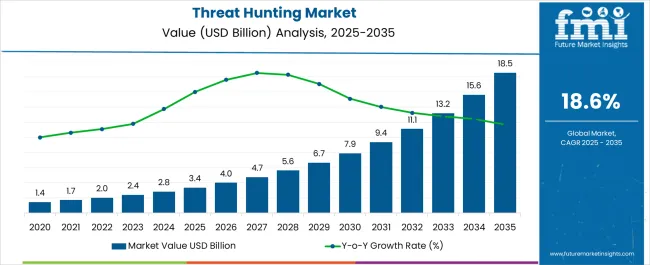

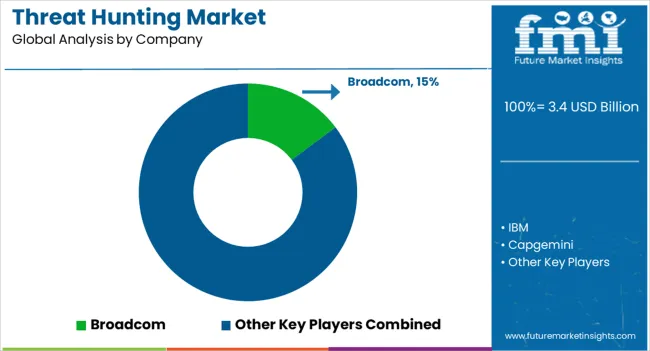

The Threat Hunting Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 18.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.6% over the forecast period.

| Metric | Value |

|---|---|

| Threat Hunting Market Estimated Value in (2025 E) | USD 3.4 billion |

| Threat Hunting Market Forecast Value in (2035 F) | USD 18.5 billion |

| Forecast CAGR (2025 to 2035) | 18.6% |

The threat hunting market is advancing rapidly, fueled by the growing sophistication of cyber threats and the need for proactive defense strategies across industries. Security journals and corporate disclosures have underscored that enterprises are shifting from reactive detection to active hunting of advanced persistent threats (APTs), insider risks, and zero-day exploits. Investments in AI-driven analytics, behavioral detection, and endpoint visibility have significantly improved the efficiency of modern threat hunting platforms.

Government-backed cybersecurity initiatives and compliance mandates have reinforced enterprise adoption, particularly in highly regulated sectors. Additionally, mergers and partnerships between cybersecurity vendors and cloud service providers have expanded solution delivery through scalable, managed models.

Rising adoption of remote and hybrid work environments has increased the attack surface, further strengthening demand for continuous hunting capabilities. Over the forecast period, the market is expected to benefit from heightened awareness of cyber resilience, adoption of security automation, and integration of advanced hunting tools within extended detection and response (XDR) frameworks.

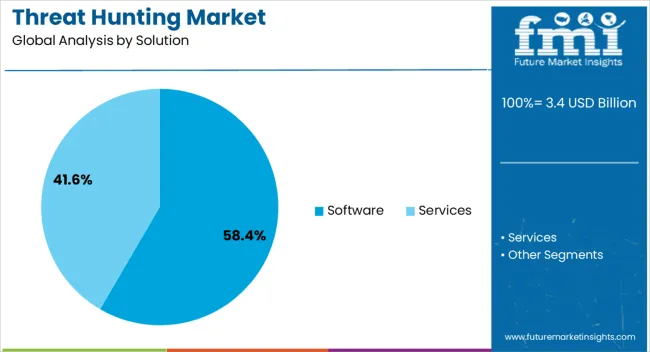

The Software segment is projected to account for 58.4% of the threat hunting market revenue in 2025, maintaining its leadership as the core enabling solution. This segment’s growth has been driven by the scalability and adaptability of software-based platforms that integrate seamlessly into existing enterprise security architectures.

Software solutions have provided advanced analytics, endpoint monitoring, and threat intelligence correlation, enabling security teams to detect hidden threats proactively. Continuous updates and the ability to deploy across hybrid and multi-cloud environments have further reinforced adoption.

Vendors have increasingly invested in machine learning and automation features that reduce manual intervention, allowing analysts to focus on high-value investigations. As the volume and complexity of cyberattacks escalate, software-driven platforms remain the foundation of enterprise threat hunting strategies, sustaining their market dominance.

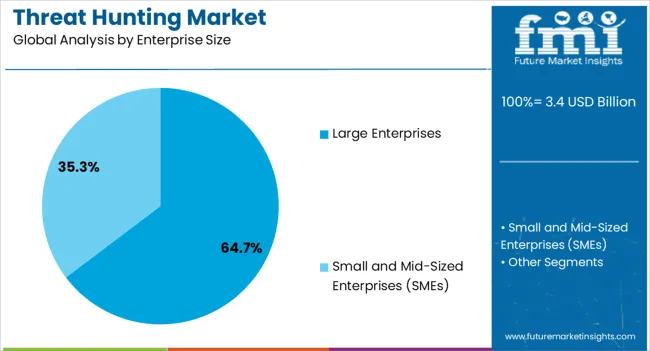

The Large Enterprises segment is projected to hold 64.7% of the threat hunting market revenue in 2025, reflecting its dominant role in driving solution adoption. Growth in this segment has been attributed to the higher risk exposure and compliance requirements faced by large-scale organizations managing complex IT infrastructures.

Annual cybersecurity spending disclosures from multinational corporations indicate significant allocation towards advanced threat hunting initiatives, driven by the need to safeguard vast networks and sensitive data. Large enterprises have also led in establishing dedicated security operations centers (SOCs) that utilize threat hunting solutions as a core component of defense.

Furthermore, the financial and technical resources of large organizations have allowed them to invest in AI-enabled platforms, automation, and skilled personnel, ensuring robust threat visibility and response. This strong capacity for implementation and continuous monitoring has positioned large enterprises as the key contributors to market growth.

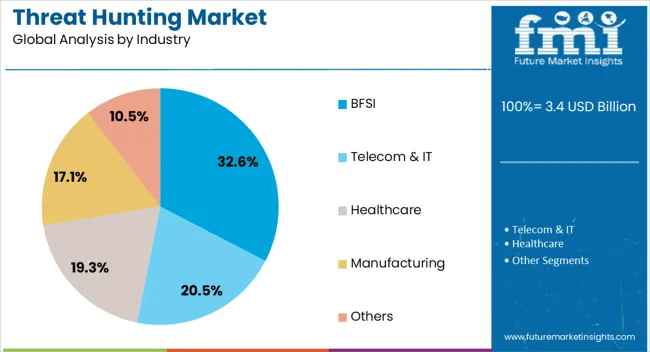

The BFSI segment is projected to capture 32.6% of the threat hunting market revenue in 2025, making it the leading industry vertical. This dominance has been driven by the sector’s heightened vulnerability to cyberattacks targeting financial data, payment infrastructure, and customer records.

Regulatory frameworks such as GDPR, PCI DSS, and sector-specific compliance mandates have intensified the focus on proactive threat identification within banking and financial institutions. Industry publications have emphasized the increasing reliance on real-time analytics, fraud detection systems, and advanced monitoring to mitigate financial crime and data breaches.

BFSI enterprises have prioritized threat hunting integration to safeguard digital banking platforms, cloud-based services, and cross-border payment systems. Additionally, the rising use of mobile banking and digital transactions has expanded the sector’s attack surface, necessitating constant vigilance. With escalating cyber risks and strict regulatory oversight, the BFSI segment is expected to remain at the forefront of threat hunting adoption.

The threat-hunting market is anticipated to grow at 18.6% CAGR between 2025 and 2035 in comparison to the 13.4% CAGR registered between 2020 and 2025. This is attributable to the rising adoption of threat-hunting solutions as well as services among small and mid-sized enterprises (SMEs) as well as large enterprises across the globe.

Cyber hunting is an approach to internet security in which threat hunters look for security risks hidden within a concealed company’s network. The global market is anticipated to witness an increase in revenue from USD 2,047.0 Million in 2025 to USD 13,224.2 million by 2035.

By enterprise size, the SME segment is expected to grow at the highest CAGR of 20.7% during the forecasted period. Moreover, by solution segment, the services segment is expected to grow at the highest CAGR of 19.8% from 2025 to 2035.

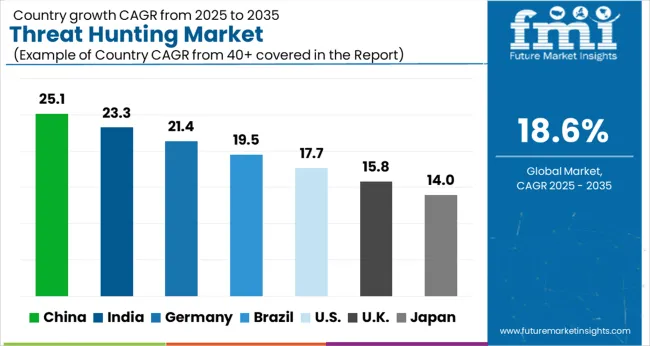

Regionally, North America is expected to dominate the global threat-hunting market, reaching a market valuation of around USD 2,969.2 Million by 2035. South Asia & Pacific market on the other hand is anticipated to grow at the highest CAGR of 22.5% from 2025 to 2035.

The proliferation of Work from Home Push Demand for Threat-Hunting Solutions

In recent years, the traditional work from the office has shifted towards always-on remote or hybrid working.

This has made organizations susceptible to cyber-attacks. As per Verizon Mobile Security Index (MSI) 2025, the new world of hybrid work that has resulted from the widespread shift to remote work has seen security teams facing an uphill struggle as the number of devices and remote employees grows.

According to the report around 79% of organizations agreed that remote working had adversely affected their cybersecurity and increased the burden on security teams. Furthermore, almost nine out of ten retail organizations (88%) were concerned that a mobile security compromise may harm their brand or client loyalty.

The report also stated that more than nine out of ten (93%) executives in financial services said cyber thieves considered their industry as a more valuable target than other businesses.

Increasing cyber threats to such industries are expected to drive the demand for threat-hunting solutions, during the forecast period.

Strong Presence of Leading Threat-Hunting Providers Driving Growth

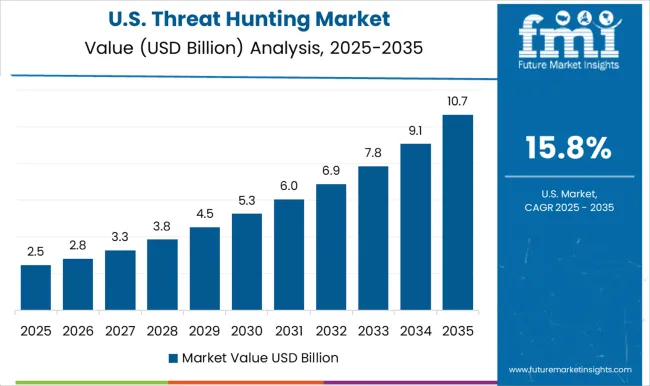

The USA threat-hunting market is projected to exhibit a prolific CAGR of over 15.2% during the forecast period of 2025 and 2035, totalling a valuation of around USD 3.4 Million in 2025.

Rising adoption of advanced cybersecurity solutions across industries, the surge in cyber-attack rates, favourable government support, and the presence of some of the leading cybersecurity giants are driving growth in the United States market.

The United States has many key cyber hunting solutions or service providers such as Broadcom, IBM, Symantec, CrowdStrike, and others. The presence of such key cyber-hunting solution providers will continue to boost the market growth in the country during the forecast period.

Increasing Government Efforts to Reduce Cyber-Attacks Pushing Demand for Cyber Hunting Solutions

As per FMI, the threat-hunting market in Germany is expected to grow at a stupendous CAGR of 21.4% during the forecast period from 2025 and 2035, creating an absolute dollar opportunity of USD 18.5 Million by 2035.

According to Germany's banking regulator, the federal financial supervisory authority (BaFin) issued a new cyber security warning to the country's financial industry. Thus, government stringent rules and regulation toward cyber threat in Germany is expected to drive the demand for cyber hunting solutions in the country during the forecast period.

Rapid Rise in Cyber-Attacks Prompting Organizations to Use Advanced Cyber Hunting Solutions

As per FMI, the threat-hunting market in India is set to grow at the highest CAGR of 24.7% between 2025 and 2035, creating an absolute dollar opportunity of USD 533.0 million by the end of 2035.

The rapid expansion of end-use industries such as BFSI and telecom & IT, the surge in cyber-attacks, and the rising penetration of both local and regional threat-hunting service providers are driving demand for cyber-hunting solutions across India.

As per Lok Sabha, there have been around 674,021 cyber-attacks in the country in 2025, making India the third most impacted by network attacks in the world.

The Indian government has taken different steps to improve cyber security and prevent cyber-attacks, including regularly publishing alerts and advisories on the newest vulnerabilities and cyber threats, as well as remedies to safeguard computers and networks.

Demand to Remain High for Threat Hunting Services in the Market

Based on the solution, the software segment will continue to dominate the global market during the forecast period. FMI predicts the software segment to grow by 5.0X through 2035.

However, the services segment is set to register the highest growth at the rate of 19.8% CAGR from 2025 to 2035. This can be attributed to the rising adoption of cyber-hunting services by small, medium, and large enterprises.

Cyber hunting services offer benefits of cyber hunting including uncovering security incidents, improving the speed of threat response, and reducing the investigation time.

Besides this, they support cybersecurity analysts in understanding the company and help to achieve appropriate mitigation of cyber threats to improve defence systems and many more. Thus, the adoption of cyber hunting services is expected to grow in the upcoming period.

Most of the Cyber Hunting Demand emerges from SMEs

Based on enterprise size, the large enterprise segment is anticipated to expand up to 4.8X during the forecast period of 2025 to 2035. However, the SME segment is set to register the highest growth rate of 20.7% from 2025 to 2035.

Cyber-attacks on SMEs are becoming more targeted, frequent, and complex. As per the annual cost of cybercrime study by Accenture, 43% of cyber-attacks are aimed at SMEs, but hardly 14% of them can defend themselves. Thus, the demand for the threat-hunting solution is expected to increase in SMEs in the forthcoming period.

BFSI to Remain Lucrative End-Use Industry for Threat Hunting Solutions

Based on the industry, the BFSI segment will be a dominating segment. The market size of the BFSI segment is anticipated to expand up to 5.1X from 2025 to 2035. This can be attributed to the rising adoption of advanced security solutions by banks and financial companies.

Financial institutions and banks all around the world have been quick to adopt advanced technology. Rapid bank digitization encourages cyber risks and has resulted in a variety of cyber threats/risks.

According to VMware Carbon Black, cyberattacks on financial institutions and banks have surged globally. As a result, it is likely to drive demand for cyber threat hunting in the BFSI business over time.

Many key players in the global market are focusing heavily on innovation, research, and development practices to provide a variety of solutions for various industry applications. They are pursuing various strategies such as partnerships, collaborations, and acquisitions to increase their presence, customer base, and solution offering. For instance,

Capgemini, Kaspersky Lab, and Cybereason - Helping Organizations to Improve Cybersecurity

Capgemini, Kaspersky Lab, and Cybereason are the top three pioneers in the field of threat hunting. Capgemini has been a top strategic partner to businesses throughout the world for more than 50 years. The Ethisphere Institute has recognized Capgemini as one of the World's Most Ethical Companies for ten years in a row.

The company leverages cloud, data, AI, connectivity, software, digital engineering, and platforms to address the entire breadth of business needs. To defend today's digital organization, cybersecurity tools are insufficient on their own.

Because of this, Capgemini's cyber hunting solution combines automated collecting and in-depth human analysis in a novel way.

Kaspersky Lab has emerged as a leading provider of cyber hunting services. The Kaspersky Managed Protection service provides complete managed services for users of the Kaspersky Endpoint Security and Kaspersky Anti-Targeted Attack Platform, using a distinctive set of cutting-edge technical methods to identify and stop targeted assaults on your business.

The service comprises round-the-clock professional monitoring by Kaspersky researchers and ongoing threat data analysis, guaranteeing the real-time identification of both well-known and emerging cyberespionage and cybercriminal campaigns aimed at key information systems.

To assure the genuine protection of the company's assets, Kaspersky specialists provide a proactive solution called Targeted Attack Discovery.

The findings of a targeted attack discovery will enable it to locate current cybercrime and cyberespionage activity within a company’s network, comprehend the causes and potential origins of these occurrences, and successfully design mitigation measures to help prevent similar assaults in the future.

The latest stats released by the company revealed that around 687 Million cyber-attacks were stopped during the last year. The company is focused on developing advanced cybersecurity solutions to help organizations to improve their security.

For instance, in March 2025, Kaspersky launched a new threat-hunting service (known as Kaspersky Threat Hunting) that enables the timely detection of adversarial activities.

Similarly, in August 2025, Kaspersky and Microsoft partnered to deliver threat intelligence to Microsoft Sentinel users.

Another key player is Cybereason, developer of the world’s first and only end-to-end threat-hunting solution. The Cybereason Defense Platform allows defenders to actively seek out the enemy and find even the most cunning threats.

The Cybereason Defense Platform is the hub for contextual correlations, threat information, and in-depth threat hunting needed to uncover the most complex threats and guarantee a proactive security posture.

The company recently (December 2020) launched the newest version of its award-winning threat-hunting solution which includes Attack Tree, Custom Detection Rules, Mitre ATT&CK Matrix, and Remote Shell Utility.

| Attribute | Details |

|---|---|

| Market Value in 2025 | USD 3.4 billion |

| Projected Market Valuation (2035) | USD 18.5 billion |

| Market CAGR 2025 to 2035 | 18.6% |

| Share of top 5 players | Around 35% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, United Kingdom, France, Italy, Spain, BENELUX, Russia, China, Japan, South Korea, India, Malaysia, Indonesia, Singapore, Australia & New Zealand, GCC Countries, Turkey, and South Africa |

| Key Segments Covered | The solution, Enterprise Size, Industry, and Region |

| Key Companies Profiled | Broadcom; IBM; Capgemini; Kaspersky Lab; Symantec; Carbon Black; Clear network; CyberDefenses; Cybereason; Delta Risk; Ingalls Information Security; IronNet Cybersecurity; Paladion; Redscan |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global threat hunting market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the threat hunting market is projected to reach USD 18.5 billion by 2035.

The threat hunting market is expected to grow at a 18.6% CAGR between 2025 and 2035.

The key product types in threat hunting market are software, endpoint detection & response (edr), security information and EVent management (siem), network threat analytics, others, services, threat hunting services, security consulting, integration & implementation and support services.

In terms of enterprise size, large enterprises segment to command 64.7% share in the threat hunting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Threat Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Hunting Equipment and Accessory Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hunting Boots Market Growth – Trends & Demand Forecast to 2035

Market Share Breakdown of Hunting Equipment Manufacturers

Threat Detection Systems Market

USA Hunting Equipment & Accessories Market Trends, Growth and Forecast 2025 to 2035

Mobile Threat Management Security Software Market Size and Share Forecast Outlook 2025 to 2035

Insider Threat Protection Market Analysis Size and Share Forecast Outlook 2025 to 2035

Specialized Threat Analysis And Protection Market

Advanced Persistent Threat Protection Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA