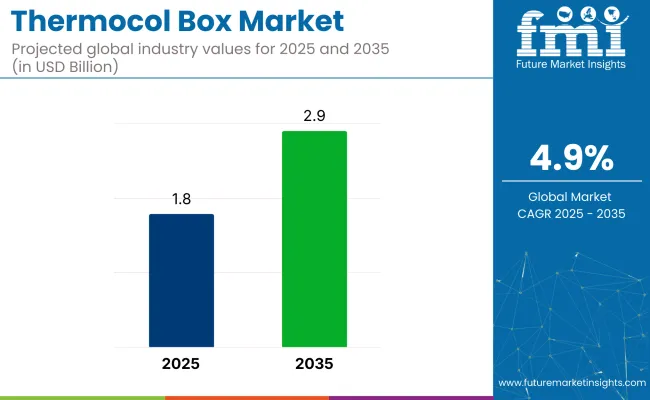

The thermocol box market is expected to expand from USD 1.8 billion in 2025 to USD 2.9 billion by 2035, registering a 4.9% CAGR. Thermocol packaging boxes market account for approximately 25-30% of the Thermocol (EPS) packaging market, due to their widespread use in insulating and protecting temperature-sensitive goods.

Key Industry Attributes

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 1.8 billion |

| Industry Size (2035) | USD 2.9 billion |

| CAGR (2025 to 2035) | 4.9% |

Within the broader protective and insulative packaging sector, they contribute roughly 8-10%, driven by applications in cold chain logistics, electronics, and vaccines. In the e-commerce packaging segment, their share stands at 5-7%, supported by increasing frozen food and medicine deliveries.

Across industrial packaging and logistics, thermocol boxes hold 6-9%, particularly in seafood exports and pharmaceutical transport. In Asia-Pacific’s packaging segment, especially in India and China, their contribution exceeds 30%, due to cost advantages and thermal performance. Their consistent demand across perishables and medical goods secures a stable position in multiple upstream packaging categories.

Growth is driven by rising demand for affordable, protective packaging in food delivery, pharmaceuticals, and electronics. These boxes provide insulation and shock resistance, making them suitable for temperature-sensitive and fragile goods.

E-commerce expansion and increased home delivery have pushed demand, especially for frozen foods and medical items. In emerging regions, logistics infrastructure improvements are boosting usage. Their role in ensuring safe transit continues to widen across industries seeking dependable, lightweight packaging options for sensitive product handling.

In a 2024 interview with Packaging South Asia, ArpitDhupar, CEO of Dharaksha, shared, “We had achieved what we desired. Our production does not leave any scope of wastage and if any product looks not up to the mark, we can easily reuse that as raw materials.

Our idea was simply to collect all the stubble. The response it gained was immense.” His remarks underscore a shift in packaging innovation-moving from traditional thermocol to bio-fabricated materials derived from stubble and mycelium. As industries seek alternatives that lower pollution, such approaches are gaining ground within cold chain and protective packaging segments.

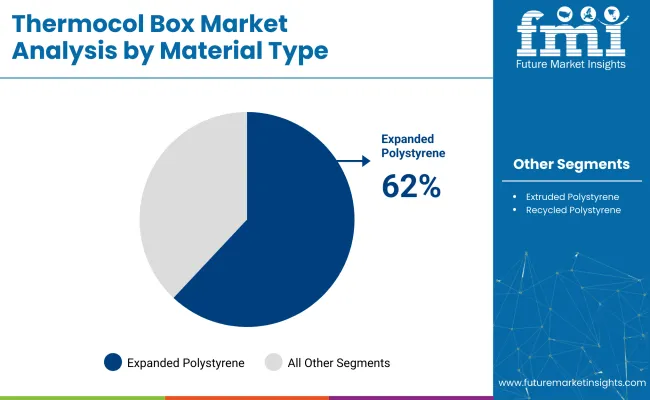

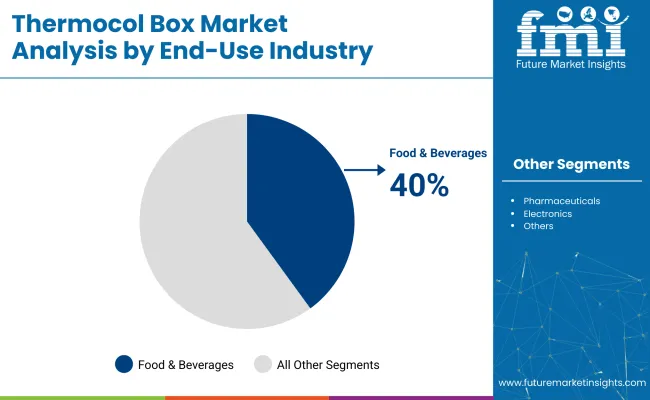

In 2025, expanded polystyrene is set to lead the thermocol box industry with a 62% share, driven by its insulation, affordability, and use in cold chain logistics. Rectangular boxes (58%) dominate due to efficient stacking. Food and beverage (40%) and direct/e-commerce channels (70%) remain top end-use and distribution segments.

Expanded Polystyrene (EPS) is anticipated to command 62% of the thermocol box industry in 2025.This material's dominance is attributed to its excellent insulating properties, lightweight structure, and cost-effectiveness, which make it ideal for temperature-sensitive goods.

Rectangular thermocol boxes are expected to capture 58% of the industry share in 2025. The rectangular shape is widely preferred due to its practical design, which ensures easy stacking, transportation, and storage.

Cold chain logistics is projected to account for 36% of the industry share in 2025. As the demand for temperature-sensitive goods grows, especially in the food, pharmaceutical, and electronics sectors, the need for reliable packaging solutions increases.

The food and beverages industry is expected to hold 40% of the thermocol box industry share in 2025.Thermocol boxes are essential in maintaining the freshness and integrity of perishable food products during transport, ensuring that items like meats, dairy, and frozen foods stay at optimal temperatures.

Direct sales and e-commerce distribution channels are expected to capture a combined market share of 70% by 2025. The direct sales model facilitates long-term partnerships with manufacturers, wholesalers, and businesses requiring large quantities of thermocol boxes, especially for the food and pharmaceutical sectors.

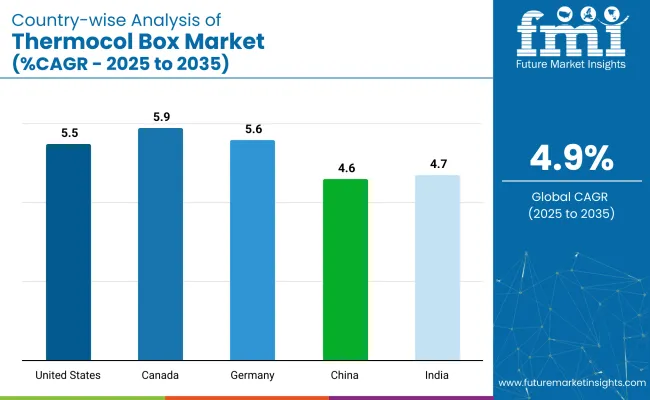

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

| Canada | 5.9% |

| Germany | 5.6% |

| China | 4.6% |

| India | 4.7% |

India’s growth is driven by increasing demand for cost-effective packaging solutions in the growing e-commerce and food delivery sectors. China follows closely, with a projected 4.6% CAGR, supported by its strong manufacturing base and expanding logistics sector. In contrast, developed economies such as Germany (5.6%), Canada (5.9%), and the United States (5.5%) are expanding at a steady 0.95-1.03x rate.

The United States leads the demand for thermocol boxes, driven by its strong logistics and food delivery industries. Canada follows closely with steady growth, supported by its growing demand for cost-effective packaging solutions. Germany benefits from innovations in green packaging, with increasing demand for thermocol products. As the market adds over USD 1 billion by 2035, both high-growth regions like India and China, and steady demand from OECD countries will shape its trajectory.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The industry in the United States is expected to grow at a CAGR of 5.5% from 2025 to 2035. The industry is being driven by the exponential growth of e-commerce and the increasing demand for food delivery services, especially in urban areas. USA businesses are adopting thermocol boxes for their superior insulation properties, which help maintain product integrity during shipping. Innovations in thermocol packaging materials, including eco-friendlier options, are contributing to industry growth while meeting regulatory requirements for safe and eco-conscious packaging.

The industry in Canada is projected to grow at a CAGR of 5.9% from 2025 to 2035. A significant driver of this growth is the continued rise of online grocery shopping and food delivery. As Canada has strict regulations regarding the safety and quality of packaging materials used for food and pharmaceutical products, the adoption of thermocol boxes remains critical.

Germany’s EPS packaging box industry is expected to grow at a CAGR of 5.6% from 2025 to 2035. The country is a leader in cold chain logistics, and with its robust regulatory framework, it ensures that packaging solutions meet high safety standards.

Germany’s commitment to reducing environmental impact through strict packaging laws is encouraging innovation in thermocol box design, focusing on recyclability and efficiency. These regulations, coupled with technological advancements in packaging materials, continue to drive the adoption of thermocol boxes, especially in the food and pharmaceutical sectors.

The EPS packaging box industry in China is projected to grow at a CAGR of 4.6% from 2025 to 2035. As China continues to experience rapid urbanization and the expansion of e-commerce, there is an increasing need for cost-effective packaging solutions.

The Chinese government has made significant investments in cold chain logistics infrastructure, which is directly contributing to the adoption of thermocol boxes. Additionally, China is seeing increased innovation in thermocol box production, focusing on lowering manufacturing costs while improving insulation efficiency, making it more suitable for large-scale distribution.

India’s EPS packaging box market is set to grow at a CAGR of 4.7% from 2025 to 2035. India’s e-commerce sector, especially in the food delivery and pharmaceutical industries, is expanding rapidly, which is creating increased demand for reliable and cost-effective packaging.

The Indian government’s focus on improving cold chain logistics and reducing packaging waste is also pushing the industry toward more efficient thermocol solutions. The widespread use of EPS packaging boxes for transporting perishable goods, especially in rural and semi-urban areas, plays a crucial role in the market’s growth.

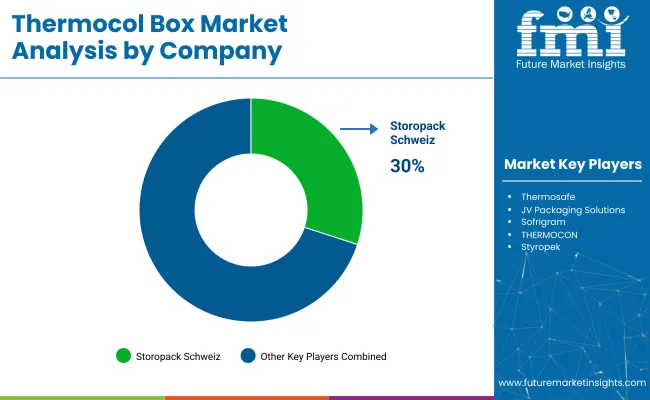

The thermocol box industry reflects a mix of established players and regional challengers. StoropackSchweiz and Thermosafe have focused on R&D-driven insulation solutions for pharma cold chains, with the former expanding its phase-change material lineup in 2024.

Sofrigram launched a modular EPS system in Q1 2025, aimed at European frozen food retailers. JV Packaging Solutions and THERMOCON continue to offer customized packaging options, while Styropek has pushed forward in Latin America through capacity enhancement. Universal Foam Products and Styrotech, Inc. remain prominent in the USA, catering to perishables and e-commerce packaging.

Entry into the industry is restricted by tooling costs, fire resistance compliance, and cold chain distribution tie-ups. The supply landscape is fragmented, with regional consolidation visible across Germany, India, and the USA, especially through backward integration and distributor acquisition by mid-sized players like Poly Molding LLC and Harbor Foam.

Recent Thermocol Box Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 2.9 billion |

| CAGR (2025 to 2035) | 4.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed | Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Recycled Polystyrene |

| Shape or Form Types Analyzed | Rectangular, Cylindrical, Customized Shapes |

| Applications Analyzed | Packaging, Cold Chain Logistics, Insulation, Storage |

| End-Use Industries Analyzed | Food & Beverages (Fruits & Vegetables, Dairy, Processed Foods, Confectionery, Meat & Poultry), Pharmaceuticals (Vaccines, Biologics, Diagnostic Kits, Cold Chain Drugs), Electronics (Semiconductors, Sensitive Equipment, Electronic Appliances), Seafood (Fresh Fish, Frozen Shrimp, Shellfish Export), Industrial Packaging (Chemicals, Specialty Materials, Components Shipping) |

| Distribution Channels Analyzed | Direct Sales, Distributors/Dealers, E-commerce Platforms |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players | Storopack Schweiz , Thermosafe , JV Packaging Solutions, Sofrigram , THERMOCON, Styropek , Universal Foam Products, Styrotech , Inc., Poly Molding LLC, Harbor Foam |

| Additional Attributes | Dollar sales growth by application (food, pharma, electronics), regional demand trends, competitive landscape, pricing strategies, distribution channel insights, material innovations, growth drivers in cold chain logistics. |

Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), and Recycled Polystyrene.

Rectangular, Cylindrical, and Customized Shapes

Packaging, Cold Chain Logistics, Insulation, and Storage

Direct Sales, Distributors/Dealers, and E-commerce platforms.

The industry size is projected to be USD 1.8 billion in 2025 and USD 2.9 billion by 2035.

The expected CAGR is 4.9% from 2025 to 2035.

Expanded Polystyrene (EPS) is expected to dominate the material segment with a 62% industry share.

Storopack Schweiz is the leading company in the market, holding 27-30% of the industry share.

India is expected to grow at a CAGR of 4.7% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Carboxymethyl Tamarind Kernel Powder Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Carboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Carboxylated Nitrile Rubber Market Size and Share Forecast Outlook 2025 to 2035

Carboxy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Cellulose Market 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA