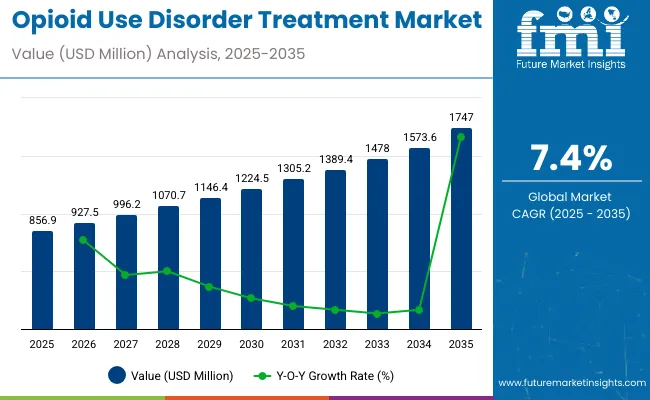

Globally, they estimate sales of opioid use disorder treatments in 2025 to be USD 856.9 million, and it is anticipated to grow to USD 1,747.0 million by 2035. It is expected to grow at an annual growth rate of 7.4% from 2025 to 2035. The revenue generated by treatments for opioid use disorders in 2024 was USD 805.2 million.

This market ranks among the fastest-growing worldwide, and even in the healthcare sector, it has become a potential high business in light of the rising morbidity from opioid addiction and increasing treatment options. Opioid use disorder is a condition of opioid misuse, including brings prescription numerous pain health, relievers, social, heroin, and economic and issues. synthetic In opioids the like last fentanyl, couple that of Opioid Use Disorder leads years, worldwide to the has dependence burden increased and of with millions affected, and there is a need for effective and options. From more conventional therapies, the landscape has evolved to medication-assisted treatments, behavioral therapies, and integrated approaches tailored according to individual needs of patients. With a growing emphasis on reducing stigma from addiction and increasing access to treatment, market dynamics are taking shape.

| Attributes | Key Insights |

|---|---|

| Industry Size (2025E) | USD 856.9 million |

| Industry Value (2035F) | USD 1,747.0 million |

| CAGR (2025 to 2035) | 7.4% |

An opioid use disorder treatment marketplace exists for investors from methadone, buprenorphine, and naltrexone (this is pharmacological treatment) up to nonpharmacological interventions such as cognitive-behavioral therapy and contingency management. The WHO is working with the patient groups, health care providers and pharmaceutical companies to create payment for work by obtaining balance between the price and quality. The newer drugs, with more efficiency, and advanced delivery systems also were likely to drive the market growth. The coming years would witness robust growth in the treatment of opioid use disorder, reflecting rising demand, support from government policies, and advancement in treatment modalities.

Pharmaceutical companies are going all out into research and development to bring the latest therapies to life and to help improve treatment that already exists. Abuse-deterrent formulations and long-acting injectables coupled with new, novel therapeutic agents will enhance treatments and improve patients' compliance and effectiveness. Meanwhile, the coordination between public-private sectors will give rise to increased innovation and also access to health care.

The increasing prevalence of opioid use disorder (OUD) has led to a growing and urgent demand for effective treatment solutions. Despite the availability of proven interventions, many individuals struggling with OUD are not receiving the recommended care they need. This gap in treatment access is contributing to a worsening public health crisis, marked by rising cases of opioid-related harm and death. Addressing this challenge requires a stronger focus on expanding access to evidence-based therapies and improving support systems for those affected.

Medications used to treat opioid use disorder, including methadone, buprenorphine, and naltrexone, are governed by strict regulations to ensure safe prescribing, controlled distribution, and effective treatment outcomes. These rules define how medications are administered, by whom, and under what clinical conditions. Certifications play a key role in ensuring that both facilities and providers meet national standards for care quality and safety.

The global opioid use disorder treatment market compound annual growth rate (CAGR) for the first half of 2024 and 2025 is compared in the table below. The first half(H1) runs from January to June while the second half(H2) runs from July to December. The business is estimated to rise at a CAGR of 8.5% in H1 of the decade 2024 to 2034, slightly lower at 8.1% in H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.6% (2024 to 2034) |

| H2 | 8.1% (2024 to 2034) |

| H1 | 7.4% (2025 to 2035) |

| H2 | 7.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.4% in the first half and remain relatively lower at 7.1% in the second half. In the first half (H1) the industry witnessed a decrease of 120 BPS while in the second half (H2), the industry witnessed a decrease of 100 BPS.

Rise in Medication-Assisted Treatment (MAT) Adoption is driving the Opioid Use Disorder Treatment Market Growth

Pharmaceutical Assisted Treatment (MAT) is employed to improve pharmaceutical remedy and intensive therapeutic measures directed at counseling with the use of FDA-prescribed drugs such as buprenorphine, methadone, naltrexone as well as group meetings for relapse prevention. MAT has been found in the most recent studies comparing therapies against this incredibly dismal course shown to cut to half the probability of relapse among clients managed under this system.

Additionally, telehealth integration has played a pivotal role, especially post-pandemic, expanding access to MAT in rural and underserved regions. The industry is also increasingly exploring new MAT modes of delivery, such as extended-release formulations, to increase adherence and improve outcomes.

Nevertheless, the MAT approach has made great strides recently but still faces a stiff mountain of barriers, including stigma and regulatory impediments. Stakeholders along all MAT value chains through various education and advocacy campaigns, aiming to normalize MAT as a vital health service and abandon all mythologies around its usage, are gradually tackling these barriers in earnest.

Rising Prevalence of Opioid Use Disorder drives revenue Growth for Opioid Use Disorder Treatment

The origin of opioid use disorder stems primarily from the misuse of prescription opioids, these opioids are often prescribed for the treatment of acute and chronic pain; it is the inappropriate use and long duration of these medications that leads to significant dependency and addiction.

This is worsening in regions like North America, where the opioid crisis is in full swing, mainly due to forging relationships with the prescribing community, together with an absence of suitable educational protocols directed towards patients regarding the opioids' risks, while illicit opioids like fentanyl are being easily made available.

The increased burden of chronic pain conditions, particularly in the aging population, has led to greater rates of prescription of opioids. Other social and economic issues like idleness and mental health disorders closely correlate to Opioid Use Disorder, and in a way create a vicious cycle of addiction and societal degradation.

The black market for drugs, especially regarding synthetic opioids, has worsened the crisis by flooding the market with far more potent and addictive substances. Other companies continue to develop novel medications and combination therapies for those unmet needs, while the research investments of public and private sources have been on a rise with further collaboration between key stakeholders in making the market.

Innovation in Long-Acting Therapies is Creating Opportunities in the Market

Long-acting treatments form a significant game-changer within the landscape of treatment of Opioid Use Disorder. The advances are seen through examples such as the monthly injectable buprenorphine and implantable naltrexone, reducing the dosing interval and associated risks of diversion among patients.

Clinical trials have shown that long-acting preparations enhance retention of treatment and quality of life. These therapies address critical pain points such as stigma and daily compliance challenges, making them particularly appealing for diverse patient demographics.

Pharmaceutical companies are investing heavily in R&D to expand this segment, exploring next-generation formulations with even longer durations. Regulatory bodies have also expressed support, with expedited approvals facilitating quicker market entry. By focusing on these advancements, the industry can cater to evolving patient needs and strengthen treatment outcomes.

Stigma and Societal Barriers and Regulatory Challenges may Restrict Market Growth

The stigma surrounding Opioid Use Disorder is a significant barrier to entry in the market. Misconceptions concerning addiction, treatment, or both have led people to fear and avoid seeking care, which worsens the public health crisis. According to research, more than 50% of those with Opioid Use Disorder fear stigma or are discriminated against and do not seek treatment.

Healthcare providers are also stigmatized. The stigma of being labeled as having a dependency on drugs or getting into trouble with the law from regulatory scrutiny limits the widespread use of effective treatments and hampers patient outcomes. Societal perceptions often inform policy decisions, which delay the much-needed critical reforms aimed at expanding access to care.

This restraint calls for a multi-dimensional approach that not only involves education campaigns for public desensitization to the stigma of addiction and treatment but also training for providers to ensure more adoption of MAT. Industry players are partnering with advocacy groups to amplify the efforts in shaping a supportive ecosystem for individuals who are battling Opioid Use Disorder.

The global opioid use disorder treatment industry recorded a CAGR of 6.1% during the historical period between 2020 and 2024. The growth of opioid use disorder treatment industry Share was positive as it reached a value of USD 805.2 million in 2024 from USD 636.2 million in 2020.

The market for the orthopedic surgical robot has seen significant evolution over the last two decades: A lot of technological advancement, increased adoption of MIS, and precision and patient outcome. Adoption has now become more widespread among Tier 1 hospitals, ambulatory surgical centers, and specialty clinics, given cost reductions and ROI clarity.

Current trends reflect increasing interest in software solutions and data analytics to augment preoperative planning and intraoperative decision-making. Additionally, the role of artificial intelligence and machine learning in predictive analytics is gaining importance for more accurate patient-specific surgical outcomes.

The future look of the market is very encouraging, with sharp growth expected for the next decade. Growth driving factors include globally increasing demand in minimally invasive surgeries, older population, as well as growth in osteoarthritis, and degenerative spine diseases cases.

This orthopedic surgical robot market will grow significantly through technological advancements, expansion of applications, and wider adoption in emerging markets such as Asia-Pacific and Latin America by 2030. Autonomous robotic systems, though at their infancy today, are likely to play a transformative role in the future, promising reduced dependence on surgeon expertise and increased operational efficiency, particularly in underserved regions.

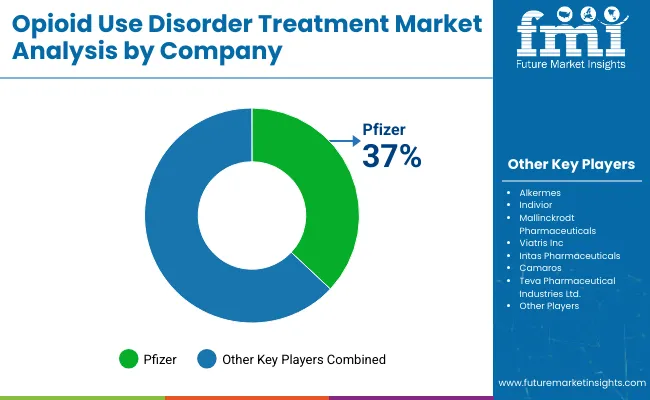

Tier 1 companies are the industry leaders with 40.9% of the global industry. These companies stand out for having a large product portfolio and a high production capacity. These industry leaders also stand out for having a wide geographic reach, a strong customer base, and substantial experience in manufacturing and having enough financial resources, which enables them to enhance their research and development efforts and expand into new industries.

The companies within tier 1 have a good reputation and high brand value. Prominent companies within tier 1 include Indivior, Alkermes, Johnson & Johnson, Teva Pharmaceutical Industries Ltd. And Pfizer

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a market share of 32.7% worldwide. These firms may not have cutting-edge technology or a broad global reach, but they do ensure regulatory compliance and have good technology.

The players are more competitive when it comes to pricing and target niche markets. Key Companies under this category include Mallinckrodt Pharmaceuticals, Viatris Inc, Braeburn Pharmaceuticals among others

Compared to Tiers 1 and 2, Tier 3 companies offer outsourced testing services, but with smaller revenue spouts and less influence. These companies mostly operate in one or two countries and have limited customer base. They specialize in specific products and cater to niche markets, adding diversity to the industry.

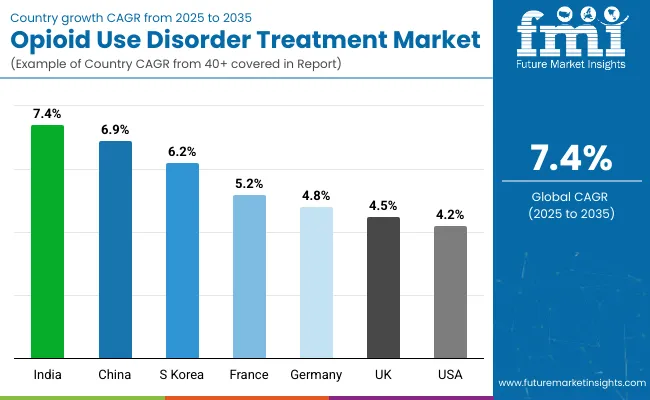

The market analysis for opioid use disorder treatment in various nations is covered in the section below. An analysis of important nations in North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and Middle East & Africa of the world has been mentioned below.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Germany | 4.8% |

| UK | 4.5% |

| France | 5.2% |

| China | 6.9% |

| South Korea | 6.2% |

| India | 7.4% |

Government-backed initiatives, such as OST, are driving the market forward. Germany's very strict regulatory environment ensures that the treatments available are of high quality and evidence-based, while prescription drug misuse is kept at a minimum. The growing trend of harm reduction strategies, such as naloxone distribution to prevent overdose, also supports the market.

Another reason for growing this sector would be the drug industry's investment in the development of non-addictive pain medicines and the modernization of MATs. Along with that, coordination on the part of healthcare providers, insurers, and policymakers ensures better accessibility and affordable treatments, providing Germany with immense potential in treating Opioid Use Disorder.

Many overdose deaths are traced to over-prescription, increased prevalence of fentanyl, use of synthetic opioids, and socio-economic gaps, indicating a need for prescription access by the patients. This has prompted initiatives by the United States government: initiatives from Substance Abuse and Mental Health Services Administration that enhance easy access to some evidence-based treatment options such as medication-assisted therapies buprenorphine, methadone, and naltrexone.

Further, collaborative relationships between public and private sectors along with active research on treatments of addiction like non-opioid medications and behavioral therapy are further expanding the market.

India is a developing market for treatment, given the rising awareness about substance use disorders and their impact on public health. As for the understated prevalence of opioid misuse over the years, more recent surveys and studies have been done to investigate the rising problem in urban and semi-urban areas due to the increasing availability of illicit opioids like heroin and misused prescription opioids. The increase in dependency is also attributed to socio-economic stressors and a lack of support for mental health.

The government has taken measures to address the issue, notably the NAPDDR (National Action Plan for Drug Demand Reduction), aimed at prevention, treatment, and rehabilitation. As they are now advised to do, both private and public healthcare providers have begun providing MAT options such as buprenorphine and methadone, through Integrated treatment programs.

One of the key growth drivers is the expanding healthcare infrastructure and the mounting investments in addiction rehabilitation centers. Additionally, whether by the government or non-governmental organizations working together, it has been possible to carry out harm reduction activities such as syringe exchange and naloxone distribution.

Another aspect of demand is that there is a growing class of middle-income populations that will demand healthcare, thus solidifying the nature of addiction as a medical condition and growing the market.

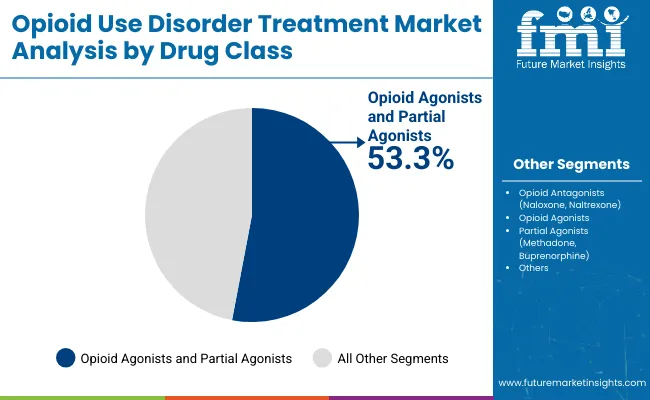

The section contains information about the leading segments in the industry. Based on drug class, the opioid antagonists segment is expected to account for 46.7% of the global share in 2025.

| By Drug Class | Value Share (2025) |

|---|---|

| Opioid Agonists and Partial Agonists | 53.3% |

Opioid antagonists are now leading drugs due to their significant role in the ongoing global opioid crisis and management of opioid-induced disorders. This group of drugs, including naloxone and naltrexone, acts by blocking the effects of opioids on receptors located in the brain, which, therefore, become crucial in reversing opioid overdoses and treating the addiction itself.

With rising indices of opioid misuse-in particular the Americas and Europe market-the utilization of opioid antagonists remains on the rise. Their demand is further supported through governments and healthcare organizations prioritizing the accessibility of such drugs in their harm-reduction strategies.

Moreover, the range of applications for opioid antagonists extends far beyond overdose reversal, into alcohol-dependence management. These combinations broaden the market potential for opioid antagonists. In addition, opioid antagonists have become increasingly used due to the increasing use of combination therapies with other drugs as a more comprehensive treatment for addiction.

With novel developments, including intranasal formulation and auto-injectors, accessibility and ease of use have made them more appealing to both providers and patients alike. Rising public awareness and government initiatives to fight opioid misuse are further strengthening the position of opioid antagonists within the health-care system. With the opioid crisis remaining a paramount global challenge, the ongoing demand for these drugs will be as robust as ever.

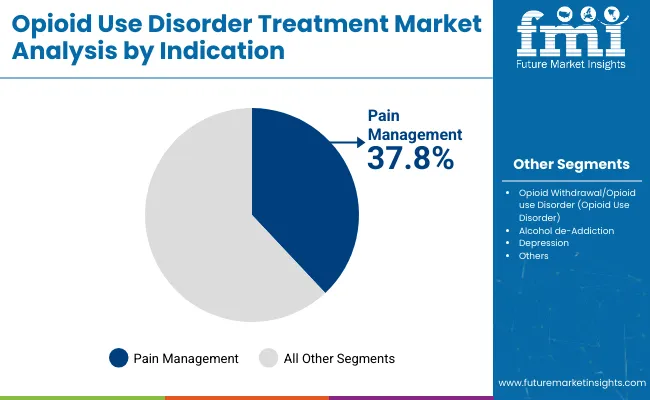

| By Indication | Value Share (2025) |

|---|---|

| Pain Management | 37.80% |

Increasing the demand for holistic pain management approaches have the increased cases of chronic pain conditions, particularly with the aging population. Other improvement areas in drug formulation technology include extended releases and patient-controlled delivery systems that support more effective and convenient modes of pain treatment.

The combination of pharmacological and non-pharmacological methods, which is known as a multimodal pain management approach, has also explored the field of this market.

The opioid use disorder (OUD) treatment market is highly competitive, with several key players driving innovation and market growth. Indivior leads with products like Suboxone and Sublocade, focusing on long-acting therapies and R&D expansion.

Alkermes offers Vivitrol and is investing in improved formulations. Orexo AB markets ZUBSOLV and digital therapeutics such as MODIA, with a push into novel delivery systems. Camurus AB provides long-acting injectables like Buvidal and Brixadi to improve treatment adherence.

Companies are also forming strategic partnerships, integrating digital tools, and expanding into emerging markets to strengthen their competitive positions.

In terms of this market, the companies involved are resorting to multiple strategies to retain a competitive position. Geographical expansion into the emerging markets, particularly United States and Asia Pacific countries, has been another strategic priority for these companies, where growth in the healthcare infrastructure and awareness is strong.

Recent Industry Developments in Opioid Use Disorder Treatment Industry Outlook

In terms of drug class, the industry is divided into opioid antagonists (naloxone, naltrexone), opioid agonists and partial agonists (methadone, buprenorphine)

In terms of indication, the industry is segregated into pain management, opioid withdrawal/opioid use disorder (Opioid Use Disorder), alcohol de-addiction, depression.

In terms of end user, the industry is divided into hospitals, rehabilitation centers, community health clinics and home-based care.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA) have been covered in the report.

The global opioid use disorder treatment industry is projected to witness CAGR of 7.4% between 2025 and 2035.

The global opioid use disorder treatment industry stood at USD 805.2 million in 2024.

The global opioid use disorder treatment industry is anticipated to reach USD 1,747.0 million by 2035 end.

China is expected to show a CAGR of 6.9% in the assessment period.

The key players operating in the global opioid use disorder treatment industry are Alkermes, Indivior, Pfizer, Mallinckrodt Pharmaceuticals, Viatris Inc, Intas Pharmaceuticals, Camaros, Teva Pharmaceutical Industries Ltd., Braeburn Pharmaceuticals, Camurus, Johnson & Johnson, Pear Therapeutics, Purdue Pharma, Titan Pharmaceuticals among others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 31: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MIDDLE EAST AND AFRICA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 142: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MIDDLE EAST AND AFRICA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 149: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 150: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 151: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MIDDLE EAST AND AFRICA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MIDDLE EAST AND AFRICA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MIDDLE EAST AND AFRICA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MIDDLE EAST AND AFRICA Market Attractiveness by Drug Type, 2023 to 2033

Figure 158: MIDDLE EAST AND AFRICA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MIDDLE EAST AND AFRICA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MIDDLE EAST AND AFRICA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Positioning & Share in the Opioid Use Disorder Treatment Sector

Market Share Distribution Among Opioid Use Disorder Treatment Providers in Europe

Australia & NZ Opioid Use Disorder Treatment Market Analysis – Size, Share & Forecast 2025-2035

Opioid Withdrawal Management Market Size and Share Forecast Outlook 2025 to 2035

Opioid Analgesics Market Analysis - Size, Share, and Forecast 2025 to 2035

Opioid-Induced Respiratory Depression Market

Opioid-Induced Constipation (OIC) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Non-opioid Pain Patches Market Size and Share Forecast Outlook 2025 to 2035

Point-of-Care Opioid Testing Market Size and Share Forecast Outlook 2025 to 2035

Global Acetaminophen-Opioid Combination Market Analysis – Size, Share & Forecast 2024-2034

Low and Middle Income Countries Opioid Substitution Therapy Market Analysis by Drug Class, Indication, Distribution Channel, and Region through 2025 to 2035

Used EV Market Size and Share Forecast Outlook 2025 to 2035

Used Commercial Kitchen Equipment Market Size and Share Forecast Outlook 2025 to 2035

Used Restaurant Equipment Market Size and Share Forecast Outlook 2025 to 2035

Used Commercial Freezer Market Size and Share Forecast Outlook 2025 to 2035

Used E-Scooter Market Growth - Trends & Forecast 2024 to 2034

User Retention Software Market

Used Passenger Car Sales Market

Museums Tourism Market Trends – Growth, Demand & Forecast 2025 to 2035

Fuse Combination Unit Market Growth - Trends, Analysis & Forecast by Type, Current Rating, Application, End-use Industry and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA