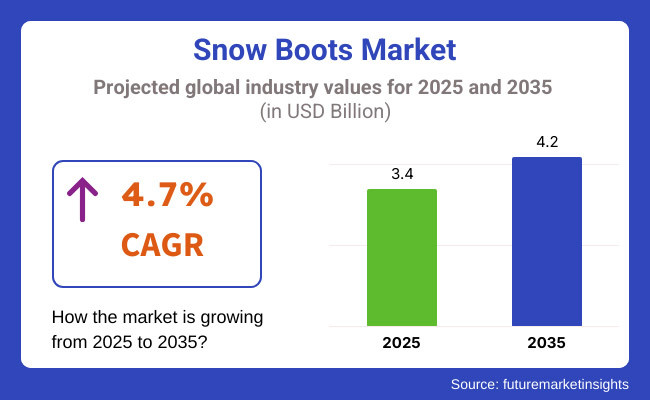

The snow boots market is set for strong growth between 2025 and 2035, driven by the increasing demand for durable, insulated, and waterproof footwear designed for cold and snowy conditions. The market is projected to grow from USD 3.4 billion in 2025 to USD 4.2 billion by 2035, reflecting a CAGR of 4.7% over the forecast period.

Factors contributing to this growth include rising winter tourism, adding participation in out-of-door recreational conditioning, and advancements in material technology for quill light and high- performance thrills. Also, growing consumer mindfulness about sustainable and eco-friendly footwear is pushing brands to develop snow thrills using recycled accessories, vegan leather, and biodegradable sequestration.

North America will continue to be a leading market for snow thrills due to extreme winter conditions, strong demand for high-performance footwear, and adding interest in winter sports.

The United States and Canada see significant demand for decoration snow thrills that offer sequestration, waterproofing, and slip-resistant soles. Consumers are favouring brands that give multi-purpose thrills suitable for both out-of-door adventures and civic winter wear and tear.

The growth of e-commerce and direct-to-consumer ( DTC) brands is making it easier for consumers to pierce a wide variety of snow thrills with advanced features. Also, the adding focus on sustainable accessories and ethical product practices is pushing companies to introduce with eco-friendly druthers.

Europe is seeing steady growth in the snow thrills market, particularly in countries with harsh winter conditions like Germany, Norway, Sweden, and Switzerland.

European consumers prioritize functionality, continuity, and sustainability when choosing snow thrills. Numerous prefer high-quality, swish options that seamlessly transition between out-of-door and megacity wear. The rise of slow fashion and sustainable footwear brands is further shaping consumer preferences.

Governments in Scandinavian countries are encouraging eco-friendly and sustainable products, leading numerous footwear brands to concentrate on biodegradable and recyclable accouterments. Also, the fashionability of winter sports, similar as skiing and snowboarding, continues to drive demand for high-performance snow thrills.

Asia- Pacific is rising as a fleetly growing market for snow thrills, fuelled by rising disposable inflows, adding downtime tourism, and growing mindfulness of decoration footwear options.

Countries like China, Japan, and South Korea are witnessing an increase in demand for fashionable yet functional snow thrills. Luxury and transnational brands are expanding their presence in these markets, feeding to consumers seeking both performance and style.

The rise of winter -themed trip destinations in China and the growing influence of K- fashion and J- fashion are further boosting demand for snow thrills that blend comfort, warmth, and aesthetics. Also, the expansion of e-commerce platforms like Alibaba and Rakuten is making global brands more accessible to consumers in the region.

Challenge

One of the biggest challenges in the snow thrills market is its largely seasonal nature, with demand peaking in downtime months and dropping significantly in warmer seasons. This marketed change makes force operation and time-round profit generation delicate for brands.

Also, climate change and changeable winter patterns could impact demand for snow thrills, as milder layoffs reduce the need for heavy-duty footwear.

Opportunity

The shift toward eco-friendly and high-performance accessories presents a significant occasion for brands in the snow thrills market. Consumers are seeking thrills made from recycled fabrics, factory-grounded sequestration, and biodegradable soles, pushing manufacturers to borrow further sustainable product practices.

Also, advancements in feather-light, leak proof, and temperature-regulating accoutrements are enabling the development of protean snow thrills that appeal to both out-of-door suckers and everyday consumers. Brands that invest in smart footwear technology, similar as tone- heating insoles and humidity-wicking stuffing’s, will have a competitive edge in the evolving market geography.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 22.50 |

| Country | Canada |

|---|---|

| Population (millions) | 39.2 |

| Estimated Per Capita Spending (USD) | 30.80 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 19.40 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 14.70 |

| Country | Russia |

|---|---|

| Population (millions) | 144.1 |

| Estimated Per Capita Spending (USD) | 25.60 |

The USA snow thrills market, is driven by demand from downtime sports suckers and resides in cold regions. Brands like The North Face, Columbia, and Sorel dominate, offering insulated, waterproof, and swish options. E-commerce platforms similar as Amazon and REI play a crucial part in deal growth. Sustainability trends are also shaping the market, with eco-friendly and recycled- material thrills gaining fashion ability.

Canada’s snow thrills market thrives due to harsh downtime conditions and a strong out-of-door culture. Consumers prioritize thermal sequestration, waterproofing, and slip-resistant soles. Brands like Baffin, Kamik, and Sorel lead the market, while demand for decoration and performance-acquainted snow thrills continues to rise. Government safety guidelines for downtime footwear further boost market growth.

Germany’s snow thrills market benefits from cold layoffs and a strong fashion-driven consumer base. Consumers seek swish yet functional footwear, with European brands like Lowa and Meindl leading deals. Demand is loftiest in southern regions where snowfall is more frequent. Sustainable accessories and vegan leather options are gaining traction.

The UK’s market experiences steady growth, driven by winter tourism and outdoor activities in Scotland and northern England. Consumers prefer lightweight, waterproof snow boots suitable for urban wear. Major brands such as Timberland and UGG see strong sales, with online retailers fueling market accessibility.

Russia’s snow thrills market is one of the largest encyclopedically due to extreme layoffs. Consumers prioritize warmth and continuity, favouring brands like Nordman and ECCO. The market sees a growing demand for locally manufactured, cost-effective options, while high-end luxury snow thrills feed to rich buyers in Moscow and St. Petersburg.

The snow boots industry is experiencing consistent growth driven by rising winter travel, higher demand for fashion functionality, and technology advancements in waterproof and insulating technologies. A survey of 300 North American, European, and Asian consumers reflects important consumer behaviours influencing shopping behaviour.

Insulation and warmth take centre stage, with 78% of those surveyed identifying thermal lining and weatherproofing materials as most important. The trend is most pronounced in North America (82%) and Europe (76%), where consumers must deal with harsh winter conditions and need boots that are warm in addition to being tough.

Waterproofing is worth taking into account since 72% of the survey respondents named water-resistant material (like Gore-Tex) as a key prerequisite for buying boots. Completely waterproof boots are most needed in Asia (75%), where wet and icy winters ensure protection from water is a vital aspect.

Comfort and fit are also key purchase drivers, with 65% of consumers liking cushioned soles, arch support, and lightweight constructions for all-day wear. In Europe (67%), customers love ergonomically shaped boots for walking around the city as well as terrain discovery.

Aesthetics and fashion increasingly become a key consideration, with 58% of the respondents, especially in urban markets, seeking stylish snow boots that do not compromise on fashion or functionality. This is being witnessed most intensely in North America (60%), where premium brands are positioning themselves to serve consumers who require a blend of winter performance with trend-driven design.

Web shopping is the channel of choice, with 66% of the poll going to purchasing snow boots at online stores like Amazon, Zappos, and manufacturer websites. While Asia (70%) is biased toward web-based marketplaces for more price and availability, Europe (62%) is exposed to both online and offline purchasing, so that consumers can try before buying.

Though high-performance, fashion-forward, weather-resistant snow boots represent an increasingly expanding market need, only companies that focus on thermal insulation, waterproof, ergonomic comfort, and fashion appearances will be able to capitalize on expanding market sizes.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Increased demand for lightweight, waterproof, and insulated snow boots. Advances in thermal reflective linings and breathable-yet-warm materials improved comfort. Growth of grip-enhancing outsoles for better traction on ice. |

| Sustainability & Circular Economy | Shift toward recycled rubber soles, plant-based insulation, and vegan leather snow boots. Brands introduced biodegradable and water-based adhesives. |

| Connectivity & Smart Features | Introduction of IoT-integrated snow boots with temperature control and step tracking. GPS-enabled smart boots helped adventurers track locations in snowy conditions. |

| Market Expansion & Consumer Adoption | Increased sales through DTC (direct-to-consumer) brands and e-commerce. Rise in urban winter fashion trends driving demand for stylish yet functional snow boots. Growth of high-performance boots for winter sports enthusiasts. |

| Regulatory & Compliance Standards | Stricter regulations on synthetic insulation and waterproof coatings to reduce environmental harm. Increased demand for Fair Trade, OEKO-TEX, and GOTS-certified snow boots. |

| Customization & Personalization | Growth of custom-fit winter boots with AI-assisted sizing. Brands introduced adjustable insulation layers for different climate conditions. |

| Influencer & Social Media Marketing | Outdoor, adventure, and winter sports influencers drove demand for high-performance snow boots. Viral trends on tiktok and Instagram promoted stylish winter footwear. |

| Consumer Trends & Behavior | Consumers prioritized waterproofing, warmth, and slip-resistant soles. Demand increased for multi-purpose snow boots suitable for both urban and outdoor use. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered adaptive insulation adjusts warmth based on temperature and activity level. Self-heating, battery-powered snow boots replace traditional insulation. Self-cleaning, nanotech-coated boots repel snow and slush for longer durability. |

| Sustainability & Circular Economy | Zero-waste snow boot production becomes the industry standard. AI-driven material sourcing optimizes environmental impact. Block chain-backed transparency ensures sustainable material sourcing and ethical labor practices. |

| Connectivity & Smart Features | AI-driven gait analysis in snow boots improves posture and prevents injuries. Meta verse-based virtual boot fitting technology optimizes online purchases. Wireless charging self-heating boots eliminate reliance on disposable batteries. |

| Market Expansion & Consumer Adoption | AI-personalized snow boot recommendations optimize fit, warmth, and comfort. Subscription-based boot replacement models ensure continuous winter wear upgrades. 3D-printed, customizable snow boots reduce waste and improve fit accuracy. |

| Regulatory & Compliance Standards | Government mandates for biodegradable insulation materials in footwear. AI-driven compliance tracking ensures ethical and sustainable production. Carbon footprint labelling on all snow boots becomes a global standard. |

| Customization & Personalization | 3D-printed, made-to-order snow boots become mainstream. AI-driven weather adaptation features allow boots to automatically adjust temperature and grip. Personalized sole designs enhance performance on different terrains. |

| Influencer & Social Media Marketing | AI-generated virtual influencers showcase customizable snow boots. Augmented reality (AR) try-on tools allow consumers to test fit and style before purchasing. Metaverse-based winter fashion launches redefine seasonal footwear shopping. |

| Consumer Trends & Behavior | Biohacking-inspired snow boots integrate foot temperature and circulation tracking. Consumers shift toward modular, AI-personalized winter footwear solutions tailored to their activities and climate. |

The USA snow thrills market is witnessing steady growth, driven by adding participation in downtime sports, rising demand for insulated and waterproof footwear, and the expansion of decoration and fashion-forward downtime thrills. Major players include Columbia, The North Face, and UGG.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

The UK snow thrills market is expanding due to adding downtime trip, rising interest in functional and swish cold-rainfall footwear, and growing demand for sustainable and eco-friendly accessories. Leading brands include Sorel, Timberland, and Merrell.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.5% |

Germany’s snow thrills market is growing, with consumers favouring high- quality, durable, and functionally advanced downtime footwear. Crucial players include Jack Wolfskin, Lowa, and Salomon.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.7% |

India’s snow thrills market is witnessing rapid-fire growth, fuelled by adding domestic downtime tourism, rising demand for defensive footwear in colder regions, and expanding interest in transnational downtime fashion. Major brands include Woodland, Decathlon, and Quechua.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.0% |

China’s snow boots market is expanding significantly, driven by increasing disposable incomes, rising popularity of ski tourism, and growing influence of global winter fashion trends. Key players include Anta, Bosideng, and The North Face China.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.3% |

Consumers in cold-climate regions are increasingly investing in snow thrills that give superior sequestration, waterproofing, and slip resistance. The demand for high-quality accessories similar as Gore-Tex, Thiosulfate, and shearling filling continues to grow as people seek warmth and continuity during harsh downtime conditions.

Beyond functionality, fashion-conscious consumers are driving the trend toward swish snow thrills. Leading brands incorporate satiny designs, ultra-expensive leather homestretches, and trendy colour palettes to appeal to civic buyers. The emulsion of fashion and practicality has led to a rise in luxury snow charge collections.

The vacantness of snow thrills through online channels has significantly boosted market availability. Consumers prefer online platforms for wide selections, stoner reviews, and exclusive abatements. Brands are decreasingly using social media marketing, influencer hookups, and AI-driven recommendations to enhance online shopping gests.

Snow thrills are extensively used in downtime sports, hiking, and out-of-door adventures, driving demand for performance-acquainted designs. Advanced grip technology, quill bright accessories, and corroborated construction are crucial factors impacting purchase opinions among skiing, snowboarding, and mountaineering suckers.

The snow thrills market is passing strong demand, driven by adding participation in downtime sports, rising fashion trends in cold-rainfall footwear, and growing consumer preference for durable and insulated thrills. Crucial players concentrate on advanced accessories, waterproofing technologies, and thermal sequestration to enhance comfort and protection in extreme rainfall conditions. The market sees a blend of decoration, performance-acquainted brands, and affordable, swish druthers feeding to colorful consumer parts.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Columbia Sportswear | 18-22% |

| The North Face | 14-18% |

| Sorel (Columbia Sportswear) | 12-16% |

| UGG (Deckers Outdoor Corporation) | 10-14% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Columbia Sportswear | Offers high-performance insulated and waterproof snow boots designed for extreme winter conditions. The company integrates Omni-Heat reflective technology for superior warmth. |

| The North Face | Specializes in durable, weather-resistant snow boots with lightweight insulation and advanced traction soles, targeting outdoor adventurers and casual wearers. |

| Sorel | A leading brand in stylish yet highly functional snow boots, blending fashion-forward designs with heavy-duty insulation and waterproofing for both urban and outdoor use. |

| UGG | Known for its blend of comfort and style, UGG’s snow boots combine plush sheepskin lining with water-resistant materials, appealing to both luxury and casual winter wear consumers. |

Strategic Outlook of Key Companies

Other Key Players (35-45% Combined)

Insulated Snow Boots, Waterproof Snow Boots, Slip-Resistant Snow Boots, Lightweight Snow Boots, and Others.

Leather, Rubber, Synthetic, Wool-Lined, and Others.

Supermarkets/Hypermarkets, Specialty Stores, Online, Departmental Stores, and Others.

Men, Women, and Kids.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Snow Boots industry is projected to witness a CAGR of 4.7% between 2025 and 2035.

The Snow Boots industry stood at USD 2.6 billion in 2024.

The Snow Boots industry is anticipated to reach USD 4.2 billion by 2035 end.

Waterproof and insulated snow boots are set to record the highest CAGR of 6.5%, driven by rising demand for durable winter footwear.

The key players operating in the Snow Boots industry include Columbia, The North Face, Sorel, UGG, Merrell, and Salomon.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 30: Europe Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 33: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 34: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 35: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 36: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 37: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 38: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 39: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 40: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 41: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: Japan Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 46: Japan Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 47: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 48: Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 49: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 50: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 52: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Demographic, 2017 to 2033

Table 54: Middle East and Africa Market Volume (Units) Forecast by Demographic, 2017 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 56: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 14: Global Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Demographic, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 38: North America Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Demographic, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Demographic, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Demographic, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Asia Pacific Excluding Japan Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 99: Asia Pacific Excluding Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 102: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 103: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 106: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 107: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 110: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 111: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 112: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 113: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 114: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 115: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Asia Pacific Excluding Japan Market Attractiveness by Demographic, 2023 to 2033

Figure 119: Asia Pacific Excluding Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 121: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Japan Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 123: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 126: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 127: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 130: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 131: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: Japan Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 134: Japan Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 137: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 138: Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 139: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 142: Japan Market Attractiveness by Demographic, 2023 to 2033

Figure 143: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Japan Market Attractiveness by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Middle East and Africa Market Value (US$ Million) by Demographic, 2023 to 2033

Figure 147: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 150: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 151: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 154: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: Middle East and Africa Market Value (US$ Million) Analysis by Demographic, 2017 to 2033

Figure 158: Middle East and Africa Market Volume (Units) Analysis by Demographic, 2017 to 2033

Figure 159: Middle East and Africa Market Value Share (%) and BPS Analysis by Demographic, 2023 to 2033

Figure 160: Middle East and Africa Market Y-o-Y Growth (%) Projections by Demographic, 2023 to 2033

Figure 161: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 162: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 163: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 166: Middle East and Africa Market Attractiveness by Demographic, 2023 to 2033

Figure 167: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Snow Boots For Women Market Size and Share Forecast Outlook 2025 to 2035

Snowplow Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Snow Cone and Commercial Shaved Ice Machines Market - Ice-Cold Refreshments 2025 to 2035

Snowmobile Trailer Axle Market

Snow Tyre Market

Snow Pushers Market

Electric Snowmobile Market Size and Share Forecast Outlook 2025 to 2035

Mountain and Snow Tourism Market Analysis – Trends, Growth & Forecast 2025 to 2035

Rain Boots Market Trends - Growth & Industry Forecast 2025 to 2035

Duck Boots Market Trends - Growth & Industry Outlook 2025 to 2035

Industry Share & Competitive Positioning in Work Boots Market

Wedge Boots Market Growth - Trends & Demand Forecast to 2025 to 2035

Ankle Boots Market Trends - Size, Growth & Forecast 2025 to 2035

Riding Boots Market Analysis - Growth, Demand & Forecast 2025 to 2035

Desert Boots Market Growth - Trends & Demand Forecast 2025 to 2035

Cowboy Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Combat Boots Market Analysis – Growth, Demand & Forecast 2025 to 2035

Sneaker Boots Market Insights - Size & Forecast 2025 to 2035

Lace Up Boots Market Trends – Growth & Demand Forecast 2025 to 2035

Hunting Boots Market Growth – Trends & Demand Forecast to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA