The bonded magnet market is expanding steadily, supported by rising demand for lightweight, high-performance magnetic materials in automotive, electronics, and industrial equipment applications. Bonded magnets offer advantages such as design flexibility, high dimensional accuracy, and cost-effective mass production compared to sintered alternatives.

Increasing electrification in vehicles and the proliferation of compact electronic devices have amplified the need for efficient magnetic components. The market benefits from the shift toward hybrid magnet compositions and advanced polymer bonding technologies that enhance magnetic strength and temperature stability.

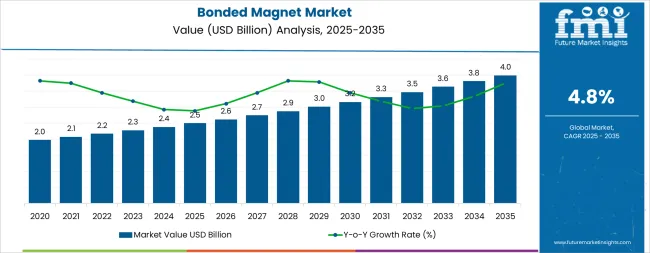

| Metric | Value |

|---|---|

| Bonded Magnet Market Estimated Value in (2025 E) | USD 2.5 billion |

| Bonded Magnet Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

Ongoing investment in automation and robotics further stimulates demand for precision magnetic components. With environmental regulations promoting efficient material utilization and reduced waste, the bonded magnet market is expected to witness sustained growth across diverse end-use sectors.

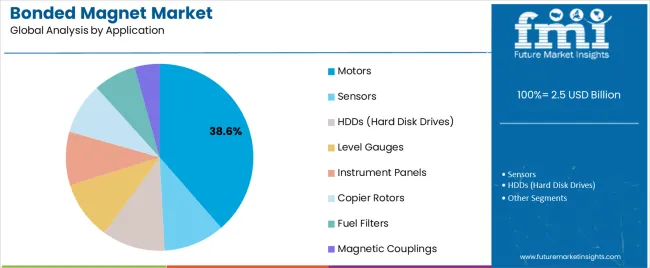

The market is segmented by Type, Process, Application, and End Use and region. By Type, the market is divided into Ferrite Magnets, Rare Earth Magnets, NdFeB, SmCo, and Others (Alnico, SmFeN, Hybrids). In terms of Process, the market is classified into Calendaring Bonded Magnets, Injection Molded Bonded Magnets, Compression Bonded Magnets, and Extrusion Bonded Magnets. Based on Application, the market is segmented into Motors, Sensors, HDDs (Hard Disk Drives), Level Gauges, Instrument Panels, Copier Rotors, Fuel Filters, and Magnetic Couplings. By End Use, the market is divided into Automotive, HVAC Equipment, Medical Devices, Cameras, Consumer Electronic Appliances, Computers And Magnetic Storage Devices, Electrical Equipment, Measurement Instruments, and Printers And Copiers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

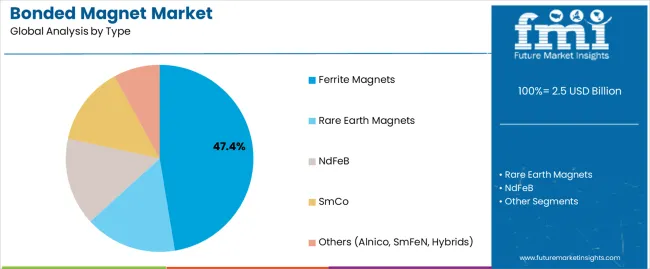

The ferrite magnets segment dominates the type category, holding approximately 47.4% share of the bonded magnet market. This leadership is attributed to ferrite’s cost-effectiveness, corrosion resistance, and thermal stability, making it ideal for mass production.

The material’s strong magnetic properties at a low cost have ensured its extensive application in consumer electronics, automotive motors, and small appliances. Ferrite’s abundance and consistent raw material supply also contribute to its market advantage.

Manufacturers continue to refine ferrite-based bonded magnet formulations to improve performance in compact devices. With growing industrial automation and increased electric motor usage, the ferrite segment is expected to maintain its significant market share during the forecast period.

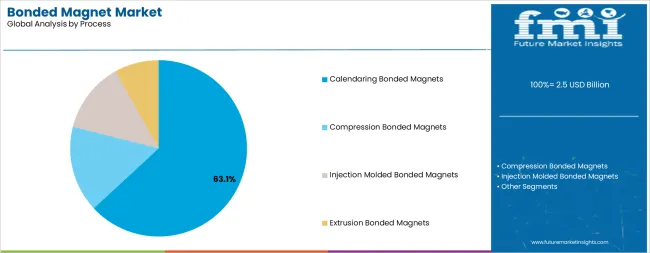

The calendaring bonded magnets segment holds approximately 63.1% share within the process category, supported by its ability to produce flexible, uniform magnetic sheets with precise dimensional control. The calendaring process allows for continuous production, enhancing scalability and cost efficiency for high-volume applications.

Its suitability for thin, lightweight magnetic products has made it a preferred choice for sensors, actuators, and consumer electronics. The process’s capability to achieve consistent magnetization and surface smoothness ensures superior performance in miniaturized devices.

With the growing adoption of flexible magnetic components in emerging technologies, the calendaring process segment is expected to retain its dominance, driven by efficiency and production versatility.

The motors segment leads the application category with approximately 38.6% share of the bonded magnet market. The segment’s growth is underpinned by increasing demand for compact, energy-efficient motors in automotive, industrial, and consumer electronics applications.

Bonded magnets are preferred in motor assemblies due to their lightweight construction, isotropic properties, and design adaptability, which enhance overall performance. Electric and hybrid vehicle adoption has significantly boosted magnet usage for traction and auxiliary motors.

Industrial automation, robotics, and home appliance manufacturing also contribute to segment expansion. With the continued electrification of mobility and the push toward energy-efficient systems, the motors segment is anticipated to sustain its leadership throughout the forecast horizon.

| Historical CAGR | 3.90% |

|---|---|

| Forecast CAGR | 4.80% |

The historical performance and future growth projections of the bonded magnet market indicate a moderate but steady increase in demand over time. The historical CAGR stood at 3.90%, reflecting a consistent yet relatively modest expansion in market size. However, the forecasted CAGR shows a notable improvement, which is expected to rise to 4.80% in the coming years.

Several factors contribute to the increase in forecasted CAGR compared to historical performance. Technological advancements in manufacturing processes have LED to the development of more efficient and cost-effective bonded magnet materials. These innovations have expanded the application scope of bonded magnets across various industries, driving higher demand for these products.

The growing emphasis on sustainability and environmental consciousness has spurred the adoption of bonded magnets as eco-friendly alternatives to traditional magnet materials. As companies seek to reduce their carbon footprint and comply with stringent regulations, the demand for sustainable magnet solutions is expected to rise, contributing to the projected increase in CAGR.

Shift Towards Electric Mobility

The global shift towards electric vehicles (EVs) and the electrification of transportation infrastructure are creating significant opportunities for bonded magnets, particularly in electric motor applications for EV drivetrains.

Increasing Demand from the Healthcare Industry

Bonded magnets are finding growing applications in medical devices, including MRI machines, diagnostic equipment, and wearable health monitors, driven by advancements in healthcare technology and an aging population.

Expansion in Aerospace Applications

The aerospace industry's growing focus on lightweight materials and advanced propulsion systems is driving the adoption of bonded magnets in aerospace applications such as actuators, sensors, and avionics systems.

Emerging Market in Asia Pacific

Rapid industrialization and infrastructure development in countries like China, India, and Southeast Asian nations are creating significant opportunities for bonded magnets in sectors such as automotive, consumer electronics, and renewable energy.

This section provides detailed insights into specific segments in the bonded magnet industry.

| Top Product Type | Ferrite Magnets |

|---|---|

| Market Share in 2025 | 47% |

The key factors behind the dominance of the segment include,

| Dominating Process Type | Calendering Bonded Magnets |

|---|---|

| Market Share in 2025 | 63.10% |

Some crucial factors responsible for dominating market share include,

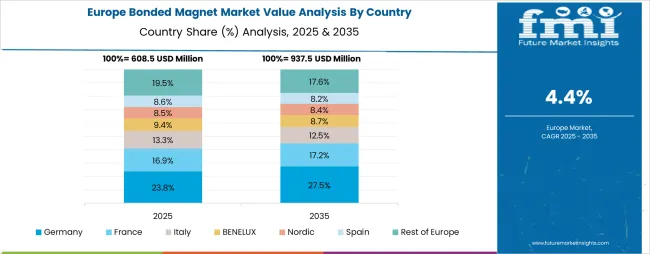

The section analyzes the bonded magnet market across key countries, including the United States, Australia, China, India, and Germany. The analysis delves into the specific factors driving the demand for bonded magnets in these countries.

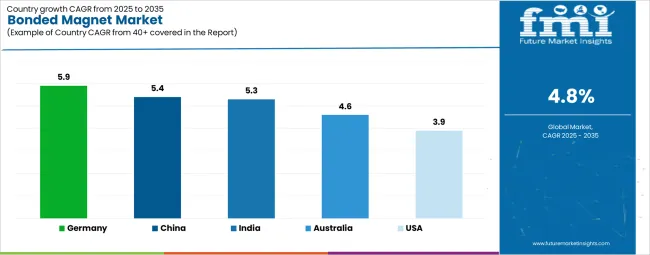

| Countries | CAGR |

|---|---|

| United States | 3.9% |

| Australia | 4.6% |

| China | 5.4% |

| India | 5.3% |

| Germany | 5.9% |

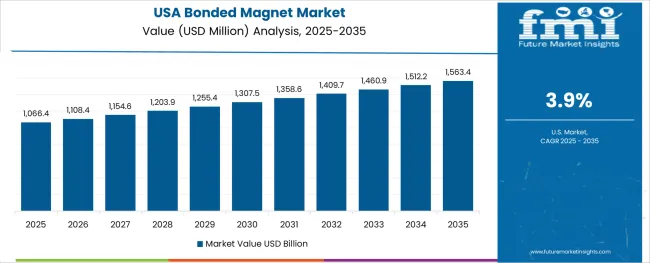

The bonded magnet industry in the United States is anticipated to rise at a CAGR of 3.9% through 2035.

The bonded magnet industry in Australia is projected to rise at a CAGR of 4.6% through 2035.

China’s bonded magnet industry is likely to witness expansion at a CAGR of 5.4% through 2035.

India's bonded magnet industry is projected to rise at a CAGR of 5.3% through 2035.

Germany's bonded magnet market is expected to rise at a 5.9% CAGR through 2035.

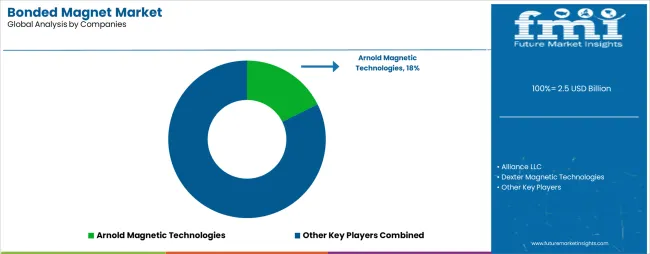

The competition in the bonded magnet industry reflects a blend of established players and emerging challengers vying for market share. Leading companies dominate with their extensive product portfolios and strong market presence. Innovative startups are disrupting the market with novel bonding techniques, material compositions, and application-specific solutions, challenging traditional players.

A focus on research and development initiatives, along with investments in advanced manufacturing technologies, underscores the industry's commitment to staying ahead in a rapidly evolving market. Companies are investing in automation, process optimization, and quality control measures to improve production efficiency, reduce costs, and meet stringent quality standards, thus gaining a competitive edge.

Recent Developments in the Bonded Magnet Industry:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 4.0 Billion |

| CAGR | 4.8% |

| Base Year for Estimation | 2025 |

| Historical Period | 2025 to 2025 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD Billion/Volume in Million Units |

| Product Analyzed | Rare Earth Magnets (NdFeB, SmCo), Ferrite Magnets, Others (Alnico, SmFeN, Hybrids) |

| Process Types Analyzed | Injection Molded, Compression, Calendaring, Extrusion Bonded Magnets |

| Application Analyzed | Sensors, Motors, HDDs, Level Gauges, Instrument Panels, Copier Rotors, Fuel Filters, Magnetic Couplings |

| End Use Analyzed | Automotive, HVAC Equipment, Medical Devices, Cameras, Consumer Electronic Appliances, Computers and Magnetic Storage Devices, Electrical Equipment, Measurement Instruments, Printers and Copiers |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, South Africa |

| Key Players | Arnold Magnetic Technologies, Alliance LLC, Dexter Magnetic Technologies, TDK Corporation, Adams Magnetic Products, SDM Magnetics Co., Ltd., Ningbo Yunsheng Co. Ltd., Advanced Technology Materials Co. Ltd., MMC Magnetics Corp, Dura Magnetics, Inc., National Imports, LLC, Super Magnet Co., Ltd., MP Material |

| Additional Attributes | Market share by company, product type performance, regional demand shifts, application-level insights, company benchmarking, annual dollar sales breakdown by region and segment |

| Customization and Pricing | Available upon request |

The global bonded magnet market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the bonded magnet market is projected to reach USD 4.0 billion by 2035.

The bonded magnet market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in bonded magnet market are ferrite magnets, rare earth magnets, ndfeb, smco and others (alnico, smfen, hybrids).

In terms of process, calendaring bonded magnets segment to command 63.1% share in the bonded magnet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bonded Abrasives Market Growth - Trends & Forecast 2025 to 2035

Industry Share Analysis for Bonded Leather Companies

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Absorption Data Line Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Material Magnetization and Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Coupler Market Size and Share Forecast Outlook 2025 to 2035

Magnet Buffer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Shielding Device Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Stripe Readers Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Drive Pump Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Ballast Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Sensor Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging Coils Market Analysis - Size, Share, and Forecast 2025 to 2035

Magnetic Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Magnetic Resonance Imaging (MRI) Contrast Agents Market Size and Share Forecast Outlook 2025 to 2035

Magneto Optic Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Crack Detectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA