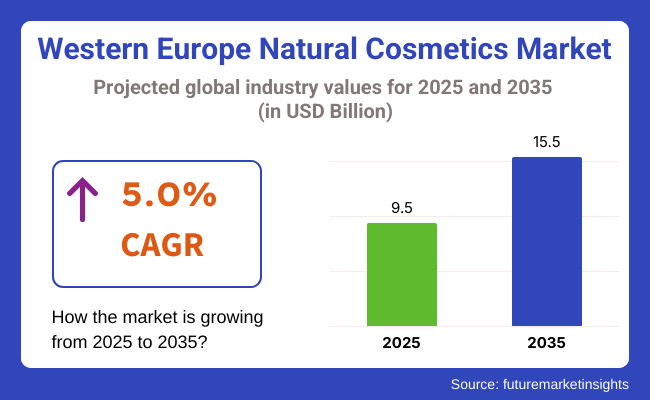

The Western Europe natural cosmetics market is poised to register a valuation of USD 9.5 billion in 2025. The industry is slated to grow at 5.0% CAGR from 2025 to 2035, witnessing USD 15.5 billion by 2035. The market is being propelled by a mix of changing consumer behavior, environmental consciousness, and regulatory changes that promote transparency and sustainability.

Over the past few years, consumers in Western Europe have become more health-conscious and are looking for beauty and personal care products that are free from synthetic chemicals, parabens, sulfates, and other ingredients that could be harmful to their health. This transformation is particularly acute amongst millennials and Gen Z, who highly value authenticity, clean labels, and products that match their lifestyle and ethical standards.

Another important driver is the region's increased sensitivity to environmental and social sustainability. European consumers increasingly actively pursue products that are cruelty-free, vegan, biodegradable, or sustainably sourced. This has driven demand for natural, organic, and locally sourced ingredient brands.

Zero-waste packaging, refillable products, and green supply chains are also now key points of sale. Consequently, even big-brand cosmetic firms are reformulating or introducing new lines to comply with these criteria.

Western Europe's regulatory environment is also crucial to the trend. The European Union has among the globe's strictest cosmetic regulations, which ban or limit thousands of chemical ingredients and mandate open labeling. Such regulations provide a supportive environment for natural cosmetic products, as they usually already satisfy or surpass such regulatory requirements.

In addition, as word gets out via social media, influencer culture, and online ratings, consumers are increasingly educated and discerning-willing to pay a premium for safer, natural options.

The Western Europe market for natural cosmetics is observing vibrant trends in end-use segments like skincare, haircare, makeup, personal hygiene, and fragrances, which are each influenced by growing consumer demand for clean, ethical, and sustainable offerings. In the largest segment, skincare, consumers are choosing simple, plant-based products addressing individual concerns such as aging, sensitivity, and hydration, with purchase influenced by ingredient transparency and environmental packaging.

Hair trends focus on sulfate- and paraben-free products, scalp well-being, and hard shampoo bars, indicating increasing interest in zero-waste products. In makeup, however, there is a definite trend toward hybrid products that provide both cosmetic and skincare benefits, with vegan and cruelty-free labeling affecting purchasing decisions, particularly among younger, socially aware consumers.

In personal care and fragrances, natural deodorants, fluoride-free oral care, and botanical perfumes are increasingly in demand. Aluminium-free, charcoal- or magnesium-based deodorants are especially in demand, and buyers of natural fragrances prefer alcohol-free, essential oil-based products from niche, moral brands.

Throughout all segments, customer trust is a key factor, with buying decisions driven more and more by third-party certified (e.g., COSMOS, Ecocert), sustainable, ethically sourced, and transparently branded products.

During 2020 to 2024, the natural cosmetics market in Western Europe changed drastically, driven by the intersection of health awareness, green awareness, and digital trends. The COVID-19 pandemic served as a driver, fueling the movement toward wellness-driven lifestyles and pushing demand for clean, safe, and ingredient-clear beauty products.

Consumers grew more cautious about what they applied to their skin, and brands redesigned products and focused on botanical, non-toxic actives. At the same time, the explosion of e-commerce and social media marketing created indie and niche natural beauty brands that gained trust by being real, sustainable, and consumer-accessible. In this time, mass players also moved into the natural category, catering to competitive pressure and changing consumer values.

Post 2025, the market is predicted to grow and diversify, with sustainability, personalization, and technology pushing the future of growth. Developments in green chemistry and biotech will unlock more effective natural formulations, plus longer-lasting product shelf lives without sacrificing purity.

Personalization will take centre stage, where AI and data-informed skincare regimes are attuned to particular requirements, types of skin, and environmental states. Packaging will also change-biodegradable, refillable, and circular systems will be the norm, not the exception.

Regulatory systems throughout Europe will probably become even more strict, upholding consumer confidence and eliminating greenwashing. Additionally, holistic beauty-connecting internal health with external treatment-will become more popular, combining supplements, adaptogens, and natural beauty rituals.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumer demand for clean, safe, and chemical-free products grew, particularly post-COVID, with a focus on natural ingredients and minimal formulations. | Natural cosmetics will converge with wellness trends, including adaptogens, ingestibles, and skin-health-oriented nutrition in beauty regimens. |

| Small brands became popular through social media and direct-to-consumer channels, emphasizing transparency and sustainability. | Traditional players will buy or partner with niche brands, building out natural product offerings and boosting R&D for next-generation formulations. |

| Shoppers grew extremely ingredient-aware, prompting companies to publish full ingredient panels and steer clear of toxic synthetics. | An increase in biotech-derived natural ingredients, enhanced efficacy, and green chemistry innovations for more effective, more stable products are expected. |

| Green packaging, cruelty-free methods, and sustainable sourcing began becoming key differentiators. | Sustainability will penetrate into circular economy systems-refillable systems, biodegradable packaging, and regenerative sourcing becoming the norm. |

The Western Europe natural cosmetics market, though set for robust growth, is subject to a range of risks that have the potential to influence its long-term development. Most urgently, there is regulatory risk. As EU regulations continue to tighten around ingredient safety, labeling, and greenwashing claims, manufacturers need to spend heavily on compliance and clear sourcing.

Newer and smaller players find it hard to keep up with changing standards, which could constrain innovation and market access. In addition, diversity in the way "natural" is used in different markets can confuse consumers and undermine trust if not handled well.

Another significant risk is supply chain vulnerabilities, especially for natural and organic ingredients that are heavily reliant on seasonal harvests, regional supply, and ethical sourcing practices. Climate change and geopolitical tensions have the potential to interfere with access to critical raw materials, causing price instability or supply shortages.

There is also increasing concern regarding overharvesting of specific botanical ingredients, which may initiate environmental and ethical backlash if sustainability is not made a priority.

Shelves are filled with products such as natural moisturizers, anti-aging creams, hyperpigmentation serums, and acne and sensitive skin treatments. Such popularity is due to increasing demand for transparency of ingredients and avoiding harsh synthetics such as parabens, sulfates, and fragrances.

Consumers are more and more attracted to natural actives like aloe vera, chamomile, hyaluronic acid of botanical origin, and essential oils, which provide established benefits for dry skin, fine lines, and inflammation without compromising safety. Sun care products formulated with mineral-based filters like zinc oxide are also witnessing increased demand owing to skin-safe concerns.

Hair care is another fast-growing category, with shoppers favoringsulfate-free shampoo, moisturizing conditioners, hair masks, and scalp treatments. Natural products such as argan oil, coconut oil, tea tree, and rosemary are especially popular for addressing conditions such as dandruff, dry or frizzy hair, and scalp irritation.

Sales of solid shampoo bars and refill packaging have also jumped, indicative of a broader desire for sustainability. This transition is also fueled by growing fears over hair loss and scalp wellness, particularly in geriatric and younger demographics driven by wellness culture.

In Western Europe, online sales channel has become the primary mode of distribution for natural cosmetics in the post-pandemic period. This is fueled by a number of factors, such as the rising level of digital literacy among consumers, the ease of home delivery, and the convenience of having access to a greater variety of niche and specialist natural cosmetic brands that might not be found in conventional retail stores.

Web-based platforms-brand-owned sites as well as third-party marketplaces-enable consumers to browse product ingredients, certifications, and reviews in detail, supporting informed and mindful buying choices. Social media, influencer marketing, and green beauty communities further increase brand visibility and consumer confidence, particularly among younger, digitally active populations who are intensely interested in clean beauty trends.

Specialty stores and mono-brand stores also have important roles to play in this market, especially for those who like to try products physically or appreciate in-store consultation and experience. Specialty beauty retailers tend to curate ranges with a high emphasis on natural, organic, or eco-certified products, providing an environment that supports the brand's clean beauty credo.

Mono-brand stores, however, enable natural cosmetic brands to build rich brand experiences and provide complete control over merchandising and customer interaction.

The Western European natural cosmetics market is becoming increasingly competitive, with a mix of multinational players and quick, mission-based niche players. These include demand for natural, sustainable, and high-performance personal care products, which continues to transform market dynamics.

Market leaders such as L'Oréal S.A., Beiersdorf AG, and Estee Lauder Companies Inc. command market share based on their large product portfolios and innovation strengths, while Clarins Group and Coty Inc. hold solid positions in both the premium and mid-range segments.

Meanwhile, firms such as Benefit Cosmetics and Amway utilize brand loyalty and community-based marketing to target niche consumer bases. Companies are responding to mounting pressure over ingredients, packaging, and ethical sourcing, indicating long-term commitment to clean beauty and green science.

| Company Name | Estimated Industry Share (%) |

|---|---|

| L'Oréal S.A. | 13-15% |

| Beiersdorf AG | 10-12% |

| Estee Lauder Companies Inc. | 9-11% |

| Clarins Group | 6-8% |

| Coty Inc. | 5-7% |

| Amway Corporation | 3-5% |

| Benefit Cosmetics LLC | 3-5% |

| Johnson & Johnson | 4-6% |

| Chanel S.A. | 4-6% |

| Kao Corporation | 2-4% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| L'Oréal S.A. | Has a broad natural cosmetics range through Garnier Bio and La Provençale Bio, targeting certified organic, environmentally friendly products with mass and premium appeal. |

| Beiersdorf AG | Has a focus on botanical ingredients and recyclable packaging in value-priced skincare solutions. |

| Estee Lauder Companies Inc. | With brands such as Origins and Aveda, Estee Lauder targets premium consumers with plant-based, cruelty-free skincare and haircare. |

| Clarins Group | Has expertise in upscale natural skin care, drawing on plant science in facial care and body care lines, with emphasis on sustainability. |

| Coty Inc. | Focuses on nature-driven beauty with brands such as Lancaster, with increased emphasis on clean, ethical sourcing. |

| Amway Corporation | Offers its Artistry Skin Nutrition brand as a clean beauty option with traceable botanicals and science-driven methodology. |

| Benefit Cosmetics LLC | While best recognized for makeup, Benefit has launched natural-extract-based skincare products, focusing on the conscious beauty consumer. |

| Johnson & Johnson | Through its brands such as Aveeno, provides dermatologist-tested products with natural oat and other soothing ingredients for sensitive skin. |

| Chanel S.A. | Chanel is incorporating more natural ingredients and more sustainable practices into its luxury skincare and fragrance lines, appealing to ethical luxury consumers. |

| Kao Corporation | Has operations through brands such as Jergens Naturals and Bioré Natural Clean, which highlight gentle formulations and green packaging. |

Strategic Outlook

The Western European natural cosmetics industry will continue to grow steadily as legacy brands and new entrants double down on innovation, ingredient integrity, and environmental responsibility. Industry leaders like L'Oréal, Beiersdorf, and Estee Lauder dominate the market with sophisticated R&D, diversified product portfolios, and strong distribution networks that enable them to reach a broad spectrum of consumers-budget-conscious shoppers and high-end skincare consumers alike. Their emphasis on certified organic ranges, circular packaging projects, and green chemistry guarantees sustained dominance.

At the same time, growth among brands such as Amway, Benefit Cosmetics, and Clarins signals an increasing consumer appetite for niche, naturally-sourced ingredients that offer performance along with ethical manufacturing. Such brands are performing well by addressing precise skin issues, offering transparency, and communicating with younger, eco-conscious consumers via digital-first approaches.

In terms of product type, the industry is divided into skin and sun care, hair care, bath & shower, men’s grooming (only shaving), color cosmetic, fragrances & deodorants, and oral care.

With respect to consumer orientation, the market is classified into men, women, unisex, and baby & kids.

Based on packaging, the market is divided into bottles & jars, tubes, pouches & sachets, and pencils & sticks.

By sales channel, the industry is divided into supermarkets/hypermarkets, department stores, specialty stores, online sales channels, mono-brand stores, and other sales channels.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 9.5 billion in 2025.

The market is projected to witness USD 15.5 billion by 2035.

The industry is slated to capture 5.0% CAGR during the study period.

Skin and sun care products are widely used.

Leading companies include L'Oréal SA, Amway Corporation, Beiersdorf, Benefit Cosmetics LLC, Chanel S.A., Clarins Group, Coty Inc., Estee Lauder Companies Inc., Johnson & Johnson, and Kao Corporation.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 12: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2019 to 2034

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 14: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 16: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 18: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 20: UK Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 22: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2019 to 2034

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 24: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 26: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 28: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 30: Germany Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 32: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2019 to 2034

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 36: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 38: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Italy Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 42: France Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2019 to 2034

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 46: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 48: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: France Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2019 to 2034

Table 52: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast By Region, 2019 to 2034

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 54: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 56: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 58: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 60: Spain Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 62: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Product Type, 2019 to 2034

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Consumer Orientation, 2019 to 2034

Table 64: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Consumer Orientation, 2019 to 2034

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging, 2019 to 2034

Table 66: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Packaging, 2019 to 2034

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 68: Rest of Industry Analysis and Outlook Volume (Unit Pack) Forecast by Sales Channel, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 37: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2019 to 2034

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 41: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 45: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 49: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 53: UK Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 56: UK Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 57: UK Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 58: UK Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 59: UK Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 67: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2019 to 2034

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 71: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 75: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 79: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 83: Germany Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 87: Germany Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 97: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2019 to 2034

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 101: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 105: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 109: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 113: Italy Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 117: Italy Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 127: France Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2019 to 2034

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 131: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 135: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 139: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 143: France Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 146: France Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 147: France Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 148: France Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 149: France Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2024 to 2034

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2019 to 2034

Figure 157: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis By Region, 2019 to 2034

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2024 to 2034

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2024 to 2034

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 161: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 165: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 169: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 173: Spain Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 177: Spain Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2024 to 2034

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by Consumer Orientation, 2024 to 2034

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging, 2024 to 2034

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 186: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Product Type, 2019 to 2034

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Consumer Orientation, 2019 to 2034

Figure 190: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Consumer Orientation, 2019 to 2034

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Consumer Orientation, 2024 to 2034

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Consumer Orientation, 2024 to 2034

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging, 2019 to 2034

Figure 194: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Packaging, 2019 to 2034

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging, 2024 to 2034

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging, 2024 to 2034

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 198: Rest of Industry Analysis and Outlook Volume (Unit Pack) Analysis by Sales Channel, 2019 to 2034

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by Consumer Orientation, 2024 to 2034

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by Packaging, 2024 to 2034

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA