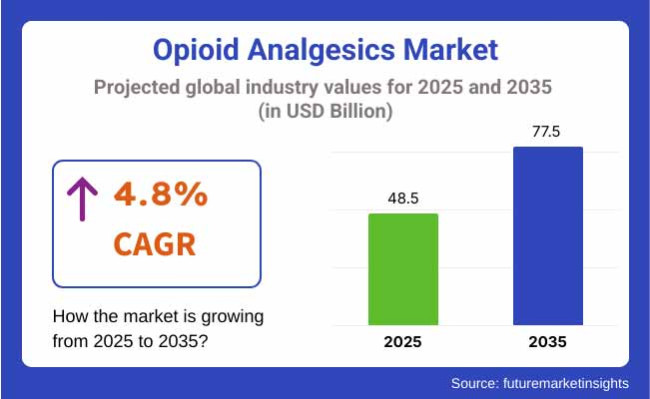

The global opioid analgesics market is projected to climb from USD 48.5 billion in 2025 to about USD 77.5 billion by 2035 at a 4.8% CAGR through 2035. Rather than shrinking the market, tightening stewardship and diversion controls are shifting demand toward premium, abuse-deterrent formulations (ADFs) that resist crushing, dissolving and rapid extraction, allowing payers to justify higher reimbursement as a risk-mitigation measure.

Innovation is centred on tamper-resistant technologies-wax-matrix microspheres, antagonist-activated tablets, RFID-locked patient-controlled analgesia pumps and extended-release injectables-that promise effective pain relief with lower misuse potential.

North America retains the highest per-patient spend despite aggressive prescription-monitoring programmes, Europe shows slower unit growth but faster ADF uptake under stringent pharmacovigilance guidelines, and Asia Pacific delivers the quickest volume gains as China expands cancer-pain coverage and India raises morphine quotas.

Environmental, social and governance pressures are also shaping supply chains-USA take-back mandates are expected to divert millions of unused doses from landfills, while manufacturers such as Mallinckrodt have moved facilities to renewable electricity to curb Scope 2 emissions.

Collegium Pharmaceutical’s CEO Vikram Karnani recently emphasised that differentiated, abuse-deterrent pain medicines remain central to delivering both patient value and durable growth. Together these forces-persistent chronic-pain prevalence, regulatory pivot to safer formulations, technological advances in delivery, and sustainability initiatives-suggest the opioid analgesics sector will expand steadily yet more responsibly through 2035.

Oxycodone is anticipated to dominate the opioid analgesics market, capturing a market share of 37.5% by 2025. Its prominence stems from extensive usage in treating moderate to severe pain, particularly post-surgical recovery and cancer-related pain management.

Physicians frequently prescribe oxycodone due to its effective analgesic properties, available in immediate-release and extended-release formulations allowing controlled dosing tailored for both acute and chronic conditions. North America leads in oxycodone prescriptions, yet stringent opioid regulations are gradually shaping tighter prescription controls.

Growing cancer and surgical cases in Europe and Asia-Pacific regions bolster global demand. Pharmaceutical companies, including Purdue Pharma and Mallinckrodt, are introducing formulations with lower addiction potential, driving market acceptance. Future trends will be dictated by tighter regulations and continued innovation in safe pain management.

Morphine continues to hold substantial market share of 28.4% by 2025 due to its wide use in severe pain management, trauma, and end-of-life care. Clinicians rely on morphine for its proven efficacy in treating cancer pain, terminal illness, and post-surgical recovery, creating consistent global demand. Growth drivers include rising volumes of surgeries, cancer prevalence, and expanding hospice and palliative care services globally.

Although concerns about addiction and stringent regulatory scrutiny may moderate growth, drug makers like Pfizer and Hospira emphasize controlled-release formulations and safer administration methods, stabilizing morphine's position within therapeutic use. Regulatory compliance, responsible opioid stewardship, and innovation in pain management practices will sustain morphine's significant market presence.

Surgical pain is set to lead the opioid analgesics market, achieving a market share of approximately 45.7% by 2025. This dominance arises from opioids' crucial role in effective pain management post-surgery and trauma treatment.

Physicians routinely prescribe opioids such as morphine, oxycodone, and fentanyl as primary components of multimodal pain control protocols, essential in surgical and recovery settings. High surgical volumes in North America and Europe, combined with rapidly increasing surgical access in Asia Pacific regions, fuel continuous opioid utilization.

Companies such as Johnson & Johnson and Endo Pharmaceuticals provide specialized opioid formulations for surgical contexts, solidifying market leadership. Continued global increases in surgical procedures will ensure ongoing segment growth.

Oral administration is forecasted to dominate opioid analgesics delivery, holding a substantial market share of 62.3% by 2025. This dominance is driven by convenience, ease of use, and excellent patient adherence.

Physicians frequently prescribe oral opioids, including oxycodone, hydrocodone, and morphine, particularly in outpatient and chronic pain management scenarios. High bioavailability and consistent absorption enhance their clinical effectiveness.

Regulatory agencies encourage tamper-resistant oral formulations to minimize abuse potential. Although intravenous and transdermal opioids remain prevalent in acute hospital care, the affordability and patient-friendly nature of oral opioids ensure continued market leadership. Companies such as Teva Pharmaceuticals and Mylan lead innovations in safer oral formulations, reinforcing the oral route’s dominance.

North America is the largest market for opioid analgesics, propelled by a high prevalence of chronic pain disorders, postoperative pain management and also cancer pain which contributes a significant share in the overall market.

The United States holds maximum revenue share based on its prescription rates and consumption for opioid analgesics towards chronic pain management and continued R&D in abuse-deterrent technology. The implementation of strict regulatory guidelines and increased concern over opioid dependence have resulted in reduced rates of opioid prescribing.

Government policies supporting opioid stewardship programs and alternative pain therapies are driving market trends. Implementation of prescription drug monitoring programs or PDMPs and analytics for tracking opioids are new trends in the region. Telemedicine and digital therapeutics are also being incorporated into pain management regimens to enhance patient compliance and lower opioid dependency.

Europe is an established market for opioid analgesics with the role of Germany, France, and Switzerland prominent in pain management medicine development. Strictly regulated prescription of opioids and government-sponsored opioid reduction initiatives are defining the market. The rising focus on other pain solutions, including non-opioid analgesics and medical cannabis, is driving the demand for opioids.

There is still an urgent need for effective palliative care and surgical pain relief despite rising concern in proper opioid prescribing procedures. This demand continues to drive opioid use in speciality clinics as well as hospitals.

Expansion in opioid de-prescription initiatives and investment in research on safer opioid medications are trends picking up pace in the European market. Furthermore, public-private collaborations between healthcare organizations and pharmaceutical companies are promoting the identification of new pain management techniques with lower risks of addiction.

The Asia-Pacific market for opioid analgesics is growing fast as a result of the rising prevalence of chronic disease coupled with rising elderly population and their shift towards pain management treatment. China and India have higher opioid usage for treating post-surgical and cancer pain.

With over 45.7 million and 182 million people living with chronic pain in these countries respectively. Regulatory limitations and strict prescription adherence are restraining mass acceptance. The increasing need for multimodal pain treatment strategies, such as acupuncture, nerve blocks as well as non-opioid options is transforming the market over the forecast years.

The initiation of government-initiated pain management awareness campaigns is aiding market growth in the region. Rising investments in setting up palliative care facilities and the launch of new transdermal patches and buccal tablets will push to market growth.

Rising Scrutiny and Declining Opioid Prescriptions Reshaping Opioid Sales

The opioid analgesics market is under increased pressure due to the ongoing opioid epidemic, increasing regulatory pressures and trending shift towards non-opioid alternative pain management options. Issues with opioid dependency and addiction have led to stringent prescribing regulations in various countries with governments applying strict monitoring systems to monitor opioid abuse.

Various cases were filed against North American pharmaceutical manufacturers and have raised the scrutiny of opioid dispensation, discouraging excessive prescription and leading to declining sales.

The growing shift towards non-opioid alternatives like NSAIDs, biologics, and cannabinoid therapy is an expression of the broader industry trend toward safer therapies. In addition, stigma related to opioid use as well as fears like respiratory depression and addiction limits their long-term application.

Physicians and regulatory agencies must collaborate with pharmaceutical manufacturers in order to weigh effective pain relief against regulatory control. Going forward, drug manufacturers shall have to innovate with abuse-deterrent technology and safer products in order to grow amid such regulatory and social challenge.

Future Growth Lies in Controlled-Release and Tamper-Resistant Opioids

Pharmaceutical firms can actually accelerate growth in the opioid analgesics industry by developing safer products, entering new markets, and partnering with other companies. With so many individuals requiring treatment for chronic pain, there is an open opportunity to bring to market products that are safer and with lesser cost.

There is a tremendous growth prospects in palliative care and surgical pain management as opioids are still quite significant to those procedures. Companies should absolutely explore new markets in regions such as Asia-Pacific and Latin America, where regulatory frameworks for opioids are a bit more lenient and healthcare quality is improving.

Educating doctors and increasing patients' awareness, industry leaders can promote responsible prescribing and enhance opioid safety. Collaboration with regulatory agencies also provides such companies the opportunity to influence policy to balance accessibility while attempting to reduce abuse.

In order to remain proactive, companies should try to provide safer opioid alternatives, investigate controlled-release technology, and possess a range of pain management options in this evolving regulatory landscape.

Between 2020 and 2024, the world market for opioid analgesics experienced a consistent growth. This largely resulted from the swelling prevalence of chronic pain, requiring efficient postoperative pain control, and expanding demands for trustful pain relief.

Manufacturers are developing improved formulas with releasing long-acting and abuse-deterrent opioids that facilitate the ability of patients to continue their therapies in safety. But with governments began to clamping down with tighter regulation to fight against opioid abuse and dependency, and people became more aware of alternative treatments that sort of put the kibosh on market expansion.

Looking forward to 2025 to 2035, we can anticipate the manufacturers to focus on creating abuse-resistant products that maintain opioid safety under control while remaining effective.

Researchers are going to explore personalized medicine and pharmacogenomics to develop pain management plans tailored to individuals with fewer side effects and improved outcomes. The sector is set to grow particularly as developing markets enhance their healthcare and access to pain relief drugs improves.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emphasis on monitoring opioid prescriptions and risk reduction initiatives |

| Technological Advancements | Formulation of extended-release and transdermal patch products |

| Consumer Demand | High dependence on opioids for chronic and postoperative pain relief |

| Market Growth Drivers | Increased growth in palliative care and pain management in cancer |

| Sustainability | Early uptake of green chemistry and sustainable drug packaging. |

| Supply Chain Dynamics | Hospitals and retail-based traditional distribution. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent regulations encouraging abuse-deterrent opioids and pain management alternatives |

| Technological Advancements | AI-based adherence monitoring devices for opioids and pain management in real-time |

| Consumer Demand | Increasing trend towards multimodal pain relief and customized therapies.. |

| Market Growth Drivers | Increased usage of non-opioid analgesics and online pain management platforms. |

| Sustainability | Mass-scale execution of environmentally friendly manufacturing and waste management tactics |

| Supply Chain Dynamics | Blockchain supply chain traceability to impede opioid counterfeiting distribution. |

The market for opioid analgesics is poised for further development, with regulatory policies, technological advancements, and sustainability initiatives driving its expansion. Manufacturers need to invest in safer formulations, digital health solutions, and alternative pain management options to stay ahead in this changing environment.

Market Outlook

The opioid analgesics market in United States is in transformation due to increasing regulatory oversight, legal actions and changing paradigms for treatment that influence business dynamics. As much as tighter prescribing mandates and opioid settlement litigations have restricted legacy opioid use, growing demand exists for safer forms of pain control.

Pharmaceutical organizations are moving to abuse-deterrent formulations and long-acting opioids to walk a fine balance between efficacy and safety. Pain management clinics and hospitals are incorporating multimodal pain therapies, decreasing the use of opioids as a standalone option.

The increase adoption across elderly population and increasing post-operative and cancer pain cases will continue to drive opioid demand, especially in palliative care. In the future, developments in opioid formulations and increased emphasis on non-addictive options will shape market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The opioid analgesics market in Germany is confronted with a multifaceted environment defined by stringent regulation, increasing cases of chronic pain, and changing prescribing habits. The German Federal Institute for Drugs and Medical Devices implements strict opioid prescribing regulations, curtailing abuse while maintaining availability for patients suffering from severe pain. In spite of regulatory restrictions, aging populations and growing cancer-related pain cases drive demand, especially in palliative and post-operative care.

Germany's public health care system focuses on multimodal pain management, seeking a balance of opioids and non-opioid options such as NSAIDs and physiotherapy. Pharmaceutical industries are investing in abuse-deterrent formulations in order to conform to safety mandates. In the future, opioid availability will rely on regulatory conformance, prescriber education, and breakthroughs in pain relief therapies for responsible prescribing purposes while filling unmet pain management needs.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.6% |

The opioid analgesics market in China is increasing with the expanding elderly population, increased surgical operations, and the growing number of cancer cases. The government has also strengthened regulations on opioids to avoid abuse, but demand in palliative treatment and post-surgical pain control is still robust.

China also boasts low per capita opioid use, mainly because prescription controls are stringent and traditional medicine is preferred. But with the growing awareness of pain management, hospitals and health care facilities are more and more incorporating opioid therapy alongside non-opioid therapies. The drug industry is putting money into safer drugs and long-acting opioids in compliance with regulatory requirements.

In the future, industry participants must address regulatory problems, enhance physicians' education, and develop properly balanced pain management solutions in an effort to support growth while staying away from abusive use of opioids.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.1% |

The market for opioid analgesics in India is expected to grow steadily with increasing cases of cancer, postoperative pain management and growing palliative care awareness. Even with the rising demand for pain management, strict guidelines were implemented under the Narcotic Drugs and Psychotropic Substances Act to hinder opioid availability, preventing abuse, but also limiting availability for legitimate medical purposes.

The low per capita rate of opioid consumption is a reflection of regulatory hurdles as well as physicians reluctance to write opioid prescriptions. Government policies are only enhancing access to opioids for cancer care and end-of-life care. Domestic manufacturer is designing safer, controlled-release formulations that comply with requirements. Future growth in the market will be subject to regulatory reform, physician education, and increases in pain management programs to make opioid use responsible but accessible.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

The opioid analgesics market in Brazil is shifting with growing demand for pain management fuelled by old aged population, increasing number of surgical procedures, and increasing cancer patient’s cases. Though the demand for opioids exists, rigid government controls and prescription monitoring curtail extensive use to avoid abuse.

Brazil's opioid use remains below North America and Europe's, mainly due to physician reluctance, cultural affinity for non-opioid analgesics, and regulatory limits. Nonetheless, increased availability of palliative care services and better physician education are driving greater opioid acceptance.

Local drugmakers are emphasizing affordable and abuse-resistant formulations to keep pace with safety guidelines. Going forward, weighing regulatory control against patient access, combined with spending on pain management programs, will drive market expansion.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.5% |

The market for opioid analgesics is very competitive, fueled by the rising incidence of chronic pain disorders, postoperative pain management requirements, and the dynamic regulatory environment regarding opioid prescriptions.

Firms are investing in abuse-deterrent products, long-acting opioids, and non-opioid pain management therapies to stay ahead of the competition. The industry is influenced by established pharmaceutical companies, specialty pharmaceutical companies, and research programs prompted by regulation, each playing their part in shaping the dynamic picture of opioid analgesic treatments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer Inc. | 10-12% |

| Abbott Laboratories | 7-10% |

| Johnson & Johnson | 5-7% |

| Novartis AG | 3-5% |

| Bayer AG | 3-5% |

| GlaxoSmithKline plc | 3-4% |

| Other Companies (combined) | 61-57% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer Inc. | Market leader offering oxycodone-based opioid analgesics, including abuse-deterrent formulations. |

| Johnson & Johnson | Develops pain management solutions, including fentanyl-based products and extended-release opioids. |

| Novartis AG | Specializes in generic opioid formulations and branded pain relief medications. |

| Abbott Laboratories | Provides a range of opioid analgesics for acute and chronic pain management, focusing on regulatory compliance. |

| GlaxoSmithKline plc | Offers opioid-based pain relief solutions, including hydrocodone and morphine formulations. |

Key Company Insights

Pfizer Inc. (10-12%)

A leading company in pain management, Pfizer produces branded and generic opioid analgesics, with an emphasis on extended-release products and safer opioid delivery systems to meet changing regulations.

Abbott Laboratories (7-10%)

One of the main suppliers of opioid-based pain relief products, Abbott deals with hospital-quality and post-surgical opioid preparations, emphasizing patient safety and compliance.

Johnson & Johnson (5-7%)

A pioneer in pharmaceutical research, Johnson & Johnson produces a series of opioid and non-opioid pain relief products, with a growing focus on opioid-sparing treatment.

Novartis AG (3-5%)

Famous for its pain management portfolio with varied offerings, Novartis creates opioid formulations with controlled-release technology and spends on non-addictive pain relief alternatives.

GlaxoSmithKline plc (3-4%)

An active player in the opioid and non-opioid pain relief market, GSK combines opioid formulation with multimodal pain management strategies, prioritizing global accessibility and regulatory alignment.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and regulatory-driven innovations. These include:

These companies focus on expanding the reach of opioid analgesic treatments, offering competitive pricing and developing safer, abuse-deterrent opioid formulations to meet diverse medical needs.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 48.5 billion |

| Projected Market Size (2035) | USD 77.5 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| By Product | Oxycodone (Highest Share), Morphine, Fentanyl, Tramadol, Codeine, Methadone, Buprenorphine, Meperidine, Dextromethorphan, Others |

| By Indication | Surgical Pain (Dominant Share), Cancer Pain, Neuropathic Pain, Others |

| By Route of Administration | Oral (Leading Share), Parenteral, Transdermal, Others |

| By Distribution Channel | Hospital Pharmacies (Major Share), Retail Pharmacies, Drug Stores, Online Pharmacies |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Germany, China, India, Brazil, South Korea, United Kingdom, Japan |

| Key Players influencing the Opioid Analgesics Market | Pfizer Inc., Abbott Laboratories, Johnson & Johnson, Novartis AG, Bayer AG, GlaxoSmithKline plc, Teva Pharmaceuticals, Sanofi S.A., Bausch Health Companies Inc., Purdue Pharmaceuticals L.P., Daiichi Sankyo Company, Ltd., Mallinckrodt Pharmaceuticals |

| Additional Attributes | Market Share by Product, Indication, and Route; Country-wise CAGR; Company-level Share Analysis |

| Customization and Pricing | Available upon Request |

The global Opioid Analgesics industry is projected to witness CAGR of 4.8% between 2025 and 2035.

The global Opioid Analgesics industry stood at USD 45,864.8 million in 2024.

The global Opioid Analgesics industry is anticipated to reach USD 77.5 billion by 2035 end.

China is expected to show a CAGR of 8.5% in the assessment period.

The key players operating in the global Opioid Analgesics industry are Pfizer Inc., Abbott Laboratories, Johnson & Johnson, Novartis AG, Bayer AG, GlaxoSmithKline plc., Boehringer Ingelheim International GmbH, Bausch Health Companies Inc., Sanofi S.A., Teva Pharmaceuticals, AbbVie Inc. , Purdue Pharmaceuticals L.P. and others

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Western Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: Western Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Eastern Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 23: Eastern Europe Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 24: Eastern Europe Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: South Asia and Pacific Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 28: South Asia and Pacific Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 29: South Asia and Pacific Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 30: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 38: Middle East and Africa Market Value (US$ Million) Forecast by Indication, 2018 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Administration, 2018 to 2033

Table 40: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indication, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Administration, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 22: Global Market Attractiveness by Indication, 2023 to 2033

Figure 23: Global Market Attractiveness by Administration, 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Administration, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 47: North America Market Attractiveness by Indication, 2023 to 2033

Figure 48: North America Market Attractiveness by Administration, 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Indication, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Indication, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Administration, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 78: Western Europe Market Value (US$ Million) by Administration, 2023 to 2033

Figure 79: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Western Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 85: Western Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 86: Western Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 87: Western Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 88: Western Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 89: Western Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 90: Western Europe Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 97: Western Europe Market Attractiveness by Indication, 2023 to 2033

Figure 98: Western Europe Market Attractiveness by Administration, 2023 to 2033

Figure 99: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 102: Eastern Europe Market Value (US$ Million) by Indication, 2023 to 2033

Figure 103: Eastern Europe Market Value (US$ Million) by Administration, 2023 to 2033

Figure 104: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 110: Eastern Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 111: Eastern Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 112: Eastern Europe Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 113: Eastern Europe Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 114: Eastern Europe Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 115: Eastern Europe Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 116: Eastern Europe Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 117: Eastern Europe Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 118: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: Eastern Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 122: Eastern Europe Market Attractiveness by Indication, 2023 to 2033

Figure 123: Eastern Europe Market Attractiveness by Administration, 2023 to 2033

Figure 124: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 125: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 126: South Asia and Pacific Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 127: South Asia and Pacific Market Value (US$ Million) by Indication, 2023 to 2033

Figure 128: South Asia and Pacific Market Value (US$ Million) by Administration, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: South Asia and Pacific Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 138: South Asia and Pacific Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 139: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 140: South Asia and Pacific Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 141: South Asia and Pacific Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 142: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 143: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: South Asia and Pacific Market Attractiveness by Drug Class, 2023 to 2033

Figure 147: South Asia and Pacific Market Attractiveness by Indication, 2023 to 2033

Figure 148: South Asia and Pacific Market Attractiveness by Administration, 2023 to 2033

Figure 149: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 150: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Indication, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Administration, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 160: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 161: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 162: East Asia Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 165: East Asia Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 172: East Asia Market Attractiveness by Indication, 2023 to 2033

Figure 173: East Asia Market Attractiveness by Administration, 2023 to 2033

Figure 174: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) by Indication, 2023 to 2033

Figure 178: Middle East and Africa Market Value (US$ Million) by Administration, 2023 to 2033

Figure 179: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: Middle East and Africa Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 185: Middle East and Africa Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 186: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 187: Middle East and Africa Market Value (US$ Million) Analysis by Indication, 2018 to 2033

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by Indication, 2023 to 2033

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indication, 2023 to 2033

Figure 190: Middle East and Africa Market Value (US$ Million) Analysis by Administration, 2018 to 2033

Figure 191: Middle East and Africa Market Value Share (%) and BPS Analysis by Administration, 2023 to 2033

Figure 192: Middle East and Africa Market Y-o-Y Growth (%) Projections by Administration, 2023 to 2033

Figure 193: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: Middle East and Africa Market Attractiveness by Drug Class, 2023 to 2033

Figure 197: Middle East and Africa Market Attractiveness by Indication, 2023 to 2033

Figure 198: Middle East and Africa Market Attractiveness by Administration, 2023 to 2033

Figure 199: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 200: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Opioid Withdrawal Management Market Size and Share Forecast Outlook 2025 to 2035

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Opioid Use Disorder Treatment Industry Analysis by Opioid Antagonists and Opioid Agonists and Partial Agonists through 2035

Market Positioning & Share in the Opioid Use Disorder Treatment Sector

Opioid-Induced Respiratory Depression Market

Non-opioid Pain Patches Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Opioid Use Disorder Treatment Providers in Europe

Point-of-Care Opioid Testing Market Size and Share Forecast Outlook 2025 to 2035

Global Acetaminophen-Opioid Combination Market Analysis – Size, Share & Forecast 2024-2034

Australia & NZ Opioid Use Disorder Treatment Market Analysis – Size, Share & Forecast 2025-2035

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Global Analgesics Market Report – Trends, Demand & Outlook 2024–2034

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA