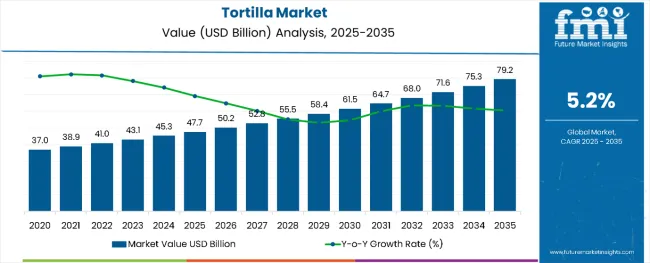

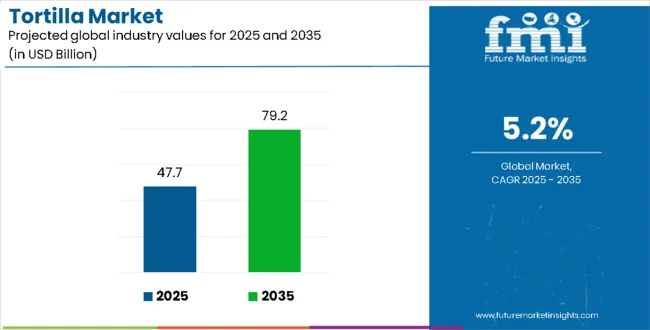

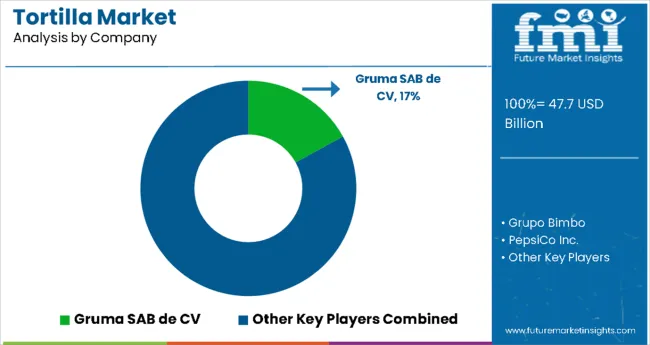

The global tortilla market is expected to rise from USD 47.7 billion in 2025 to USD 79.2 billion by 2035, reflecting an absolute increase of USD 31.5 billion and a CAGR of about 5.2%. This translates into a total growth of 66.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.20% between 2025 and 2035. The overall market size is expected to grow by nearly 1.66X during the same period, supported by increasing global acceptance of Mexican cuisine and growing demand for convenient food products.

Tortilla Market Key Takeaways

| Metric | Value |

|---|---|

| Tortilla Market Value (2025) | USD 47.7 billion |

| Tortilla Market Forecast (2035) | USD 79.2 billion |

| Tortilla Market Forecast CAGR | 5.20% |

Between 2020 and 2025, the tortilla market experienced steady expansion, driven by increasing globalization of food preferences and growing recognition of tortilla versatility in various culinary applications. The market developed as food service establishments and retail channels recognized the potential of tortilla products for diverse menu applications. Consumers and food manufacturers began emphasizing tortilla products for their convenience, nutritional benefits, and cultural authenticity in international cuisine offerings.

Between 2025 and 2030, the tortilla market is projected to expand from USD 47.7 billion to USD 61.9 billion, resulting in a value increase of USD 14.2 billion, which represents 45.1% of the total forecast growth for the decade. This phase of growth will be shaped by rising popularity of Mexican cuisine globally, increasing adoption of tortillas as versatile food bases across various culinary applications, and growing consumer preference for ethnic and authentic food experiences. Manufacturers are expanding their production capabilities to address the growing demand for premium tortilla products across various market segments.

From 2030 to 2035, the market is forecast to grow from USD 61.9 billion to USD 79.2 billion, adding another USD 17.3 billion, which constitutes 54.9% of the overall ten-year expansion. This period is expected to be characterized by expansion of tortilla applications in fusion cuisines, integration of health-focused ingredient formulations, and development of specialty tortilla varieties for specific dietary requirements. The growing adoption of plant-based and gluten-free tortilla options will drive demand for more sophisticated processing methods and specialized ingredient sourcing.

Market expansion is being supported by the increasing globalization of Mexican cuisine and the corresponding need for authentic tortilla products in international food service and retail applications. Modern food systems rely on tortillas as versatile food bases for creating diverse meal solutions including wraps, quesadillas, tacos, and fusion cuisine applications. Even minor menu innovations require comprehensive ingredient sourcing and quality control to maintain optimal product authenticity and consumer satisfaction.

The growing popularity of ethnic cuisines and increasing consumer interest in convenient meal solutions are driving demand for high-quality tortilla products from certified suppliers with appropriate processing methods and expertise. Food service operators are increasingly incorporating tortilla-based menu items into their offerings following consumer trends demonstrating preference for diverse culinary experiences. Quality standards and food safety regulations are establishing standardized production procedures that require specialized equipment and trained production staff.

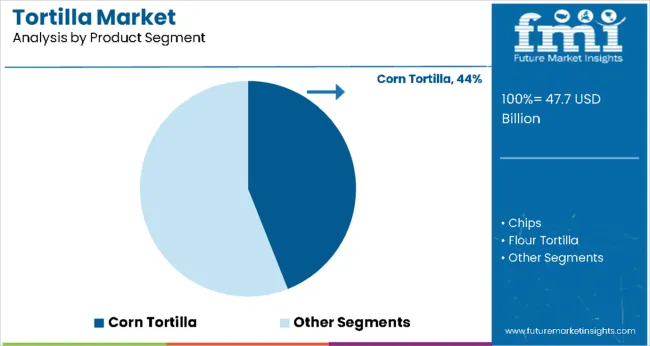

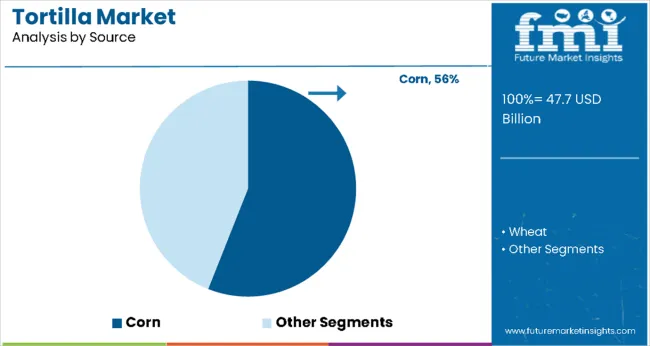

The market is segmented by product type, source, processing type, distribution channel, and region. By product, the market is divided into corn tortilla, chips, flour tortilla, tostadas, and taco shells. Based on source, the market is categorized into corn and wheat. By processing type, the market is categorized into fresh and frozen. In terms of distribution channel, the market is divided into online, offline, supermarkets, convenience stores, and others such as independent grocery stores, foodservice outlets, institutional buyers, and specialty & ethnic stores. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The corn tortilla segment is projected to account for 44% of the tortilla market in 2025. This leading share is supported by the traditional authenticity and widespread acceptance of corn tortillas in Mexican cuisine and their growing popularity in international markets. Corn tortillas provide distinctive flavor profiles and texture characteristics that make them the preferred choice for authentic Mexican food applications and health-conscious consumers seeking gluten-free alternatives. The segment benefits from established production processes and comprehensive manufacturing capabilities from multiple suppliers across traditional and emerging markets.

Traditional preparation methods including nixtamalization process and ancient grain heritage contribute to superior nutritional profiles and authentic taste characteristics preferred by consumers seeking genuine Mexican culinary experiences. Processing facilities equipped with specialized masa preparation systems enable consistent production of high-quality corn tortillas with optimal texture and flavor development. The corn tortilla segment also benefits from cultural authenticity recognition and growing consumer awareness of traditional food preparation methods. Health advantages including natural gluten-free properties, higher fiber content, and mineral availability further enhance the long-term appeal of corn tortillas across diverse consumer demographics and dietary preference categories.

Corn source is expected to represent 56% of tortilla market demand in 2025. This dominant share reflects the traditional foundation of Mexican tortilla production and the superior functional characteristics of corn-based formulations in authentic tortilla manufacturing. Corn provides essential starch structures and flavor compounds that create the distinctive texture and taste profiles associated with traditional tortilla products. The segment benefits from established agricultural supply chains and growing cultivation of specialty corn varieties designed specifically for tortilla production applications.

Agricultural advantages including diverse corn variety availability, traditional cultivation techniques, and specialized processing requirements contribute to consistent quality and authentic flavor development in corn-based tortilla production. Specialized corn varieties including white corn, yellow corn, and heirloom cultivars offer distinct flavor profiles and nutritional characteristics suited to different market preferences and culinary applications. The corn segment also benefits from sustainable agricultural practices and heritage seed preservation programs that maintain genetic diversity and traditional cultivation methods. Nutritional advantages including complete protein profiles when combined with complementary foods, natural mineral content, and traditional processing methods that enhance bioavailability further support the preference for corn-based tortilla products across cultural and health-conscious consumer segments.

The tortilla market is advancing steadily due to increasing global cuisine diversification and growing recognition of tortilla versatility in food applications. However, the market faces challenges including fluctuating raw material costs, seasonal availability of specialty corn varieties, and varying production standards across different regions. Cultural authenticity preservation and quality certification programs continue to influence production methods and market development patterns.

Expansion of Health-Conscious and Specialty Formulations

The growing deployment of health-focused tortilla formulations is enabling development of products targeting gluten-free consumers, organic food preferences, and enhanced nutritional profiles. Advanced formulations incorporating ancient grains, plant-based proteins, and functional ingredients provide expanded nutritional benefits while maintaining traditional taste and texture characteristics. These applications are particularly valuable for health-conscious consumers seeking authentic ethnic foods and food manufacturers focusing on premium market segments.

Integration of Advanced Processing and Quality Control Technologies

Modern tortilla producers are incorporating advanced processing technologies and automated quality control systems that improve product consistency and reduce production costs. Integration of moisture control systems and specialized pressing equipment enables more precise texture development and comprehensive quality assurance. Advanced processing equipment also supports production of specialty tortilla varieties including organic formulations, non-GMO products, and artisanal preparation methods for premium market applications.

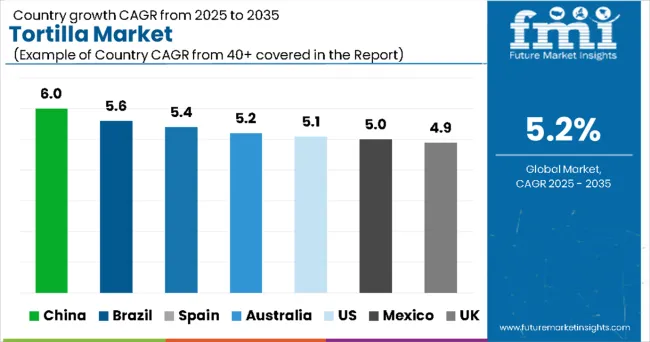

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.0% |

| Brazil | 5.6% |

| Spain | 5.4% |

| Australia | 5.2% |

| United States | 5.1% |

| Mexico | 5.0% |

| United Kingdom | 4.9% |

The tortilla market is growing rapidly across key regions, with China leading at a 6.0% CAGR through 2035, driven by expanding international cuisine adoption, growing urban population exposure to Mexican food, and increasing food service sector development. Brazil follows at 5.6%, supported by cultural culinary diversity and growing fast-food chain expansion featuring Mexican-inspired menu items. Spain records 5.4% growth, emphasizing cultural cuisine familiarity and established distribution networks for ethnic food products. Australia shows 5.2% expansion, focusing on multicultural food preferences and growing Mexican restaurant sector development. The United States demonstrates 5.1% growth through market maturity and premium product segment expansion, while Mexico and the United Kingdom achieve 5.0% and 4.9% growth respectively, with emphasis on traditional market leadership and international cuisine adoption patterns.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from tortilla products in China is projected to exhibit the highest growth rate with a CAGR of 6.0% through 2035, driven by rapid expansion of international cuisine acceptance and increasing urbanization creating demand for diverse food experiences. The country's growing middle-class population and rising exposure to Western and Latin American food cultures are creating significant demand for tortilla products across food service and retail channels. Major food service operators and international restaurant chains are establishing comprehensive supply chains to support the growing population seeking authentic ethnic food experiences across major metropolitan areas.

Revenue from tortilla products in Brazil is expanding at a CAGR of 5.6%, supported by the country's established cultural diversity and increasing integration of international cuisine elements into traditional food service offerings. The expanding urban food service sector and growing consumer interest in Mexican and Tex-Mex cuisine are driving demand for high-quality tortilla products. Food service operators and specialty food distributors are gradually establishing capabilities to serve the growing population seeking diverse culinary experiences through authentic ethnic food offerings.

Revenue from tortilla products in Spain is growing at a CAGR of 5.4%, driven by the country's established familiarity with Latin American cuisine and growing food service infrastructure supporting ethnic food applications. Spanish food service operators are gradually expanding tortilla product offerings while leveraging cultural connections with Latin American culinary traditions. Restaurant operators and specialty food distributors are investing in tortilla sourcing and menu development to address growing market demand for authentic Mexican and Tex-Mex food experiences.

Demand for tortilla products in Australia is projected to grow at a CAGR of 5.2%, supported by the country's multicultural population and growing acceptance of diverse ethnic cuisine options in mainstream food service operations. Australian food service operators and retail distributors are implementing comprehensive tortilla product offerings that meet diverse consumer preferences for international cuisine experiences. The market is characterized by focus on product quality, cultural authenticity, and compliance with comprehensive food safety and import regulations.

Demand for tortilla products in the United States is expanding at a CAGR of 5.1%, driven by market maturity and increasing consumer focus on premium and specialty tortilla varieties. American food manufacturers and retail operators are establishing comprehensive tortilla product portfolios to serve diverse consumer needs across traditional and health-conscious market segments. The market benefits from established distribution networks and consumer familiarity with Mexican cuisine applications following decades of cultural food integration.

Demand for tortilla products in Mexico is projected to grow at a CAGR of 5.0%, driven by traditional market leadership and increasing focus on product innovation and export market development. Mexican tortilla manufacturers are implementing advanced production technologies and quality control systems that support both domestic consumption and international market expansion. The market benefits from cultural authenticity, established supply chains, and comprehensive manufacturing expertise developed over generations of traditional tortilla production.

Revenue from tortilla products in the United Kingdom is expanding at a CAGR of 4.9%, supported by increasing adoption of international cuisine and growing availability of Mexican food products through retail and food service channels. British food service operators and retail distributors are establishing comprehensive tortilla product availability to serve diverse consumer demographics seeking ethnic food experiences. The market is characterized by focus on product accessibility, cultural authenticity, and compliance with European food quality and safety standards.

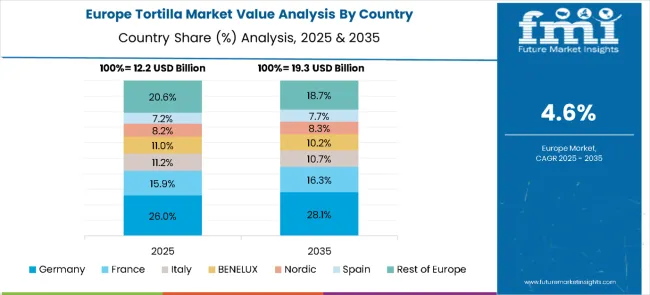

The tortilla market in Europe is projected to grow from USD 12.2 billion in 2025 to USD 19.3 billion by 2035, registering a CAGR of 4.6% over the forecast period. Germany is expected to lead with a 26.0% share in 2025, followed by France at 15.9%, reflecting growing adoption of tortillas as part of convenient and ethnic food offerings. Italy holds 11.2% of the market, while BENELUX accounts for 11.0% and the Nordic countries represent 8.2%.

Spain contributes 7.2%, while the Rest of Europe collectively makes up 20.6%. By 2035, Germany will further expand its dominance to 28.1%, France will increase slightly to 16.3%, and Italy will hold 10.7%. BENELUX and the Nordic region are projected at 10.2% and 8.3%, respectively, while Spain will edge up to 7.7%, and the Rest of Europe will moderate to 18.7%, reflecting a steady consolidation of consumption in Western Europe’s key food markets.

The tortilla market is defined by competition among established food manufacturers, specialty ethnic food producers, and integrated agricultural processing companies. Companies are investing in advanced production equipment, quality control systems, authentic preparation methods, and distribution capabilities to deliver traditional, consistent, and culturally authentic tortilla solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Gruma SAB de CV, Mexico-based, holds a 17% market position and offers comprehensive tortilla products with a focus on traditional authenticity and global market expansion. Grupo Bimbo provides integrated tortilla solutions across bakery operations and Latin American food manufacturing capabilities. PepsiCo Inc., United States, delivers tortilla chip products with emphasis on snack food applications and mass market distribution. General Mills emphasizes specialty tortilla formulations and North American market penetration for diverse food service applications.

Ole Mexican Foods Inc. offers tortilla solutions integrated into comprehensive Mexican food product portfolios. These companies provide specialized production expertise, traditional preparation methods, and reliable distribution capabilities across global and regional networks, focusing on authentic Mexican food applications, retail consumer products, and food service industry requirements.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 47.7 Billion |

| Product Type | Corn Tortilla, Chips, Flour Tortilla, Tostadas, Taco Shells |

| Source | Corn, Wheat |

| Processing Type | Fresh and Frozen |

| Distribution Channel | Online, Offline, Supermarkets, Convenience Stores, Others (Independent Grocery Stores, Foodservice Outlets, Institutional Buyers, and Specialty & Ethnic Stores) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, Brazil, Spain, Australia, United States, Mexico, United Kingdom, and 40+ countries |

| Key Companies Profiled | Grupo Bimbo SAB de CV, General Mills, Aranda's Company Inc., Ole Mexican Foods Inc., Easy Foods Inc., Gruma SAB de CV, PepsiCo Inc., La Factory, Catallia Mexican Foods, Tyson Foods Inc., Azteca Foods Inc. |

| Additional Attributes | Dollar sales by product/source, regional demand (APAC, Latin America, NA), competition (food majors vs specialty), consumer preference (corn vs wheat), distribution integration, specialty innovations, and traditional methods adoption |

The industry is expected to reach USD 79.2 billion by 2035, up from USD 47.7 billion in 2025.

Corn segment lead the industry with estimated sales of USD 21.4 billion in 2025, accounting for nearly 45% of total revenue.

Flour segment are projected to grow from USD 10.8 billion in 2025 to USD 17.3 billion by 2035, registering a CAGR of 4.8%.

Online retail is forecasted to grow at a 5.6% CAGR, reaching USD 11.3 billion by 2035 from USD 6.5 billion in 2025.

The United States, Mexico, Spain, France, and the United Kingdom are the leading markets, contributing over 60% of total global sales in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tortilla Machine Market Size and Share Forecast Outlook 2025 to 2035

Tortilla Mix Market Insights - Authentic & Gluten-Free Growth 2025 to 2035

Market Leaders & Share in the Tortilla Bread Industry

USA Tortilla Market Report – Growth, Demand & Forecast 2025-2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Korea Tortilla Market Analysis by Product Type, Nature, Source Type, Process Type, Sales Channel, and Region Through 2035

Frozen Tortilla Market Size, Growth, and Forecast for 2025 to 2035

Gluten-Free Tortilla Market Trends – Free-From Foods & Market Growth 2024-2034

Western Europe Tortilla Market Analysis by Product Type, Nature, Source, Process, Sales Channel, and Country through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA