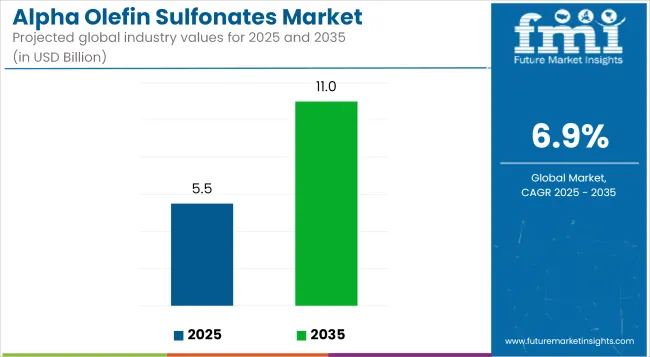

The global alpha olefin sulfonates (AOS) market is projected to grow from USD 5.5 billion in 2025 to USD 11.0 billion by 2035, registering a CAGR of 6.9%. This expansion is supported by the widespread application of AOS in home care, personal care, and industrial cleaning products.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.5 billion |

| Projected Market Size in 2035 | USD 11.0 billion |

| CAGR (2025 to 2035) | 6.9% |

AOS has gained traction as a preferred surfactant due to its high foaming capability, excellent biodegradability, and mildness compared to traditional sulfate-based alternatives. Growing regulatory scrutiny and consumer preference for sulfate-free formulations have led to increased AOS adoption across multiple sectors.

Detergent, shampoo, and body wash formulations have undergone significant changes in the USA and Europe to eliminate sodium lauryl sulfate (SLS) and sodium laureth sulfate (SLES), which are associated with skin irritation and environmental concerns. These developments were influenced by compliance with REACH regulations and EPA toxicity guidelines, prompting reformulation efforts by major brands.

During the pandemic, increased hygiene awareness boosted the demand for surfactants in hand cleansers, kitchen degreasers, and disinfectants. AOS-based solutions were selected for their compatibility with hard water, stability in acidic and alkaline media, and ability to maintain efficacy without compromising skin compatibility. Industrial cleaning and vehicle wash segments also incorporated concentrated AOS blends introduced by manufacturers such as Stepan Company and Pilot Chemical.

Moving forward, demand for AOS is expected to grow in applications such as agrochemical emulsifiers, textile wetting agents, and leather processing aids. Circular economy principles and green chemistry initiatives are encouraging a transition toward bio-based feedstocks. In Europe, palm-free and renewable AOS variants have been developed to meet the criteria of eco-labels and cosmetic safety standards. Clariant AG and its bio-feedstock partners have contributed to this progress through the development of palm-oil-alternative AOS ingredients.

Product innovation is driving market differentiation. Cold-processable AOS blends are being adopted to reduce energy consumption during production. Powder and granule forms of AOS are being used in solid shampoos, facial cleansers, and waterless personal care products to reduce packaging waste and meet zero-waste goals.

In Asia, particularly Japan and South Korea, AOS is widely used in sensitive skin and infant hygiene products due to its low irritancy and favorable safety profile. These formulations, regulated under stringent national standards, are increasingly being exported to global markets, expanding the reach of AOS-based products.

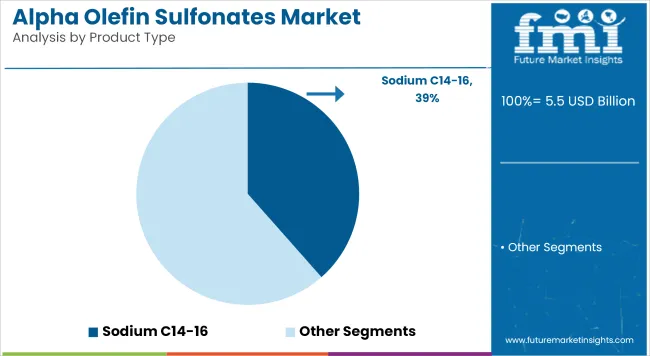

Sodium C14-16 alpha olefin sulfonates are projected to hold approximately 38.5% of the market share in 2025 and are expected to grow at a CAGR of 7.2% through 2035. This product type is used across soaps, detergents, and personal care formulations due to its chain length, which supports foaming and emulsification. It is applied in laundry detergents, dishwashing liquids, and cleansing products. It performs in both hard and soft water and is included in formulations in several countries.

Demand is supported by detergent manufacturers seeking consistent raw materials for high-volume production. Personal care applications also contribute to demand, particularly for facial cleansers and body washes. The product is integrated into formulations that meet regional and export requirements. Market growth is supported by stable production capabilities and demand from manufacturers in Asia and Latin America.

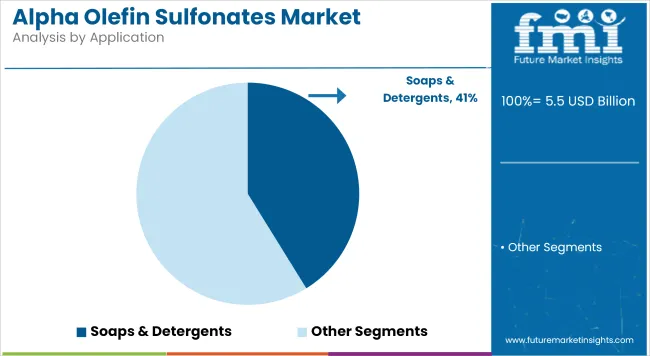

Soaps and detergents are expected to account for approximately 41.2% of the alpha olefin sulfonates market in 2025 and are projected to grow at a CAGR of 7.3% through 2035. This application segment includes use in laundry detergents, dishwashing formulations, and surface cleaners. AOS is selected for its foaming and emulsification properties and is incorporated into both powder and liquid formats.

The demand from home care and fabric care product manufacturers remains consistent, particularly in countries with growing urban populations. Market expansion is influenced by increased consumption of household cleaning products. Production scale-up from contract manufacturers and brand owners also contributes to steady demand.

Regional demand in Asia and Latin America is supported by retail distribution expansion and consumer shift toward packaged cleaning agents. Product usage in detergent bars, liquids, and gels sustains its position across low- and middle-income economies.

Feedstock price volatility, formulation limitations, and regulatory complexities present constraints

Alpha olefin sulfonates are synthesized from linear alpha-olefins, and the cost of these materials is tightly coupled with the corresponding petrochemical supply chains. Changes in raw material prices have implications on cost competitiveness, particularly for price-sensitive detergent markets.

Moreover, the aesthetic structure of AOS which may formulate into the ultra-mild personal care products may need to be mixed with the co-surfactants.Additionally, diverging regional regulatory guidelines on surfactant use and green labeling pose new compliance challenges for global formulators. In some sectors of industry the market penetration is hindered by the availability of cheaper alternatives and low awareness level of performance benefits in AOS.

Green product demand, sulfate-free innovations, and industrial diversification propel growth

In an era where brands scramble to cater to sharply defined consumer expectations around clean-label and eco-certified formulations, AOS is a robust, sulfate-free option. Baby care, natural cosmetics and brands focused on dermatology requiring cleansing agents that are mild yet effective are especially in demand.

The other industry segment likely to register growth includes textile processing, institutional cleaning, and emulsification for pesticide delivery systems. Paying more attention to bio-based innovation in alpha olefins and in regional production of sulfonation derivatives can alleviate cost barriers and give the supply chain greater resilience. Digitally native consumer brands are broadening the use of AOS in niche formulations for pet care, hand sanitizers and facial cleansers.

The AOS market in the USA is expected to rise steadily as the demand continues to grow across personal care, household detergents, as well as industrial cleaners. Being anionic surfactants, they are preferred because of their excellent foaming and emulsification properties, leading to the formulation of sulfate-free shampoos and body washes.

The movement to AOS-based surfactants is being fueled by regulatory pressure to reduce dioxane and sulfate levels in consumer products. The country’s strong manufacturing base, along with the growing trend toward biodegradable ingredients in eco-labeled products, also driving up demand for AOS in all retail and institutional markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

In the UK, the demand for alpha olefin sulfonates is increasing in response to brands looking for more sustainable and skin-friendly alternatives to sulfates traditionally used. AOS have been widely used in sulfate-free cosmetics, baby care products and natural household cleaning formulations.

Post-Brexit REACH-like chemical safety standards have resulted in manufacturers opting for low-toxicity surfactants. Consumer trends favoring ethical and cruelty-free products also help drive growth. Domestic companies are investing in AOS blends that will provide high cleansing performance without sacrificing mildness or biodegradability.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.6% |

Under ECHA regulation pressure, the EU AOS market is expanding with consumers who demand environmentally friendly surfactants. AOS is widely used in laundry detergents, personal hygiene and industrial degreasers in Germany, France, and the Netherlands.

AOS has great action of biodegradation, and it is suitable compatible with the other anionic and nonionic surfactant. It is vital to use this trend where EU directives on sustainable chemicals and clean-label personal care products drive the innovation: bio based and palm free AOS formulation, Source UN. Custom-tailored pH ranges and foam structures are once again used to prepare AOS blends by manufacturers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.9% |

With growing user preference for mild surfactants used in skin and hair care formulations, cognizant of both capillary swimming and skin irritation, Japan alpha olefin sulfonates market is poised to witness an upswing. In Japan’s premium beauty products, AOS are favored for their superior foaming even in hard water, and lower skin irritation compared with sulfates.

Examples of demand will be the fact that the Ministry of Health, Labour and Welfare (MHLW) has strong regulation and restrictions on ingredients for personal care which will potentially support the broad-based adoption of AOS in hypoallergenic and sensitive skin products. And local chemical enterprises are targeting low-residue and fragrance-compatible AOS variants for potential engagement in wellness and aromatherapy product regimens.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.5% |

South Korea’s alpha olefin sulfonates market is booming in the wake of the K-beauty craze and increasingly natural and sulfate-free cosmetics exported. AOS are commonly found in foaming cleansers, body washes and scalp-care products, because they balance cleansing efficacy with mildness.

This also drives the transition towards AOS to replace traditional surfactants through government policies supporting green chemistry and consumer interest in clean-label formulations. AOS formulations with high purity are being produced by domestic manufacturers for domestic and overseas private-label brands. There is growing AOS demand in institutional cleaners and hard surface sanitizers as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

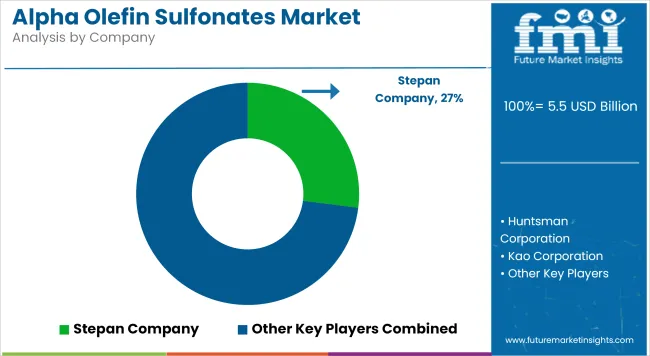

The alpha olefin sulfonates market is moderately consolidated with strong global and regional players. Key companies include Stepan Company, Clariant, BASF SE, Solvay S.A., Pilot Chemical, Kao Corporation, and Huntsman Corporation. These players are focusing on expanding production capacities, improving sulfonation efficiency, and introducing application-specific AOS grades. Stepan and Pilot Chemical are known for tailored industrial-grade formulations, while Kao and BASF focus on home and personal care grades with a high degree of formulation compatibility.

Local manufacturers are partnering with regional detergent brands to scale up supply for laundry liquids and household cleaning agents. Regulatory pressures in Europe are accelerating demand for sulfate alternatives, prompting innovation in sulfonation chemistry and product development. Global players are integrating sustainability in operations, ensuring that surfactants meet green chemistry standards without compromising performance.

The overall market size for the Alpha Olefin Sulfonates market was approximately USD 5.5 billion in 2025.

The Alpha Olefin Sulfonates market is expected to reach approximately USD 11.0 billion by 2035.

The demand for Alpha Olefin Sulfonates is rising due to their increasing usage as anionic surfactants in industrial chemical processing and laundry detergents.

The top 5 countries driving the development of the Alpha Olefin Sulfonates market are the United States, China, India, Germany, and Japan.

Powder-form Alpha Olefin Sulfonates and personal care applications are expected to command significant shares over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Alpha Olefin Market Forecast and Outlook 2025 to 2035

Linear Alpha Olefin Market

Alpha-Sulfophenylacetic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Linolenic Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Arbutin Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid (AHA) Serums Market Size and Share Forecast Outlook 2025 to 2035

Alpha Hydroxy Acid Market Size and Share Forecast Outlook 2025 to 2035

Alpha-Methylstyrene Market Size and Share Forecast Outlook 2025 to 2035

Alpha-1 Antitrypsin Deficiency Market Size and Share Forecast Outlook 2025 to 2035

Alpha Glucosidase Inhibitors Market Size and Share Forecast Outlook 2025 to 2035

Alpha-lactalbumin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Alpha-Amylase Baking Enzyme Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Olefinic Thermoplastic Elastomers Market

Polyolefin Pipe Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Polyolefin Powder Market

Polyolefin Resin Paints Market

Polyolefin Films Market

Lignosulfonates Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA