s algal protein market is projected to grow at a CAGR of 7.5% from 2025 to 2035, with a growing demand for plant-based ingredients and government-backed health initiatives. There is growing consumer demand across the nation for functional ingredients that offer benefits related to immunity, detox, skin, and energy all of which are core claims linked to algae-sourced products.

India’s algal protein market is projected to grow at a CAGR of 8.1% from 2025 to 2035, fueled by the increasing popularity of plant-based nutrition and Ayurvedic wellness practices. Algae like spirulina have long been used in Ayurveda for their detoxifying and rejuvenating benefits. Algae-based powders and capsules are being integrated into wellness rituals among Indian consumers. They’re sold as energy boosters and skin health-boosters, muscle recovery aids.

Japan is expected to grow at a CAGR of 6.8% from 2025 to 2035, driven by the country's growing focus on longevity, health, and functional food production. Japanese consumers use algae oil with high bioavailability and low oxidation levels to promote brain health, anti-aging, and metabolic health. An aging population is also increasing demand for algae-based omega-3 oils, particularly in elderly care and memory support supplements.

The industry is growing, driven by companies like Corbion, Cyanotech Corporation, Roquette Frères, and DIC Corporation, which focus on innovation and algae-based proteins for food, beverages, and nutraceuticals. EID Parry and TerraVia Holdings invest in algae cultivation and advanced extraction technologies, enhancing protein purity and expanding production.

Emerging players like Far East Microalgae Industries and Prolgae are contributing niche innovations, especially in regional markets. The industy is fragmented, with high entry barriers such as capital investment and complex production methods. Despite the dominance of larger firms, smaller companies continue to drive innovation, and consolidation is anticipated as competition increases.

Recent Algal Protein Market News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 872.9 million |

| Projected Market Value (2035) | USD 2,104.6 million |

| CAGR (2025 to 2035) | 9.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million |

| Product Form | Powder, Liquid |

| Product Source | Marine Algae, Freshwater Algae |

| Type | Spirulina, Chlorella |

| Application | Dietary Supplements, Food & Beverages, Animal Feed, Cosmetics, Others |

| Region | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia & Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | Corbion, Cyanotech Corporation, Roquette Frères, DIC Corporation, EID Parry, TerraVia Holdings, Far East Microalgae Industries, Bio-engineering Co., Tianjin Norland Biotech, Prolgae, NB Laboratories |

| Additional Attributes | Dollar sales, CAGR trends, product form distribution, algae source demand, type segmentation, price range segmentation, competitor market share, regional growth patterns, application sector insights |

The market is segmented into powder and liquid forms.

Segmentation includes marine algae and freshwater algae.

The market is divided into spirulina and chlorella types.

Applications encompass dietary supplements, food and beverages, animal feed, cosmetics, and others.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The projected valuation of this industry in 2025 is USD 872.9 million.

The forecast valuation of the algal protein Market by 2035 is USD 2,104.6 million.

The expected CAGR for the algal protein Market from 2025 to 2035 is 9.2%.

The powder form segment is expected to lead the algal protein market in 2035, with approximately 65% share.

India is expected to be the fastest-growing region in the algal protein market, with a projected 8.1% CAGR.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.