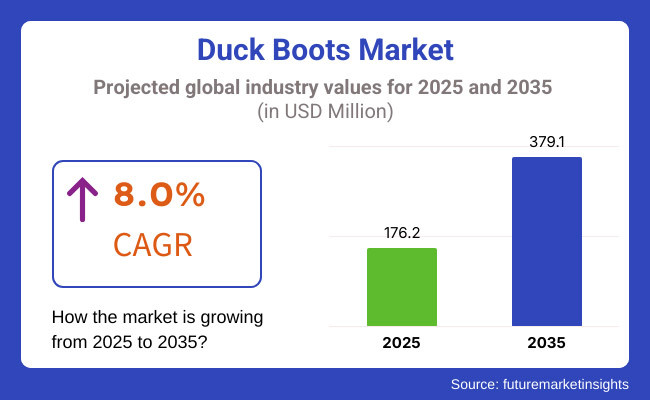

The duck boot market will increase steadily from 2025 to 2035 as the demand for weather-resistant and long-lasting footwear by consumers drives the market. The size of the market in 2025 will be around USD 176.2 million and will be at its highest at USD 379.1 million in 2035 with a compound annual growth rate (CAGR) of 8.0% during 2025 to 2035.

There are some reasons that are behind the shifting market trends. Its largest is the rise in popularity in outdoor recreation and that is driving cold- and wet-condition tough footwear sales. Duck boots, once used merely for hunting and farm use, have arrived as an urban style trend now and are being purchased by functional purchasers and fashion buyers.

For example, Sperry and L.L.Bean brands are flying high with young consumers searching for all-weather boots with traditional craftsmanship blended with style. Green issues are also impacting product innovation as firms are spending money on green materials like recycled rubber and eco-friendly leather.

Market for duck boots is segmented on the basis of type based on material and usage. The most durable boots are made of leather-rubber composites, thanks to their water repellence and strength. Green consumers with vegan and artificial preferences are fast on the rise, though. duck boot functionality is not restricted to outdoor use alone; duck boots are preferred by urban civilians and university students to stride rain and snow with vigour. The need for functional and fashionable boots has created the need for fashion like fleece-lined linings and high grip soles to stay steadfast on wet ground.

North America is the market leader for duck boots market primarily because of the cold and rough winters here, coupled with outdoor culture. USA and Canadian consumers like a boot that can traverse wet, cold, and muddy grounds, and duck boots are thus seasonal best sellers.

Revival of classic brands such as L.L.Bean and new players who are providing improved craftsmanship is propelling business growth. Furthermore, casual outdoor style is emerging to be an increasingly popular among urban millennial and Gen Z shoppers seeking stylish yet comfortable shoes. The stores also enjoy the trend through personalization options such as color patterns and monogramming.

There is increased demand for duck boots in Europe, especially in those nations with longer wet seasons such as the United Kingdom, Germany, and the Netherlands. It is warm and waterproof footwear that people in these nations want, and therefore duck boots are familiar to them. The shoe industry has also played a significant role, and high-end brands have included duck boot characteristics in their best-seller lists.

Nevertheless, eco-friendliness in Europe has pushed firms to be environmentally friendly with biodegradable rubber and organic cotton lining. Greater European retail penetration has allowed European buyers to go global and go regional and thus propelling the industry's growth.

Asia-Pacific would see the maximum growth in the duck boots market due to a change in climatic trends and evolving consumer needs. South Korea and Japan, for instance, are seeing the increase in demand for premium water-proofing shoes largely in urban cities due to recurring rains in such cities all year round.

Even Western fashion has generated a generation of young consumer bases hungry for duck boots, which local and foreign fashion makers are queuing up to set up tie-ups with. Market penetration is driven by the growth of the rising middle class and increasing disposable incomes in China and India. Web portals allow brands to open up to their universe of customers. Home, price-competitive offerings remain a ball and chain to the premium players.

Challenge

Price Sensitivity and Market Competition

Though duck boots provide value and reliability, the comparatively greater expense than commodity waterproof boots present a challenge in price-sensitive markets. To enjoy low-price competition and cost and quality at the same time is what the brands need to achieve. Counterfeits and bottom-end knockoffs destroy consumer trust and brand image. This has to be overcome by successful brand positioning, quality control programs, and communications that are compelling.

Opportunity

Innovation in Technology and Sustainability

The duck boots market has huge potential for sustainable footwear. More and more companies are using more and more sustainably sourced leather, recycled materials, and vegetable-based rubber to appeal to environmentally conscious consumers.

Self-drying boots, ergonomically designed soles, and moisture-wicking linings are technologies that create consumer interest. The companies that make investments in technologies such as these will be the market's top dog. Bloggers of fashion and outdoor activists, as well, offer scope to brands to reach and sell out.

From 2020 to 2024, duck boots market rode a boom sparked by heightened outdoor activities, heightened e-commerce shopping, and changed fashion needs. Demand for low-cost multi-functional boots with functional yet fashionable footwear went into hyper drive among shoppers in a period of global supply chain disruptions and raw material deficits that hit makers hard and pushed them to move focus to regional manufacturing and environmentally friendly sourcing vehicles.

In the pre to 2025 to 2035 era, the market will evolve with emphasis on sustainable materials, technological innovation, and e-commerce growth. The brands will develop lightweight seasonal duck boots with improved warmth and ventilation. Smart shoe technology, such as temperature control and anti-fatigue support, will be incorporated to attract digitally active consumers. DTC business models and personalized online retailing will define the future of the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Laws for material safety, such as phthalate-free and lead-free stipulations for making shoes. Ethical sourcing of leather gained in popularity. |

| Technological Advancements | The invention of waterproof membrane technology, for example, developments in seam-sealing technology, enhanced the life of duck boots. Smart temperature-controlled insoles emerged. |

| Consumer Preferences | Growth in the demand for fashion-conscious and functional outdoor footwear affected the launching of fashion-leading duck boots in differing color patterns. Collaborations with fashion brands and designers were common. |

| Retail and Distribution Trends | Growth in e-commerce led to significant online sales gains, with brands investing in direct-to-consumer (DTC) channels. Traditional retailers reacted with improved Omni channel experiences. |

| Performance and Durability | Weather-resistant rubber and leather combinations remained predominant due to weathering resistance. Light EVA midsoles added comfort. |

| Environmental Sustainability | Brands incorporated recycled rubber in outsoles and made efforts towards take-back programs for worn-out boots. Environmentally friendly packaging became a priority. |

| Production & Supply Chain Dynamics | Supply chain disruptions caused by raw material shortages affected production timelines. Brands diversified sourcing as a risk mitigation measure. |

| Market Growth Drivers | Expansion fueled by increasing outdoor recreation, urban fashion, and demand for all-weather footwear. Adventure tourism expansion boosted sales. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments and regulatory agencies demand tighter environmental regulations, requiring biodegradable products and green adhesives. Extended producer responsibility (EPR) legislation promotes environmentally friendly manufacturing and waste handling in the shoe business. |

| Technological Advancements | Technological advancements in material sciences produce self-cleaning, water-repellent coatings for longer product life. 3D printing makes customization a reality, allowing customers to design bespoke duck boots with accurate fit and visual attractiveness. |

| Consumer Preferences | Consumers are focusing on sustainability, compelling brands to launch vegan and recycled-material duck boots. Demand for hybrid shoes that can be used outdoors and in cities propels design transformation. |

| Retail and Distribution Trends | Augmented reality (AR) and virtual try-on technologies revolutionize online shopping, minimizing return rates. Subscription models and resale sites expand as sustainable-focused consumers adopt circular fashion behaviours. |

| Performance and Durability | New technologies in biodegradable rubber and plant leather make them more resistant with low ecological footprint. Temperature control becomes even better through advancements in insulation technology in extreme climates. |

| Environmental Sustainability | Modular duck boots set the pace through component replace ability rather than end-of-life product disposal. Technologies for dyeing without water and carbon-free manufacturing become common industry practice. |

| Production & Supply Chain Dynamics | Automated nearshoring and capital investments enhance manufacturing efficiency. Blockchain technology supports authentic ethical sourcing and sustainability assurances. |

| Market Growth Drivers | Market growth fueled by environmentally friendly consumers, urbanization of duck boots, and increasing disposable incomes in developing economies. Advances in performance footwear technology propel growth even more. |

The USA market for duck boots keeps growing with growing popularity of outdoor pursuits and fashion seasons. Adventure travel and hiking mania have driven demand. Veterans like L.L. Bean and Sperry leverage legacy value and innovative performance today.

In the years ahead, sustainability will be a driving force in the market, with companies embracing bio-based water-repellent coatings and recycled materials. Increased demand for hybrid lifestyle footwear, suitable for both outdoor activities and city wear, drives innovation even more. The direct-to-consumer (DTC) business model continues to grow, with AR-powered virtual try-ons making physical stores obsolete.

Increased Demand for Green Shoes: America's USD 86 billion plus footwear industry is witnessing the green trend of material. People go out of their way to purchase duck boots that have organic wool linings, vegetable-based leathers, and biodegradable rubber outsoles, thus taking the industry towards greener horizons.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

UK duck booting industry registers steady growth with widespread wet weather climate and increased consumer demand for shoes to be used outdoors across more seasons. Established or mature players dominate e-commerce uptake with favourable uptick rates, driven by AR-suggested fit levels in enhancing user confidence.

REACH rules spur green material usage innovation by way of bio-based rubber and water-repellent PFC-free coatings. Fashion-forward category market demand sees a convergence of classic brand and designer pairings, making duck boots fashion statements. Festival attendee and backcountry hiking culture are the underpinnings for the new sporty outdoors trend further supporting demand.

A Green Shift towards Innovation: As the UK works towards net-zero carbon emissions, eco-friendly innovations like closed-loop production systems and algae-based foam midsoles place brands in a favourable position.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.0% |

Europe's duck boot market is design- and functionality-led. Demand is highest in France, Germany, and Italy, where demand is driven by growing demand for high-quality weather-resistant footwear. EU Green Deal legislation is driving the industry towards lower carbon foot printing and eco-friendly resource exploration.

Winter sports and outdoor activities fuel heavy, insulated duck boot sales. "Slow fashion" also encourages consumers to invest in durable, repairable shoes, creating additional brand loyalty for luxury brands. The circular economy model becomes increasingly mainstream, with major brands launching repair and resale initiatives.

Development of Performance Footwear: European buyers prize most their ergonomic designs and ecologically insulating materials, which is the reason why temperature-regulating boots that adjust for changing temperatures are trending.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 8.1% |

Demand is driven in the Japanese duck boot industry by purchases based on premium quality craftsmanship, technical attributes, and usability. Inclement weather conditions in the country increase need for waterproof as well as slip-resistant footwear.

A strong focus on sustainability and minimalism informs the application of recycled and natural materials. Japanese consumers prefer lightweight yet durable designs, leading to the development of sophisticated polymer-based waterproofing and shock-absorbing midsoles. Leading brands employ AI-based customization to maximize fit and comfort.

Technology Leadership in Footwear: As Japan prioritizes precision manufacturing, brands apply nanotechnology in waterproofing solutions for enhanced performance and reduced environmental impact.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.9% |

South Korean duck boot market is driven by the harmony of fashion and outdoor utility. Young consumers are seeking both utility and style, thus the demand for stylish duck boots with svelte silhouettes and futuristic materials.

Conscious consumption behaviours drive the incorporation of natural plant-based water-repellence as well as plant-based biodegradable rubber outsoles. Regulations promoting sustainable manufacturing of footwear require companies to be low-carbon in their making.

Growing Influence of K-Fashion and Technology: Merging K-fashion with performance shoes renders stylish, weather-resistant duck boots a desirable choice for global consumers. Moreover, intelligent fabrics integrated into duck boots enhance breathability and thermal sensitivity, further propelling the growth of South Korea's market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

Leather is the top-selling duck boot material because it has better resilience, water resistance, and stylish appearance. High-end outdoor fashion-conscious customers prefer leather duck boots that are a combination of fashion and functionality. Leaders in the market such as L.L. Bean and The Original Muck Boot Company are further solidifying this position by launching premium leather duck boots for tough outdoor as well as city applications. Growing demand for winter clothing and all-season boots in Europe and North America also creates demand for leather duck boots.

Last but not least, in the last few years, innovation in treatment processes of leather has rendered duck boots water resistant and hence more wear-friendly in rainy weather. Since customers prefer long-lasting shoes, the leather sector can be anticipated to lead the market for duck boots.

Web-based retailers today are among the largest sales platforms for duck boots, creating a stupendous rate of market expansion. Web-retailing giants such as Amazon, Zappos, and corporate-owned websites make it easy for customers to shop through vast collections, price checks, and selection of special web-only designs.

Those companies which have embraced the direct-to-consumer (DTC) methods, such as All-Weather Boots Co., have achieved unprecedented growths through offering customer-targeted products, limited editions, and sale-of-season discounts through their websites. The facility of connecting international consumers with doorstep delivery and hassle-free returns has made online shops a force to reckon with in the duck boots sector. Online promotions, celebrity endorsements, and social media marketing are also driving popularity and demand for duck boots on the web.

Women's segment is showing strong growth in duck boots market because of the increased demand for fashionable yet functional footwear. Fashion-conscious luxury brands have introduced fashion-forward designs in their product line, including pastel colors, faux fur trimming, and light-weight material, which have been found to be desirable for women customers.

Companies such as Sperry and Sorel have managed to catch this wave by introducing duck boots for city use, merging utility with modern fashion. The growing power of celebrity culture and social media culture has also speeded up the trend among women for duck boots, and this category has emerged as a key growth driver in the market.

Rubber duck boots are also gaining popularity with clients who require the top waterproofing shoes as well as weather protection. Rubber duck boots are particularly suitable for outdoor labourers, farmers, and employees who work in wet and muddy environments because they are made to withstand heavy water exposure.

They are then trailed by companies like Kamik and Bogs, who have introduced high-end rubber duck boots with insulating internal linings and slip-resistant tread outsoles to people in areas that receive massive rains and snow. Rainproof boot sales have been the driving force of this market, and rubber is one of the basic raw materials used on duck boots.

Children's category is increasing in demand since parents require children's shoes to warm, protect, and comfort children during movement. Children's duck boots for kids feature light weight material, easy fastening, and playful, colourful children's designs to attract children and parents simultaneously. The North Face and Baffin are two brands that diversified their product with cold-weather use duck boots that have insulation, attracting more and more desire to warm and dry kids when outdoors.

With more families engaging in outdoor seasonal activities such as hiking and camping, there is a consistent demand for trustworthy kids' shoes, and therefore the kids' segment of the duck boots market contributes heavily to overall market growth.

Duck boots market is a competitive market, led by dominant global brands and regionally experienced producers making customer demand. High-performance material applications, weather-resistant designs, and fashion-oriented styling are controlled by the industry leaders.

The companies are spending significantly on innovation, sustainable production, and diversified product lineups to entice outdoor sporting and urban shoppers. The market has good industry leaders and emerging competitors, both creating market trends through differentiated products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| L.L.Bean | 20-25% |

| Sperry | 12-18% |

| The Original Muck Boot Company | 8-14% |

| Sorel | 6-10% |

| Kamik | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| L.L.Bean | Pioneered the classic duck boot with handcrafted, waterproof leather and rubber soles. Focuses on durability and lifetime customer satisfaction. |

| Sperry | Specializes in stylish, weather-resistant duck boots that blend function and fashion. Offers seasonal collections with contemporary designs. |

| The Original Muck Boot Company | Produces high-performance, insulated duck boots tailored for extreme weather conditions. Uses innovative neoprene materials for enhanced comfort. |

| Sorel | Blends fashion and utility, offering trendy yet durable duck boots for both casual and outdoor wear. Targets urban and adventure-driven markets. |

| Kamik | Focuses on eco-friendly, lightweight duck boots designed for cold and wet conditions. Uses sustainable materials and ethical manufacturing processes. |

Key Company Insights

L.L.Bean (20-25%)

L.L.Bean is the top duck boot market leader that started making the original Maine Hunting Shoe that evolved into the signature duck boot of today. L.L.Bean has been a master of hand-stitched construction, waterproof leather, and rubber outsoles.

The company is concerned with craftsmanship and durability and offers a lifetime guarantee on its products. It maintains its core USA base while expanding internationally, establishing itself as a top outdoor footwear market leader.

Sperry (12-18%)

Sperry, as a brand well-known for nautical footwear, has managed to penetrate the duck boot market with fashionable and trendy waterproof offerings. The company targets fashion-oriented consumers who need functionality and style.

Sperry frequently collaborates with celebrity designers and social influencers to launch limited-edition collections, thus boosting its visibility in the market. Its wave-siped bottomed boots grip better on icy and slippery surfaces and are a favourite among outdoor users and city residents.

Original Muck Boot Company (8-14%)

The Original Muck Boot Company deals in creating high-performance, completely insulated duck boots for inclement weather. The company uses neoprene-lined insulations and thermal insulation to keep the wearer warm and flexible under extreme conditions.

By its agricultural and outdoor working boots, Muck Boot has established a niche among farmers, hunters, and field labourers. The company enjoys a stable customer base as a consequence of comfort-focused innovation and protection against the elements for the whole year.

Sorel (6-10%)

Sorel has thrived as a fashion-focused outdoors’s-inducing shoe brand, whereby raw outdoors’s is married to innovative design. Its shearling-insulated, leather-protected, weather-treaded bottoms duck boots are cold-weather tourist's and fashion-conscious consumers' best buddies.

Sorel's high-fashion apparel store chain association has helped the brand to gain momentum in the city, whereby design-leading beauty is married to performance. The company is still experimenting with new materials with an eye to constant improvement in warmth and water-proofing.

Kamik (4-8%)

Kamik stands out in environmental policy, using recycled rubber and green material in its duck boots. Kamik is attractive to environmentally conscious consumers as well as demanding performance and green options. Kamik boots are lightweight but resilient, providing waterproof protection without additional bulk. Kamik is popular in North America and Europe due to its ethical production and value over expensive competitors.

Other Key Players (40-50% Combined)

Beyond these major players, several brands contribute significantly to the market by offering cost-effective, innovative, and sustainable alternatives. These include:

The overall market size for the duck boots market was USD 176.2 million in 2025.

The duck boots market is expected to reach USD 379.1 million in 2035.

The increasing demand for all-weather footwear, rising outdoor recreation activities, and growing fashion trends fuel the duck boots market during the forecast period.

The top 5 countries which drive the development of the duck boots market are the USA, Canada, Germany, UK, and France.

On the basis of end-use, the outdoor and adventure segment is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Pairs) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Global Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 8: Global Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 12: North America Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: North America Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 20: Latin America Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Latin America Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 28: Western Europe Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Western Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 32: Western Europe Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 36: Eastern Europe Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Eastern Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 40: Eastern Europe Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 52: East Asia Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 54: East Asia Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 56: East Asia Market Volume (Pairs) Forecast by End User, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Pairs) Forecast by Material, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Pairs) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Pairs) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 10: Global Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 18: Global Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Material, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End User, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 34: North America Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 42: North America Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: North America Market Attractiveness by Material, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End User, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 58: Latin America Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 66: Latin America Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 82: Western Europe Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Western Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 90: Western Europe Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 154: East Asia Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 158: East Asia Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 162: East Asia Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Pairs) Analysis by Material, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Pairs) Analysis by End User, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Duck Plucker Machine Market Size and Share Forecast Outlook 2025 to 2035

Duckweed Market Insights – Trends, Demand & Growth 2025–2035

Duckweed Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Snow Boots For Women Market Size and Share Forecast Outlook 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Snow Boots Market Analysis - Trends, Growth & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Work Boots Market

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Korea Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Japan Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Region Through 2035

Ankle Boots Market Trends - Size, Growth & Forecast 2025 to 2035

Europe Duckweed Protein Market Trends – Size, Demand & Forecast 2025–2035

Riding Boots Market Analysis - Growth, Demand & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Cowboy Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Combat Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Hunting Boots Market Growth – Trends & Demand Forecast to 2035

Lace Up Boots Market Trends – Growth & Demand Forecast 2025 to 2035

Cowgirl Boots Market Trends – Growth & Industry Outlook to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA