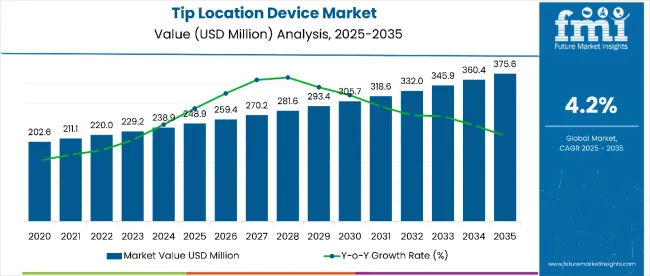

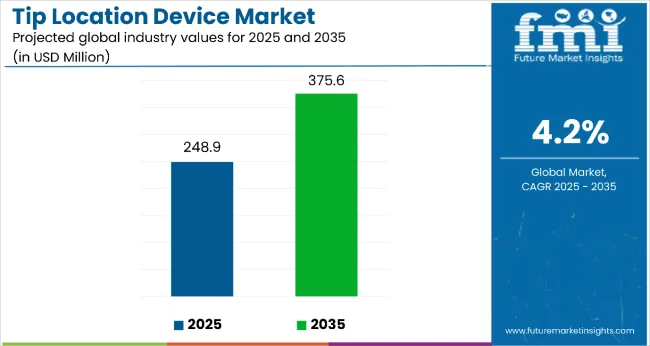

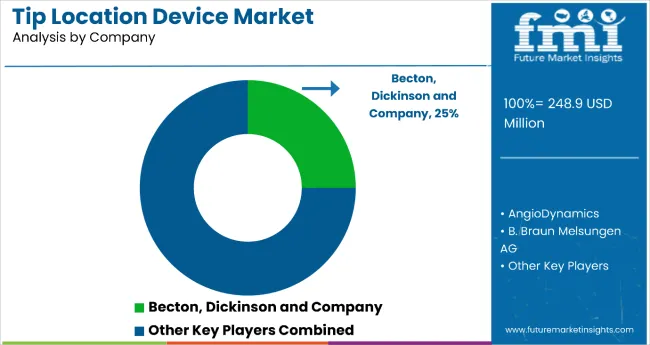

The tip location device market is expected to expand steadily from USD 248.9 million in 2025 to USD 375.6 million by 2035, progressing at a CAGR of 4.2%. Market growth is driven by advances in technology, increasing adoption in healthcare settings, and rising demand for catheter placement accuracy and safety. Despite challenges such as the requirement for skilled operators, the market shows strong potential due to continuous innovation and increasing use in critical care and interventional procedures globally.

By 2030, the market is projected to reach nearly USD 305.7 million, highlighting steady mid-term growth. This progression reflects growing demand for real-time catheter tip confirmation technologies, improved safety protocols, and expanding applications across hospitals and medical facilities. Over 2025 to 2035, the sector is poised to achieve an absolute growth of USD 126.7 million, underscoring consistent clinical reliance on precise vascular access devices and ongoing development of enhanced imaging and monitoring technologies worldwide.

Leading companies such as Becton, Dickinson and Company, Angio Dynamics, B. Braun Melsungen AG, Vygon (UK) Ltd., and Teleflex Incorporated are consolidating their positions by strengthening product portfolios and advancing next-generation tip location technologies. Their focus includes real-time catheter tip confirmation systems, enhanced imaging accuracy, user-friendly interfaces, and disposable device options that improve patient safety and procedural efficiency. By investing in innovation, precision, and cost-effective solutions, these players are enhancing access for healthcare providers while capturing growth opportunities across developed healthcare systems and emerging markets.

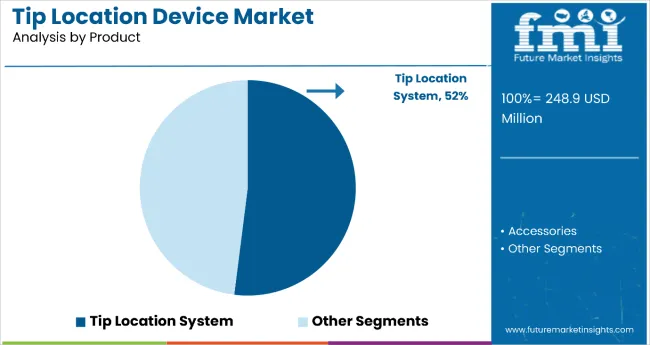

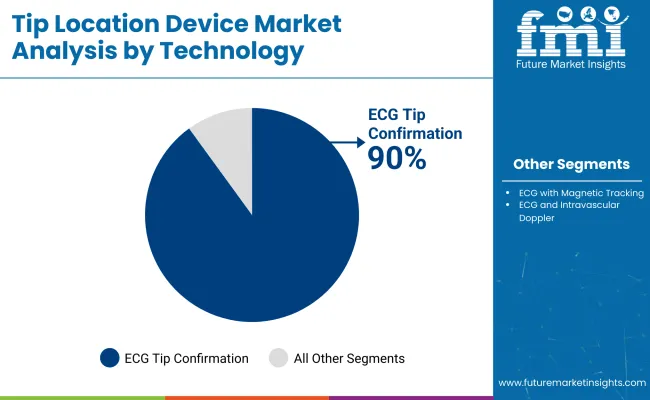

The market holds a critical position in vascular access and catheterization procedures, with tip location systems representing over 52% of product usage due to their superior accuracy and reliability in catheter placement verification. ECG tip confirmation technology, accounting for 90% of the technology segment, remains central to clinical practice by enabling bedside confirmation and reducing the need for confirmatory radiography. This sector contributes substantially to the broader medical device landscape, driven by increasing demand for minimally invasive procedures, technological advancements, and expanding healthcare infrastructure worldwide.

The market is evolving with innovative features such as ECG combined with magnetic tracking and intravascular Doppler technologies, which enhance precision, reduce procedure times, and improve patient outcomes. Companies are strengthening their portfolios with smarter, integrated tip location systems designed to minimize complications, streamline vascular access, and support diverse clinical settings, from hospitals to ambulatory care centers. Strategic collaborations with healthcare providers, training institutions, and regional distributors are reshaping accessibility and positioning advanced tip location devices as essential solutions for safe and effective catheter placement globally.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 248.9 million |

| Market Forecast Value (2035) | USD 375.6 million |

| CAGR (2025 to 2035) | 4.2% |

The market is growing steadily due to several key factors driving demand and technological advancements. The increasing adoption of minimally invasive catheter placement procedures in hospitals and healthcare facilities fuels the need for accurate tip location technology, which enhances patient safety and reduces complications such as catheter misplacement. Real-time confirmation of catheter placement, especially through ECG tip confirmation technology, allows clinicians to efficiently perform vascular access with higher precision. This reduces reliance on confirmatory chest X-rays, saving time and healthcare costs.

Technological innovations, including advancements in ECG combined with magnetic tracking and intravascular Doppler, are improving the accuracy and ease of use of tip location devices. These advancements provide continuous monitoring capabilities and integrate with existing clinical workflows, further encouraging adoption.

Growing prevalence of chronic diseases and critical care procedures requiring reliable catheter placement, such as oncology treatments, dialysis, and intensive care interventions, also bolsters market growth. Additionally, increasing healthcare infrastructure investments in emerging regions like China, India, and parts of Europe expand market accessibility.

The market is segmented by product, technology, end user, and region. By product, the market is bifurcated into tip location systems and accessories (integrated catheters, ECG cables, ECG clip cables, and ECG lead sets). Based on technology, the market is divided into ECG tip confirmation, ECG with magnetic tracking, and ECG and intravascular Doppler. In terms of end user, the market is categorized into hospitals, ambulatory surgical centers, and catheterization labs. Regionally, the market is classified into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa.

The most lucrative product segment is tip location systems, commanding a significant market share of 52% as of 2025. This dominance is attributed to its crucial role in providing real-time, accurate catheter tip positioning, which is essential for minimizing procedural complications, enhancing patient safety, and improving clinical outcomes. Tip Location Systems offer clinicians immediate feedback during catheter placements, reducing reliance on confirmatory radiographic imaging and shortening procedure times, which collectively bolster operational efficiency in healthcare settings.

Additionally, advances in technology have enhanced system accuracy and usability, with integrated features that support patient safety and clinical decision-making. The growing adoption of minimally invasive catheterization procedures further fuels demand. Continuous R&D investments focus on improving device reliability, ease of use, and disposability, solidifying the tip location system segment’s leading position and strong growth potential in the medical device market.

ECG Tip Confirmation is the leading technology segment in the market, commanding 90% market share as of 2025. This technology is highly valued for its ability to provide real-time, precise catheter tip positioning by detecting the heart’s P-wave. This bedside verification capability significantly reduces the need for confirmatory chest X-rays, accelerating procedure times and enhancing overall clinical workflow efficiency. The technology’s proven clinical efficacy improves patient safety by minimizing risks of catheter misplacement, which can lead to complications.

Its widespread adoption across hospitals and catheterization centers is driven by its simplicity, reliability, and ease of integration into existing clinical protocols. Unlike newer technologies that combine ECG with magnetic tracking or intravascular Doppler, ECG Tip Confirmation remains preferred for its cost-effectiveness and regulatory approvals. Ongoing innovations such as device miniaturization and disposable designs further strengthen its market position. These factors collectively make ECG Tip Confirmation the most profitable and dominant technology segment in tip location devices, sustaining strong growth prospects.

The tip location device market from 2025 to 2035 is driven by increasing demand for accurate and real-time catheter tip positioning, rising prevalence of chronic diseases requiring vascular access, and expanding healthcare infrastructure across the globe. Technological advancements such as ECG tip confirmation, magnetic tracking, and intravascular Doppler enhance device accuracy and usability, encouraging wider clinical adoption. Growing access to advanced healthcare in emerging regions like China and India further fuels market growth.

Health Awareness and Clinical Innovation Boost Tip Location Device Market Growth

Increasing awareness among healthcare professionals about the importance of precise catheter placement, combined with improvements in catheterization techniques, is a key driver of the tip location device market. Innovative technologies like real-time ECG-based tip confirmation systems improve procedural outcomes by reducing complications and minimizing reliance on confirmatory radiographic imaging. The rising adoption of minimally invasive vascular interventions also supports market expansion.

Innovation and Sustainability Expanding Tip Location Device Market Opportunities

Innovation in tip location device technology is broadening market opportunities beyond traditional systems. Advances include integration of ECG with magnetic tracking, disposable and user-friendly designs, and enhanced software for critical care monitoring. These innovations address diverse clinical needs and improve patient safety during catheter placement. Manufacturers are increasingly focusing on sustainable product development, eco-friendly materials, and compliance with stringent regulatory standards, appealing to healthcare providers and advancing long-term market growth.

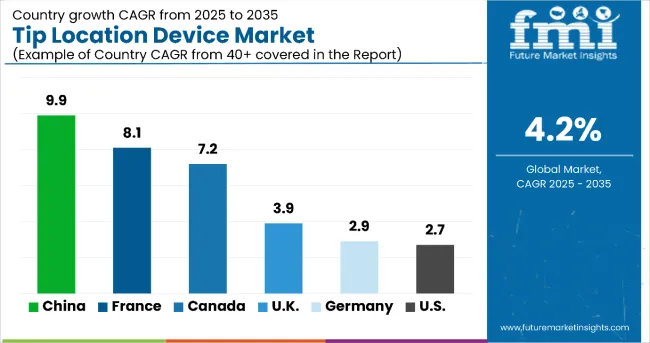

| Country | CAGR (%) |

| China | 9.9 |

| France | 8.1 |

| Canada | 7.2 |

| United Kingdom | 3.9 |

| Germany | 2.9 |

| United States | 2.7 |

The tip location device market is experiencing varied growth rates across key global regions, reflecting differences in healthcare infrastructure, technology adoption, and demographic trends. China leads the market with a robust CAGR of 9.9%, driven by rapid healthcare modernization, government support, and rising chronic disease prevalence, making it the fastest-growing market globally. France follows with an 8.1% CAGR, benefiting from a strong regulatory framework and collaborative innovation in medical technology. Canada and Japan show substantial growth at 7.2% and 7.0%, respectively, fueled by aging populations, healthcare investments, and high technology adoption rates. In contrast, the United Kingdom demonstrates a moderate CAGR of 3.9% due to its mature healthcare system focused on cost-effective, minimally invasive procedures. Germany and the United States exhibit slower growth rates of 2.9% and 2.7%, respectively, reflecting established markets with high device penetration but incremental adoption rates.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

Revenue from tip location device in China with a robust CAGR of 9.9%, driven by rapid healthcare infrastructure growth and rising chronic disease prevalence. The government’s focus on expanding healthcare access and adopting advanced medical technologies fuels demand for accurate catheter placement devices. Hospitals and catheterization centers increasingly invest in cost-effective, locally manufactured tip location systems. Training programs and awareness campaigns further accelerate adoption, improving patient outcomes. The aging population intensifies demand for vascular access procedures, supporting sustained market growth. Additionally, rising investment in R&D fosters innovation tailored to regional clinical needs. Continuous upgrades in device accuracy and usability reinforce China’s leading role in this market.

Revenue from tip location device in France is growing at a healthy CAGR of 8.1%, supported by a well-established healthcare system prioritizing patient safety and clinical precision. Regulatory rigor ensures high standards for device quality, encouraging adoption of ECG-based catheter tip confirmation technologies. The healthcare sector emphasizes collaborative research between medical institutions and device manufacturers, fostering product innovation. Increasing geriatric population and chronic disease burdens drive demand for reliable vascular access solutions. Moreover, France invests in healthcare IT integration, enhancing device interoperability and clinical workflows. These trends position France as a key innovation hub within the European tip location device landscape.

Demand for tip location device in the UK experiences a steady CAGR of 3.9%, reflecting widespread adoption across NHS hospitals and specialized care centers. National health policies promote minimally invasive vascular procedures that enhance patient safety and reduce hospital stays. Growth in outpatient and ambulatory surgical facilities drives the need for efficient and reliable tip location systems. Medical tourism adds further momentum, prompting healthcare providers to prioritize advanced procedural technologies. Training initiatives increase clinician proficiency in vascular access techniques. Strategic partnerships between providers and device makers support market expansion. Cost-containment pressures encourage adoption of user-friendly, disposable devices, strengthening the UK market’s structural growth.

Revenue from tip location device in Germany grows at a CAGR of 2.9%, powered by its strong healthcare infrastructure and emphasis on precision medicine. Chronic disease prevalence fuels demand for reliable and accurate catheter placement technologies. Public healthcare programs incentivize the adoption of tip location systems to reduce complications and improve critical care outcomes. Hospitals maintain advanced radiology facilities that complement these technologies. Collaborative R&D efforts among universities and medical device companies foster continuous product improvements. Infection control and patient safety initiatives further boost market acceptance. Germany’s focus on integrating innovative medical devices within clinical practice drives steady market progress.

Revenue from tip location device in the United States grows at a CAGR of 2.7%, supported by advanced healthcare R&D and a large patient population needing vascular access. Leading medical device companies invest heavily in innovation, developing devices with improved accuracy and ease of use. Widespread clinical training programs facilitate rapid adoption across hospitals and ambulatory centers. Integration of tip location systems with electronic health records enhances workflow efficiency and patient safety. Reimbursement frameworks incentivize use of these technologies. Increasing preference for outpatient procedures further expands market opportunities. Focus on cost savings through quicker catheter placements supports sustainable growth.

Demand for tip location device in Canada experiences robust growth with a CAGR of 7.2%, driven by government support and rising investments in healthcare modernization. Enhanced awareness of vascular access complications promotes adoption of tip location technologies across hospitals and outpatient centers. The expanding elderly demographic and chronic illness rates increase demand for catheter-based interventions. Collaboration between public health institutions and vendors accelerates product deployment. Focus on procedural accuracy and patient throughput optimizes healthcare delivery. Increasing outpatient care platforms contribute to market dynamism. Continuous innovation and training improve clinical outcomes and device utilization.

The Tip Location Device Market is expanding rapidly, driven by the increasing adoption of peripherally inserted central catheters (PICCs) and central venous access devices in hospitals and ambulatory care settings. Tip location devices are essential for accurately positioning catheter tips within the venous system—ensuring safety, reducing complications, and improving clinical outcomes. The market’s growth is propelled by rising incidences of chronic diseases requiring long-term intravenous therapy, advancements in real-time navigation technologies, and growing emphasis on minimally invasive procedures.

Major medical device manufacturers such as Becton, Dickinson and Company (BD), AngioDynamics, Inc., and B. Braun Melsungen AG lead the market through technologically advanced vascular access solutions. BD dominates with its Sherlock 3CG Tip Confirmation System, which integrates electromagnetic tracking and ECG technology to enhance placement accuracy and procedural efficiency. AngioDynamics continues to innovate in vascular access with systems that combine ultrasound guidance and tip confirmation for reduced insertion time. B. Braun Melsungen AG leverages its expertise in infusion therapy to offer integrated catheter placement systems with high precision and patient safety standards.

Vygon (UK) Ltd. and Teleflex Incorporated are key European and U.S. players offering ECG-based tip location technologies compatible with a wide range of central lines. Boston Scientific Corporation and GE Healthcare are expanding their presence through advanced imaging and real-time guidance platforms integrated into catheter navigation systems. Smiths Medical focuses on portable, user-friendly tip location devices designed for bedside applications, improving workflow in acute and home-care environments.

Avanos Medical, Inc. and Terumo Corporation are contributing to the Asia-Pacific and North American markets with versatile and cost-effective tip confirmation systems, catering to the rising number of outpatient and ambulatory care procedures.

| Items | Values |

| Quantitative Units (2025) | USD 248.9 million |

| Product Type | Tip Location Systems, Accessories (Integrated Catheters, ECG Cables, ECG Clip Cables, ECG Lead Sets) |

| Technology | ECG Tip Confirmation, ECG with Magnetic Tracking, ECG and Intravascular Doppler |

| End User | Hospitals, Ambulatory Surgical Centers, Catheterization Labs |

| Regions Covered | North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Becton, Dickinson and Company; Angio Dynamics, Inc.; B. Braun Melsungen AG; Vygon (UK) Ltd.; Teleflex Incorporated; Boston Scientific Corporation; GE Healthcare; Smiths Medical; Avanos Medical, Inc.; Terumo Corporation |

| Additional Attributes | Market revenue by product and technology; regional demand trends; competitive landscape; adoption of disposable and advanced tip location systems; R&D investments; healthcare IT integration; infrastructure growth; rising vascular procedures; chronic disease prevalence worldwide |

The global tip location device market is estimated to be valued at USD 248.9 million in 2025.

The market size for tip location devices is projected to reach USD 375.6 million by 2035.

The tip location device market is expected to grow at a 4.2% CAGR between 2025 and 2035.

Tip location systems are projected to lead the tip location device market with 52% market share in 2025.

ECG tip confirmation is expected to command 90% share in the tip location device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tipper Body Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tipping Foils Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Tipping Foils Industry

Tipper Pads Market

Antiperspirants and Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Antipruritic Market Size and Share Forecast Outlook 2025 to 2035

Antiperspirants / Deo-Actives Market Size and Share Forecast Outlook 2025 to 2035

Multipurpose Goods Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Sepsis Biomarker Panels Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Biomarker Imaging Market Forecast and Outlook 2025 to 2035

Multiplex PCR Assays Market Size and Share Forecast Outlook 2025 to 2035

Multiparameter Patient Monitoring Systems Market Size and Share Forecast Outlook 2025 to 2035

Multiple Reaction Monitoring Assay Market Size and Share Forecast Outlook 2025 to 2035

Vertiports Market Size and Share Forecast Outlook 2025 to 2035

Multiplex Molecular Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Multiple System Atrophy (MSA) Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Multiprotocol Storage Market Size and Share Forecast Outlook 2025 to 2035

MUPS Market Overview - Growth & Forecast 2025 to 2035

Multiple Myeloma Diagnostics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA