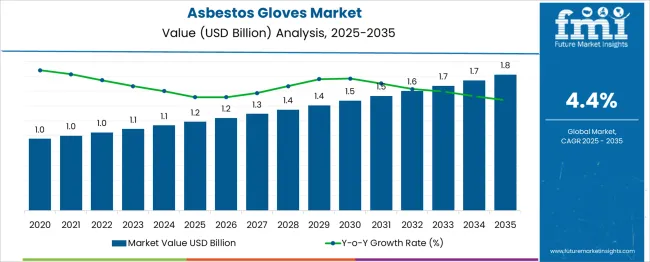

The Asbestos Gloves Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period. Analyzing the year-wise progression from USD 1.0 billion to 1.8 billion suggests a steady, linear growth pattern with minimal volatility, indicating the absence of strong seasonality or cyclicality. Early years (2025–2028) exhibit incremental gains of USD 0.1 billion every two years, a trend sustained through mid-phase, where values increase from USD 1.3 billion in 2030 to 1.5 billion by 2032. No sharp dips or spikes are observed, signaling that demand is primarily regulated by industrial safety compliance rather than discretionary factors or seasonal demand shifts.

The market’s dependency on heavy industries such as foundries, steel plants, and high-temperature manufacturing creates a continuous consumption base. Regulatory restrictions on asbestos-based PPE introduce gradual substitution trends rather than abrupt cyclic shifts. Incremental additions average USD 0.05 billion annually with no irregular amplitude, reinforcing that growth is structural, compliance-driven, and linked to replacement cycles rather than cyclical expansions. This consistency positions the market as a low-volatility segment with predictable procurement patterns and limited exposure to macroeconomic fluctuations.

| Metric | Value |

|---|---|

| Asbestos Gloves Market Estimated Value in (2025 E) | USD 1.2 billion |

| Asbestos Gloves Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The asbestos gloves market occupies a small yet historically significant niche across protective equipment sectors. In the heat‑resistant hand protection market, they claimed 8–10% share, offering thermal shielding in molten metal, foundry, and glass‑making environments before regulatory bans emerged. Within the broader industrial safety gloves market, asbestos gloves currently comprise merely 1–2%, as safer, performance-focused solutions have largely replaced them. Their relevance in cut‑resistant or puncture‑resistant segments is minimal—around 0.5–1%, given the superior properties of advanced synthetic and metal-reinforced gloves. In the all-encompassing occupational safety equipment market, they make up under 1%, classified among aging PPE categories.

Even in the high‑temperature workwear & PPE domain, residual usage is limited to about 3–4%, mostly in legacy operations or regions where bans are still in process. With global phase-outs and stricter regulations, asbestos gloves are in steep decline; however, their historical role in extreme-heat protection secures a small residual market share in very specific industrial environments.

The asbestos gloves market is witnessing consistent demand due to their continued utility in high-heat industrial applications and controlled environments, despite growing regulatory scrutiny. Industries such as construction, welding, and metallurgy continue to rely on asbestos-based protective gear due to its superior resistance to heat, flame, and abrasives.

While stringent health and environmental regulations have reduced broader asbestos usage, niche demand persists in regions where alternatives remain cost-prohibitive or less effective under extreme temperatures. Legacy industrial practices and limited substitution in high-risk sectors also support the market.

With ongoing maintenance of aging infrastructure and industrial plants, short-term demand is expected to remain stable. However, future growth is likely to be shaped by increasing product innovation aimed at replicating asbestos properties with safer materials, and by greater compliance-driven product segmentation in regulated markets.

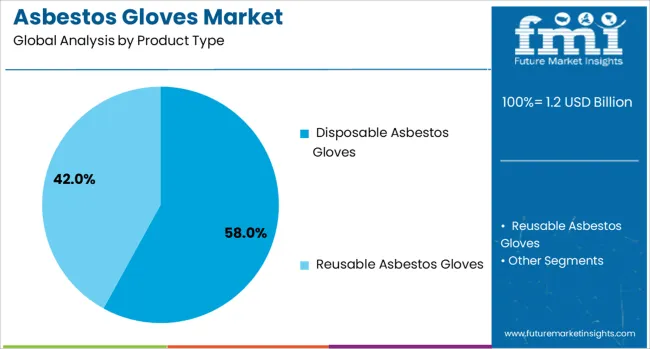

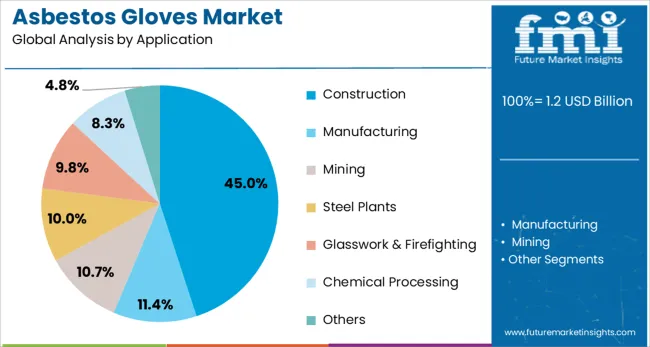

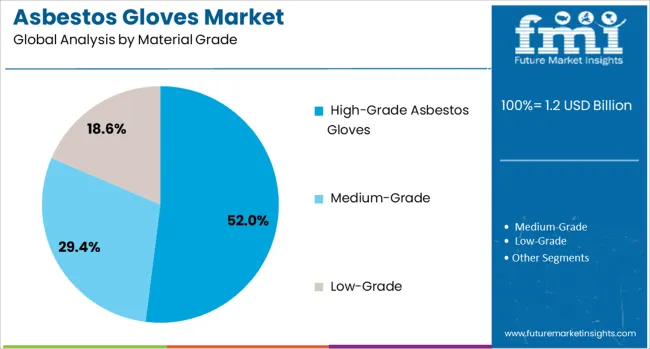

The asbestos gloves market is segmented by product type, application, material grade, finger configuration, and distribution channel and geographic regions. By product type of the asbestos gloves market is divided into Disposable Asbestos Gloves and Reusable Asbestos Gloves. In terms of application of the asbestos gloves market is classified into Construction, Manufacturing, Mining, Steel Plants, Glasswork & Firefighting, Chemical Processing, and Others. Based on material grade of the asbestos gloves market is segmented into High-Grade Asbestos Gloves, Medium-Grade, and Low-Grade. By finger configuration of the asbestos gloves market is segmented into Five-Finger Gloves and Two-Finger Gloves. By distribution channel of the asbestos gloves market is segmented into Direct Sales, Wholesale Distributors, Specialized Dealers, and Online Retailers. Regionally, the asbestos gloves industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Disposable asbestos gloves are projected to account for 58.0% of the total market revenue in 2025, establishing them as the leading product type. This dominance is attributed to their cost-effectiveness, wide availability, and frequent usage in short-term or single-use industrial tasks.

These gloves are often favored in sectors such as maintenance, small-scale thermal applications, and temporary repair work where high-heat resistance is needed but long-term durability is not essential. Their disposability reduces contamination risk, especially in hazardous material handling, further supporting demand in regulated workplaces.

Additionally, employers continue to adopt disposable models to comply with safety protocols while minimizing laundering and decontamination costs.

Construction is expected to hold 45.0% of the application share in 2025, making it the top contributor to asbestos glove demand. This is primarily due to ongoing reliance on heat- and abrasion-resistant gloves in demolition, insulation removal, and fireproofing operations.

Workers in construction zones are frequently exposed to high temperatures and hazardous particulates, where asbestos gloves provide reliable protection. Despite rising awareness of health risks, usage continues in regions with legacy infrastructure or limited regulatory enforcement.

The nature of construction work, with its exposure to open flame, hot surfaces, and abrasive materials, sustains high glove turnover and supports recurring demand.

High-grade asbestos gloves are anticipated to command 52.0% of the revenue share in 2025, making them the leading material grade segment. These gloves are engineered for maximum thermal insulation and mechanical durability, often required in foundries, heavy manufacturing, and emergency response settings.

Their ability to withstand prolonged exposure to temperatures exceeding 500°C without structural degradation has made them indispensable in legacy systems still reliant on heat-intensive processes. Enhanced glove thickness, reinforced stitching, and layered composites contribute to their premium positioning.

Continued demand from niche, critical applications has helped this segment maintain its leadership despite increasing health and environmental scrutiny.

Asbestos gloves are industrial protective gloves designed to provide thermal insulation and resistance to high temperatures, commonly used in foundries, welding, and glass manufacturing. These gloves offer protection against heat exposure and abrasions, making them essential in heavy-duty operations. Market growth has historically been supported by industries requiring extreme heat resistance. However, declining acceptance due to health hazards has shifted demand toward alternatives. Manufacturers are focusing on providing compliance-certified products for specialized applications while exploring asbestos-free materials that deliver comparable thermal performance without compromising safety standards.

Adoption of asbestos gloves has been driven by their ability to withstand temperatures exceeding conventional protective gear limits. Industries such as metal fabrication, foundries, and glass processing have relied on these gloves for handling molten metals and operating high-temperature equipment. Their durability, combined with protection against cuts and abrasions, has reinforced preference for heavy-duty applications. Market presence has also been supported by long-standing use in sectors with minimal exposure to public health regulations. High demand from niche markets requiring superior thermal protection continues to sustain limited adoption, particularly in regions with fewer restrictions on asbestos-based products.

Market growth has been severely constrained by global regulations prohibiting or restricting asbestos due to its association with respiratory diseases, including asbestosis and mesothelioma. Strict occupational safety standards in developed economies have led to bans on asbestos gloves, significantly reducing their commercial availability. Compliance requirements for labeling, handling, and disposal have increased operational complexities for manufacturers and users. Awareness campaigns highlighting health risks have further discouraged adoption in industrial environments. The availability of safer alternatives with equivalent thermal resistance has accelerated the decline of asbestos-based protective gear, limiting its relevance in mainstream markets.

Significant opportunities exist in transitioning toward asbestos-free thermal gloves using advanced fibers such as Kevlar, Nomex, and carbon-based composites. Manufacturers investing in high-performance substitutes can target sectors such as welding, foundries, and power generation where thermal resistance remains critical. Development of multi-layered gloves combining thermal insulation with ergonomic flexibility can create competitive advantages. Partnerships with industrial safety certification bodies for compliance-driven products will strengthen market positioning. Demand from emerging markets with ongoing industrialization provides limited opportunities, although replacement of legacy asbestos products with modern alternatives presents a long-term growth path for safety equipment manufacturers.

Recent trends emphasize complete replacement of asbestos gloves with non-hazardous thermal protection solutions across major industries. Advanced manufacturing techniques for heat-resistant gloves using synthetic and natural fibers are gaining traction. Increased focus on compliance with global occupational safety regulations is influencing procurement strategies, favoring certified non-asbestos products. Digital platforms for safety training and product selection are being adopted by industrial users to reduce risks. Growth in automation and robotics for high-temperature environments is reducing manual handling, indirectly limiting the need for asbestos-based gloves. Continuous innovation in heat-resistant materials is shaping the evolution of industrial protective gear.

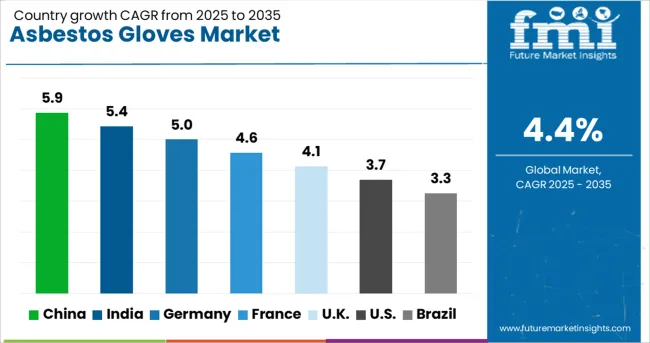

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.4% |

| Germany | 5.0% |

| France | 4.6% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.3% |

The asbestos gloves market is projected to grow at a CAGR of 4.4% from 2025 to 2035. Among the top five markets, China leads at 5.9%, followed by India at 5.4%, while Germany posts 5.0%, the United Kingdom records 4.1%, and the United States stands at 3.7%. These figures represent a premium of +34% for China and +23% for India over the global average, while Germany stays slightly ahead at +14%, and the UK and US lag behind by –7% and –16%, respectively. Stronger growth in BRICS economies reflects expanding heavy industry and metal fabrication sectors, whereas OECD countries show steady demand, primarily driven by safety compliance in legacy industrial operations and high-temperature handling applications. The analysis spans over 40 countries, with the leading markets detailed below.

China is projected to grow at a CAGR of 5.9% through 2035, supported by robust industrialization and rising investments in high-temperature manufacturing processes. The country’s extensive metal fabrication, foundry operations, and shipbuilding sectors are primary users of asbestos gloves for heat protection. Local manufacturers are increasing production capacity to meet domestic demand while focusing on improving durability and compliance with international safety norms. Despite the rising shift toward asbestos alternatives, demand for asbestos gloves remains steady in heavy-duty applications where extreme heat resistance is required. Partnerships between manufacturers and industrial contractors are strengthening supply chains for bulk procurement.

India is forecasted to achieve a CAGR of 5.4% through 2035, driven by rapid expansion in construction, welding, and industrial fabrication sectors. High-temperature handling applications in steel plants, glass manufacturing, and ship repair yards sustain strong demand for asbestos gloves. Domestic producers cater to cost-sensitive markets, while international brands target premium segments with higher safety standards and ergonomic designs. Despite increasing awareness of asbestos-related health concerns, usage persists in sectors requiring durable thermal protection, particularly for furnace operations and heavy-duty welding tasks. Ongoing initiatives to improve workplace safety standards will influence gradual adoption of safer alternatives while supporting steady near-term demand.

Germany is expected to grow at a CAGR of 5.0% through 2035, supported by its advanced manufacturing sector and strict adherence to workplace safety protocols. Demand for asbestos gloves remains in specific industrial processes involving high heat, including automotive component production and specialized metal casting. German suppliers emphasize compliance with EU health regulations, driving development of hybrid gloves incorporating asbestos for heat resistance alongside safer material layers for worker protection. Industrial operators are increasingly shifting toward controlled use environments, limiting exposure risks while retaining performance benefits in critical applications.

The United Kingdom is projected to post a CAGR of 4.1% through 2035, reflecting moderate growth primarily in legacy industrial operations and high-heat maintenance work. Demand persists in sectors like ship repair, power generation, and furnace maintenance, where asbestos gloves deliver proven thermal protection. British distributors are focusing on importing compliant products with reinforced designs to minimize fiber release during prolonged usage. Increased investments in safety training and stricter compliance audits are pushing industrial users to upgrade glove quality standards. The gradual transition to asbestos-free heat-resistant gloves, however, is expected to influence market share distribution in the coming decade.

The United States is projected to grow at a CAGR of 3.7% through 2035, with demand concentrated in specialized sectors such as foundries, glass manufacturing, and heavy equipment maintenance. Strict regulatory frameworks by OSHA and NIOSH have significantly reduced asbestos usage in mainstream industries; however, limited applications persist in environments requiring exceptional thermal protection. USA suppliers are prioritizing advanced designs that combine asbestos insulation with external layers to enhance safety and minimize direct contact risks. Growing interest in asbestos substitutes, such as ceramic and Kevlar-based gloves, will gradually shift the competitive landscape while ensuring continuity in heat-resistant glove applications.

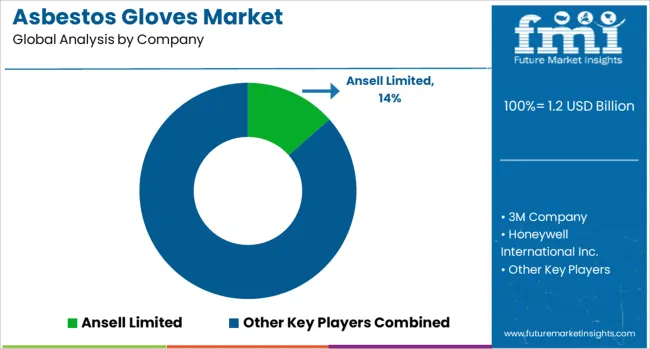

The asbestos gloves market is dominated by global PPE manufacturers and regional safety equipment providers catering to industrial applications requiring extreme heat resistance, such as foundries, welding, and metal processing. Ansell Limited, Honeywell International Inc., and 3M Company lead the segment with comprehensive portfolios of industrial safety gloves, including asbestos-based and asbestos-alternative high-heat protective products. Kimberly-Clark Corporation and Lakeland Industries, Inc. provide specialized gloves for thermal protection and hazardous environments, ensuring compliance with OSHA and international safety standards. DuPont de Nemours, Inc. emphasizes advanced material alternatives such as Kevlar and Nomex, offering high-performance gloves that replace traditional asbestos-based products in regulated markets.

Top Glove Corporation and Showa Group focus on industrial hand protection, targeting Asia-Pacific regions where asbestos use persists in certain high-heat sectors. Unarco supplies asbestos gloves primarily to legacy markets and specialized applications requiring extreme thermal durability. Competitive differentiation centers on compliance with heat resistance standards, durability, comfort, and transition to non-asbestos alternatives due to growing regulatory restrictions. Barriers to entry include stringent health and safety regulations, rising litigation risks associated with asbestos, and high certification costs for thermal PPE. Strategic priorities involve phasing out asbestos-containing products, innovating eco-friendly thermal protection materials, and expanding global supply chains for high-heat protective gloves in industrial markets.

Core initiatives within the asbestos gloves market center on diversifying product portfolios to serve high-temperature industrial environments, including foundries, welding operations, and glass processing. Producers are concentrating on adding advanced lining materials that enhance comfort and durability while retaining thermal and abrasion resistance. Collaborations with distributors and safety equipment providers are being strengthened to broaden distribution networks.

Adherence to occupational safety norms and offering certified products remain essential to ensure buyer confidence. Additionally, manufacturers are directing efforts toward emerging regions by establishing localized production facilities and competitive pricing strategies to address the growing requirement for heat protection in heavy industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Product Type | Disposable Asbestos Gloves and Reusable Asbestos Gloves |

| Application | Construction, Manufacturing, Mining, Steel Plants, Glasswork & Firefighting, Chemical Processing, and Others |

| Material Grade | High-Grade Asbestos Gloves, Medium-Grade, and Low-Grade |

| Finger Configuration | Five-Finger Gloves and Two-Finger Gloves |

| Distribution Channel | Direct Sales, Wholesale Distributors, Specialized Dealers, and Online Retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ansell Limited, 3M Company, Honeywell International Inc., Kimberly‑Clark Corporation, Lakeland Industries, Inc., DuPont de Nemours, Inc., Top Glove Corporation, Showa Group, and Unarco |

| Additional Attributes | Dollar sales by product type (asbestos gloves, asbestos-alternative thermal gloves) and end-use segments (metalworking, glass manufacturing, foundries, welding). Demand dynamics are influenced by regulatory compliance, ongoing asbestos bans in developed economies, and demand for substitutes in high-heat applications. Regional trends show declining asbestos glove usage in North America and Europe due to health regulations, while Asia-Pacific continues to drive demand for low-cost asbestos-based PPE in select industries. Innovation trends include development of multi-layer composite gloves, ceramic fiber-based materials, and high-performance aramid fibers as safe alternatives to asbestos. |

The global asbestos gloves market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the asbestos gloves market is projected to reach USD 1.8 billion by 2035.

The asbestos gloves market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in asbestos gloves market are disposable asbestos gloves and reusable asbestos gloves.

In terms of application , construction segment to command 45.0% share in the asbestos gloves market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA