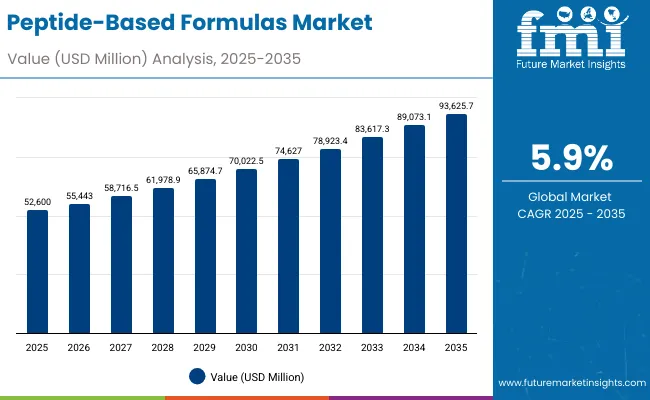

The peptide-based formulas market is projected to grow from USD 52.6 billion in 2025 to USD 93.62 billion by 2035, recording an absolute increase of USD 41 billion over the forecast period. Growth is driven by increasing global demand for specialized nutritional solutions, growing adoption of peptide-based formulations in clinical nutrition applications, and rising health consciousness across the global healthcare and nutrition sectors.

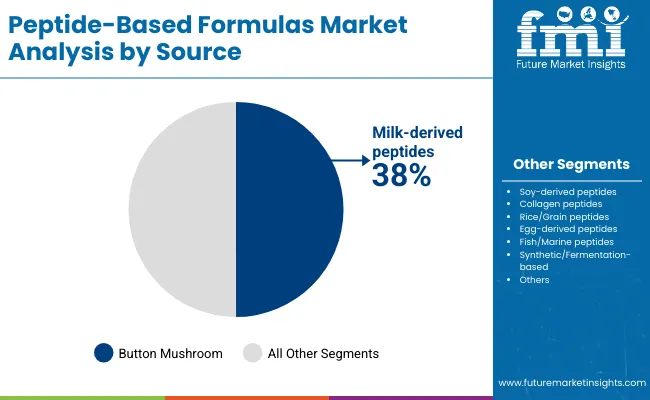

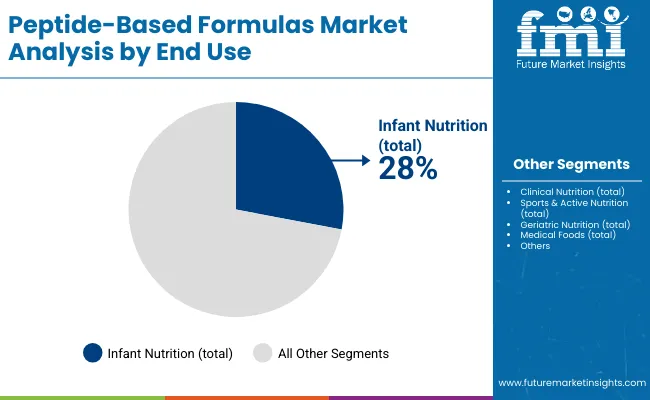

Peptide-based formulas offer superior bioavailability, enhanced gastrointestinal tolerance, and optimized absorption rates, making them suitable for clinical nutrition applications, infant formula manufacturing, and specialized therapeutic feeding programs. Milk-derived peptides account for the largest share at 38% due to proven clinical effectiveness, established safety profiles, and compatibility with standard nutritional formulations, while synthetic and fermentation-based systems support specialized therapeutic applications requiring precise molecular specifications. Infant nutrition applications represent the dominant share of demand at 28%, followed by clinical nutrition programs as manufacturers expand specialized feeding solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 52.6 billion |

| Industry Value (2035F) | USD 93.62 billion |

| CAGR (2025 to 2035) | 5.9% |

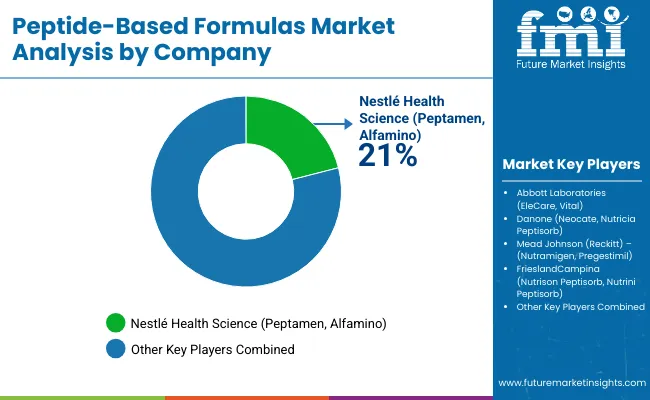

Asia Pacific, particularly India and China, leads growth due to expanding healthcare infrastructure and nutritional awareness, while North America and Europe show steady demand supported by established clinical nutrition operations. Competition in the peptide-based formulas market remains moderately consolidated, with key companies such as Nestlé Health Science, Abbott Laboratories, and Danone focusing on advanced bioavailability technologies, specialized formulation systems, and clinical validation capabilities to strengthen market positioning.

Manufacturing consolidation defines competitive dynamics as processors manage complex bioavailability specifications while maintaining cost-effective production capabilities. Major formula companies including Nestlé Health Science, Abbott Laboratories, and Danone control significant market share through vertical integration strategies that secure peptide supply chains and quality control systems. These companies leverage established regulatory approval pathways across multiple countries to maintain comprehensive market access.

Supply chain coordination challenges affect smaller manufacturers who lack comprehensive procurement capabilities needed to secure consistent peptide supplies across multiple source categories. Raw material price volatility creates particular difficulties for processors serving price-sensitive segments while maintaining quality specifications required for clinical applications. Established companies maintain supplier relationships spanning multiple years to ensure supply consistency and manage foreign exchange risks affecting international sourcing.

Regulatory compliance costs affect market entry strategies as companies navigate diverse approval requirements across multiple countries and application categories. European Union novel food regulations create barriers for innovative peptide ingredients while establishing quality standards that favor established processors over imports. United States FDA requirements emphasize comprehensive safety documentation and manufacturing practice compliance.

Innovation focus areas include bioavailability enhancement technologies, specialized formulations for therapeutic applications, and processing efficiency improvements that reduce manufacturing costs while maintaining quality standards. Companies developing application-specific peptide grades with documented performance benefits maintain competitive advantages in premium market segments where technical specifications drive purchasing decisions rather than price considerations alone.

| NUTRITIONAL & HEALTH TRENDS | MANUFACTURING REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Source | Milk-derived peptides, Soy-derived peptides, Collagen peptides, Rice/Grain peptides, Egg-derived peptides, Fish/marine peptides, Synthetic/fermentation-based peptides |

| By End Use | Infant Nutrition (Hypoallergenic Infant Formula, Preterm Infant Formula), Clinical Nutrition (Oncology Nutrition, Malabsorption/IBD, Critical Care), Sports & Active Nutrition (Muscle Recovery, Lean Mass Gain), Geriatric Nutrition (Sarcopenia Management, General Aging Support), Medical Foods (Metabolic Disorders, Post-operative Recovery) |

| By Product Format | Ready-to-Drink Liquid, Powder, Concentrate, Semi-solid |

| By Sales Channel | Hospital/Institutional Supply, Retail Pharmacies, Online Channels, Specialty Nutrition Stores, Direct-to-Consumer (DTC) |

| By Region | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

Milk-derived peptides will remain the anchor of the market through 2035 with a 38% share in 2025 and broad applicability across infant nutrition, clinical formulations and specialized therapeutic products. Their established supply chains and predictable functional performance support steady to strong momentum, although exposure to raw material price volatility remains a structural risk. Soy-derived peptides will expand at about 6.8% annually as plant-based nutrition gains mainstream adoption and demand for hypoallergenic formulations rises.

Synthetic and fermentation-based peptides represent the fastest growing category at roughly 8.8% a year, supported by advances in precision manufacturing and increasing use in targeted therapeutic applications, but manufacturers face higher qualification requirements and greater process complexity. Collagen peptides will grow at an estimated 7.2% annually driven by continued uptake in geriatric nutrition and sports recovery products, with momentum concentrated in premium segments that favor documented performance benefits and consistent quality.

Infant nutrition will remain the largest application segment with a 28% share in 2025, supported by long-standing integration of peptides into specialized formulas. Hypoallergenic products account for 65% of this segment, and growth will continue at around 6.6% a year as clinical recommendations increasingly favor peptide-based options for sensitive infants. The main risk centers on regulatory changes that could alter permissible formulations. Clinical nutrition will expand at roughly 7.3% annually, driven by oncology and malabsorption applications that dominate demand within this category. Momentum is expected to remain strong through 2030 as clinical awareness rises, although reimbursement policy adjustments could influence adoption in hospital settings.

Sports and active nutrition is the fastest-growing major segment at about 7.8% a year, underpinned by demand for muscle recovery and high-absorption performance products. Growth is robust but subject to evolving regulatory requirements governing sports claims and ingredient compliance. Geriatric nutrition will grow at about 7.6% annually, with sarcopenia management representing 55% of segment demand. Expansion is supported by demographic trends and rising nutritional awareness, although growth is more moderate than in performance segments.

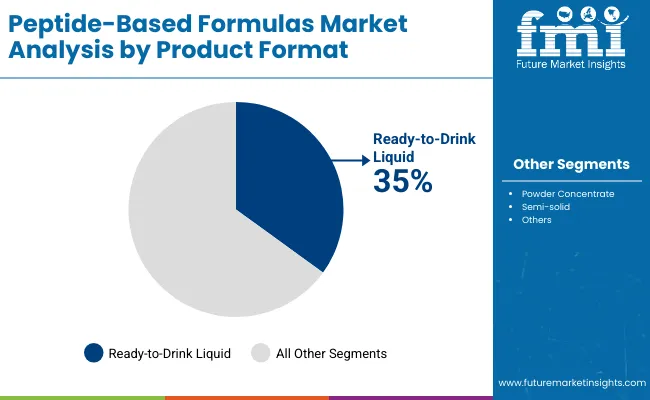

Powder will remain the dominant format with a 45% share in 2025, supported by its suitability for clinical and infant nutrition formulations, longer shelf life and manufacturing efficiency. Growth is expected to continue at about 6.6% a year, although moisture sensitivity can create handling challenges in certain environments.

Ready to drink liquid formulas hold a 35% share and require specialized processing capabilities, but their convenience and immediate consumption benefits position them for strong growth of around 7.4% annually as demand rises in both clinical and performance settings. Concentrates will expand at roughly 7% a year, driven by institutional and clinical applications that require precise dosing and custom concentrations. Growth is steady but concentrated in specialized use cases where controlled formulation is a priority.

Global health awareness is expanding across both mature and emerging markets, creating sustained demand for nutritional formulas that offer higher bioavailability and better gastrointestinal tolerance. Aging populations reinforce this trend as clinicians increasingly rely on peptide-based delivery systems to improve absorption and support specialized nutritional needs, particularly in chronic care and recovery settings. Demand for premium formulas continues to rise as hospitals and manufacturers prioritize products that combine performance benefits with processing efficiency.

Manufacturers face several constraints that shape competitive dynamics. Raw material price volatility affects cost structures and complicates long-term supply planning, while the technical complexity of peptide formulations raises development costs and slows standardization. Qualification requirements across clinical, infant and therapeutic applications can extend validation timelines, and competing nutritional delivery technologies occasionally divert demand in cost-sensitive markets.

Industry trends point toward deeper technical specialization. Advances in processing technologies are improving operational efficiency and enabling tighter control of peptide characteristics. Performance enhancement remains a central theme as companies prioritize absorption profiles and digestive tolerance that outperform traditional formulas. Specialized formulations tailored to distinct clinical and nutritional needs are gaining traction, supported by continued innovation in peptide development and more sophisticated processing management systems.

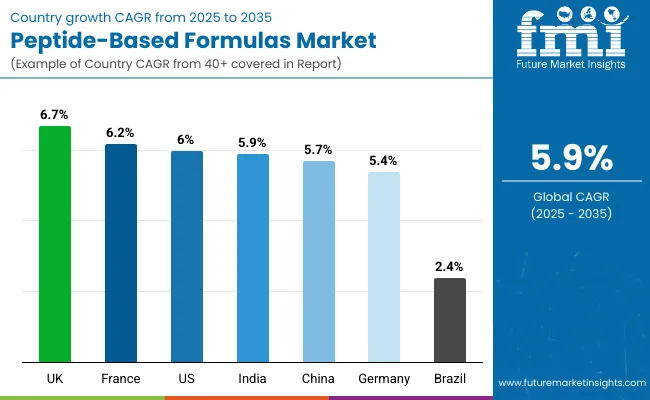

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

| China | 5.7% |

| UK | 6.7% |

| France | 6.2% |

| USA | 6.0% |

| Germany | 5.4% |

Revenue from peptide-based formulas in India is projected to exhibit strong growth driven by expanding health consciousness infrastructure and comprehensive nutritional formula innovation creating opportunities for peptide suppliers across clinical nutrition operations, infant formula applications, and specialized therapeutic sectors. The country's developing nutritional manufacturing tradition and expanding healthcare capabilities are creating demand for both conventional and high-performance peptide-based ingredients. Major formula companies are establishing comprehensive local peptide processing facilities to support large-scale manufacturing operations and meet growing demand for efficient nutritional solutions.

Revenue from peptide-based formulas in China is expanding supported by extensive formula manufacturing expansion and comprehensive nutritional processing industry development creating demand for reliable peptide ingredients across diverse manufacturing categories and specialized therapeutic segments. The country's dominant formula production position and expanding nutritional manufacturing capabilities are driving demand for peptide solutions that provide consistent performance while supporting cost-effective processing requirements. Nutritional processors and manufacturers are investing in local production facilities to support growing manufacturing operations and formula demand.

Demand for peptide-based formulas in UK is projected to grow supported by the country's expanding clinical nutrition manufacturing base and nutritional processing technologies requiring advanced peptide systems for formula production and therapeutic applications. British formula companies are implementing processing systems that support advanced manufacturing techniques, operational efficiency, and comprehensive quality protocols. The market is characterized by focus on operational excellence, nutritional performance, and compliance with clinical nutrition quality standards.

Revenue from peptide-based formulas in France is growing driven by advanced clinical nutrition development programs and increasing nutritional technology innovation creating opportunities for peptide suppliers serving both formula operations and therapeutic contractors. The country's extensive healthcare base and expanding clinical awareness are creating demand for peptide ingredients that support diverse performance requirements while maintaining processing performance standards. Formula manufacturers and specialty ingredient service providers are developing procurement strategies to support operational efficiency and regulatory compliance.

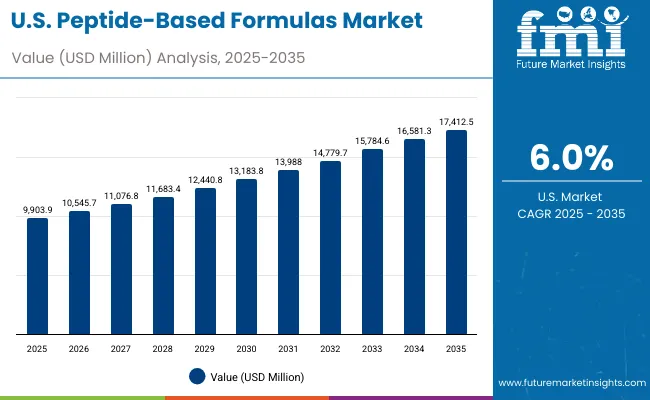

Demand for peptide-based formulas in the USA is projected to grow at around 6.0% CAGR over 2025-2035, underpinned by a mature reimbursement environment, hospital-driven purchasing models, and a large sports and performance nutrition ecosystem. The market is shaped by payor coverage decisions, formulary inclusion in hospitals, and a regulatory regime that clearly distinguishes between conventional foods, dietary supplements, and medical foods under FDA oversight.

Demand for peptide-based formulas in Germany is projected to grow driven by advanced formula manufacturing excellence and specialty peptide capabilities supporting nutritional development and comprehensive clinical applications. The country's established nutritional processing tradition and growing performance nutrition market segments are creating demand for high-quality peptide ingredients that support operational performance and nutritional standards.

Demand for peptide-based formulas in Brazil is projected to grow driven by expanding nutritional manufacturing capabilities and developing peptide processing infrastructure supporting clinical applications and infant nutrition requirements. The country's growing healthcare awareness and nutritional development programs are creating opportunities for peptide suppliers serving regional manufacturing operations.

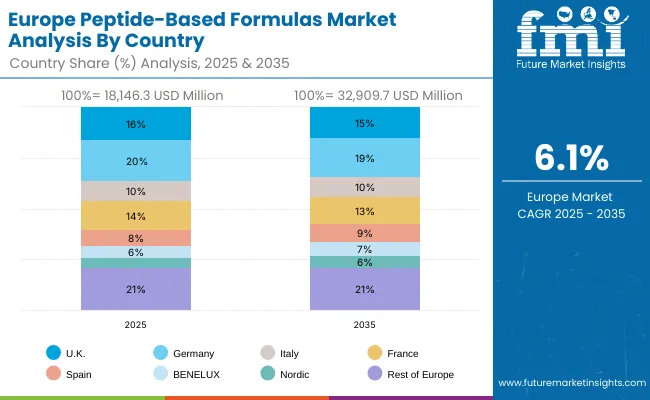

European peptide-based formulas operations are increasingly polarized between Western European precision processing and Eastern European cost-competitive manufacturing. German (USD 6,267.9 million) and UK facilities (USD 5,264.6 million) dominate premium clinical nutrition and infant formula peptide processing, leveraging advanced nutritional technologies and strict quality protocols that command price premiums in global markets. German processors maintain leadership in high-performance peptide applications, with major formula companies driving technical specifications that smaller suppliers must meet to access supply contracts.

The regulatory environment presents both opportunities and constraints. EU Novel Food regulations and clinical nutrition directives create barriers for novel peptide ingredients but establish quality standards that favor established European processors over imports. Brexit has fragmented UK sourcing from EU suppliers, creating opportunities for direct relationships between processors and British formula manufacturers.

Supply chain consolidation accelerates as processors seek economies of scale to absorb rising energy costs and compliance expenses. Vertical integration increases, with major formula manufacturers acquiring processing facilities to secure peptide supplies and quality control. Smaller processors face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream clinical nutrition manufacturing requirements.

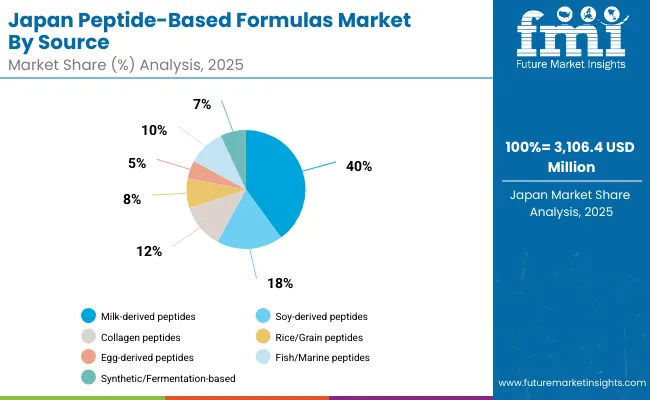

Japanese Peptide-Based Formulas operations reflect the country's exacting quality standards and sophisticated nutritional expectations. Major formula manufacturers maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, batch testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium product positioning.

The Japanese market demonstrates unique application preferences with Clinical Nutrition accounting for 30.0%, Infant Nutrition 25.0%, Sports & Active Nutrition 20.0%, Geriatric Nutrition 18.0%, and Medical Foods 7.0%. Companies require specific peptide ratios and purity specifications that differ from Western applications, driving demand for customized processing capabilities.

Japanese market demonstrates unique source preferences with Milk-derived peptides accounting for 40.0%, Soy-derived peptides 18.0%, Collagen peptides 12.0%, Rice/Grain peptides 8.0%, Fish/Marine peptides 10.0%, Egg-derived peptides 5.0%, and Synthetic/Fermentation-based 7.0%. Companies require specific molecular binding and bioavailability specifications that differ from Western applications, driving demand for customized peptide capabilities.

Regulatory oversight emphasizes comprehensive nutritional ingredient management and traceability requirements that surpass most international standards. The clinical nutrition registration system requires detailed ingredient sourcing information, creating advantages for suppliers with transparent supply chains and comprehensive documentation systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese companies typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing quality consistency over price competition. This stability supports investment in specialized processing equipment tailored to Japanese specifications.

South Korean Peptide-Based Formulas operations reflect the country's advanced clinical nutrition sector and export-oriented business model. Major formula companies drive sophisticated ingredient procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and pricing for their clinical nutrition and infant formula operations targeting both domestic and international markets.

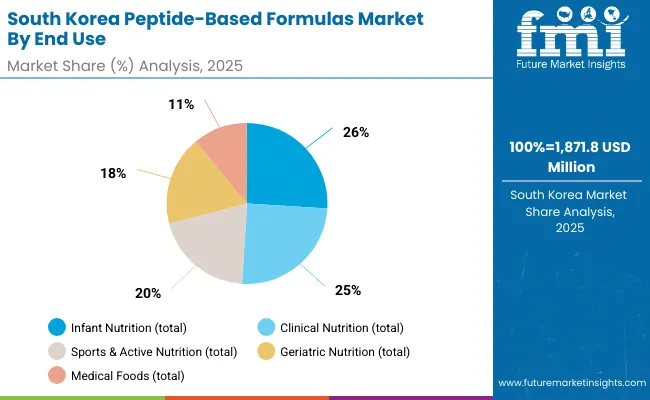

The Korean market demonstrates particular strength in application distribution with Clinical Nutrition accounting for 25.0%, Infant Nutrition 26.0%, Sports & Active Nutrition 20.0%, Geriatric Nutrition 18.0%, and Medical Foods 11.0%. This health-focused approach creates demand for specific bioavailability specifications that differ from Western applications, requiring suppliers to adapt peptide processing and purification techniques.

Regulatory frameworks emphasize nutritional ingredient safety and traceability, with Korean food administration standards often exceeding international requirements. This creates barriers for smaller formula suppliers but benefits established processors who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with comprehensive certification and documentation systems.

Supply chain efficiency remains critical given Korea's geographic limitations and import dependence. Companies increasingly pursue long-term contracts with suppliers in United States, Germany, and Japan to ensure reliable access to raw materials while managing foreign exchange risks. Technical logistics investments support quality preservation during extended shipping periods.

The market faces pressure from rising labor costs and competition from lower-cost regional manufacturers, driving automation investments and consolidation among smaller processors. However, the premium positioning of Korean formula brands internationally continues to support demand for high-quality peptide ingredients that meet stringent specifications.

Profit pools are consolidating upstream in scaled peptide production systems and downstream in value-added specialty grades for infant nutrition, clinical nutrition, and therapeutic applications where certification, traceability, and consistent bioavailability command premiums. Value is migrating from raw peptide commodity trading to specification-tight, application-ready peptide formulations where technical expertise and quality control drive competitive advantage.

Several archetypes set the pace: global nutritional integrators defending share through production scale and technical reliability; multi-application processors that manage complexity and serve diverse segments; specialty peptide developers with formulation expertise and clinical industry ties; and bioavailability-driven suppliers pulling volume in premium clinical and therapeutic applications.

Switching costs including re-qualification, bioavailability testing, performance validation, provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers. Consolidation and verticalization continue; digital procurement emerges in commodity grades while premium specifications remain relationship-led. Focus areas: lock clinical and nutrition pipelines with application-specific grades and service level agreements; establish multi-application production capabilities and technical disclosure; develop specialized peptide formulations with bioavailability claims.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global nutritional integrators | Scale, production integration, technical reliability | Long-term contracts, tight specs, co-development with clinical/nutrition |

| Multi-application processors | Application diversification, segment expertise, supply flexibility | Multi-segment serving, technical support, quality assurance across applications |

| Specialty peptide developers | Formulation expertise and industry relationships | Custom formulations, bioavailability science, performance SLAs |

| Bioavailability suppliers | Application-focused demand and specialized service | Technical bioavailability claims, specialized formulations, application activation |

| Nutritional distributors & platforms | Technical support for mid-tier manufacturers | Application selection, smaller volumes, technical service |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD Billion |

| Source | Milk-derived peptides, Soy-derived peptides, Collagen peptides, Rice/Grain peptides, Egg-derived peptides, Fish/marine peptides, Synthetic/fermentation-based peptides |

| End Use | Infant Nutrition (Hypoallergenic Infant Formula, Preterm Infant Formula), Clinical Nutrition (Oncology Nutrition, Malabsorption/IBD, Critical Care), Sports & Active Nutrition (Muscle Recovery, Lean Mass Gain), Geriatric Nutrition (Sarcopenia Management, General Aging Support), Medical Foods (Metabolic Disorders, Post-operative Recovery) |

| Product Format | Ready-to-Drink Liquid, Powder, Concentrate, Semi-solid |

| Sales Channel | Hospital/Institutional Supply, Retail Pharmacies, Online Channels, Specialty Nutrition Stores, Direct-to-Consumer (DTC) |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, South Korea, France, UK, Brazil, and other 40+ countries |

| Key Companies Profiled | Nestlé Health Science, Abbott Laboratories, Danone, Mead Johnson (Reckitt), FrieslandCampina |

| Additional Attributes | Dollar sales by source/end use/product format/sales channel, regional demand (NA, EU, APAC), competitive landscape, powder vs. liquid adoption, production/processing integration, and advanced processing innovations driving bioavailability enhancement, technical advancement, and efficiency |

The market is valued at USD 52.6 billion in 2025 and is projected to reach USD 93.62 billion by 2035, growing at a 5.9% CAGR.

Milk-derived peptides (38%) lead due to established safety, clinical evidence, and compatibility with major nutritional formulations.

Infant nutrition (28%) is the largest segment, followed by clinical nutrition, sports & active nutrition, and geriatric nutrition. Hypoallergenic and preterm formulas drive infant nutrition demand.

Powder formulas (45%) dominate due to formulation flexibility, longer shelf life, and established use in clinical and infant nutrition products.

Growth is led by Asia Pacific especially India (5.9% CAGR) and China (5.7% CAGR) supported by expanding healthcare infrastructure. The UK (6.7%) and France (6.2%) also show strong momentum.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Psoriasis Care Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Coconut Water-Based Formulas Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Mimetic Silk Protein Formulas Market Size and Share Forecast Outlook 2025 to 2035

Resveratrol Enriched Formulas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA