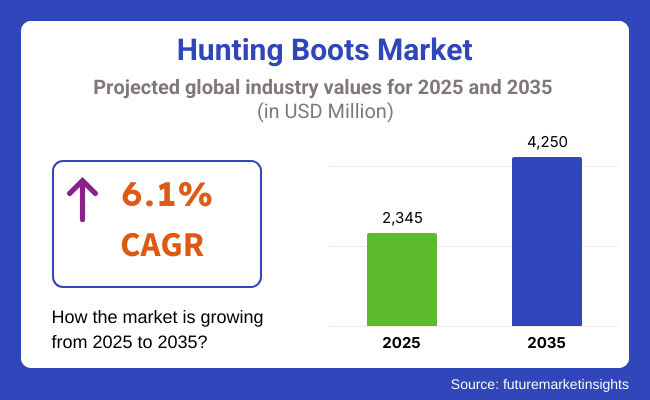

The hunting boots industry is expected to see good growth over the 2025 to 2035 forecast period since growing demand for taking part in hunting activity, outdoor wear technology progress, and increasing consumer need for high-performance shoes exist. The industry would be around USD 2,345 million in 2025 and USD 4,250 million in 2035 at a compound annual growth rate (CAGR) of 6.1% over the forecast period.

There are a number of driving factors for the market. They include outdoor recreation sports development, particularly in North America and Europe as hunting is a mass-participated yet regulated sport. The newest generation of hunting footwear is becoming tougher in extreme weather and terrain use as well as longer-term usage.

For example, waterproofing and insulating technologies like Gore-Tex lining and Thinsulate insulation are infusing strength and comfort in hunters. Unpredictable raw material prices and heightened restrictions on hunting in some geographic regions are, nonetheless, impeding market growth.

Market is divided according to product types and materials. Insulated boots, rubber boots, and leather boots are the leading sellers to suit different environmental conditions and styles of hunting. Water-resistant rubber hunting shoes due to water resistance are a massive demand, best suited for hunting in wetlands, and synthetic or wool-insulated shoes are preferred for cold climatic region hunters. Full-grain and nubuck leather footwear is weather-resistant and breathable, best suited for long-term use.

North America is a dominant hunting boot market in the wakes of United States and Canada firm hunting culture. With an increased number of registered hunters, more so deer, elk, and waterfowl hunting, the demand for specialty hunting boots increases. Brands at the top level such as Danner, Rocky, and LaCrosse are targeting high-tech materials to achieve improved performance, such as scent-free technologies for reducing human scent detection by animals.

Besides that, cold winter conditions in certain North American regions induce insulated boot sales, i.e., Alaska, Montana, and Minnesota states. Conversely, green trends force manufacturers to develop eco-friendly substitutes, i.e., biobased rubber and recyclable polyester linings, to meet evolving customer demands.

Europe is a large hunting boots market, stimulated by the hunting sport in Sweden, Germany, and France. Hunting is traditionally practiced as a conservation measure, where there are imposed restrictions to limit it, thus generating demand for long-lasting and durable hunting boots. Handcrafted boots of high durability by Meindl and Crispi are highly sought after by veteran hunters in the continent, while traditional leather hunting boots are still very much sought after.

More focus by European governments on ethics and use of green hunting practices is forcing business enterprises to take on environmentally friendly production methods. Business firms are switching to alternatives such as vegetable tanning of leather shoes intended to minimize environmental consequences of chemical use in production.

The hunting boot market is growing in Asia-Pacific, with enormous growth in countries like Australia, Japan, and China. With hunting being more regulated in the majority of Asia, there is growing demand for hunting shoes from increased activity levels at outdoor survival schools and shooting sport competitions. As a country with extensive open outback ranges and regulation over feral animal hunting, Australia provides enormous growth to the market.

Wildlife trekking and wildlife adventure travel also are cannibalizing the Asian-Pacific market. Enthusiasts use high-performance hunting boots for multi-day trips and wildlife trailing, and they are extremely popular.

Challenge

Environmental Concerns and Hunting Regulations

More robust wildlife protection laws in some countries are undermining the hunting boots industry. Governments across the globe are making it more challenging to obtain game species protection permits to hunt and, thus, indirectly suppressing demand for hunting equipment. Third, ethical opposition to hunting is also discouraging other consumers from buying traditional leather boots and opting for other synthetic and vegan alternatives instead.

Opportunity

Footwear Technological Advances

High-performance shoe technology is a great opportunity for the hunting shoe industry. Businessmen are creating lightweight, stronger material such as carbon fiber base and Kevlar reinforcement with the vision to improve performance. Intelligent boots with the heating feature integrated into the shoes and GPS tracker are being bought by wildlife hunters in remote areas more and more.

Sustainable material innovation is also a future growth area. Firms are creating biodegradable rubber outsoles and water-repelling plant-based coatings to engineer eco-friendly hunting boots. They are tracking international trends in sustainability and providing the ultimate functionality to the end-consumers.

Hunting boots market in 2020 to 2024 was driven by rising outdoor activity demand during post-pandemic phases. Buyers spent on rugged, multi-purpose boots with dual functionality to be used for hiking, trekking, and hunting activities as well. Next-generation waterproofing technologies helped improve comfort and functionality of premium hunting boots as well.

The next decades will witness increased application of green materials, intelligent shoe technology, and high-performance footwear designs for 2025 to 2035 markets. The future trend would be customization since it would be brand-specific to enable the hunter to be adaptive depending on the environment with varying insulation ability, boot height, and traction under the sole.

As ethical hunting grows in popularity and people shift their attention to regulation, the makers also would attract nature enthusiasts and hunters, and the market would be supported by a lively game of a burgeoning outdoor world.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Technological Advancements | Manufacturers added revolutionary materials like Gore-Tex and Thinsulate to hunting boots to render them more waterproof and insulating. Advances focused on improving durability and comfort on terrain of all kinds. |

| Consumer Preferences | Comfort and functionality are important to hunters, so there was a demand for boots that could endure various types of weather. The fashion trend evolved towards multi-purpose models that would be used outside of the hunting sport, such as hiking. |

| Distribution Channels | Physical brick-and-mortar stores dominated the sales, with gradual movement to online stores. The customers began enjoying the convenience of online shopping but preferred making purchases in-store for fitting reasons. |

| Environmental Regulations | There was growing awareness of the environmental impact that led to some producers adopting sustainable practices. Industrywide standards, however, were few, and consequently the adoption rates were varied. |

| Market Growth Drivers | The resurgence of outdoor recreational pursuits like hunting fueled demand. Technological advances in boot construction and design attracted both experienced hunters and beginners. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technological Advancements | Manufacturers added revolutionary materials like Gore-Tex and Thinsulate to hunting boots to render them more waterproof and insulating. Advances focused on improving durability and comfort on terrain of all kinds. |

| Consumer Preferences | Comfort and functionality are important to hunters, so there was a demand for boots that could endure various types of weather. The fashion trend evolved towards multi-purpose models that would be used outside of the hunting sport, such as hiking. |

| Distribution Channels | Physical brick-and-mortar stores dominated the sales, with gradual movement to online stores. The customers began enjoying the convenience of online shopping but preferred making purchases in-store for fitting reasons. |

| Environmental Regulations | There was growing awareness of the environmental impact that led to some producers adopting sustainable practices. Industrywide standards, however, were few, and consequently the adoption rates were varied. |

| Market Growth Drivers | The resurgence of outdoor recreational pursuits like hunting fueled demand. Technological advances in boot construction and design attracted both experienced hunters and beginners. |

The USA hunting boots market grew steadily throughout 2020 to 2024 due to the country's hunting cultural heritage and increasing outdoor recreation. Erratic hunting seasons, increasing hunting tourism, and increased consumer spending drove demand for high-quality boots.

The firms infused technology-enriched materials like waterproof membranes, insulation, and abrasion-resistant soles to enhance durability, comfort, and water resistance. The development of e-commerce also played a major role in market expansion because customers could discover different products and compare their characteristics prior to buying them.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

UK hunting boots industry was slowly increasing from 2020 to 2024 because the market was driven by ongoing growth in outdoor recreation, as well as rising sport hunting demand. Market penetration was achieved on the basis of considerations such as changed climatic conditions and needs of multi-purpose outdoor shoes.

The company pioneered innovation by providing improved grip, lightest build, and water-proofing to cater to diverse terrain from woods to wet moors. Other than this, the most sought-after trend was sustainability by which companies were engaged in the utilization of green material and procurement of ethically sourced material. More internet shopping avenues made it even simpler, boosting sales even more for the outdoor consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

European Union hunting boots market also grew consistently from 2020 to 2024 due to deeply entrenched culture for hunting and growing popularity of outdoor activities. Germany, France, and Spain were some of the top countries driving demand for the market, whose diverse topographies demanded specialist footwear.

Firms emphasized ruggedness, comfort, and flexibility to the weather, with features like air-porous linings, anti-skid soles, and toe caps with enhanced protection. Increased popularity of trekking and backpacking had the same effect on market directions, with crossover styles that are either more or less flexible to other outdoor activities. Increased environmental consciousness prompted firms to go greener in production practices.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.8% |

The Japanese market for hunting boots exhibited consistent growth between 2020 to 2024 on the back of a niche but robust base of hunting and outdoor-oriented end-users of hunting and greater demand for outdoor products such as hiking and camping. Owing to geographical diversity and Japanese geography and climate variability, there was greater demand for boots that were more insulated, water-proof, and ergonomic.

Premium models had the finest materials such as full-grain leather, rubber heels, and sweat-wicking liners. Even more sophisticated products were available in the market, constructed from light but extremely resistant synthetic material. Foreign and domestic brand shops and online shops in cities boosted sales.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

Demand for hunting boots also continued to increase in South Korea from 2020 to 2024 because outdoor activities such as hiking, camping, and hunting were being performed more. Although hunting is a sport, customers required functional shoes that would stay on its feet even when the ground became wetter and wetter by every minute, either mountainous ground or forestland that was moist.

Companies incorporated new technologies such as Gore-Tex membranes and EVA midsoles into designs to enhance waterproofing, breathability, and shock absorption. Higher demand for high-end and foreign brands also spurred market expansion. Expansion in digital marketing and online retail penetration also encouraged brands to reach more customers, enhancing overall sales performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Inside the insulated hunting boots, there is tremendous market share for the 400 to 800-gram insulation category as it provides multi-temperature flexibility. The boots provide best heat and ventilation ratio and function best for mid-season elk and deer hunting in temperate weather.

These hunters require this level of insulation since it provides them with the ability to stay cold during hunting during early morning hours but not too much that they become overheated when they are in transit. Thinsulate and PrimaLoft technology also provides thermic performance without extra weight, driving demand for this category.

Personalizing tough style boots to order are experiencing sky-high demand among professional hunters who want the finest-end precision-fit boots capable of bearing rugged terrain. They have tough soles and ankle protection. They can easily accommodate hunters operating in mountains or heavy forest covers.

The premium brands such as Kenetrek and Crispi use full-grain leather and proprietary waterproofing technology to provide maximum durability and comfort. Their wider use in severe hunting operations, like Alaskan big-game hunting, has got them featured on the rising market.

Full-grain leather boots are given the highest priority in the market as they are stronger, more mature, and easier. Full-grain leather boots are also more water-resistant and longer-lasting than mesh or nylon boots, thus a choice for highlands and long-distance hunting operations.

Luxury brands such as Danner and Lowa employ hand-stitched full-grain leather uppers with Gore-Tex membranes for enhanced waterproofing and breathability. Applications of boots that will endure abusive conditions such as the Appalachian backwoods or Canadian bush indicate exposure of this material type.

The 8 to 12-inch shaft height category is the monarch in the hunt boots market with the ideal balance between ankle stability and mobility. They are favoured by whitetail deer hunters in country with rolling hills and marshes where ultimate concealment from mud, water, and brush is not hindered by immobilizing weights.

Market demand is also spurred by waterproof and insulated models that accommodate diverse hunting conditions. Irish Setter and Rocky Boots are only two instances of companies tapping into this demand by adding better traction soles and reinforced toe guards to help offer more protection.

Online sales websites are becoming increasingly trendy in the hunting boots space, supported by the ease of direct-to-consumer models and the allure of online-only bargains. Online retailers like Amazon, Bass Pro Shops, and specialty hunting gear websites offer a vast array of styles and sizes, from casual to professional hunters.

Furthermore, the addition of digital fitting technology and in-depth product reviews has given consumers more confidence in purchasing high-performance boots online. The shift to online purchasing, especially by young hunters and sportsmen who go outdoors, is likely to continue driving the market's buying patterns.

Hunting boot market is an up-and-coming, competitive market with top global players and domestic producers who are focusing on product development and innovation. Market leaders focus on waterproofing, insulation, ruggedness, and innovative traction technology to enhance user experience.

The market is challenged by established brands with their own customer loyalty and new entrants that provide specialized boots for various types of terrain and weather conditions. Firms invest in high-performance products, green manufacturing, and higher comfort levels to compete.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| LaCrosse Footwear | 14-18% |

| Irish Setter (Red Wing Shoes) | 12-16% |

| Danner (ABC-Mart) | 10-14% |

| Muck Boot Company | 7-11% |

| Rocky Brands | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| LaCrosse Footwear | Develops high-durability hunting boots with Thinsulate insulation and waterproof Gore-Tex linings. Focuses on extreme weather resistance. |

| Irish Setter (Red Wing Shoes) | Specializes in scent-free, lightweight hunting boots with UltraDry waterproofing and RPM composite soles for enhanced comfort. |

| Danner (ABC-Mart) | Manufactures handcrafted hunting boots with Vibram outsoles and breathable, moisture-wicking linings for all-terrain performance. |

| Muck Boot Company | Produces 100% waterproof hunting boots with neoprene insulation for superior flexibility and warmth in cold conditions. |

| Rocky Brands | Offers aggressive tread hunting boots with proprietary 3M Thinsulate insulation and dual-density EVA midsoles for added comfort. |

Key Company Insights

LaCrosse Footwear (14-18%)

LaCrosse Footwear leads the market for hunting boots with its rugged and high-quality boots for extreme weather conditions. It is renowned for Gore-Tex-lined boots with Thinsulate Ultra insulation to keep the hunters warm and dry in cold and wet weather. LaCrosse also uses scent-control technology for evading detection while out in the wild and is deeply entrenched in North America through direct-to-consumer sales and retail partnerships.

Irish Setter (Red Wing Shoes) (12-16%)

Irish Setter, Red Wing Shoes, is known for light, odor-free hunting boots with UltraDry waterproofing and RPM composite technology for added range of motion. Irish Setter's VaprTrek line has popularity among bowhunters because of its silent profile and light weight. Irish Setter gains customer loyalty and repeat sales over time by consistently investing in ergonomic technology and premium materials.

Danner (ABC-Mart) (10-14%)

Danner is owned by ABC-Mart, and it's renowned for hand-stitched, durable hunting boots with Vibram soles and moisture-wicking linings to give added comfort. Danner targets serious hunters who require tough, durable shoes with great ankle support. Danner's Pronghorn series remains one of the best sellers, and its American-based manufacturing units guarantee high-quality production.

Muck Boot Company (7-11%)

Muck Boot Company sells 100% waterproof hunting boots, which are apt for wet and muddy grounds. The neoprene-lined Arctic Pro boot by the company is a favorite with hunters who go hunting in sub-zero temperatures as it is pliable, insulation, and resilient to extreme cold. Muck Boot is described as rugged and keeps launching new slip-resistant, shock-absorbing models.

Rocky Brands (5-9%)

Rocky Brands leads with aggressive tread hunting boots that feature dual-density EVA midsoles and 3M Thinsulate insulation for comfort. Rocky Brands Lynx series is in greatest demand for rugged terrains, with waterproof build and a revolutionary ankle support system. Rocky Brands grows aggressively in tactical and outdoor markets on the back of its good brand reputation.

Other Big Players (40-50% Combined)

Besides these market leaders, there are many firms that have a significant impact in the market through specialization by feature, price, and eco-friendliness. These include:

The overall market size for the hunting boots market was USD 2,345 million in 2025.

The hunting boots market is expected to reach USD 4,250 million in 2035.

The increasing participation in hunting activities, rising preference for durable and weather-resistant footwear, and advancements in boot materials and design fuel the hunting boots market during the forecast period.

The top 5 countries which drive the development of the hunting boots market are the USA, Canada, Germany, France, and Russia.

On the basis of material, leather hunting boots are expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Pairs) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 4: Global Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 6: Global Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 8: Global Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 10: Global Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 16: North America Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 18: North America Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: North America Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 22: North America Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 28: Latin America Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 30: Latin America Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 32: Latin America Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 34: Latin America Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 40: Western Europe Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 42: Western Europe Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Western Europe Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 46: Western Europe Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Western Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 52: Eastern Europe Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 54: Eastern Europe Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: Eastern Europe Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 58: Eastern Europe Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Eastern Europe Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 76: East Asia Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 78: East Asia Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 80: East Asia Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 82: East Asia Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 84: East Asia Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Pairs) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Insulation, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Pairs) Forecast by Insulation, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Hunting Style, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Pairs) Forecast by Hunting Style, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Pairs) Forecast by Material Type, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Shaft Height, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Pairs) Forecast by Shaft Height, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Pairs) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Pairs) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 12: Global Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 16: Global Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 20: Global Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 24: Global Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Insulation, 2023 to 2033

Figure 32: Global Market Attractiveness by Hunting Style, 2023 to 2033

Figure 33: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 34: Global Market Attractiveness by Shaft Height, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 48: North America Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 52: North America Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 56: North America Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 60: North America Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Insulation, 2023 to 2033

Figure 68: North America Market Attractiveness by Hunting Style, 2023 to 2033

Figure 69: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: North America Market Attractiveness by Shaft Height, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 84: Latin America Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 88: Latin America Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 92: Latin America Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 96: Latin America Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Insulation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Hunting Style, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Shaft Height, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 120: Western Europe Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 124: Western Europe Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 128: Western Europe Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 132: Western Europe Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Western Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Insulation, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Hunting Style, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Shaft Height, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Insulation, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Hunting Style, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Shaft Height, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Insulation, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Hunting Style, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Shaft Height, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 228: East Asia Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 232: East Asia Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 236: East Asia Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 240: East Asia Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 244: East Asia Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Insulation, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Hunting Style, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Shaft Height, 2023 to 2033

Figure 251: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Insulation, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Hunting Style, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Shaft Height, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Pairs) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Insulation, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Pairs) Analysis by Insulation, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Insulation, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Insulation, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Hunting Style, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Pairs) Analysis by Hunting Style, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Hunting Style, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Hunting Style, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Pairs) Analysis by Material Type, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Shaft Height, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Pairs) Analysis by Shaft Height, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Shaft Height, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Shaft Height, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Pairs) Analysis by Sales Channel, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Insulation, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Hunting Style, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Shaft Height, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hunting Equipment and Accessory Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Breakdown of Hunting Equipment Manufacturers

USA Hunting Equipment & Accessories Market Trends, Growth and Forecast 2025 to 2035

Threat Hunting Market Size and Share Forecast Outlook 2025 to 2035

Snow Boots For Women Market Size and Share Forecast Outlook 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Snow Boots Market Analysis - Trends, Growth & Forecast 2025 to 2035

Duck Boots Market Trends - Growth & Industry Outlook 2025 to 2035

Industry Share & Competitive Positioning in Work Boots Market

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Ankle Boots Market Trends - Size, Growth & Forecast 2025 to 2035

Riding Boots Market Analysis - Growth, Demand & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Cowboy Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Combat Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Lace Up Boots Market Trends – Growth & Demand Forecast 2025 to 2035

Cowgirl Boots Market Trends – Growth & Industry Outlook to 2035

Tactical Boots Market Analysis - Growth & Industry Forecast to 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA