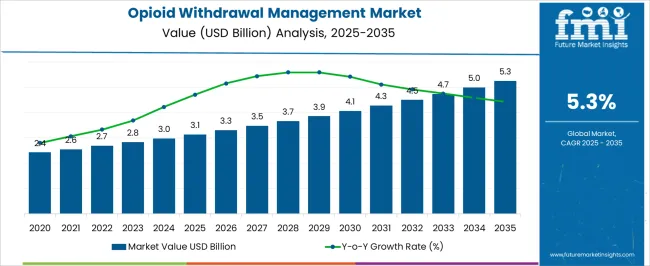

The Opioid Withdrawal Management Market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

| Metric | Value |

|---|---|

| Opioid Withdrawal Management Market Estimated Value in (2025 E) | USD 3.1 billion |

| Opioid Withdrawal Management Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The Opioid Withdrawal Management market is experiencing robust growth, driven by the rising prevalence of opioid dependence and increasing awareness regarding the need for structured withdrawal management programs. The current market scenario reflects heightened demand across hospitals, rehabilitation centers, and outpatient clinics that require clinically validated treatment protocols. In 2025, the market is primarily shaped by the adoption of pharmacological interventions that can safely mitigate withdrawal symptoms while supporting long-term recovery.

Advances in drug formulations, including opioid agonists, have provided more effective and tolerable options for patients, reducing the risks associated with abrupt cessation. The growing focus on patient-centric care, coupled with enhanced healthcare infrastructure and government initiatives aimed at combating the opioid crisis, is expected to support market expansion.

The future outlook is further reinforced by increasing investment in clinical research, growing availability of trained medical professionals, and the integration of telemedicine and digital monitoring tools for improved patient compliance With opioid abuse remaining a public health priority, the market is poised for continued growth, offering opportunities for both pharmaceutical providers and healthcare institutions.

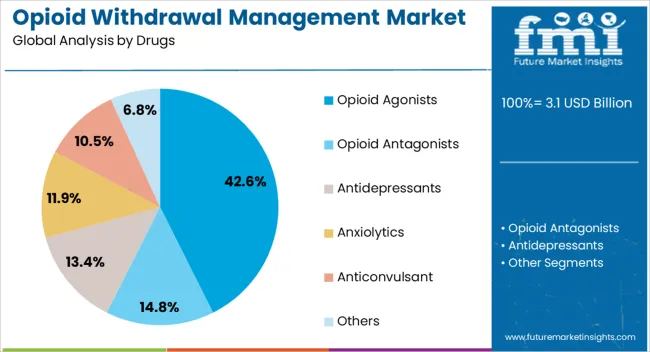

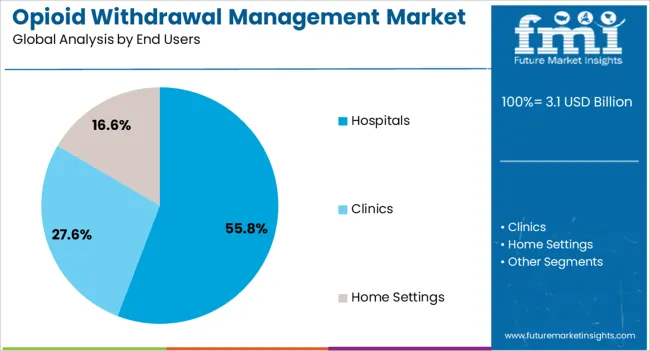

The opioid withdrawal management market is segmented by drugs, end users, and geographic regions. By drugs, opioid withdrawal management market is divided into Opioid Agonists, Opioid Antagonists, Antidepressants, Anxiolytics, Anticonvulsant, and Others. In terms of end users, opioid withdrawal management market is classified into Hospitals, Clinics, and Home Settings. Regionally, the opioid withdrawal management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The opioid agonists segment is projected to hold 42.60% of the Opioid Withdrawal Management market revenue in 2025, establishing it as the leading drug class. This dominance is being driven by its efficacy in managing withdrawal symptoms by partially stimulating opioid receptors to reduce cravings and discomfort. Adoption has been accelerated by their ability to provide a gradual and controlled detoxification process, minimizing the risk of relapse and severe adverse effects.

The segment has benefited from advancements in formulation and delivery methods that improve patient adherence and reduce hospital stay durations. Increased clinical acceptance and standardization of treatment protocols using opioid agonists have also strengthened their market position.

As healthcare providers seek safer and evidence-based solutions for opioid dependency management, these drugs continue to be preferred due to their proven therapeutic outcomes, tolerability, and the ability to integrate into comprehensive treatment programs The segment’s leadership is expected to remain steady as regulatory support and clinical guidelines continue to favor controlled and medically supervised withdrawal approaches.

The hospitals end-use segment is expected to account for 55.80% of the Opioid Withdrawal Management market revenue in 2025, making it the largest consumer of withdrawal management services and drugs. This leading position is being attributed to hospitals’ ability to provide structured inpatient care, continuous monitoring, and access to multidisciplinary medical teams. Hospitals offer an environment where opioid withdrawal can be safely managed under clinical supervision, which is particularly crucial for patients with severe dependency or co-morbid conditions.

Adoption has been encouraged by the increasing prevalence of hospital-based addiction treatment programs and the incorporation of evidence-based pharmacological therapies, including opioid agonists. Enhanced training of healthcare personnel and improved hospital infrastructure have further supported the growth of this segment.

In addition, hospitals benefit from established protocols for managing complications, administering detoxification drugs, and coordinating post-discharge rehabilitation plans As awareness of opioid-related health risks rises and the demand for medically supervised withdrawal services expands, the hospital segment is expected to maintain its dominant position, driven by patient preference for safe, comprehensive, and clinically guided treatment environments.

Opioid withdrawal management, is the treatment with drugs to manage and reduce the intensity of bio physiological withdrawal symptoms associated with dependence or addiction to opioids and to reduce the chances of relapse. Addiction is the compulsive and uncontrollable use of drugs for non-medical uses despite adverse consequences. Dependence is the adaption of body to the presence of a drug, resulting in withdrawal symptoms when drug use is discontinued.

The physiological opioid withdrawal symptoms include Muscle aches, pain, spasms, Involuntary movements, Mild hypertension, and others. The psychological opioid withdrawal symptoms include agitation, anxiety, panic, restlessness, rapid heart rate, seizures, fear, paranoia and others. Thus opioid withdrawal management aids the patient to avoid relapsing and to quit opioid addiction and dependence with minimal discomfort.

The explosive use of opioids for management of pain, opioid abuse resulting from illegal use coupled with the perverse incentives and misdirection by pharmaceutical pain management companies are the driving factors for the market.

The National Institute on Drug Abuse and the Centers for Disease Control and Prevention, have declared that the USA is in the midst of an opioid epidemic. USA consumes about 80% of global opioids although it has less than 5% of the world's population. Concerns about Opioid overdose related deaths which accounted for 49,000 of the 72,000 drug overdose deaths in the USA. in 2025 alone has generated a lot of market enthusiasm. According to the center of disease control, around 66% of the more than 63,600 drug overdose deaths in 2025 involved an opioid and on average, 115 Americans die every day from an opioid overdose

This has resulted in a cry from the media resulting in growing stringency of regulations. According to the center of disease control, the sharpest increase among the 72,000 drug overdose deaths in 2025, were related to fentanyl and analogs at nearly 30,000. The development of withdrawal clinics and the growing success of opioid withdrawal treatment especially the development of non-opioid drugs for the treatment and mitigation of opioid withdrawal symptoms is driving a faster adoption. Work place policies such as zero tolerance policies for substance abuse, regular check-ups and screening is another driver of the market.

The unfortunate reality of the prospering drug trade traversing international borders, the spread of heroin abuse has further stimulated the market. According to the national institute of drug abuse, almost 2.1 million people in the USA suffer from prescription opioid pain medicines related substance use disorder related in 2025 with only 17.5 percent receiving treatment.

A large market enthusiasm has been generated by the approval of lofexidine, the first drug intended for reducing symptoms associated with opioid withdrawal by the USA Food and Drug Administration. However, the social stigma associated with opioid addiction, discriminating and strict workplace rules and the lower success rate of Opioid withdrawal management is hampering the market.

The global market for opioid withdrawal management is expected to charge owing to growing stringency of regulations. For example, on 12 December 2006, the USA President signed the Bill H.R.6344, under which the physician holding rights to prescribe opioid would have to provide opioid dependence treatment to up to 100 patients (previously 30).

Medicare, Medicaid, and other government organizations pay or supplemented payments for opioid withdrawal management treatment in almost 80% of the population. Private health insurance supplements the remaining 30% of the population. Togeather they account for large market equity for the players operating in the opioid withdrawal management market. The market trends include a definite shift in favor of developing regions of Asia Pacific, such as India and China.

The global opioid withdrawal management market can be classified into the following region: North America, Latin America, Western Europe, Eastern Europe, Asia-Pacific, Japan, Middle East and Africa. North America, led by the USA, is expected to account for the largest share in the global opioid withdrawal management market, owing to the large use of opioids, large healthcare expenditure, and large per capita income in the region.

The Asia Pacific opioid withdrawal management market excluding Japan is projected to expand and dominate the scene in the near future, owing to the growing healthcare and detoxification clinics.

China and India are anticipated to account for the major share of the Asia Pacific opioid withdrawal management market growth. Germany, France and the UK, are projected to be the largest drivers of the Europe opioid withdrawal management market. The Middle East and Africa Opioid withdrawal management market is anticipated to be dominated by the gulf economies of Saudi Arabia, Kuwait, UAE and Qatar.

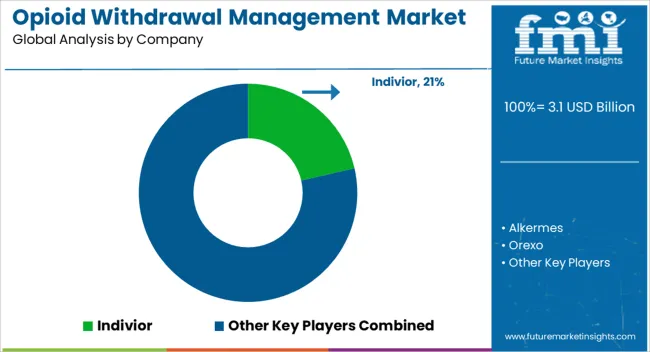

Some of the major vendors operating in the global opioid withdrawal management market are Alkermes, Inc., Orexo AB, Ethypharm, Indivior PLC, Mylan Pharmaceuticals Inc., Sun Pharmaceutical Industries, Inc., Teva Pharmaceuticals USA, Inc., Dr. Reddy's Laboratories, Indivior PLC, BioDelivery Sciences International , Inc., Rhodes Pharmaceuticals L.P., Hikma Pharmaceuticals USA Inc., Actavis Elizabeth LLC, Mallinckrodt Pharmaceuticals and others.

The global opioid withdrawal management report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

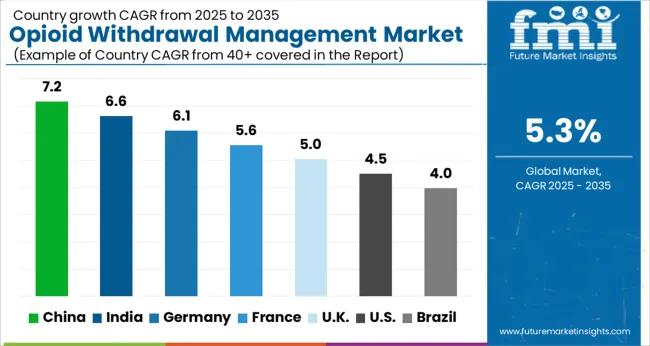

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The Opioid Withdrawal Management Market is expected to register a CAGR of 5.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.2%, followed by India at 6.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.0%, yet still underscores a broadly positive trajectory for the global Opioid Withdrawal Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.1%. The USA Opioid Withdrawal Management Market is estimated to be valued at USD 1.1 billion in 2025 and is anticipated to reach a valuation of USD 1.8 billion by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 164.1 million and USD 90.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Drugs | Opioid Agonists, Opioid Antagonists, Antidepressants, Anxiolytics, Anticonvulsant, and Others |

| End Users | Hospitals, Clinics, and Home Settings |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Indivior, Alkermes, Orexo, Financiere Verdi, Mylan, Sun Pharmaceutical Industries, Teva, Dr. Reddy’s Laboratories, BioDelivery Sciences, Rhodes Pharmaceuticals, Hikma Pharmaceuticals, Actavis Elizabeth, and Mallinckrodt Pharmaceuticals |

The global opioid withdrawal management market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the opioid withdrawal management market is projected to reach USD 5.3 billion by 2035.

The opioid withdrawal management market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in opioid withdrawal management market are opioid agonists, opioid antagonists, antidepressants, anxiolytics, anticonvulsant and others.

In terms of end users, hospitals segment to command 55.8% share in the opioid withdrawal management market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA