The placental growth factors Market is valued at USD 37.1 million in 2025. As per FMI'analysis, the industry will grow at a CAGR of 6.3% and reach approximately USD 68.1 million by 2035. Thisindustry saw significant traction due to growing research emphasis on angiogenic biomarkers for early pregnancy diagnostics.

Several biotech companies also initiated collaborations to explore recombinant placental growth factors in preeclampsia treatment. In addition, increased funding for maternal health programs globally accelerated innovation pipelines in this space.

From 2025 to 2035, industry growth is expected to be driven by rising awareness of high-risk pregnancies and the expanding application of placental growth factors in diagnostic and therapeutic procedures. Advancements in molecular biology and proteomics are anticipated to enhance the specificity and sensitivity of PGF-based tests.

Further, increasing government support for maternal-fetal medicine and the growing prevalence of complications such as intrauterine growth restriction will continue to fuel demand. North America and Europe are projected to remain dominant, while Asia Pacific will likely witness the fastest growth due to rising healthcare infrastructure and maternal care initiatives. The industry's long-term outlook remains positive with a steady rise in clinical relevance and product innovation.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 37.1 million |

| Industry Value (2035F) | USD 68.1 million |

| CAGR (2025 to 2035) | 6.3% |

The placental growth factors industry is set for steady expansion through 2035, driven by the rising need for maternal-fetal diagnostic solutions and innovations in angiogenic biomarkers. Increased investments in maternal healthcare and biotech R&D are reinforcing the relevance of PGF in early pregnancy assessments and complications. Stakeholders in diagnostics, biotechnology, and maternal health services stand to benefit, while players slow to adopt biomarker integration may face stagnation.

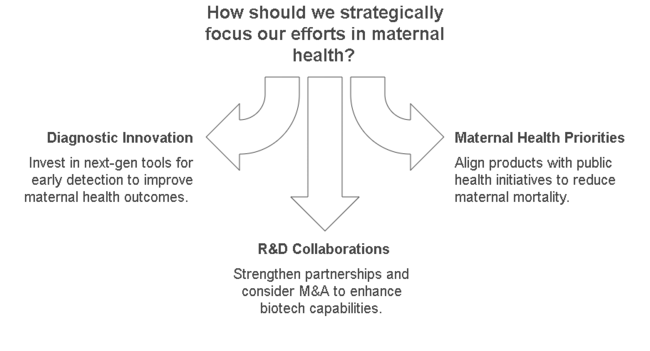

Accelerate Diagnostic Innovation

nvest in developing next-gen diagnostic tools leveraging placental growth factors for early detection of high-risk pregnancies and preeclampsia.

Align with Evolving Maternal Health Priorities

Adapt product offerings to support public health initiatives focused on maternal mortality and prenatal care, particularly in emerging industries.

Strengthen R&D and Strategic Collaborations

Explore R&D partnerships with academic institutions and tech companies; consider M&A to integrate upstream biotech capabilities.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays for PGF diagnostics | Medium - High |

| Slow adoption in emerging industries | High - Medium |

| Technological obsolescence | Medium - High |

| Priority | Immediate Action |

|---|---|

| Expand Product-Market Fit | Run feasibility on PGF applications for preeclampsia diagnostics |

| Engage with Key Healthcare Systems | Initiate provider feedback loop on maternal health diagnostics |

| Boost Global Reach | Launch regional distribution pilot in Southeast Asia |

The placental growth factors industry is transitioning from niche diagnostics to mainstream maternal healthcare solutions. Leadership must prioritize early-stage innovation and foster partnerships that embed PGF tools within existing maternal care ecosystems. This intelligence signals an opportunity to reposition portfolios toward predictive diagnostics and preventative care, giving first movers a long-term competitive edge, particularly in high-burden industries across Asia and Africa.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across diagnostic manufacturers, biotech firms, maternal health providers, and OB/GYNs across North America, Europe, India, and East Asia)

Early Risk Detection

Regional Variance

High Variance

ROI Perception

Consensus

Variance

Shared Challenges

Regional Differences

Manufacturers

Distributors

End-Users (Clinicians)

Alignment

Divergence

Variance vs. Consensus

| Countries/Region | Policy & Regulatory Impact |

|---|---|

| United States | PGF-based diagnostics fall under FDA regulation as in-vitro diagnostic (IVD) devices. Clearance via 510(k) is required for clinical use. CMS and private insurers vary in reimbursement; state-level maternal health initiatives (e.g., California’s prenatal care mandates) are boosting clinical demand. |

| Canada | Regulated by Health Canada under the Medical Devices Regulations (SOR/98-282). Class II or III licensing is required depending on assay risk classification. Provincial funding influences adoption in public maternal programs. |

| European Union | PGF diagnostics are subject to EU In Vitro Diagnostic Regulation (IVDR 2017/746)-mandatory since May 2022. Requires conformity assessment by a Notified Body and CE marking. EU's 2023 to 2027 Perinatal Health Strategy supports biomarker diagnostics inclusion. |

| United Kingdom | Post- Brexit, the UK uses the UKCA (UK Conformity Assessed) marking for diagnostics. The Medicines and Healthcare Products Regulatory Agency (MHRA) oversees regulatory approvals; guidance aligns closely with EU IVDR until 2028. |

| Germany | Strong support under federal maternal health reforms. Reimbursement eligibility through G-BA (Federal Joint Committee) requires HTA evaluation of clinical utility. Alignment with EU IVDR is strictly enforced. |

| India | Regulated by the Central Drugs Standard Control Organization (CDSCO) under the Medical Device Rules, 2017. Most PGF tests fall under Class B or C; importers require registration. Adoption is supported by National Health Mission maternal programs. |

| China | NMPA (National Medical Products Administration) regulates diagnostics; local clinical trial data required for registration. Biomarker tests like PGF are encouraged under Healthy China 2030, but reimbursement is limited. |

| Japan | PMDA oversees diagnostics, with approval required under the Pharmaceuticals and Medical Devices Act (PMD Act). PGF tests must demonstrate clinical utility for national health insurance coverage-currently limited in scope. |

| South Korea | MFDS regulates diagnostic kits; PGF tests require Class II device certification and performance evaluation. Government prenatal care subsidies do not yet include PGF diagnostics, limiting mainstream adoption. |

| Brazil | Regulated by ANVISA as Class II or III IVD devices. National maternal health programs are expanding, but slow regulatory timelines and inconsistent reimbursement affect industry entry. |

| Australia | TGA (Therapeutic Goods Administration) classifies PGF tests as IVD medical devices. Clinical performance data required for listing on the Australian Register of Therapeutic Goods (ARTG). Medicare coverage decisions remain fragmented. |

F. Hoffmann-La Roche Ltd.Industry Share ~25-30%

A dominant player through its diagnostics division, Roche maintains leadership in biomarker-based diagnostics, including preeclampsia risk stratification via PGF-based assays.

Thermo Fisher Scientific Inc.Industry Share ~20-25%

Thermo Fisher supports a broad IVD portfolio and partners with academic labs and public health entities for placental biomarker assay development.

PerkinElmer Inc. (Now Revvity)Industry Share ~15-20%

Through Revvity (spun off from PerkinElmer), the firm has developed multiplexed assays targeting maternal and fetal health, with active partnerships in Europe and Asia.

Siemens Healthineers AGIndustry Share ~10-15%

Focuses on integrating PGF testing within prenatal screening panels and automated diagnostic platforms across hospital networks in the EU and USA

Bio Vendor GroupIndustry Share ~5-10%

A European biotech firm with proprietary placental growth factor ELISA kits; active in regional healthcare systems under EU regulatory frameworks.

DRG International, Inc.Industry Share ~5-8%

Specializes in research-use-only and clinical-grade PGF assays distributed globally, particularly in Latin America and Eastern Europe.

Ophthalmology dominated the placental growth factors industry with aindustry share of 57.0% in 2024. Ophthalmology is expected to be a dominant application area for placental growth factors. The growing incidence of retinal vascular diseases such as diabetic retinopathy and age-related macular degeneration has driven interest in the angiogenic properties of placental growth factors.

These proteins are being actively investigated for their ability to promote neovascularization and tissue repair, which is especially relevant in degenerative eye disorders. In the field of metabolic disorders, placental growth factors are gaining traction for their potential role in modulating inflammation and vascular function in conditions such as diabetes and obesity.

Research is underway to evaluate their use as biomarkers for disease progression and treatment response. Oncology continues to be another significant area where placental growth factors are applied, particularly due to their role in tumor angiogenesis and metastasis. Lastly, the others category includes cardiovascular and inflammatory diseases, where exploratory studies are expanding clinical interest.

The pharmaceutical and biotechnology companies segment dominated the placental growth factors industry with industry share of 51.2% in 2024. Pharmaceutical and biotechnology companies are anticipated to remain the largest end users of placental growth factor-based solutions.

These companies are heavily investing in R&D pipelines focused on angiogenesis modulators and novel diagnostics, often using placental growth factors as biomarkers or therapeutic targets. The application of these proteins in drug discovery platforms has made them a critical tool for early-stage screening and biomarker validation.

Research centers and academic institutes are also expected to maintain strong engagement with placental growth factors, especially in preclinical studies and translational research. Their focus remains on elucidating the biological mechanisms and therapeutic implications of these proteins in various disease models.

CMOs and CDMOs are increasingly involved due to the rising demand for assay development, large-scale production, and regulatory-compliant manufacturing services for biologics based on placental growth factors. As outsourcing trends grow, these organizations will play a critical role in enabling faster and more efficient product development lifecycles.

The USA placental growth factors industry is expected to expand at a CAGR of around 6.8% from 2025 to 2035. This growth is attributable to the country’s advanced maternal healthcare infrastructure, early adoption of biomarker-based diagnostics, and robust clinical research support. PGF testing is being implemented in standard prenatal care workflows, most notably in high-risk pregnancies.

Biomarker use, particularly in the Medicaid population, is additionally supported through government-funded health initiatives that focus on maternal mortality. These findings are now reinforced by strong data generated by leading academic institutions and research hospitals that further validate the role of PGF in the early diagnosis of preeclampsia.

Partnerships between diagnostic industry giants and obstetric networks in the USA are hastening industry penetration. Stability in regulation and existing fast-track pathways from the FDA facilitate speed to advance the assay to commercial phase further elevate the USA as a vibrant center for innovation and demand.

The placental growth factors industry in the United Kingdom is estimated to grow at a CAGR of around 6.5% from 2025 to 2035. Finally, as one of the world's largest health care institutions the UK National Health Service (NHS) could also greatly influence demand by introducing placental biomarkers like PGF into its own antenatal screening protocols. The UK industry is characterized by systematic use of the PGF assay in public hospitals with an even better emphasis on early diagnostic of hypertensive disorders in pregnancy.

Partnerships of diagnostics companies and NHS Trusts spread adoption by population. Finally, the smooth transition of UK testing capabilities developed due to the UK’s early uptake through compliance with EU IVDR regulations before Brexit cutovers the rift. Ongoing government investments in women’s health strategies are expected to promote the inclusion of PGF in routine prenatal screening offerings.

This industry in France is projected to grow with a CAGR of 6.4% from 2025 to 2035. Repeat testing offers a unique opportunity to alleviate the burden of excess resources and cost while providing a clear and meaningful clinical result as to whether the person currently has exacting (GETME) PGF-based diagnosis is enhanced by France’s robust public healthcare system and high rate of institutional births, which allow for scaling to other countries.

The French National Authority for Health has a history of evaluating the clinical utility of new reference markers in maternal serum, particularly placental growth factors. Based on a recent increase in gynecologists and maternal-fetal medicine specialists in France using these biomarkers, there is a separation of costs and improvement in risk stratification of preeclampsia.

And public-private partnerships with French diagnostics laboratories and biotech companies are driving innovation. PGF Testing: Industry Development Focus PGF is the focus of several national research programs complementary to those conducted in the frameworks of the EU initiatives toward maternal health and enable the alignment needed for one testing pathway from reimbursement through regulatory approval.

Germany placenta growth factor industry is expected to grow at a CAGR of 6.6% during 2025 to 2035. The country’s state-of-the-art medical diagnostics infrastructure facilitates widespread incorporation of PGF testing into maternal care, particularly in university hospitals and perinatal centers. Due to rising maternal age and pregnancy-related complications, German obstetricians are early adopters of biomarker panels for the inclusion of PGF for preeclampsia screening.

Alignment with EU regulatory requirements such as IVDR simplifies industry access in the country for novel PGF assays. Germany’s participation in multinational research consortia dedicated to the maternal-fetal health area similarly expedites take on adoption. Thanks to ongoing public health investments in digital diagnostics and predictive screening tools, Germany is a PGF industry with lucrative growth potential.

The Italy placental growth factors industry is projected to expand at a CAGR of close to 6.1% over the 2025 to 2035 assessment period. In Italy, the results from prenatal screening solutions have now been consistently incorporated into clinical workflows in major tertiary care centers in metropolitan hubs.

And although adoption in rural and southern areas is slower, national maternal health initiatives keep talking about the importance of early screening for pre-eclampsia, the condition in which PGF plays a crucial role. Italy's diagnostic labs are improving availability of assays across regional healthcare networks, often in collaboration with EU-funded projects.

As such the inclusion of PGF tests into public reimbursement lists is still being evaluated, however pilot programs are encouraging their use in high-risk pregnancy clinics. A further massive growth potential lies behind academic led training of obstetricians around close-to-industry plans to deliver biomarker based positive early intervention/ember needs.

New Zealand’s placental growth factors industry is projected to witness a CAGR of 5.9% from 2025 to 2035. Although the industry size is relatively modest, the country has made notable strides in maternal health innovation, particularly within the public healthcare sector. PGF assays are increasingly used in specialized maternal fetal medicine units, especially in Auckland and Wellington.

The New Zealand Ministry of Health has shown interest in incorporating biomarker testing into national guidelines for managing hypertensive disorders in pregnancy. Indigenous health equity programs focusing on Māori populations are also encouraging broader diagnostic inclusion.

Partnerships between diagnostic companies and regional health boards aim to streamline PGF test procurement and training. As the country continues to prioritize maternal health outcomes, diagnostic precision with PGF will become more central.

South Korea’s placental growth factors industry is expected to expand at a CAGR of 6.7% from 2025 to 2035. The country’s rapidly aging maternal population and rising incidence of gestational hypertension create a strong case for PGF test adoption.

South Korea’s national health insurance system supports early screening tools, and there is growing interest among OBGYNs to integrate PGF into prenatal care. Advanced diagnostic labs, particularly in Seoul and Busan, are collaborating with global biotech companies to bring CE-marked PGF kits to local clinics.

The country’s emphasis on high-quality maternal care and digital health solutions enhances test uptake. As the healthcare system shifts toward personalized medicine, biomarker-based screening will continue to play an increasingly critical role, supported by robust regulatory and reimbursement frameworks.

The placental growth factors industry in Japan is projected to grow at a CAGR of 6.2% between 2025 and 2035. Japan’s strong emphasis on prenatal health and structured maternal monitoring programs supports the inclusion of PGF assays in routine risk assessments. Hospitals across metropolitan areas such as Tokyo and Osaka have already implemented pilot programs evaluating PGF as part of early preeclampsia diagnostics.

Japan’s Ministry of Health, Labour and Welfare has encouraged innovation in maternal-fetal diagnostics through funding for clinical trials and academic research. Additionally, local biotech players are increasingly partnering with global diagnostics companies to co-develop PGF test kits that align with domestic regulatory standards. The push for early detection technologies, especially for aging mothers, continues to drive PGF integration into Japan’s healthcare framework.

China’s placental growth factors industry is set to grow at a CAGR of 7.1% from 2025 to 2035, the highest among analyzed countries. Driven by a large maternal population base, increasing rates of pregnancy-related complications, and robust government spending on maternal healthcare, PGF testing is expanding rapidly. Tier-1 hospitals in cities like Beijing, Shanghai, and Guangzhou are already deploying PGF assays for early risk detection.

National health guidelines are beginning to recognize biomarker-based diagnostics, with support from China's Healthy China 2030 initiative. Local biotech firms are also contributing to industry supply through joint ventures with international companies. As China continues to digitize its healthcare infrastructure and prioritize maternal health, PGF diagnostics are positioned for rapid scale-up across both public and private sectors.

Australia’s placental growth factors industry is expected to grow at a CAGR of 6.3% from 2025 to 2035. The country’s public healthcare system, combined with a strong private sector, supports widespread maternal diagnostic access. Major hospitals and pathology labs are incorporating PGF assays into high-risk pregnancy workflows, particularly for early detection of preeclampsia.

The Australian government’s focus on rural maternal health outcomes is encouraging the decentralization of advanced diagnostics, including PGF testing, beyond metropolitan areas. Academic and clinical research institutions are also collaborating with diagnostics companies to generate local efficacy data.

Regulatory alignment with European IVDR standards ensures easy import of CE-marked PGF assays, further supporting availability. With digital pathology and women’s health strategies expanding, Australia represents a stable and progressive industry for PGF diagnostics.

The industry is segmented into ophthalmology, metabolic disorder, oncology, and others.

The industry is segmented into pharmaceutical and biotechnology companies, research centers & academic institutes, and CMO and CDMO.

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The placental growth factors market is expected to reach approximately USD 68.1 million by 2035, growing at a CAGR of 6.3% from 2025 to 2035.

Leading companies include Thermo Fisher Scientific, Merck KGaA, Abcam plc, R&D Systems, and Bio-Rad Laboratories, all of which are actively engaged in expanding their assay portfolios and global distribution networks.

Growth is primarily driven by increased demand for angiogenesis-based diagnostics, rising prevalence of cancer and eye diseases, and growing investments in targeted therapy research.

Regulatory frameworks in the USA, Europe, and Japan-such as FDA, EMA, and PMDA guidelines-are influencing the pace of clinical trials, commercialization, and quality assurance for products based on placental growth factors.

Key challenges include high R&D costs, stringent regulatory approval processes, and the need for specialized assay validation and biomarker standardization across global regions.

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 04: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 05: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 07: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 08: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 09: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 10: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 11: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 12: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 13: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 14: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 15: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 16: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 17: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 18: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by End User

Table 19: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 20: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 21: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Table 22: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 23: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Therapy Area

Table 24: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033 by End User

Figure 01: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Therapy Area

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Therapy Area

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Therapy Area

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 13: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 14: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 15: North America Market Value Share, by Therapy Area (2023 E)

Figure 16: North America Market Value Share, by End User (2023 E)

Figure 17: North America Market Value Share, by Country (2023 E)

Figure 18: North America Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 19: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 20: USA Market Value Proportion Analysis, 2022

Figure 21: Global Vs. USA Growth Comparison

Figure 22: USA Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 23: USA Market Share Analysis (%) by End User, 2022 & 2033

Figure 24: Canada Market Value Proportion Analysis, 2022

Figure 25: Global Vs. Canada. Growth Comparison

Figure 26: Canada Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 27: Canada Market Share Analysis (%) by End User, 2022 & 2033

Figure 28: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 29: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 30: Latin America Market Value Share, by Therapy Area (2023 E)

Figure 31: Latin America Market Value Share, by End User (2023 E)

Figure 32: Latin America Market Value Share, by Country (2023 E)

Figure 33: Latin America Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 34: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 35: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 36: Mexico Market Value Proportion Analysis, 2022

Figure 37: Global Vs Mexico Growth Comparison

Figure 38: Mexico Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 39: Mexico Market Share Analysis (%) by End User, 2022 & 2033

Figure 40: Brazil Market Value Proportion Analysis, 2022

Figure 41: Global Vs. Brazil. Growth Comparison

Figure 42: Brazil Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 43: Brazil Market Share Analysis (%) by End User, 2022 & 2033

Figure 44: Argentina Market Value Proportion Analysis, 2022

Figure 45: Global Vs Argentina Growth Comparison

Figure 46: Argentina Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 47: Argentina Market Share Analysis (%) by End User, 2022 & 2033

Figure 48: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 49: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 50: Europe Market Value Share, by Therapy Area (2023 E)

Figure 51: Europe Market Value Share, by End User (2023 E)

Figure 52: Europe Market Value Share, by Country (2023 E)

Figure 53: Europe Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 54: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 55: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 56: UK Market Value Proportion Analysis, 2022

Figure 57: Global Vs. UK Growth Comparison

Figure 58: UK Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 59: UK Market Share Analysis (%) by End User, 2022 & 2033

Figure 60: Germany Market Value Proportion Analysis, 2022

Figure 61: Global Vs. Germany Growth Comparison

Figure 62: Germany Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 63: Germany Market Share Analysis (%) by End User, 2022 & 2033

Figure 64: Italy Market Value Proportion Analysis, 2022

Figure 65: Global Vs. Italy Growth Comparison

Figure 66: Italy Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 67: Italy Market Share Analysis (%) by End User, 2022 & 2033

Figure 68: France Market Value Proportion Analysis, 2022

Figure 69: Global Vs France Growth Comparison

Figure 70: France Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 71: France Market Share Analysis (%) by End User, 2022 & 2033

Figure 72: Spain Market Value Proportion Analysis, 2022

Figure 73: Global Vs Spain Growth Comparison

Figure 74: Spain Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 75: Spain Market Share Analysis (%) by End User, 2022 & 2033

Figure 76: Russia Market Value Proportion Analysis, 2022

Figure 77: Global Vs Russia Growth Comparison

Figure 78: Russia Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 79: Russia Market Share Analysis (%) by End User, 2022 & 2033

Figure 80: BENELUX Market Value Proportion Analysis, 2022

Figure 81: Global Vs BENELUX Growth Comparison

Figure 82: BENELUX Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 83: BENELUX Market Share Analysis (%) by End User, 2022 & 2033

Figure 84: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 85: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 86: East Asia Market Value Share, by Therapy Area (2023 E)

Figure 87: East Asia Market Value Share, by End User (2023 E)

Figure 88: East Asia Market Value Share, by Country (2023 E)

Figure 89: East Asia Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 90: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 91: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 92: China Market Value Proportion Analysis, 2022

Figure 93: Global Vs. China Growth Comparison

Figure 94: China Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 95: China Market Share Analysis (%) by End User, 2022 & 2033

Figure 96: Japan Market Value Proportion Analysis, 2022

Figure 97: Global Vs. Japan Growth Comparison

Figure 98: Japan Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 99: Japan Market Share Analysis (%) by End User, 2022 & 2033

Figure 100: South Korea Market Value Proportion Analysis, 2022

Figure 101: Global Vs South Korea Growth Comparison

Figure 102: South Korea Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 103: South Korea Market Share Analysis (%) by End User, 2022 & 2033

Figure 104: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 105: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 106: South Asia Market Value Share, by Therapy Area (2023 E)

Figure 107: South Asia Market Value Share, by End User (2023 E)

Figure 108: South Asia Market Value Share, by Country (2023 E)

Figure 109: South Asia Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 110: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 111: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 112: India Market Value Proportion Analysis, 2022

Figure 113: Global Vs. India Growth Comparison

Figure 114: India Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 115: India Market Share Analysis (%) by End User, 2022 & 2033

Figure 116: Indonesia Market Value Proportion Analysis, 2022

Figure 117: Global Vs. Indonesia Growth Comparison

Figure 118: Indonesia Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 119: Indonesia Market Share Analysis (%) by End User, 2022 & 2033

Figure 120: Malaysia Market Value Proportion Analysis, 2022

Figure 121: Global Vs. Malaysia Growth Comparison

Figure 122: Malaysia Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 123: Malaysia Market Share Analysis (%) by End User, 2022 & 2033

Figure 124: Thailand Market Value Proportion Analysis, 2022

Figure 125: Global Vs. Thailand Growth Comparison

Figure 126: Thailand Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 127: Thailand Market Share Analysis (%) by End User, 2022 & 2033

Figure 128: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 129: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 130: Oceania Market Value Share, by Therapy Area (2023 E)

Figure 131: Oceania Market Value Share, by End User (2023 E)

Figure 132: Oceania Market Value Share, by Country (2023 E)

Figure 133: Oceania Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 134: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 135: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 136: Australia Market Value Proportion Analysis, 2022

Figure 137: Global Vs. Australia Growth Comparison

Figure 138: Australia Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 139: Australia Market Share Analysis (%) by End User, 2022 & 2033

Figure 140: New Zealand Market Value Proportion Analysis, 2022

Figure 141: Global Vs New Zealand Growth Comparison

Figure 142: New Zealand Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 143: New Zealand Market Share Analysis (%) by End User, 2022 & 2033

Figure 144: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 145: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 146: Middle East & Africa Market Value Share, by Therapy Area (2023 E)

Figure 147: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 148: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 149: Middle East & Africa Market Attractiveness Analysis by Therapy Area, 2023 to 2033

Figure 150: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 151: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 152: GCC Countries Market Value Proportion Analysis, 2022

Figure 153: Global Vs GCC Countries Growth Comparison

Figure 154: GCC Countries Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 155: GCC Countries Market Share Analysis (%) by End User, 2022 & 2033

Figure 156: Türkiye Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Türkiye Growth Comparison

Figure 158: Türkiye Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 159: Türkiye Market Share Analysis (%) by End User, 2022 & 2033

Figure 160: South Africa Market Value Proportion Analysis, 2022

Figure 161: Global Vs. South Africa Growth Comparison

Figure 162: South Africa Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 163: South Africa Market Share Analysis (%) by End User, 2022 & 2033

Figure 164: Northern Africa Market Value Proportion Analysis, 2022

Figure 165: Global Vs Northern Africa Growth Comparison

Figure 166: Northern Africa Market Share Analysis (%) by Therapy Area, 2022 & 2033

Figure 167: Northern Africa Market Share Analysis (%) by End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Growth Hormone Inhibiting Hormone Drugs Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Promoters / Anti-Hair Loss Agents Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bone Growth Stimulators Market is segmented by product type, application and end user from 2025 to 2035

Plant Growth Regulators Market Size and Share Forecast Outlook 2025 to 2035

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Hair Regrowth Treatments Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in GCC Countries Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Rail Tourism in Europe Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Tourism in Burma Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Shisha Tobacco in GCC Countries Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in France Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Drinking Water in Saudi Arabia Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Culinary Tourism in Italy Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, Opportunity Analysis of Medical Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Outbound Tourism in China Market Forecast and Outlook 2025 to 2035

Trends, Growth, and Opportunity Analysis of Data Center Facility in Morocco Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA