The global Ankle Boots Market is anticipated to grow at a considerable CAGR over the investigation period between 2025 and 2035; the market growth can be credited to regular fashion, the need of buyers for chic, classy shoes or boots that are more relaxed, combined aided by the increasing instructions of disposable revenue.

Furthermore, and increasingly today, consumers across the globe are opting for multi-functional, hardy, and fashionable ankle boots that are not just aesthetically stylish but practical too. As with celebrity endorsements and fashion influencers, social media is also increasingly impacting marketing trends not only in offline but in online retail, leading to shifts in consumer demand for ankle boots among Millennial- and Gen Z-ready buyers.

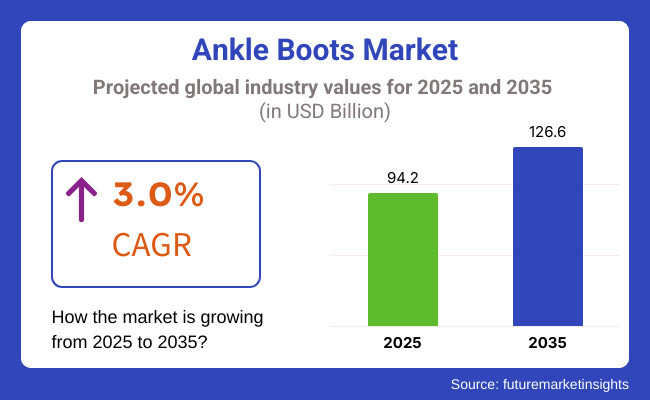

The market is expected to grow from USD 94.2 billion in 2025 to USD 126.6 billion by 2035, at a CAGR of 3.0% in the forecast period. The market dynamics are reflected in the increasing desire for eco-friendly and sustainable materials, alongside the availability of custom and personalized footwear solutions.

Leading footwear brands are using high-tech innovations such as 3D printing, smart insoles, and water-resistant coatings to deliver comfort and durability in their shoes. Moreover, the rising phenomenon of e-commerce and omni-channel retailing is making these ankle boots accessible to customers globally, driving the growth of this market.

Ankle boots demand continues to be led by North America, benefiting from improved consumer purchasing power, shifting style preferences, and a high concentration of the major global footwear brands. The increase in the market in the USA and Canada is owing to the increasing trend towards premium and luxury range ankle boots that provide comfort.

To obtain customer engagement, retailers target more than ever at digital marketing strategies, DTC (direct-to-consumer) models, and AI-driven personalized recommendations. The growing popularity of sustainable and ethically produced footwear is also propelling market growth, as leading brands introduce vegan leather and recycled-material ankle boots to align with environmentally conscious customers. Also, the increasing need for ankle boots during autumn and winter is another important growth driver for sales in regions.

Europe has a major share of the ankle boots market, with a strong fashion heritage, which leads to higher consumer spending on footwear and the availability of premium footwear brands. In fact, France Italy, Germany, and the UK lead the world in footwear innovation, desig,n and craftsmanship.

In Europe, the shift towards handmade leather boots, fashionable collaborations, and sustainable footwear options are influencing purchasing trends. There are also new opportunities on the high end as vintage boots become big business through resale marketplaces. The growing impact of Paris, Milan, and London Fashion Weeks on global trends has also pushed consumer demand in the direction of sophisticated, quality ankle boots.

The Asia-Pacific market is likely to grow at the fastest rate due to growing disposable incomes, rapid urbanization, and evolving fashion trends in emerging economies. The regional market is dominated by countries such as China, India, Japan, and South Korea, where more and more fashion-conscious customers look for stylish and durable footwear.

Online retail platforms, digital payment solutions, and influencer-driven marketing have also made ankle boots more readily available to younger generations. The increasing middle-class population in the region and the expansion of international footwear brands are expected to fuel the demand for premium and affordable ankle boots even further. Moreover, the continuing rise of streetwear and athleisure trends impact the market, leading labels to create hybrid designs that combine casual and formal elements.

Challenge

Supply Chain Disruptions

Market challenges include supply chain disruptions, which have been complicated by geopolitical tensions, labor shortages, and automotive and logistics bottlenecks. Shortage of products due to obstacles faced in timely procurement of raw materials and a slowdown in production affects the supply chain, which in turn leads to a gap in inventory and loss of opportunity in sales.

An added cost for brands is through unpredictable costs transported by ship or tram, which adds to the final price sticker as the product moves from ports to stores. In response to these risks, businesses are rapidly investing in localized production, diversifying supplier networks, and utilizing digital supply chain solutions that drive efficiency and responsiveness.

Opportunities

Rise in Demand for Earth-Friendly Footwear

This makes it a prime opportunity for brands to really sink their teeth into sustainability as a purchasing opportunity for consumers, especially for brands who invest in eco ankle boots. Leading a move towards ethical production methods, consumers are searching for biodegradable materials and plant-based and cruelty brands.

Companies that embrace sustainable sourcing and minimize carbon footprints and waste through circular economy policies (such as designs for recyclability and take-back programs) are reaping a competitive advantage. This is a growing demand from buyers, not just a niche trend, but a long-term shift inspiring brands to innovate in material science, create transparent supply chains, and effectively market their sustainability efforts to eco-savvy consumers.

2020 to 2024: Surge in Fashion-Driven Demand and E-Commerce Expansion

The ankle boots market is expected to grow robustly between 2020 and 2024 due to changing fashion trends, an increase in consumer spending on premium footwear, and the rapid proliferation of e-commerce. Demand across casual, formal, and outdoor segments soared as consumers, particularly millennials and Gen Z, opted for multipurpose, stylish, and functional ankle boots.

Brands focusing on sustainable production practices and ethical sourcing are enjoying a surge in demand as the trend toward environmental sustainability continues to grow. More eco-friendly practices took hold, such as using vegan leather, plant-based dyes, and recycled materials, paving the way for a greater acceptance of sustainable ankle boots. Industrial-level manufacturers plug 3D printing capabilities and AI-oriented design software into their facilities, which have provided less lead time when producing, as well as personalized customizations for consumers.

Market growth was heavily reliant on the e-commerce boom. AI-based recommendations, virtual try-ons, and AR shopping drove customer engagement for direct-to-consumer (DTC) brands. Realizing a necessity among digital-footprint savvy buyers, marketing via social media and influencers helped galvanize customers to purchase trendy, limited-edition or celebrity-endorsed pairs of ankle boots.

2025 to 2035: Innovation in Smart Footwear, Sustainable Materials, and Customization

Technology will change the landscape of the ankle boots market between 2025 and 2035 with smart footwear, AI-generated personalization, and sustainable innovations. To enhance functionality, companies will embed self-adjusting insoles, temperature-regulating fabrics, and AI-powered comfort tracking.

It will be the age of the customization. Brands will deliver customers bespoke ankle boots, printed in 3D, that will be made to fit and allow a choice of fit, materials, and style. Meanwhile, artificial intelligence-based fashion analytics will predict customer desires and aid brands in the creation of hyper-personalized collections made in accordance with fast-changing fashion trends.

Sustainability will pave the way for the use of biodegradable and lab-grown substitutes for leather. Plant-based polyurethane, mushroom leather, and fabrics from algae will be made by manufacturers, reducing reliance on traditional leather. On the whole, circular economy projects will encourage shoe recycling programs, so consumers get points from shoe companies when they hand in worn boots that can be reconditioned or given to others.

Storefronts will evolve into storefronts with AI-driven virtual shopping taking center stage. When buying ankle boots, for example, shoppers will don haptic feedback wearables and walk into AR-fueled fitting rooms so that they can feel what they’re trying on before they buy and reduce returns based on size. AI-powered production processes will reduce waste and ensure the most efficient use of resources, leading to more economical and sustainable manufacturing.

Smart supply chain management of the brand, such as blockchain technology, transparent sourcing, and tracking of raw material in quasi-real time, will also be done. Hence, this will further deliver greater efficiency and reduced production time in footwear assembly lines, owing to which footwear is anticipated to deliver shorter delivery cycles with high-quality craftsmanship.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased focus on sustainable and ethical sourcing. |

| Technological Advancements | AI-driven design tools and AR-powered shopping experiences. |

| Industry Adoption | Rising demand for vegan leather and sustainable materials. |

| Smart Retailing | E-commerce and influencer marketing drove consumer engagement. |

| Market Growth Drivers | Fashion trends, comfort-oriented designs, and premium footwear demand. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Governments will mandate carbon-neutral production and eco-friendly materials. |

| Technological Advancements | Smart footwear with self-adjusting insoles, temperature control, and AI-enhanced durability. |

| Industry Adoption | Full-scale adoption of biodegradable, lab-grown, and algae-based leather alternatives. |

| Smart Retailing | AI-powered hyper-personalization, virtual reality shopping, and blockchain-based product authentication. |

| Market Growth Drivers | Smart ankle boots, AI-enhanced customization, and sustainability-focused innovations will dominate. |

In North America, the popularity of percentage of consumer foot apparel & fashion in the percentage of consumer trend-setter and functionality footwear, particularly in the United States, is driving the demand for the Ankle Boots Market. The disposable incomes have increased, which in turn aided the growth of the market along with changes in fashion trends and sustainable fashion. Luxury brands fast fashion retailers and online platforms are broadening the scope of their portfolios to cater to varied consumer sensibilities. Winter promotions and celebrity endorsements also spur demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.8% |

The UK market has a strong cultural bias toward chic but weather-appropriate shoes. Sales are heavily reliant on seasonal demand, primarily in the fall and winter. The trend is growing for sustainable and vegan ankle boots as consumers focus on more eco-friendly options. The impact of online retail growth, social media, etc., on sales growth

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.7% |

The European Union remains a steady growth market due to demand in fashion clusters such as France, Italy, and Germany. Consumers prefer premium and designer ankle boots as brands keep hitting innovations in materials, designs and comfort technologies. Ethical fashion rise and sustainable leather alternatives drive growth. Demand for insulated and water-resistant flannels swells in cold climate regions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.9% |

The ankle boots market in Japan thrives on a combination of high fashion trends and practical designs. Aesthetics, durability, and comfort are top consumer preferences, prompting brands to launch light, high-quality, weekend-perfect urban boots. The fusion of traditional craftsmanship with contemporary styling fuels demand, especially among younger and fashion-savvy demographics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

Consumers in South Korea drive expansion in the market, with the country’s fashion-forward customers cheering on growth. K-pop and Korean dramas drive and increase sales of trendy ankle boots as brands capitalize on celebrity endorsements and partnerships. Sales on online shopping platforms are robust, particularly among younger consumers who seek out versatile and stylish footwear choices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.2% |

As consumers hunt for that perfect balance of style versus function when the time comes for fashionable footwear, the ankle boots segment continues to thrive. In response, companies have been pushing towards new designs, exciting materials, and modern construction methods, hoping to meet the ever-growing demand for high-quality, fashionable, and long-lasting boots.

The seasonal trends, changing fashion choices, and the need for disposable income have fueled the market as brands are continuously launching stylish designers with comfort-centric booties across the world to satisfy the diversified needs of consumers.

Demand for ankle boots is coming from both men and women who value their all-season wearability, functional design, and easy-to-wear pairing with a range of outfits. Social media, celebrity endorsements, and e-commerce have catalyzed ankle boots adoption across various fashion segments, such as casual, formal, and athleisure wear.

Block-heel ankle Boots Offer Stability and Elegance for All-day Wear

Block-heel ankle boots lead the pack because they offer style, comfort, and versatility. These boots use great stability and weight distribution as well as comfort to do the job, perfect for casual wear and smart attire, especially for long days. Trendy chunky heel design is everything for practical but fashionable shoe seekers, enabling one to go from daywear to night attire within just one shoe.

Block heel ankle booties can be made of leather, suede, and synthetic materials and often incorporate side zippers, lace-up design, and buckle details for an elevated look. Expect season fashion brands to launch new collections in new shades, patterns, and ornaments for the shifting wardrobes.

While these are popular styles with shoppers, some consumers say block heel boots are a little heavier than other styles. However, lightweight material technology and cushioned insoles are ameliorating these challenges, and block heel ankle boots continue to be the top-selling category.

Flat Ankle Boots Provide Comfort and Everyday Wear Ability.

Flat ankle boots continue to be a consumer favorite, especially for comfort, durability, and practicality-minded shoppers. This opens these boots to a wide range of demographics, from workers to travelers, to the person who just wants comfort all day long.

Flat ankle boots have the versatility of being dressed up or down, with styles coming equipped with padded insoles, slip-resistant soles, or waterproof materials directly built into their designs. Sketches with elastic side panels, slip-on closures, and fur-lined designs are popular for the winter and transitional seasons, and clean-lined leather and sleek suede dominate the round-the-clock style.

Women’s Ankle Boots Lead Fashion Trends with Expansive Style Options

Women’s ankle boots hold the largest share of the market due to their increasing demand in casual, formal and luxury fashion categories. It becomes as important as your classic LBD or stylish knee-highs to wear ankle boots that suit your seasonal ensembles, individual taste, and life requirements.

Knee-high and short-skirted forms are always easy to sell, here paired with kitten heels, wedges, lace-ups, and strappy ankle boots for trend-conscious (and work-minded) resting places. All the while, even luxury fashion houses and fast-fashion retailers are pouring money into eco-friendly materials, advanced cushioning technology and ergonomic designs, all to up their game in women’s ankle boots.

From sustainable sandals to heat-mouldable clogs, the innovation in this space is even further driven by the emergence of sustainable and vegan footwear brands offering cruelty-free leather, recycled materials, and biodegradable soles to appeal to the eco-conscientious consumer. The women’s ankle boots market is a tough nut to crack, yet the brands offering style, comfort, and durability continue to find their place in the lady-loving market.

Men’s Ankle Boots Gain Popularity in Casual and Formal Footwear Segments

Men's ankle boots are growing steadily, especially in the casual and semi-formal footwear segments. Topping the list of styles are classic leather Chelsea boots, lace-up boots and buckle-detail ankle boots.

Brands do consider those who are looking for long-life, good quality men's ankle boots and have spent years designing premium crafted designs, high full grain leather material, along with moisture resistant leather. The introduction of memory foam insoles, lightweight soles, and hybrid rubber-leather materials also helped stimulate demand, offering the utmost in comfort without sacrificing style.

Men’s ankle boots command a smaller share of the market than women’s, but the segment is growing as style-conscious male consumers, office workers and outdoor adventurers adopt modern, fashionable ankle boot styles. This is also encouraging growth as brands are designing active, stylish, and functional ankle boot footwear in order to meet the rising demand for business-casual and smart-casual options.

This is bound to play in favour of the global ankle boots market owing to consumer preferences that have now shifted towards multifunctional, trendy yet comfortable footwear choice for casual, work, and high-fashion segments. The brand is investing in sustainable materials, ergonomic designs, and digital-first DTC models to drives customer engagement. Innovations in vegan leather, comfort-enhancing insoles, and customizable fits drive market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thursday Boot Co. | 15-20% |

| M.Gemi | 12-16% |

| Everlane | 10-14% |

| Blundstone Australia | 8-12% |

| Vagabond Shoemakers | 6-10% |

| Nisolo | 5-9% |

| MARC FISHER FOOTWEAR | 5-9% |

| Asos Design | 4-8% |

| Sam Edelman | 3-7% |

| Aldo Group Inc. | 3-7% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thursday Boot Co. | Crafts durable, handcrafted leather ankle boots with a DTC model, offering premium quality at accessible prices. |

| M.Gemi | Designs Italian-made luxury ankle boots, focusing on timeless craftsmanship and premium suede and leather materials. |

| Everlane | Produces sustainable ankle boots featuring ethically sourced leather and eco-friendly manufacturing practices. |

| Blundstone Australia | Manufactures rugged, slip-on Chelsea boots, blending comfort, water resistance, and workwear durability. |

| Vagabond Shoemakers | Offers Scandinavian-inspired ankle boots, emphasizing sleek design, sustainable materials, and contemporary styles. |

| Nisolo | It specializes in ethically made leather ankle boots and promotes fair-trade practices and carbon neutrality. |

| MARC FISHER FOOTWEAR | Delivers fashion-forward ankle boots, incorporating trendy designs and high-quality materials for modern consumers. |

| Asos Design | It features affordable, trend-driven ankle boots that are available in diverse styles, including Chelsea, combat, and heeled designs. |

| Sam Edelman | Produces stylish ankle booties, merging comfort, versatility, and premium craftsmanship. |

| Aldo Group Inc. | Sells fashionable and budget-friendly ankle boots, catering to fast-fashion and trend-conscious shoppers. |

Key Company Insights

Thursday Boot Co. (15-20%)

Thursday Boot Co. dominates the premium handcrafted leather boot segment, offering direct-to-consumer, high-quality ankle boots with a focus on durability, affordability, and timeless design.

M.Gemi (12-16%)

M.Gemi leads the luxury handmade Italian ankle boots market, combining artisanal craftsmanship with modern styling and limited-edition releases.

Everlane (10-14%)

Everlane pioneers sustainable ankle boots, prioritizing ethical leather sourcing, eco-conscious production, and transparency in pricing.

Blundstone Australia (8-12%)

Blundstone stands out for durable, slip-on Chelsea boots, catering to outdoor, workwear, and casual fashion enthusiasts.

Vagabond Shoemakers (6-10%)

Vagabond merges Scandinavian minimalism with modern styles, offering sleek, durable, and responsibly sourced ankle boots.

Nisolo (5-9%)

Nisolo emphasizes fair-trade and ethical manufacturing, producing stylish, handcrafted leather ankle boots with a focus on sustainability.

MARC FISHER FOOTWEAR (5-9%)

MARC FISHER delivers fashion-forward ankle boots, blending elegance, comfort, and trendy designs for fashion-conscious consumers.

Asos Design (4-8%)

Asos Design captures fast-fashion trends in ankle boots, offering affordable and stylish options with wide accessibility.

Sam Edelman (3-7%)

Sam Edelman excels in versatile, comfortable ankle booties, appealing to both casual and upscale fashion segments.

Aldo Group Inc. (3-7%)

Aldo caters to budget-conscious shoppers, offering trendy and accessible ankle boots for diverse fashion preferences.

Other Key Players (30-40% Combined)

Numerous emerging and established brands drive innovation in vegan leather boots, 3D-printed footwear customization, and hybrid comfort-technology designs. These include:

The overall market size for the Ankle Boots Market was USD 94.2 Billion in 2025.

The Ankle Boots Market is expected to reach USD 126.6 Billion in 2035.

The demand is driven by evolving fashion trends, increasing disposable incomes, growing online retail penetration, and rising consumer preference for stylish yet comfortable footwear.

The top 5 countries driving market growth are the USA, UK, Japan, South Korea and Europe.

Fashion-forward Designs and Functional Styles are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Pairs) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 6: Global Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 8: Global Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 14: North America Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 16: North America Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 22: Latin America Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 24: Latin America Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 30: Western Europe Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 32: Western Europe Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 38: Eastern Europe Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 40: Eastern Europe Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 54: East Asia Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 56: East Asia Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Pairs) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by User, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Pairs) Forecast by User, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Shoe Size, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Pairs) Forecast by Shoe Size, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Pairs) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 14: Global Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 18: Global Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by User, 2023 to 2033

Figure 23: Global Market Attractiveness by Shoe Size, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 38: North America Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 42: North America Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by User, 2023 to 2033

Figure 47: North America Market Attractiveness by Shoe Size, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 62: Latin America Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 66: Latin America Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Shoe Size, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by User, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 86: Western Europe Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 90: Western Europe Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by User, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Shoe Size, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by User, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by User, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Shoe Size, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by User, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by User, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Shoe Size, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by User, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 158: East Asia Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 162: East Asia Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by User, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Shoe Size, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by User, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Shoe Size, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Pairs) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by User, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Pairs) Analysis by User, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by User, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by User, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Shoe Size, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Pairs) Analysis by Shoe Size, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Shoe Size, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shoe Size, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by User, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Shoe Size, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Foot and Ankle Devices Market Analysis - Trends, Growth & Forecast 2024 to 2034

Snow Boots For Women Market Size and Share Forecast Outlook 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Snow Boots Market Analysis - Trends, Growth & Forecast 2025 to 2035

Duck Boots Market Trends - Growth & Industry Outlook 2025 to 2035

Industry Share & Competitive Positioning in Work Boots Market

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Riding Boots Market Analysis - Growth, Demand & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Cowboy Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Combat Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Lace Up Boots Market Trends – Growth & Demand Forecast 2025 to 2035

Hunting Boots Market Growth – Trends & Demand Forecast to 2035

Cowgirl Boots Market Trends – Growth & Industry Outlook to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Military Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Waterproof Boots Market Trends - Growth & Forecast to 2035

Motorcycle Boots Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA