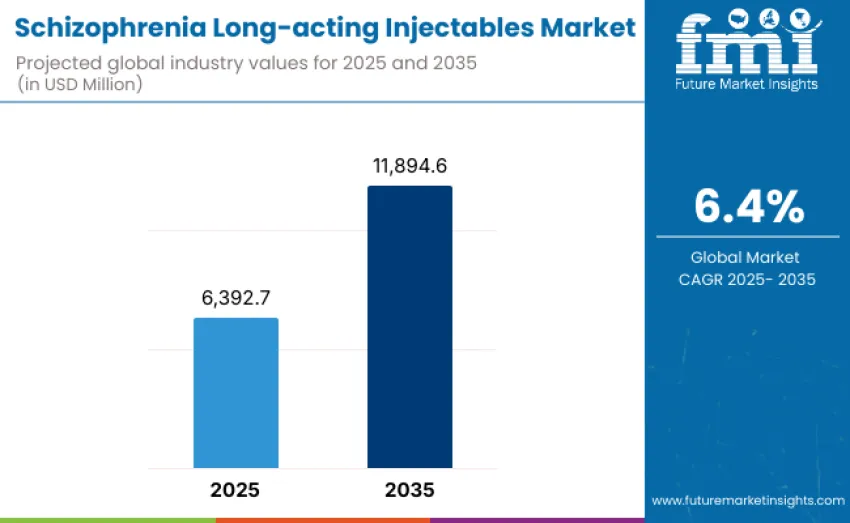

The global schizophrenia long-acting injectables market is projected to reach USD 11,894.6 million by 2035, recording an absolute increase of USD 5,501.9 million over the forecast period. This market is valued at USD 6,392.7 million in 2025 and is set to rise at a CAGR of 6.4% during the assessment period. Growth is underpinned by increasing clinical emphasis on long-term disease stabilization, improved adherence outcomes, and the need to reduce significant economic and operational burden associated with schizophrenia relapse and re-hospitalization.

Dynamics are influenced by advancements in sustained-release drug delivery technologies. Improvements in polymer-based depot systems, microsphere formulations, and extended-release suspensions allow for consistent plasma drug concentrations over longer periods. Current products support intervals ranging from one month to three months, while several pipeline candidates are targeting four- to six-month administration cycles. Reduced dosing frequency aligns with health system objectives to streamline patient management, reduce clinic workload, and minimize interruptions to treatment continuity.

Reimbursement policies and cost-containment priorities play a major role in expansion. The high economic burden associated with schizophrenia, driven primarily by relapse-related hospital visits, makes LAIs an economically attractive intervention for payers. Evidence indicating that LAIs significantly reduce emergency service utilization and inpatient stays has encouraged favorable reimbursement decisions in major regions such as the United States, Canada, Germany, the United Kingdom, and Japan.

Between 2025 and 2030, the schizophrenia long-acting injectables market is projected to expand from USD 6,392.7 million to USD 8,720 million, resulting in a value increase of USD 2,327.3 million, which represents 42.3% of total forecast growth for the decade. Expansion during this period is anticipated to be driven by rising clinical preference for long-acting antipsychotic formulations, increased prioritization of relapse prevention strategies, and broader adoption of depot therapies in community mental health settings.

From 2030 to 2035, growth is forecast from USD 8,720 million to USD 11,894.6 million, adding USD 3,174.6 million, constituting 57.7% of overall ten-year expansion. Growth in this phase is expected to be shaped by introduction of next-generation LAI antipsychotics, including ultra-long-acting formulations, novel mechanism-of-action candidates, and improved safety-optimized depot delivery systems. Strategic collaborations between pharmaceutical manufacturers, digital adherence technology developers, and healthcare providers are anticipated to enhance patient management and treatment coordination.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 6,392.7 million |

| Market Forecast Value (2035) | USD 11,894.6 million |

| Forecast CAGR (2025 to 2035) | 6.4% |

The schizophrenia long-acting injectables market is growing as healthcare systems increasingly favor treatments that improve adherence and reduce relapse-related hospitalizations. Poor adherence to daily oral antipsychotics remains one of the primary drivers of acute psychiatric episodes, and LAIs provide sustained plasma drug levels that significantly lower discontinuation rates, making them a preferred option in maintenance therapy across major regions. Growth is supported by rising global schizophrenia prevalence, expansion of community mental-health programs, and broader adoption of guideline-recommended treatment pathways.

High acquisition costs for branded LAIs and the need for trained personnel to administer injections may limit adoption in low-income regions and resource-constrained healthcare systems. Despite these challenges, strong clinical outcomes, supportive reimbursement policies, and ongoing mental-health infrastructure investments continue to drive global expansion. LAIs position themselves as essential components of comprehensive psychiatric care protocols focused on long-term patient stability and reduced healthcare utilization.

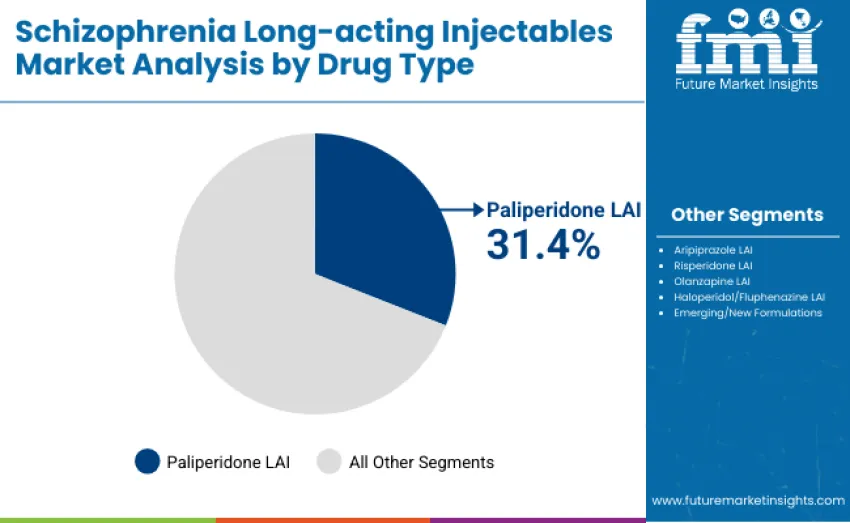

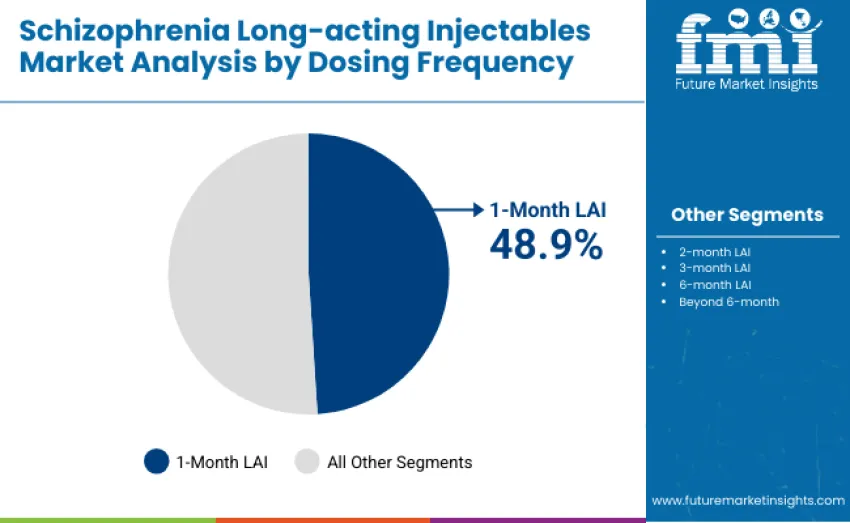

The schizophrenia long-acting injectables market is segmented by drug type, dosing frequency and region. By drug type, division includes aripiprazole LAI, paliperidone LAI (1-month and 3-month), risperidone LAI, olanzapine LAI, haloperidol/fluphenazine LAI, and emerging or new formulations. Based on dosing frequency, categorization covers 1-month LAI, 2-month LAI, 3-month LAI, 6-month LAI, and beyond 6-month formulations. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

Paliperidone long-acting injectables (1-month and 3-month formulations) account for the dominant share, representing 31.4% of total revenue in 2025. This leadership is driven by established clinical efficacy, broad psychiatric guideline endorsement, strong real-world adherence outcomes, and availability of multiple dosing intervals that support individualized treatment planning. Leadership is reinforced by widespread use in relapse prevention programs, formulary inclusion across major healthcare systems, and favorable prescribing familiarity among psychiatrists.

Aripiprazole LAI follows with a significant 27.3% share, supported by its favorable side-effect profile, partial agonist mechanism, and increasing uptake in early-intervention psychiatry settings. The risperidone LAI category holds 15.8% share, reflecting its longstanding clinical role and availability of both branded and generic versions. Olanzapine LAI captures 10.6% share, with adoption shaped by post-injection monitoring requirements, while haloperidol/fluphenazine LAIs represent 8.7% share, primarily used in cost-sensitive regions.

Key advantages supporting paliperidone’s leadership include:

The 1-month LAI segment holds the largest share, accounting for 48.9% of revenue in 2025. This dominance reflects optimal balance between dosing convenience, clinical monitoring needs, and physician confidence in maintaining therapeutic plasma levels. Monthly formulations remain the standard of care for both stabilization and maintenance therapy, supported by well-established treatment protocols and widespread formulary access in hospital and community mental health settings.

The 2-month LAI category represents 21.4%, driven by improvements in patient adherence and reduced clinic visit burden, while maintaining clinical continuity. The 3-month LAI segment accounts for 17.2%, benefiting from strong uptake in stable patients and expanding guideline recommendations. The 6-month LAI class captures 7.9% share as a growing but still emerging category, offering extended protection against relapse with minimal dosing frequency. Beyond 6-month formulations represent 4.6% of share, reflecting early-stage adoption of ultra-long-acting innovations.

Key market dynamics shaping dosing-frequency adoption include:

The schizophrenia long-acting injectables market is driven by several clinically grounded and system-level demand factors. Global rise in schizophrenia prevalence and relapse-related hospitalizations is increasing demand for long-acting therapies, with relapse rates exceeding 60% among patients on inconsistent oral medication driving strong clinical preference for LAIs that support sustained symptom control and adherence improvement. Expanding integration of LAIs into psychiatric care pathways is accelerating adoption, as 45-60% of mental-health systems in North America and Europe are standardizing LAIs within early-intervention and community psychiatry programs.

Administration complexity limits adoption in resource-constrained settings, as LAIs require cold-chain integrity, injectable administration capacity, and trained clinicians for proper dosing and monitoring. Clinical hesitancy in parts of the psychiatric community restrains uptake, driven by concerns around injection-site reactions, risk of prolonged side effects due to extended drug action, and the need for supplemental oral dosing during initiation for certain formulations.

Key trends indicate accelerated uptake in Asia-Pacific regions, particularly China and India, where mental-health infrastructure expansion, government-backed psychiatric care programs, and increasing reimbursement reforms are improving LAI accessibility. Innovation trends are shifting toward ultra-long-acting formulations with dosing intervals beyond 3 and 6 months, driven by both adherence benefits and payer interest in reduced administration burden. Growing use of digital adherence tools, outcome-based contracting, and real-world evidence integration is strengthening clinical utility of LAIs.

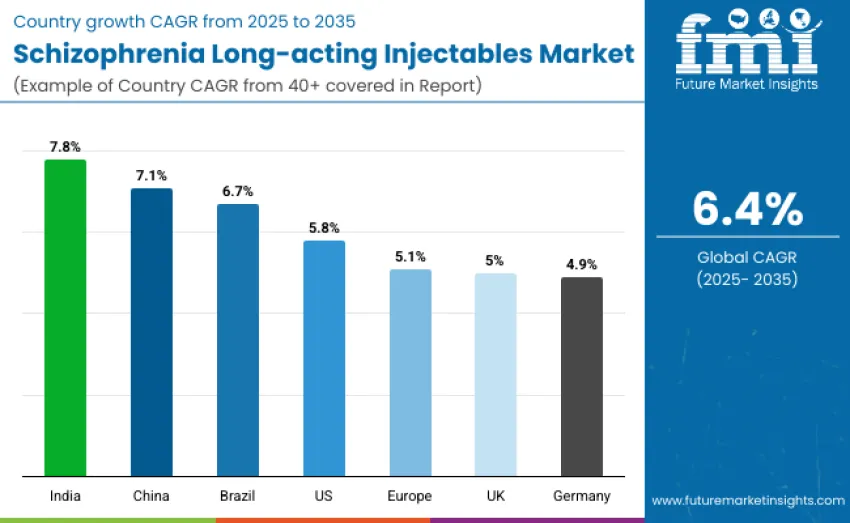

| Country/Region | CAGR 2025 to 2035 (%) |

|---|---|

| United States | 5.8 |

| Brazil | 6.7 |

| China | 7.1 |

| India | 7.8 |

| Europe | 5.1 |

| Germany | 4.9 |

| United Kingdom | 5.0 |

The schizophrenia long-acting injectables market is expanding globally, with India leading at a 7.8% CAGR driven by national mental-health programs, improved psychiatric capacity, and rising adoption of adherence-focused LAIs. China follows at 7.1%, supported by rapid psychiatric-care modernization and broader formulary inclusion. Brazil grows at 6.7% through wider public-health coverage and expanding psychiatric networks. The United States records 5.8% growth, driven by a mature mental-health ecosystem and strong clinician confidence. Europe advances at 5.1%, with Germany at 4.9% and France at 4.8%, reinforced by structured mental-health infrastructure and modernization initiatives.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China is projected to exhibit robust growth with a CAGR of 7.1% through 2035, driven by healthcare modernization and expanding psychiatric care infrastructure. Increasing government investment in mental health facilities and public awareness campaigns has facilitated early diagnosis and treatment adoption across urban and semi-urban centers. The Made in China 2025 initiative has indirectly supported development through enhanced local manufacturing capabilities and quality control standards for injectable pharmaceuticals.

Large hospital networks in Beijing, Shanghai, and Guangzhou have implemented structured schizophrenia treatment programs, improving patient adherence to long-acting therapies. Distribution channels are being strengthened through integration with national e-health systems and major hospital procurement frameworks, ensuring consistent availability of LAIs. Regulatory reforms have accelerated product approval processes and fostered domestic production, allowing broader patient access. Policy incentives supporting mental healthcare workforce training, combined with targeted clinical awareness initiatives, have contributed to adoption of long-acting injectables.

India is expected to witness a CAGR of 7.8% through 2035, supported by expansion of medical infrastructure and increased accessibility to psychiatric care. The rollout of National Mental Health Programs and state-level healthcare initiatives has enabled integration of LAIs into government hospitals and community mental health centers. Local manufacturing capacity for injectable formulations has been expanded, reducing dependency on imports and enhancing supply chain resilience.

Awareness campaigns and clinical education programs have been implemented to improve adherence and acceptance among patients and caregivers. Metropolitan clusters such as Bangalore, Mumbai, and Hyderabad have emerged as focal points for treatment adoption due to higher hospital density and skilled psychiatric professionals. Partnerships between domestic pharmaceutical manufacturers and multinational firms have facilitated technology transfer, improving formulation quality and availability. Private-sector healthcare facilities have increasingly incorporated LAIs into standard schizophrenia treatment protocols.

Germany is anticipated to grow at a CAGR of 4.9% through 2035, driven by high regulatory standards and focus on treatment precision. Development is primarily supported by well-established psychiatric hospital networks and specialized outpatient clinics, where adherence to European treatment guidelines ensures consistent LAI administration. Research and development investments in novel formulations and extended-release technologies have been promoted by public-private collaborations, fostering continuous innovation in therapy options.

Strict pharmacovigilance and quality control regulations have maintained high product reliability, which encourages clinician confidence in long-acting formulations. Reimbursement frameworks within statutory health insurance schemes facilitate patient access to LAIs, reducing financial barriers. Germany's strong medical education system and psychiatric specialization programs have led to increased prescriber familiarity with LAI treatment protocols. Sustainability initiatives in pharmaceutical production have encouraged environmentally responsible manufacturing practices for injectable therapies.

Brazil is projected to register a CAGR of 6.7% through 2035, driven by healthcare access expansion and cost-efficiency trends in public and private sectors. National health programs and psychiatric care policies have prioritized inclusion of LAIs in hospital formularies and outpatient clinics, particularly in metropolitan regions such as São Paulo, Rio de Janeiro, and Brasília. Public awareness campaigns and community-based mental health initiatives have improved early diagnosis and long-term treatment adherence.

Efforts to modernize supply chain logistics and establish cold-chain distribution networks have enhanced product availability across remote and urban centers. Partnerships between local pharmaceutical manufacturers and multinational companies have facilitated domestic production of cost-effective LAIs while maintaining high-quality standards. Health insurance coverage expansion and subsidy programs for psychiatric medications have reduced financial barriers, enabling broader adoption among low- and middle-income populations. The combination of public health initiatives and infrastructure investments positions Brazil as a leading Latin American presence.

The United States schizophrenia long-acting injectables market is expected to grow at a CAGR of 5.8% through 2035, supported by advanced technology adoption and well-established clinical research infrastructure. Treatment adoption is facilitated through large hospital networks, outpatient psychiatric clinics, and integrated health systems that emphasize long-term adherence monitoring. Extensive investment in clinical trials, real-world evidence studies, and digital patient monitoring platforms has enhanced prescriber confidence in LAI therapies.

Major pharmaceutical companies maintain robust distribution networks, ensuring timely delivery to hospitals, pharmacies, and community health centers. Insurance coverage and reimbursement policies for long-acting formulations have improved patient access, particularly for high-cost atypical antipsychotics. Academic medical centers and psychiatric residency programs provide structured training on LAI administration, supporting adoption. Expansion is supported by ongoing development of extended-release and combination formulations, addressing unmet needs in treatment-resistant populations.

The United Kingdom is anticipated to grow at a CAGR of 5.0% through 2035, driven by public healthcare system modernization and structured psychiatric treatment frameworks. Adoption of LAIs is facilitated through National Health Service mental health programs and community mental health teams, which ensure continuity of care and adherence to standardized treatment protocols. Investments in psychiatric research and digital health initiatives have promoted monitoring of treatment outcomes.

Regional mental health networks across London, Manchester, Bristol, and Edinburgh have implemented training programs for LAI administration, ensuring high-quality service delivery. Collaboration with pharmaceutical manufacturers has facilitated access to innovative formulations, supported by NHS procurement and tendering systems. Policy initiatives focusing on early intervention and patient education have contributed to increased acceptance of long-acting injectables. Integrated electronic health record systems enable data-driven treatment optimization.

The schizophrenia long-acting injectables market in Europe is projected to grow from USD 1,636.5 million in 2025 to USD 2,926.1 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to retain its leading position with a 27.5% share in 2025, slightly decreasing to 27.0% by 2035, supported by advanced healthcare infrastructure, strong psychiatric treatment programs, and established pharmaceutical networks.

France follows with a 21.5% share in 2025, rising marginally to 21.8% by 2035, driven by well-developed psychiatric care services and early adoption of long-acting injectable therapies. The United Kingdom accounts for 18.5% in 2025, projected to reach 18.8% by 2035, supported by expanding mental health initiatives and patient access programs. Italy holds 12.5% throughout the forecast period, bolstered by public healthcare coverage for schizophrenia treatments.

Spain captures 9.0% in 2025, increasing to 9.3% by 2035 due to growing awareness campaigns and mental health infrastructure. The Netherlands maintains 6.0% share consistently, while the Rest of Europe represents 5.0% in 2025, rising to 5.1% by 2035, driven by emerging Central and Eastern European mental health programs and improved access to advanced long-acting injectable formulations.

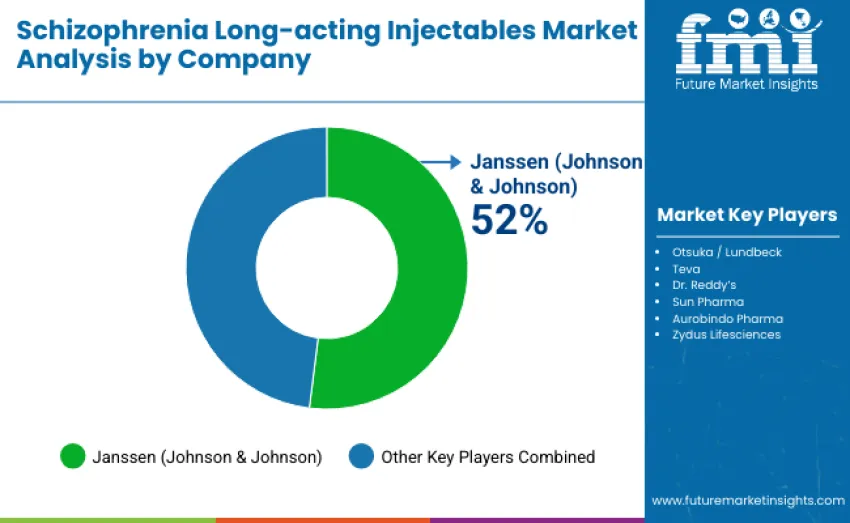

The global schizophrenia long-acting injectables market is moderately concentrated, shaped by 8-10 companies, with the top three, Janssen (Johnson & Johnson), Otsuka/Lundbeck, and Teva, collectively holding 55-60% of total share. Janssen leads with a dominant 52% share, driven by its risperidone and paliperidone LAI innovations, supported by extensive clinical evidence demonstrating strong efficacy, long-term safety, and relapse-prevention benefits. Its leadership is strengthened further by comprehensive adherence-focused patient support programs, including digital monitoring tools and caregiver education resources that reinforce clinician confidence.

Otsuka and Lundbeck maintain strong positioning through aripiprazole LAI formulations emphasizing flexible dosing, favorable safety profiles, and digital adherence solutions. Teva sustains its presence through a blend of branded and generic LAIs, offering cost-effective, reliable treatment options supported by scalable global manufacturing capabilities that ensure consistent supply.

Regional and emerging players such as Dr. Reddy’s Laboratories, Sun Pharma, Aurobindo Pharma, and Zydus Lifesciences target cost-sensitive markets with affordable alternatives to branded LAIs. These companies rely on rapid regulatory approvals, localized distribution strength, and partnerships with hospitals and psychiatric networks. Competitive dynamics prioritize clinical performance, adherence support, portfolio breadth, and operational scalability rather than pricing alone, shaping the evolution of global LAI availability.

| Items | Values |

|---|---|

| Quantitative Units | USD 6,392.7 million |

| Drug Type | Aripiprazole LAI, Paliperidone LAI (1-mo & 3-mo), Risperidone LAI, Olanzapine LAI, Haloperidol/Fluphenazine LAI, Emerging/New Formulations |

| Dosing Frequency | 1-month LAI, 2-month LAI, 3-month LAI, 6-month LAI, Beyond 6-month |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Janssen (Johnson & Johnson), Otsuka/Lundbeck, Teva, Dr. Reddy's, Sun Pharma, Aurobindo Pharma, Zydus Lifesciences, Other Generics |

| Additional Attributes | Dollar sales by drug type and dosing frequency, regional trends across Asia Pacific, Europe, and North America, competitive landscape of long-acting injectable antipsychotics, technical specifications, integration with clinical protocols, patient adherence programs, innovations in formulation, dosing frequency, and safety profiles |

The global schizophrenia long-acting injectables market is valued at USD 6,392.7 million in 2025.

The market is projected to reach USD 11,894.6 million by 2035.

The market will grow at a CAGR of 6.4% from 2025 to 2035.

Paliperidone LAI (1-month and 3-month) leads the market with a 31.4% share in 2025.

Key players include Janssen (Johnson & Johnson), Otsuka/Lundbeck, Teva, Dr. Reddy's, Sun Pharma, Aurobindo Pharma, and Zydus Lifesciences.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Schizophrenia Treatment Market Size and Share Forecast Outlook 2025 to 2035

Image-Guided Injectables Market Forecast and Outlook 2025 to 2035

Microparticle Injectables Market

Pain Therapeutic Injectables Market Size and Share Forecast Outlook 2025 to 2035

Ophthalmic Prefilled Injectables Market Size and Share Forecast Outlook 2025 to 2035

Regenerative Biologic Injectables Market Size and Share Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA