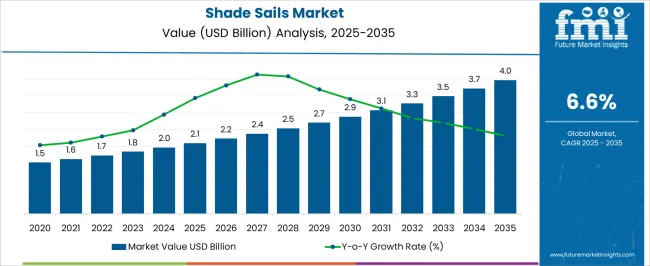

The shade sails sector is projected to expand from USD 2.1 billion in 2025 to USD 4.0 billion in 2035, advancing at a CAGR of 6.6%. The CAGR curve shows a smooth, upward path, with values moving to 2.4 billion in 2027, 2.7 billion in 2029, and 3.1 billion in 2031, then 3.7 billion in 2034 and 4.0 billion in 2035. This profile is viewed as durable, anchored by wider use across residential patios, hospitality terraces, school playgrounds, car parks, and public realm projects. UV protection, thermal comfort, and glare control are being prioritized, which strengthens repeat purchase cycles in DIY kits and custom commercial grade installations.

Long term value creation is being reinforced by material and hardware choices that improve outcomes. Permeable HDPE shade cloths and PVC coated polyester options deliver UV stability, colorfastness, and targeted water resistance, while corrosion resistant fittings, galvanized posts, and precise tensioning hardware support service life and wind load requirements. Procurement teams favor warranty backed systems, standardized anchor layouts, and modular spans that simplify installation and maintenance. The curve indicates practical, specification led growth rather than hype, with tensile shade structures embedded in landscaping, outdoor dining, and sports venues. Consistent replacement and retrofit cycles keep demand persistent across regions.

| Metric | Value |

|---|---|

| Shade Sails Market Estimated Value in (2025 E) | USD 2.1 billion |

| Shade Sails Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The shade sails segment is estimated to account for about 22% of the outdoor awnings and sunshades market, roughly 18% of the architectural fabrics and tensile membranes market, close to 9% of the outdoor living and patio products market, nearly 16% of the commercial and residential canopies market, and around 12% of the landscaping and outdoor structures market. These shares aggregate to approximately 77% across the listed parent categories.

Procurement decisions are often guided by fabric longevity, UV resistance, wind loading, anchor hardware quality, and installation expertise, which positions specialist suppliers with engineering support at an advantage. Adoption has been reinforced by space optimization needs where fixed roofs are not preferred and permitting is sensitive, making tensioned membranes a practical alternative. In my assessment, shade sails set the tone for mid-tier projects that seek premium aesthetics without the cost of full tensile architecture. Growth is also supported by retrofit opportunities across schools, hospitality venues, and residential renovations where quick installation and seasonal adjustability are valued. As product warranties, colorfastness, and fire ratings improve, shade sails are likely to secure deeper specification in public realm upgrades and private developments, sustaining their weight within these interconnected parent markets.

The shade sails market is witnessing significant growth, propelled by the increasing demand for effective and aesthetically appealing sun protection solutions across residential, commercial, and recreational spaces. Rising awareness regarding ultraviolet radiation hazards and the need for comfortable outdoor environments are stimulating the adoption of shade sails. The versatility offered by shade sails in providing customizable coverage and design flexibility is driving their popularity among homeowners and facility managers.

Advancements in material technology have enhanced durability, UV resistance, and weather performance, enabling longer product lifespans and reduced maintenance. The growing trend of outdoor living spaces, combined with urbanization and increased disposable income, is encouraging investments in shade sails for patios, gardens, and playgrounds.

Additionally, environmental concerns and preferences for eco-friendly and sustainable materials are influencing product innovation and consumer choices As outdoor lifestyle culture continues to expand globally, the shade sails market is expected to maintain strong growth, driven by product diversification and increasing application scope.

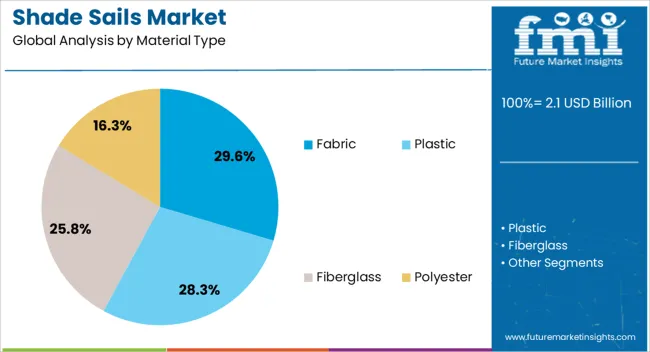

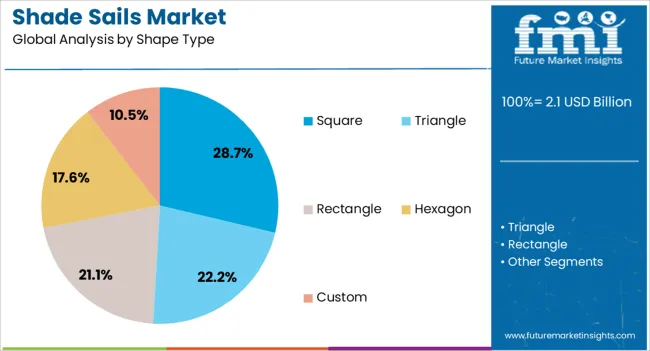

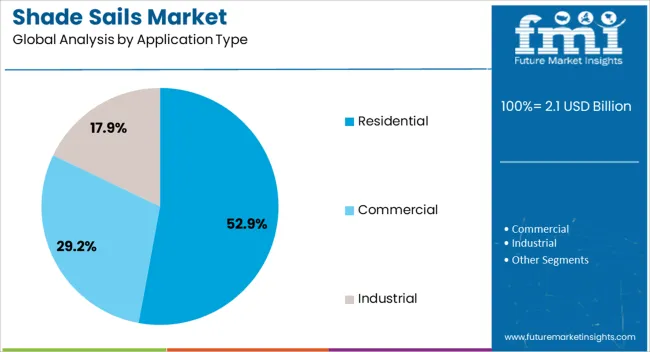

The shade sails market is segmented by material type, shape type, application type, and geographic regions. By material type, shade sails market is divided into fabric, plastic, fiberglass, and polyester. In terms of shape type, shade sails market is classified into square, triangle, rectangle, hexagon, and custom. Based on application type, shade sails market is segmented into residential, commercial, and industrial. Regionally, the shade sails industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fabric material type segment is projected to hold 29.6% of the shade sails market revenue share in 2025, making it the leading material category. This leadership is supported by fabric’s inherent properties of breathability, flexibility, and high UV protection, which ensure effective shading and comfort. The wide variety of fabric options available, including high-density polyethylene and polyester blends, offer resistance to weather elements such as sun, rain, and wind, increasing product durability.

Fabric shade sails allow for easy customization in terms of color, texture, and size, meeting diverse consumer preferences and design requirements. The material’s lightweight nature simplifies installation and maintenance processes, making it favored by residential and commercial users alike.

Moreover, ongoing improvements in fabric treatments to enhance water repellency and mildew resistance are further driving adoption The combination of performance, versatility, and aesthetic appeal continues to position fabric as the preferred material type in the market.

The square shape type segment is expected to account for 28.7% of the shade sails market revenue share in 2025, establishing it as the dominant shape category. This prominence is attributed to the shape’s versatility and ease of installation, allowing effective coverage of various outdoor spaces, including patios, decks, and playgrounds. Square shade sails provide consistent shading with simple anchoring points, making them ideal for both DIY installations and professional setups.

The geometric regularity simplifies spatial planning and integration with existing architectural elements, increasing their appeal to homeowners and landscape designers. Additionally, square sails can be combined in modular configurations to cover larger or irregular spaces, enhancing their functionality.

The balance between cost-efficiency and coverage area has led to widespread adoption in residential and commercial projects As customization trends evolve, the square shape continues to be favored for its practical benefits and adaptability across diverse application scenarios.

The residential application type segment is anticipated to hold 52.9% of the shade sails market revenue share in 2025, positioning it as the largest end-use segment. This dominance is being driven by the rising trend of outdoor living spaces in private homes, including patios, gardens, and backyards, where shade sails provide a cost-effective and visually appealing solution. Growing consumer preference for enhancing outdoor comfort and safety, particularly in regions with intense sunlight exposure, is fueling adoption.

Shade sails in residential settings are being valued for their ease of installation, aesthetic customization, and ability to create shaded retreats for leisure and family gatherings. The segment benefits from increasing disposable incomes, urbanization, and awareness of UV protection’s health benefits.

Additionally, the rise in home improvement activities and smart landscaping designs is supporting demand. The residential sector’s focus on combining functionality with style ensures that shade sails remain a preferred choice for outdoor shading solutions, sustaining growth in the market.

The shade sails market is expected to expand steadily as outdoor living, hospitality refurbishments, and public-space upgrades are prioritized. Demand has been reinforced by the need for UV protection, cooler microclimates, and low-maintenance shade across homes, schools, cafés, and sports venues. Opportunities are being unlocked through custom geometries, turnkey installation packages, and premium fabrics for coastal and desert climates. Trends point toward HDPE shade cloth, PVC-coated membranes, retractable kits, and smart tension hardware. Yet adoption is being shaped by wind ratings, code compliance, warranty confidence, and price competition from fixed canopies and pergola systems.

Market demand has been strengthened by widespread use of shade sails for patios, playgrounds, rooftop decks, car parks, and poolside areas where glare reduction and heat control are required. UV-stabilized HDPE and PVC-coated fabrics have been preferred as protective canopies that filter sunlight while allowing airflow, making family spaces, café terraces, and school courtyards more usable through hot seasons. Public agencies have specified sails for parks and outdoor classrooms, while retailers have promoted DIY kits for quick residential upgrades. Shade sails have been undervalued relative to fixed awnings; comparable coverage with fewer posts and faster install times has been delivered, often with better aesthetics. As insurance and facility managers place emphasis on visitor comfort and duty-of-care, specifiers have increasingly favored robust corner hardware, stainless turnbuckles, and reinforced webbing, further anchoring recurring demand across residential and light-commercial projects.

Opportunities have been opening in bespoke, engineered installations for resorts, quick-service restaurants, schools, and healthcare courtyards where large spans, brand colors, and complex footprints are requested. Fabricators have been positioned to upsell by offering site surveys, CAD layout, wind-load calculations, and stamped drawings bundled with powder-coated posts and galvanized anchors. Coastal and desert markets have been targeted with marine-grade stainless fittings, PTFE thread, and high-shade-factor cloths designed for salt and sand exposure. Packaging of maintenance contracts, seasonal tension checks, resews, and cleaning, has been used to add lifetime value. The most attractive margin profile is being found where turnkey services and rapid permitting support are delivered, not in price-only e-commerce listings. Export channels into island tourism and stadium refurbishments have been cited as further expansion paths, while co-branding with playground OEMs and landscape architects has created steady bid pipelines.

Trends have been centered on denser HDPE (e.g., 320–400 gsm) for better shade coefficients, lighter colors with heat-reflective characteristics, and PVC/PVDF membranes specified where waterproof coverage is required. Multi-sail layouts, triangles, hypars, and overlapping rectangles—have been favored to sculpt shade while controlling rain run-off. Hardware has shifted toward heavy-duty perimeter cables, adjustable jaw/eye turnbuckles, and concealed plate mounts for cleaner lines. DIY audiences have adopted pre-cut kits with color-matched rope and quick-connect carabiners; premium buyers have preferred patterning via 3D site scans to reduce sag and catenary mismatches. Fire-retardant certifications (NFPA/AS standards), hail-rated cloth, and anti-microbial coatings have been requested by schools and foodservice operators. Design-led differentiation, color blocking, edge details, and mast angles, has been the real conversion driver, with fabric spec as the credibility check rather than the headline story.

Market growth has been constrained by wind exposure, snow load risk, and uneven permitting rules that require engineering sign-off, soil reports, or setback changes. Budget buyers have compared sails against low-cost gazebos and pergola kits, forcing discounts that erode dealer margins. Fabric lead times, post galvanizing queues, and custom hardware procurement have introduced project delays, while counterfeit UV claims have undermined trust for online shoppers. Warranty disputes over improper tensioning or poor drainage have added friction for installers. From a candid stance, many failures have been preventable: undersized posts, shallow footings, and bargain hardware have been specified too often. To scale confidently, vendors must standardize wind-load tiers, publish clear tensioning guides, and bundle maintenance plans; otherwise, replacements and callbacks will keep profitability under pressure in weather-exposed regions.

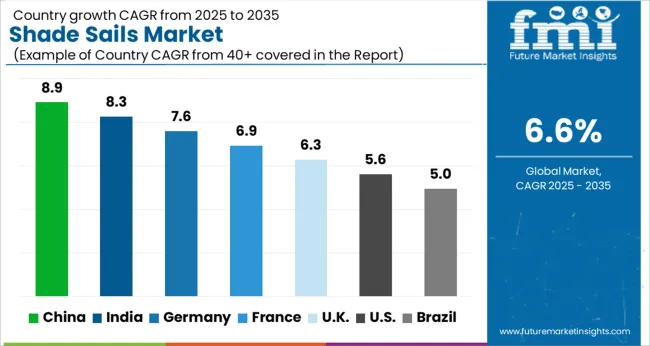

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global shade sails market is projected to grow at a CAGR of 6.6% from 2025–2035. China is estimated at 8.9%, India at 8.3%, and France at 6.9%, while the UK and US are expected at 6.3% and 5.6%, respectively. Demand is being propelled by outdoor living upgrades, hospitality expansions, and requirements for UV protection across schools, parks, and commercial patios. Asia is set to outpace other regions on the back of large-scale manufacturing, competitive pricing, and rapid distribution buildouts. Europe is expected to favor premium HDPE and PVC-coated polyester membranes with rigorous fire ratings. The US outlook appears steadier, with growth centered on DIY patio kits, retrofits, and higher wind-load designs for coastal markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The shade sails market in China is projected to grow at a CAGR of 8.9%. Growth is expected to be anchored by expansive export capacity, widespread adoption across municipal parks, and fast build cycles for commercial patios and car parks. Production of UV-rated HDPE and PVC-coated polyester canopies has been scaled, while corrosion-resistant hardware and powder-coated posts have been standardized for large orders. Design–to–installation timelines are being compressed through integrated fabrication clusters, allowing packaged solutions for playgrounds, retail forecourts, and transit areas. Domestic buyers are showing preference for heavier GSM fabrics and reinforced perimeter webbing to address wind uplift. Given China’s scale in textiles and fittings, pricing power is likely to be retained, positioning suppliers to shape specifications in regional tenders and private developments.

The shade sails market in India is forecast to expand at a CAGR of 8.3%. Adoption is being pulled by education campuses, healthcare courtyards, and quick-service dining where shaded outdoor seating is prioritized. Domestic converters have been expanding lamination and edge-seaming capabilities, while stainless hardware and turnbuckle kits are being localized to cut import costs. Preference is forming around high-shade-factor HDPE meshes with double-stitched hems and corner plates. Retail channels are broadening through marketplace platforms, and organized installers are standardizing site surveys for mast spacing and wind loading. Given warmer climates and extended sun exposure, premium UV warranties are likely to command share in metros and tier-2 cities, with DIY kits addressing villa and apartment rooftops.

The shade sails market in France is projected to grow at a CAGR of 6.9%. Adoption is being supported by hospitality terraces, schools, and coastal leisure sites that require certified fire-retardant membranes and engineered anchoring. Buyers are gravitating toward premium woven HDPE and PTFE/PVC composites with low stretch, high tear strength, and colorfast pigments suited to Mediterranean and Atlantic conditions. Project specifiers are emphasizing wind-load calculations, stainless tensioning, and wall-plate verification on masonry. Aesthetic considerations are guiding triangular and hypar geometries, with concealed hardware preferred for upscale venues. With design integrity and compliance at a premium, French installers are expected to command higher ASPs, while local distributors curate European brands and warranty-backed lines to meet municipal procurement standards.

The shade sails market in the UK is anticipated to expand at a CAGR of 6.3%. Demand is being led by education, garden centres, pubs, and hospitality courtyards seeking weather-resilient coverage with compliant fire ratings. Installers are prioritizing high-tenacity HDPE meshes, marine-grade stainless hardware, and engineered footings to address gusty conditions. Retrofits for heritage facades are being managed with non-penetrating mounts and careful load path design. E-commerce channels have broadened access to bespoke sizes, while project work relies on site surveys for spacing, mast height, and drainage falls. With variable weather patterns, quick-dry fabrics and reinforced corners are being favored, and off-season storage guidance is commonly included in maintenance packs to protect fabric life and tension systems.

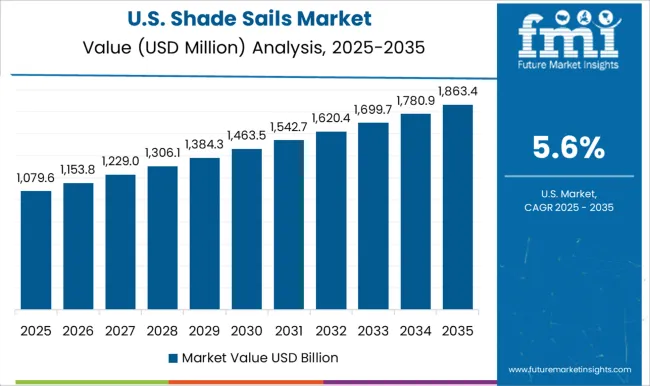

The shade sails market in the US is expected to grow at a CAGR of 5.6%. Expansion is being shaped by residential patios, HOA common areas, playgrounds, and resort pools where UV protection and design aesthetics are prioritized. Higher wind-load standards along the Gulf and Atlantic coasts are steering buyers toward heavy-duty meshes, cable-edge construction, and deeper footings. DIY kits with pre-measured cables and turnbuckles are seeing traction, while commercial jobs continue to rely on stamped drawings and engineered anchor layouts. Color palettes are trending toward sand, slate, and terracotta for heat management. With retailers streamlining click-to-curb programs and installers offering annual re-tension services, a stable upgrade cycle is likely to emerge across suburban markets.

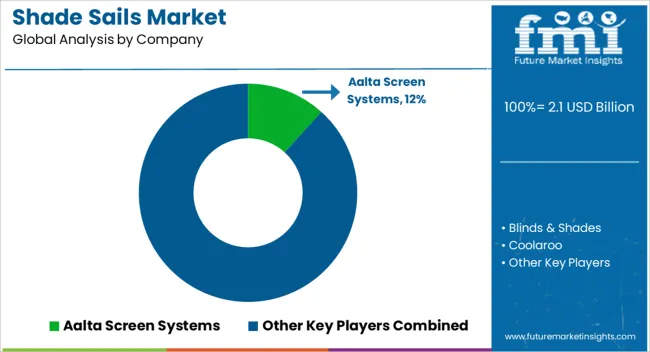

The shade sails market is highly competitive, driven by growing demand for outdoor protection, aesthetic enhancements, and functional shading solutions in residential, commercial, and recreational spaces. Companies differentiate through material quality, UV resistance, durability, design, color variety, and customization options. Market rivalry is shaped by product innovation, manufacturing efficiency, and distribution networks that ensure timely delivery and customer satisfaction.

Key players such as Coolaroo, ShadeFX, Aussie Shade, Gale Pacific, Sailrite, Greendrip, Shade Pro, Tenara, Sombra Shade, and Shelter Logic dominate the market by offering high-quality, durable, and customizable shade sails. Strategic partnerships with outdoor furnishing retailers, home improvement stores, and online platforms are leveraged to expand market reach. Regional and emerging manufacturers compete by providing cost-effective, locally tailored, and eco-friendly solutions. The market is moderately fragmented, with top companies focusing on innovation, UV-protection technology, installation convenience, and aesthetic appeal to maintain leadership and meet growing demand for functional and stylish outdoor shading solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 billion |

| Material Type | Fabric, Plastic, Fiberglass, and Polyester |

| Shape Type | Square, Triangle, Rectangle, Hexagon, and Custom |

| Application Type | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aalta Screen Systems, Blinds & Shades, Coolaroo, Custom Shade Sails, FTH Industries, GALE Pacific, Nelson Shade Solutions, Sail Shade World, Shade Comforts, Shade FX, Sunesta, Sunbrella, Tenshon, Tensile Structure Systems (TSS), USA Shade, and Sunbrella |

| Additional Attributes | Dollar sales by fabric type (HDPE, PVC, polyester), Dollar sales by application (residential, commercial, public spaces), Trends in UV-blocking performance and motorized systems, Role in sun protection, heat mitigation, and aesthetics, Growth from hospitality, schools, parks, and outdoor dining projects, Regional demand across North America, Europe, Asia Pacific, Middle East. |

The global shade sails market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the shade sails market is projected to reach USD 4.0 billion by 2035.

The shade sails market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in shade sails market are fabric, plastic, fiberglass and polyester.

In terms of shape type, square segment to command 28.7% share in the shade sails market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pre-Shaded Zirconia Blocks for All-Ceramic Restorations Market Size and Share Forecast Outlook 2025 to 2035

Lamp shades Market Size and Share Forecast Outlook 2025 to 2035

Blinds and Shades Market Size and Share Forecast Outlook 2025 to 2035

Custom Lipstick Shade Market Growth – Demand & Forecast 2024-2034

Cellular Blinds & Shades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA