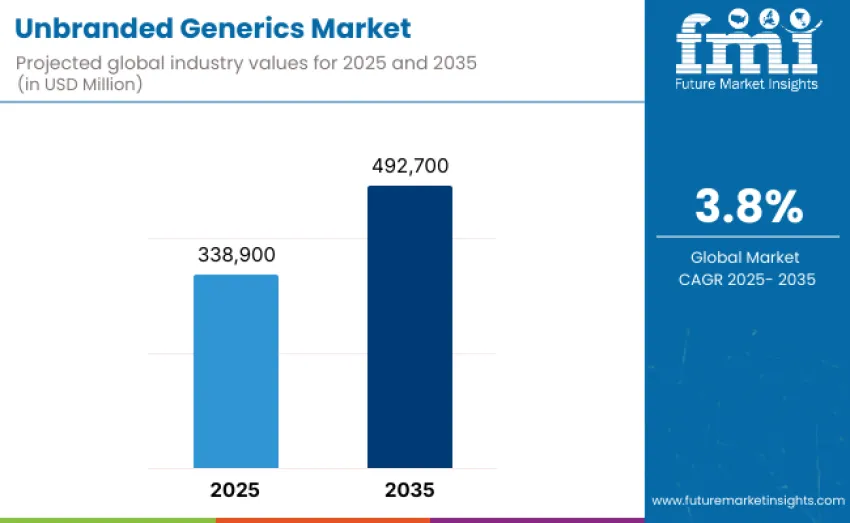

The global unbranded generics market is projected to reach USD 492,700 million by 2035, recording an absolute increase of USD 153,800 million over the forecast period. This market is valued at USD 338,900 million in 2025 and is set to rise at a CAGR of 3.8% during the assessment period. Overall size is expected to grow by nearly 1.5 times during the same period, supported by increasing demand for affordable and accessible medicines across global healthcare systems, rising prevalence of chronic diseases, and growing adoption of cost-containment strategies within public health programs.

Expansion reflects fundamental shifts in pharmaceutical manufacturing and healthcare delivery models, where unbranded generics enable hospitals, clinics, and national procurement agencies to maintain therapeutic continuity and affordability without compromising clinical efficacy. Healthcare providers across both developed and emerging economies face mounting pressure to optimize treatment costs while ensuring wide access to essential therapies, with unbranded generics often achieving cost savings compared to originator drugs, making them indispensable to long-term sustainability of global healthcare expenditure frameworks.

Integration of advanced analytical techniques such as high-performance liquid chromatography and dissolution profiling enables enhanced control over drug release characteristics and stability, ensuring therapeutic reliability comparable to branded formulations. Adoption of serialization and digital traceability systems strengthens supply chain transparency, reducing risks of counterfeit distribution and reinforcing patient trust in generic pharmaceutical products. Government healthcare affordability initiatives and national medicine security programs accelerate growth through generic substitution mandates and centralized tender procurement systems.

Between 2025 and 2030, the unbranded generics market is projected to expand from USD 338,900 million to USD 408,627 million, resulting in a value increase of USD 69,727 million, which represents 45.3% of total forecast growth for the decade. This phase of expansion will be driven by increasing global access to essential medicines, favorable regulatory initiatives encouraging generic substitution, and cost containment strategies implemented by healthcare systems worldwide. The period will see intensified competition among leading manufacturers focusing on high-volume production efficiency and quality standardization.

From 2030 to 2035, growth is forecast from USD 408,627 million to USD 492,700 million, adding USD 84,073 million, constituting 54.7% of the overall ten-year expansion. This phase will be characterized by strategic product diversification, accelerated entry of off-patent biologics, and integration of digital manufacturing and traceability technologies, ensuring quality compliance. Companies will increasingly invest in automated production lines, regional manufacturing hubs, and sustainable sourcing models to improve supply reliability and operational efficiency.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 338,900 million |

| Market Forecast Value (2035) | USD 492,700 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

The unbranded generics market is expanding globally due to rising demand for affordable, high-quality medicines that reduce overall healthcare costs and increase patient access to essential treatments. As patent expiries of branded drugs continue, generic manufacturers are capitalizing on opportunities to provide therapeutically equivalent products at significantly lower prices than branded counterparts. This cost advantage has led governments, healthcare providers, and insurance systems to actively promote use of unbranded generics to manage budgetary pressures and expand treatment coverage.

International organizations and public health programs are encouraging widespread use of unbranded generics to improve affordability and treatment adherence in low- and middle-income countries. Challenges such as price erosion, quality perception issues, and complex regulatory compliance requirements may restrain profit margins for manufacturers in highly competitive regions. The ability to maintain therapeutic equivalence while reducing costs positions unbranded generics as essential components in sustainable healthcare delivery systems.

The unbranded generics market is segmented based on dosage form, distribution channel and region. By dosage form, classification includes oral solids, injectables, topicals and transdermals, ophthalmics and otics, inhalation, and others. By distribution channel, division covers retail pharmacies, hospital and institutional, government tenders or public procurement, and online or direct-to-consumer and mail order. Regionally, segmentation spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

The oral solids segment represents the dominant force, capturing 58.0% of total share in 2025. This category includes tablets, capsules, and other solid dosage forms that remain the most widely prescribed format due to ease of manufacturing, long shelf life, patient convenience, and cost efficiency in large-scale production. Leadership is supported by extensive use in chronic therapies such as cardiovascular, diabetes, and central nervous system disorders, where generic substitution rates are particularly high.

The injectables segment accounts for an estimated 22.0% of total share, driven by growing adoption of sterile formulations, parenteral antibiotics, oncology drugs, and biosimilars across hospital and institutional settings. Increased emphasis on quality assurance, regulatory compliance, and cold chain capabilities has strengthened competitiveness of unbranded injectable products. Topicals and transdermals, ophthalmics and otics, and inhalation segments serve specialized therapeutic areas with growing demand for cost-effective alternatives.

Key advantages driving the oral solids segment include:

Retail pharmacies dominate with 55.0% share in 2025, reflecting their critical role in ensuring broad patient access to affordable medicines across both developed and emerging economies. Leadership is supported by high prescription volumes, pharmacist-driven substitution practices, and strong consumer trust in local pharmacy networks. Retail pharmacies remain the primary sales channel for oral solid formulations and chronic disease therapies, with steady growth reinforced by increasing awareness of cost-effective generic alternatives.

The hospital and institutional segment accounts for 25.0% of share, driven by large-scale procurement of injectables, antibiotics, oncology products, and biosimilars used in inpatient and outpatient care settings. This segment benefits from structured purchasing programs, tender-based supply contracts, and expanding hospital networks. Government tenders and public procurement represent 15.0% of total share, reflecting importance in national healthcare systems, particularly in low- and middle-income countries.

Key market dynamics supporting channel preferences include:

The growth trajectory has been defined by evolving healthcare affordability needs, policy-led procurement mechanisms, and expanding prevalence of chronic diseases across global populations. Increasing emphasis on cost containment and equitable drug access within public and private healthcare systems has reinforced strategic importance. Government support for local manufacturing, coupled with expiration of major branded patents, has accelerated entry of multiple unbranded formulations, ensuring competitive pricing and broader therapeutic coverage.

Despite robust policy and demand fundamentals, structural constraints persist. Intense price competition has led to persistent margin compression, limiting capacity for technological reinvestment and process innovation among small and mid-sized manufacturers. Regulatory approval delays and compliance variability across jurisdictions have contributed to product launch bottlenecks, affecting agility. Dependence on imported raw materials has exposed manufacturers to volatility in global trade and supply chain disruptions.

Technological modernization across production environments has been recognized as a defining trend shaping the future of the unbranded generics industry. Adoption of automation, digital process control, and real-time quality assurance platforms has been accelerated to enhance consistency, reduce error margins, and ensure compliance with international manufacturing standards. Integration of data analytics and predictive maintenance systems within manufacturing operations has improved process stability, cost optimization, and regulatory readiness.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.6% |

| Brazil | 5.1% |

| China | 4.6% |

| India | 6.2% |

| Europe | 3.2% |

| Germany | 2.9% |

| United Kingdom | 3.0% |

The unbranded generics market is expanding globally, with India leading at a 6.2% CAGR due to its strong pharmaceutical manufacturing ecosystem, government initiatives, and growing export footprint. Brazil follows with 5.1% growth, supported by public healthcare investments and regulatory reforms promoting drug access. China grows at 4.6%, driven by its large-scale manufacturing capacity and healthcare reforms. The USA maintains steady growth at 3.6%, supported by patent expirations and insurer cost-containment measures. In Europe, Germany records a 2.9% growth, while the UK grows at 3.0%, driven by substitution policies and expanding biosimilars.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China exhibits one of the most dynamic growth trajectories, projected to record a CAGR of 4.6% through 2035. Leadership is being reinforced by systematic healthcare reform initiatives, large-scale domestic pharmaceutical manufacturing expansion, and government-led cost containment policies that prioritize use of affordable generic medicines. Strengthening of healthcare delivery systems under national programs such as "Healthy China 2030" has increased patient access to essential drugs, while centralized procurement reforms have driven large-volume acquisitions across hospitals and public institutions.

Key market factors:

Growth in India has been recorded at a CAGR of 6.2% through 2035, supported by the Pharma Vision 2020 and Skill India programs, which aim to enhance technical competence and GMP compliance across the domestic pharmaceutical ecosystem. National initiatives such as the Pharmaceuticals Skill Development Council and Production Linked Incentive Scheme for Pharmaceuticals have been instrumental in improving process efficiency, standardization, and quality of locally manufactured generics for both domestic and export regions.

Expansion of government-supported training programs has accelerated skill acquisition in formulation science, packaging technology, and regulatory documentation, enabling Indian manufacturers to meet international quality benchmarks, including WHO-GMP and USFDA certification requirements. Integration of digital learning platforms under the Skill India Digital Hub has facilitated remote training in analytical testing, cleanroom operations, and data integrity management, directly improving workforce readiness in small and mid-sized enterprises operating within the unbranded generics segment.

Germany's pharmaceutical sector continues to demonstrate strong leadership, supported by advanced manufacturing infrastructure, rigorous regulatory frameworks, and sustained emphasis on quality assurance. The country's healthcare system, one of the largest in Europe, has been characterized by systematic cost-containment strategies, leading to widespread adoption of generics as part of national reimbursement and prescription substitution policies. The unbranded generics market has been projected to expand at a CAGR of 2.9% through 2035.

Key development areas:

Brazil has emerged as one of the leading regions in Latin America, supported by a robust policy framework, expanding domestic manufacturing capabilities, and growing healthcare accessibility initiatives. Growth has been projected at a CAGR of 5.1% through 2035, driven by national pharmaceutical sector expansion and rising demand for affordable medicines within both public and private healthcare systems. The country's universal healthcare system plays a central role in ensuring broad access to essential medicines.

Leading market segments:

The United States unbranded generics market represents one of the most mature and structured generic pharmaceutical ecosystems globally, characterized by strong regulatory oversight, extensive distribution networks, and high prescription substitution rates. Growth has maintained steady expansion with a CAGR of 3.6% through 2035, underpinned by continuous rise in chronic disease prevalence, expiration of branded drug patents, and emphasis on cost reduction across insurance-driven healthcare systems.

Key market characteristics:

In the United Kingdom, the unbranded generics market benefits from strategic adoption across NHS hospitals, community pharmacies, and private healthcare providers, enabling cost-effective treatment options and expanded patient access. Government programs and healthcare policies, including mandatory generic substitution and accelerated approval pathways, are documented to reduce drug costs while maintaining therapeutic efficacy, with efficiency improvements enabling up to 15-25% reduction in procurement expenditure without affecting treatment outcomes.

Growth shows solid potential with a CAGR of 3.0% through 2035, linked to ongoing NHS cost containment measures, increasing chronic disease prevalence, and national emphasis on healthcare sustainability. British healthcare professionals and patients are adopting unbranded generics to balance quality and affordability while maintaining clinical standards in primary care, hospitals, and specialized treatment centers. Healthcare provider adoption includes NHS trusts and hospital pharmacies implementing standardized procurement processes and formulary integration programs.

The unbranded generics market in Europe is projected to grow from USD 73,541.3 million in 2025 to USD 101,988.9 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain leadership with a 28.5% share in 2025, declining slightly to 27.8% by 2035, supported by strong healthcare infrastructure, well-established generic substitution programs, and robust regulatory frameworks promoting cost-effective medicine adoption across hospitals and community pharmacies.

France follows with a 22.3% share in 2025, projected to reach 22.6% by 2035, driven by government-led healthcare cost-containment policies, widespread hospital formulary adoption, and initiatives encouraging prescriber and patient confidence in unbranded generics. The United Kingdom holds a 19.5% share in 2025, expected to reach 19.8% by 2035, supported by NHS-led generic substitution programs, standardized procurement processes, and growing awareness of cost-efficient pharmaceutical options.

Italy commands a 13.2% share in both 2025 and 2035, backed by regional healthcare system efficiency programs, pharmacist-led substitution protocols, and hospital-based generic medicine adoption. Spain accounts for 9.5% in 2025, rising to 9.7% by 2035, supported by expansion of pharmacy networks, educational programs for prescribers on therapeutic equivalence, and regional health authority initiatives. The Netherlands maintains a 6.8% share throughout the forecast period due to consistent government support for generic medicine uptake.

The global unbranded generics market is moderately concentrated, with a 12 to 15 players shaping the competitive landscape. The top companies collectively hold a significant portion of the global market share, with the remaining share held by smaller manufacturers and regional players. Competition is driven by factors such as manufacturing quality, regulatory compliance, product portfolio breadth, and distribution network efficiency, rather than price alone.

Teva Pharmaceuticals leads the market with a 12% share, leveraging its extensive regulatory approvals across major regions, a robust global supply chain, and strong relationships with healthcare providers and distributors. Sandoz and Viatris also maintain competitive advantages through similar strategies, focusing on research and development investments in process optimization, formulation standardization, and manufacturing scale. These companies are expanding into emerging markets and new therapeutic segments to sustain their leadership.

Other significant players include Sun Pharmaceutical, Dr. Reddy's Laboratories, Cipla, Aurobindo Pharma, Lupin, Zydus Lifesciences, and Hikma Pharmaceuticals, which compete through specialized offerings, regional expertise, and value-driven strategies. Smaller and emerging manufacturers from Asia, Latin America, and the Middle East exert competitive pressure through aggressive pricing strategies and flexible production capacities. Innovation in manufacturing and regulatory compliance continues to define competitive positioning.

| Items | Values |

|---|---|

| Quantitative Units | USD 338,900 million |

| Dosage Form | Oral Solids, Injectables, Topicals and Transdermals, Ophthalmics and Optics, Inhalation, and Others |

| Distribution Channel | Retail Pharmacies, Hospital and Institutional, Government Tenders or Public Procurement, Online or Direct-to-Consumer and Mail Order |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | USA, Brazil, China, India, Europe, Germany, France, UK |

| Key Companies Profiled | Teva Pharmaceuticals, Sandoz, Viatris, Sun Pharmaceutical, Dr. Reddy's Laboratories, Cipla, Aurobindo Pharma, Lupin, Zydus Lifesciences, Hikma Pharmaceuticals, Others |

| Additional Attributes | Dollar sales by dosage form and distribution channel, regional trends across North America, Europe, and Asia Pacific, competitive landscape of generic manufacturers and contract organizations, regulatory compliance, integration with pharmacies, hospitals, procurement channels, innovations in complex generics, biosimilars, and specialized configurations |

The global unbranded generics market is valued at USD 338,900 million in 2025.

The market is projected to reach USD 492,700 million by 2035.

The market will grow at a CAGR of 3.8% from 2025 to 2035.

Oral solids lead the market with a 58.7% share in 2025.

Key players include Teva Pharmaceuticals, Sandoz, Viatris, Sun Pharmaceutical, Dr. Reddy's Laboratories, Cipla, Aurobindo Pharma, Lupin, Zydus Lifesciences, and Hikma Pharmaceuticals.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

The Super Generics Market Is Segmented by Drug Type, Therapeutic Area, Route of Administration and Distribution Channel from 2025 To 2035

Super Generics Industry Analysis in Europe Report - Trends & Innovations 2025 to 2035

Branded Generics Market Analysis - Size, Share, and Forecast Outlook from 2025 to 2035

Complex Generics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Specialty Generics Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA