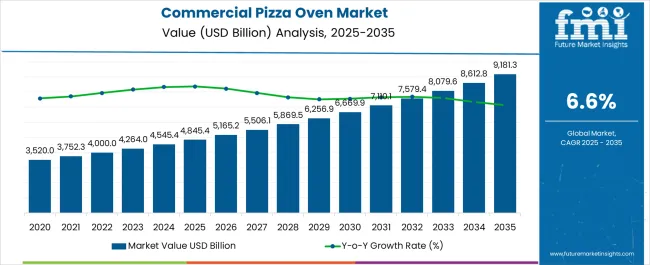

The commercial pizza oven market is estimated to be valued at USD 4845.4 billion in 2025 and is projected to reach USD 9181.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

Restaurant operators increasingly prioritize ovens capable of handling diverse menu applications beyond traditional pizza preparation, creating demand for versatile units that accommodate flatbreads, roasted vegetables, and baked proteins within single cooking chambers. Equipment manufacturers respond by developing hybrid designs that integrate convection heating with radiant stone surfaces, enabling operators to maximize kitchen space utilization while maintaining consistent product quality across varied cooking requirements. Installation considerations drive purchasing decisions as facility managers evaluate ventilation requirements, floor space constraints, and utility infrastructure compatibility when specifying commercial pizza ovens for new construction or retrofit applications.

The commercial pizza oven market demonstrates resilient expansion driven by evolving consumer preferences toward artisanal dining experiences and the proliferation of quick-service restaurant concepts globally. Market valuation stands at USD 4,845.4 billion in 2025, with projections indicating growth to USD 9,181.3 billion by 2035, reflecting a compound annual growth rate of 6.6% throughout the forecast period. This trajectory stems from operational demands within food service establishments seeking equipment that balances throughput capacity with energy efficiency considerations.

Restaurant operators increasingly prioritize ovens capable of handling diverse menu applications beyond traditional pizza preparation, creating demand for versatile units that accommodate flatbreads, roasted vegetables, and baked proteins within single cooking chambers. Equipment manufacturers respond by developing hybrid designs that integrate convection heating with radiant stone surfaces, enabling operators to maximize kitchen space utilization while maintaining consistent product quality across varied cooking requirements. Installation considerations drive purchasing decisions as facility managers evaluate ventilation requirements, floor space constraints, and utility infrastructure compatibility when specifying commercial pizza ovens for new construction or retrofit applications.

Supply chain relationships between equipment manufacturers and foodservice distributors face ongoing pressure from material cost fluctuations affecting steel, refractory components, and electronic control systems integral to modern pizza oven construction. Procurement departments within restaurant chains negotiate volume pricing agreements that balance initial capital expenditure against long-term operational costs, including energy consumption patterns, maintenance intervals, and replacement part availability. Quality assurance protocols established by corporate food service operations mandate specific temperature uniformity standards and recovery time benchmarks that influence equipment selection processes across franchise networks.

Manufacturing constraints limit production capacity for specialty oven configurations, particularly wood-fired units requiring hand-crafted refractory assemblies and custom ventilation systems. Regional regulatory compliance requirements create additional complexity as commercial kitchen equipment must satisfy local fire codes, emissions standards, and accessibility mandates that vary significantly between metropolitan markets. Cross-functional tensions emerge between culinary teams seeking authentic cooking methods and facilities management groups prioritizing standardized equipment platforms that simplify training requirements and service protocols.

| Metric | Value |

|---|---|

| Commercial Pizza Oven Market Estimated Value in (2025 E) | USD 4845.4 billion |

| Commercial Pizza Oven Market Forecast Value in (2035 F) | USD 9181.3 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The commercial pizza oven market is experiencing steady growth driven by rising consumer preference for artisanal and premium pizza offerings along with expanding foodservice outlets globally. Increasing demand from quick service restaurants, hotel chains, and independent pizzerias has accelerated the adoption of advanced oven technologies.

Energy efficiency, consistent heat distribution, and faster cooking cycles have emerged as key factors influencing equipment selection. Manufacturers are focusing on innovative designs that optimize fuel consumption while enhancing baking quality and throughput.

Additionally, the global trend of experiential dining and the growing popularity of pizza as a staple food in both developed and emerging markets are reinforcing demand for commercial ovens. The market outlook remains positive with opportunities for growth supported by automation, smart controls, and sustainability focused solutions designed to reduce operational costs and improve food quality.

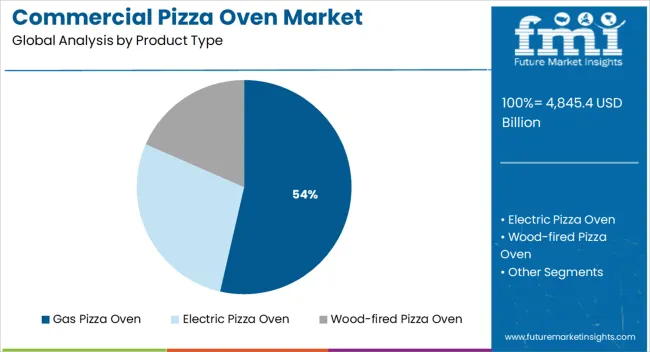

The market is segmented by Product Type, Type, Application, and Sales Channel and region. By Product Type, the market is divided into Gas Pizza Oven, Electric Pizza Oven, and Wood-fired Pizza Oven. In terms of Type, the market is classified into Deck, Convection, Brick, Conveyer, and Countertop. Based on Application, the market is segmented into Hotels, Restaurants, Cafés, Bakeries, and Catering Units. By Sales Channel, the market is divided into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gas pizza oven segment is projected to account for 53.60% of total revenue by 2025 within the product type category, establishing it as the leading format. This growth is being driven by its ability to provide consistent heat distribution, lower operational costs, and faster cooking times compared to alternative formats.

Its adaptability for both small and large scale establishments has made it an attractive investment for businesses seeking efficiency and reliability. In addition, gas ovens offer greater control over temperature adjustments, ensuring uniform cooking which is essential in high demand commercial environments.

Their cost effectiveness and operational convenience continue to reinforce their dominance in the product type segment.

The deck type segment is expected to hold 47.20% of overall market revenue by 2025 under the type category, positioning it as the most preferred configuration. Its popularity is attributed to the ability to bake multiple pizzas simultaneously while ensuring authentic taste and texture.

Deck ovens are recognized for their versatility and suitability in handling high volume operations without compromising quality. Their robust design and ability to maintain consistent baking conditions have enhanced their adoption across restaurants and hotels.

As businesses prioritize both capacity and product quality, deck ovens remain central to operational strategies within the type category.

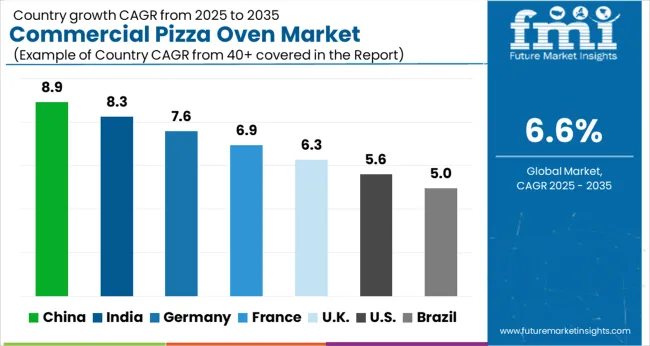

According to predictions put forward by Future Market Insights, the market for commercial pizza ovens is projected to surge steadily over the next ten years. Developing nations are expected to showcase promising growth prospects, especially industrialized countries such as India and China.

Since pizza ovens are already a common fixture in virtually all commercial kitchens across developed countries, tapping into the market is set to be simple for key companies. Offering cutting-edge styles and designs can provide key players with new opportunities. Trendy features that require less cleaning, are small, versatile, able to quickly pre-heat, and simple to build are few of the features that are preferred by users.

Expansion of Online Food Delivery Platforms to Fuel Demand for Professional Pizza Ovens

Pizza is considered to be a very popular food item in practically every food service establishment, which is the primary driver of the global market for commercial pizza ovens. Increasing businesses demanding unique pizza ovens with superior features has surged the sales of pizza.

Availability of a wide range of pizzas to satisfy consumer cravings across the globe has further generated a sizable market share for commercial pizza ovens. Sales are expected to be driven by high demand for new ovens that are equipped with multiple cooking functions.

Expansion of online food delivery platforms in both developed and developing countries is projected to result in high demand for pizza as a snacking item. House parties, office parties, and similar get together events worldwide include pizza as a staple fast food or snack.

Key restaurants and cafés are projected to expand their online presence so that consumers can instantly order their favorite pizzas with just a click. The aforementioned factors are anticipated to drive commercial pizza oven demand worldwide.

Numerous influential factors have been identified to stir soup in the commercial pizza oven market. Analysts at Future Market Insights have analyzed restraining factors, lucrative opportunities, and upcoming threats that can pose a challenge to progression of the market for commercial pizza ovens.

The drivers, restraints, opportunities, and threats identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

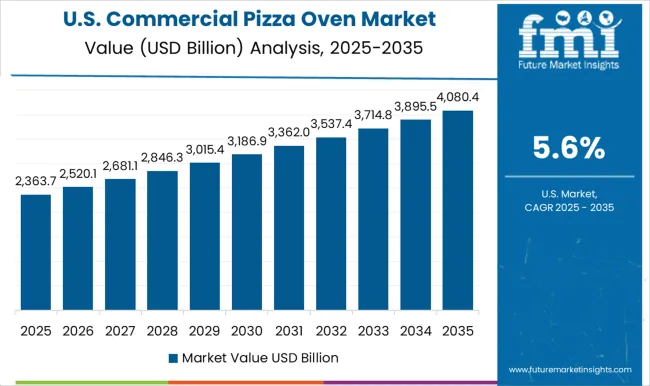

Rising Demand for Commercial Outdoor Pizza Ovens among Key Restaurants to Boost Sales in the United States

The United States is considered to be a leading country in the North America market for commercial pizza ovens. The country is estimated to create an incremental valuation of nearly USD 1,033.6 million and generate a share of around 68% throughout the assessment period.

Growth is attributed to several commercial companies looking for unique pizza ovens for providing fast service to their customers. Keeping the United States aside, Canada and Mexico are projected to contribute to about 38% of the global market share.

Surging Trend for Online Food Ordering in the United Kingdom to Flourish Sales of Industrial Pizza Ovens

Europe is set to be one of the most prominent commercial pizza oven markets with more than two-fifths of share. Growth is attributed to rising trend for online food ordering and easy accessibility of numerous types of pizzas through online platforms.

The United Kingdom is estimated to generate a share of 22% and create an absolute dollar opportunity of USD 9181.3.0 million by 2035. As per Future Market Insights, Germany, France, Russia, and Italy are set to together contribute to around 40% of total market share.

Fast Food Giants in India and China to Look for Commercial Pizza Making Machines to Provide Quick Delivery Service

In Asia Pacific, India and China are anticipated to be two dominant countries in the commercial pizza oven market. Expansion of the hotel/restaurant/catering industry across both countries with rising middle-class population and increasing disposable income would drive sales in the market. Asia Pacific is likely to contribute around 18% of the global market share and surpass USD 720.0 million driven by India and China.

In India, several pizza joints are offering quick home delivery services to attract a large consumer base. Domino’s India, for instance, unveiled its 20-minute pizza delivery service across 20 areas in the country. With this launch, the company aims to enhance operational efficiencies, improve in-store process movements, extend stores within the vicinity, and upgrade existing technology.

Demand for Convection Restaurant Pizza Ovens to Escalate across the Globe

Finding an ideal commercial pizza oven is essential for any restaurant, bakery, cafeteria, or other enterprise that depends on its ability to efficiently and swiftly feed various customers. One of the most common models of commercial pizza oven available today is convection oven.

To guarantee that the baked food is heated properly and uniformly, convection ovens contain a fan that circulates air inside the oven. They are hence considered to be a suitable option for even and consistent cooking.

Consumers Prefer Online Sales Channel for Buying Industrial Pizza Makers

One of the most convenient ways to choose products and compare them with other brands is through e-commerce platforms. Expansion of the e-commerce sector amid investments by key manufacturers in partnering with delivery services, adding direct-to-consumer operations, and developing an improved website experience is projected to drive the online segment in terms of sales channel.

Another factor driving commercial pizza ovens demand through online sales channels is their ease of use and serviceability.

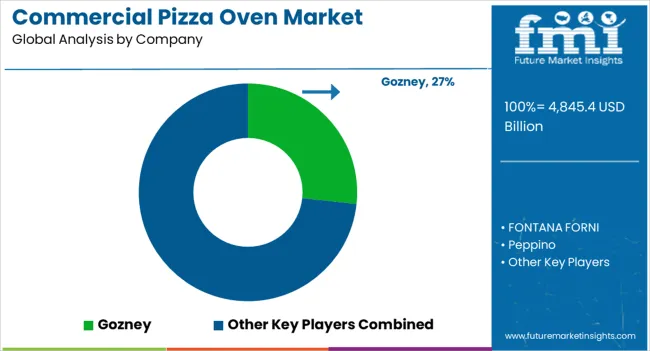

The commercial pizza oven market is competitive, featuring a blend of established brands and specialized manufacturers offering innovative, high-performance solutions. Leading the market are Gozney, Fontana Forni, Forno Bravo, Mugnaini Imports, Inc., Wachtel GmbH, Californo, and Le Panyol, each offering distinctive products to cater to various commercial foodservice needs.

Gozney is known for its modern, modular wood-fired ovens that prioritize design and versatility, appealing to both professional chefs and enthusiasts. Fontana Forni offers handcrafted Italian ovens, renowned for durability and premium results, ideal for high-end pizzerias. Forno Bravo combines traditional Italian design with modern efficiency, providing customizable ovens for both small and large-scale operations. Mugnaini Imports offers a wide range of high-performance ovens and strong customer support, making it a top choice for pizzeria owners. Wachtel GmbH specializes in German-engineered ovens known for their precision and energy efficiency. Californo delivers customizable, durable wood-fired ovens that maximize fuel efficiency while reducing cooking times. Le Panyol provides French-made ovens known for exceptional heat retention and consistent results, favored by artisanal pizzerias.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 4845.4 billion |

| Projected Market Valuation (2035) | USD 9181.3 billion |

| Value-based CAGR (2025 to 2035) | 6.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD million) |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Key Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Russia, China, Japan, India, Korea, Brazil, Argentina, Chile |

| Key Segments Covered | Product Type, Type, Application, Sales Channel, Region |

| Key Companies Profiled | Gozney; Fontana Forni; Forno Bravo; Mugnaini Imports, Inc.; Wachtel GmbH; Californo; Le Panyol |

| Report Coverage | Drivers, Restraints, Opportunities and Threats Analysis, Market Forecast, Company Share Analysis, Market Dynamics and Challenges, Competitive Landscape, and Strategic Growth Initiatives |

The global commercial pizza oven market is estimated to be valued at USD 4,845.4 billion in 2025.

The market size for the commercial pizza oven market is projected to reach USD 9,181.3 billion by 2035.

The commercial pizza oven market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in commercial pizza oven market are gas pizza oven, electric pizza oven and wood-fired pizza oven.

In terms of type, deck segment to command 47.2% share in the commercial pizza oven market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA