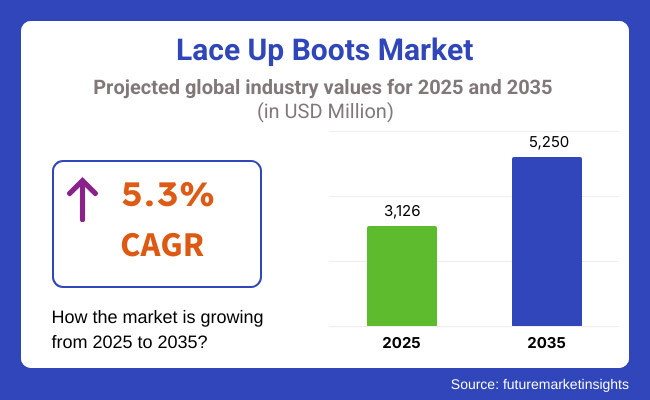

Lace Up Boots Market will expand exponentially during 2025 to 2035 on the back of changing consumer preferences and rising fashion, outdoor, and utility sector demand. Market size will be around USD 3,126 million in 2025 and reach USD 5,250 million in 2035 with a compound annual growth rate (CAGR) of 5.3% over the forecast period.

There are several major drivers that have driven market growth. Most important drivers are increasing demand for solid and multi-functional boots that business and casual consumers require. Builders and soldiers, for example, utilize lace-up boots since they are safe and protective.

Casual consumers, however, require quality leather lace-up boots to wear every day and are propelling premiums sales. But while sources of leather raw material and synthetic alternatives to issues with sustainability are production matters, manufacturers are being compelled to create green material at the expense of not sacrificing durability and attractiveness.

Lace-up boot segment is also sub-divided based on material, usage, and consumer preference. Leasing, synthesizing, and hybrid are top segments. Leasing is dominated by leather lace-up boots, followed by Timberland and Dr. Martens for improved quality and durability. Synthetic options in terms of Adidas and Nike are creating turbulence on the basis of price quotation and consumerism trends through veganism.

The market also serves many applications such as casual, industrial, military, and hiking boots. Outdoor consumers increasingly require waterproof and insulated lace-up boots for climbing and trekking. Military boots, however, are the world military troops' standard with focus on strength, slipping, and ankle protection. The workwear market, especially among construction workers and factory workers, remains strong due to protection footwear demand by safety regulations.

North America is a massive market for lace-up boots where work boots, hiking, and fashion markets are driving the demand. There is a massive market in high-end leather boots both in the US and Canada, and robust consumer confidence also being experienced by Red Wing as well as Wolverine.

Increasing need for outdoor activities such as hiking and camping is driving the demand for abrasion and water-proof lace-up boots. Green trends are compelling companies beyond the boundaries of recycled content and green leather finish technologies.

Europe led market place in the market place of lace-up boots, and it has market leading positions in the UK, Italy, and Germany as consumers. There is also huge demand in the premium fashion segment, where lace-up boots by fashion designer are being introduced by Prada and Gucci.

In domestic work segment also, incremental growth is being offered with heavy and protective industrial footwear codes. Strict European environmental regulations are compelling companies to invest in circular economy practices and bio-based products, which are facilitating boot recycling and material reuse.

Asia-Pacific will see the lion's share of vibrant growth in lace-up boots business due to urbanization, rising disposable incomes, and industrialization. Japan, India, and China are the ones to watch here, and although China is still the manufacturing base even as a consumer.

The rising middle-class citizens of the nations are creating demand for comfort and fashion lace-up boots. Aside from this, the extremely fast-growing online shopping platform of Alibaba and Flipkart and others is making luxury and economy lace-up boots affordable for masses. However, corporate malfeasance and mass production sustainability is a matter of the moment.

Challenge

Sustainability and Ethical Sourcing

The lace-up boots industry has severe issues pertaining to sourcing ethical plastic waste and leather. The traditional process of manufacturing leather has been in dispute for centuries because of pollution issues, which have led to regulation and disenfranchisement of consumers. Similarly, the synthetics, which are mostly made of plastics, are also harming the environment.

More regulation and shifting customer attitudes are forcing organizations to buy biodegradable material, water-saving tanning, and fair supply chains.

Opportunity

Technological advancements in the production of shoes

Material and process technology innovation provides new avenues for the lace-up boots industry. Innovation in other eco-friendly leathers like mycelium leather or cultured leather provides a more environmentally friendly alternative to traditional leathers.

The 3D printing technology also transforms the manufacturing processes of shoes, saving resources and facilitating mass customization. Smart shoe technology like GPS shoes or pressure-sensitive factory boots also can serve as a driver of innovation and diversification of the industry.

Throughout 2020 to 2024, fashion and outdoor consumers wanted lace-up boots with behemothic brand-based innovations that were centered on comfort and sustainability. Demand was for adaptive boots for extreme outdoor usage as well as urban usage. Disruption of the supply chain and raw material availability during this time compelled the manufacturers to redefine trends in manufacturing and procurement.

To 2025 to 2035, the lace-up boots industry will go on developing with technological advancements, more emphasis on sustainability, and fashion drifting toward transformation. Businesses will implement bio-based materials, artificial intelligence-powered designing technologies, and circular fashion practices as part of strategies for realizing global goals in terms of sustainability.

Personalization styles will also be a customer demand for bespoke products and intelligent technologies on their shoe products. The fusion of style, durability, and sound manufacturing processes will be the mass market phenomenon of lace-up boots in the next decade.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Consumer Preferences | Customers preferred traditional leather lace-up boots for their longevity and enduring style. |

| Technological Advancements | Producers employed traditional boot-making methods with minimal automation. |

| Fashion Trends | Lace-up boots had a consistent presence in fashion, mostly in workwear and casual markets. |

| E-commerce Expansion | Physical stores dominated sales, with internet sites slowly increasing market share. |

| Environmental Sustainability | Minimal emphasis on sustainable processes in production and materials. |

| Market Growth Drivers | Consistent demand fueled by workwear needs and seasonal fashion. |

| Market Shift | 2025 to 2035 |

|---|---|

| Consumer Preferences | Increased focus on sustainability convinces consumers to opt for sustainable materials, like vegan leather and recycled material, in lace-up boots. |

| Technological Advancements | Emerging production technologies, like 3D printing and robot sewing, improve manufacturing productivity and have the potential for custom design in lace-up boots. |

| Fashion Trends | Streetwear-high fashion convergence puts lace-up boots on a low-entry point in casual and formal wear with fashion designers showcasing new trends and brand collaborations. |

| E-commerce Expansion | Online shopping enables online buying to become the prime sales channel for lace-up boots because of convenience in online buying and worldwide adoption of online sales channels. |

| Environmental Sustainability | Greenness is achieved in brands by green activities like using green resources and producing products ethically because of rising demands for green products from consumers. |

| Market Growth Drivers | Fashion awareness, rising disposable incomes, and influence of social media on buying behaviors propel growth. |

The USA lace-up boots industry expanded steadily from 2020 to 2024 led by a strong workwear industry. The demand for leather boots was driven by functional and fashion reasons. The industry will also expand in the next few years as sustainability is becoming a core consumer concern.

Companies are staying ahead of plant-based materials and environmentally-friendly manufacturing techniques with increased demand for sustainable fashion. The fame of the web portals has also popularized lace-up boots, making them easily accessible, which has boosted the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

Lace-up boots were also fashionable in the United Kingdom because of the comfort and versatility offered by such footwear in Britain's changeable weather conditions. From 2020 to 2024, clients favored classic designs with a sufficient blend of style and utility.

The foresight timeframe predicts future guidance in design toward emerging designs to combine traditional appearances and novel materials. UK trendsetter market will see heritage brands partnering with emerging designers in fashionable lace-up boots to introduce niche lace-up boots for differing consumer needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

The lace-up boot sector in the European Union was strong, with the driving force coming from consumption and production in France, Germany, and Italy. The industry was driven from 2020 to 2024 by largely high quality and improved material demand. In the future, consumers are going to expect sustainable practices to drive expansion as they become more likely to expect sustainability.

Use of novel manufacturing technology will also assist in meeting the changing customers' needs demanding style and sustainability in the shoes that they purchase.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 3.9% |

Japan’s lace-up boots market increased modestly from 2020 to 2024 due to the collaboration of the Western and the indigenous fashion trends. The clients valued quality craftsmanship and good-quality material. The prediction is that there will be increased demand for custom and limited-edition lace-up boots, considering the requirement for special products.

Furthermore, the increased outdoor activities will continue to maintain the increased demand for stylish yet practical lace-up boots for various types of terrain.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

Fashion-conscious South Korean market embraced lace-up boots as a multichannel footwear product in 2020-2024. The popularity of Korean drama and K-pop boosted various types of boots. Future development in the market is due to increased adoption of vintage and new-age fashion themes. Eco-friendly consumers will call for sustainable, green material-made new-generation boots, which will drive future growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Leather is the most desirable material used to the lace-up boot market due to its durability for extended periods, ventilability, and intense appearance. Full-grain leather boots are especially liked by outdoor sportsmen and workers requiring durable footwear, including soldiers and builders. Red Wing and Timberland have been pushed by demand for leather boots through high-performance collections with capabilities to withstand aggressive weather patterns.

Apart from functionality, leather lace-up boots are also a fashion icon. Their timeless look guarantees that they never go out of fashion in urban wear, with fashion brands such as Dr. Martens and Prada featuring them in their designer lines. Apart from this, the need for more eco-friendly produced leather has compelled companies to use more eco-friendly tanning methods, particularly in North America and Europe, further solidifying the place of leather in the market.

Faux leather and man-made materials are gaining demand in the lace-up boots market, primarily amongst poor clients and clients who want to have a vegan option. Faux leather has an aesthetic that's nearly impossible to differentiate from real leather without extra cost and thereby is highly desirable by low-price footwear retailers like ASOS and H&M.

Besides that, artificial materials such as polyester and polyurethane are also sought after since they are waterproof and lightweight. They accommodate fast fashion trends, where consumers purchase frequently, driven by rapid production and price. Though they are less enduring than leather, with advances in technology in materials science, they are becoming increasingly long-lasting and therefore competitive alternatives to the industry.

Lace-up boots among men dominate the market in terms of popularity, and the reason for this is that they are extensively utilized in work boots, the military, and outdoor use. Steel-toe lace-up boots, in the construction and industrial market segment, are widely demanded, and brands like Caterpillar and Wolverine dominate the category.

Moreover, men's lace-up boots are the royalty of casual and formal clothing. Combat boots and Chelsea boots are gaining more traction among urban consumers, as propelled by the synergy of luxury fashion and streetwear. The fashion is highly dominant in Europe and North America, as fashion is trending towards fashion but rugged styles in men's footwear fashion.

Medium and wide widths dominate lace-up boot sales, in accordance with normal distribution of average foot size by mass consumer groups. Firms are placing greater emphasis on further offering a variety of widths to accommodate many different shapes of feet for greater comfort and fit.

Extra-broad and broad sizes are in demand more for working boots to be worn over a period of time without discomfort, of major concern to value-seeking working individuals with stressful professions. Slim-width lace-up boots, although less fashionable, are still a bet in high-fashion and women's footwear markets. Narrow-profiled and pointed-toe boots, being part of mainstream formal and luxury houses, are still popular with a niche though consistent client base.

Home shopping channel is grasping stunning expansion for lace-up boots as a class, under the guise of convenience of home shopping, larger selection, and cheaper price. Amazon, Zappos, and ASOS-type online shops have established themselves via channels of universe-sized choice, return arrangements, and purchaser posts influencing buy behaviour.

The current DTC competitors such as Thursday Boot Company and Taft have disrupted the market by avoiding the traditional retail shops and selling superior lace-up boots at cheaper prices through online platforms. E-business is the most prevalent trend among the high-penetrating nations that are being witnessed, which include North America, Europe, and the Asia-Pacific.

Despite the rise of e-commerce, conventional channels such as shoe shops, hypermarkets, and convenience stores remain a vital element of the lace-up boot market. Consumers still want to try on boots to see if they fit and feel right before they buy, especially work boots and premium products.

Shoe specialty stores remain destination stores for shoppers seeking advice prior to buying boots, and Decathlon and Walmart remain destination stores for mass market shoppers. Additionally, Omni channel integration where consumers buy online and collect offline are also driving store sales.

The lace-up boots market is an innovative, entrepreneurial, and competitive market with niche players and global mainstream players and therefore on the leading edge of innovation and satisfying different customer needs. The large brands are focusing on merging functionality and fashion, ranging from outdoor casual boots to city fashion apparel. The market has established players with goliath market shares and new ones who would like to capture niche markets.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dr. Martens | 10-15% |

| C. & J. Clark International (Clarks) | 8-12% |

| Timberland | 7-10% |

| Wolverine World Wide | 5-8% |

| Red Wing Shoe Company | 4-6% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dr. Martens | Offers iconic lace-up boots known for durability and distinctive style. Focuses on appealing to both fashion-forward consumers and those seeking practical footwear. |

| C. & J. Clark International (Clarks) | Provides a range of lace-up boots emphasizing comfort and timeless design. Invests in sustainable materials and practices to align with environmentally conscious consumers. |

| Timberland | Specializes in rugged lace-up boots suitable for outdoor activities. Integrates eco-friendly materials and supports reforestation initiatives, appealing to environmentally conscious consumers. |

| Wolverine World Wide | Markets lace-up boots under various brands, including Merrell and Caterpillar. Focuses on technological innovations to enhance comfort and performance, catering to both outdoor enthusiasts and industrial workers. |

| Red Wing Shoe Company | Produces high-quality work and safety lace-up boots. Emphasizes craftsmanship and durability, serving professionals in demanding industries. |

Key Company Insights

Dr. Martens (10-15%)

Dr. Martens leads the lace-up boots industry with its original designs, which are fashionable and functional. Dr. Martens' boots are world known to be durable and have unique looks, which attract a broad range of customers. Dr. Martens is a fashion leader by continuously innovating through new launches and co-branding, thereby staying in fashion.

C. & J. Clark International (Clarks) (8-12%)

Clarks owns the lace-up boots segment, strongly preferred for comfort and classic styles. Clarks has focused on green issues such as green raw material procurement in a bid to respond to growing consumers' demands for ecologically friendly goods. Clarks' focus on quality and sustainability adds to its dominance.

Timberland (7-10%)

Timberland is also renowned for its outdoor sports lace-up boots. Timberland uses environmentally friendly materials in products and makes nature-related contributions in the form of tree planting initiatives for winning over green consumers. Timberland's sustainability and quality focus are the elements that are responsible for its brand equity and market share.

Wolverine World Wide (5-8%)

Wolverine World Wide retails lace-up boots under a variety of brand names, including Merrell and Caterpillar. Wolverine designs for performance and comfort for the consumer in the outdoor category and for the industrial consumer. Wolverine's multi-brand strength and innovation efforts are assets in competitiveness.

Red Wing Shoe Company (4-6%)

Red Wing Shoe Company is one of the biggest manufacturers of safety and work lace-up boots that are high-performing. Drawing from its brand of durability and craftsmanship, the company deals with professionals who have a hand in demanding industries such as construction and manufacturing. The quality and dependability brand of Red Wing firmly stands in the market for lace-up boots.

Other Key Players (50-60% Combined)

Beyond the top lace-up boots brands listed above, there are other lace-up boots brands that offer alternative designs and features to cater to different consumer needs. These include:

The overall market size for the lace-up boots market was USD 3,126 million in 2025.

The lace-up boots market is expected to reach USD 5,250 million in 2035.

The growing consumer preference for durable and stylish footwear, along with increasing demand from outdoor and fashion segments, fuels the lace-up boots market during the forecast period.

The top 5 countries which drive the development of the lace-up boots market are the USA, UK, Germany, China, and Japan.

On the basis of end-user, the men’s segment is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Pairs) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: Global Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 8: Global Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 16: North America Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 18: North America Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 26: Latin America Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 28: Latin America Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: Western Europe Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 38: Western Europe Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 46: Eastern Europe Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 48: Eastern Europe Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 66: East Asia Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 68: East Asia Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Pairs) Forecast by End-User, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Shoe Width, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Pairs) Forecast by Shoe Width, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Pairs) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 15: Global Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 19: Global Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by End-User, 2023 to 2033

Figure 28: Global Market Attractiveness by Shoe Width, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 45: North America Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 49: North America Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by End-User, 2023 to 2033

Figure 58: North America Market Attractiveness by Shoe Width, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 75: Latin America Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 79: Latin America Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Shoe Width, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 105: Western Europe Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 109: Western Europe Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Shoe Width, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Shoe Width, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Shoe Width, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 195: East Asia Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 199: East Asia Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Shoe Width, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Shoe Width, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Pairs) Analysis by End-User, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Shoe Width, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Pairs) Analysis by Shoe Width, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Shoe Width, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shoe Width, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Shoe Width, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Placental Growth Factors Market Analysis - Share, Size, and Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Acetylacetone Market Size and Share Forecast Outlook 2025 to 2035

Workplace Management Tools Market Size and Share Forecast Outlook 2025 to 2035

Workplace Wellness Market Size and Share Forecast Outlook 2025 to 2035

Fat Replacers, Salt Reducers and Replacers Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Fat Replacers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Knee Replacement Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

Joint Replacement Market Trends - Growth & Forecast 2025 to 2035

Metal Replacement Market Growth – Trends & Forecast 2024-2034

Pick and Place Machines Market Size and Share Forecast Outlook 2025 to 2035

Enzyme Replacement Therapy Market Insights - Size & Forecast 2025 to 2035

Pick and Place Carton Packers Market

Smart Workplace Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA