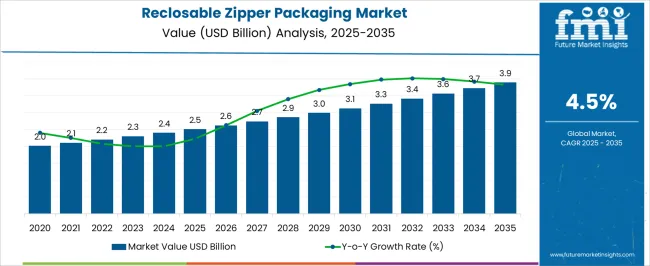

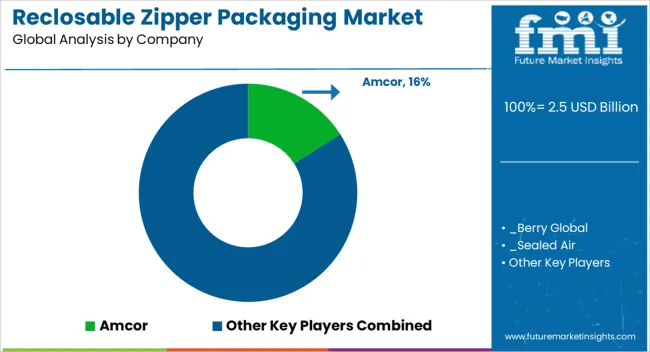

The reclosable zipper packaging market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

Between 2025 and 2030, the market is projected to move from USD 2.5 billion to USD 3.1 billion, reflecting a gradual yet steady curve. The consistent rise highlights growing demand for packaging formats that offer consumer convenience, product safety, and reusability. Food and beverage applications remain the primary growth driver, with reclosable zippers gaining popularity for their role in maintaining freshness and extending shelf life. This stage of expansion indicates a predictable and stable growth path, where adoption is guided by practicality and value addition across multiple industries. From 2030 to 2035, the market will continue its upward trajectory, expanding from USD 3.1 billion to USD 3.9 billion.

The growth curve here reflects a smooth and steady shape, underscoring the long-term reliability of this packaging solution in retail, household, and personal care sectors. Demand is being fueled by consumer preference for packaging that balances convenience with durability, while manufacturers are focusing on designs that enhance usability and product protection. The steady slope of the curve illustrates a balanced market outlook, with opportunities arising from the integration of zipper formats into new packaging categories. This growth pattern suggests that reclosable zipper packaging will remain a preferred solution for both manufacturers and consumers, maintaining its position as a practical and reliable packaging choice.

| Metric | Value |

|---|---|

| Reclosable Zipper Packaging Market Estimated Value in (2025 E) | USD 2.5 billion |

| Reclosable Zipper Packaging Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The reclosable zipper packaging market secures a relevant share across several broader packaging industries, with its positioning shaped by convenience, product protection, and consumer usability. Within the flexible packaging market, reclosable zipper formats contribute around 8%, highlighting their importance in pouches, bags, and films that prioritize ease of use. In the plastic packaging market, the share stands at nearly 6%, as zippers are integrated into polyethylene and polypropylene-based packs used widely in multiple product categories. In the food and beverage packaging market, reclosable zipper packaging accounts for about 10%, reflecting its extensive application in snacks, dairy, frozen foods, and beverages where resealability ensures freshness and portion control. Within the consumer goods packaging market, the segment represents close to 5%, supporting personal care, household products, and pet foods where reclosable systems provide added value.

Lastly, in the sustainable and convenience packaging market, reclosable zipper packaging holds a share of nearly 7%, since its reusability helps reduce wastage and extends product usability compared to single-use formats. Together, these percentages illustrate that reclosable zipper packaging has its strongest positioning in food and beverage packaging and flexible formats, where the demand for resealability is highest. Its moderate presence in consumer goods and plastics indicates scope for expansion as convenience-driven packaging continues to influence both retail and industrial packaging choices globally.

The market is experiencing sustained growth as demand rises across industries for flexible, reusable, and convenient packaging formats. Increasing consumer preference for packaging that preserves product freshness and supports portion control has driven adoption, particularly in food and beverage, personal care, and household product categories.

The growing focus on reducing single-use plastics and enhancing sustainability has accelerated the shift toward recyclable and reusable zipper packaging solutions. Technological advancements in zipper closure mechanisms and material science have enabled higher durability, leak resistance, and compatibility with automated packaging lines.

Regulatory initiatives promoting eco-friendly packaging and the expansion of e-commerce are further contributing to market growth, as reclosable zipper formats offer both product protection and ease of use in shipping The market outlook remains positive, with innovation in material types, zipper designs, and application-specific features expected to create new opportunities and strengthen adoption across multiple sectors.

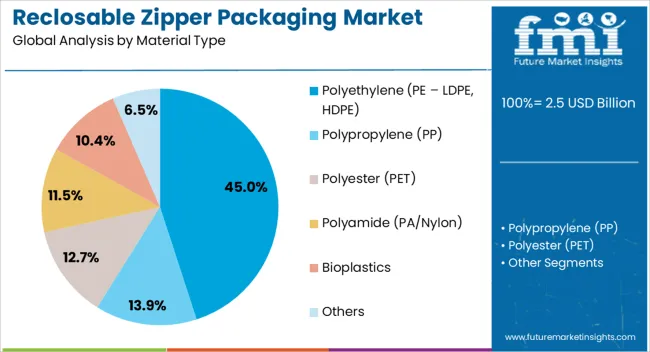

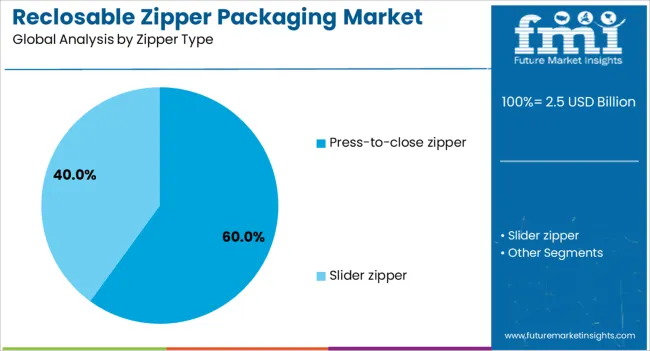

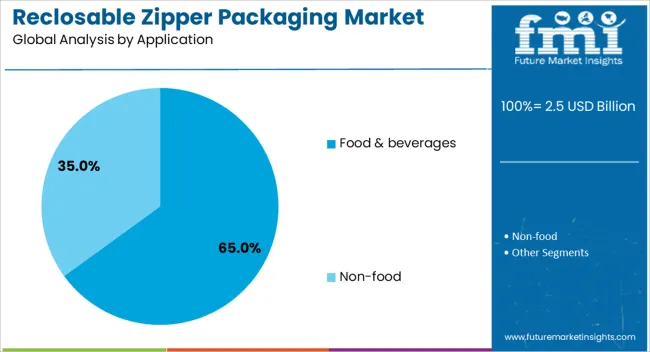

The reclosable zipper packaging market is segmented by material type, zipper type, application, and geographic regions. By material type, reclosable zipper packaging market is divided into polyethylene (PE – LDPE, HDPE), polypropylene (PP), polyester (PET), polyamide (PA/Nylon), bioplastics, and others. In terms of zipper type, reclosable zipper packaging market is classified into press-to-close zipper and slider zipper. Based on application, reclosable zipper packaging market is segmented into food & beverages and non-food. Regionally, the reclosable zipper packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene segment, including LDPE and HDPE variants, is projected to hold 45% of the reclosable zipper packaging market revenue share in 2025, making it the leading material type. Its dominance is attributed to its versatility, cost-effectiveness, and proven performance in preserving product integrity. Polyethylene offers excellent moisture resistance, flexibility, and compatibility with a variety of products, which has made it a preferred choice for manufacturers across food, personal care, and industrial sectors.

The material’s ability to be recycled has also supported its adoption in line with growing sustainability demands. LDPE provides softness and clarity for retail presentation, while HDPE delivers greater strength and barrier properties for heavier or bulk packaging needs.

The adaptability of polyethylene to various printing and sealing techniques further enhances brand visibility and consumer appeal Its compatibility with modern zipper closure systems ensures ease of manufacturing, making it a reliable and widely accepted option in the reclosable packaging industry.

The press-to-close zipper type is anticipated to command 60% of the market revenue share in 2025, securing its position as the leading zipper type. Its growth has been supported by the convenience it offers to consumers through easy opening and secure resealing, which preserves product freshness and prevents spillage.

This zipper type is widely adopted in flexible packaging for food, personal care, and household products due to its low production cost, ease of integration into existing packaging lines, and compatibility with various film materials. The durability and repeated usability of press-to-close zippers enhance product value perception, contributing to stronger brand loyalty.

In addition, advancements in closure design have improved tactile feedback and sealing reliability, addressing consumer demand for both functionality and ease of use As brands increasingly focus on packaging that combines practicality with a premium user experience, the press-to-close zipper format continues to strengthen its market leadership.

The food and beverages segment is expected to account for 65% of the market revenue share in 2025, making it the largest application category. This growth is driven by the rising demand for packaging that extends shelf life, maintains product quality, and supports portion control in both retail and food service channels. Reclosable zipper packaging offers consumers the convenience of resealing products such as snacks, dairy items, frozen foods, and beverages without compromising freshness.

The format also supports brand differentiation through customizable printing and design options that enhance shelf appeal. Regulatory emphasis on food safety and the reduction of food waste has further propelled adoption in this sector.

Additionally, the growth of online grocery shopping and direct-to-consumer food delivery has increased the need for secure yet user-friendly packaging solutions As health-conscious consumers and busy lifestyles continue to shape purchasing habits, reclosable zipper packaging is expected to remain the preferred choice in the food and beverage industry.

The reclosable zipper packaging market is expanding as convenience, product freshness, and consumer-friendly formats drive adoption across food, personal care, and e-commerce sectors. Opportunities are growing in online retail and frozen foods, while trends highlight flexible formats, premium branding, and packaging differentiation. Challenges remain in recyclability, rising raw material costs, and compliance with stricter packaging regulations. In my opinion, the most successful companies will be those that balance cost efficiency with innovation, offering recyclable and customizable zipper solutions that meet evolving consumer and regulatory expectations globally.

Demand for reclosable zipper packaging has been reinforced by consumer preference for convenience, portion control, and product freshness. Food, beverage, and personal care sectors rely heavily on resealable pouches and bags to maintain product integrity after opening. Retailers favor such packaging for its ability to reduce waste and improve storage efficiency. In my opinion, demand will continue to grow as households and industries increasingly prefer flexible formats that balance practicality with product protection, making reclosable zipper packaging a vital element in modern packaging strategies.

Opportunities are most evident in packaged food, pet care, and e-commerce shipments, where reclosable zipper packaging offers portability and product protection. Growth in online shopping has boosted demand for durable, resealable formats that enhance consumer experience and minimize product damage during delivery. Expanding applications in frozen foods, ready-to-eat meals, and snack packaging further add to the potential. I believe companies that innovate in barrier coatings, tamper-evident seals, and customizable zipper solutions will unlock significant opportunities, particularly in competitive retail and rapidly growing online food delivery markets.

Trends in this market highlight the growing adoption of flexible packaging formats combined with consumer-driven demand for premium appeal. Brands are using reclosable zippers to enhance packaging aesthetics, functionality, and shelf presence. Transparent windows, tactile finishes, and ergonomic designs are shaping buyer perceptions and influencing purchase decisions. Growth of stand-up pouches with advanced zipper mechanisms is another visible trend. In my opinion, these developments show that reclosable zipper packaging is no longer just functional but also a branding tool, helping companies achieve stronger differentiation in crowded marketplaces.

Challenges in reclosable zipper packaging revolve around recycling difficulties, as multi-layer laminates and zipper components complicate material recovery. Rising raw material prices and cost pressures impact profitability for manufacturers. Smaller businesses often face barriers in adopting premium zipper technologies due to higher production costs. Regulatory scrutiny over single-use plastics creates another layer of uncertainty. In my assessment, companies that focus on material innovation, recyclable designs, and cost optimization will gain competitive advantage, while those unable to address these challenges may face declining adoption in stricter regulatory environments.

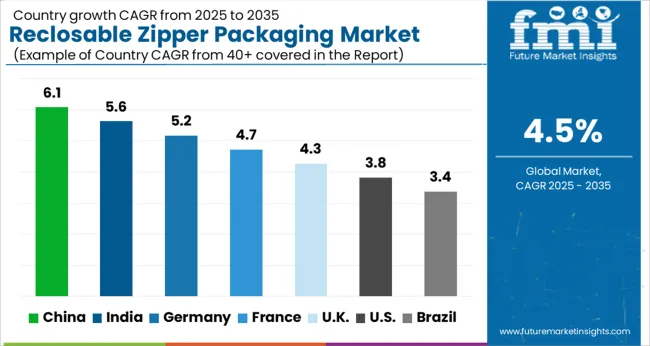

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global reclosable zipper packaging market is projected to grow at a CAGR of 4.5% from 2025 to 2035. China leads with a growth rate of 6.1%, followed by India at 5.6%, and France at 4.7%. The United Kingdom records a growth rate of 4.3%, while the United States shows the slowest growth at 3.8%. Market expansion is fueled by increasing demand for convenient packaging formats in food, personal care, and household products. Emerging markets such as China and India are seeing faster adoption due to expanding retail and e-commerce channels, while mature regions like the USA and UK focus on product innovation, recyclable materials, and value-added packaging solutions to meet consumer and regulatory expectations. This report includes insights on 40+ countries; the top markets are shown here for reference.

The reclosable zipper packaging market in China is projected to grow at a CAGR of 6.1%. Rising packaged food consumption, growing online retail, and demand for flexible packaging solutions are key drivers. Chinese manufacturers are focusing on affordability and efficiency, while also investing in recyclable materials to align with regulatory goals. Expansion of frozen food, snacks, and ready-to-eat segments continues to accelerate zipper packaging demand. With e-commerce playing a pivotal role in consumer access, the demand for secure and resealable packaging formats has further intensified.

The reclosable zipper packaging market in India is expected to grow at a CAGR of 5.6%. Growth is driven by expansion in packaged food, dairy, and snacks, alongside increasing adoption in personal care products. Rising middle-class incomes and growing reliance on convenience foods are boosting demand. Domestic producers are focusing on cost-effective zipper solutions to cater to the mass market, while premium brands are shifting to eco-friendly materials. Expanding modern retail and rapid e-commerce penetration ensure wider accessibility and usage across consumer categories.

The reclosable zipper packaging market in France is projected to grow at a CAGR of 4.7%. Strong consumer demand for convenience and sustainability in packaging solutions is shaping the market. Food manufacturers, particularly in bakery, frozen, and snack categories, are increasingly adopting zipper formats to maintain freshness and improve consumer convenience. France’s strict packaging regulations are encouraging the use of recyclable and eco-friendly materials, pushing brands toward innovation. Growing demand in personal care and household segments also supports adoption of zipper packaging solutions.

The reclosable zipper packaging market in the UK is projected to grow at a CAGR of 4.3%. Growth is supported by the strong presence of food and beverage industries and increasing consumer preference for resealable and portion-control packaging. Innovation in premium packaging formats, including stand-up pouches with advanced zipper closures, is driving adoption. Regulatory emphasis on recyclability and brand initiatives toward eco-friendly packaging continue to influence demand. The rise of online grocery shopping has also increased the need for durable and resealable packaging.

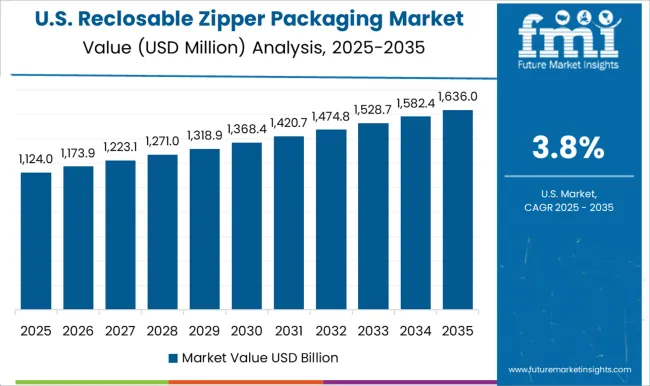

The reclosable zipper packaging market in the USA is projected to grow at a CAGR of 3.8%. While slower than emerging markets, growth is supported by strong demand in packaged snacks, frozen food, and pet care products. Consumers increasingly prefer resealable packaging for convenience, freshness, and portion control. Manufacturers are focusing on recyclable materials and innovations in zipper technologies to meet evolving regulatory and consumer expectations. Growth in online grocery and retail channels continues to reinforce demand for protective and resealable packaging solutions across industries.

Competition in the reclosable zipper packaging market has been led by a concentrated set of global packaging manufacturers that command strong brand authority and extensive production capacity. Amcor has been regarded as a leader in flexible packaging innovation, where reclosable zipper formats have been integrated into pouches and bags designed for food, beverages, and personal care. Berry Global has been leveraging its vast scale in plastics manufacturing, supplying zipper packaging solutions that emphasize functionality, durability, and compatibility with automated filling lines. Sealed Air has been focusing on high-value packaging for food preservation, where reclosable zipper systems have been highlighted as tools to maintain freshness and extend product shelf life.

Mondi has been differentiating through paper-based and hybrid pouch solutions, embedding zipper closures into eco-conscious flexible packaging tailored for retail brands. Sonoco and ProAmpac have been strengthening their positions with multipurpose zipper packaging for snacks, frozen food, and household products, supported by extensive customer partnerships. Collectively, these players have been shaping the competitive field by combining packaging functionality, shelf appeal, and performance across diverse product categories. Strategic positioning among these firms has been influenced by their ability to merge innovation with market reach. Amcor and Mondi have been regarded as design-driven leaders, tailoring zipper pouches to meet evolving brand requirements and retail presentation demands. Berry Global has been emphasizing production efficiency and cost-effective scaling, appealing to large food and consumer goods manufacturers.

Sealed Air has been competing by integrating zipper features with barrier technologies, strengthening its role in high-value food applications. Sonoco and ProAmpac have been balancing customer-specific customization with broad supply networks, ensuring versatility across multiple sectors. This competition has been defined by the capacity to deliver convenience, reliability, and consumer engagement through packaging, where leadership has been granted to companies that consistently provide reclosable zipper solutions aligned with both brand expectations and end-user functionality.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.5 Billion |

| Material Type | Polyethylene (PE – LDPE, HDPE), Polypropylene (PP), Polyester (PET), Polyamide (PA/Nylon), Bioplastics, and Others |

| Zipper Type | Press-to-close zipper and Slider zipper |

| Application | Food & beverages and Non-food |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor, Berry Global, Sealed Air, Mondi, Sonoco |

| Additional Attributes | Dollar sales by product type (single-track vs double-track zippers), Dollar sales by application (food, beverages, pharmaceuticals, personal care), Trends in convenience packaging and portion control, Use in resealable pouches and stand-up bags, Growth in demand for extended product freshness, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global reclosable zipper packaging market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the reclosable zipper packaging market is projected to reach USD 3.9 billion by 2035.

The reclosable zipper packaging market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in reclosable zipper packaging market are polyethylene (pe – ldpe, hdpe), polypropylene (pp), polyester (pet), polyamide (pa/nylon), bioplastics and others.

In terms of zipper type, press-to-close zipper segment to command 60.0% share in the reclosable zipper packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Reclosable Zipper Market Size and Share Forecast Outlook 2025 to 2035

Zipper Pouch Market Size and Share Forecast Outlook 2025 to 2035

Zipper Bag Market Trends & Growth Forecast 2024-2034

Zippered Bottle Suit Market

Pre-zippered Pouches Market

Foil Zipper Bags Market

Double Zipper Bags Market Outlook & Key Trends 2024-2034

Stand-up Zipper Pouches Market Analysis – Trends & Forecast 2025 to 2035

Competitive Landscape of Aluminium Foil Zipper Pouch Providers

Aluminum Foil Zipper Pouch Market Trends - Growth & Forecast 2024 to 2034

Press-to-Close Zippers Market

Child resistant Zipper Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA