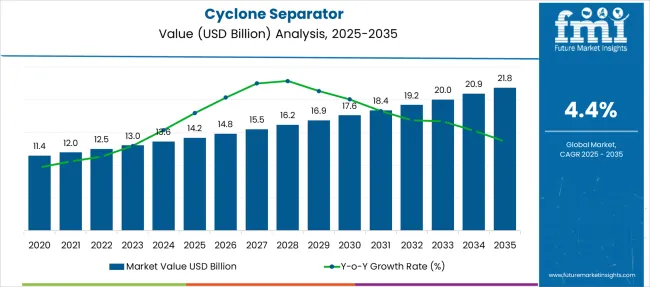

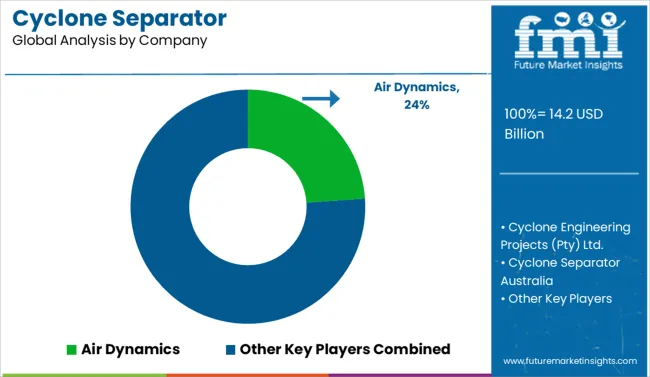

The Cyclone Separator Market is estimated to be valued at USD 14.2 billion in 2025 and is projected to reach USD 21.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Cyclone Separator Market Estimated Value in (2025E) | USD 14.2 billion |

| Cyclone Separator Market Forecast Value in (2035F) | USD 21.8 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The cyclone separator market is experiencing sustained growth owing to increasing environmental regulations, industrial process optimization, and demand for effective particulate matter control. Industries such as food processing, pharmaceuticals, cement, and chemicals are actively integrating cyclone separators to enhance air quality, reduce emissions, and improve material recovery.

The growing need for dust control systems that operate without filters or consumables has boosted the preference for cyclone-based technologies. These systems are valued for their low maintenance, durability, and cost effectiveness in continuous operation settings.

Advancements in separator geometry, flow efficiency, and material strength are also expanding their application range. With increasing industrialization and enforcement of air quality standards, the market is expected to grow steadily across both established and developing economies.

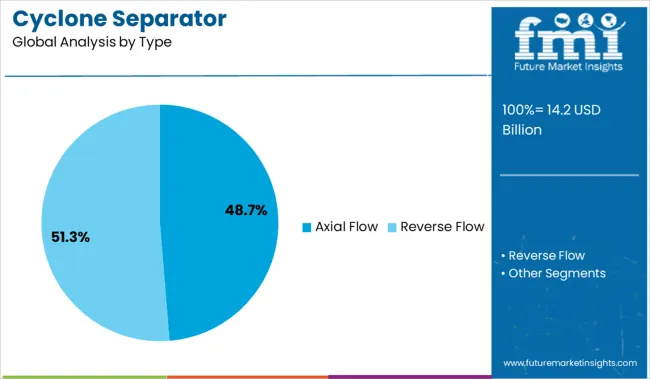

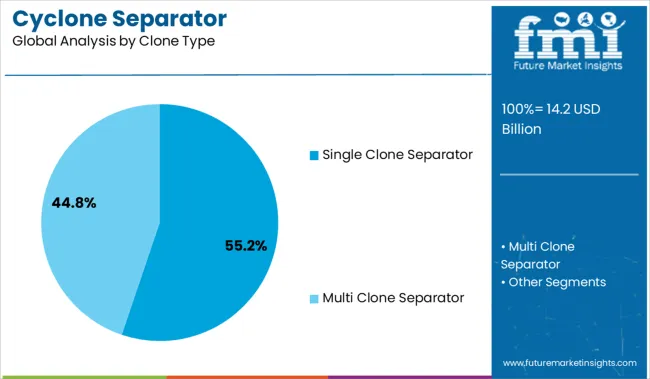

The cyclone separator market is segmented by type, clone type, capacity, application, end use industry, and distribution channel and geographic regions. By type of the cyclone separator market is divided into Axial Flow and Reverse Flow. In terms of clone type of the cyclone separator market is classified into Single Clone Separator and Multi Clone Separator.

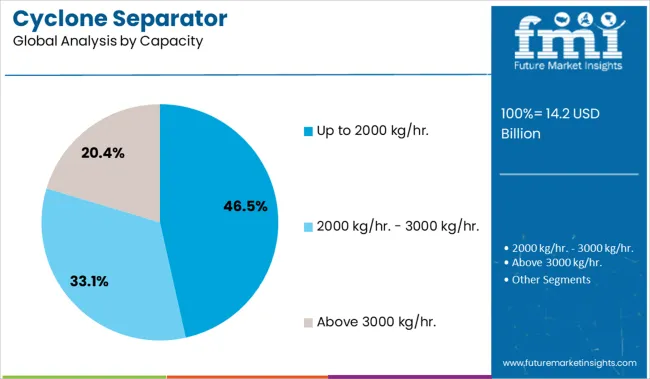

Based on capacity of the cyclone separator market is segmented into Up to 2000 kg/hr., 2000 kg/hr. - 3000 kg/hr., and Above 3000 kg/hr.. By application of the cyclone separator market is segmented into Dehydration cyclone, Desliming cyclone, Slag removal cyclones, and Others (Concentration cyclone, Cyclone group). By end use industry of the cyclone separator market is segmented into Oil and Gas, Chemical, Mining and Mineral Processing, Power Generation, Food and Beverage, and Others (Pulp & Paper, Textiles, Pharmaceutical).

By distribution channel of the cyclone separator market is segmented into Direct Sales and Indirect Sales. Regionally, the cyclone separator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The axial flow segment is projected to hold 48.70% of total revenue by 2025 under the type category, positioning it as the leading design. This dominance is driven by its ability to manage high flow rates and reduce pressure drop while maintaining separation efficiency.

Axial flow cyclone separators are particularly effective in applications requiring low resistance and continuous throughput, such as in pneumatic conveying systems and high-dust-load environments. Their straightforward structure and compatibility with vertical installations support compact plant layouts and flexible integration.

The efficiency in capturing coarse and fine particles without moving parts enhances operational reliability, making axial flow separators a preferred choice across a broad spectrum of industries.

Single clone separators are expected to account for 55.20% of the total market revenue within the design category by 2025, establishing them as the leading segment. This growth is attributed to their simplicity, ease of maintenance, and suitability for standalone applications.

Industries prioritize single clone separators for their ability to handle moderate dust loads with consistent separation performance. Their compact design and low operational cost make them favorable for small to medium-scale industrial processes.

In settings where multiple-stage separation is unnecessary, these units offer a reliable and cost-effective solution. Their adaptability to varying flow conditions and material types has reinforced their position as the preferred design type in the cyclone separator market.

The up to 2000 kilograms per hour capacity segment is projected to contribute 46.50% of the overall market revenue by 2025 under the capacity category, making it the dominant throughput range. This is driven by the high number of small and medium scale operations that require efficient dust and particle removal without investing in large scale equipment.

Industries such as food processing, agriculture, and light manufacturing often operate within this capacity bracket, seeking compact and reliable solutions for material separation. These units offer favorable energy consumption and occupy minimal space while ensuring compliance with emission control standards.

As operational agility and process cleanliness become more critical, this capacity segment continues to see increased adoption across diverse industrial environments.

Demand for cyclone separators is rising across mining, cement, and pharmaceutical sectors due to stricter dust control mandates and process efficiency goals. Sales of high-efficiency multicyclone and hybrid models are gaining momentum as plants retrofit aging systems and aim to cut emissions and energy losses.

Demand for high-efficiency cyclone separators rose 26% in 2025 as cement kilns and ore processing plants upgraded air filtration systems. Latin American mining firms installing tangential-entry cyclones with ceramic liners extended unit lifespan by 2.4×, reducing maintenance shutdowns. Cement factories in Southeast Asia adopting modular multicyclone arrays reported 18% lower PM10 emissions, enabling faster compliance with updated ambient air quality rules. Energy audits showed that retrofits with low-pressure-drop designs saved up to 11% in auxiliary power costs. European calcination plants also shifted from venturi scrubbers to dry cyclone units to reduce water use and meet ESG targets, driving 21% growth in dry-separator installations.

Sales of hybrid cyclone separators surged 32% in 2025, driven by demand in pharmaceutical and agrochemical manufacturing environments. USA-based tablet plants using stainless-steel cyclonic pre-filters ahead of HEPA systems extended final filter life by 39%. Indian agrochemical processors installed PTFE-lined cyclones to minimize corrosion from acidic dust streams, cutting downtime by 14%. Modular cyclone skids with integrated PLC controls helped reduce manual intervention in powder handling zones by 27%. European CDMO facilities prioritized closed-loop cyclone installations to reduce fugitive emissions and comply with REACH compliance audits. This shift is positioning cyclone systems as core components in cleanroom-adjacent dust capture lines.

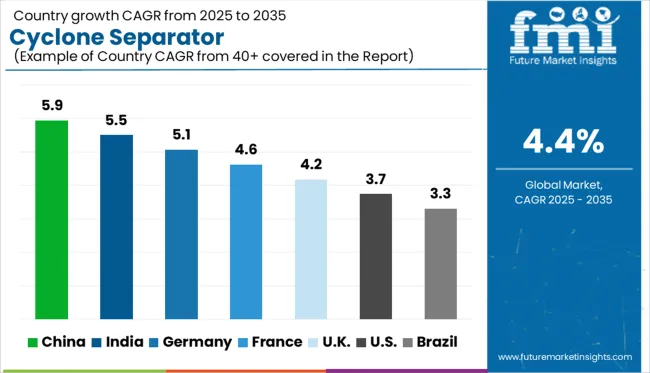

| Country | CAGR |

|---|---|

| China | 5.9% |

| India | 5.5% |

| Germany | 5.1% |

| France | 4.6% |

| UK | 4.2% |

| USA | 3.7% |

| Brazil | 3.3% |

The global market is forecast to grow at a CAGR of 4.4% between 2025 and 2035. Among the fastest-growing regions, China (BRICS) leads with a CAGR of 5.9%, outperforming the global average by 1.5 percentage points, driven by tightening air pollution controls and rising demand from mining and cement sectors. India (BRICS) follows at 5.5% (+1.1 pp), supported by increasing investments in industrial air filtration systems and infrastructure development. In the OECD region, Germany posts 5.1% (+0.7 pp), benefiting from strict environmental regulations and strong engineering exports. In contrast, the UK records 4.2% (-0.2 pp), while the United States trails at 3.7% (-0.7 pp), reflecting a more saturated industrial base with slower equipment replacement cycles. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

A CAGR of 5.9% is projected for China’s cyclone separator market between 2025 and 2035, driven by the country’s commitment to industrial emission control. From 2020 to 2024, adoption was concentrated in cement and steel sectors where basic dust collection was required. In the coming decade, stricter regulatory standards under China's new environmental policies are pushing industries to upgrade to high-efficiency multi-cyclone systems. Retrofitting of aging separation equipment is accelerating in mining, power generation, and waste incineration plants.

India’s cyclone separator market is expected to grow at a CAGR of 5.5% through 2035, bolstered by rising investments in process industries and air quality compliance. During 2020 to 2024, demand was primarily driven by biomass energy and thermal power installations. Looking ahead, the focus is on compact, low-maintenance separators suited for decentralized setups. Growth is also fueled by pollution control mandates in emerging sectors such as food processing and agro-chemical manufacturing.

Germany’s cyclone separator market is poised to advance at a CAGR of 5.1% between 2025 and 2035, driven by circular economy principles and emissions reduction across industrial processes. In 2020 to 2024, installations were focused on enhancing energy efficiency in existing filtration systems. Going forward, integration of separators in waste recovery and recycling applications is emerging as a key trend. Industrial furnace manufacturers are increasingly bundling high-performance cyclone modules into their pollution control packages.

The UK cyclone separator market is forecast to expand at a CAGR of 4.2% through 2035, supported by cleaner production practices and emission standards enforced post-Brexit. Between 2020 and 2024, growth came from industrial heating and materials handling. As industries shift to cleaner fuels and renewable processing, cyclone separators are being customized for multi-phase separation and energy-saving operation. Investments in pharmaceutical and chemical plants are also contributing to broader adoption.

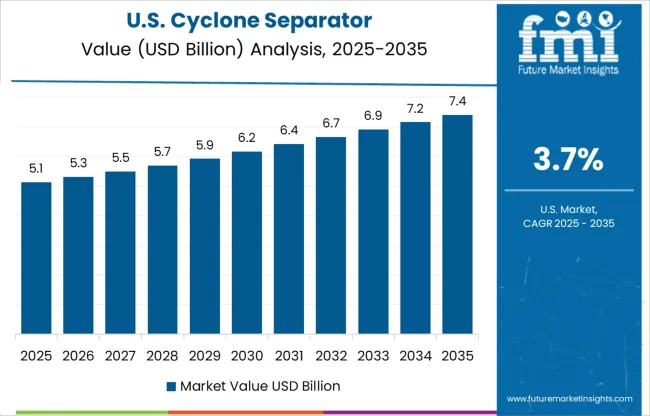

The USA market for cyclone separators is projected to grow at a CAGR of 3.7% from 2025 to 2035, with a notable push from industrial decarbonization efforts and federal clean air mandates. From 2020 to 2024, the market showed moderate growth, mostly concentrated in wood processing and grain milling. Looking ahead, automation-compatible separators are gaining traction in large-scale manufacturing. EPA-backed compliance programs are supporting upgrades in heavy-duty processing zones.

Demand for cyclone separators is surging in 2025 as stricter emission norms and rising particulate control requirements reshape industrial air and fluid handling systems. Air Dynamics leads the market with a 23.9% share, bolstered by its advanced multi-clone technologies for cement, power, and petrochemical applications.

Multotec and FLSmidth are expanding their presence in mining-heavy economies, where sales of cyclone separators are accelerating due to tailings and slurry management upgrades. The Weir Group and Sulzer Ltd. remain dominant in oil & gas and energy sectors, offering corrosion-resistant, high-capacity solutions. Meanwhile, Gulf Coast Air & Hydraulics and Haiwang Hydrocyclone Co. are tapping into Asia’s growth by supplying customizable designs for OEM integration across process industries and bulk material handling systems.

In February 2025, FLSmidth secured a major contract to deliver 18 of the world’s largest vertical tower mills, 30 KREBS slurry pumps, and 18 KREBS gMAX hydrocyclones to an Indian iron ore beneficiation plant. The order underscores its global leadership in hydrocyclone-based classification systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.2 Billion |

| Type | Axial Flow and Reverse Flow |

| Clone Type | Single Clone Separator and Multi Clone Separator |

| Capacity | Up to 2000 kg/hr., 2000 kg/hr. - 3000 kg/hr., and Above 3000 kg/hr. |

| Application | Dehydration cyclone, Desliming cyclone, Slag removal cyclones, and Others (Concentration cyclone, Cyclone group) |

| End Use Industry | Oil and Gas, Chemical, Mining and Mineral Processing, Power Generation, Food and Beverage, and Others (Pulp & Paper, Textiles, Pharmaceutical) |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Dynamics, Cyclone Engineering Projects (Pty) Ltd., Cyclone Separator Australia, Cyclotech, Elgin Separation Solutions, Exterran Corporation, FLSmidth, Gulf Coast Air & Hydraulics, Haiwang Hydrocyclone Co., Ltd., KREBS, Mahle Industrial Filtration (India) Pvt. Ltd., Mikropor, Multotec, Sulzer Ltd., and The Weir Group |

| Additional Attributes | Dollar sales by separator type and industrial application, demand dynamics across dust collection and gas-solid separation processes, regional trends in high-efficiency cyclone adoption, innovation in multi-stage and compact cyclone configurations, environmental impact of particulate emissions and filter waste management, and emerging use cases in pneumatic conveying systems and emissions control in processing industries. |

The global cyclone separator market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the cyclone separator market is projected to reach USD 21.8 billion by 2035.

The cyclone separator market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in cyclone separator market are axial flow and reverse flow.

In terms of clone type, single clone separator segment to command 55.2% share in the cyclone separator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrocyclone Liners Market Size and Share Forecast Outlook 2025 to 2035

Cream Separator Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Separators Film Market

Droplet Separator Market

Magnetic Separator Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in the Magnetic Separator Industry

Clean Steam Separator Market Analysis - Size, Share & Forecast 2025 to 2035

Centrifugal Separator Market Segmentation based on Product Type, End Use and Region: A Forecast for 2025 and 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

ASEAN Magnetic Separator Market Analysis – Size, Demand & Forecast 2025-2035

Japan Magnetic Separator Market Insights – Demand, Share & Forecast 2025-2035

Demand for Hydrocyclone Liners in USA Size and Share Forecast Outlook 2025 to 2035

Germany Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

Marine Oil Water Separator Market

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

United States Magnetic Separator Market Report – Demand, Size & Industry Trends 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

High Pressure Oil and Gas Separator Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA