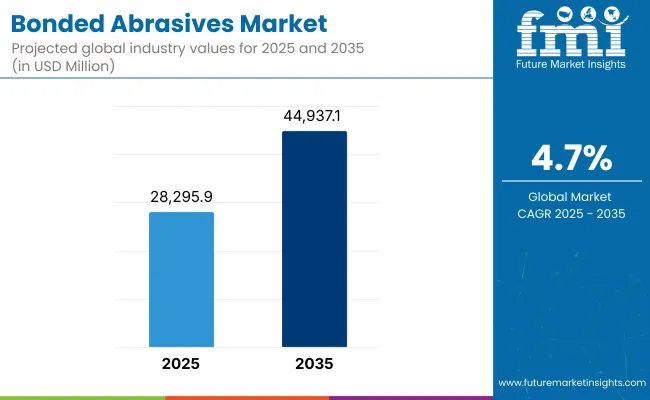

The global bonded abrasives market is projected to expand from USD 28,295.9 million in 2025 to USD 44,937.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.7% during the forecast period. Growth is expected to be supported by continued demand from automotive manufacturing, general metalworking, construction, and precision engineering.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 28,295.9 million |

| Projected Size (2035) | USD 44,937.1 million |

| Value-based CAGR (2025 to 2035) | 4.7% |

Bonded abrasives are used in grinding, cutting, and finishing operations where material removal, surface preparation, or edge profiling is required. These tools are composed of abrasive grains held together by a bonding agent and are applied across processes that demand consistency and high dimensional accuracy. Industries such as aerospace, foundry, and toolmaking rely on bonded abrasives for manufacturing and refurbishing components under tight tolerances.

Grinding wheels and discs continue to be the most utilized bonded abrasive products, favored for their adaptability in both automated and manual operations. These are deployed in tasks such as gear finishing, valve seat machining, weld blending, and die preparation. The automotive industry uses bonded abrasives for deburring engine parts and honing transmission components, while construction applications include concrete cutting and masonry surface leveling.

Technological improvements in abrasive composition are enhancing product life, heat resistance, and material compatibility. Resin bonds, vitrified bonds, and rubber bonds are being engineered to match specific performance parameters. For example, hybrid bond structures combining metal and resin matrices are used to improve wheel stability and cutting efficiency in CNC grinding systems. Manufacturers are also focusing on reduced vibration and increased porosity to aid coolant flow and chip evacuation during high-speed operations.

Environmental, Health, and Safety (EHS) standards are influencing product innovation. Low-dust formulations and bonded abrasives with reduced volatile organic compounds (VOCs) are being adopted to improve workplace safety. Several global manufacturers are pursuing ISO 14001 certifications and investing in eco-conscious manufacturing processes.

Global demand is being influenced by increased automation in fabrication and the need for advanced materials processing, particularly in electric vehicle components and high-strength alloys. As machining complexity rises, bonded abrasives are playing a critical role in ensuring quality, repeatability, and operational efficiency across precision-driven industries.

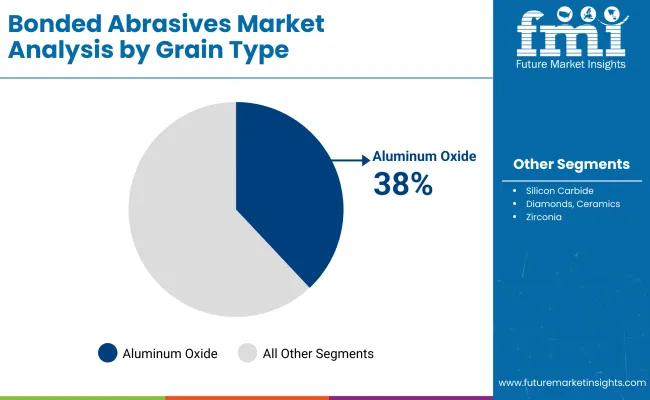

Aluminum oxide is projected to hold approximately 38% of the global bonded abrasive market share in 2025 and is expected to grow at a CAGR of 4.6% through 2035. It is widely used in grinding wheels, sharpening stones, and cutting discs across industries that process ferrous metals. Known for its hardness and long service life, aluminum oxide is preferred in both rough and precision grinding operations.

The grain type is extensively used in the fabrication of components for automotive parts, tools, and industrial machinery. Manufacturers are enhancing performance by incorporating heat-treated and friable variations to improve cutting efficiency and reduce thermal damage on workpieces.

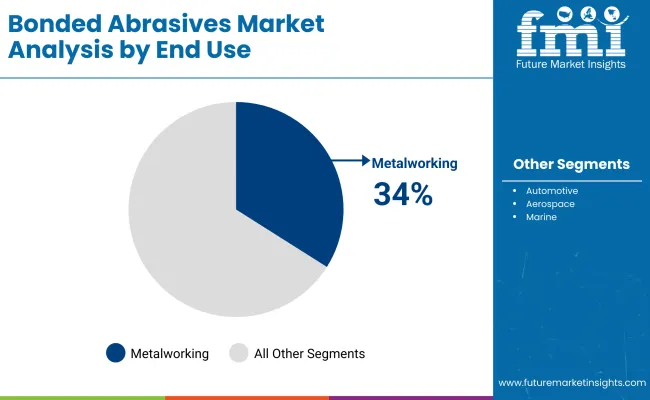

The metalworking segment is estimated to account for approximately 34% of the global bonded abrasive market share in 2025 and is expected to grow at a CAGR of 4.8% through 2035. Bonded abrasives are used for grinding, deburring, polishing, and shaping metal components in manufacturing, welding, and heavy fabrication industries.

Demand is particularly strong in Asia-Pacific, driven by ongoing industrial expansion, increasing investment in capital goods, and infrastructure development. As end users seek to improve productivity and surface quality while minimizing tool wear, the adoption of advanced bonded abrasives continues to rise. The metalworking sector remains a primary consumer of abrasives, especially in operations requiring high material removal rates and dimensional accuracy.

The annual growth rates of the bonded abrasives market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 3.6% in the first half (H1) of 2024. However, in the second half (H2), there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 3.6% |

| H2(2024 to 2034) | 3.8% |

| H1(2025 to 2035) | 3.9% |

| H2(2025 to 2035) | 4.1% |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 3.9% in the first half and grow to 4.1% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 20 BPS each.

Need for bonded abrasives in the modern era

Modern civilization would not be possible without bonded abrasive products. Bonded abrasive products have a three-dimensional structure consisting of abrasive particles, a bonding agent, and porosity. Each of these three elements may be varied in amount in a precisely controlled fashion to alter the behavioral characteristics of the abrasive article in predictable ways.

Bonded abrasive articles may take the form of sticks, wheels, wheel segments, and variously shaped cylinders, cones, balls, etc., to which are affixed metal rods for insertion into chucking devices of power tools. A bonded abrasive article, being three-dimensional in concept, operates sacrificially during use, with retention of sharpness until all the usable portion has been worn away. In contrast, a coated abrasive product must be discarded when its single abrasive layer loses its sharpness.

Several technological developments is also playing pivotal role in the development of bonded abrasives industry. Bonded abrasives are well suited for diverse grinding applications including ball grinding & lapping, crankshaft & camshaft grinding, gear grinding, centerless grinding, and others. All these factors are in demand across several industries, thus amplifying the demand for bonded abrasives.

Technological advancement associated with production of bonded abrasives

Growth in industries such as automotive, aerospace, marine, and construction have demanded for advanced bonded abrasives. Key players in the bonded abrasive are adopting advanced production technologies to improve the grinding efficiency. For instance, Norton Quantum uses a new generation of alumina grain chemistry and shape developed from the Norton’s patented Seeded-Gel Technology. With innovative organic and vitrified bonds specially developed to enhance grain performance, Norton Quantum Wheels provide the fastest and finest grinding in the industry.

This revolutionary ceramic grain multiplies the cutting efficiency by controlling the grain breakdown at the micrometric level. Norton Quantum is a versatile technology that is ideal for low, medium and high force applications on materials ranging from cast iron to stainless steel as well as hard to grind inconel and titanium. These advanced bonded abrasives are gaining importance across niche applications such as steel roller grinding, micro-sized automotive part grinding, and bearing internal & race grinding.

Ceramic based bonded abrasives offers high length-width ratio compared to other abrasives, thus making it suitable for precision grinding application across diverse industrial sectors. Ceramic based bonded abrasives are also proven to offer sharper cutting edge and better metal removal capability making it ideal for high-efficiency and high-precision grinding applications.

Metal removal rate is crucial as high metal removal rate dramatically reduces the cycle time. For instance, bonded abrasives offered by Saint-Gobain are capable of reducing the cycle times by 50%. These bonded abrasives also offer longer wheel life thus minimizing the cost of frequent changes.

High demand for bonded abrasives in aerospace industry

For aerospace manufacturers, there is constant pressure to innovate, building safer, and more efficient aircraft. World demand for commercial aircraft is at record levels. Industry trends call for more complex, high-cost parts. Processing these parts and materials is costly. Bonded abrasive products are used to improve the quality of aircraft finished parts, minimize abrasive costs, and reduce production time. Bonded abrasives are gaining popularity in the aerospace industry for blending and polishing operations.

Aerospace industry relies on bonded abrasives as aerospace parts such as aircraft engine, turbine blades, and other heat-sensitive parts require blending and polishing. Light grinding and polishing applications are usually carried with use of bonded abrasives and several advancements have been made in the bonded abrasives for aerospace applications.

For example, Ni-Cr Steels and Titanium based bonded abrasives offered by Marrose Abrasives offer low vibration at the hand/arm of the operator, are easy to use giving controlled metal removal and low risk of damage to the turbine blade. Surface finished is improved with a higher bearing area compared to conventional grinding with vitrified or CBN tools, helping to reduce induced grinding stresses prior to subsequent surface treatments such as blasting or plating.

Removing casting gates and cutting stock to length is still a manual practice for many aerospace parts manufacturers. However, advancements in the abrasives industry particularly bonded abrasives has reduced the manual practice. While grinding is already the standard best practice for surface finishing, however advancement in surface finishing abrasive are making high MRR achievable to manufacture precise profiles of high nickel alloy, titanium aluminide, and ceramic parts at tighter tolerances, reduced cycle times, and increased throughputs compared to machining.

Aerospace metal and composite parts are highly susceptible major mismatch, edge break, and deburr. These usually arise during finishing and grinding process. Adoption of ceramic based bonded abrasives are proven to minimize these risk and provide smoot aerospace parts. All these factors are collectively driving the demand for bonded abrasives globally.

Recent development of abrasive machining processes enhanced with non-newtonian fluids

Abrasive machining processes have long been integral to various manufacturing industries, enabling precise material removal and surface finishing. In recent years, the integration of non-Newtonian fluids has emerged as a promising strategy to enhance the performance and efficiency of these processes.

With the continuous development of aerospace and other fields, the processing of high-performance components has become a focus of scholarly research, with both traditional and non-traditional machining methods playing increasingly important roles. Abrasive machining processes, as one of the non-traditional methods, have long been integral to precision manufacturing techniques, including lapping and polishing, playing a crucial role in achieving high-quality surfaces.

Typically, these methods utilize abrasive particles suspended in a carrier medium to meticulously remove material from a workpiece. Despite their effectiveness, traditional abrasive machining approaches encounter challenges when striving for specific surface characteristics, particularly in intricate contours, narrow spaces, and inaccessible regions.

These limitations arise due to the inherent nature of abrasive machining, where achieving uniform material removal across diverse workpiece geometries proves challenging. As manufacturing demands evolve towards greater intricacy and miniaturization, there is an increasing need for innovative solutions that can address these challenges and enhance the capabilities of abrasive machining processes.

The integration of non-Newtonian fluids into abrasive machining processes represents a significant advancement in addressing the challenges inherent in traditional methods. Unlike Newtonian fluids, which follow linear viscosity patterns, non-Newtonian fluids exhibit diverse rheological behaviors such as viscoelasticity and thixotropy.

These unique characteristics enable them to respond dynamically to shear forces, adapting their viscosity accordingly. As a result, non-Newtonian fluids can efficiently carry and distribute abrasive particles during machining operations. This dynamic behavior enhances the fluid’s ability to penetrate intricate geometries, reach challenging areas, and optimize material removal rates.

Sustainability issue associated with use of bonded abrasives is expected to hamper the growth

The use of bonded abrasives poses sustainability challenges, primarily due to the environmental impact of their production and disposal. These abrasives often consist of synthetic materials such as resins, ceramics, and adhesives, which can release harmful substances during manufacturing.

The energy-intensive production processes contribute significantly to carbon emissions, making it difficult for manufacturers to meet increasingly stringent environmental regulations. Additionally, the extraction and processing of raw materials, such as aluminum oxide and silicon carbide, can have adverse environmental consequences, including resource depletion and habitat destruction.

The disposal of used bonded abrasives adds to sustainability concerns. Most abrasives are not biodegradable, and improper disposal can lead to landfill accumulation. Residual materials, such as metal dust and synthetic resins, may pose risks of soil and water contamination.

While recycling options exist, they remain limited due to the complex composition of bonded abrasives, making the separation and reuse of materials challenging. These sustainability challenges have driven demand for eco-friendly alternatives, pushing manufacturers to develop abrasives with recyclable materials or reduced environmental footprints. However, the transition to sustainable solutions often comes with increased costs, potentially impacting market growth and adoption rates.

Tier 1 companies comprise players with a revenue of above USD 1,000 million capturing a significant share of 40-45% in the global market. These players are characterized by high production capacity and a wide product portfolio. These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple bonded abrasives applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Saint-Gobain, 3M, Carborundum Universal Limited, and other players.

Tier 2 companies include mid-size players with revenue of below USD 1,000 million having a presence in specific regions and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include United Abrasives, Empire Abrasives, Karbosan, SurfacePrep, and other player.

The section below covers the industry analysis for bonded abrasives demand in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided.

China will hold 68.9% in East Asia due to easy access to critical raw materials such as aluminum oxide, silicon carbide, and zirconia, which are essential for manufacturing bonded abrasives. The USA will capture 80.1% in North America. The USA boasts a robust industrial sector, including automotive, aerospace, defense, and heavy machinery manufacturing. These industries require bonded abrasives for applications such as grinding, cutting, and polishing, driving significant demand within the country.

Germany will lead Western Europe with 31.6%. German industries are renowned for adopting advanced manufacturing technologies and automation. This drives the demand for high-quality and precision-engineered bonded abrasives, which are integral to achieving exacting manufacturing standards.

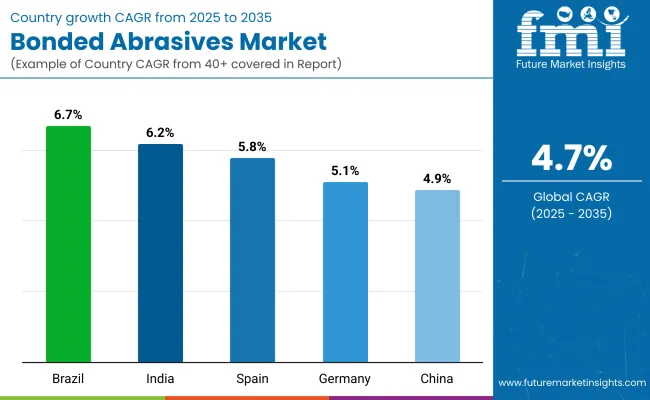

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Spain | 5.8% |

| India | 6.2% |

| Brazil | 6.7% |

| Germany | 5.1% |

| China | 4.9% |

The sale of bonded abrasives in China is projected to reach USD 7,926.2 million and is estimated to grow at an 4.9% CAGR by 2035.

China's position as a global manufacturing hub is unparalleled, making it a cornerstone for the bonded abrasives market. The country boasts the largest network of factories and industrial production facilities, producing everything from consumer goods to heavy machinery.

This extensive manufacturing base fuels a continuous demand for bonded abrasives, which are integral in processes like cutting, grinding, polishing, and shaping materials. Whether in the production of precision components or large-scale industrial equipment, bonded abrasives play a critical role in ensuring quality and efficiency.

The sales of bonded abrasives in the USA are projected to reach USD 7,234.9 million by 2035.

In recent years, USA companies in the bonded abrasives industry have placed a strong emphasis on sustainability, driven by both regulatory requirements and growing consumer demand for environmentally friendly products. As environmental concerns rise globally, there has been a shift toward adopting green manufacturing practices, such as reducing energy consumption, minimizing waste, and using eco-friendly raw materials in the production of bonded abrasives. This commitment to sustainability not only helps meet stricter environmental regulations but also resonates with consumers who increasingly prioritize sustainable practices in the products they use.

The sale of bonded abrasives in Germany is projected to reach USD 2,215.2 million and grow at a CAGR of 5.1% by 2035.

Germany’s commitment to innovation and quality in manufacturing has positioned the country as a leader in these sectors. The country’s automotive giants, aerospace firms, and precision engineering companies demand high-performance bonded abrasives that ensure the accuracy and durability of parts and components. This continuous demand for quality abrasives drives the growth of the bonded abrasives market in Germany, making it a dominant player in the European region. The synergy between Germany’s industrial capabilities and the performance of bonded abrasives is a key factor in the country’s leadership in the market.

The bonded abrasives market is evolving with key players focusing on advanced technologies to meet the precision demands of industries like automotive, aerospace, and manufacturing. Innovations such as gear grinding abrasives, offering superior form holding and reduced burn risk, are positioning companies to deliver high-quality solutions.

Additionally, expedited delivery services for custom-engineered grinding wheels are addressing the growing need for faster lead times, improving customer satisfaction. The development of high-performance materials, such as alumina-based grains, is also helping companies enhance cutting performance, thermal stability, and durability, ensuring they stay competitive in an increasingly demanding market.

The Product Type segment is further categorized into Cone Bonded Abrasives, Mounted Point Bonded Abrasives, Chop Saw Blade Bonded Abrasives, Grinding Disc Bonded Abrasives, and Others.

The Grain Type segment is classified into cBN, Silicon Carbide, Diamonds, Ceramics, Aluminum Oxide, Zirconia, and Combination Grains.

The End Use segment is classified into Automotive, Metal Working, Aerospace, Marine, Construction, and Other Industries.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The global bonded abrasives market for aluminum oxide grain type was valued at USD 28,295.9 million in 2025.

The demand for bonded abrasives industry is set to reach USD 44,937.1 million in 2035.

Bonded abrasives are extensively used in precision grinding applications, especially in industries such as automotive, aerospace, and heavy machinery, where high-quality finishes are required for components.

The bonded abrasives demand was valued at USD 23,657.1 million in 2020 and is projected to reach USD 44,937.1 million by 2035 growing at CAGR of 4.7% in the forecast period.

Automotive end use is expected to lead during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bonded Magnet Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Bonded Leather Companies

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Synthetic Abrasives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA