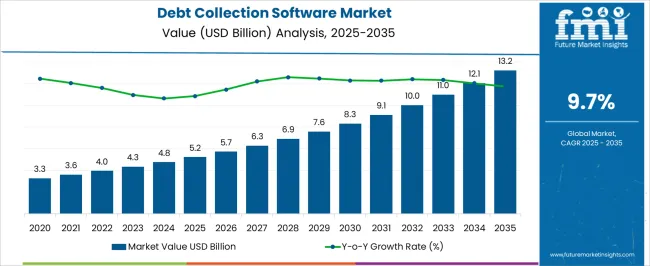

The Debt Collection Software Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 13.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

| Metric | Value |

|---|---|

| Debt Collection Software Market Estimated Value in (2025 E) | USD 5.2 billion |

| Debt Collection Software Market Forecast Value in (2035 F) | USD 13.2 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The debt collection software market is expanding as financial institutions, collection agencies, and enterprises increasingly rely on digital solutions to streamline recovery processes and improve operational efficiency. The rise in non performing loans, stricter compliance requirements, and the demand for real time account monitoring are accelerating adoption.

Cloud integration, AI driven analytics, and automation have enhanced predictive capabilities and improved customer communication, reducing delinquency rates and operational costs. Enterprises are investing in solutions that ensure regulatory compliance while also maintaining customer relationships through personalized collection strategies.

With financial services embracing digital transformation and SMEs seeking cost effective platforms, the market outlook is strongly positive. Future growth is expected to be reinforced by ongoing technological innovation, greater emphasis on data security, and the integration of advanced analytics to optimize recovery outcomes.

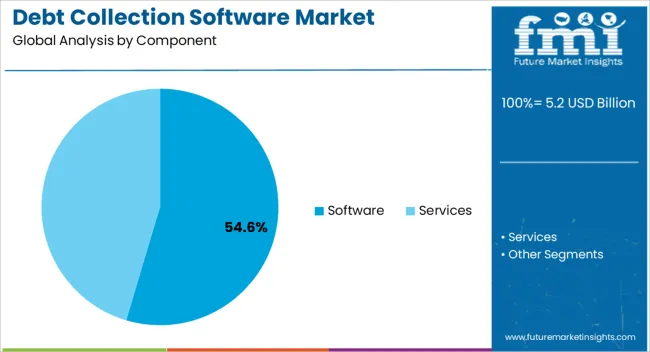

The software component is projected to account for 54.60% of total revenue by 2025, making it the leading component segment. This dominance is attributed to the increasing reliance on specialized software platforms to manage large volumes of delinquent accounts with speed and accuracy.

Automation of workflows, integration with payment gateways, and compliance monitoring capabilities have strengthened its adoption. The ability of software to deliver scalability, reporting, and predictive insights has been particularly valuable for organizations managing complex portfolios.

As digital-first strategies gain momentum, the software segment continues to reinforce its leadership in the debt collection software market.

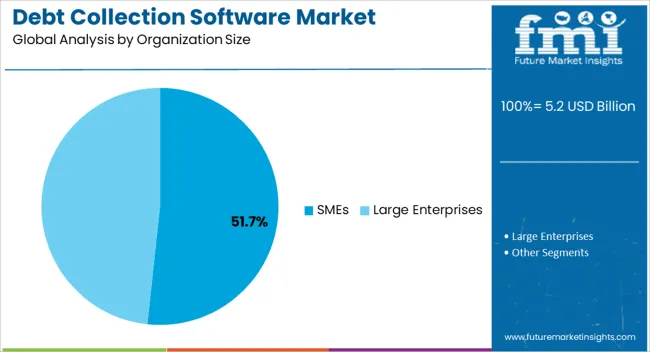

The SMEs segment is projected to represent 51.70% of total revenue by 2025 within the organization size category, establishing it as the leading segment. Small and medium enterprises are adopting debt collection software to address resource constraints, reduce manual efforts, and ensure faster recovery cycles.

Affordable pricing models and user friendly interfaces have enabled SMEs to integrate digital solutions without significant IT infrastructure investments. Cloud accessibility and automation features have further improved adoption rates among smaller businesses, allowing them to compete with larger players in managing debt portfolios effectively.

The increasing importance of cash flow optimization has reinforced the role of SMEs as key contributors to market expansion.

The sales of debt collection software are anticipated to grow during the forecast period by large health institutions to cope with internal medical debt recovery has become critical. The market secured a valuation of USD 3.3 billion in 2020 and USD 5.2.0 billion in 2025. The market grew steadily by increasing the demand for debt collection software, increasing debt levels, and strict regulations.

The growing advanced technologies such as machine learning, artificial intelligence, and analytics fuel the global market. These technologies improve efficiency during debt processes. Cloud-based solutions have recently gained popularity due to various benefits, including data security, scalability, and cost-effectiveness. The increasing new market entrance, innovations, new product launches, and strict regulation is estimated to continue to expand the global market by 2035.

Due to a spike in acceptance of cloud-based debt collection software among large organizations and SMEs, attributable to the need to reduce infrastructure investment, the cloud-based deployment mode is predicted to grow at a significant rate of 9.2% over the projection period.

The on-premise segment is also anticipated to grow rapidly in the debt-collection software market, and this trend is likely to continue over the forecast period. It is due to the growing requirement to protect vital data from cyber threats and monitor data intrusion within enterprises, encouraging customers to adopt on-premises debt collection software. It also allows businesses to take responsibility for costly software upgrades.

In 2024, the financial institution sector led the global market, projected to continue during the forecast period. It can be linked to the banking industry's fast digitalization. Furthermore, debt collection software allows banks to automate their collections activities, which is projected to promote software adoption among banks.

However, due to rising patient costs and bad debt in the healthcare industry, the healthcare industry is predicted to increase at a significant rate. Furthermore, the expansion of debt collection software in the healthcare business is fueled by a surge in demand for debt collection software and technologically enhanced systems to reduce bad debt and speed up and automate the revenue cycle.

| Countries | Current Market Share 2025 |

|---|---|

| United States | 19.2% |

| Germany | 10.2% |

| Japan | 5.4% |

| Australia | 3.3% |

The North American region has much potential for the debt collection software market to flourish. In terms of debt recovery, the region has faced several difficulties. Even if student debts in the United States were forgiven or modified, there would still be trillions of dollars in debt to be repaid in the US alone. Despite this, the debt collection sector has largely escaped the fintech revolution of the last decade.

Traditional debt collection measures, such as aggressive calls, door-to-door collections, and invoice reminders, have all failed. Inefficient collection procedures based on flawed tactics and models raise operating costs and hurt liquidity. According to a whitepaper published by Collect Edge, the industry average for unpaid debt collection in 2020 was only 20%, down from 30% a year ago.

Debt collection software allows banks to automate their collections activities, which is projected to promote software adoption among banks. However, due to rising patient costs and bad debt in the healthcare industry, the healthcare industry is predicted to increase at the fast rate.

The expansion of debt collection software in the healthcare business is fueled by a surge in demand for technologically enhanced systems to reduce bad debt and speed and automate the revenue cycle. These countries are continue to expand the global market by innovating advanced products by invest in research and developing activities.

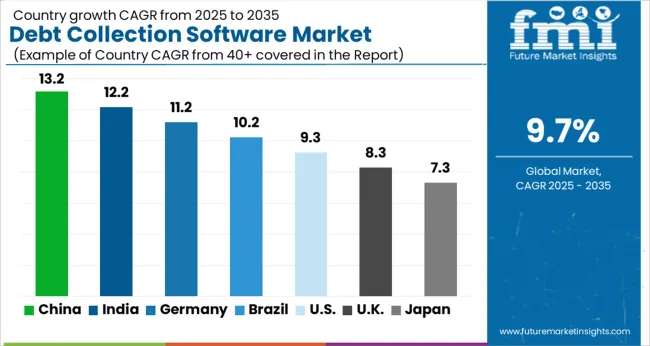

| Countries | Current CAGR Market Values 2025 |

|---|---|

| China | 19.2% |

| India | 10.2% |

| United Kingdom | 5.4% |

Vendors of debt collection software use a variety of expansion techniques to expand their presence and market share in the worldwide market. Partnerships and collaborations with other companies, mergers and acquisitions, strategic alliances, new product launches, and the strengthening of regional and worldwide distribution networks are all methods that vendors employ.

These key players are developing improved and advanced products as per customers' requirements to enhance their experiences. They are upsurging the global market through various sales and distribution networks. These players invest their time in research and development activities to improve solutions and attract end users' attention.

Other Essential Players in the Market are

Recent Developments in the Global Market

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered | Component, Deployment, Organization Size, End User, Region |

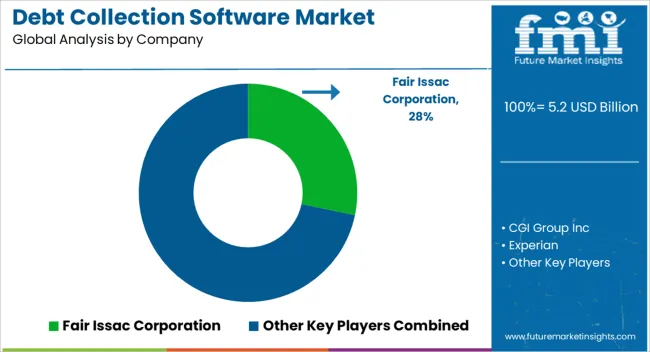

| Key Companies Profiled | Fair Issac Corporation; CGI Group Inc; Experian; Pegasystems Inc; JST Collection System Co., Ltd; Interactive Intelligence Group Inc; Chetu Inc; Temenos Group AG; Fiserv Inc; TransUnion; Nucleus Software; TietoEVRY; AMEYO; Kuhlet; Totality Software; Advantage Software; InterProse Corporation; Interctive Intelligence Group Inc |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global debt collection software market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the debt collection software market is projected to reach USD 13.2 billion by 2035.

The debt collection software market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in debt collection software market are software, services, _implementation & integration, _consulting and _support & maintenance.

In terms of deployment, cloud-based segment to command 63.8% share in the debt collection software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bile Collection Bags Market Size and Share Forecast Outlook 2025 to 2035

Blood Collection Devices Market Insights – Trends & Forecast 2025 to 2035

Urinary Collection Device Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Blood Collection Device Market Analysis - Size, Share & Forecast 2025 to 2035

Assessing Vacuum Blood Collection Devices Market Share & Industry Trends

Electronic Toll Collection Market Analysis by Product Type, Technology Type, Application Type, and Region Through 2025 to 2035

Virology Specimen Collection Market Size and Share Forecast Outlook 2025 to 2035

Medical Waste Liquid Collection Device Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Data Center Market Size and Share Forecast Outlook 2025 to 2035

Software Containers Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Application And Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA